Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FedNat Holding Co | fnhc827188k.htm |

FedNat Holding Company (NASDAQ: FNHC) Investor Update August 27, 2018

SAFE HARBOR STATEMENT Safe harbor statement under the Private Securities Litigation Reform Act of 1995: Statements that are not historical fact are forward-looking statements that are subject to certain risks and uncertainties that could cause actual events and results to differ materially from those discussed herein. The risks and uncertainties include, without limitation, risks and uncertainties related to estimates, assumptions and projections generally; the nature of the Company’s business; the adequacy of its reserves for losses and loss adjustment expense; claims experience; weather conditions (including the severity and frequency of storms, hurricanes, tornadoes and hail) and other catastrophic losses; reinsurance costs and the ability of reinsurers to indemnify the Company; raising additional capital and our potential failure to meet minimum capital and surplus requirements; potential assessments that support property and casualty insurance pools and associations; the effectiveness of internal financial controls; the effectiveness of our underwriting, pricing and related loss limitation methods; changes in loss trends, including as a result of insureds’ assignment of benefits; court decisions and trends in litigation; our potential failure to pay claims accurately; ability to obtain regulatory approval applications for requested rate increases, or to underwrite in additional jurisdictions, and the timing thereof; inflation and other changes in economic conditions (including changes in interest rates and financial markets); pricing competition and other initiatives by competitors; legislative and regulatory developments; the outcome of litigation pending against the Company, and any settlement thereof; dependence on investment income and the composition of the Company’s investment portfolio; insurance agents; ratings by industry services; the reliability and security of our information technology systems; reliance on key personnel; acts of war and terrorist activities; and other matters described from time to time by the Company in releases and publications, and in periodic reports and other documents filed with the United States Securities and Exchange Commission In addition, investors should be aware that generally accepted accounting principles prescribe when a company may reserve for particular risks, including claims and litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when a reserve is established for a contingency. Reported results may therefore appear to be volatile in certain accounting periods. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We do not undertake any obligation to update publicly or revise any forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. 2

FEDNAT CORPORATE PROFILE Overview: • Leader in coastal Florida homeowners market • High quality book of business with proven underwriting excellence • Strong, large partner agent network and brand recognition • Experienced leadership team Key Metrics*: (FNIC) is a homeowners’ insurer • Cash and Investments: $500M+ predominantly in Florida • Book Value Per Common Share: $16.89 with controlled expansion in • Agency Partnerships: 2,500+ AL, LA, SC and TX. • Gross Written Premiums for 1H18: $300M+ • Florida OIR Market Share**: 4.9% • Demotech Financial Stability Rating: A * As of June 30, 2018, unless otherwise noted ** Market data as of March 31, 2018 (Source: Florida OIR) 3

LONG-TERM TRACK RECORD OF BOOK VALUE GROWTH $18.00 $16.52 $16.89 $16.01 $16.29 $16.00 BVPS CAGR 13.7% $13.91 $14.00 2011 - Q218 $12.00 $10.00 $9.79 $8.26 $8.00 $7.32 $6.00 $4.00 $2.00 $0.00 2011 2012 2013 2014 2015 2016 * 2017** Q2 2018 * Impacted by Hurricane Matthew ** Impacted by Hurricane Irma Source: Company Filings and SNL Financial Note: Based on GAAP financial information 4

IMPACT OF HURRICANE IRMA • The strongest hurricane to make continental US landfall in over a decade • Over $20B of insurable property loss • FedNat losses estimated at $630M • $21M retention (recorded in 3Q17) • 36,000+ claims received, spanning 61 counties, over 93% of which have been closed • Storm-related income has substantially reduced our net retention • Claims handling revenue of $12M • Incremental reinsurance brokerage income from reinstated layers of $3M • To date, have recovered over 70% of our net retention, resulting in a ($4M) after-tax net impact from the storm 5

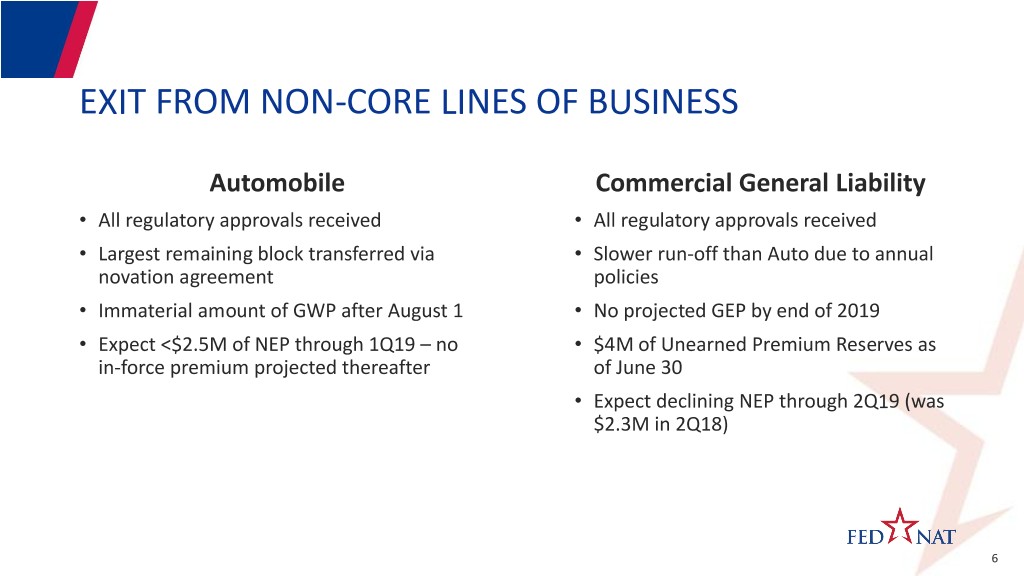

EXIT FROM NON-CORE LINES OF BUSINESS Automobile Commercial General Liability • All regulatory approvals received • All regulatory approvals received • Largest remaining block transferred via • Slower run-off than Auto due to annual novation agreement policies • Immaterial amount of GWP after August 1 • No projected GEP by end of 2019 • Expect <$2.5M of NEP through 1Q19 – no • $4M of Unearned Premium Reserves as in-force premium projected thereafter of June 30 • Expect declining NEP through 2Q19 (was $2.3M in 2Q18) 6

SUCCESSFULLY MITIGATING AOB HEADWIND AOB has been a significant drag on FL HO providers, but FedNat’s multi-pronged strategy has positioned the company for improved underwriting profitability. The Assignment of Benefits (“AOB”) Challenge FedNat’s AOB Strategy • Incurred loss ratios for FL homeowners increased by • Achieved aggregate 16+% compounded homeowners rate more than 5 points in 2016, primarily driven by AOB increase • AOB unlikely to see legislative solution near-term but • Proactive management, training and engagement significant rate increases have been approved by OIR • Educating policyholders on reporting claims upon • Combining 2016 storm activity and attritional loss occurrence pressure, the FL HO industry reported an aggregate • Analyze expected costs and work directly with AOB combined ratio of 107% in 2016 vs. 90% in 2015 contractors and preferred FNHC vendors to arrive at a fair • 2016 upward trend has leveled off with higher payment, else invoke policy appraisal clause frequency and lower severity • Reducing litigation and mitigation expense risk • Minimal additional rate needed to further mitigate • Aggressively pursuing Alternative Dispute Resolution effects of AOB practices • FNHC instituted FL OIR approved policy language changes that restrict emergency mitigation expenses 7

SECOND QUARTER KEY FINANCIAL HIGHLIGHTS • Strong year-over-year and sequential EPS growth to $0.67, excluding investment gains • Best combined ratio in 2 years – 99.0% compared with 110.6% in 2Q17 and 100.3% in 1Q18 • Homeowners net earned premiums increased 6% driven by strong non-Florida performance (up 50%) • Significantly reduced Auto loss as business line winds down • $5 million capital investment in stock re-purchases, year-to-date • Book value grew to $17.31, excluding Accumulated Other Comprehensive Income • Annualized ROE of 16.4%, excluding investment gains 8

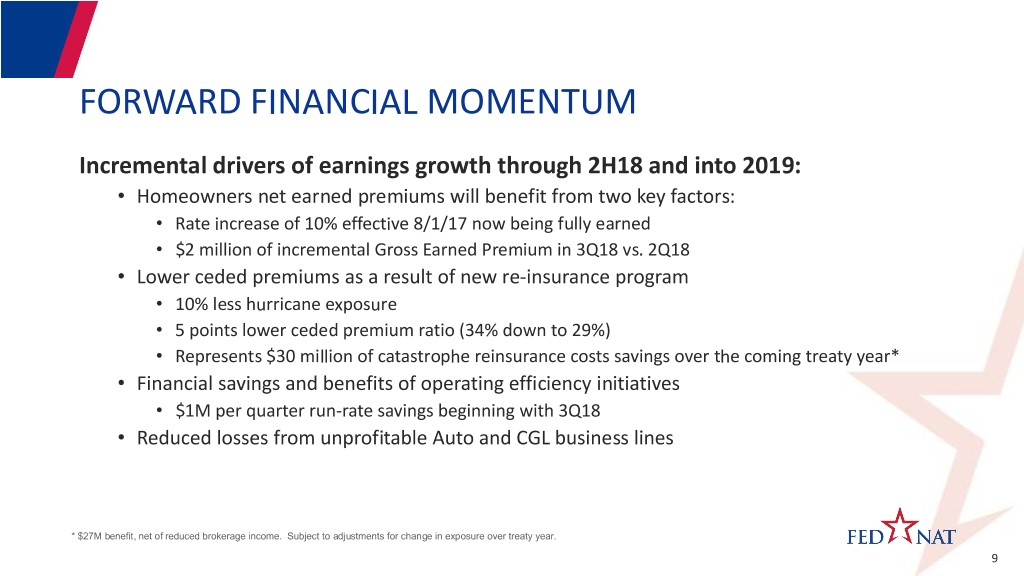

FORWARD FINANCIAL MOMENTUM Incremental drivers of earnings growth through 2H18 and into 2019: • Homeowners net earned premiums will benefit from two key factors: • Rate increase of 10% effective 8/1/17 now being fully earned • $2 million of incremental Gross Earned Premium in 3Q18 vs. 2Q18 • Lower ceded premiums as a result of new re-insurance program • 10% less hurricane exposure • 5 points lower ceded premium ratio (34% down to 29%) • Represents $30 million of catastrophe reinsurance costs savings over the coming treaty year* • Financial savings and benefits of operating efficiency initiatives • $1M per quarter run-rate savings beginning with 3Q18 • Reduced losses from unprofitable Auto and CGL business lines * $27M benefit, net of reduced brokerage income. Subject to adjustments for change in exposure over treaty year. 9

VALUE CREATION STRATEGY

2018 & BEYOND: BUILDING FOUNDATION FOR LONG-TERM VALUE CREATION Re-focusing on FNHC’s core strengths Maintain market leadership in Florida top tier Selectively expanding into markets in other coastal states Expand into $4.6B Florida risk adjusted market through Monarch Rigorous focus on profitability of our book driving lower catastrophe exposure as evidenced in our 2018-2019 reinsurance program Continued investments in people, processes and technology 11

FLORIDA: BROADENING REGIONAL PENETRATION FedNat Insurance Company – Florida Market for Homeowners Panhandle 11.9% • Statewide offering of HO3, HO6, North FL HO4 and DP-3 Forms 5.6% • Risk Management through utilization of both analytics and Central FL geographic exposure management 14.4% Total Florida Tampa/ • Distribute through independent Policies in Force St. Pete 13.9% retail partner agents and national for Homeowners/Fire Treasure carrier affinities as of June 30, 2018 Coast 8.0% • Managed catastrophe exposure by 247,138 ceding risk through reinsurance Tri-County treaties SW FL 24.1% 22.1% 12

DIVERSIFYING FLORIDA BOOK - MONARCH Full Ownership of Monarch offers path to large, untapped market segment Monarch National Insurance Overview Ownership Benefits • Established in 2015 as joint venture (JV) • Full control in executing on the Monarch opportunity • Consolidated JV in February 2018 for $16.7 • Provides second prong to FL diversification strategy, million in cash and retired $5 million note expanding access to 50% of the FL HO market of which we are underweight • Strategy: Leverage FedNat’s agent network to access risk-adjusted class of FL HO market • Long term non-Florida expansion opportunities • Enhancing underwriting process and risk • Opportunity to expand and deepen partner agent management by deploying sophisticated scoring relationships and leveraging reinsurance partnerships • Improved capital efficiency with Monarch National stacked under FedNat 13

MIDDLE MARKET OPPORTUNITY HO Insurance Market FedNat Current Share Segments of Market Segment High-end Segment High Quality Our Focus Well Mitigated Risk Vast middle-market growth opportunity Middle Market ~50% of total HO Segment Underweight Insurance Market Risk Adjusted Houses Low-end Segment Poorly/Un-Mitigated Risk Not our Focus 14

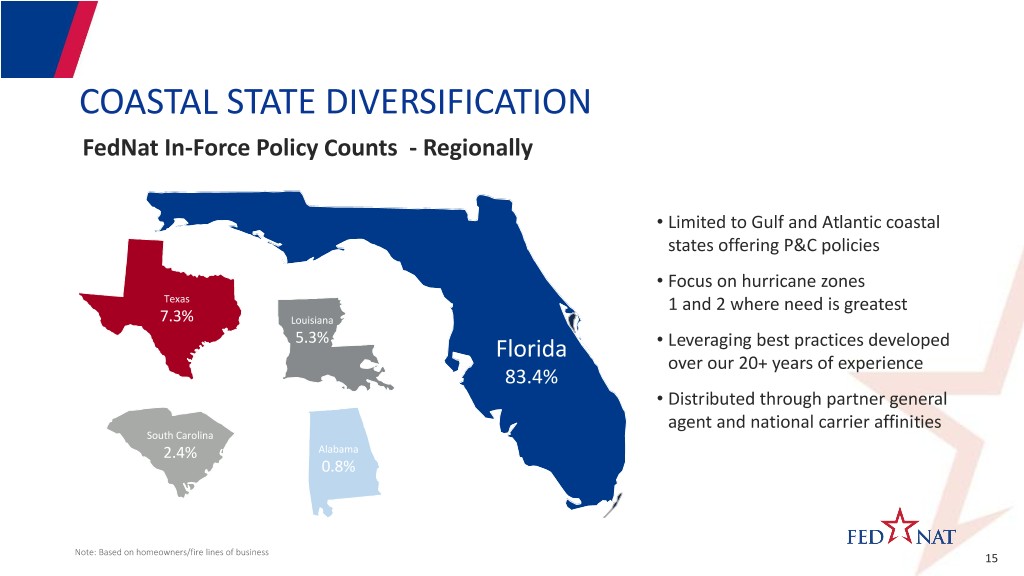

COASTAL STATE DIVERSIFICATION FedNat In-Force Policy Counts - Regionally • Limited to Gulf and Atlantic coastal states offering P&C policies • Focus on hurricane zones Texas 1 and 2 where need is greatest 7.3% Louisiana 5.3% Florida • Leveraging best practices developed over our 20+ years of experience 83.4% • Distributed through partner general agent and national carrier affinities South Carolina 2.4% Alabama 0.8% Note: Based on homeowners/fire lines of business 15

MARKET POSITION & OPERATING APPROACH

LEADING POSITION IN FRAGMENTED FLORIDA MARKET Market dominated by “specialists”, with limited national P&C carrier presence 2018 Q1 FL HO FL HO Mkt Share Rank Insurer DWP ($ mm) (%) 1 Universal Insurance 950 9.9 2 Citizens Property Insurance 771 8.0 • Nation’s third largest state 3 FedNat Insurance 467 4.9 4 Heritage Insurance 432 4.5 5 Security First Insurance 393 4.1 • Population growth has averaged 1,000 people per day Homeowner’s Choice 6 338 3.5 Insurance • $9.6 billion HO insurance market 7 First Protective Insurance 312 3.2 8 American Integrity 296 3.1 9 United Property & Casualty 291 3.0 • Highly fragmented market with national players comprising 10 St. John’s Insurance 269 2.8 less than 20%, none with higher market share than FedNat 11 United Services Auto 258 2.7 12 Florida Peninsula 239 2.5 13 Tower Hill Prime Insurance 238 2.5 • FedNat’s focus is on high quality, well-mitigated homes 14 People’s Trust Insurance 232 2.4 (built after 1994) – we have ~20% of homes in this class 15 Federal Insurance 207 2.2 16 ASI Preferred 173 1.8 statewide 17 AIG Property Casualty 172 1.8 18 Safepoint Insurance 147 1.5 19 Olympus Insurance 142 1.5 • With Citizens policies reduced by ~two-thirds since 2011, 20 Tower Hill Signature 134 1.4 carriers pursuing geographic expansion and new products 21 USAA Casualty 127 1.3 22 Tower Hill Preferred 107 1.1 23 Gulfstream P&C Insurance 104 1.1 24 Auto Club Insurance 104 1.1 25 Southern Fidelity P&C 104 1.1 Others 2,609 26.2 Total $9,616 100.0 Source: Florida Office of insurance Regulation data as of March 31, 2018 17

STRONG, PROFITABLE FLORIDA BOOK FNIC Total Insured Value and Policies In- FNIC Homeowners Florida Market Share Force Premiums in Force and % Market Share 7.0% 140 300 272 273 266 271 271 269 500 $473.9 264 $464.0 $466.1 $468.9 $470.0 $471.9 $467.3 $461.5 256 270 $455.3 6.0% 120 247 $105 $105 $103 240 $102 $100 400 $98 $96 5.0% 100 $93 210 $89 (Thousands) PIF Force at Quarter End Quarter at Force 180 - 4.0% 80 300 266 271 272 273 271 269 264 256 247 150 3.0% TIV TIV (Billions) 60 120 200 2.0% 40 90 60 100 Premiums/Policies In Premiums/Policies 1.0% 20 30 0 0.0% 0 0 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Total Insured Value Policies In Force Premiums In-Force ($in Mill) Policies In-Force (# in Thousands) % of Market Share per OIR Disciplined underwriting driving increased profitability on flat premiums OIR = Florida Office of Insurance Regulation % Market share per OIR for Q1 and Q2-17 unavailable as of 8/17/2017. 18

DISCIPLINED UNDERWRITING APPROACH FedNat’s meticulous underwriting approach allows the Company to manage its current exposures while profitably underwriting new risks. • Focus on properties with more advanced wind / hurricane mitigation features and lower All Other Peril (non-catastrophe) losses • Generalized Linear Model (“GLM”) used to derive pre-quote pass/fail position based on each risk’s associated expenses, CAT and non-CAT exposure, cost of capital and risk concentration • Manual reviews of every bound risk to ensure accuracy of information • Regulatory approved use of our GLM-based analytics to provide a layer of pre-binding portfolio optimization management • Rates on every policy a function of FNIC’s historical loss experience, concentration of risk, expenses and current market conditions • All risks are subject to an annual review to ensure low performing risks are not offered a renewal • Business written by MNIC utilizes a similar disciplined approach as its policies are also underwritten by FedNat Underwriters (“FNU”), the Company’s wholly owned MGA 19

BENEFITTING FROM RIGOROUS EXPOSURE MANAGEMENT All States 1-in-100 Year Probable Maximum Loss / In-Force Excess-of-Loss Cat Reinsurance Premium (“PML to Premium”) • $30M* lower spend for the treaty year 300% ending 6/30/19 versus the preceding 248% 247% 250% 242% 236% period 226% 214% • Homeowners ceded premium ratio for 200% 194% 200% 187% catastrophe coverage will drop 5 points to 29% 150% • Same purchasing methodology and level of coverage as preceding years 100% 50% 0% Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 * $27M benefit, net of reduced brokerage income. Notes:PML modeled using average of AIR and RMS. Subject to adjustments for change in exposure over treaty year. Includes Monarch National from Q1-18 forward. Assumptions: LT, No LA, No SS 20

2018-2019 REINSURANCE STRUCTURE Full indemnity reinsurance with highly rated reinsurers, many with multi-year relationships Program Highlights ~ $1.8 billion Per occurrence 80+ of aggregate coverage with pretax reinsurance partners, all of which maximum single event retention of are rated “A-” or higher coverage of approximately $23 million by A.M. Best or fully $1.3 billion collateralized Program expected to drive 7 point improvement in HO combined ratio in 2H18 21

FINANCIAL OVERVIEW

EARNINGS MOMENTUM DRIVERS • Better rate environment in Florida Homeowners market mitigating AOB • Steady improvement in underwriting profitability over the last three quarters • Improved operating efficiency and reduced staff levels leading to meaningful expense reductions • Exiting unprofitable non-core auto and commercial general liability lines • Renewed focus on building core Florida and coastal states Homeowners book • Significantly reduced our hurricane exposure, as evidenced by our reduced 2018/2019 reinsurance program costs • Expanded Total Addressable Market longer-term with Monarch consolidation • Effective capital management 23

FINANCIAL HIGHLIGHTS (in thousands) Q117 Q217 Q317* Q417 Q118 Q218 Income Statement Data: Gross Premiums Written $146,051 $168,692 $154,782 $133,892 $134,395 $166,734 Net Premiums Earned 81,660 83,554 80,764 87,503 82,109 83,557 Net Investment Income 2,318 2,560 2,603 2,773 2,943 2,978 Pre-Tax Income (Loss) 3,884 5,655 (10,179) 9,567 9,616 12,016 Net Income (Loss) 2,422 3,995 (4,724) 6,296 7,463 8,820 Balance Sheet Data: Cash and Investments 505,956 534,305 524,879 530,249 506,861 532,084 Shareholders Equity 218,770 217,492 208,576 211,637 208,080 215,028 Book Value per Share $16.23 $16.65 $15.98 $16.29 $16.36 $16.89 Financial Ratios: Net Loss Ratio 69.7% 67.5% 93.3% 67.3% 56.1% 56.9% Net Expense Ratio 39.4% 43.1% 41.4% 38.0% 44.2% 42.1% Net Combined Ratio 109.1% 110.6% 134.7% 105.3% 100.3% 99.0% *Impacted by Hurricane Irma 24

SIGNIFICANTLY IMPROVED UNDERWRITING PROFITABILITY $12,000 $1.20 140% 135% $10,000 $8,820 $1.00 120% $7,463 109% 111% $8,000 $0.80 41% 105% $6,296 100% 99% 100% $6,000 $0.60 $3,995 39% 43% 38% $4,000 $0.40 80% 44% 42% $2,422 $2,000 $0.20 60% $- $- 93% 40% 70% 68% 67% $(2,000) $(0.20) 56% 57% 20% $(4,000) $(0.40) 0% $(6,000) $(4,724) $(0.60) Q1 2017 Q2 2017 Q3 2017* Q4 2017 Q1 2018 Q2 2018 Q1 2017 Q2 2017 Q3 2017* Q4 2017 Q1 2018 Q2 2018 Net Loss Ratio Net Expense Ratio Net Combined Ratio Net Income (thousands) EPS Steady improvement in net combined ratio for the last three quarters; Stable net loss and expense ratio *Impacted by Hurricane Irma 25

EXIT FROM NON-CORE LINES DRIVING RAPID EARNINGS IMPROVEMENT Q2 2017 Q1 2018 Q2 2018 HO Auto Other Consolidated HO Auto Other Consolidated HO Auto Other Consolidated Total Revenue $79,862 $8,949 $9,348 $98,159 $83,305 $4,166 $5,606 $93,077 $85,474 $3,341 $6,927 $95,742 Costs and expenses: Losses and loss adjustment expenses 49,095 8,547 (1,225) 56,417 41,955 2,236 1,880 46,071 42,617 1,932 3,021 47,570 All other expenses 29,808 4,022 2,257 36,087 32,345 1,985 3,060 37,390 31,566 1,691 2,899 36,156 Total costs and expenses 78,903 12,569 1,032 92,504 74,300 4,221 4,940 83,461 74,183 3,623 5,920 83,726 Income before income taxes 959 (3,620) 8,316 5,655 9,005 (55) 666 9,616 11,291 (282) 1,007 12,016 Income taxes 371 (1,396) 3,013 1,988 2,282 (14) 103 2,371 2,861 (71) 406 3,196 Net income 588 (2,224) 5,303 3,667 6,723 (41) 563 7,245 8,430 (211) 601 8,820 Net loss attributable to noncontrolling interest (328) - - (328) (218) - - (218) - - - - Net income attributable to FNHC shareholders $916 ($2,224) $5,303 $3,995 $6,941 ($41) $563 $7,463 $8,430 ($211) $601 $8,820 Q2 earnings from Homeowners up $7.5M YoY and $1.5M sequentially 26

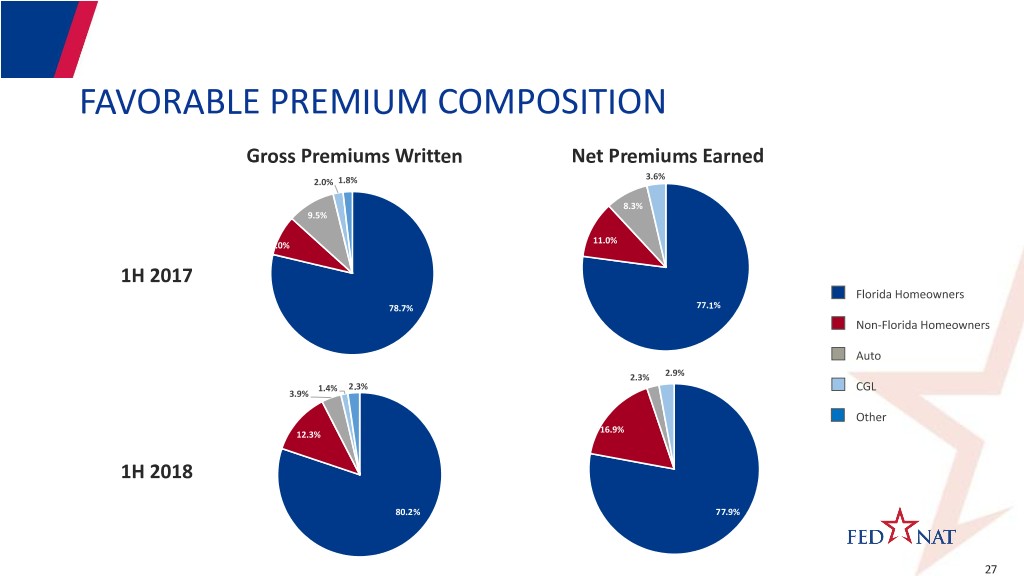

FAVORABLE PREMIUM COMPOSITION Gross Premiums Written Net Premiums Earned 3.6% 2.0% 1.8% 8.3% 9.5% 11.0% 8.0% 1H 2017 Florida Homeowners 78.7% 77.1% Non-Florida Homeowners Auto 2.3% 2.9% 1.4% 2.3% CGL 3.9% Other 16.9% 12.3% 1H 2018 80.2% 77.9% 27

INVESTMENT PORTFOLIO COMPOSITION Corporate & Collaterized Mortgage Obligations • Designed to preserve capital, maximize after-tax $295.4 State. Muni, and investment income, maintain liquidity and minimize Political Subs risk $24.0 • As of 6/30/2018, 97.8% of the Company’s fixed income portfolio was rated investment grade • Average duration: 3.976 years • Composite rating: A- (S&P Composite) Common Stock & • YTM: 3.40% Mutual Funds • Book yield: 2.90% $17.4 • Historical total returns on cash and investments as of 6/30/2018 Cash and Cash • 1 Year: 0.48% US Gov. & Agency Equivalents • 2 Years: 0.96% $83.9 Sec. $111.4 as of June 30, 2018 (in millions) 28

LIQUIDITY & LEVERAGE Non-insurance Liquidity Cash Flow from Operations $ in millions $ in millions $60 $40 $33 $55 $29 $30 $24 $55 $50 $50 $50 $20 $12 $45 $10 $40 $0 $35 -$10 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 $30 $25 -$20 -$15* $20 -$30 -$29* Q4 2017 Q1 2018 Q2 2018 -$40 * Impacted by Hurricane Irma. Financial Leverage Underwriting Leverage Debt/Capital NPE/Equity 20% 40% 39.5% 17.8% 17.6% 17.1% 38.9% 39% 38.5% 15% 38% 37% 35.9% 35.5% 10% 36% 35% 34.4% 34% 5% 2.0% 2.1% 2.1% 33% 32% 0% Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 31% Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 29

EFFECTIVE CAPITAL MANAGEMENT 350,000 $16.65 $16.36 $16.89 $17.50 $16.23 $15.98 $16.29 $15.50 49,251 44,353 44,328 $13.50 250,000 4,914 4,919 4,925 $11.50 $9.50 150,000 $7.50 237,504 235,661 225,070 227,459 208,080 215,028 $5.50 $3.50 50,000 $1.50 -$0.50 -2,990 -10,293 -12,681 -14,965 -21,031 -22,133 -50,000 -$2.50 Q117 Q217 Q317* Q417 Q118** Q218 Accumulated Share Repurchases & Dividends Common Equity Total Debt BVPS $10M share repurchase program authorized March 2017; Additional $10M program authorized December 2017 * Impacted by Hurricane Irma ** Acquired the non-controlling interest in Monarch National during 1Q18 30

Questions? Michael Braun Chief Executive Officer, FedNat Holding Company Phone: 954-308-1322 mbraun@FedNat.com Ron Jordan Chief Financial Officer, FedNat Holding Company Phone: 954-308-1363 rjordan@FedNat.com