Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Engility Holdings, Inc. | d621868dex993.htm |

| EX-99.2 - EX-99.2 - Engility Holdings, Inc. | d621868dex992.htm |

| EX-99.1 - EX-99.1 - Engility Holdings, Inc. | d621868dex991.htm |

| 8-K - 8-K - Engility Holdings, Inc. | d621868d8k.htm |

Exhibit 99.4

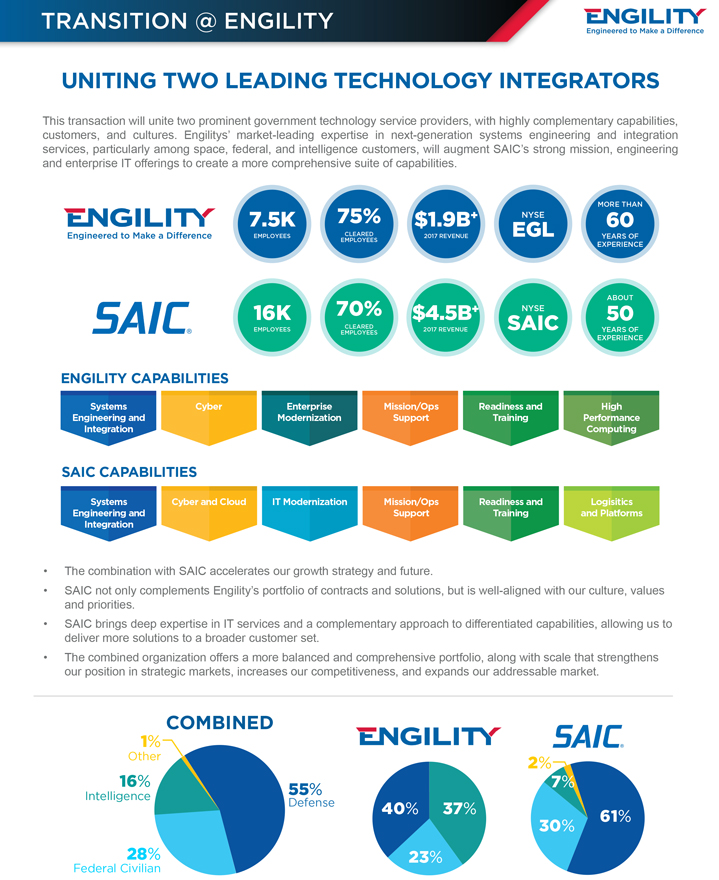

UNITING TWO LEADING TECHNOLOGY INTEGRATORS This transaction will unite two prominent government technology service providers, with highly complementary capabilities, customers, and cultures. Engilitys’ market-leading expertise in next-generation systems engineering and integration services, particularly among space, federal, and intelligence customers, will augment SAIC’s strong mission, engineering and enterprise IT offerings to create a more comprehensive suite of capabilities. MORE THAN 60 YEARS OF EXPERIENCE 75% CLEARED EMPLOYEES $1.9B+ 2017 REVENUE 7.5K EMPLOYEES NYSE EGL ABOUT 50 YEARS OF EXPERIENCE 70% CLEARED EMPLOYEES $4.5B+ 2017 REVENUE 16K EMPLOYEES NYSE SAIC ENGILITY CAPABILITIES High Performance Computing Systems Engineering and Integration Cyber Enterprise Modernization Mission/Ops Support Readiness and Training SAIC CAPABILITIES IT Modernization Systems Engineering and Integration Cyber and Cloud Mission/Ops Support Readiness and Training Logisitics and Platforms The combination with SAIC accelerates our growth strategy and future. SAIC not only cocmplements Engility’s portfolio of contracts and solutions, but is well-aligned with our culture, values and priorities. SAIC brings deep expertise in IT services and a complementary approach to differentiated capabilities, allowing us to deliver more solutions to a broader customer set. The combined organization offers a more balanced and comprehensive portfolio, along with scale that strengthens our position in strategic markets, increases our competitiveness, and expands our addressable market. COMBINED 1% Other 2% 7% 16% 55% Intelligence 40% 37% Defense 61% 30% 23% 28% Federal Civilian

No Offer or Solicitation This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Additional Information and Where to Find It In connection with the proposed acquisition of Engility, SAIC will file with the SEC a registration statement on Form S-4 to register the shares of SAIC common stock to be issued in connection with the merger. The registration statement will include a joint proxy statement/prospectus which will be sent to the shareholders of SAIC and Engility seeking their approval of the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THESE DOCUMENTS DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT SAIC, ENGILITY, AND THE PROPOSED TRANSACTION. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from SAIC at its website, www.saic.com, or from Engility at its website, www.engility.com. Participants in Solicitation SAIC, Engility, and their respective directors, executive officers, and other employees may be deemed to be participants in the solicitation of proxies from the stockholders of SAIC and Engility in connection with the proposed transaction. Information about SAIC’s executive officers and directors is set forth in its Annual Report on Form 10-K, which was filed with the SEC on March 29, 2018 and its proxy statement for its 2018 annual meeting of stockholders, which was filed with the SEC on April 25, 2018. Information about Engility’s executive officers and directors is set forth in its Annual Report on Form 10-K, which was filed with the SEC on March 2, 2018, and the proxy statement for its 2018 annual meeting of stockholders, which was filed with the SEC on April 13, 2018. Investors may obtain more detailed information regarding the direct and indirect interests of SAIC, Engility, and their respective executive officers and directors in the transaction by reading the preliminary and definitive joint proxy statement/prospectus regarding the transaction, which will be filed with the SEC. Forward-Looking Statements Certain statements in this written communication contain or are based on “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995 that involves risks and uncertainties concerning the proposed transaction between SAIC and Engility, SAIC’s and Engility’s expected financial performance, and SAIC’s and Engility’s strategic and operational plans. In some cases, you can identify forward-looking statements by words such as “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” and similar words or phrases. Forward-looking statements in this written communication include, among others, statements regarding benefits of the proposed acquisition (including anticipated future financial operating performance and results), estimates of future revenues, operating income, earnings, earnings per share, charges, backlog, outstanding shares and cash flows, as well as statements about future dividends, share repurchases and other capital deployment plans. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Actual performance and results may differ materially from the forward-looking statements made in this written communication depending on a variety of factors, including: the possibility that the transaction will not close or that the closing may be delayed; the possibility that SAIC or Engility may be unable to obtain stockholder approval as required for the transaction or that the other conditions to the closing of the transaction may not be satisfied; the risk that Engility will not be integrated successfully into SAIC following the consummation of the acquisition and the risk that revenue opportunities, cost savings, synergies and other anticipated benefits from the merger may not be fully realized or may take longer to realize than expected, diversion of management’s attention from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from the acquisition, difficulties in entering markets in which we have previously had limited direct prior experience, the potential loss of customers and other business partners following announcement of the acquisition, our ability to obtain financing on anticipated terms, compliance with new bank financial and other covenants, assumption of the known and unknown liabilities of the acquired company, recordation of goodwill and nonamortizable intangible assets subject to regular impairment testing and potential impairment charges, incurrence of amortization expenses related to certain intangible assets, assumption that we will enjoy material future tax benefits acquired in connection with the acquisition, developments in the U.S. government defense and intelligence community budgets, including budget reductions, implementation of spending cuts (sequestration) or changes in budgetary priorities; delays in the U.S. government budget process or approval to raise the U.S. debt ceiling; delays in the U.S. government contract procurement process or the award of contracts; delays or loss of contracts as result of competitor protests; changes in U.S. government procurement rules, regulations and practices; our compliance with various U.S. government and other government procurement rules and regulations; governmental reviews, audits and investigations of our company; our ability to effectively compete and win contracts with the U.S. government and other customers; our ability to attract, train and retain skilled employees, including our management team, and to retain and obtain security clearances for our employees; our ability to accurately estimate costs associated with our firm-fixed-price and other contracts; cybersecurity, data security or other security threats, systems failures or other disruptions of our business; resolution of legal and other disputes with our customers and others or legal or regulatory compliance issues, including in relation to the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement; our ability to effectively deploy capital and make investments in our business; our ability to maintain relationships with prime contractors, subcontractors and joint venture partners; our ability to manage performance and other risks related to customer contracts; the adequacy of our insurance programs designed to protect us from significant product or other liability claims; our ability to declare future dividends based on our earnings, financial condition, capital requirements and other factors, including compliance with applicable laws and contractual agreements; and our ability to execute our business plan and long-term management initiatives effectively and to overcome these and other known and unknown risks that we face. These are only some of the factors that may affect the forward-looking statements contained in this written communication. You should be aware that new factors may emerge from time to time and it is not possible for us to identify all such factors, nor can we predict the impact of each such factor on the proposed transaction or the combined company. For further information concerning risks and uncertainties associated with our business, please refer to the filings on Form 10-K, 10-Q and 8-K that we or Engility make from time to time with the SEC, including the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Legal Proceedings” sections of our and Engility’s Annual Report on Form 10-K which may be viewed or obtained through the Investor Relations section of our web site at www.investors.saic.com or Engility’s web site at www.engility.com. All information in this written communication is as of the date hereof. SAIC and Engility expressly disclaim any duty to update any forward-looking statement provided in this written communication to reflect subsequent events, actual results or changes in SAIC’s or Engility’s expectations. SAIC and Engility also disclaim any duty to comment upon or correct information that may be contained in reports published by investment analysts or others.