Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASHFORD HOSPITALITY TRUST INC | ahtinvestorpresentation8-k.htm |

September 2018

Forward Looking Statements and Non-GAAP Measures Certain statements made during this presentation could be considered forward-looking within the meaning of the SEC’s rules and regulations. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results and performance, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the appendix to this presentation. Non-GAAP measures should not be a substitute for GAAP measures when reviewing our financial information. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. or any of its respective affiliates. This information does not form a part of any prospectus of Ashford Hospitality Trust that may be used to offer securities. 2

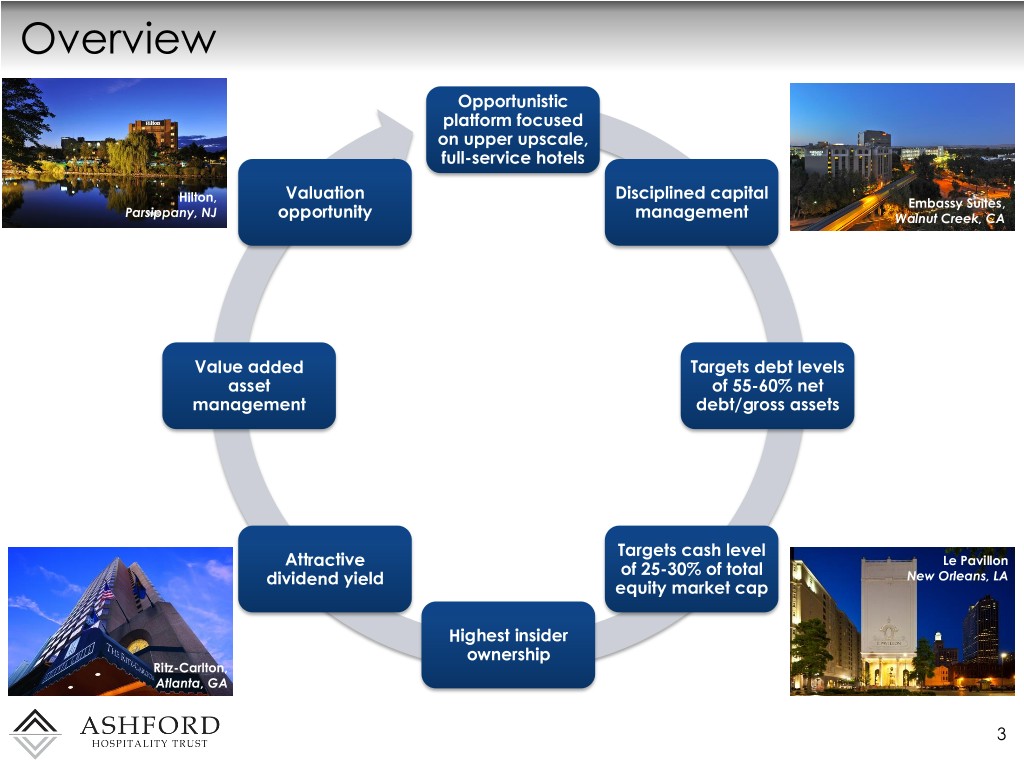

Overview Opportunistic platform focused on upper upscale, full-service hotels Valuation Disciplined capital Hilton, Embassy Suites, Parsippany, NJ opportunity management Walnut Creek, CA Value added Targets debt levels asset of 55-60% net management debt/gross assets Targets cash level Attractive Le Pavillon of 25-30% of total dividend yield New Orleans, LA equity market cap Highest insider ownership Ritz-Carlton, Atlanta, GA 3

Management Team DOUGLAS A. KESSLER DERIC S. EUBANKS, CFA JEREMY J. WELTER Chief Executive Officer & Chief Financial Officer Chief Operating Officer President . 33 years of real estate & . 18 years of hospitality experience . 13 years of hospitality experience . hospitality experience . 15 years with Ashford 8 years with Ashford (5 years with . 15 years with Ashford . Ashford predecessor) 3 years with ClubCorp . . 10 years with Goldman Sachs . 5 years with Stephens Investment CFA charterholder Bank . Stanford BA, MBA . Southern Methodist University BBA . Oklahoma State University BS MARK L. NUNNELEY J. ROBISON HAYS Chief Accounting Officer Chief Strategy Officer . 33 years of hospitality experience . 13 years of hospitality experience . 15 years with Ashford (18 years . 13 years with Ashford with Ashford predecessor) . 3 years of M&A experience at . Pepperdine University BS, Dresser Inc. & Merrill Lynch University of Houston MS, CPA . Princeton University AB 4

Recent Developments Recently Announced ERFP agreement with Advisor • Potential to enhance five year IRRs by 700 to 1,200 basis points(1) for AHT $50M ERFP Allocation(2) hotel acquisitions • Targeting 33% reductions in required $100M AHT Equity equity capital for each new AHT asset acquisition $350M Mortgage • Current AHT excess corporate cash Debt Plus of approximately $327 million(3) Allocated Corporate Preferred • Designed to improve overall shareholder returns for AHT • AHT advantage vs. competing $500M Initial market bids Program Capacity 33% Reduction in AHT Equity for acquisitions (1) Assumes approximately 15% to 20% levered returns without ERFP funding over five years, between 25% and 40% required equity amounts per acquisition, and funding of ERFP at end of year one (2) Assuming 10% ERFP commitment funded immediately at acquisition 5 (3) As of June 30, 2018

Recent Developments Recently Announced Acquisition of Hilton Alexandria Old Town utilizing ERFP • Fee simple ownership of 252-room hotel with 12,967 square feet of meeting space • T12 operating stats through May 2018: Occupancy 85% / ADR $190 / RevPAR $161 • No near-term owner funded capital needs - $9.6m of capital invested into the hotel ($38k/key) since 2013 • Two operated F&B outlets, including a full-service Starbucks with street front access • Hilton management – convertible to franchise after sale with no liquidated damages; no PIP if converted prior to December 31, 2019 • Non-union labor High quality, well-branded full-service asset located in Washington, DC MSA 6

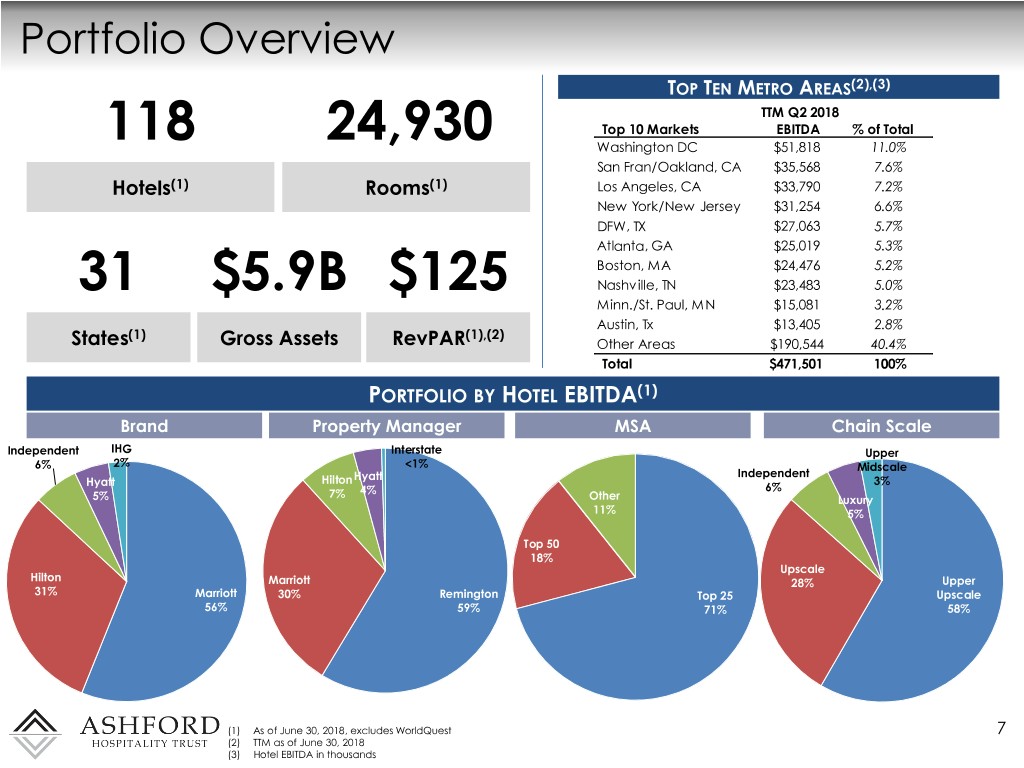

Portfolio Overview TOP TEN METRO AREAS(2),(3) TTM Q2 2018 118 24,930 Top 10 Markets EBITDA % of Total Washington DC $51,818 11.0% San Fran/Oakland, CA $35,568 7.6% Hotels(1) Rooms(1) Los Angeles, CA $33,790 7.2% New York/New Jersey $31,254 6.6% DFW, TX $27,063 5.7% Atlanta, GA $25,019 5.3% Boston, MA $24,476 5.2% 31 $5.9B $125 Nashville, TN $23,483 5.0% Minn./St. Paul, MN $15,081 3.2% Austin, Tx $13,405 2.8% (1) (1),(2) States Gross Assets RevPAR Other Areas $190,544 40.4% Total $471,501 100% PORTFOLIO BY HOTEL EBITDA(1) Brand Property Manager MSA Chain Scale Independent IHG Interstate Upper 6% 2% <1% Midscale Independent Hilton Hyatt 3% Hyatt 6% 7% 4% 5% Other Luxury 11% 5% Top 50 18% Upscale Hilton Marriott 28% Upper 31% Marriott 30% Remington Top 25 Upscale 56% 59% 71% 58% (1) As of June 30, 2018, excludes WorldQuest 7 (2) TTM as of June 30, 2018 (3) Hotel EBITDA in thousands

Geographically Diverse Las Vegas – 1.8% Dallas / Ft. Worth – 5.7% Minneapolis – 3.2% Indianapolis – 2.3% Boston – 5.2% New York – 6.6% Portland – 2.0% Philadelphia – 1.7% Baltimore – 1.3% San Francisco – 7.5% Washington D.C. – 11.0% Los Angeles – 7.2% Nashville – 5.0% Atlanta – 5.3% San Diego – 1.5% Savannah – 2.8% Phoenix – 1.4% Austin – 2.8% Jacksonville – 2.2% Orlando – 2.1% <1% Houston – 2.6% Tampa – 2.1% Key West – 1.9% Miami – 2.8% Note: percent of total portfolio TTM Hotel EBITDA for the 118 properties owned as of June 30, 2018 8

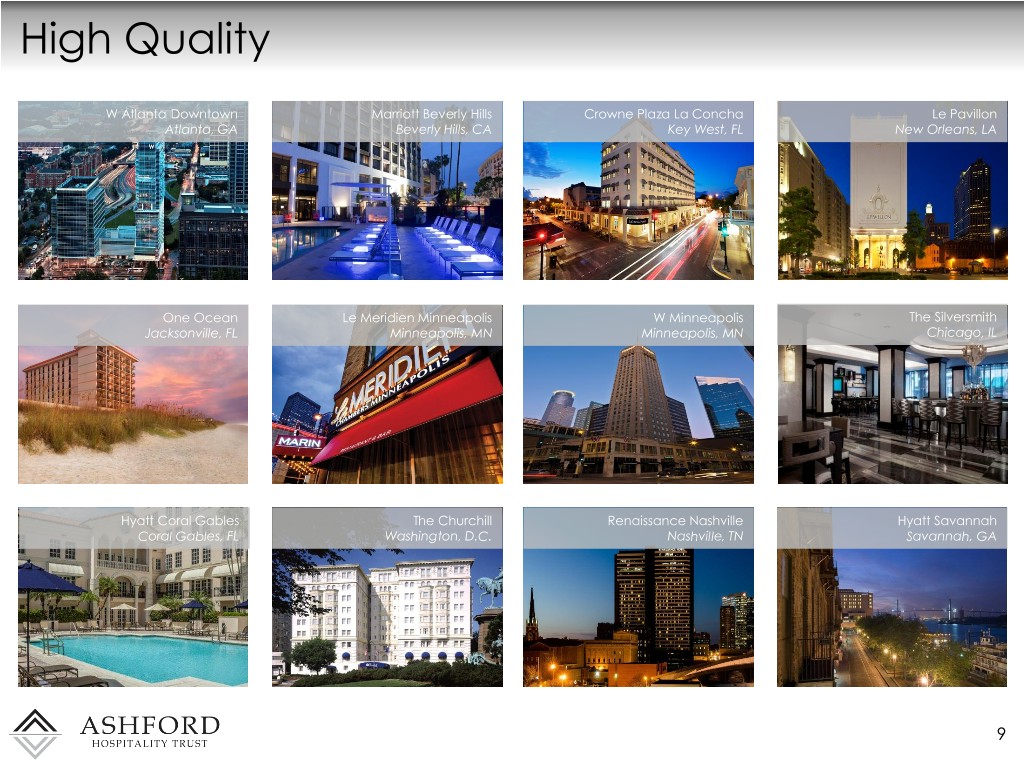

High Quality W Atlanta Downtown Marriott Beverly Hills Crowne Plaza La Concha Le Pavillon Atlanta, GA Beverly Hills, CA Key West, FL New Orleans, LA One Ocean Le Meridien Minneapolis W Minneapolis The Silversmith Jacksonville, FL Minneapolis, MN Minneapolis, MN Chicago, IL Hyatt Coral Gables The Churchill Renaissance Nashville Hyatt Savannah Coral Gables, FL Washington, D.C. Nashville, TN Savannah, GA 9

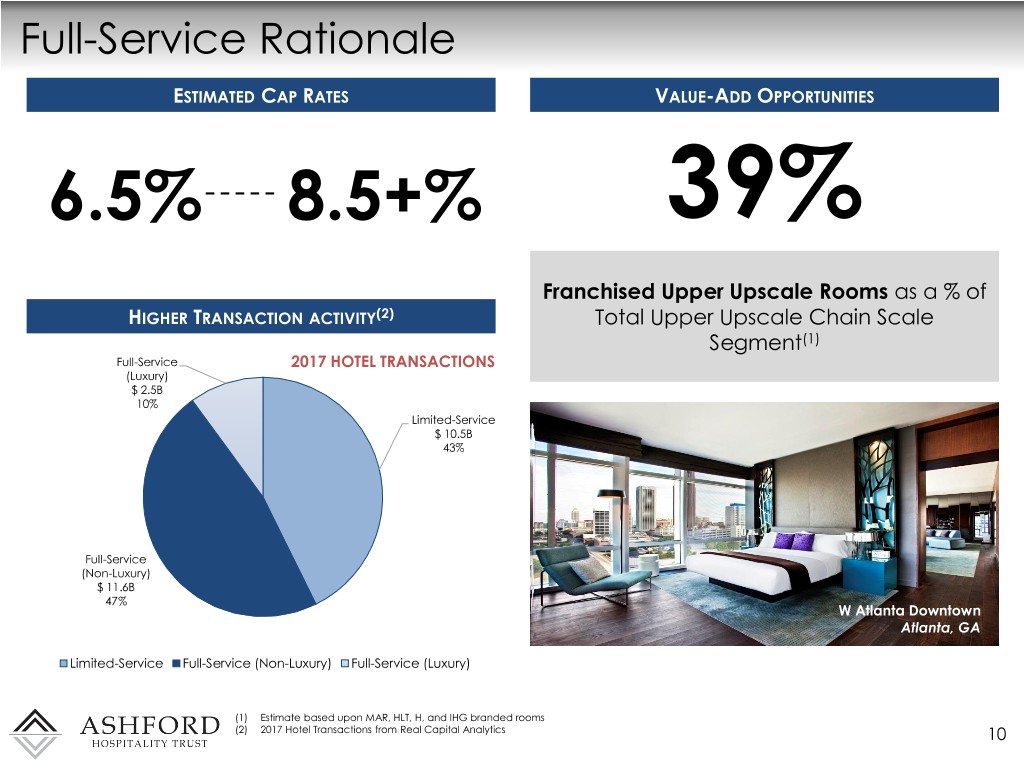

Full-Service Rationale ESTIMATED CAP RATES VALUE-ADD OPPORTUNITIES 6.5% 8.5+% 39% Franchised Upper Upscale Rooms as a % of HIGHER TRANSACTION ACTIVITY(2) Total Upper Upscale Chain Scale Segment(1) Full-Service 2017 HOTEL TRANSACTIONS (Luxury) $ 2.5B 10% Limited-Service $ 10.5B 43% Full-Service (Non-Luxury) $ 11.6B 47% W Atlanta Downtown Atlanta, GA Limited-Service Full-Service (Non-Luxury) Full-Service (Luxury) (1) Estimate based upon MAR, HLT, H, and IHG branded rooms (2) 2017 Hotel Transactions from Real Capital Analytics 10

Financially Calibrated Sales Ashford Trust Hotel Sales 2015 - 2018 PROPERTIES SOLD SALES OF MAINLY SELECT-SERVICE PROPERTIES Hampton Inn Terre Haute Sales Proceeds Courtyard Marriott Village LBV $375 million SpringHill Suites Marriott Village LBV Fairfield Inn Marriott Village LBV REMOVAL OF LOWER REVPAR HOTELS Residence Inn Atlanta Buckhead TTM Avg. RevPAR Courtyard Edison $80 Hampton Inn & Suites Gainesville SpringHill Suites Gaithersburg TRANSACTIONS AT FAVORABLE CAP RATES Residence Inn Palm Desert TTM Avg. Cap Rate Courtyard Palm Desert 8.1% Renaissance Portsmouth All-in Basis Cap Rate(1) 6.9% Embassy Suites Syracuse Crowne Plaza Atlanta Ravinia SpringHill Suites Richmond Glen Allen SpringHill Suites Centreville Residence Inn Tampa (1) Based on expected capex to be invested by the buyer 11

Disciplined Capital Management Track record of increasing shareholder returns by capitalizing upon cyclical changes and advantageous pricing of our securities COMMON SHARE BUYBACKS $1,400 73.6M 50% $3.28 Of Outstanding Average Financial Crisis Shares $1,200 Shares Buyback $200 RECENT PREFERRED EQUITY ACTIVITY $1,000 2016 2017 $800 $400 9.0% 7.4% 8.5% 7.5% Old Coupon New Coupon Old Coupon New Coupon $600 $18 (In millions (In $) $400 $116 $218 $574 $73 $200 $65 $305 $10 $11 $76 $112 $52 $275 $218 $230 $170 $45 $147 $68 $97 $81 $72 $90 $89 $112 $0 $17 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Common Raises Common Buybacks Preferred Raises Preferred Buybacks / Redemptions 12

Leverage Target Non-recourse, property level mortgage Leverage policy consistent since IPO debt $6,000 70.0% 64.9% 63.8% 65.0% 61.2% 61.9% 59.6% $5,000 58.7% 59.1% 58.5% 58.3% 60.0% 56.1% 56.4% 55.5% 55.7% 55.0% $4,000 49.2% 50.0% $3,000 42.4% 45.0% Millions 40.0% $2,000 35.0% 30.0% $1,000 (1) (1) 25.0% $0 20.0% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Q2 (1) Gross Assets (1) Net Debt Net Debt / Gross Assets (1) Based on public filings; adjusted for unconsolidated Highland JV from 2011 – 2014 Note: Gross Assets and Net Debt adjusted for cash & cash equivalents and other liquid cash-like items as reported 13

Cash Target FINANCIAL CRISIS CURRENT CYCLE Positioned to buy back approximately 50% of Flexibility to execute opportunistic growth and outstanding common shares for about $240 million maintain hedge against an economic downturn leading to outsized total shareholder returns FINANCIAL CRISIS CURRENT CYCLE $1,400 80% 75% $1,200 70% 60% $1,000 47% 50% 44% $800 40% Millions 40% 28% $600 28% 28% 30% 24% 24% 23% 22% $400 20% 9% 10% 9% $200 10% $0 0% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018Q2 (1) Avg Cash (1) Avg Equity Market Cap (2) Cash / Equity Market Cap (2) (1) Based on public filings; adjusted for unconsolidated Highland JV from 2011 - 2014 (2) Source: Bloomberg 14

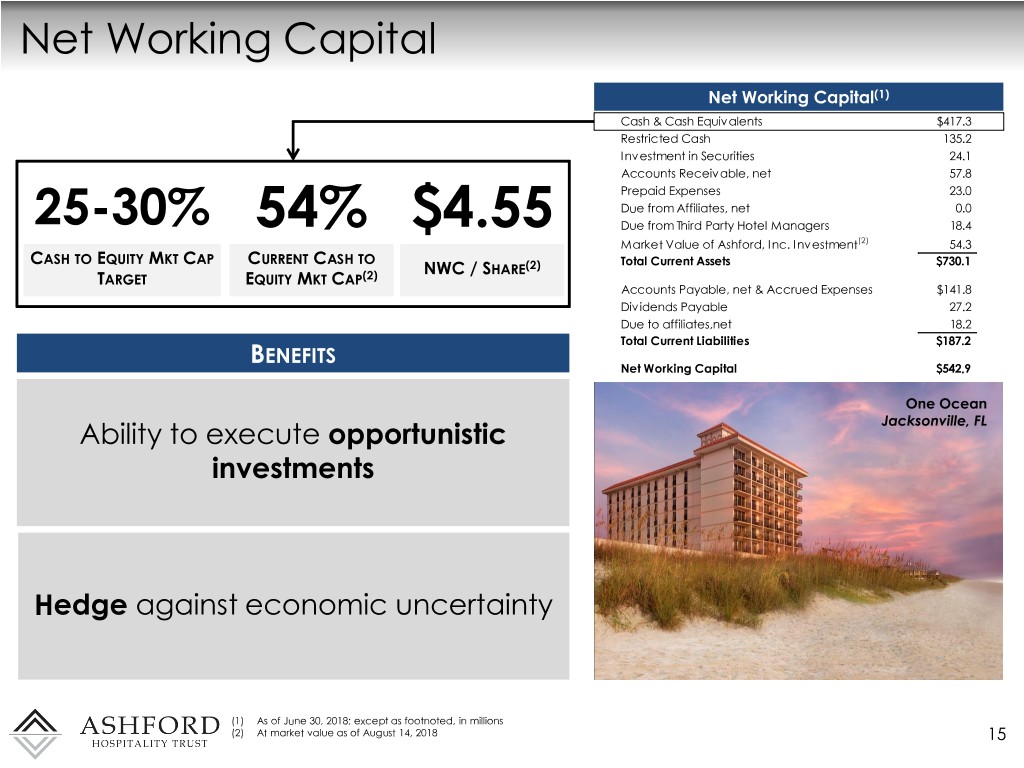

Net Working Capital Net Working Capital(1) Cash & Cash Equivalents $417.3 Restricted Cash 135.2 Investment in Securities 24.1 Accounts Receivable, net 57.8 Prepaid Expenses 23.0 Due from Affiliates, net 0.0 25-30% 54% $4.55 Due from Third Party Hotel Managers 18.4 Market Value of Ashford, Inc. Investment(2) 54.3 CASH TO EQUITY MKT CAP CURRENT CASH TO Total Current Assets $730.1 NWC / SHARE(2) TARGET EQUITY MKT CAP(2) Accounts Payable, net & Accrued Expenses $141.8 Dividends Payable 27.2 Due to affiliates,net 18.2 Total Current Liabilities $187.2 BENEFITS Net Working Capital $542.9 One Ocean Ability to execute opportunistic Jacksonville, FL investments Hedge against economic uncertainty (1) As of June 30, 2018; except as footnoted, in millions (2) At market value as of August 14, 2018 15

Non-Recourse Debt Total Enterprise Value 100% 100% 0% Stock Price(1) $6.45 Fully Diluted Shares Outstanding(2) 119.2 PROPERTY LEVEL, NON-RECOURSE DEBT CORPORATE LEVEL DEBT MORTGAGE DEBT Equity Value $769.1 Plus: Preferred Equity(2) 564.7 Plus: Debt, net of JV Interest(2) 3,998.9 Total Market Capitalization $5,332.7 Less: Net Working Capital(2),(3) (542.9) Total Enterprise Value $4,789.8 BENEFITS The Churchill Churchill Washington, D.C. Non-recourse debt Maximizes flexibility Washington D.C. lowers risk profile of in all economic the platform environments High lender interest in Long-standing lender our high quality hotel relationships assets (1) As of August 14, 2018 (2) As of June 30, 2018; in millions (3) Includes Investment in Ashford Inc. at market value as of August 14, 2018 16

Value Enhancement through Refinancing 17-PACK – OCT 2017 8-HOTEL PORTFOLIO – JAN 2018 22-HOTEL PORTFOLIO – APR 2018 L+5.52% L+3.00% L+4.95% L+2.92% L+4.39% L+3.20% Old Interest Rate New Interest Rate Old Interest Rate New Interest Rate Old Interest Rate New Interest Rate ~$9.8 million in annual debt service ~$6.8 million in annual debt service ~$11.0 million in annual debt savings over prior loan terms savings over prior loan terms service savings over prior loan terms 34-PACK – JUN 2018 W Atlanta Downtown Atlanta, GA L+4.57% L+3.83% Old Interest Rate New Interest Rate 74bp decrease over prior loan terms STRATEGIC RATIONALE Extend maturity Greater flexibility Interest expense savings 17

Debt Maturity(1) 2018 NO DEBT MATURITIES 5.5% TOTAL PORTFOLIO WEIGHTED AVERAGE INTEREST RATE Debt Yield: Debt Yield: Debt Yield: Debt Yield: Debt Yield: Debt Yield: 21.4% 10.1% 14.9% 12.3% 12.4% 11.4% $3,000 $2,500 $2,000 $1,500 Millions $2,627.8 $1,000 $500 $0.0 $427.0 $191.2 $53.3 $5.3 $287.3 $71.8 $0 $138.1 $73.5 $125.7 2018 2019 2020 2021 2022 2023 2024 2025 Fixed-Rate Floating-Rate (1) As of June 30, 2018; assumes extension options are exercised Note: All debt yield statistics are based on EBITDA to principal 18

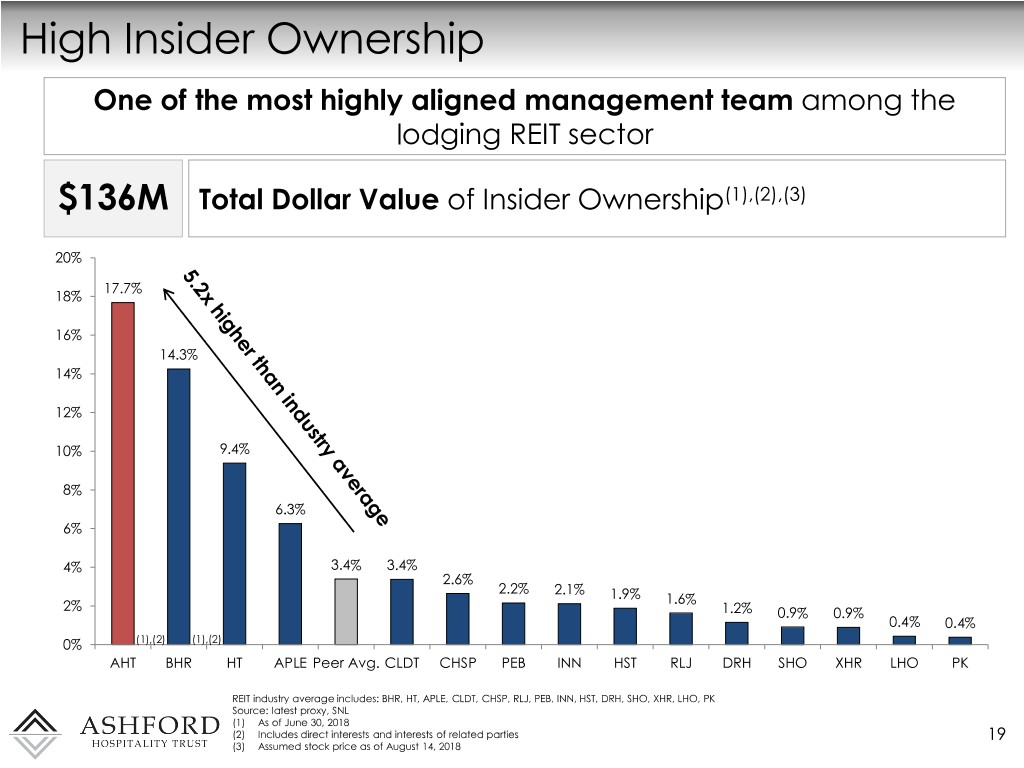

High Insider Ownership One of the most highly aligned management team among the lodging REIT sector $136M Total Dollar Value of Insider Ownership(1),(2),(3) 20% 17.7% 18% 16% 14.3% 14% 12% 10% 9.4% 8% 6.3% 6% 4% 3.4% 3.4% 2.6% 2.2% 2.1% 1.9% 2% 1.6% 1.2% 0.9% 0.9% 0.4% 0.4% 0% (1),(2) (1),(2) (1),(2) (1),(2) AHT BHR HT APLE Peer Avg. CLDT CHSP PEB INN HST RLJ DRH SHO XHR LHO PK REIT industry average includes: BHR, HT, APLE, CLDT, CHSP, RLJ, PEB, INN, HST, DRH, SHO, XHR, LHO, PK Source: latest proxy, SNL (1) As of June 30, 2018 (2) Includes direct interests and interests of related parties 19 (3) Assumed stock price as of August 14, 2018

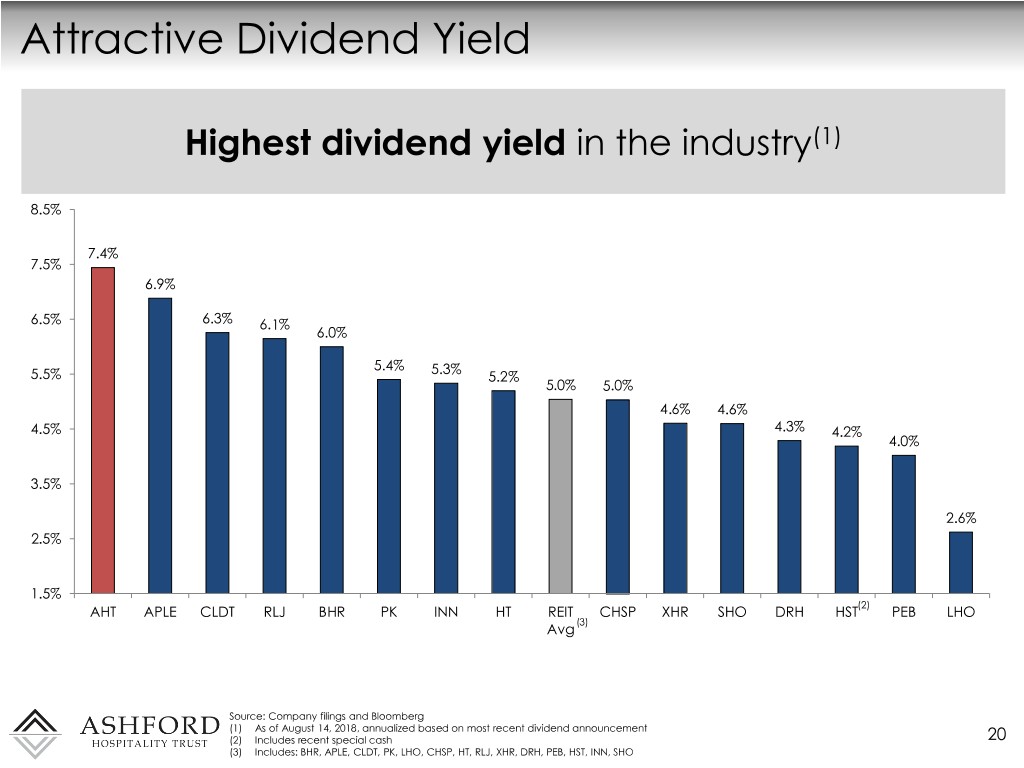

Attractive Dividend Yield Highest dividend yield in the industry(1) 8.5% 7.4% 7.5% 6.9% 6.5% 6.3% 6.1% 6.0% 5.4% 5.3% 5.5% 5.2% 5.0% 5.0% 4.6% 4.6% 4.5% 4.3% 4.2% 4.0% 3.5% 2.6% 2.5% 1.5% (2) AHT APLE CLDT RLJ BHR PK INN HT REIT CHSP XHR SHO DRH HST PEB LHO (3) Avg Source: Company filings and Bloomberg (1) As of August 14, 2018, annualized based on most recent dividend announcement (2) Includes recent special cash 20 (3) Includes: BHR, APLE, CLDT, PK, LHO, CHSP, HT, RLJ, XHR, DRH, PEB, HST, INN, SHO

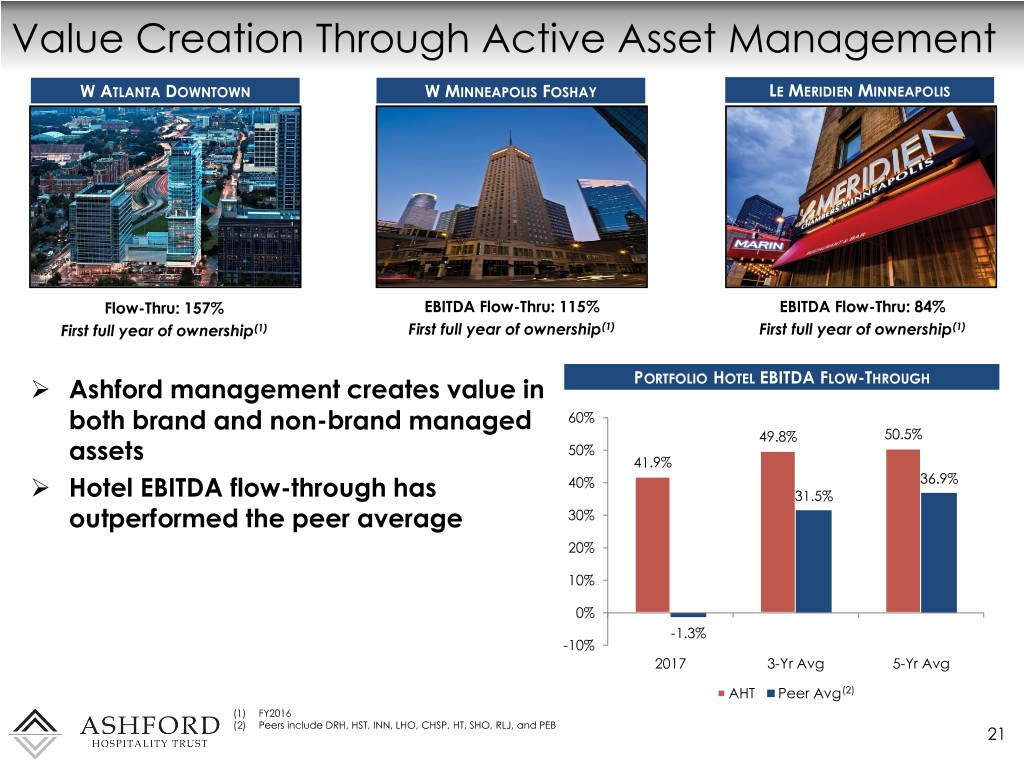

Value Creation Through Active Asset Management W ATLANTA DOWNTOWN W MINNEAPOLIS FOSHAY LE MERIDIEN MINNEAPOLIS Flow-Thru: 157% EBITDA Flow-Thru: 115% EBITDA Flow-Thru: 84% First full year of ownership(1) First full year of ownership(1) First full year of ownership(1) Ashford management creates value in PORTFOLIO HOTEL EBITDA FLOW-THROUGH both brand and non-brand managed 60% 49.8% 50.5% 50% assets 41.9% 40% 36.9% Hotel EBITDA flow-through has 31.5% outperformed the peer average 30% 20% 10% 0% -1.3% -10% 2017 3-Yr Avg 5-Yr Avg AHT Peer Avg (2) (1) FY2016 (2) Peers include DRH, HST, INN, LHO, CHSP, HT, SHO, RLJ, and PEB 21

Case Study – Aggressive Asset Management Hotel Overview W Atlanta – Atlanta, GA 237 keys, 9,000 sq. ft. of meeting space Close proximity to the downtown and midtown demand generators: Centennial Olympic Park, the Atlanta Aquarium, and Mercedes Benz Stadium Implemented Strategies Replaced unprofitable restaurant manager and re-positioned restaurant New management of the on-premise digital billboard Renegotiated valet parking agreement Eliminated operational loss at Bliss Spa through restructuring First full year of ownership EBITDA flow- thru of 157%, and EBITDA growth of 27% 22

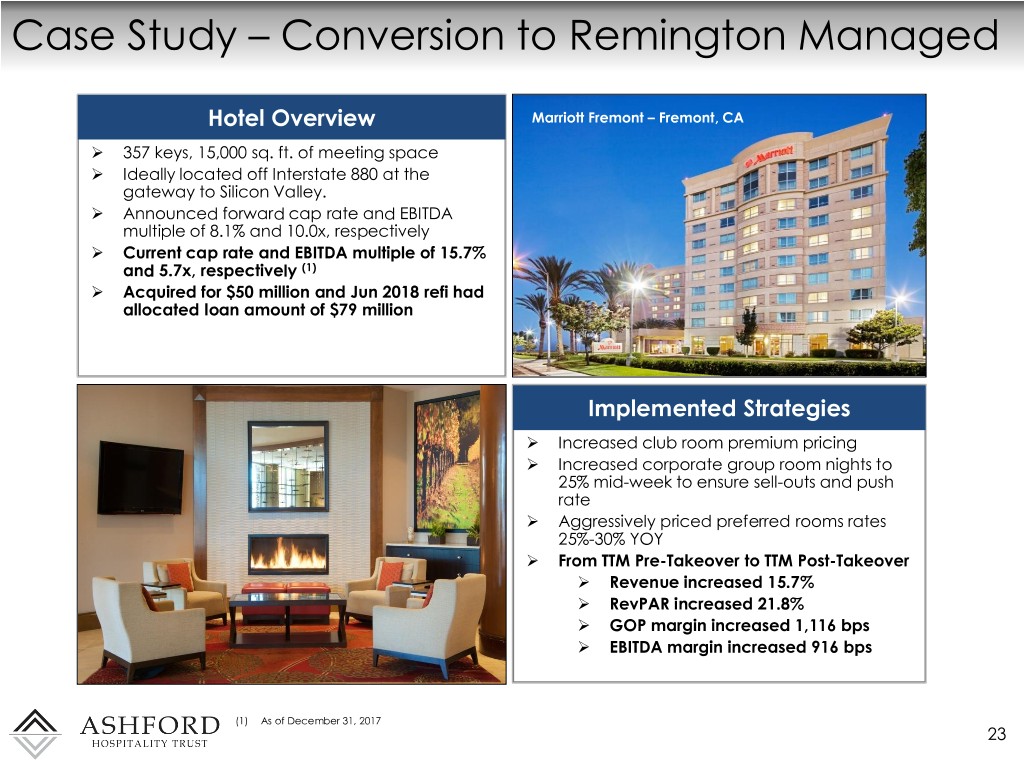

Case Study – Conversion to Remington Managed Hotel Overview Marriott Fremont – Fremont, CA 357 keys, 15,000 sq. ft. of meeting space Ideally located off Interstate 880 at the gateway to Silicon Valley. Announced forward cap rate and EBITDA multiple of 8.1% and 10.0x, respectively Current cap rate and EBITDA multiple of 15.7% and 5.7x, respectively (1) Acquired for $50 million and Jun 2018 refi had allocated loan amount of $79 million Implemented Strategies Increased club room premium pricing Increased corporate group room nights to 25% mid-week to ensure sell-outs and push rate Aggressively priced preferred rooms rates 25%-30% YOY From TTM Pre-Takeover to TTM Post-Takeover Revenue increased 15.7% RevPAR increased 21.8% GOP margin increased 1,116 bps EBITDA margin increased 916 bps (1) As of December 31, 2017 23

Asset Management Initiatives – Recently Completed Renaissance Palm Springs: Guestroom, restaurant, meeting space and public area renovations completed Courtyard Crystal City: Guestroom renovations and public area carpet completed. Embassy Suites Santa Clara: Guestroom renovation and fitness center completed. Embassy Suites Orlando Airport: Guestrooms completed Extensive atrium, restaurant, and public space completed, including implementation of a corner pantry. Westin Princeton: Guestroom renovation completed. Embassy Suites Philadelphia Airport: Guestroom Renovation completed Courtyard Gaithersburg: Guestrooms and meeting rooms refurbished. Former Courtyard Café converted to a Bistro Marriott Omaha: Refurbishment of concierge lounge, business center, and guestroom corridors completed The Churchill: Lobby refurbishment completed Note: list is representative of recently completed initiatives, but does not include all assets 24

Asset Management Initiatives – Upcoming Renaissance Nashville: First Phase of NCC meeting space completed April 2018 including the grand and junior ballrooms. Extensive first floor public space renovation now underway. Project completion scheduled Q1 2019. Hotel Indigo Atlanta Midtown: Guestroom renovation underway, scheduled for completion in Q3 2018 Hyatt Regency Coral Gables: Guestroom renovation planned for Q3 2018 – Q1 2019 Courtyard Louisville: Guestroom renovation planned for Q4 2018 – Q2 2019 Hilton Tampa Westshore: Guestroom renovation underway, to be completed Q4 2018 Ritz Carlton Atlanta: Extensive renovation of guestrooms and Ritz Carlton Club Lounge to be completed Q1 2019 Residence Inn Orlando Sea World: Guestroom renovation to be completed Q3 2018 Hilton Garden Inn BWI: Guestroom renovation scheduled to commence in Q4 2018 Note: list is representative of upcoming or undergoing capital expenditures, but does not include all assets 25

Asset Management Initiatives – Upcoming Marriott Omaha: Refurbishment of lobby and restaurant expected to be completed Q4 2018 La Pavillion New Orleans: Public areas and restaurant refurbishment expected to be completed Q4 2018 Embassy Suites Crystal City: Full room refurbishment scheduled expected to start Q4 2018 Marriott DFW Airport: Guestroom renovation expected to begin Q4 2018 Hampton Inn Columbus: Guestroom renovation scheduled to commence in Q4 2018 W Atlanta: Restaurant re-concept and renovation scheduled for Q4 2018 Note: list is representative of upcoming or undergoing capital expenditures, but does not include all assets 26

Valuation VALUATION 160 1.5x 6.6x Discount to Discount to Discount to average peer average peer average peer trading cap trading EBITDA trading AFFO rate (bps) multiple multiple Sheraton Anchorage, AK TEV / 2018E EBITDA MULTIPLE(1),(2) PRICE / 2018E AFFO / SHARE MULTIPLE(1),(2) TTM CAP RATE(1) 17.0x 16.0x 8.5% 8.3% 15.6x 8.1% 15.1x 14.5x 15.0x 14.1x 8.0% 15.0x 13.6x 14.5x 7.5% 7.2% 13.0x 7.1% 11.7x 7.0% 11.6x 11.7x 6.9% 14.0x 11.0x 7.0% 13.4x 13.4x 6.7% 13.1x 11.0x 10.1x 9.7x 6.5% 6.2% 13.0x 12.8x 9.2x 6.1% 6.0% 12.3x 12.4x 9.0x 6.0% 11.9x 12.0x 11.8x 5.5% 7.0x 5.5% 5.1x 11.0x 5.0% 5.0x 4.5% 10.0x 3.0x RLJ AHT HST DRH CLDT SHO INN Peer HT CHSP LHO AHT RLJ HT INN CLDT DRH HST Peer CHSP SHO LHO 4.0% Avg Avg AHT RLJ CLDT DRH SHO INN Peer CHSP HST LHO HT (1) Balance sheet data as of June 30, 2018; stock price as of August 14, 2018 Avg (2) Based on consensus estimates 27 Source: SNL, Bloomberg, Company Filings

Key Takeaways Opportunistic platform focused on upper upscale, full-service hotels Valuation Disciplined capital Hilton, Embassy Suites, Parsippany, NJ opportunity management Walnut Creek, CA Value added Targets debt levels asset of 55-60% net management debt/gross assets Targets cash level Attractive Le Pavillon of 25-30% of total dividend yield New Orleans, LA equity market cap Highest insider ownership Ritz-Carlton, Atlanta, GA 28

September 2018