Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Montage Resources Corp | d594536d8k.htm |

| EX-99.1 - EX-99.1 - Montage Resources Corp | d594536dex991.htm |

| EX-10.8 - EX-10.8 - Montage Resources Corp | d594536dex108.htm |

| EX-10.7 - EX-10.7 - Montage Resources Corp | d594536dex107.htm |

| EX-10.6 - EX-10.6 - Montage Resources Corp | d594536dex106.htm |

| EX-10.5 - EX-10.5 - Montage Resources Corp | d594536dex105.htm |

| EX-10.4 - EX-10.4 - Montage Resources Corp | d594536dex104.htm |

| EX-10.3 - EX-10.3 - Montage Resources Corp | d594536dex103.htm |

| EX-10.2 - EX-10.2 - Montage Resources Corp | d594536dex102.htm |

| EX-10.1 - EX-10.1 - Montage Resources Corp | d594536dex101.htm |

| EX-2.1 - EX-2.1 - Montage Resources Corp | d594536dex21.htm |

Strategic Combination: Eclipse Resources and Blue Ridge Mountain Resources Transformative Transaction in the Appalachian Basin August xx, 2018 August 2018 Exhibit 99.2

Forward-Looking Statements, Cautionary Statements, and Other Disclosures No Offer or Solicitation This communication relates to a proposed business combination transaction (the “Transaction”) between the Company and Blue Ridge. This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find It In connection with the Transaction, the Company will file with the SEC a registration statement on Form S-4 that will include a consent solicitation statement of Blue Ridge and an information statement of the Company and that also constitutes a prospectus of the Company. The Company may also file other documents with the SEC regarding the Transaction. The definitive consent solicitation statement/information statement/prospectus will be sent to the stockholders of the Company and Blue Ridge. This document is not a substitute for the registration statement and consent solicitation statement/information statement/prospectus that will be filed with the SEC or any other documents that the Company may file with the SEC or that the Company or Blue Ridge may send to stockholders of the Company or Blue Ridge in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF THE COMPANY AND BLUE RIDGE ARE URGED TO READ THE REGISTRATION STATEMENT, THE CONSENT SOLICITATION STATEMENT/INFORMATION STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the registration statement and the consent solicitation statement/information statement/prospectus (when available) and all other documents filed or that will be filed with the SEC by the Company through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by the Company will be made available free of charge on the Company’s website at www.eclipseresources.com or by contacting the Company’s Investor Relations Department by phone at 814-325-2059. Participants in Solicitation The Company, Blue Ridge and certain of their respective directors, executive officers and members of management and employees may be deemed to be participants in the solicitation of consents from the holders of Blue Ridge’s common stock in respect to the Transaction. Information regarding the Company’s directors and executive officers is contained in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Information regarding Blue Ridge’s directors and executive officers will be contained in the consent solicitation statement/information statement/prospectus and other relevant materials filed with the SEC. You can obtain a free copy of these documents at the SEC’s website at www.sec.gov or by accessing the Company’s website at www.eclipseresources.com. Investors may obtain additional information regarding the interests of those persons who may be deemed participants in the Transaction by reading the consent solicitation statement/information statement/prospectus and other relevant documents filed with the SEC regarding the Transaction when they become available. You may obtain free copies of these documents as described above. Forward-Looking Statements and Cautionary Statements The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that the Company or Blue Ridge expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Transaction, pro forma descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, the possibility that stockholders of Blue Ridge may not approve the adoption of the Merger Agreement, the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the Transaction, the risk that any announcements relating to the Transaction could have adverse effects on the market price of the Company’s common stock, the risk that the Transaction and its announcement could have an adverse effect on the ability of the Company and Blue Ridge to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than expected to achieve those synergies and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond the Company’s or Blue Ridge’s control, including those factors and risks detailed in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on its website at www.eclipseresources.com and on the SEC’s website at www.sec.gov. All forward-looking statements are based on assumptions that the Company or Blue Ridge believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company and Blue Ridge undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. Cautionary Note Regarding Hydrocarbon Quantities The SEC permits oil and gas companies to disclose in their filings with the SEC only proved, probable and possible reserve estimates. Eclipse has provided proved reserve estimates that were independently engineered by Netherland Sewell & Associates, Inc. Unless otherwise noted, proved reserves are as of December 31, 2017. Actual quantities that may be ultimately recovered from Eclipse’s interests may differ substantially from the estimates in this presentation. The Company may use the terms “resource potential,” “EUR,” “upside potential” and similar phrases to describe estimates of potentially recoverable hydrocarbons that the SEC rules prohibit from being included in filings with the SEC. These are based on analogy to the Company’s existing models applied to additional acres, additional zones and tighter spacing and are the Company’s internal estimates of hydrocarbon quantities that may be potentially discovered through exploratory drilling or recovered with additional drilling or recovery techniques. These quantities may not constitute “reserves” within the meaning of the Society of Petroleum Engineer’s Petroleum Resource Management System or SEC rules. EUR estimates, resource potential and identified drilling locations have not been fully risked by Company management and are inherently more speculative than proved reserves estimates. Actual locations drilled and quantities that may be ultimately recovered from the Company’s interests could differ substantially. There is no commitment by the Company to drill all of the drilling locations, which have been attributed to these quantities. Factors affecting ultimate recovery include the scope of the Company’s ongoing drilling program, which will be directly affected by the availability of capital, drilling and production costs, availability of drilling services and equipment, drilling results, lease expirations, transportation constraints, regulatory approvals, actual drilling results, including geological and mechanical factors affecting recovery rates, and other factors. Resource potential and EUR may change significantly as development of the Company’s oil and natural gas assets provide additional data. The Company’s production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling cost increases. The type curve areas included in this presentation are based upon our analysis of available Utica Shale well data, including, but not limited to, information regarding initial production rates, Btu content, natural gas yields and condensate yields, all of which may change over time. As a result, the well data with respect to the type curve areas presented herein may not be indicative of the actual hydrocarbon composition for the type curve areas, and the performance, Btu content and natural gas and/or condensate yields of our wells may be substantially less than we anticipate or substantially less than performance and yields of other operators in our area of operation. Cautionary Note Regarding Non-GAAP Financial Measure This presentation includes financial measures that are not in accordance with generally accepted accounting principles (“GAAP”), including Adjusted EBITDAX. While management believes such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. For a reconciliation of Adjusted EBITDAX to the nearest comparable measure in accordance with GAAP, please see the Appendix of this presentation.

Transaction Terms 100% stock combination of Eclipse Resources (“Eclipse”) and Blue Ridge Mountain Resources (“Blue Ridge” or “BRMR”) ~230 million shares to be issued to Blue Ridge shareholders (~540 million total shares) 15-to-1 reverse stock split at close Post-stock split pro forma shares of ~36 million Pro forma equity value of $908 million and enterprise value of $1,426 million as of August 24, 2018 4.4259 Exchange Ratio Pro Forma Ownership & Governance Eclipse: 57.5%, Blue Ridge: 42.5% Blue Ridge CEO John Reinhart will become President & CEO of the combined company 10 Board members 5 named by Eclipse 5 named by Blue Ridge, including John Reinhart Approvals & Closing Unanimously approved by board of directors of Eclipse and Blue Ridge and approved by Eclipse shareholders Subject to Blue Ridge shareholder approval Voting agreement in place from 60% of Blue Ridge shareholders Subject to customary regulatory approvals and other customary closing conditions Expected closing in Q4 2018 Transaction Summary

Transaction Rationale Improved balance sheet & liquidity drives increased production growth at low leverage levels Significant operating & corporate level synergies Furthers ability to optimize netbacks, as well as midstream & marketing commitments Increases inventory of core Utica locations and adds substantial Marcellus development opportunity Substantial increase to public float and anticipated improvement in stock market liquidity Scale and growth provide pathway to free cash flow and additional value to shareholders1 Materially expands operating footprint Significant operating & corporate level synergies Enhances optionality for future consolidation and growth Diversifies asset portfolio to include Flat Castle North Central PA development opportunities Improves stock market trading liquidity Scale and growth provide pathway to free cash flow and additional value to shareholders1 Free cash flow defined as EBITDAX less CAPEX.

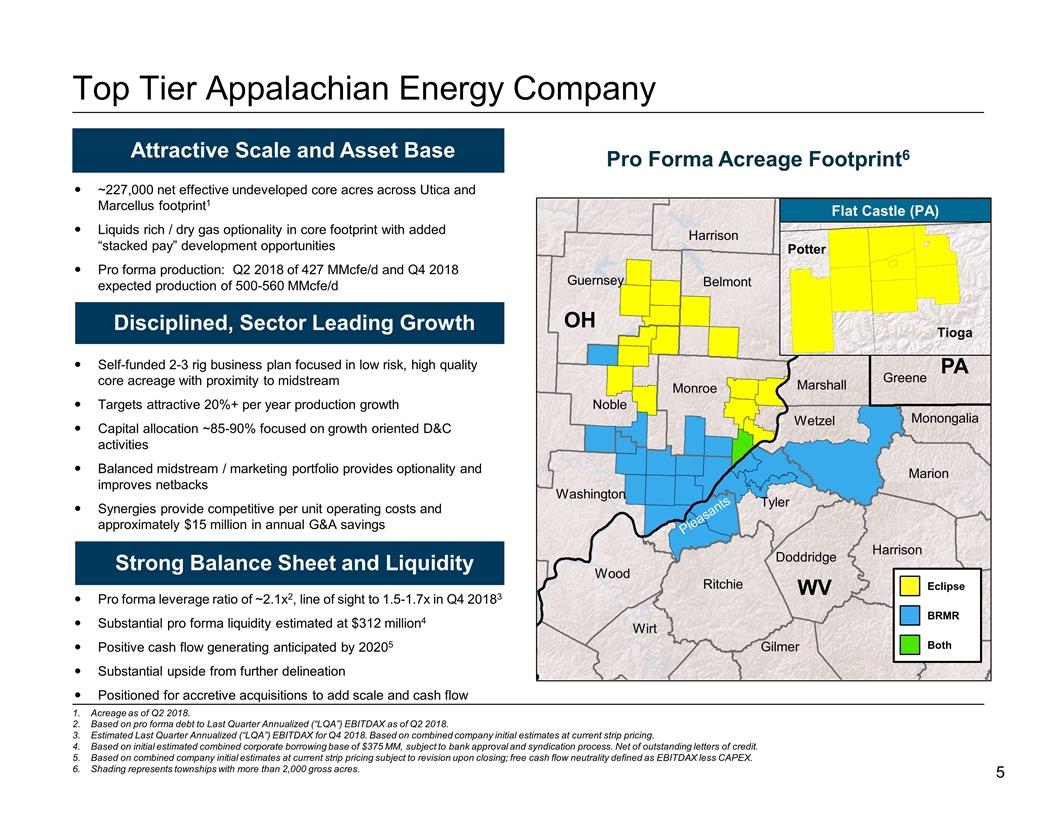

Pro forma leverage ratio of ~2.1x2, line of sight to 1.5-1.7x in Q4 20183 Substantial pro forma liquidity estimated at $312 million4 Positive cash flow generating anticipated by 20205 Substantial upside from further delineation Positioned for accretive acquisitions to add scale and cash flow Top Tier Appalachian Energy Company Self-funded 2-3 rig business plan focused in low risk, high quality core acreage with proximity to midstream Targets attractive 20%+ per year production growth Capital allocation ~85-90% focused on growth oriented D&C activities Balanced midstream / marketing portfolio provides optionality and improves netbacks Synergies provide competitive per unit operating costs and approximately $15 million in annual G&A savings ~227,000 net effective undeveloped core acres across Utica and Marcellus footprint1 Liquids rich / dry gas optionality in core footprint with added “stacked pay” development opportunities Pro forma production: Q2 2018 of 427 MMcfe/d and Q4 2018 expected production of 500-560 MMcfe/d Disciplined, Sector Leading Growth Strong Balance Sheet and Liquidity Acreage as of Q2 2018. Based on pro forma debt to Last Quarter Annualized (“LQA”) EBITDAX as of Q2 2018. Estimated Last Quarter Annualized (“LQA”) EBITDAX for Q4 2018. Based on combined company initial estimates at current strip pricing. Based on initial estimated combined corporate borrowing base of $375 MM, subject to bank approval and syndication process. Net of outstanding letters of credit. Based on combined company initial estimates at current strip pricing subject to revision upon closing; free cash flow neutrality defined as EBITDAX less CAPEX. Shading represents townships with more than 2,000 gross acres. Attractive Scale and Asset Base Flat Castle (PA) Potter Tioga Guernsey Noble Monroe Belmont Washington Wood Wirt Ritchie Pleasants Tyler Doddridge Gilmer Harrison Wetzel Marion Monongalia Greene Marshall Harrison Eclipse BRMR Both OH WV PA Pro Forma Acreage Footprint6

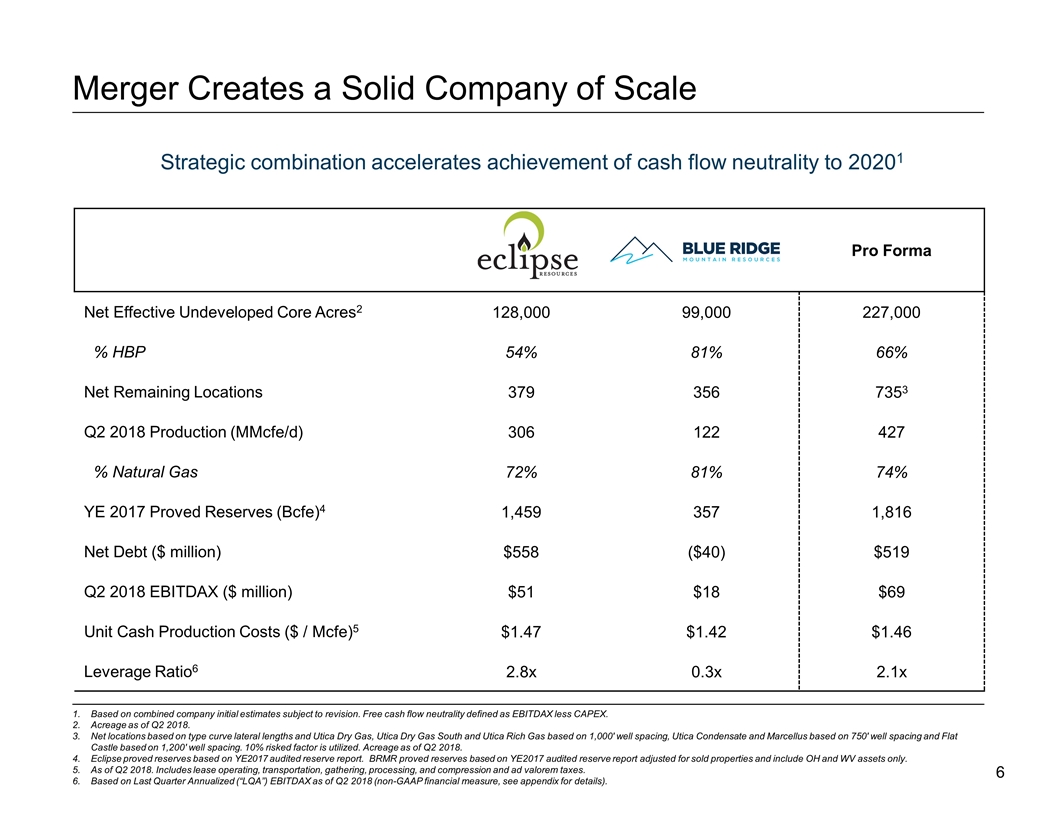

Pro Forma Net Effective Undeveloped Core Acres2 128,000 99,000 227,000 % HBP 54% 81% 66% Net Remaining Locations 379 356 7353 Q2 2018 Production (MMcfe/d) 306 122 427 % Natural Gas 72% 81% 74% YE 2017 Proved Reserves (Bcfe)4 1,459 357 1,816 Net Debt ($ million) $558 ($40) $519 Q2 2018 EBITDAX ($ million) $51 $18 $69 Unit Cash Production Costs ($ / Mcfe)5 $1.47 $1.42 $1.46 Leverage Ratio6 2.8x 0.3x 2.1x Merger Creates a Solid Company of Scale Based on combined company initial estimates subject to revision. Free cash flow neutrality defined as EBITDAX less CAPEX. Acreage as of Q2 2018. Net locations based on type curve lateral lengths and Utica Dry Gas, Utica Dry Gas South and Utica Rich Gas based on 1,000' well spacing, Utica Condensate and Marcellus based on 750' well spacing and Flat Castle based on 1,200' well spacing. 10% risked factor is utilized. Acreage as of Q2 2018. Eclipse proved reserves based on YE2017 audited reserve report. BRMR proved reserves based on YE2017 audited reserve report adjusted for sold properties and include OH and WV assets only. As of Q2 2018. Includes lease operating, transportation, gathering, processing, and compression and ad valorem taxes. Based on Last Quarter Annualized (“LQA”) EBITDAX as of Q2 2018 (non-GAAP financial measure, see appendix for details). Strategic combination accelerates achievement of cash flow neutrality to 20201

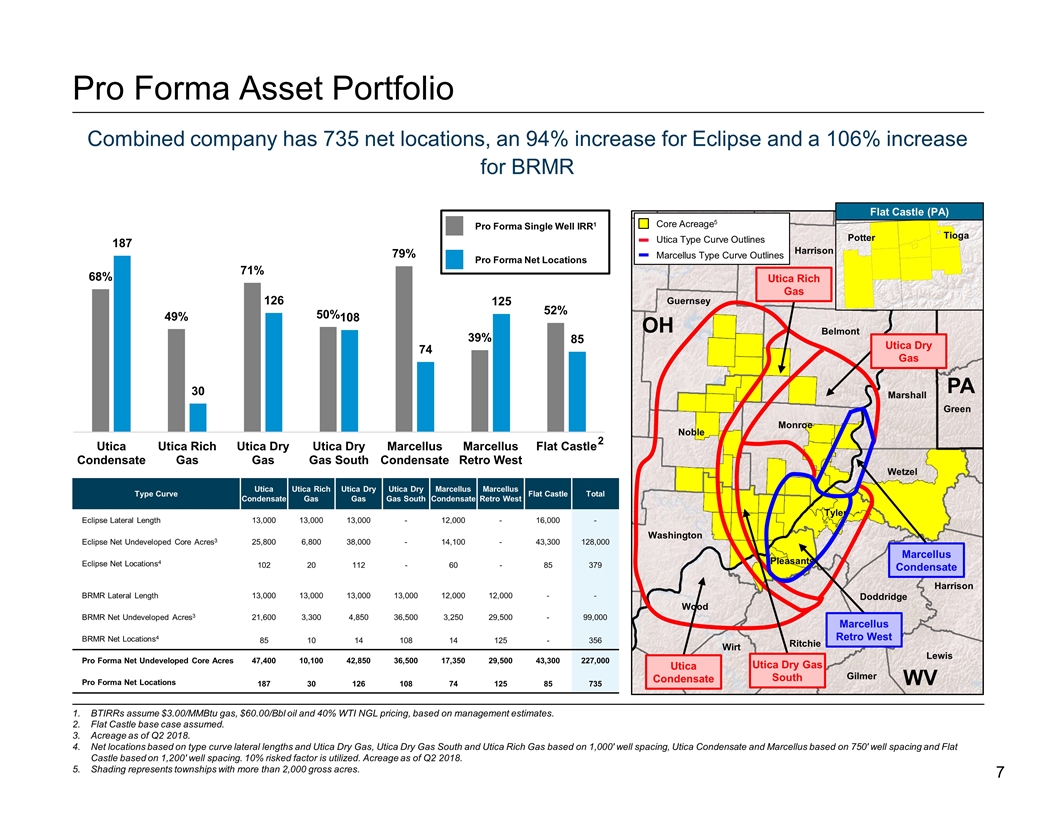

Type Curve Utica Condensate Utica Rich Gas Utica Dry Gas Utica Dry Gas South Marcellus Condensate Marcellus Retro West Flat Castle Total Eclipse Lateral Length 13,000 13,000 13,000 - 12,000 - 16,000 - Eclipse Net Undeveloped Core Acres3 25,800 6,800 38,000 - 14,100 - 43,300 128,000 Eclipse Net Locations4 102 20 112 - 60 - 85 379 BRMR Lateral Length 13,000 13,000 13,000 13,000 12,000 12,000 - - BRMR Net Undeveloped Acres3 21,600 3,300 4,850 36,500 3,250 29,500 - 99,000 BRMR Net Locations4 85 10 14 108 14 125 - 356 Pro Forma Net Undeveloped Core Acres 47,400 10,100 42,850 36,500 17,350 29,500 43,300 227,000 Pro Forma Net Locations 187 30 126 108 74 125 85 735 2 Pro Forma Asset Portfolio Combined company has 735 net locations, an 94% increase for Eclipse and a 106% increase for BRMR BTIRRs assume $3.00/MMBtu gas, $60.00/Bbl oil and 40% WTI NGL pricing, based on management estimates. Flat Castle base case assumed. Acreage as of Q2 2018. Net locations based on type curve lateral lengths and Utica Dry Gas, Utica Dry Gas South and Utica Rich Gas based on 1,000' well spacing, Utica Condensate and Marcellus based on 750' well spacing and Flat Castle based on 1,200' well spacing. 10% risked factor is utilized. Acreage as of Q2 2018. Shading represents townships with more than 2,000 gross acres. Pro Forma Net Locations Pro Forma Single Well IRR1 Guernsey Harrison Belmont Monroe Noble Washington Wood Ritchie Pleasants Doddridge Lewis Gilmer Wirt Wetzel Marshall Belmont Harrison Tyler Green Flat Castle (PA) Potter Tioga OH WV PA Utica Type Curve Outlines Core Acreage5 Marcellus Condensate Marcellus Retro West Utica Dry Gas South Utica Dry Gas Utica Rich Gas Utica Condensate Marcellus Type Curve Outlines

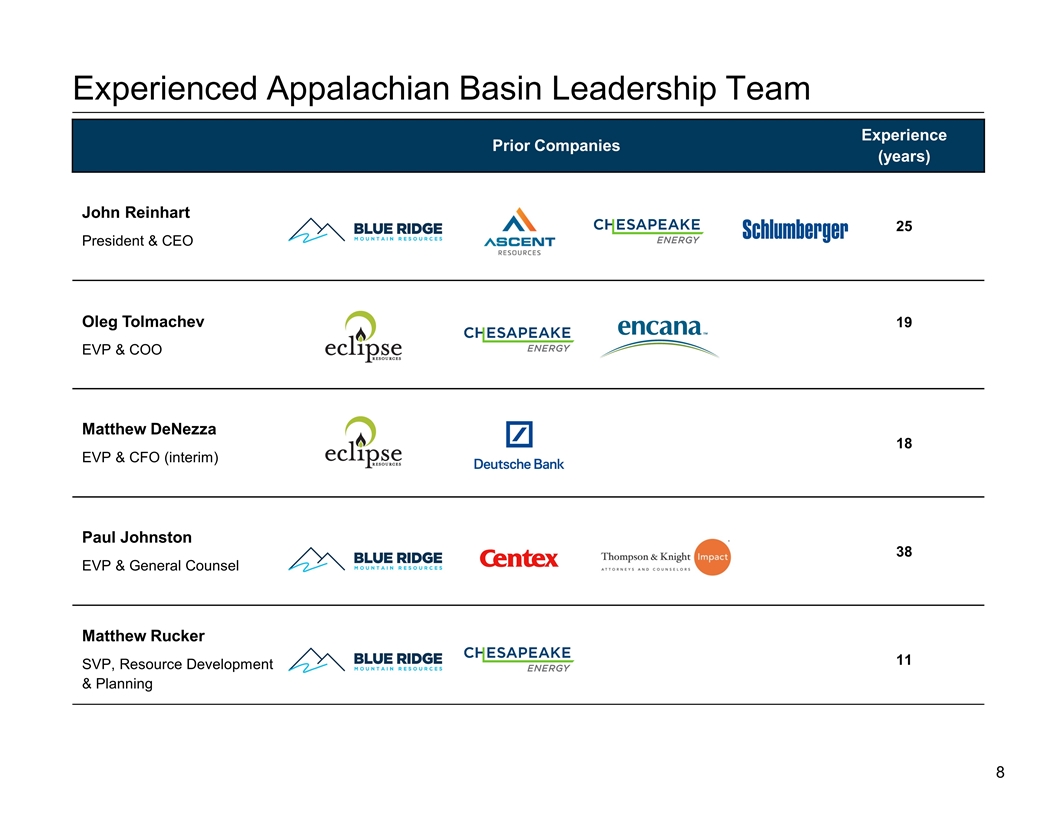

Prior Companies Experience (years) John Reinhart President & CEO 25 Oleg Tolmachev EVP & COO 19 Matthew DeNezza EVP & CFO (interim) 18 Paul Johnston EVP & General Counsel 38 Matthew Rucker SVP, Resource Development & Planning 11 Experienced Appalachian Basin Leadership Team

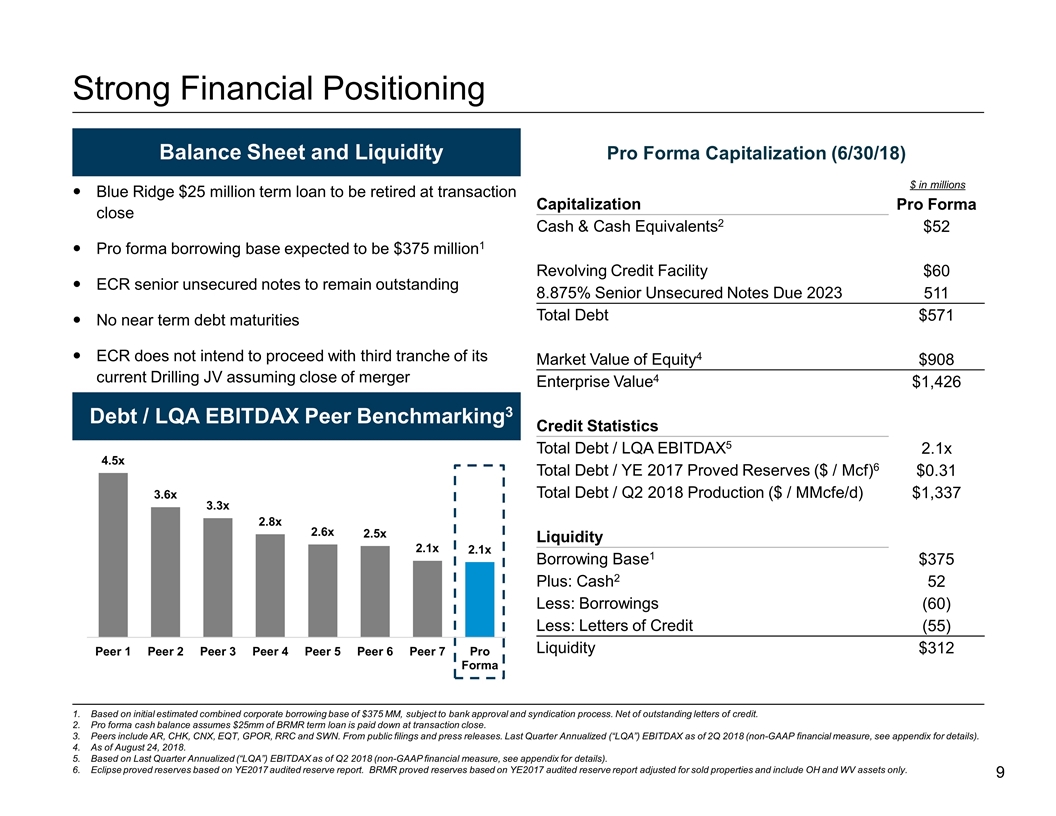

Strong Financial Positioning Balance Sheet and Liquidity Blue Ridge $25 million term loan to be retired at transaction close Pro forma borrowing base expected to be $375 million1 ECR senior unsecured notes to remain outstanding No near term debt maturities ECR does not intend to proceed with third tranche of its current Drilling JV assuming close of merger Based on initial estimated combined corporate borrowing base of $375 MM, subject to bank approval and syndication process. Net of outstanding letters of credit. Pro forma cash balance assumes $25mm of BRMR term loan is paid down at transaction close. Peers include AR, CHK, CNX, EQT, GPOR, RRC and SWN. From public filings and press releases. Last Quarter Annualized (“LQA”) EBITDAX as of 2Q 2018 (non-GAAP financial measure, see appendix for details). As of August 24, 2018. Based on Last Quarter Annualized (“LQA”) EBITDAX as of Q2 2018 (non-GAAP financial measure, see appendix for details). Eclipse proved reserves based on YE2017 audited reserve report. BRMR proved reserves based on YE2017 audited reserve report adjusted for sold properties and include OH and WV assets only. Debt / LQA EBITDAX Peer Benchmarking3 Capitalization Pro Forma Cash & Cash Equivalents2 $52 Revolving Credit Facility $60 8.875% Senior Unsecured Notes Due 2023 511 Total Debt $571 Market Value of Equity4 $908 Enterprise Value4 $1,426 Credit Statistics Total Debt / LQA EBITDAX5 2.1x Total Debt / YE 2017 Proved Reserves ($ / Mcf)6 $0.31 Total Debt / Q2 2018 Production ($ / MMcfe/d) $1,337 Liquidity Borrowing Base1 $375 Plus: Cash2 52 Less: Borrowings (60) Less: Letters of Credit (55) Liquidity $312 $ in millions Pro Forma Capitalization (6/30/18)

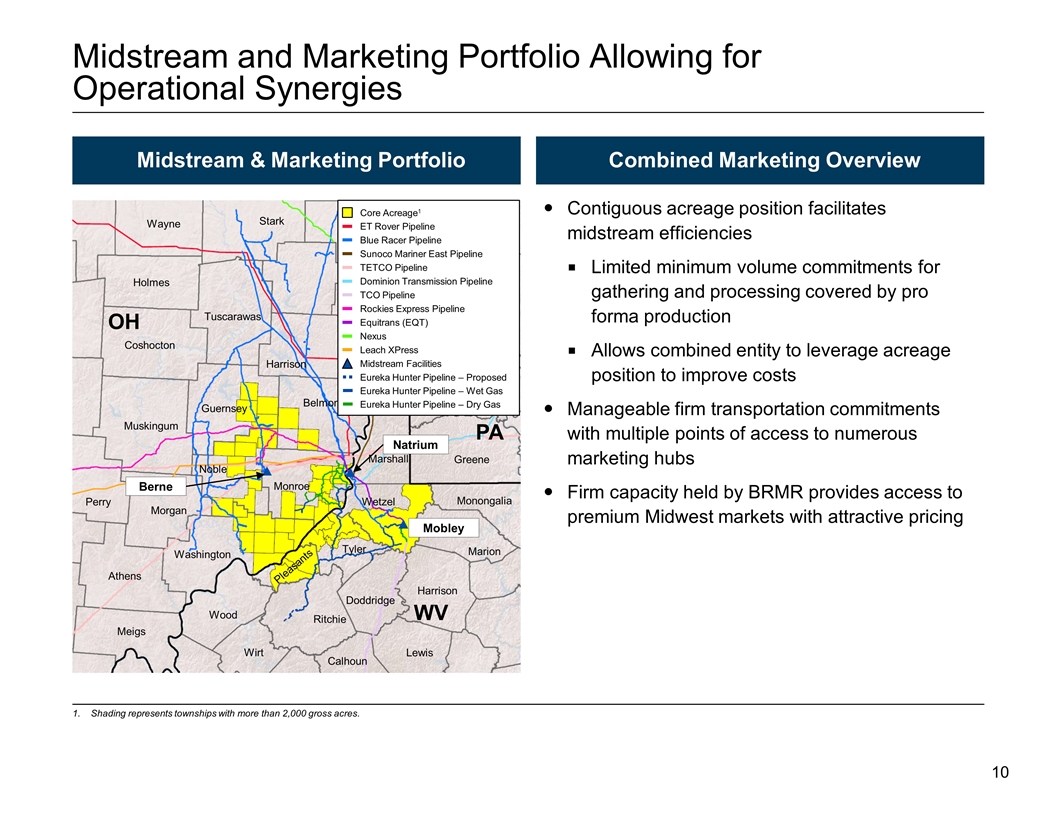

Midstream and Marketing Portfolio Allowing for Operational Synergies Midstream & Marketing Portfolio Combined Marketing Overview Contiguous acreage position facilitates midstream efficiencies Limited minimum volume commitments for gathering and processing covered by pro forma production Allows combined entity to leverage acreage position to improve costs Manageable firm transportation commitments with multiple points of access to numerous marketing hubs Firm capacity held by BRMR provides access to premium Midwest markets with attractive pricing Shading represents townships with more than 2,000 gross acres. Taylor Barbour Berne Mobley Guernsey Noble Monroe Belmont Washington Wood Wirt Ritchie Pleasants Tyler Doddridge Harrison Wetzel Marion Monongalia Greene Marshall Harrison Lewis Calhoun Tuscarawas Coshocton Muskingum Morgan Athens Meigs Perry Holmes Wayne Stark Natrium Midstream Facilities ET Rover Pipeline Blue Racer Pipeline Sunoco Mariner East Pipeline TETCO Pipeline Dominion Transmission Pipeline Eureka Hunter Pipeline – Proposed TCO Pipeline Rockies Express Pipeline Core Acreage1 Eureka Hunter Pipeline – Wet Gas Eureka Hunter Pipeline – Dry Gas Equitrans (EQT) Nexus Leach XPress OH WV PA

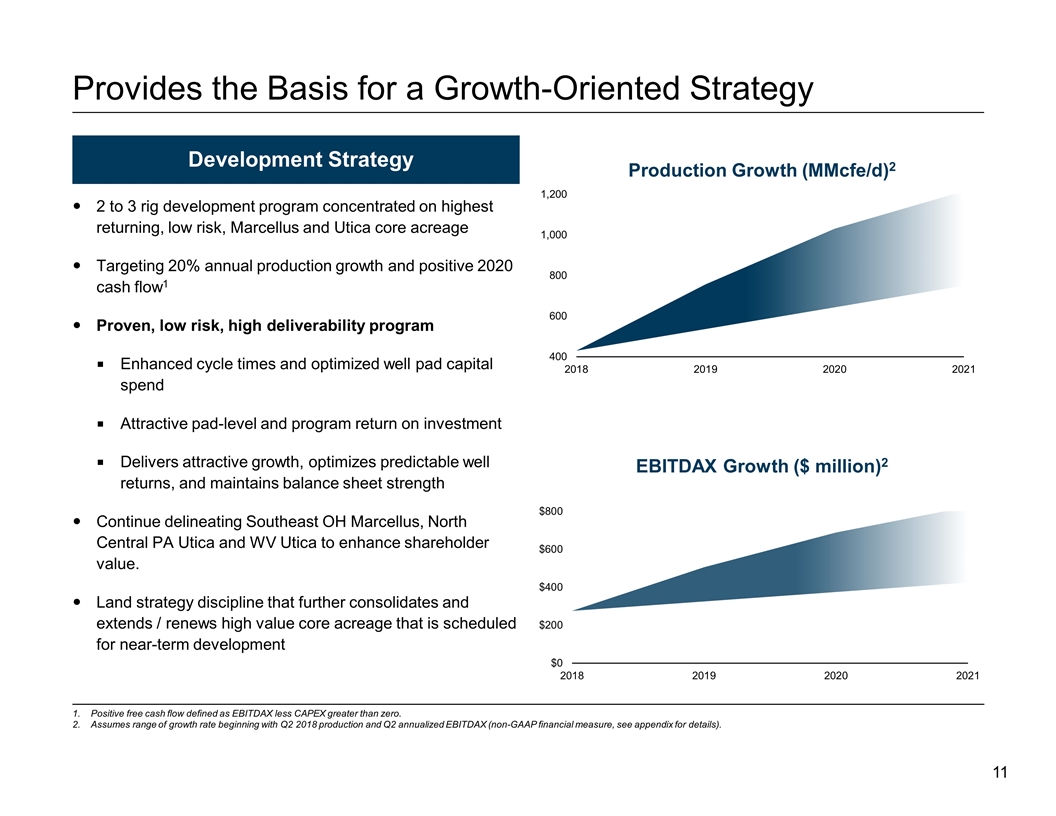

Provides the Basis for a Growth-Oriented Strategy 2 to 3 rig development program concentrated on highest returning, low risk, Marcellus and Utica core acreage Targeting 20% annual production growth and positive 2020 cash flow1 Proven, low risk, high deliverability program Enhanced cycle times and optimized well pad capital spend Attractive pad-level and program return on investment Delivers attractive growth, optimizes predictable well returns, and maintains balance sheet strength Continue delineating Southeast OH Marcellus, North Central PA Utica and WV Utica to enhance shareholder value. Land strategy discipline that further consolidates and extends / renews high value core acreage that is scheduled for near-term development Development Strategy Positive free cash flow defined as EBITDAX less CAPEX greater than zero. Assumes range of growth rate beginning with Q2 2018 production and Q2 annualized EBITDAX (non-GAAP financial measure, see appendix for details). Production Growth (MMcfe/d)2 EBITDAX Growth ($ million)2

Combined Management Team Highly experienced team with a history of success in Appalachia 111 years of combined Oil and Gas Experience Highly Complementary Asset Fit Ability to high grade development plan Maximize efficiency and cash generation Healthy Balance Sheet Credit accretive transaction supports improved growth profile at low leverage levels Strong liquidity position Optimized Midstream Solution Incremental access to new markets Flexibility for future growth and contract negotiation Additional Growth Opportunities Accelerates cash flow neutrality – expected by 20201 Ability to generate attractive growth through the drillbit while “living within means” Creates a platform to assess and act upon inorganic growth opportunities across the basin Compelling Appalachia Story Based on combined company initial estimates subject to revision. Free cash flow neutrality defined as EBITDAX less CAPEX.

Appendices

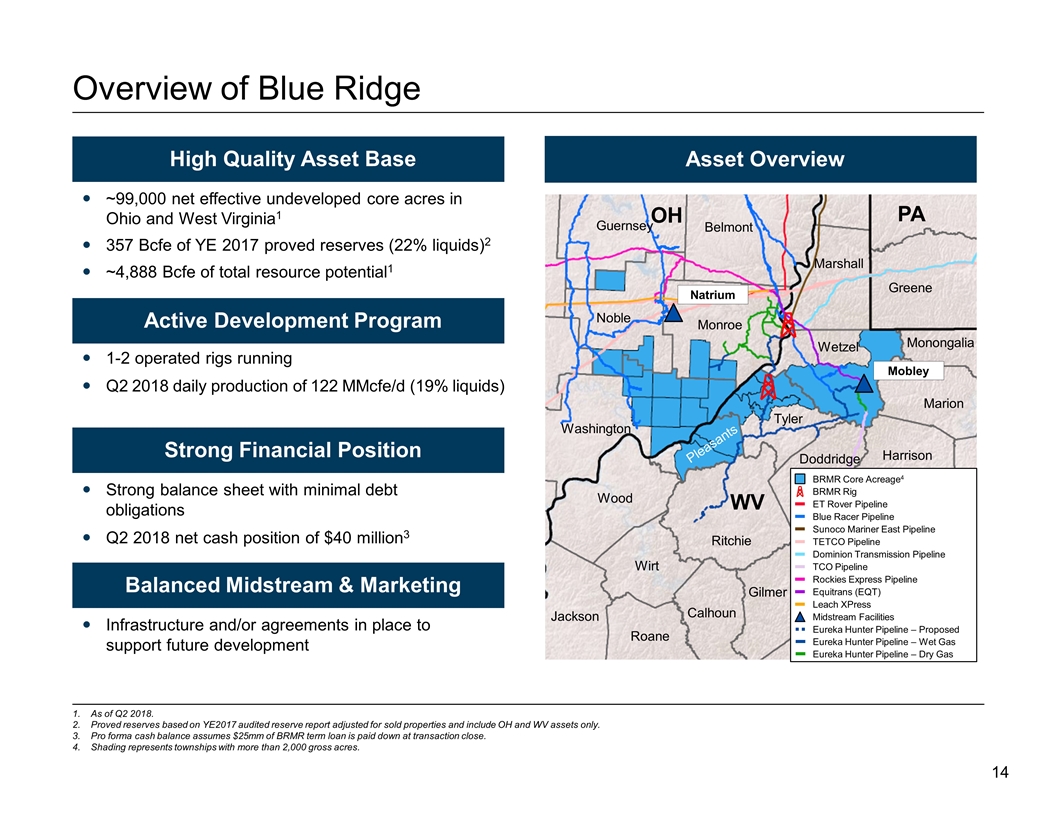

Overview of Blue Ridge Disciplined, sector leading, growth 1-2 operated rigs running Q2 2018 daily production of 122 MMcfe/d (19% liquids) Strong asset base ~99,000 net effective undeveloped core acres in Ohio and West Virginia1 357 Bcfe of YE 2017 proved reserves (22% liquids)2 ~4,888 Bcfe of total resource potential1 High Quality Asset Base Active Development Program Strong Financial Position Strong balance sheet with minimal debt obligations Q2 2018 net cash position of $40 million3 Balanced Midstream & Marketing Infrastructure and/or agreements in place to support future development Asset Overview Midstream Facilities ET Rover Pipeline Blue Racer Pipeline Sunoco Mariner East Pipeline TETCO Pipeline Dominion Transmission Pipeline Eureka Hunter Pipeline – Proposed TCO Pipeline Rockies Express Pipeline BRMR Core Acreage4 Eureka Hunter Pipeline – Wet Gas Eureka Hunter Pipeline – Dry Gas Equitrans (EQT) Leach XPress BRMR Rig Guernsey Noble Monroe Belmont Washington Wood Wirt Ritchie Pleasants Tyler Doddridge Gilmer Harrison Wetzel Marion Monongalia Greene Marshall Calhoun Roane Jackson Mobley Natrium As of Q2 2018. Proved reserves based on YE2017 audited reserve report adjusted for sold properties and include OH and WV assets only. Pro forma cash balance assumes $25mm of BRMR term loan is paid down at transaction close. Shading represents townships with more than 2,000 gross acres. OH WV PA

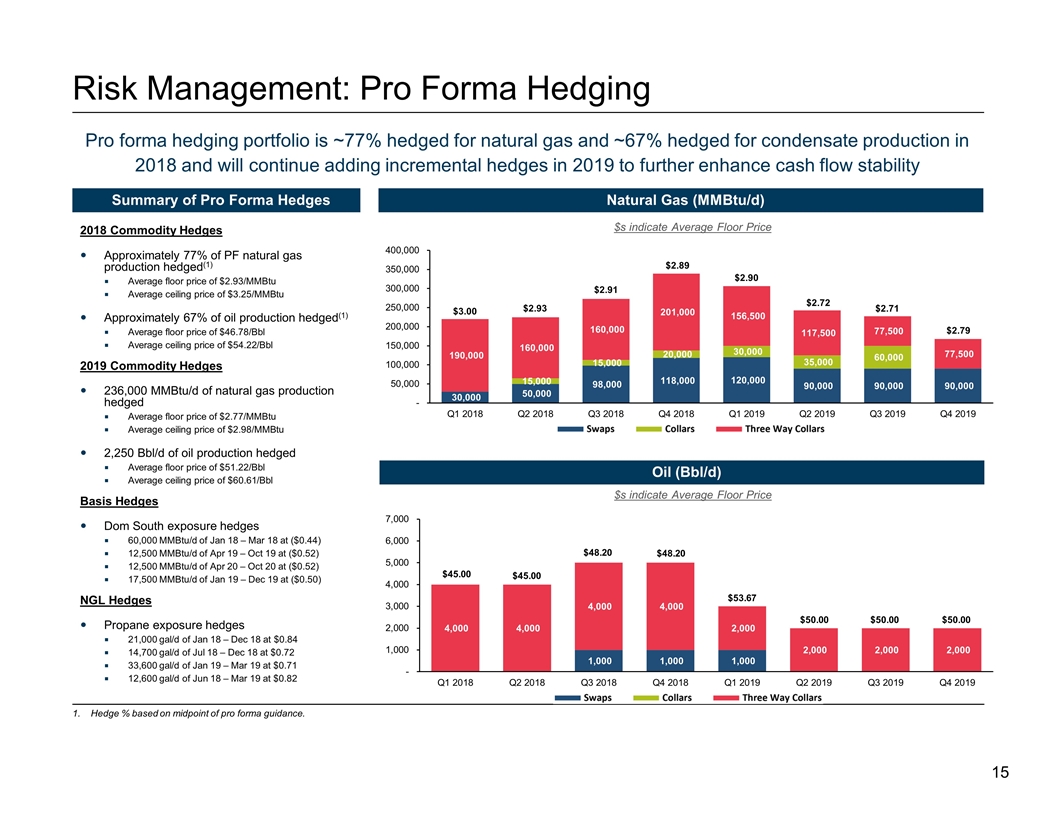

Risk Management: Pro Forma Hedging Pro forma hedging portfolio is ~77% hedged for natural gas and ~67% hedged for condensate production in 2018 and will continue adding incremental hedges in 2019 to further enhance cash flow stability Summary of Pro Forma Hedges Natural Gas (MMBtu/d) Hedge % based on midpoint of pro forma guidance. 2018 Commodity Hedges Approximately 77% of PF natural gas production hedged(1) Average floor price of $2.93/MMBtu Average ceiling price of $3.25/MMBtu Approximately 67% of oil production hedged(1) Average floor price of $46.78/Bbl Average ceiling price of $54.22/Bbl 2019 Commodity Hedges 236,000 MMBtu/d of natural gas production hedged Average floor price of $2.77/MMBtu Average ceiling price of $2.98/MMBtu 2,250 Bbl/d of oil production hedged Average floor price of $51.22/Bbl Average ceiling price of $60.61/Bbl Basis Hedges Dom South exposure hedges 60,000 MMBtu/d of Jan 18 – Mar 18 at ($0.44) 12,500 MMBtu/d of Apr 19 – Oct 19 at ($0.52) 12,500 MMBtu/d of Apr 20 – Oct 20 at ($0.52) 17,500 MMBtu/d of Jan 19 – Dec 19 at ($0.50) NGL Hedges Propane exposure hedges 21,000 gal/d of Jan 18 – Dec 18 at $0.84 14,700 gal/d of Jul 18 – Dec 18 at $0.72 33,600 gal/d of Jan 19 – Mar 19 at $0.71 12,600 gal/d of Jun 18 – Mar 19 at $0.82 $s indicate Average Floor Price $s indicate Average Floor Price $3.00 $2.93 $2.91 $2.89 $2.90 $2.72 $2.71 $2.79 $45.00 $45.00 $48.20 $48.20 $53.67 $50.00 $50.00 $50.00 Oil (Bbl/d)

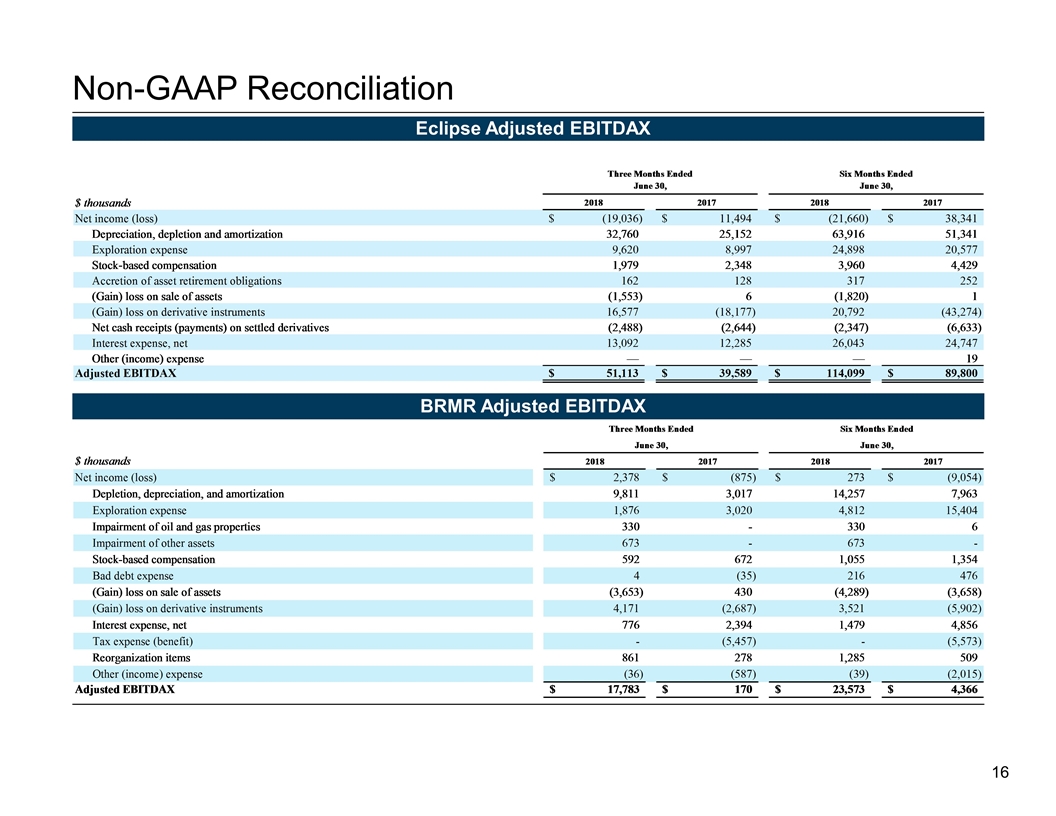

Non-GAAP Reconciliation Eclipse Adjusted EBITDAX BRMR Adjusted EBITDAX