Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RigNet, Inc. | d620768d8k.htm |

RigNet Investor Update September, 2018 Enabling Intelligence. Delivering Results. Exhibit 99.1

Forward-looking statements and non-gaap measures Certain statements made in this presentation may constitute "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 — that is, statements related to the future, not past, events. Forward-looking statements are based on current expectations and include any statement that does not directly relate to a current or historical fact. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "anticipate," "believe," "intend, “will”, "expect," "plan" or other similar words. Forward-looking statements in this presentation include, without limitation, statements regarding the timing of the closing of future acquisitions, if at all, or the benefits provided by such acquisitions. These forward-looking statements involve certain risks and uncertainties that ultimately may not prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from those contemplated in our forward-looking statements include, among others: adverse changes in economic conditions in the markets we operate; the extent, timing and overall effects of competition in our industry; the impact of new, emerging or competing technologies; material changes in the communications industry that could adversely affect vendor relationships with equipment and network suppliers and customer relationships with wholesale customers; unfavorable results of litigation or intellectual property infringement claims asserted against us; unanticipated increases or other changes in our future cash requirements; the effects of federal and state legislation, and rules and regulations governing the communications industry; the impact of equipment failure, natural disasters or terrorist acts; and those additional factors set forth under the caption “Risk Factors” and other factors described in our filings with the SEC, including under the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-K for the fiscal period December 31, 2017, which is incorporated by reference herein. RigNet undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement. In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. Definitions of these non-GAAP measures and reconciliations between certain GAAP and non-GAAP measures are included in the appendix to this presentation.

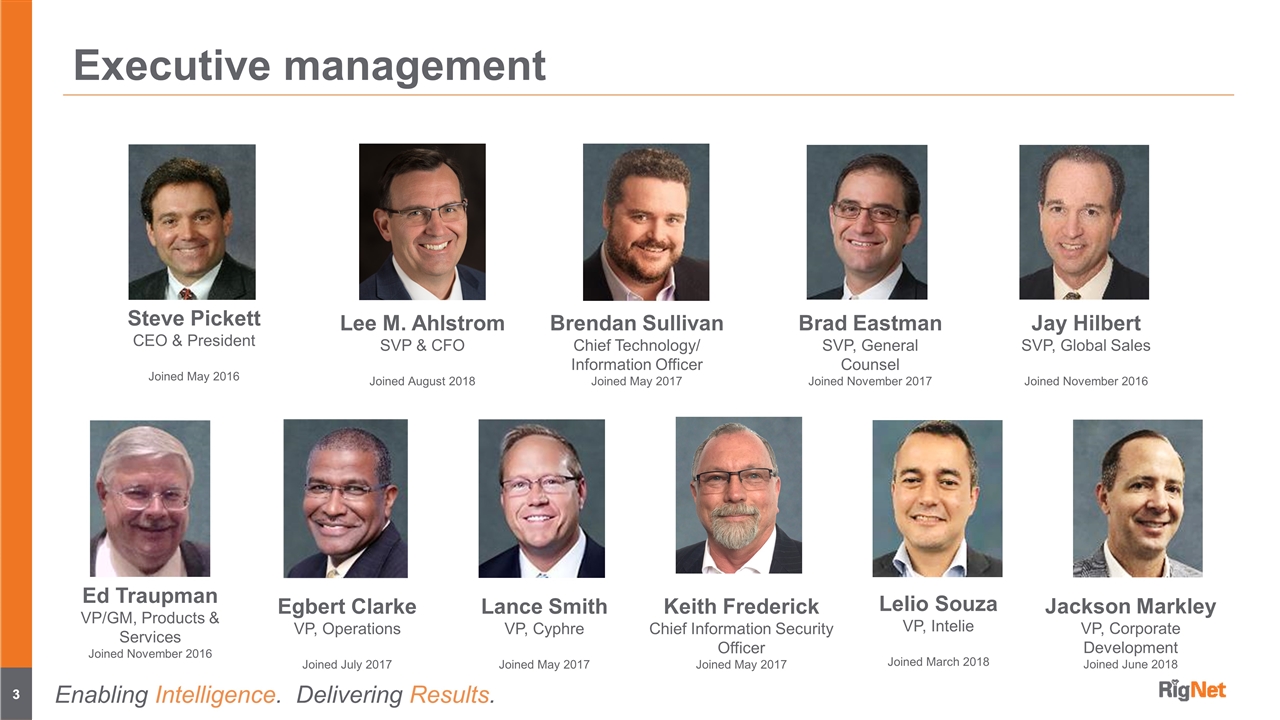

Executive management Steve Pickett CEO & President Joined May 2016 Brendan Sullivan Chief Technology/ Information Officer Joined May 2017 Brad Eastman SVP, General Counsel Joined November 2017 Jay Hilbert SVP, Global Sales Joined November 2016 Ed Traupman VP/GM, Products & Services Joined November 2016 Egbert Clarke VP, Operations Joined July 2017 Lance Smith VP, Cyphre Joined May 2017 Lelio Souza VP, Intelie Joined March 2018 Jackson Markley VP, Corporate Development Joined June 2018 Lee M. Ahlstrom SVP & CFO Joined August 2018 Keith Frederick Chief Information Security Officer Joined May 2017

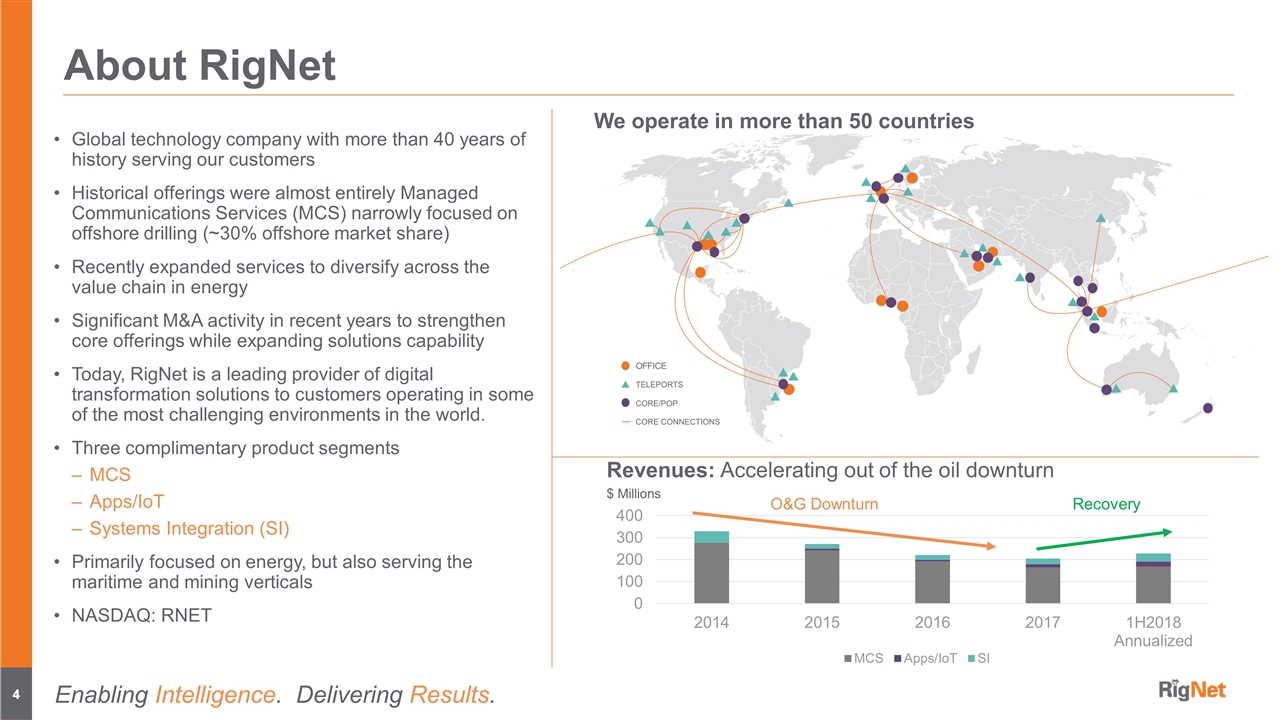

We operate in more than 50 countries About RigNet Global technology company with more than 40 years of history serving our customers Historical offerings were almost entirely Managed Communications Services (MCS) narrowly focused on offshore drilling (~30% offshore market share) Recently expanded services to diversify across the value chain in energy Significant M&A activity in recent years to strengthen core offerings while expanding solutions capability Today, RigNet is a leading provider of digital transformation solutions to customers operating in some of the most challenging environments in the world. Three complimentary product segments MCS Apps/IoT Systems Integration (SI) Primarily focused on energy, but also serving the maritime and mining verticals NASDAQ: RNET Revenues: Accelerating out of the oil downturn $ Millions O&G Downturn Recovery

OIL & GAS DRILLING OIL & GAS OPERATORS CONTRACTORS SERVICE COMPANIES OTHER RigNet serves major customers globally

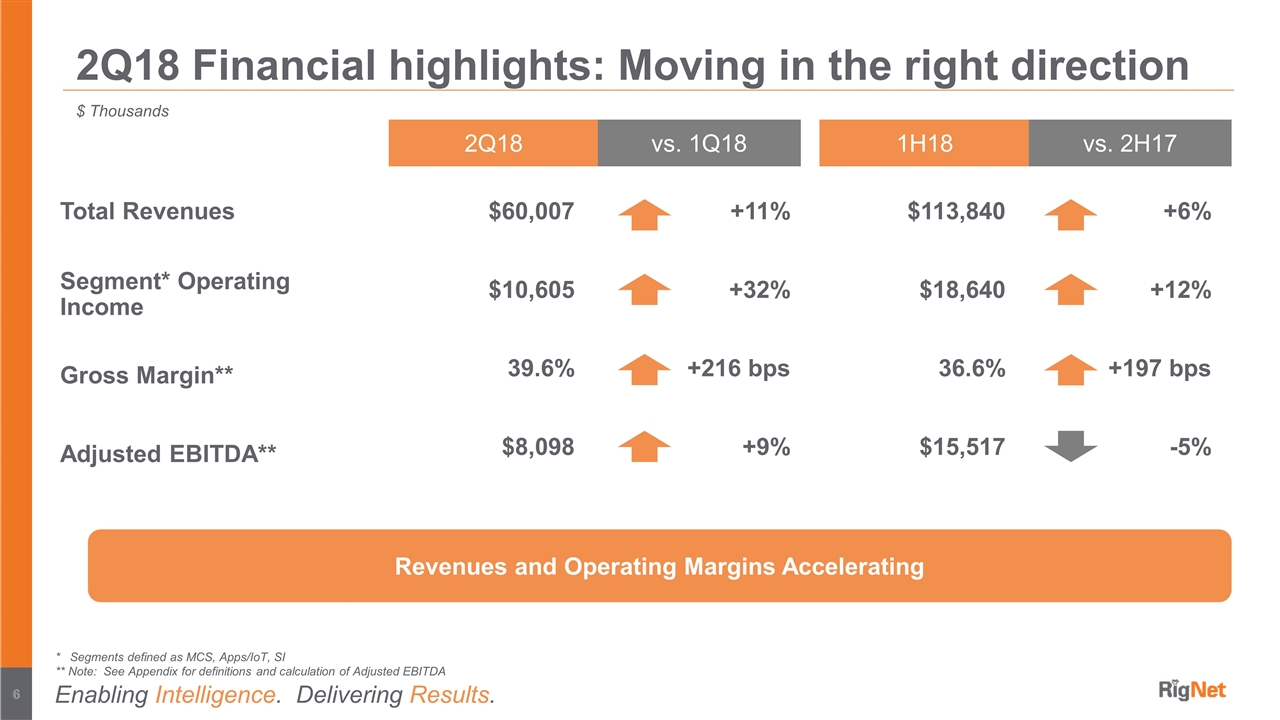

2Q18 Financial highlights: Moving in the right direction Total Revenues Segment* Operating Income Gross Margin** Adjusted EBITDA** 2Q18 vs. 1Q18 1H18 vs. 2H17 $60,007 $10,605 39.6% $8,098 +11% +32% +216 bps +9% $113,840 $18,640 36.6% $15,517 +6% +12% +197 bps -5% Revenues and Operating Margins Accelerating $ Thousands * Segments defined as MCS, Apps/IoT, SI ** Note: See Appendix for definitions and calculation of Adjusted EBITDA

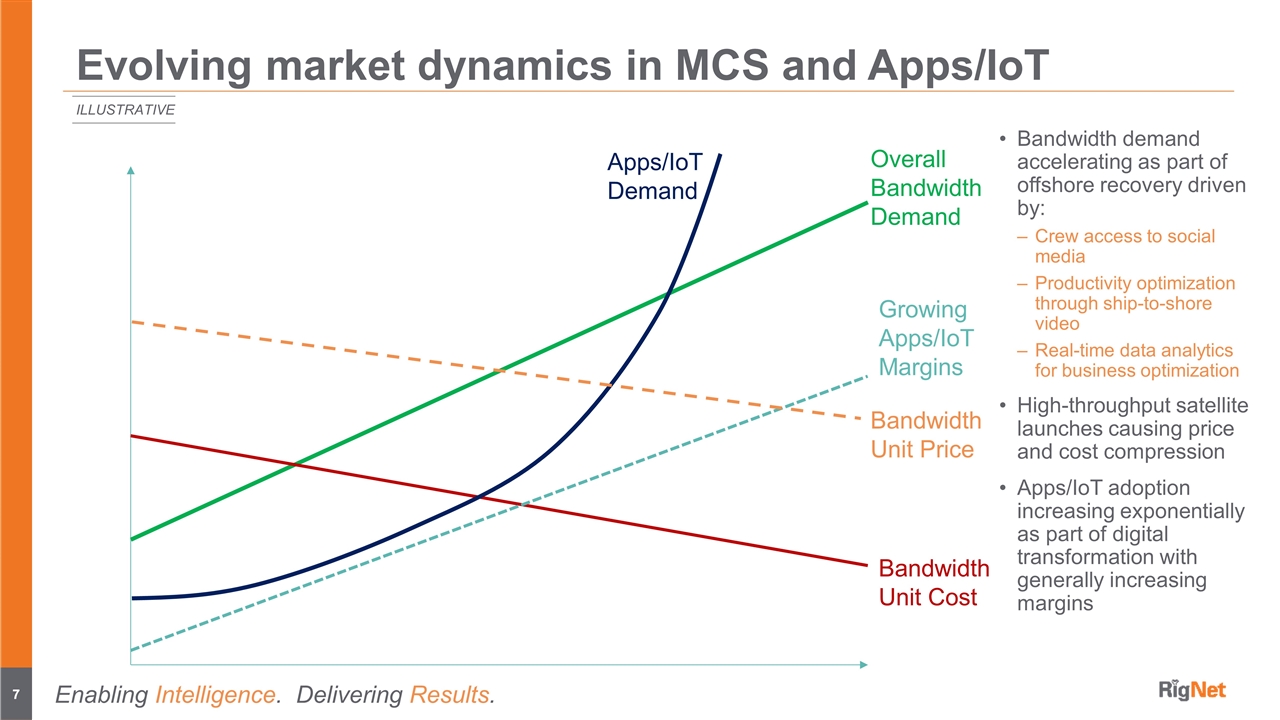

Evolving market dynamics in MCS and Apps/IoT Bandwidth demand accelerating as part of offshore recovery driven by: Crew access to social media Productivity optimization through ship-to-shore video Real-time data analytics for business optimization High-throughput satellite launches causing price and cost compression Apps/IoT adoption increasing exponentially as part of digital transformation with generally increasing margins Overall Bandwidth Demand Bandwidth Unit Cost Apps/IoT Demand ILLUSTRATIVE Growing Apps/IoT Margins Bandwidth Unit Price

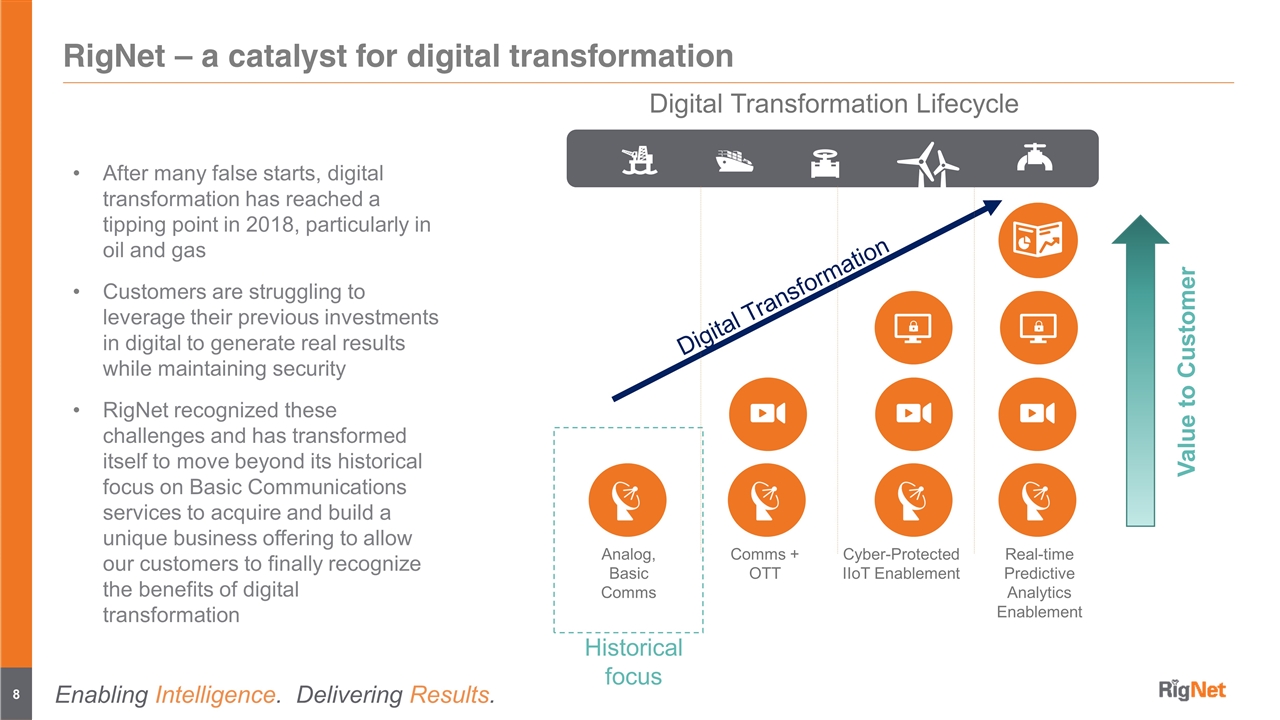

RigNet – a catalyst for digital transformation After many false starts, digital transformation has reached a tipping point in 2018, particularly in oil and gas Customers are struggling to leverage their previous investments in digital to generate real results while maintaining security RigNet recognized these challenges and has transformed itself to move beyond its historical focus on Basic Communications services to acquire and build a unique business offering to allow our customers to finally recognize the benefits of digital transformation Historical focus Digital Transformation Value to Customer Analog, Basic Comms Comms + OTT Cyber-Protected IIoT Enablement Real-time Predictive Analytics Enablement Digital Transformation Lifecycle

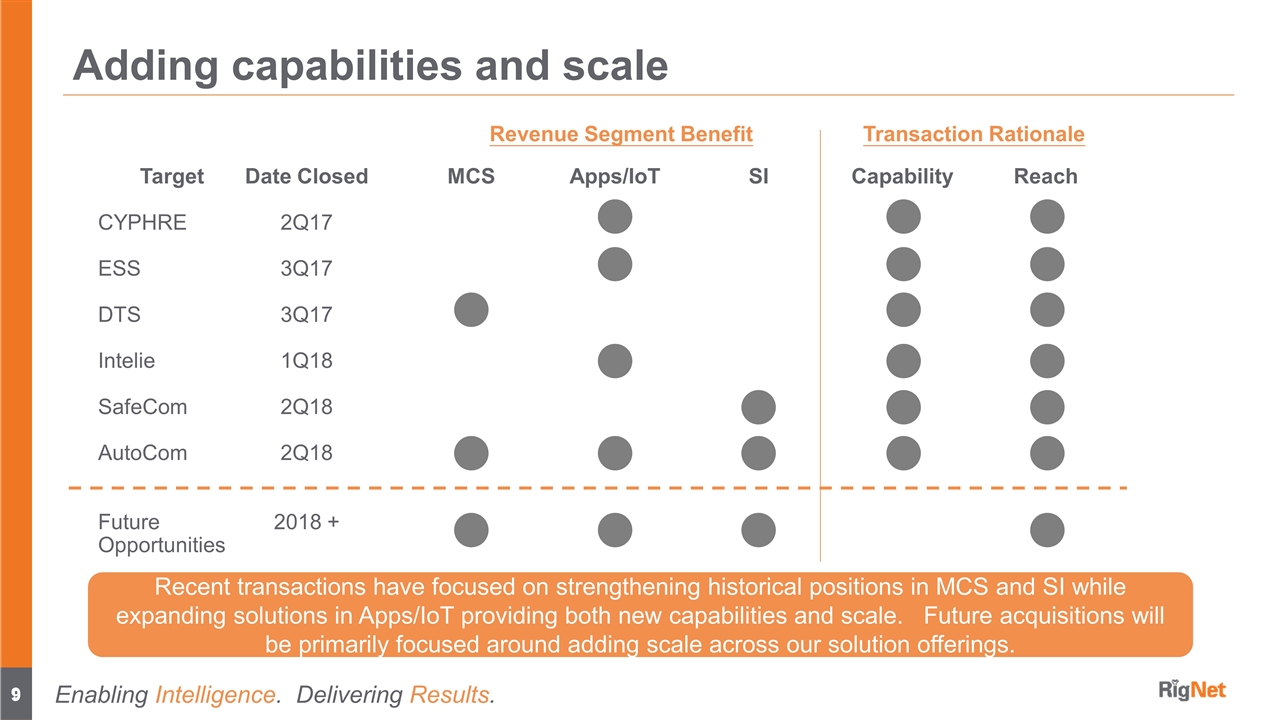

Adding capabilities and scale Target CYPHRE ESS DTS Intelie SafeCom AutoCom Future Opportunities Date Closed 2Q17 3Q17 3Q17 1Q18 2Q18 2Q18 2018 + MCS Apps/IoT SI Capability Reach Revenue Segment Benefit Transaction Rationale Recent transactions have focused on strengthening historical positions in MCS and SI while expanding solutions in Apps/IoT providing both new capabilities and scale. Future acquisitions will be primarily focused around adding scale across our solution offerings.

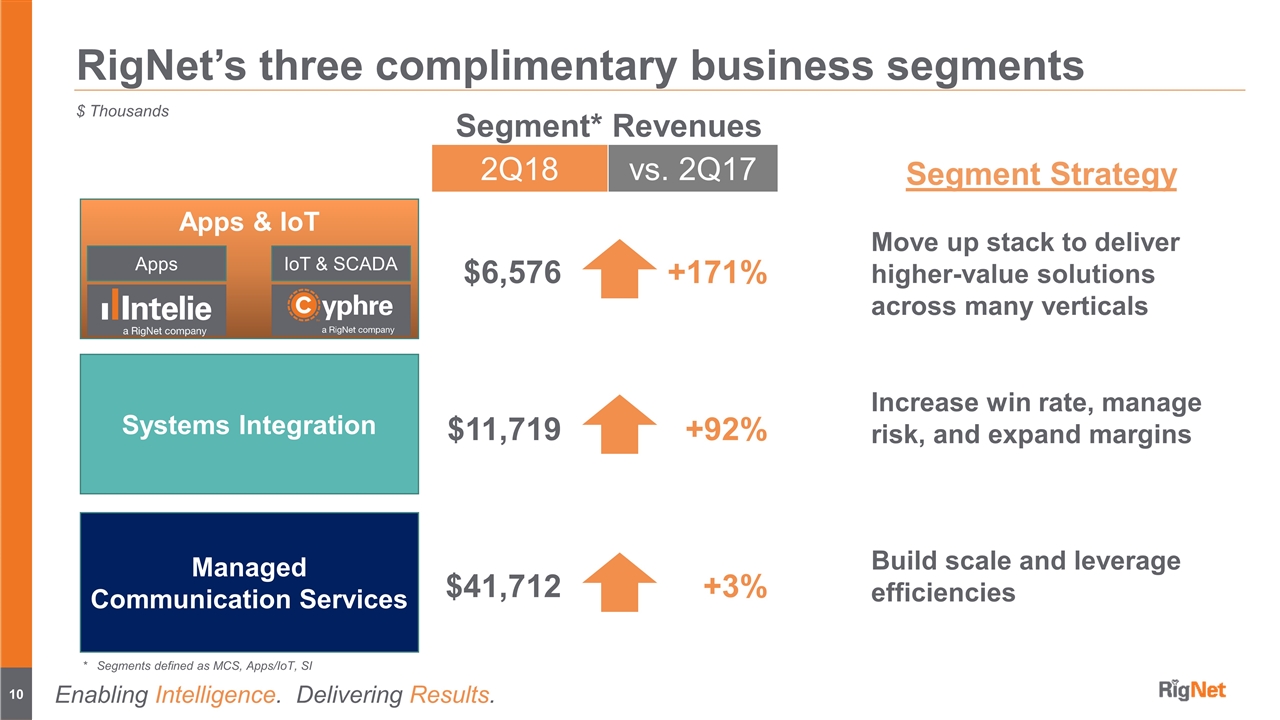

RigNet’s three complimentary business segments 2Q18 vs. 2Q17 $6,576 $11,719 $41,712 +171% +92% +3% $ Thousands Managed Communication Services Systems Integration Apps & IoT Apps IoT & SCADA Move up stack to deliver higher-value solutions across many verticals Segment* Revenues Increase win rate, manage risk, and expand margins Build scale and leverage efficiencies Segment Strategy * Segments defined as MCS, Apps/IoT, SI

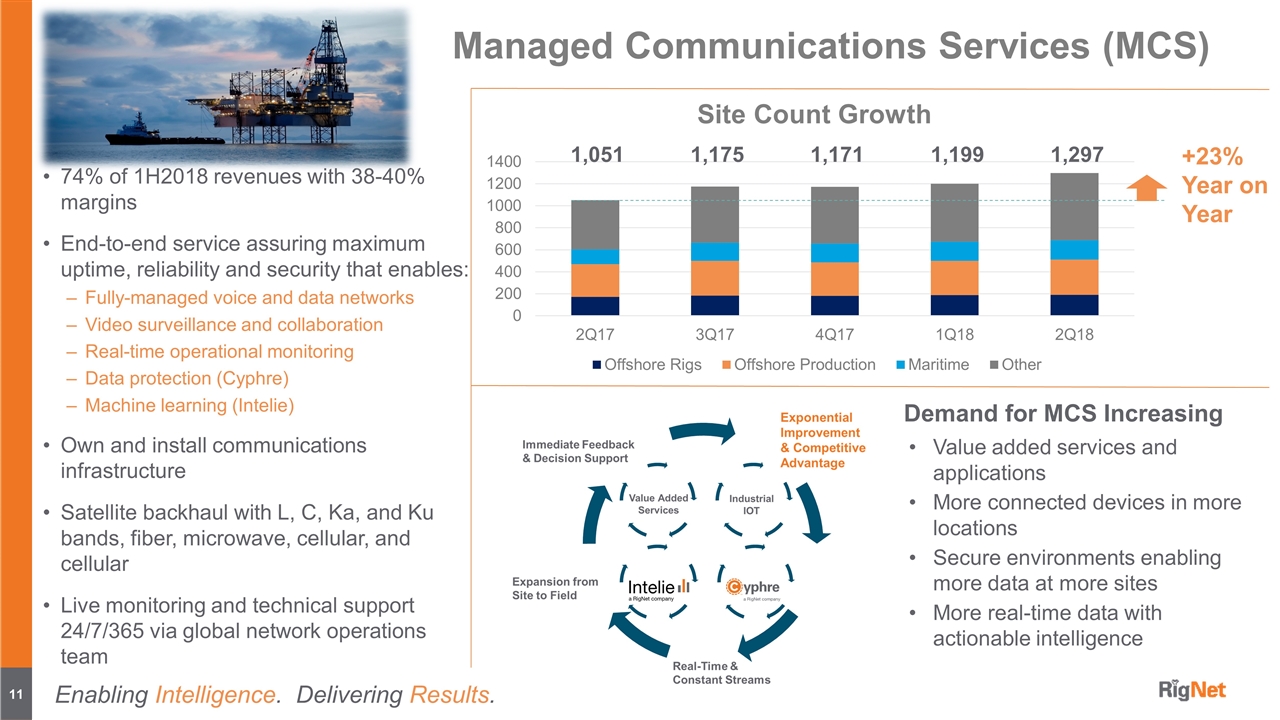

Managed Communications Services (MCS) 1,051 1,175 1,171 1,199 1,297 +23% Year on Year 74% of 1H2018 revenues with 38-40% margins End-to-end service assuring maximum uptime, reliability and security that enables: Fully-managed voice and data networks Video surveillance and collaboration Real-time operational monitoring Data protection (Cyphre) Machine learning (Intelie) Own and install communications infrastructure Satellite backhaul with L, C, Ka, and Ku bands, fiber, microwave, cellular, and cellular Live monitoring and technical support 24/7/365 via global network operations team Demand for MCS Increasing Value added services and applications More connected devices in more locations Secure environments enabling more data at more sites More real-time data with actionable intelligence

RigNet’s Apps & IoT: a rapidly growing segment 10% of 1H2018 revenues with growing margins One of the largest IoT/SCADA footprints in North America operating SkyEdge I and SkyEdge II Global leader in SCADA M2M traffic Solutions harness and protect mission-critical information to enhance business performance : Intelie collects and analyzes operational data to drive real-time mission-critical decisions that optimize business performance Cyphre, with BlackTIE ® Technology, provides best-in-class data protection and cybersecurity Adaptive Video Intelligence (AVI) uses lower bandwidth to stream high-quality video content CrewConnect™ portfolio provides internet and infotainment services to crews in remote locations MetOcean Systems provide accurate, reliable weather data

RigNet’s Recent Accolades: RigNet’s Intelie grows our customers’ profits via real-time machine learning and artificial intelligence Ten year pioneer in machine learning and predictive analytics solutions Real deployments with real results Oil and gas Mining E-commerce, banking, retail Instant awareness of critical trends and events Drive more profitable projects Works seamlessly on RigNet’s MCS platform and Cyphre security Intelligence to weaponize your data to improve safety and efficiency “Process safety and surveillance have been considerably improved with the employment of real-time analytic tools (Intelie) being developed in the RTOC (Real-Time Operations Center).” - QGOG Constellation white paper at 2018 Offshore Technology Conference “The new tool will allow us to save about R$ 10 million (USD$2.4 million) in 2016. This estimate still does not include the potential drilling optimization (drilling time reduction and drilling cost reduction).” - Petrobras Case Study (available at www.intelie.com)

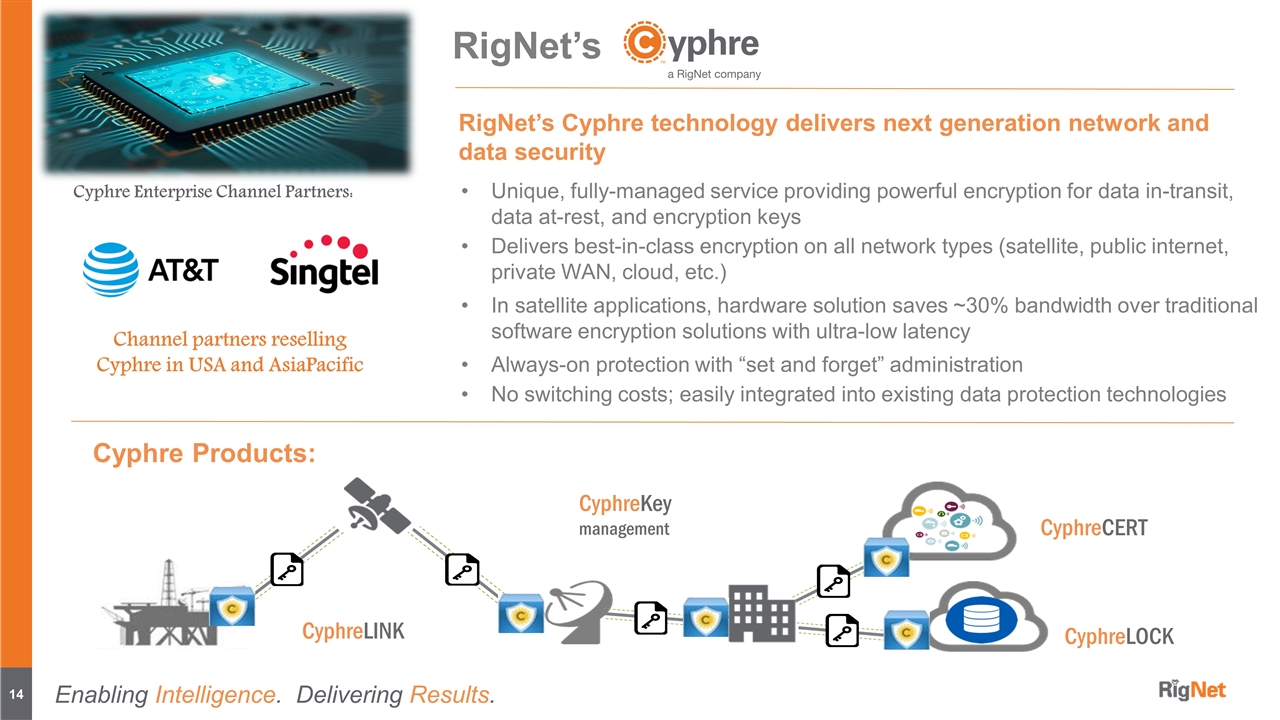

RigNet’s Cyphre Products: RigNet’s Cyphre technology delivers next generation network and data security CyphreLINK CyphreLOCK CyphreCERT CyphreKey management Cyphre Enterprise Channel Partners: Unique, fully-managed service providing powerful encryption for data in-transit, data at-rest, and encryption keys Delivers best-in-class encryption on all network types (satellite, public internet, private WAN, cloud, etc.) In satellite applications, hardware solution saves ~30% bandwidth over traditional software encryption solutions with ultra-low latency Always-on protection with “set and forget” administration No switching costs; easily integrated into existing data protection technologies Channel partners reselling Cyphre in USA and AsiaPacific

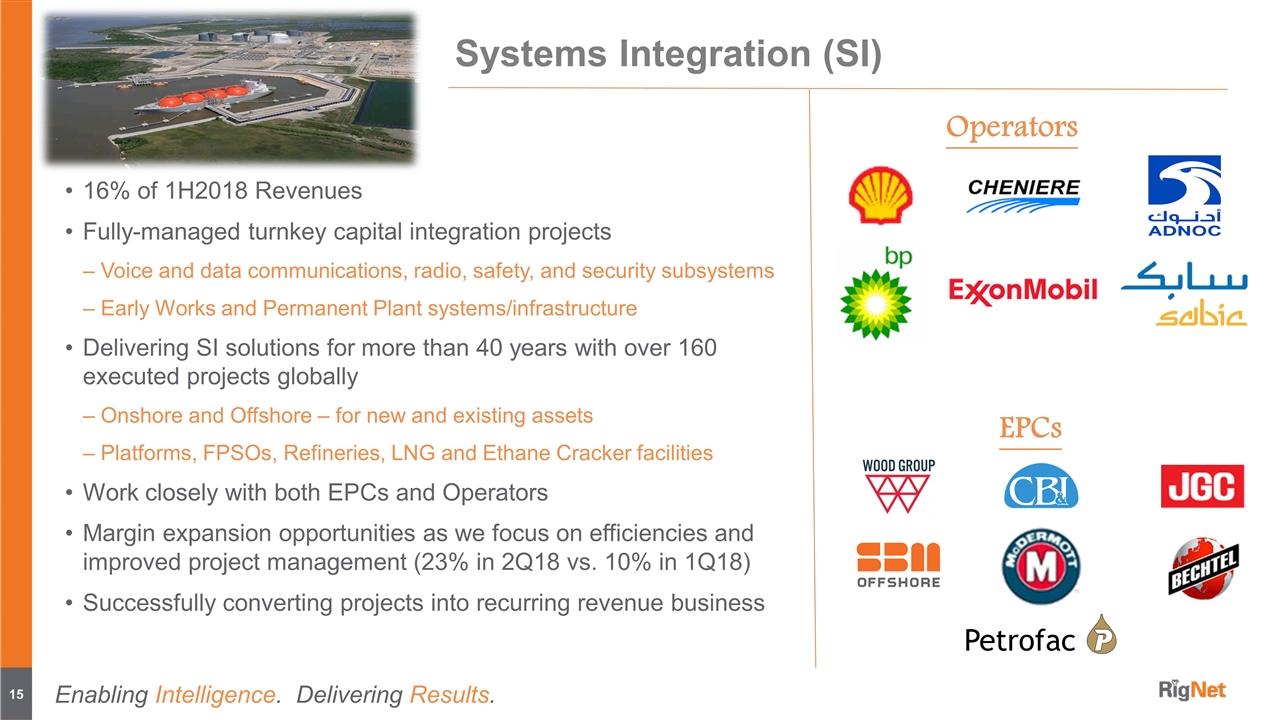

Systems Integration (SI) 16% of 1H2018 Revenues Fully-managed turnkey capital integration projects Voice and data communications, radio, safety, and security subsystems Early Works and Permanent Plant systems/infrastructure Delivering SI solutions for more than 40 years with over 160 executed projects globally Onshore and Offshore – for new and existing assets Platforms, FPSOs, Refineries, LNG and Ethane Cracker facilities Work closely with both EPCs and Operators Margin expansion opportunities as we focus on efficiencies and improved project management (23% in 2Q18 vs. 10% in 1Q18) Successfully converting projects into recurring revenue business EPCs Operators

Near term objectives Expand EBITDA margins through scale and associated efficiencies Reduce costs through strategic sourcing, back-office automation, and best practices adoption Invest in human capital Maintain cash discipline Financial Plan Business Plan Differentiate MCS and deliver high-value services by growing over-the-top solutions revenue Increase customer ‘stickiness’ through more robust, bundled offerings Invest opportunistically to build scale and expand into additional verticals

Digital transformation strategies driving increased need for bandwidth, intelligence, and security Unique, holistic, end-to-end solutions provider with a growing portfolio of advanced technology, services, and expertise Leading position in oil and gas with growing presence in other verticals Global footprint with expanding universe of significant long-term, regional partnerships Increasing revenues and EBITDA margins Strong balance sheet with low leverage RigNet delivers the advanced software, optimized industry solutions, and secure communications infrastructure that allows the oil and gas industry, and others, to finally realize the business results of digital transformation. RigNet: Well-positioned for further success

15115 Park Row, Suite 300 | Houston, TX 77084 | USA www.rig.net NASDAQ: RNET Investor Contact: Lee M. Ahlstrom SVP & CFO 281.674.0100

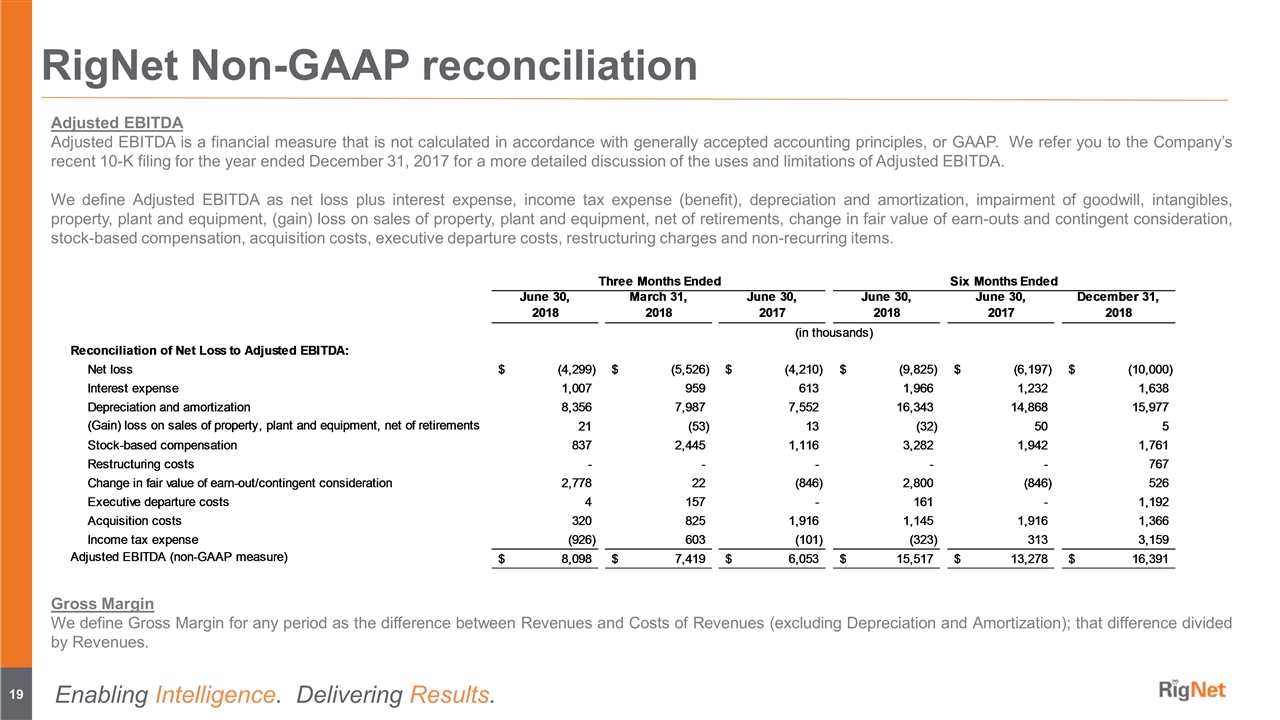

RigNet Non-GAAP reconciliation Adjusted EBITDA Adjusted EBITDA is a financial measure that is not calculated in accordance with generally accepted accounting principles, or GAAP. We refer you to the Company’s recent 10-K filing for the year ended December 31, 2017 for a more detailed discussion of the uses and limitations of Adjusted EBITDA. We define Adjusted EBITDA as net loss plus interest expense, income tax expense (benefit), depreciation and amortization, impairment of goodwill, intangibles, property, plant and equipment, (gain) loss on sales of property, plant and equipment, net of retirements, change in fair value of earn-outs and contingent consideration, stock-based compensation, acquisition costs, executive departure costs, restructuring charges and non-recurring items. Gross Margin We define Gross Margin for any period as the difference between Revenues and Costs of Revenues (excluding Depreciation and Amortization); that difference divided by Revenues.