Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SAExploration Holdings, Inc. | saex-8k_20180906.htm |

Exhibit 4.1

WARRANT AGREEMENT

dated as of September 6, 2018

between

SAExploration Holdings, Inc.

and

Continental Stock Transfer & Trust Company,

as Warrant Agent

Page

|

Article 1 Definitions |

|

1 |

||||

|

|

|

Section 1.01 |

|

Certain Definitions |

|

1 |

|

|

|

|

||||

|

Article 2 Issuance, Execution and Transfer of Warrants |

|

8 |

||||

|

|

|

Section 2.01 |

|

Issuance and Delivery of Warrants |

|

8 |

|

|

|

Section 2.02 |

|

Reserved |

|

9 |

|

|

|

Section 2.03 |

|

Registration, Transfer, Exchange and Substitution |

|

9 |

|

|

|

Section 2.04 |

|

Reserved |

|

10 |

|

|

|

Section 2.05 |

|

Reserved |

|

10 |

|

|

|

Section 2.06 |

|

Limitations on Transfer |

|

10 |

|

|

|

|

||||

|

Article 3 Exercise and Settlement of Warrants |

|

12 |

||||

|

|

|

Section 3.01 |

|

Exercise of Warrants |

|

12 |

|

|

|

Section 3.02 |

|

Procedure for Exercise by Warrant Holder |

|

12 |

|

|

|

Section 3.03 |

|

Procedure for Mandatory Exercise |

|

14 |

|

|

|

Section 3.04 |

|

Settlement of Warrants |

|

14 |

|

|

|

Section 3.05 |

|

Delivery of Common Shares |

|

15 |

|

|

|

Section 3.06 |

|

No Fractional Common Shares to Be Issued |

|

16 |

|

|

|

Section 3.07 |

|

Acquisition of Warrants by Company |

|

17 |

|

|

|

Section 3.08 |

|

Validity of Exercise |

|

17 |

|

|

|

Section 3.09 |

|

Certain Calculations |

|

17 |

|

|

|

Section 3.10 |

|

Limitation on Exercise |

|

17 |

|

|

|

Section 3.11 |

|

Form and Delivery |

|

18 |

|

|

|

|

||||

|

Article 4 Adjustments |

|

18 |

||||

|

|

|

Section 4.01 |

|

Adjustments to Number of Common Shares |

|

18 |

|

|

|

Section 4.02 |

|

Adjustments to Number of Warrants |

|

21 |

|

|

|

Section 4.03 |

|

Certain Distributions of Rights and Warrants |

|

21 |

|

|

|

Section 4.04 |

|

Stockholder Rights Plans |

|

22 |

|

|

|

Section 4.05 |

|

Restrictions on Adjustments |

|

22 |

|

|

|

Section 4.06 |

|

Successor upon Consolidation, Merger and Sale of Assets |

|

23 |

|

|

|

Section 4.07 |

|

Adjustment upon Reorganization Event |

|

24 |

|

|

|

Section 4.08 |

|

Reserved |

|

26 |

|

|

|

Section 4.09 |

|

Common Shares Outstanding; Common Shares Reserved for Issuance on Exercise |

|

26 |

|

|

|

Section 4.10 |

|

Calculations; Instructions to Warrant Agent |

|

26 |

|

|

|

Section 4.11 |

|

Notice of Adjustments |

|

26 |

|

|

|

Section 4.12 |

|

Warrant Agent Not Responsible for Adjustments or Validity |

|

27 |

|

|

|

Section 4.13 |

|

Reserved |

|

27 |

|

|

|

|

||||

|

Article 5 Other Provisions Relating to the Rights of Warrant Holders |

|

27 |

||||

|

|

|

Section 5.01 |

|

No Rights as Stockholders |

|

27 |

i

TABLE OF CONTENTS

(continued)

Page

|

|

|

Section 5.02 |

|

Reserved |

|

27 |

|

|

|

Section 5.03 |

|

Modification, Waiver and Meetings |

|

28 |

|

|

|

Section 5.04 |

|

Notices of Date, etc |

|

29 |

|

|

|

Section 5.05 |

|

Rights as Warrant Holders |

|

29 |

|

|

|

Section 5.06 |

|

Tax Consequences |

|

29 |

|

|

|

Section 5.07 |

|

Dividends |

|

29 |

|

|

|

|

||||

|

Article 6 Representations of the Company |

|

29 |

||||

|

|

|

Section 6.01 |

|

Representations |

|

29 |

|

|

|

|

||||

|

Article 7 Concerning the Warrant Agent and Other Matters |

|

30 |

||||

|

|

|

Section 7.01 |

|

Payment of Certain Taxes |

|

30 |

|

|

|

Section 7.02 |

|

Reserved |

|

30 |

|

|

|

Section 7.03 |

|

Change of Warrant Agent |

|

30 |

|

|

|

Section 7.04 |

|

Compensation; Further Assurances |

|

31 |

|

|

|

Section 7.05 |

|

Reliance on Counsel |

|

32 |

|

|

|

Section 7.06 |

|

Proof of Actions Taken |

|

32 |

|

|

|

Section 7.07 |

|

Correctness of Statements |

|

32 |

|

|

|

Section 7.08 |

|

Validity of Agreement |

|

32 |

|

|

|

Section 7.09 |

|

Use of Agents |

|

33 |

|

|

|

Section 7.10 |

|

Liability of Warrant Agent |

|

33 |

|

|

|

Section 7.11 |

|

Legal Proceedings |

|

33 |

|

|

|

Section 7.12 |

|

Actions as Agent |

|

33 |

|

|

|

Section 7.13 |

|

Appointment and Acceptance of Agency |

|

33 |

|

|

|

Section 7.14 |

|

Successors and Assigns |

|

34 |

|

|

|

Section 7.15 |

|

Notices |

|

34 |

|

|

|

Section 7.16 |

|

Applicable Law; Jurisdiction |

|

34 |

|

|

|

Section 7.17 |

|

Waiver of Jury Trial |

|

35 |

|

|

|

Section 7.18 |

|

Benefit of this Warrant Agreement |

|

35 |

|

|

|

Section 7.19 |

|

Registered Warrant Holder |

|

35 |

|

|

|

Section 7.20 |

|

Headings |

|

35 |

|

|

|

Section 7.21 |

|

Counterparts |

|

35 |

|

|

|

Section 7.22 |

|

Entire Agreement |

|

36 |

|

|

|

Section 7.23 |

|

Severability |

|

36 |

|

|

|

Section 7.24 |

|

Termination |

|

36 |

|

|

|

Section 7.25 |

|

Confidentiality |

|

36 |

|

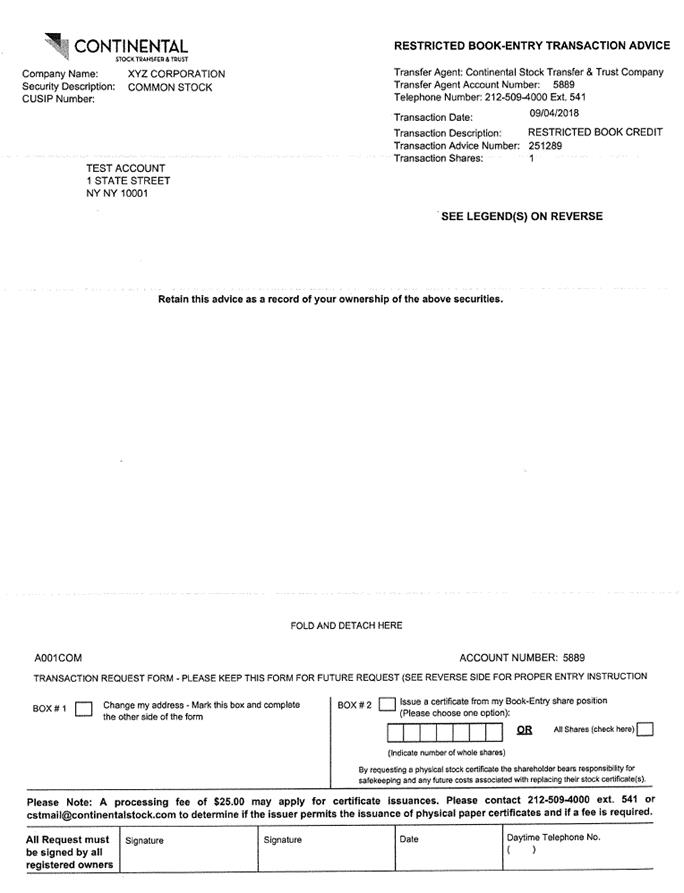

EXHIBIT A |

FORM OF WARRANT STATEMENT |

|

|

|

|

EXHIBIT B |

FORM OF EXERCISE NOTICE |

|

|

|

|

EXHIBIT C |

WARRANT AGENT FEE SCHEDULE |

ii

Warrant Agreement (as it may be amended from time to time, this “Warrant Agreement”), dated as of September 6, 2018, between SAExploration Holdings, Inc., a Delaware corporation (the “Company”), and Continental Stock Transfer & Trust Company, a New York corporation (the “Warrant Agent”).

WITNESSETH THAT:

WHEREAS, the Company is issuing Series E Warrants (the “Warrants”) to purchase shares of common stock, par value $0.0001 per share, of the Company (“Common Shares”) to certain eligible holders of record of the Company’s 8.0% Cumulative Perpetual Series A Preferred Stock.

WHEREAS, the Company desires the Warrant Agent to act on behalf of the Company, and the Warrant Agent is willing to so act, in connection with the issuance, exchange, Transfer (as defined below), substitution and exercise of the Warrants;

WHEREAS, the Company desires to provide for the terms upon which the Warrants shall be issued and exercised, and the respective rights, limitation of rights, and immunities of the Company, the Warrant Agent, and the holders of the Warrants;

WHEREAS, the Warrants have the terms and conditions set forth in this Warrant Agreement (including the Exhibits hereto); and

WHEREAS, all acts and things have been done and performed which are necessary to make the Warrants, when issued and delivered on behalf of the Company and registered on the books of the Warrant Agent as provided herein, the valid, binding and legal obligations of the Company, and to authorize the execution and delivery of this Warrant Agreement.

NOW THEREFORE in consideration of the mutual agreements herein contained, the Company and the Warrant Agent agree as follows:

Section 1.01Certain Definitions. As used in this Warrant Agreement, the following terms shall have their respective meanings set forth below:

“Affiliate” shall mean, with respect to any specified Person, any other Person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such first specified Person. For the purposes of this definition, “control” when used with respect to any Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

1

“Affiliated Buyer” means, with respect to an Asset Sale or tender offer, any Person (i) who is an Affiliate of the Company, (ii) who is an officer, director, employee or member of the Company or any Affiliate of the Company, or (iii) a majority of which Person’s total outstanding equity, upon consummation of such transaction, is held by Persons who are equity holders in the Company immediately prior to the consummation of such transaction.

“Appropriate Officer” means the Chief Executive Officer, President, the Chief Financial Officer, any Executive Vice President, any Senior Vice President or any Vice President, any Treasurer or Secretary of the Company.

“Asset Sale” has the meaning set forth in Section 4.06(c).

“Board” means the board of directors of the Company or any committee of such board duly authorized to exercise the power of the board of directors with respect to the matters provided for in this Warrant Agreement as to which the board of directors is authorized or required to act.

“Business Day” means any day other than (x) a Saturday or Sunday or (y) any day which is a legal holiday in the State of New York or a day on which banking institutions and trust companies in the state in which the Warrant Agent is located are authorized or obligated by Law, regulation or executive order to close.

“Cash” means such coin or currency of the United States as at any time of payment is legal tender for the payment of public and private debts.

“Change of Control” means the occurrence of any of the following: (i) the direct or indirect sale, lease, transfer, conveyance or other disposition (other than by way of merger or consolidation), in one or a series of related transactions, of all or substantially all of the properties or assets of the Company and its subsidiaries taken as a whole to any “person” (as that term is used in Section 13(d) of the Exchange Act) other than a Permitted Holder; (ii) the adoption or the approval by the holders of capital stock of a plan relating to the liquidation or dissolution of the Company; (iii) the consummation of any transaction (including, without limitation, any merger or consolidation), the result of which is that any person, other than a Permitted Holder, becomes the beneficial owner, directly or indirectly, of more than 50% of the Voting Stock of the Company, measured by voting power rather than number of shares; or (iv) the Company consolidates with, or merges with or into, any person, or any person consolidates with, or merges with or into, the Company, in any such event pursuant to a transaction in which any of the outstanding voting stock of the Company or such other person is converted into or exchanged for cash, securities or other property, other than any such transaction where the Voting Stock of the Company outstanding immediately prior to such transaction is converted into or exchanged for Voting Stock (other than Disqualified Stock (as defined in the Existing Indenture)) of the surviving or transferee person constituting a majority of the outstanding shares of such Voting Stock of such surviving or transferee person (immediately after giving effect to such issuance). For the avoidance of doubt, a Change of Control will not be deemed to have occurred if a Permitted Holder has the ability to appoint a majority of the Board of the Company, and none of the transactions contemplated by the RSA shall be deemed a Change of Control.

2

“Close of Business” means 5:00 p.m., New York City time.

“Closing Date” means September 6, 2018.

“Common Shares” has the meaning set forth in the recitals.

“Common Shares Deemed Outstanding” means, at any given time, the sum of (a) the number of Common Shares actually outstanding at such time, plus (b) the number of Common Shares issuable upon conversion or exchange of Convertible Securities actually outstanding at such time, regardless of whether the Convertible Securities are actually exercisable at such time, plus (c) the number of Common Shares reserved for issuance at such time under the Management Plan or any other equity incentive plan of the Company, regardless of whether the Common Shares are actually subject to outstanding options at such time or whether any outstanding options are actually exercisable at such time; provided, that Common Shares Deemed Outstanding at any given time shall not include shares owned or held by or for the account of the Company or any of its wholly-owned subsidiaries.

“Company” has the meaning set forth in the preamble.

“Company Order” means a written request or order signed in the name of the Company by any Appropriate Officer or other duly authorized officer of the Company and delivered to the Warrant Agent.

“Conversion Blocker” has the meaning set forth in Section 3.10.

“Convertible Securities” means options, rights, warrants or other securities convertible into or exchangeable or exercisable for Common Shares (including the Warrants).

“Domestic Restricted Warrant” means a Warrant issued in reliance on Regulation D or Section 4(a)(2) of the Securities Act.

“Equity Incentive Plans” means any equity incentive plans for officers, employees or directors of the Company, including the Management Plan.

“Exchange Act” means the Securities Exchange Act of 1934, as amended from time to time, and the related rules and regulations promulgated there under.

“Exchange Offer” means the Company’s exchange offer and consent solicitation related to the Company’s 10.000% Senior Secured Second Lien Notes due 2019 and the Company’s 10.000% Senior Secured Notes due 2019.

“Exercise Date” has the meaning, (i) with respect to exercise by a Warrant Holder, set forth in Section 3.02(b), and (ii) with respect to exercise by the Company, set forth in Section 3.03(b).

“Ex-Date” means with respect to a dividend or distribution to holders of the Common Shares, the first date on which the Common Shares can be traded without the right to receive such dividend or distribution.

3

“Exercise Notice” means, for any Warrant, an exercise notice substantially in the form set forth in Exhibit B hereto.

“Exercise Price” means $0.0001 per share.

“Existing Indenture” means the Indenture dated as of July 27, 2016, among the Company, its domestic subsidiaries party thereto and Wilmington Savings Fund Society, FSB, as trustee and noteholder collateral agent.

“Fair Value,” as of a specified date, means the price per Common Share, other Securities or other distributed property determined as follows:

(i) in the case of Common Shares or other Securities listed on the New York Stock Exchange or the NASDAQ Stock Market, the VWAP of a Common Share or a single unit of such other Security for the 20 Trading Days ending on, but excluding, the specified date (or if the Common Shares or other Security has been listed for less than 20 Trading Days, the VWAP for such lesser period of time);

(ii) in the case of Common Shares or other Securities not listed on the New York Stock Exchange or the NASDAQ Stock Market, the VWAP of a Common Share or a single unit of such other Security in composite trading for the principal U.S. national or regional securities exchange on which such securities are then listed for the 20 Trading Days ending on, but excluding, the specified date (or if the Common Shares or other Security has been listed for less than 20 Trading Days, the VWAP for such lesser period of time); or

(iii) in all other cases, the fair value per Common Share, other Securities or other distributed property as of a date not earlier than 10 Business Days preceding the specified date as determined in good faith by the Board and, if the Board elects to engage the same, upon the advice of an independent investment banking, financial advisory or valuation firm or appraiser selected by the Board (a “Representative”); provided, however, that

(iv) notwithstanding the foregoing, if the Board determines in good faith that the application of clauses (i) or (ii) of this definition would result in a VWAP based on the trading prices of a thinly-traded Security such that the price resulting therefrom may not represent an accurate measurement of the fair value of such Security, the Board at its election may apply the provisions of clause (iii) of this definition in lieu of the applicable clause (i) or (ii) with respect to the determination of the fair value of such Security.

“Full Physical Settlement” means the settlement method pursuant to which an exercising Warrant Holder shall be entitled to receive from the Company, for each Warrant exercised, a number of Common Shares equal to the Full Physical Share Amount in exchange for payment by the Warrant Holder of the applicable Exercise Price.

“Full Physical Share Amount” means, for each Warrant exercised as to which Full Physical Settlement is applicable, one Common Share.

4

“Fully Diluted Basis” means the issued and outstanding Common Shares of the Company, assuming the exercise or conversion of all outstanding Convertible Securities for cash, but excluding any Common Shares or Convertible Securities issued or issuable pursuant to (i) an Equity Incentive Plan, (ii) the Company’s outstanding Series A Warrants or (iii) the Company’s outstanding Series B Warrants.

“Fundamental Equity Change” has the meaning set forth in Section 4.06(a).

“Funds” has the meaning set forth in Section 3.02(d).

“Funds Account” has the meaning set forth in Section 3.02(d).

“Governmental Authority” means (a) any national, supranational, federal, state, provincial, county, municipal or local government or any entity exercising executive, legislative, judicial, quasi-judicial, arbitral, regulatory, taxing or administrative functions of or pertaining to government and (b) any agency, commission, division, bureau, department, court, tribunal, instrumentality, authority, quasi-governmental authority or other political subdivision of any government, entity or organization described in the foregoing clause (a), in each case, whether U.S. or non-U.S.

“Law” means any Order, law, statute, regulation, code, ordinance, policy, rule, consent decree, consent order or other requirement of any Governmental Authority.

“Management Plan” means the management incentive plan adopted by the Company which shall reserve 10%, on a Fully Diluted Basis, of the total outstanding Common Shares for distribution to covered employees, as amended, restated or otherwise modified from time to time.

“Net Share Amount” means for each Warrant exercised as to which Net Share Settlement is applicable, a fraction of a Common Share equal to (i) the Fair Value (as of the Exercise Date for such Warrant) of one Common Share minus the Exercise Price therefor divided by (ii) such Fair Value. The number of Common Shares issuable upon exercise, on the same Exercise Date, of Warrants as to which Net Share Settlement is applicable shall be aggregated, with any fractional Common Share rounded down to the nearest whole share as provided in Section 3.06. In no event shall the Company deliver a fractional Common Share in connection with an exercise of Warrants as to which Net Share Settlement is applicable.

“Net Share Settlement” means the settlement method pursuant to which an exercising Warrant Holder shall be entitled to receive from the Company, for each Warrant exercised, a number of Common Shares equal to the Net Share Amount without any payment of Cash therefor.

“Number of Warrants” means the “Number of Warrants” specified in the Warrant Register, subject to adjustment pursuant to Article 4.

“Officer’s Certificate” means a certificate signed by any Appropriate Officer or other duly authorized officer of the Company.

“Open of Business” means 9:00 a.m., New York City time.

5

“Order” means any award, injunction, judgment, decree, order, ruling, subpoena or verdict or other decision issued, promulgated or entered by or with a Governmental Authority of competent jurisdiction.

“Permitted Holders” means (a) Whitebox Advisors LLC, BlueMountain Capital Management, LLC, Highbridge Capital Management, LLC, Morgan Stanley Investment Management Inc., DuPont Capital Management, Amzak Capital Management, LLC, Minerva Advisors, Steven Roth, and any Related Party of any of the foregoing, (b) any Person acting in the capacity of an underwriter or initial purchaser in connection with a public or private offering of the capital stock of the Company or any direct or indirect parent entity or securities convertible into or exchangeable or exercisable for such capital stock, (c) any immediate family member of a Person (in the case of an individual) described in clause (a) above, (d) any trust, corporation, partnership, limited liability company or other entity, of whose Voting Stock more than 50% is beneficially owned by one or more of the Persons described in clauses (a), (b), and (c) and (e) any co-investor in any person described in clause (d) above.

“Person” means an individual, partnership, firm, corporation, limited liability company, business trust, joint stock company, trust, unincorporated association, joint venture, governmental authority or other entity of whatever nature.

“Record Date” means, with respect to any dividend, distribution or other transaction or event in which the holders of Common Shares have the right to receive any Cash, Securities or other property or in which Common Shares (or another applicable Security) are exchanged for or converted into, or any combination of, Cash, Securities or other property, the date fixed for determination of holders of Common Shares entitled to receive such Cash, Securities or other property or participate in such exchange or conversion (whether such date is fixed by the Board or by statute, contract or otherwise).

“Reference Property” has the meaning set forth in Section 4.07(a).

“Registration Rights Agreement” shall mean that certain Registration Rights Agreement, dated as of January 29, 2018, by and among the Company and certain holders of the Company’s Securities, entered into in conjunction with the Exchange Offer.

“Regulation D” means Regulation D promulgated under the Securities Act.

“Regulation S” means Regulation S promulgated under the Securities Act.

“Regulation S Warrant” means a Warrant issued pursuant to Regulation S.

“Related Party” of a Person means (1) any fund manager of such Person or any fund or account under common management with such Person, (2) any controlling equityholder of such Person and (3) any Person or entity of whose Voting Stock more than 50% is beneficially owned by such Person.

“Reorganization Event” has the meaning set forth in Section 4.07(a).

“Representative” has the meaning set forth in clause (iii) of the definition of Fair Value.

6

“Restricted Ownership Percentage” has the meaning set forth in Section 3.10.

“RSA” means the Restructuring Support Agreement dated as of December 19, 2017 among the Company and the Supporting Holders identified therein, as amended, restated or otherwise modified from time to time.

“SEC” means the United States Securities and Exchange Commission, or any other federal agency at the time administering the Securities Act or the Exchange Act, whichever is the relevant statute for the particular purpose.

“Securities” means (i) any capital stock (whether Common Shares or preferred stock, voting or non-voting), partnership, membership or limited liability company interest or other equity or voting interest, (ii) any right, option, warrant or other security or evidence of indebtedness convertible into, or exercisable or exchangeable for, directly or indirectly, any interest described in clause (i), (iii) any notes, bonds, debentures, trust receipts and other obligations, instruments or evidences of indebtedness, and (iv) any other “securities,” as such term is defined or determined under the Securities Act.

“Securities Act” means the Securities Act of 1933, as amended from time to time, and the related rules and regulations promulgated thereunder.

“Settlement Date” means, in respect of a Warrant that is exercised hereunder, the second Business Day immediately following the Exercise Date for such Warrant.

“Subsidiary” means, as to any Person, any corporation, partnership, limited liability company or other organization, whether incorporated or unincorporated, of which at least a majority of the securities or other interests having by their terms voting power to elect a majority of the Board or others performing similar functions with respect to such corporation or other organization is directly or indirectly beneficially owned or controlled by such party or by any one or more of its subsidiaries, or by such party and one or more of its subsidiaries.

“Trading Day” means each Monday, Tuesday, Wednesday, Thursday and Friday, other than any day on which Securities are not traded on the applicable securities exchange.

“Transfer” means, with respect to any Warrant, to directly or indirectly (whether by act, omission or operation of law), sell, exchange, transfer, hypothecate, negotiate, gift, convey in trust, pledge, assign, encumber, or otherwise dispose of, or by adjudication of a Person as bankrupt, by assignment for the benefit of creditors, by attachment, levy or other seizure by any creditor (whether or not pursuant to judicial process), or by passage or distribution of Warrants under judicial order or legal process, carry out or permit the transfer or other disposition of, all or any portion of such Warrant.

“Transfer Agent” means Continental Stock Transfer & Trust Company or its successors.

“Transferee” means a Person to whom any Warrant is Transferred.

“Unit of Reference Property” has the meaning set forth in Section 4.07(a).

7

“Voting Stock” of a person, as of any time, means the equity securities of such person that at such time is entitled to vote in the election of the board of directors (or similar governing body) of such person.

“VWAP” means, for any Trading Day, the price for Securities (including Common Shares) determined by the daily volume weighted average price per unit of such Securities for such Trading Day on the trading market on which such Securities are then listed or quoted, in each case, for the regular trading session (including any extensions thereof, without regard to pre-open or after hours trading outside of such regular trading session) as reported on the New York Stock Exchange or NASDAQ Stock Market, or if such Securities are not listed or quoted on the New York Stock Exchange or NASDAQ Stock Market, as reported by the principal U.S. national or regional securities exchange on which such Securities are then listed or quoted, whichever is applicable, as published by Bloomberg at 4:15 P.M., New York City time (or 15 minutes following the end of any extension of the regular trading session), on such Trading Day, or if such volume weighted average price is unavailable or in manifest error, the price per unit of such Securities using a volume weighted average price method selected by an independent nationally recognized investment bank or other qualified financial institution selected by the Board.

“Warrant” or “Warrants” means the warrants of the Company, each of which is exercisable for a single Common Share as provided herein, issued pursuant to this Warrant Agreement with the terms, conditions and rights set forth herein.

“Warrant Agent” has the meaning set forth in the preamble and shall include any successor warrant agent appointed in accordance with Section 7.03.

“Warrant Agreement” has the meaning set forth in the preamble.

“Warrant Holder” has the meaning set forth in Section 7.19.

“Warrant Register” has the meaning set forth in Section 2.03(a).

“Warrant Statement” has the meaning set forth in Section 2.01(a).

Article 2

Issuance, Execution and Transfer of Warrants

Section 2.01Issuance and Delivery of Warrants.

(a)On the Closing Date, the Company shall initially issue upon original issuance an aggregate of 94,813,594 Warrants (such Number of Warrants to be subject to adjustment from time to time as described herein) in accordance with the terms of this Warrant Agreement by delivering to the Warrant Agent a Company Order specifying such aggregate Number of Warrants so to be issued and the names of the respective original Persons entitled thereto. Each Warrant shall be exercisable (upon payment of the Exercise Price and compliance with the procedures set forth in this Warrant Agreement) for one Common Share. On the Closing Date, the Warrant Agent shall, upon receipt of such Company Order, register the issuance of

8

such Warrants by electronic entry registration in the Warrant Register. Upon such issuance, the Warrant Agent shall promptly deliver to the Warrant Holders a statement confirming the Number of Warrants held by such Warrant Holder as so registered on the Warrant Register, substantially in the form of Exhibit A herein (the “Warrant Statements”).

(b)All Warrants issued under this Warrant Agreement shall in all respects be equally and ratably entitled to the benefits hereof, without preference, priority, or distinction on account of the actual time of the issuance or any other terms thereof. Each Warrant shall be, and shall remain, subject to the provisions of this Warrant Agreement until such time as such Warrant shall have been duly exercised or shall have been canceled in accordance with the terms hereof. The Warrant Holder shall be bound by all of the terms and provisions of this Warrant Agreement as fully and effectively as if the Warrant Holder had signed the same.

(c)Any Warrant that is forfeited by a Warrant Holder or repurchased by the Company shall be deemed to be no longer outstanding for all purposes of this Warrant Agreement.

Section 2.02Reserved.

Section 2.03Registration, Transfer, Exchange and Substitution.

(a)The Company shall cause to be kept at the office of the Warrant Agent, and the Warrant Agent shall maintain, an electronic entry register (the “Warrant Register”) in which the Company shall provide for the registration of any Warrants and Transfers, exchanges and cancellations thereof and for changes in the Number of Warrants as provided herein. Any Warrant issued upon any registration of Transfer or exchange of or substitution for any Warrant shall be a valid obligation of the Company, evidencing the same obligations, and entitled to the same benefits under this Warrant Agreement, as any Warrant tendered or otherwise surrendered for such registration of Transfer, exchange or substitution.

(b)A Warrant may be Transferred upon the delivery of a written instruction of Transfer in form reasonably satisfactory to the Warrant Agent and the Company, duly executed by the Warrant Holder or by such Warrant Holder’s attorney, duly authorized in writing. No such Transfer shall be effected until, and the Transferee shall succeed to the rights of the Warrant Holder only upon, final acceptance and registration of the Transfer in the Warrant Register by the Warrant Agent. Upon such acceptance and registration, the Warrant Agent shall promptly deliver a Warrant Statement to such designated Transferee or Transferees. Prior to the registration of any Transfer of a Warrant by the Warrant Holder in the Warrant Register as provided herein, the Company, the Warrant Agent, and any agent of the Company or the Warrant Agent may treat the Person in whose name such Warrant is registered as the owner thereof for all purposes, notwithstanding any notice to the contrary. No service charge shall be made for any such registration of Transfer. A party requesting transfer of a Warrant must provide any evidence of authority that may be required by the Warrant Agent, including but not limited to, a signature guarantee from an eligible guarantor institution participating in a signature guarantee program approved by the Securities Transfer Association, Inc.

(c)Transfers hereunder shall be subject at all times to Section 2.06 hereof.

9

Section 2.05Cancellation of Warrants. The cancellation of any Warrant that has been exercised shall be registered effective as of the Exercise Date on the Warrant Register.

Section 2.06Limitations on Transfer.

(a)Notwithstanding any other provision of this Warrant Agreement, the Warrants, and the Common Shares issuable upon exercise thereof, have not been registered under the Securities Act and, accordingly, may not be resold or otherwise transferred within the United States or to, or for the account or benefit of, U.S. Persons (as defined in Regulation S under the Securities Act), except as set forth in the following sentence. The Warrant Holders may not sell or transfer any Warrants in the absence of an effective registration statement under the Securities Act or pursuant to an available exemption from the registration requirements of the Securities Act. By accepting a Warrant (whether at initial issuance or pursuant to a Transfer thereof), the recipient thereof agrees (A) that, prior to the expiration of the applicable holding period pursuant to Rule 144 under the Securities Act, it will not resell or otherwise transfer such Warrants except (1) to the Company or any Subsidiary thereof or (2) in accordance with an exemption from the registration requirements of the Securities Act (and based upon an opinion of counsel if the Company or the Warrant Agent so requests), and (B) to inform any subsequent Warrant Holder of the limitations on Transfer set forth in this Section 2.06, and shall instruct and direct each such Warrant Holder to conform to the restrictions set forth herein and shall maintain any applicable legends in its books and records. Any attempted or purported Transfer of all or a portion of the Warrants held by a Warrant Holder in violation of this Section 2.06 shall be null and void and of no force or effect whatsoever, such purported transferee will not be treated as an owner of the Warrants for purposes of this Warrant Agreement or otherwise, and the Warrant Agent will not register such Transfer in the Warrant Register. The Common Shares issuable in connection with the exercise of a Warrant shall be issued in accordance with Section 3.05(b) hereof. The Warrant Agent shall not be under any duty or responsibility to ensure compliance by the Company, any Warrant Holder or any other Person with any applicable U.S. federal or state securities laws.

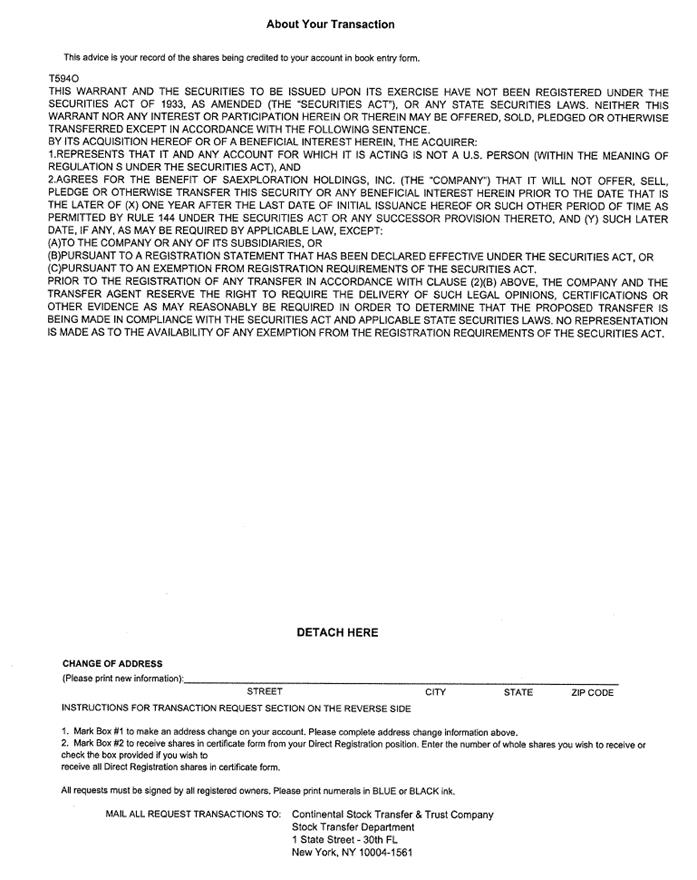

(b)Legend.

(1)Each Warrant Statement shall bear a legend in substantially the following form:

“THIS WARRANT AND THE SECURITIES TO BE ISSUED UPON ITS EXERCISE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS. NEITHER THIS WARRANT NOR ANY INTEREST OR PARTICIPATION HEREIN OR THEREIN MAY BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT IN ACCORDANCE WITH THE FOLLOWING SENTENCE.

10

BY ITS ACQUISITION HEREOF OR OF A BENEFICIAL INTEREST HEREIN, THE ACQUIRER:

1.REPRESENTS THAT IT AND ANY ACCOUNT FOR WHICH IT IS ACTING IS [AN “ACCREDITED INVESTOR” (WITHIN THE MEANING OF RULE 501(a) UNDER THE SECURITIES ACT) (AN “ACCREDITED INVESTOR”)] [NOT A U.S. PERSON (WITHIN THE MEANING OF REGULATION S UNDER THE SECURITIES ACT)], AND

2.AGREES FOR THE BENEFIT OF SAEXPLORATION HOLDINGS, INC. (THE “COMPANY”) THAT IT WILL NOT OFFER, SELL, PLEDGE OR OTHERWISE TRANSFER THIS SECURITY OR ANY BENEFICIAL INTEREST HEREIN PRIOR TO THE DATE THAT IS THE LATER OF (X) ONE YEAR AFTER THE LAST DATE OF INITIAL ISSUANCE HEREOF OR SUCH OTHER PERIOD OF TIME AS PERMITTED BY RULE 144 UNDER THE SECURITIES ACT OR ANY SUCCESSOR PROVISION THERETO, AND (Y) SUCH LATER DATE, IF ANY, AS MAY BE REQUIRED BY APPLICABLE LAW, EXCEPT:

(A)TO THE COMPANY OR ANY OF ITS SUBSIDIARIES, OR

(B)PURSUANT TO A REGISTRATION STATEMENT THAT HAS BEEN DECLARED EFFECTIVE UNDER THE SECURITIES ACT, OR

(C)PURSUANT TO AN EXEMPTION FROM REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.

PRIOR TO THE REGISTRATION OF ANY TRANSFER IN ACCORDANCE WITH CLAUSE (2)(B) ABOVE, THE COMPANY AND THE TRANSFER AGENT RESERVE THE RIGHT TO REQUIRE THE DELIVERY OF SUCH LEGAL OPINIONS, CERTIFICATIONS OR OTHER EVIDENCE AS MAY REASONABLY BE REQUIRED IN ORDER TO DETERMINE THAT THE PROPOSED TRANSFER IS BEING MADE IN COMPLIANCE WITH THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS. NO REPRESENTATION IS MADE AS TO THE AVAILABILITY OF ANY EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.”

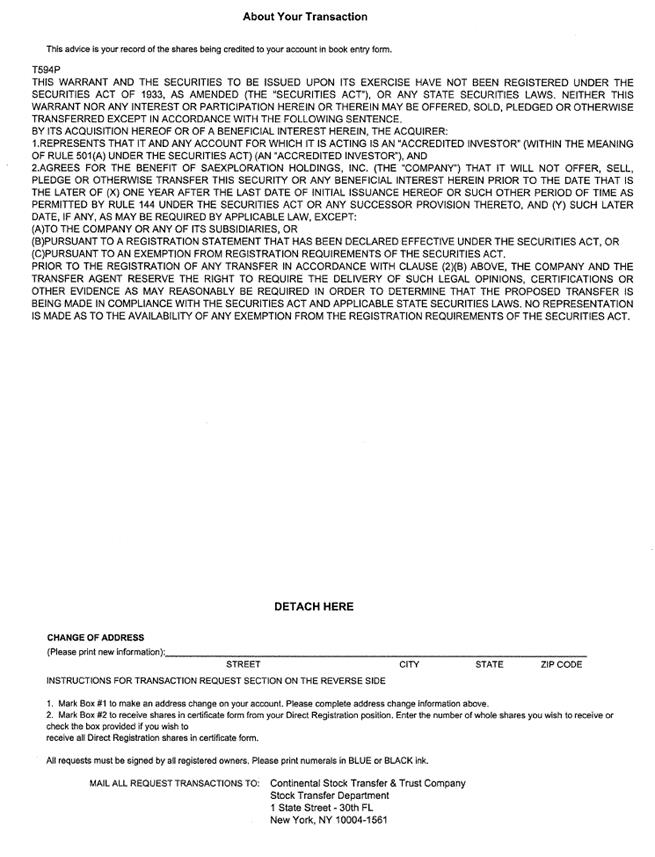

(2)Each certificate evidencing Common Stock in certificated form, and each transaction statement with respect to Common Stock in uncertificated form, shall bear a legend in substantially the following form:

“THIS SHARE OF COMMON STOCK HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS. NEITHER THIS SHARE OF COMMON STOCK NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT IN ACCORDANCE WITH THE FOLLOWING SENTENCE.

11

BY ITS ACQUISITION HEREOF OR OF A BENEFICIAL INTEREST HEREIN, THE ACQUIRER:

1.REPRESENTS THAT IT AND ANY ACCOUNT FOR WHICH IT IS ACTING IS [AN “ACCREDITED INVESTOR” (WITHIN THE MEANING OF RULE 501(a) UNDER THE SECURITIES ACT) (AN “ACCREDITED INVESTOR”)] [NOT A U.S. PERSON (WITHIN THE MEANING OF REGULATION S UNDER THE SECURITIES ACT)], AND

2.AGREES FOR THE BENEFIT OF SAEXPLORATION HOLDINGS, INC. (THE “COMPANY”) THAT IT WILL NOT OFFER, SELL, PLEDGE OR OTHERWISE TRANSFER THIS SECURITY OR ANY BENEFICIAL INTEREST HEREIN PRIOR TO THE DATE THAT IS THE LATER OF (X) ONE YEAR AFTER THE LAST DATE OF INITIAL ISSUANCE HEREOF OR SUCH OTHER PERIOD OF TIME AS PERMITTED BY RULE 144 UNDER THE SECURITIES ACT OR ANY SUCCESSOR PROVISION THERETO, AND (Y) SUCH LATER DATE, IF ANY, AS MAY BE REQUIRED BY APPLICABLE LAW, EXCEPT:

|

|

(A) |

TO THE COMPANY OR ANY OF ITS SUBSIDIARIES, OR |

|

|

(B) |

PURSUANT TO A REGISTRATION STATEMENT THAT HAS BEEN DECLARED EFFECTIVE UNDER THE SECURITIES ACT, OR |

|

|

(C) |

PURSUANT TO AN EXEMPTION FROM REGISTRATION REQUIREMENTS OF THE SECURITIES ACT. |

PRIOR TO THE REGISTRATION OF ANY TRANSFER IN ACCORDANCE WITH CLAUSE (2)(B) ABOVE, THE COMPANY AND THE TRANSFER AGENT RESERVE THE RIGHT TO REQUIRE THE DELIVERY OF SUCH LEGAL OPINIONS, CERTIFICATIONS OR OTHER EVIDENCE AS MAY REASONABLY BE REQUIRED IN ORDER TO DETERMINE THAT THE PROPOSED TRANSFER IS BEING MADE IN COMPLIANCE WITH THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS. NO REPRESENTATION IS MADE AS TO THE AVAILABILITY OF ANY EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.”

Article 3

Exercise and Settlement of Warrants

Section 3.01Exercise of Warrants. Subject to and upon compliance with the terms and conditions set forth herein, Warrants may be exercised immediately and at any time and from time to time, for the Common Shares obtainable thereunder. Only whole Warrants may be exercised.

Section 3.02Procedure for Exercise by Warrant Holder.

12

(a)To exercise each Warrant, a Warrant Holder must arrange for (i) the delivery of the Exercise Notice duly completed and executed to the principal office of the Warrant Agent and the Company, together with any evidence of authority that may be required by the Warrant Agent, including but not limited to, a signature guarantee from an eligible guarantor institution participating in a signature guarantee program approved by the Securities Transfer Association, Inc., (ii) if Full Physical Settlement is elected, payment to the Warrant Agent in an amount equal to the respective Exercise Price for each Common Share issuable upon exercise of each Warrant to be exercised together with all applicable taxes and charges thereto, and (iii) compliance with all other procedures established by the Warrant Agent for the exercise of Warrants.

(b)The date on which all the requirements for exercise set forth in this Section 3.02 in respect of a Warrant are satisfied is the “Exercise Date” for such Warrant.

(c)Subject to Section 3.02(e) and Section 3.02(f), any exercise of a Warrant by a Warrant Holder pursuant to the terms of this Warrant Agreement shall be irrevocable and enforceable in accordance with its terms.

(d)All funds received by the Warrant Agent under this Warrant Agreement that are to be distributed or applied by the Warrant Agent in the performance of services in accordance with this Warrant Agreement (the “Funds”) shall be held by the Warrant Agent as agent for the Company and deposited in one or more bank accounts to be maintained by the Warrant Agent in its name as agent for the Company (the “Funds Account”). Until paid pursuant to the terms of this Warrant Agreement, the Warrant Agent will hold the Funds through the Funds Account in deposit accounts of commercial banks with Tier 1 capital exceeding $1 billion or with an average rating above investment grade by S&P (LT Local Issuer Credit Rating), Moody’s (Long Term Rating) and Fitch Ratings, Inc. (LT Issuer Default Rating), each as reported by Bloomberg Finance L.P. The Warrant Agent shall have no responsibility or liability for any diminution of the Funds that may result from any deposit made by the Warrant Agent in accordance with this paragraph, including any losses resulting from a default by any bank, financial institution or other third party. The Warrant Agent may from time to time receive interest, dividends or other earnings in connection with such deposits. The Warrant Agent shall not be obligated to pay such interest, dividends or earnings to the Company, any Warrant Holder or any other party.

(e)In connection with any exercise of a Warrant by a Warrant Holder, the Company shall assist and cooperate with any Warrant Holder required to make any governmental filings or obtain any governmental approvals prior to or in connection with any exercise of a Warrant (including, without limitation, making any filings required to be made by the Company), and any exercise of a Warrant may be made contingent upon the making of any such filing and the receipt of any such approval.

(f)Notwithstanding any other provision of this Warrant Agreement, if the exercise of any Warrant by a Warrant Holder is to be made in connection with a registered public offering or a Change of Control, such exercise may, upon proper election in the Exercise Notice, be conditioned upon consummation of such transaction or event, in which case such exercise shall not be deemed effective until the consummation of such transaction or event.

13

(g)The Warrant Agent shall forward funds deposited in the Funds Account in a given month by the fifth Business Day of the following month by wire transfer to an account designated by the Company.

(h)Payment of the applicable Exercise Price by or on behalf of a Warrant Holder upon exercise of Warrants, in the case of Full Physical Settlement, shall be by federal wire or in lawful money of the United States, in good certified check or good bank draft payable to the order of the Warrant Agent.

Section 3.03Procedure for Mandatory Exercise.

(a)Subject to Section 3.10, upon a Change of Control and for a period of 30 days following such consummation, the Company may cause all (but not less than all) of the outstanding Warrants to be mandatorily exercised by issuing a press release for publication on the Dow Jones News Service or Bloomberg Business News (or if either such service is not available, another broadly disseminated news or press release service selected by the Company) announcing such mandatory exercise and specifying the terms of such mandatory exercise.

(b)The “Exercise Date” will be a date selected by the Company that will be no earlier than 5 Business Days and no later than 20 Business Days after the date on which the Company issues such press release.

(c)Net Share Settlement will apply to any Warrant exercised by the Company pursuant to this Section 3.03.

(d)In addition to any information required by applicable law or regulation, the press release and notice of mandatory exercise described in Section 3.03(a) shall state, as appropriate: (1) the Exercise Date; and (2) the number of shares of Common Stock to be issued upon exercise of each Warrant.

(e)On and after the Exercise Date established pursuant to Section 3.03(b), all rights of Holders of Warrants shall terminate except for the right to receive the whole shares of Common Stock issuable upon exercise thereof with any fractional Common Share rounded down to the nearest whole share as provided in Section 3.06.

Section 3.04Settlement of Warrants.

(a)Full Physical Settlement shall apply to each Warrant unless the Warrant Holder elects for Net Share Settlement to apply upon exercise of such Warrant or in the case of exercise by the Company pursuant to Section 3.03. Such election shall be made in the Exercise Notice for such Warrant.

(b)If Full Physical Settlement applies to the exercise of a Warrant, upon the proper and valid exercise thereof by a Warrant Holder, the Company shall cause to be delivered to the exercising Warrant Holder the Full Physical Settlement Amount on the Settlement Date, with any fractional Common Share rounded down to the nearest whole share as provided in Section 3.06.

14

(c)If Net Share Settlement applies to the exercise of a Warrant, upon the proper and valid exercise thereof by a Warrant Holder or the Company, the Company shall cause to be delivered to the Warrant Holder the Net Share Amount on the Settlement Date, with any fractional Common Share rounded down to the nearest whole share as provided in Section 3.06.

(d)If there is a dispute as to the determination of the applicable Exercise Price or the calculation of the number of shares of Common Shares to be delivered to an exercising Warrant Holder, the Company shall cause to be promptly delivered to the exercising Warrant Holder the number of Common Shares that is not in dispute.

Section 3.05Delivery of Common Shares.

(a)In connection with the exercise of Warrants by a Warrant Holder, the Warrant Agent shall:

(1)examine all Exercise Notices and all other documents delivered to it to ascertain whether, on their face, such Exercise Notices and any such other documents have been executed and completed in accordance with their terms;

(2)where an Exercise Notice or other document appears on its face to have been improperly completed or executed or some other irregularity in connection with the exercise of the Warrant exists, endeavor to inform the appropriate parties (including the Person submitting such instrument) of the need for fulfillment of all requirements, specifying those requirements which appear to be unfulfilled;

(3)inform the Company of and cooperate with and assist the Company in resolving any reconciliation problems between the Exercise Notices received and delivery of Warrants to the Warrant Agent’s account;

(4)advise the Company with respect to an exercise, no later than two Business Days following the satisfaction of each of the applicable procedures for exercise set forth in Section 3.02(a), of (v) the receipt of such Exercise Notice and the number of Warrants exercised in accordance with the terms and conditions of this Warrant Agreement, (w) the number of Common Shares to be delivered by the Company; (x) the instructions with respect to issuance of the Common Shares, subject to the timely receipt from the Warrant Holder of the necessary information, (y) the number of Persons who will become holders of record of the Company (who were not previously holders of record) as a result of receiving Common Shares upon exercise of the Warrants and (z) such other information as the Company shall reasonably require;

(5)promptly deposit in the Funds Account all Funds received in payment of the applicable Exercise Price in connection with Full Physical Settlement of Warrants; and

15

(6)provide to the Company, upon the Company’s request, the number of Warrants previously exercised, the number of Common Shares issued in connection with such exercises and the number of remaining outstanding Warrants.

(b)In connection with the mandatory exercise of Warrants by the Company, the Warrant Agent shall advise the Company of (1) the number of Common Shares to be delivered by the Company; (2) the instructions with respect to issuance of the Common Shares, subject to the timely receipt from the Warrant Holder of the necessary information, (3) the number of Persons who will become holders of record of the Company (who were not previously holders of record) as a result of receiving Common Shares upon exercise of the Warrants and (4) such other information as the Company shall reasonably require.

(c)If a registration statement covering the resale of the Common Shares issuable in connection with the exercise of a Warrant and naming the Warrant Holder as a selling stockholder thereunder is not effective or the Common Shares issued in connection with such exercise are not freely transferable without volume restrictions pursuant to Rule 144(b) under the Securities Act, with respect to each properly exercised Warrant in accordance with this Warrant Agreement, the Company shall, in accordance with the applicable Exercise Notice, effect an electronic delivery of the Common Shares with appropriate restrictive legends issuable in connection with such exercise to the Warrant Holder’s account. If a registration statement covering the resale of the Common Shares the Common Shares issuable in connection with the exercise of a Warrant and naming the Warrant Holder as a selling stockholder thereunder is effective or the Common Shares issued in connection with such exercise are freely transferable without volume restrictions pursuant to Rule 144(b) under the Securities Act, with respect to each properly exercised Warrant in accordance with this Warrant Agreement, the Company shall, in accordance with such Exercise Notice, effect an electronic delivery of the Common Shares free of restrictive legends issuable in connection with such exercise to the Warrant Holder’s account. The Person on whose behalf and in whose name any Common Shares are registered shall for all purposes be deemed to have become the holder of record of such Common Shares as of the Close of Business on the applicable Exercise Date.

(d)If a registration statement covering a resale of Common Shares issued in connection with properly exercised Warrants is not effective and the Warrant Holder directs the Company to deliver the Common Shares issued in connection with such exercise in a name other than that of the Warrant Holder or an Affiliate of the Warrant Holder, such Warrant Holder shall deliver to the Company on the Exercise Date an opinion of counsel reasonably satisfactory to the Company to the effect that the issuance of such Common Shares in such other name may be made pursuant to an available exemption from the registration requirements of the Securities Act and all applicable state securities or blue sky laws.

(e)Promptly after the Warrant Agent shall have taken the action required by this Section 3.05 (or at such later time as may be mutually agreeable to the Company and the Warrant Agent), the Warrant Agent shall account to the Company with respect to the consummation of any exercise of any Warrants.

Section 3.06No Fractional Common Shares to Be Issued.

16

(a)Notwithstanding anything to the contrary in this Warrant Agreement, the Company shall not be required to issue any fraction of a Common Share upon exercise of any Warrants.

(b)If any fraction of a Common Share would, except for the provisions of this Section 3.06, be issuable on the exercise of any Warrants, the Company shall instead round down to the nearest whole share the number of Common Shares that such Person designated in the applicable Exercise Notice shall receive. All Warrants exercised by a Warrant Holder on the same Exercise Date shall be aggregated for purposes of determining the number of Common Shares to be delivered pursuant to this Article 3.

(c)Each Warrant Holder, by its acceptance of an interest in a Warrant, expressly waives its right to any fraction of a Common Share upon its exercise of such Warrant.

Section 3.07Acquisition of Warrants by Company. The Company shall have the right, except as limited by Law, to offer to purchase or otherwise to offer to acquire one or more Warrants at such times, in such manner and for such consideration as it may deem appropriate.

Section 3.08Validity of Exercise. All questions as to the validity, form and sufficiency (including time of receipt) of a Warrant exercise shall be determined by the Company, which determination shall be final and binding with respect to the Warrant Agent. The Warrant Agent shall incur no liability for or in respect of and, except to the extent such liability arises from the Warrant Agent’s gross negligence, willful misconduct or bad faith (as determined by a court of competent jurisdiction in a final non-appealable judgment), shall be indemnified and held harmless by the Company for acting or refraining from acting upon, or as a result of such determination by the Company. The Company reserves the absolute right to waive any of the conditions to the exercise of Warrants or defects in Exercise Notices with regard to any particular exercise of Warrants.

Section 3.09Certain Calculations.

(a)The Warrant Agent shall be responsible for performing all calculations, save for in the case of Net Share Settlements, required in connection with the exercise and settlement of the Warrants as described in this Article 3. In connection therewith, the Warrant Agent shall provide prompt written notice to the Company, in accordance with Section 3.05(a)(4) and Section 3.05(b), of the number of Common Shares deliverable upon exercise and settlement of Warrants. For the avoidance of doubt, the Warrant Agent shall not be responsible for performing the calculations set forth in Article 4.

(b)The Warrant Agent shall not be accountable with respect to the validity or value of any Common Shares or Units of Reference Property that may at any time be issued or delivered upon the exercise of any Warrant, and it makes no representation with respect thereto. The Warrant Agent shall not be responsible, to the extent not arising from the Warrant Agent’s gross negligence, willful misconduct or bad faith (as determined by a court of competent jurisdiction in a final non-appealable judgment), for any failure of the Company to issue, transfer or deliver any Common Shares or Units of Reference Property, or to comply with any of the covenants of the Company contained in this Article 3.

17

Section 3.10Limitation on Exercise. Except in the context of a Change in Control, a Warrant Holder that owns less than 10% of the shares of the Company’s Common Shares outstanding and is not otherwise an Affiliate of the Company will not have the right to exercise such Warrant and such Warrant shall not be exercisable by the Company, for so long as the Common Shares are registered under the Exchange Act, if and to the extent that after giving effect to such exercise, such Person (together with such Person’s Affiliates) or any “group” (within the meaning of Section 13(d) of the Exchange Act) that includes such person would beneficially own in excess of 9.99% (the “Restricted Ownership Percentage”) of the shares of Common Shares outstanding immediately after giving effect to such exercise (the “Conversion Blocker”); provided, that the Conversion Blocker shall continue to apply to Blue Mountain Capital Management, LLC and its affiliates (which, for the avoidance of doubt, shall not include the Company and its other affiliates) that are Holders at any time when Blue Mountain Capital Management, LLC and its affiliates are Affiliates of the Company. Each Warrant Holder shall have the right at any time and from time to time to reduce the Restricted Ownership Percentage applicable to such Warrant Holder immediately upon prior written notice to the Company or increase the Restricted Ownership Percentage applicable to such holder upon 61 days’ prior written notice to the Company.

Section 3.11Form and Delivery. Notwithstanding anything to the contrary herein, (i) unless otherwise agreed by the Company and the Warrant Holder, the Common Shares into which the Warrants convert shall be in uncertificated, book entry form as permitted by the bylaws of the Company and the Delaware General Corporation Law, and (ii) delivery of Common Shares upon exercise of a Warrant shall be made to the applicable Warrant Holder through the facilities of The Depository Trust Company as reasonably directed by such Warrant Holder, unless such Warrant Holder shall otherwise request that such Common Shares into which the Warrants convert be registered in the Warrant Holder’s name in book entry form on the Transfer Agent’s records.

Section 4.01Adjustments to Number of Common Shares. After the date on which the Warrants are first issued and while any Warrants remain outstanding and unexpired, the number of Common Shares issuable upon exercise of the Warrants shall be subject to adjustment (without duplication) upon the occurrence of any of the following events:

(a)The issuance of Common Shares as a dividend or distribution to all holders of Common Shares, or a subdivision, combination, split, reverse split or reclassification of the outstanding Common Shares into a greater or smaller number of Common Shares, in which event the number of Common Shares issuable upon exercise of the Warrants shall be adjusted based on the following formula:

|

E1 = E0 x N1 |

|

|

N0 |

|

where:

18

|

E0 = |

the number of Common Shares issuable upon exercise of the Warrants in effect immediately prior to (i) the Open of Business on the Ex-Date in the case of a dividend or distribution or (ii) the consummation of the transaction in the case of a subdivision, combination, split, reverse split or reclassification; |

|

N0 = |

the number of Common Shares Deemed Outstanding immediately prior to (i) the Open of Business on the Record Date in the case of a dividend or distribution or (ii) the consummation of the transaction in the case of a subdivision, combination, split, reverse split or reclassification; and |

|

N1 = |

the number of Common Shares equal to (i) in the case of a dividend or distribution, the sum of the number of Common Shares Deemed Outstanding immediately prior to the Open of Business on the Record Date for such dividend or distribution plus the total number of Common Shares issued pursuant to such dividend or distribution or (ii) in the case of a subdivision, combination, split, reverse split or reclassification, the number of Common Shares Deemed Outstanding immediately after such subdivision, combination, split, reverse split or reclassification. |

Such adjustment shall become effective immediately after (i) the Open of Business on the Ex-Date in the case of a dividend or distribution or (ii) the consummation of the transaction in the case of a subdivision, combination, split, reverse split or reclassification. If any dividend or distribution or subdivision, combination, split, reverse split or reclassification of the type described in this Section 4.01(a) is declared or announced but not so paid or made, the number of Common Shares issuable upon exercise of the Warrants shall again be adjusted to the number of Common Shares issuable upon exercise of the Warrants that would then be in effect if such dividend or distribution or subdivision, combination, split, reverse split or reclassification had not been declared or announced, as the case may be.

(c)The issuance as a dividend or distribution to all holders of Common Shares of evidences of indebtedness, Securities of the Company or any other Person (other than Common Shares), Cash rights, options or warrants entitling such holders of Common Shares to subscribe for or purchase Common Shares at less than the market value thereof, preferred stock, common stock of or related to a subsidiary or other business unit or other property (excluding (i) any dividend or distribution covered by Section 4.01(a), (ii) any rights, options or warrants covered by Section 4.03, (iii) any consideration payable in connection with Section 4.01(d), or (iv) any dividend of preferred stock, or common stock of or related to a subsidiary or other business unit in the case of transactions described in Section 4.07, in which event the Exercise Price will be adjusted in the reasonable discretion of the Board to appropriately ensure that the economic and other benefits of the Warrants are preserved and protected after taking into account the transaction that triggers this Section 4.01(c). Such actions may include the

19

distribution of rights, options, warrants or other consideration or property to holders of Warrants on an as-exercised basis.

Such adjustment shall become effective immediately after the Open of Business on the Ex-Date for such dividend or distribution. In the event that such dividend or distribution is declared or announced but not so paid or made, the Exercise Price shall again be adjusted to be the Exercise Price which would then be in effect if such distribution had not been declared or announced.

(d)The payment in respect of any tender offer or exchange offer by the Company for Common Shares, where the cash and Fair Value of any other consideration included in the payment per Common Share exceeds the Fair Value of a Common Share as of the open of business on the second business day preceding the expiration date of the tender or exchange offer (the “Offer Expiration Date”), in which event the Exercise Price will be adjusted in the reasonable discretion of the Board to appropriately ensure that the economic and other benefits of the Warrants are preserved and protected after taking into account the transaction that triggers this Section 4.01(d). Such actions may include the distribution of rights, options, warrants or other consideration or property to holders of Warrants on an as-exercised basis.

Such adjustment shall become effective immediately after the Close of Business on the Offer Expiration Date. In the event that the Company or a Subsidiary of the Company is obligated to purchase Common Shares pursuant to any such tender offer or exchange offer, but the Company or such Subsidiary is permanently prevented by applicable Law from effecting any such purchases, or all such purchases are rescinded, then the Exercise Price shall again be adjusted to be the Exercise Price which would then be in effect if such tender offer or exchange offer had not been made. Except as set forth in the preceding sentence, if the application of this clause (d) to any tender offer or exchange offer would result in an increase in the Exercise Price, no adjustment shall be made for such tender offer or exchange offer under this clause (d).

(e)If any single action would require adjustment of the Exercise Price pursuant to more than one subsection of this Section 4.01, only one adjustment shall be made and such adjustment shall be the amount of adjustment that has the highest, relative to the rights and interests of the registered holders of the Warrants then outstanding, absolute value. For the purpose of calculations pursuant to Section 4.01, the number of Common Shares outstanding shall be equal to the sum of (i) the number of Common Shares issued and outstanding and (ii) the number of Common Shares issuable pursuant to the conversion or exercise of Convertible Securities that are outstanding, in each case on the applicable date of determination.

(f)The Company may from time to time, to the extent permitted by Law, decrease the Exercise Price and/or increase the Number of Warrants by any amount for any period of at least twenty days. In that case, the Company shall give the Warrant Holders and the Warrant Agent at least ten days’ prior written notice of such increase or decrease, and such notice shall state the applicable decreased Exercise Price and/or increased Number of Warrants and the period during which the decrease and/or increase will be in effect. The Company may make such decreases in the Exercise Price and/or increases in the Number of Warrants, in addition to those set forth in this Article 4, as the Board deems advisable, including to avoid or

20

diminish any income tax to holders of the Common Shares resulting from any dividend or distribution of stock (or rights to acquire stock) or from any event treated as such for income tax purposes.

(g)Notwithstanding this Section 4.01 or any other provision of this Warrant Agreement or the Warrants, if an Exercise Price adjustment becomes effective on any Ex-Date, and a Warrant has been exercised on or after such Ex-Date and on or prior to the related Record Date resulting in the Person issued Common Shares being treated as the record holder of the Common Shares on or prior to the Record Date, then, notwithstanding the Exercise Price adjustment provisions in this Section 4.01, the Exercise Price adjustment relating to such Ex-Date will not be made with respect to such Warrant. Instead, such Person will be treated as if it were the record owner of Common Shares on an un-adjusted basis and participate in the related dividend, distribution or other event giving rise to such adjustment. Notwithstanding this Section 4.01 or any other provision of this Warrant Agreement or the Warrants, the Exercise Price shall never be less than the par value of the Common Shares.

(h)Notwithstanding anything to the contrary contained in Section 4.01, if, as a result of an adjustment pursuant to Section 4.01, the par value per Common Share would be greater than the Exercise Price, then the Exercise Price shall be an amount equal to the par value per Common Share but the number of shares the holder of a Warrant shall be entitled to purchase shall be such greater number of Common Shares as would have resulted from the Exercise Price that, absent such limitation, would have been in effect pursuant to this Section 4.

Section 4.02Adjustments to Number of Warrants. Concurrently with any adjustment to the Exercise Price under Section 4.01 (except for any adjustment pursuant to Section 4.01(a)), the Number of Warrants will be adjusted such that the Number of Warrants in effect immediately following the effectiveness of such adjustment will be equal to the Number of Warrants in effect immediately prior to such adjustment, multiplied by a fraction, (i) the numerator of which is the applicable Exercise Price in effect immediately prior to such adjustment and (ii) the denominator of which is the applicable Exercise Price in effect immediately following such adjustment. Upon any such adjustment to the Number of Warrants, the Warrant Agent shall (i) increase or decrease, as applicable, the Number of Warrants specified on the Warrant Register to which each Warrant Holder is entitled and (ii) promptly deliver a Warrant Statement to each Warrant Holder specifying the resulting Number of Warrants held by such Warrant Holder. The Company may, from time to time, at its sole discretion, increase the number of shares of Common Shares issuable upon the exercise of a Warrant for a period of not less than 20 Trading Days. After the expiration of such period, the number of shares of Common Shares issuable upon exercise of a Warrant shall revert to the number of such shares issuable upon exercise as of immediately prior to such period.

Section 4.03Certain Distributions of Rights and Warrants.

(a)Rights or warrants distributed by the Company to all holders of Common Shares entitling the holders thereof to subscribe for or purchase the Company’s Securities (either initially or under certain circumstances), which rights or warrants, until the occurrence of a specified event or events (a “Trigger Event”):

21

(1)are deemed to be transferred with such Common Shares;

(3)are also issued in respect of future issuances of Common Shares,

shall be deemed not to have been distributed for purposes of Article 4 (and no adjustment to the Exercise Price or the Number of Warrants under this Article 4 will be made) until the occurrence of the earliest Trigger Event, whereupon such rights and warrants shall be deemed to have been distributed and an appropriate adjustment (if any is required) to the Exercise Price and the Number of Warrants shall be made under this Article 4 (subject in all respects to Section 4.04).

(b)If any such right or warrant is subject to events, upon the occurrence of which such rights or warrants become exercisable to purchase different securities, evidences of indebtedness or other assets, then the date of the occurrence of any and each such event shall be deemed to be the date of distribution and Record Date with respect to new rights or warrants with such rights (subject in all respects to Section 4.04).

(c)In addition, except as set forth in Section 4.04, in the event of any distribution (or deemed distribution) of rights or warrants, or any Trigger Event or other event (of the type described in Section 4.03(b)) with respect thereto that was counted for purposes of calculating a distribution amount for which an adjustment to the Exercise Price and the Number of Warrants under Article 4 was made (including any adjustment contemplated in Section 4.04):

(1)in the case of any such rights or warrants that shall all have been redeemed or repurchased without exercise by the holders thereof, the Exercise Price and the Number of Warrants shall be readjusted upon such final redemption or repurchase to give effect to such distribution or Trigger Event, as the case may be, as though it were a distribution under Section 4.01(c), equal to the per share redemption or repurchase price received by a holder or holders of Common Shares with respect to such rights or warrants (assuming such holder had retained such rights or warrants), made to all holders of Common Shares as of the date of such redemption or repurchase; and

(2)in the case of such rights or warrants that shall have expired or been terminated without exercise by the holders thereof, the Exercise Price and the Number of Warrants shall be readjusted as if such rights and warrants had not been issued or distributed.

Section 4.04Stockholder Rights Plans. If the Company has a stockholder rights plan in effect with respect to the Common Shares, upon exercise of a Warrant the holder shall be entitled to receive, in addition to the Common Shares, the rights under such stockholder rights plan, unless, prior to such exercise, such rights have separated from the Common Shares.

Section 4.05Restrictions on Adjustments.

22

(a)Except in accordance with Section 4.01, the Exercise Price and the Number of Warrants will not be adjusted for the issuance of Common Shares or other Securities of the Company.

(b)For the avoidance of doubt, neither the Exercise Price nor the Number of Warrants will be adjusted:

(1)upon the issuance of any Common Shares or other Securities or any payments pursuant to the Management Plan or any other equity incentive plan of the Company;

(2)upon any issuance of any Common Shares (or Convertible Securities) pursuant to the exercise or conversion, as applicable, of the Warrants, the Company’s Series A Warrants, the Company’s Series B Warrants, the Company’s Series C Warrants, or the Company’s Series D Warrants;

(3)upon the issuance of Common Shares or other Securities of the Company in connection with a business acquisition transaction (except to the extent otherwise expressly required by this Warrant Agreement); or

(4)upon any dividend or distribution made by the Company in accordance with Section 5.07.

(c)No adjustment shall be made to the Exercise Price or the Number of Warrants for any of the transactions described in Section 4.01 if the Company makes provisions for participation in any such transaction with respect to Warrants without exercise of such Warrants on the same basis as with respect to Common Shares with notice that the Board determines in good faith to be fair and appropriate.

(e)No adjustment shall be made to the Exercise Price, nor will any corresponding adjustment be made to the Number of Warrants, unless the adjustment would result in a change of at least 1% of the Exercise Price; provided, however, that any adjustment of less than 1% that was not made by reason of this Section 4.05(e) shall be carried forward and made as soon as such adjustment, together with any other adjustments not previously made by reason of this Section 4.05(e), would result in a change of at least 1% in the aggregate. All calculations under this Article 4 shall be made to the nearest cent or to the nearest 1/100th of a Common Share, as the case may be.

(f)If the Company takes a record of the holders of Common Shares for the purpose of entitling them to receive a dividend or other distribution, and thereafter (and before the dividend or distribution has been paid or delivered to members) legally abandons its plan to pay or deliver such dividend or distribution, then thereafter no adjustment to the Exercise Price or the Number of Warrants then in effect shall be required by reason of the taking of such record.

Section 4.06Successor upon Consolidation, Merger and Sale of Assets.

23

(a)The Company may consolidate or merge with another Person (a “Fundamental Equity Change”) only (i) if the Company is the surviving Person or (ii), if the Company is not the surviving Person, then:

(1)the successor to the Company assumes all of the Company’s obligations under this Warrant Agreement and the Warrants, other than as provided in Section 4.07, shall become exercisable into the common stock or other common equity of the successor; and

(2)the successor to the Company provides written notice of such assumption to the Warrant Agent promptly following the Fundamental Equity Change.

(b)In the case of a Fundamental Equity Change, the successor Person to the Company shall succeed to and be substituted for the Company with the same effect as if it had been named herein as the Company, and the Company shall thereupon be released from all obligations and covenants under this Warrant Agreement and the Warrants. Such successor Person shall provide in writing to the Warrant Agent such identifying corporate information as may be reasonably requested by the Warrant Agent. Such successor Person thereafter may cause to be signed, and may issue any or all of, the Warrants issuable pursuant to this Warrant Agreement which theretofore shall not have been issued by the Company; and, upon the order of such successor Person, instead of the Company, and subject to all the terms, conditions and limitations in this Warrant Agreement, the Warrant Agent shall authenticate and deliver, as applicable, any Warrants that previously shall have been signed and delivered by the officers of the Company to the Warrant Agent for authentication, and any Warrants which such successor Person thereafter shall cause to be signed and delivered to the Warrant Agent for such purpose.