Attached files

| file | filename |

|---|---|

| EX-32 - Progreen US, Inc. | ex-32.htm |

| EX-31 - Progreen US, Inc. | ex-31.htm |

| EX-21 - Progreen US, Inc. | ex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: April 30, 2018

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File No. 000-25429

PROGREEN US, INC.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 59-3087128 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| Incorporation or organization) | Identification No.) |

2667 Camino del Rio South, Suite 312 San Diego, CA |

92108-3763 | |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s Telephone Number, Including Area Code: (619) 487-9585

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by checkmark if the registrant is not required to file reports to Section 13 or 15(d) Of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| (Do not check if a smaller reporting company) | |||

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes [X] No [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $4,930,991.

Number of shares of Common Stock outstanding as of August 12, 2018: 432,120,413 shares.

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS

This Report contains forward-looking statements within the meaning of the Private Securities Reform Act of 1995 including the adequacy of our working capital and our acquisition plans. In addition to these statements, trend analyses and other information including words such as “seek,” “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend” and other similar expressions are forward looking statements. These statements are based on our beliefs as well as assumptions we made using information currently available to us. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Because these statements reflect our current views concerning future events, these statements involve risks, uncertainties, and assumptions. Actual future results may differ significantly from the results discussed in the forward-looking statements. We anticipate that some or all of the results may not occur because of factors which we discuss in the “Risk Factors” section.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” beginning on page 7.

General

We have recently moved our offices from Oakland County, Michigan, to San Diego, California, proximate to our agricultural and development projects in Baja California, on which our current business operations are focused. The purchase of a condominium unit on July 28, 2009 initiated our real estate development operations directed at purchasing income-producing residential real estate apartment homes, condominiums and houses in the State of Michigan. As of April 30, 2018, we had sold all properties owned in Michigan, and we have refocused our efforts to concentrate on the same line of business for our Cielo Mar development in Baja, California.

Real Estate Development and Marketing Operations

Environmental Objectives in our Operations

To make homes more comfortable, we try to, whenever practical, optimize space by creating openness, introducing more natural light, creating better storage areas, as well as aiming to improve insulation, all with a view to make even small condominiums and apartments eco-friendly and practical. This ideology, we believe, will increase property value as well as to further create tenant loyalty in the rental market.

For a healthier living environment, we use eco-friendly, paints, primers and adhesives; improve air quality through better ventilation and air filtration in heating and air conditioning system, whenever feasible.

Property Acquisition Strategy

Each property acquired utilized a separate wholly-owned limited liability company for that particular property. This limited the risk exposure to a particular property solely to that property. Our property management strategy is to deliver quality services, thereby promoting tenant satisfaction, maintaining high tenant retention, and enhancing the value of each of our operating real estate assets through eco-friendly improvements.

| 1 |

In analyzing the potential development of a particular project, we evaluate the geographic, demographic, economic, and financial data, including:

| ● | Households, population and employment growth; | |

| ● | Prevailing rental and occupancy rates in the market area, and possible growth in those rates; and | |

| ● | Location of the property in respect to schools and public transportation. |

Environmental and Other Regulatory Matters

Under various federal, state, and local laws and regulations, an owner of real estate is liable for the costs of removal or remediation of hazardous or toxic substances on the property. Those laws often impose liability without regard to whether the owner knew of, or was responsible for, the presence of the hazardous or toxic substances. The costs of remediation or removal of the substances may be substantial, and the presence of the substances, or the failure to remediate the substances promptly, may adversely affect the owner’s ability to sell the real estate or to borrow using the real estate as collateral.

Insurance

We carry comprehensive property, general liability, fire, extended coverage and environmental on all of our existing properties, with policy specifications, insured limits, and deductibles customarily carried for similar properties.

Baja California

Our real estate development operations are now concentrated in Baja California, Mexico. On February 11, 2016, we signed a definitive agreement with Inmobiliaria Contel S.R.L.C.V. (“Contel”) for Progreen to finance the first tract of land of approximately 300 acres which is being developed by Contel for agriculture use.

Procon Baja JV, S. de R.L. de C.V.

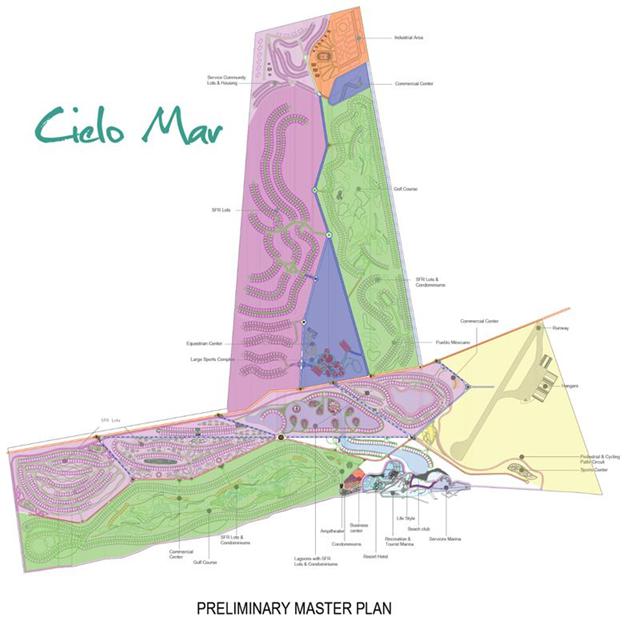

On June 17, 2016, the Company formed Procon Baja JV, S. de R.L. de C.V. (“Procon” or “Procon joint venture”), a subsidiary owned by Progreen (51%) and Contel (49%). Procon is managed by a board of Managing Directors consisting of three members, of which two represent Progreen and one represents Contel, and Jan Telander, our CEO, is the General Manager of Procon. On January 23, 2017, Procon entered into a definitive purchase agreement for, and has took possession of, a large tract of land situated near the town of El Rosario in Baja California, Mexico. The land, planned for residential real estate development, is bordering the Pacific Ocean and covers a total area of approximately 5,000 acres with 4.5 miles of ocean front. The execution of the deed transferring the 5,000-acre oceanfront property to Procon was completed on March 15, 2017, and a Master Plan for all of this land is being created for a resort-type retirement and vacation community with the name “Cielo Mar”. Translated into English, Cielo means “heaven” and Mar means “sea”, the Cielo Mar planned community thus being “heaven by the sea.” The Preliminary Master Plan was published April 19, 2018, and the planning for the first execution phase of the development is currently underway.

| 2 |

Cielo Mar location photo, Bahia del Rosario, Baja California, Mexico – March 1, 2017 (above)

| 3 |

Cielo Mar Preliminary Master Plan – April 19, 2018 (above)

Cielo Mar Phase I Execution Plan – July 2, 2018 (above)

In Mexico, as the land cost in Baja California through our joint venture is substantially below market price, we have a distinct advantage and will have a competitive edge as far as pricing is concerned. We initially found substantial amounts of water, which increases the value and attractiveness to the land.

On June 15, 2018, Procon entered into a definitive purchase agreement for, and took possession of a second large tract of land covering approximately 2,500 acres, situated less than a mile from the 300 acres that is being developed by Contel. Part of the land, with over 1,000 acres expected to be farmable, is planned for expansion of the ProGreen Farms™ operation.

| 4 |

Agricultural Operations

Our agricultural operations are branded under the trademark name, “ProGreen Farms.” We funded our joint operating partner, Contel, for the development of a “pilot” farm operation on the 300-acre parcel at Rancho Arenoso, where 80 acres were developed for farming in 2017.

Last year was considered a pilot year where the farm grew 6 different types of chilies to determine the most suitable for the area/soil etc. The farm did harvest some but really only one type produced decent results, which is the type the farm is growing this year. Total income from the harvest last year was approximately $225,000 out of which $50,000 was paid back to Progreen with the balance went to cover the operating costs of the farm.

Also in 2017, ProGreen Farms US, LLC, a wholly owned subsidiary of the Company, was set up to handle sales and distribution of Contel’s produce.

The farming on the Arenoso farm is progressing well as planned. We will start harvesting in August 2018 and go on through December 2018.

A suitable variety of chili pepper with high yield was grown and harvested at the Arenoso farm in 2017, and was subsequently approved by Huy Fong Foods, Inc., resulting in a contract for ProGreen Farms US, LLC to supply red chili peppers to Huy Fong in 2018. The farm will be delivering 2,500 tons (worth $1,200,000) of red chilis to Huy Fong Foods as per the agreement in place, but expect to be producing more like 3,500 or perhaps even 4,000 tons this year on the 40HA or 100 acres we are actively now farming.

The surplus we will likely sell to the fresh produce market in Baja as we will be producing late in fall when the availability is very limited and the prices much higher than in the summer months. This will be to buyers that buy and pick up the produce directly at the farm (en campo).

With the successful establishment of the pilot farm operation at Rancho Arenoso and a sales contract for 2018, our agriculture operation is well-positioned for growth, with the pilot farm serving as a model for further land development and operations.

ProGreen Farms™ Rancho Arenoso farm – May 4, 2018 (above)

| 5 |

2018 Chili Pepper Plants, ProGreen Farms™ Rancho Arenoso – May 8, 2018 (above)

2018 Chili Pepper Plants, ProGreen Farms™ Rancho Arenoso – July 11, 2018 (above & below)

| 6 |

2018 Chili Pepper Plants, ProGreen Farms™ Rancho Arenoso – May 8, 2018 (above)

Employees

As of April 30, 2018, we had one full-time employee, our Chief Executive Officer. Our administrator as well as our real estate broker work as independent contractors. Our management expects to confer with consultants, attorneys and accountants as necessary.

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors before deciding whether to invest in the Company. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations or our financial condition. If any of the events discussed in the risk factors below occur, our business, consolidated financial condition, results of operations or prospects could be materially and adversely affected. In such case, the value and marketability of the common stock could decline.

Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations or our financial condition. If any of the events discussed in the risk factors below occur, our business, consolidated financial condition, results of operations or prospects could be materially and adversely affected. In such case, the value and marketability of the common stock could decline.

| 7 |

Risks Relating to Our Business

Because we have a limited operating history to evaluate our company, the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delay frequently encountered by a new company.

We have a limited operating history. As of April 30, 2018, we had cash on hand of approximately $106,000 and approximately $500,000 of land under development. At that same date our liabilities totaled approximately $3,482,000. As at April 30, 2018, we had a stockholders’ deficit of approximately $1,531,000.

The Company will require significant additional funding to execute its future strategic business plan. Successful business operations and its transition to attaining profitability is dependent upon obtaining additional financing and achieving a level of revenue adequate to support its cost structure. The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. This basis of accounting contemplates the recovery of the Company’s assets and the satisfaction of liabilities in the normal course of business. The consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of this uncertainty.

If we need additional capital to fund our growing operations, we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

The severe recession, freezing of the global credit markets and the decline in the stock market which continues to affect smaller companies like us may adversely affect our ability to raise capital if we need additional working capital. Because we have not reported profitable operations to date, we may need to raise working capital. If adequate additional financing is not available on reasonable terms or at all, we may not be able to undertake expansion, and we will have to modify our business plans accordingly.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments will dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

Because real estate properties are illiquid and may be difficult to sell, we could face future difficulties in selling these properties and may not be able to sell them at a profit.

Real estate investments are relatively illiquid, which limits our ability to react quickly to adverse changes in economic or other market conditions. Our ability to dispose of assets in the future will depend on prevailing economic and market conditions. Interested buyers may be unable to obtain the financing they need. We may be unable to sell our properties when we would prefer to do so to raise capital we need to fund our planned development and construction program or to fund distributions to investors.

Because we operate in the Baja, Mexico, area, we are subject to risks that affect that local area.

General economic conditions and other factors beyond our control may adversely affect real property income and capital appreciation of our agricultural and resort development operations in the Mexico.

Because of environmental laws, we may have liability under environmental laws even though we did not violate these laws.

Under federal, state, and local environmental laws, ordinances, and regulations, we may be required to investigate and clean up the effects of releases of hazardous or toxic substances or petroleum products at our properties, regardless of our knowledge or responsibility, simply because of our current or past ownership or operation of the real estate. If environmental problems arise, we may have to take extensive measures to remedy the problems, which could adversely affect our cash flow and operating results. The presence of hazardous or toxic substances or petroleum products and the failure to remediate that contamination properly may materially and adversely affect our ability to borrow against, sell, or lease an affected property. In addition, applicable environmental laws create liens on contaminated sites in favor of the government for damages and costs it incurs in connection with a contamination.

| 8 |

International operations expose us to political, economic and currency risks.

With regard to our investments in properties located in Mexico, we are subject to the risks of doing business abroad, including,

| ● | Currency fluctuations; | |

| ● | Changes in tariffs and taxes; and | |

| ● | Political and economic instability. |

Changes in currency exchange rates may affect the relative costs of operations in Mexico, and may affect the cost of developing the properties, thus possibly adversely affecting our profitability.

In addition, there are inherent risks for the foreseeable future of conducting business internationally. Language barriers, foreign laws and tariff and taxation issues all have a potential negative effect on our ability to transact business. Changes in tariffs or taxes applicable to investments in foreign operations may adversely affect our profitability. Political instability may increase the difficulties and costs of doing business. We may be subject to the jurisdiction of the government and/or private litigants in foreign countries where we transact business, and may be forced to expend funds to contest legal matters in those countries in disputes with those governments or with customers or suppliers.

Property development in Mexico has many regulatory uncertainties.

Our property investments in Mexico are subject to numerous risks beyond our control. Decisions to purchase, explore, develop or otherwise exploit prospects or properties in which we have invested will depend in part on the evaluation of data obtained through geophysical and geological analyses, water production data and engineering studies, the results of which are often inconclusive or subject to varying interpretations. Overruns in budgeted expenditures are common risks that can make a particular project uneconomical. Further, many factors may curtail, delay or cancel development of these properties, including the following:

| ● | delays imposed by or resulting from compliance with regulatory requirements; | |

| ● | shortages of or delays in obtaining qualified personnel or equipment; | |

| ● | equipment failures or accidents; and | |

| ● | adverse weather conditions, such as hurricanes and storms. |

The presence of one or a combination of these factors at our properties could adversely affect our business, financial condition or results of operations.

We are subject to complex laws that can affect the cost, manner or feasibility of doing business.

The development of real estate is subject to extensive federal and provincial regulation in Mexico. We may be required to make large expenditures to comply with governmental regulations. Matters subject to regulation include:

| ● | water production permits; | |

| ● | reports concerning operations; |

| 9 |

| ● | the spacing of wells; | |

| ● | unitization and pooling of properties; and | |

| ● | taxation. |

Under these laws, we could be liable for personal injuries, property damage and other damages. Failure to comply with these laws also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws could change in ways that could substantially increase our costs. Any such liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations.

Operations of properties in which we have investments may incur substantial liabilities to comply with environmental laws and regulations.

The properties in which we have invested are subject to stringent federal and provincial laws and regulations relating to the release or disposal of materials into the environment or otherwise relating to environmental protection. These laws and regulations may require an environmental impact study before development commences; and impose substantial liabilities for pollution resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of penalties or the incurrence of investigatory or remedial obligations.

Risks Related to Our Common Stock

Since we expect to incur expenses in excess of revenues for the near future, we may not become profitable and your investment may be lost.

We expect to incur losses for the foreseeable future. We had minimal revenues in our fiscal year ended April 30, 2018, and may never be profitable. If we become profitable, we may be unable to sustain profitability. As a result, your investment in our securities may be lost.

Due to factors beyond our control, our stock price may be volatile.

The market price for our common stock has been highly volatile at times. As long as the future market for our common stock is limited, investors who purchase our common stock may only be able to sell them at a loss.

Because we may not be able to attract the attention of major brokerage firms, it could have a material impact upon the price of our common stock.

It is not likely that securities analysts of major brokerage firms will provide research coverage for our common stock since the firm itself cannot recommend the purchase of our common stock under the penny stock rules referenced in an earlier risk factor. The absence of such coverage limits the likelihood that an active market will develop for our common stock. It may also make it more difficult for us to attract new investors at times when we require additional capital.

Our bylaws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our bylaws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by them, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which they are made parties by reason of their being or having been our directors or officers.

| 10 |

We do not intend to pay dividends on any investment in the shares of common stock of our company and any gain on an investment in our common stock will need to come through an increase in our stock’s price, which may never happen.

We have never paid any cash dividends and currently do not intend to pay any dividends on our common stock for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in our company will need to come through an increase in our common stock’s price. This may never happen and investors may lose all of their investment in our company.

We are an emerging growth company, and reduced reporting and disclosure requirements applicable to emerging growth companies could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier, including if the market value of our common stock held by non-affiliates exceeds $700 million as of any June 30 before that time, in which case we would no longer be an emerging growth company as of the following December 31. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourself of this exemption from new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Because our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our shares as penny stocks, are covered by Section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice requirements on broker/dealers who sell our company’s securities including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. These rules apply to companies whose shares are not traded on a national stock exchange, trade at less than $5.00 per share, or who do not meet certain other financial requirements specified by the Securities and Exchange Commission. These rules require brokers who sell “penny stocks” to persons other than established customers and “accredited investors” to complete certain documentation, make suitability inquiries of investors, and provide investors with certain information concerning the risks of trading in such penny stocks. These rules may discourage or restrict the ability of brokers to sell our shares of common stock and may affect the secondary market for our shares of common stock. These rules could also hamper our ability to raise funds in the primary market for our shares of common stock.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (known as “FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

| 11 |

Item 1B. Unresolved Staff Comments.

Not applicable.

On May 30, 2017, we leased our offices at 2667 Camino del Rio South, Suite 312, San Diego, CA 92108, of approximately 740 sq. ft., at a current monthly rent of $1,250, under a four-month lease, after which the lease became month-to-month.

On May 16, 2017, ProCon leased an office in Ensenada, Mexico of approximately 3,300 Sq. Ft, at a current monthly rent of $30,000 pesos per month, the rent will increase to $40,000 peso per month on May 16, 2018. The lease commenced on May 16, 2017 and will expire on May 15, 2020.

We also continue to be obligated under a lease for our former offices at 6443 Inkster Road, Suite 170-D, Bloomfield Township, MI 48301, of approximately 1,000 sq. ft., at a monthly rent of $934 through March 1, 2019.

We are not party to any material legal proceedings.

Item 4. Mine Safety Disclosures.

None.

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common shares are trading in the OTC markets under the symbol “PGUS”.

The following table sets forth, for the periods indicated, the high and low bid prices of our common stock, as reported in published financial sources. Quotations reflect inter-dealer prices, without retail mark-up, mark-down, commission, and may not represent actual transactions.

| High | Low | |||||||

| Fiscal Year Ended April 30, 2016 | $ | |||||||

| Quarter Ended July 31, 2015 | $ | 0.013 | $ | 0.005 | ||||

| Quarter Ended October 31, 2015 | $ | 0.004 | $ | 0.001 | ||||

| Quarter Ended January 31, 2016 | $ | 0.001 | $ | 0.001 | ||||

| Quarter Ended April 30, 2016 | $ | 0.004 | $ | 0.001 | ||||

| Fiscal Year Ended April 30, 2017 | ||||||||

| Quarter Ended July 31, 2016 | $ | 0.006 | $ | 0.004 | ||||

| Quarter Ended October 31, 2016 | $ | 0.028 | $ | 0.005 | ||||

| Quarter Ended January 31, 2017 | $ | 0.019 | $ | 0.01 | ||||

| Quarter Ended April 30, 2017 | $ | 0.029 | $ | 0.011 | ||||

| Fiscal Year Ended April 30, 2018 | ||||||||

| Quarter Ended July 31, 2017 | $ | 0.022 | $ | 0.019 | ||||

| Quarter Ended October 31, 2017 | $ | 0.017 | $ | 0.01 | ||||

| Quarter Ended January 31, 2018 | $ | 0.0175 | $ | 0.0095 | ||||

| Quarter Ended April 30, 2018 | $ | 0.037 | $ | 0.017 | ||||

| 12 |

Holders

As of August 12, 2018 there were approximately 541 holders of record of our common stock.

Dividends

We do not anticipate paying cash dividends in the foreseeable future. Our current policy is to retain any earnings to finance our future development and growth. We may reconsider this policy from time to time in light of conditions then existing, including our earnings performance, financial condition and capital requirements. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend upon our financial condition, operating results, capital requirements, general business conditions and other factors that our board of directors deems relevant.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of our financial condition and results of operations should be read in conjunction with the financial statements and notes thereto and other financial information included elsewhere in this report.

Certain statements contained in this report, including, without limitation, statements containing the words “believes,” “anticipates,” “expects” and words of similar import, constitute “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including our ability to create, sustain, manage or forecast our growth; our ability to attract and retain key personnel; changes in our business strategy or development plans; competition; business disruptions; adverse publicity; and international, national and local general economic and market conditions.

GENERAL

Throughout this report, the terms “we,” “us,” “our,” “ProGreen” and the “Company” refer to ProGreen US, Inc., a Delaware corporation and, unless the context indicates otherwise, includes our subsidiaries.

The Company was incorporated in Florida on April 23, 1998 and reincorporated in Delaware on December 12, 2008. Effective September 11, 2009, we changed our name from Diversified Product Inspections, Inc. to Progreen Properties, Inc. to reflect the change in our business operations from the conduct of investigations and laboratory analyses operations to the purchase of income producing properties and changed our name effective July 22, 2016 to ProGreen US, Inc., to reflect initiation of development operations in Baja Mexico.

OUR BUSINESS

Our office is in San Diego, California, which is proximate to our agricultural and development projects in Baja California, on which our current business operations are focused. The purchase of a condominium unit on July 28, 2009 initiated our real estate development operations directed at purchasing income-producing residential real estate apartment homes, condominiums and houses in the State of Michigan. As of April 30, 2018, we had sold all properties owned in Michigan, and we have refocused our efforts to concentrate on the same line of business for our Cielo Mar development in Baja, California.

| 13 |

Michigan

We liquidated our real estate portfolio in Michigan by offering the properties with land contracts to buyers unable to obtain conventional financing. The goal of selling these properties is to focus on the agricultural and Cielo Mar project.

During the years ended April 30, 2018 and 2017 we sold ten and four of our properties, respectively. We have no properties as of April 30, 2018. We do not offer, and do not intend in the future to offer, managed properties as investment properties.

Baja California Joint Venture Agreement

On February 11, 2016, we signed a definitive agreement with Contel for Progreen to finance the first tract of land of approximately 300 acres which has been developed and is operated by Contel for agriculture use. Four wells were drilled on the first tract, and the growing operation commenced with a first produce purchase agreement for chile peppers - from Agricola Consuela, an exporter/importer to the U.S. market.

In addition, we have formed the Procon joint venture subsidiary, which is the holding company for further non-agricultural land and real estate developments. On January 23, 2017, Procon entered into a definitive purchase agreement for, and took possession of, a large tract of land situated near the town of El Rosario in Baja California. The land, planned for a residential real estate development, is bordering the Pacific Ocean and covers a total area of 2,016 ha (5,000 acres) with 7.5 km (4.5 miles) of ocean front.

The transfer of deed for the 5,000-acre oceanfront property to Procon was completed on March 15, 2017, and a Master Plan for all of this land is being created for a very large resort-type retirement and vacation community with the name “Cielo Mar”. The first phase of the development of the master plan is underway.

FINANCIAL CONDITION

At April 30, 2018, we had total assets of approximately $1,951,000 compared to total assets of approximately $2,395,000 at April 30, 2017. The decrease in total assets was primarily due to:

| ● | Decrease in Cash of approximately $183,000, | |

| ● | Rental Property decrease approximately $732,000 due to the sale of ten remaining properties during the year ended April 30, 2018, |

Net Accounts Receivable decreased by approximately $5,000 due the write off of rent due from tenants in the amount of approximately $30,600 and $7,400, in the years ended April 30, 2018 and 2017, respectively,

| ● | Notes Receivable-Related Party increased by approximately $497,000 due to a net $497,000 loan ($50,000 was repaid) to Contel for operations of the agriculture activity, | |

| ● | Other Assets increased approximately $66,000 due to an increase in activities carried on by Procon,of approximately $70,000, offset by a decrease in miscellaneous assets of approximately $4,000, | |

| ● | Notes Receivable Land Contract decreased approximately $87,000 due to the Company’s issuance of land contracts to the buyers of three of the properties sold in the year ended April 30, 2018, offset by an increase in allowance for uncollectible accounts of approximately $216,000. |

Cash decreased to approximately $106,000 for the year ended April 30, 2018, compared to cash of approximately $289,000 at April 30, 2017. Cash used in operating activities was approximately $887,000 in the year ended April 30, 2018, as compared with cash used in operating activities of approximately $617,000 in the year ended April 30, 2017.

| 14 |

At April 30, 2018, we had stockholders’ deficit of approximately $1,531,000 compared to a deficit of approximately $200,000 as of April 30, 2017. The increase in stockholders’ deficit was due to:

| ● | Net operating losses of approximately $1,052,000; | |

| ● | Dividend on redeemable, Convertible Preferred Stock, Series B of approximately $95,000; | |

| ● | Issuance of Common Stock with true-up feature of approximately $1,258,000; | |

| ● | Tainting due to convertible debt and warrants of approximately $151,000 | |

| ● | Other comprehensive loss of approximately $33,000, |

Offset by

| ● | Common stock issued under convertible debt of approximately $101,000; | |

| ● | Common stock issued for convertible note settlement of approximately $18,000; | |

| ● | Common stock issued for cash of approximately $705,000; | |

| ● | Common stock warrants issued for services of approximately $23,000; | |

| ● | Warrants issued related to convertible note of approximately $29,000; | |

| ● | Common stock issued for services of approximately $9,000, | |

| ● | Reclassification of derivative liability due to conversion of approximately $374,000. |

Costs incurred in the renovation of the properties that enhance the value or extend the life of the properties are capitalized. The Company owned 0 and ten rental properties as of April 30, 2018 and 2017, respectively. The Company held no properties under development as of April 30, 2018 and one as of April 30, 2017.

Going Concern

The Company’s financial statements for the year ended April 30, 2018, have been prepared on a going concern basis which contemplates the realization of assets and settlement of liabilities and commitments in the normal course of business. The Company has incurred losses from operations since its change of ownership, management and line of business on April 30, 2009. Management recognizes successful business operations and the Company’s transition to attaining profitability are dependent upon obtaining additional financing and achieving a level of revenue adequate to support its cost structure. These conditions raise substantial doubt about its ability to continue as a going concern. The consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of uncertainties.

While the Company is attempting to establish an ongoing source of revenues sufficient to cover its operating costs and allow it to continue as a going concern, the Company’s cash position may not be adequate to support the Company’s daily operations. Management intends to raise additional funds by seeking equity and/or debt financing; however there can be no assurances that it will be successful in those efforts. The ability of the Company to continue as a going concern is dependent upon the Company’s ability to obtain financing, further implement its business plan, and generate revenues.

As it is the second year for the agriculture operation and with the Cielo Mar project under development, it is impossible to identify any trends in the Company’s business prospects. Accordingly, there can be no assurance that we will be able to pay obligations which we may incur in the future.

The Company’s only sources of additional funds to meet continuing operating expenses, fund additional development and fund additional working capital are through the sale of securities and/or debt instruments. We are actively seeking additional debt or equity financing, but no assurances can be given that such financing will be obtained or what the terms thereof will be. The Company may need to discontinue a portion or all of our operations if the Company is unsuccessful in generating positive cash flow or financing for the Company’s operations through the issuance of securities.

| 15 |

Cash

Cash decreased approximately $183,000 for the year ended April 30, 2018. Cash used in operating activities was approximately $887,000 for the year ended April 30, 2018, as compared with cash used in operating activities of approximately $617,000 in fiscal 2017. During fiscal 2018, the Company loaned approximately $547,000 to Contel and purchased fixed assets in the amount of approximately $3,000, which were offset by proceeds from the sale of properties of approximately $505,000, proceeds from related party loan repayment of $50,000 and proceeds from notes receivable in the amount of approximately $4,000.

The Company received: approximately $705,000 in proceeds from the sale of common stock, approximately $480,000 in proceeds from advances from a related party, approximately $49,000 in proceeds from note payable and approximately $1,140,000 in proceeds from convertible debentures and repaid: approximately $53,000 of notes payable to a related party, approximately $907,000 of convertible debentures, approximately $682,000 on the line of credit, and approximately $3,000 on obligations under capital leases .

Rental properties and properties under development

The Company owned no and ten rental properties as of April 30, 2018 and 2017, respectively. Rental properties totaled $0 and $732,000 at April 30, 2018 and 2017, respectively.

The Company held no properties under development as of April 30, 2018 and 2017.

Land under Development

The Company owned land under development in the amount of $500,000 at April 30, 2018 and 2017.

Business Combination

On March 8, 2016, the Company restructured its working arrangements with AMREFA through entry into a purchase agreement, amended March 16, 2016, with AMREFA for the purchase of a 100% interest in AMREFA’s U.S. subsidiary, ARG LLC (ARG), which holds real estate properties in Birmingham, Michigan, that were purchased by AMREFA and which the Company managed for AMREFA. The Company recorded Goodwill in the amount of $180,000 in connection with the purchase of ARG. During fiscal 2017, the Company determined the carrying amount of its net assets exceeded the estimated fair value and the Company recognized a goodwill impairment loss in the amount of $180,000 and the entire goodwill balance was written off during the year ended April 30, 2017.

Investment

On February 11, 2016, the Company signed a definitive agreement with Inmobiliaria Contel S.R.L.C.V. (“Contel”) to finance the first tract of land of approximately 300 acres which is being developed by Contel for agriculture use in Baja California, Mexico. The Company’s Chief Executive Officer has made personal investments in this project, and has a 49.5% minority partnership interest in Contel. The Company and its Chief Executive Office have no management or governance authority in Contel. Contel’s general manager is not required to consult with our Chief Executive Officer on any management decisions in the conduct of Contel’s business.

The property acquired by Contel will be developed for agricultural purposes and multi-use purposes. The Company initially committed to loan(s) up to the amount of $350,000 and on February 1, 2017, the Company increased its loan commitment to $1,000,000. On April 18, 2018, the loan commitment was increased to $1,500,000.

The Company is entitled to a 50% share of Contel’s profits and losses subsequent to repayment of all outstanding loans.

| 16 |

In the years ended April 2018 and 2017, the Company contributed $547,000 to and received repayments in the amount of $50,000 from Contel and contributed $580,500 to Contel, respectively, which is accounted for as an investment loan. Note Receivable - Related Party totaled $1,187,500 and $690,500 as of April 30, 2018 and 2017, respectively.

RESULTS OF OPERATIONS

Year Ended April 30, 2018 Compared to Year Ended April 30, 2017

During the year ended April 30, 2018, we incurred a net loss of approximately $1,052,000 compared to a net loss of $1,478,000 for the year ended April 30, 2017. The decrease in our loss for the year ended April 30, 2018 from the comparable prior year is due to a decrease in our revenue of approximately $150,000 and an increase of approximately $79,000 in operating expenses which were partially offset by a decrease in net other expenses of approximately $654,000.

The decrease in revenue in the fiscal year ended April 30, 2018 compared to fiscal 2017 is due to:

Rental revenue decreased to approximately $25,000 during the year ended April 30, 2018 as compared to $91,000 during the prior fiscal year. The Company received rental income on five properties during portions of the year ended April 30, 2018, as compared to rental income earned on between five and seven properties during the entire year ended April 30, 2017.

Proceeds from the sale of properties increased to approximately $747,000 during the year ended April 30, 2018 as compared to $575,000 in the comparable prior year end and corresponding cost of properties sold increased to approximately $783,000 as compared to $554,000 during the year ended April 30, 2017. However, during 2018 and 2017, the profit in connection with the sale of three and two properties, which the Company financed, was deferred in the amount of $64,000 and $42,000, resulting in a net loss from sale of properties of approximately $100,000 and $21,000, respectively. The Company sold ten properties in the year ended April 30, 2018 as compared to four in the comparable prior year end.

Commission revenue was $0 for the year ended April 30, 2018 as compared to approximately $4,000 during the fiscal year ended April 30, 2017. The Company received commissions on the sale of two of the properties in the fiscal year ended April 30, 2017. There were no such commissions earned during the current fiscal year.

There have been fluctuations in certain expenses in the fiscal year ended April 30, 2018, as compared to the fiscal year ended April 30, 2017.

Selling, general and administrative expense decreased approximately $104,000 for the year ended April 30, 2018 as compared to the comparable prior year mainly due to the following:

Rental property costs and depreciation expense decreased approximately $29,000 for the year ended April 30, 2018 as compared to the comparable prior period as a result of the sale, during fiscal 2018 and 2017, of all of the rental properties the Company acquired from ARG in the last quarter of fiscal 2016.

Commission and closing costs expense decreased approximately $36,000 for the year ended April 30, 2018 as compared to the comparable prior period as a result of the sale of ten properties with no commissions paid in fiscal 2018. Commission was paid on the sale of two of the four properties sold in fiscal 2017.

Travel fees decreased approximately $26,000 for the year ended April 30, 2018 as compared to the comparable prior period as a result of the CEO’s move to Mexico resulting in less business travel costs between California and Mexico.

Salary, payroll tax and employee related expenses decreased approximately $144,000 for the year ended April 30, 2018 as compared to the comparable prior period mainly due to the reduction in the Company’s CEO salary, related payroll taxes and housing allowance and the termination of the office manager in fiscal 2018.

| 17 |

Compensation expense decreased approximately $7,000 for the year ended April 30, 2018 as compared to the comparable prior period due to the expiration of stock options.

Rent and office expenses increased approximately $22,000 for the year ended April 30, 2018 as compared to the comparable prior period as a result of the Company operating out of offices in California and Mexico.

Investor relations expense increased approximately $27,000 for the year ended April 30, 2018 as compared to the comparable prior period as a result of more activity in publicity for the Company.

Miscellaneous expense and other expenses, which includes costs from ProCon increased approximately $89,000 due to architectural costs and administrative cost incurred by the architects for the Cielo Mar project.

Bad debt expense increased approximately $179,000 from $10,000 for the year ended April 30, 2017 to a loss of $189,000 in the current year ended April 30, 2018 as the Company recorded approximately $195,000 in connection with its Notes receivable land contracts. The Company wrote off approximately $12,000 of rent from rental properties (all of which were sold by April 30, 2018). Due to the irregular payments from the land contracts, all but one of the land contracts have been reserved 100%.

During the fiscal year ended April 30, 2017 the Company recorded a bad debt reserve of approximately $7,000 in connection with rent due on one of its rental properties and approximately $5,000 in connection with its Notes receivable land contracts, net of $2,000 received in payment in full on a previously written off land contract receivable.

Professional fees increased approximately $184,000 for the year ended April 30, 2018 as compared to the comparable prior year mainly due to:

Audit, accounting and legal and fees increased approximately $69,000 mainly due to, the increased complexity of accounting issues and regulatory compliance costs.

Consultant fees paid increased approximately $114,000 for the year ended April 30, 2018 as compared to the comparable prior period due to increased use of a consultant due to the complexity of accounting issues and increased assistance needed with securing financing arrangements.

Impairment loss expense decreased from approximately $180,000 for the year ended April 30, 2017 to $0 for the year ended April 30, 2018 due to the Company’s determination the goodwill relating to its acquisition of ARG was impaired and a loss in the amount of approximately $180,000 was recognized in the last quarter of fiscal 2017.

Interest expense was approximately $1,141,000 for the year ended April 30, 2018 as compared to approximately $300,000 for the comparable prior year mainly due to increased debt and convertible debt during the current year and the related interest and amortization of debt discounts for the year ended April 30, 2018.

Loss on settlement of related party liabilities, Series A decreased to $0 for the year ended April 30, 2018 as compared to approximately $428,000 for the comparable prior year due to the issuance of Series A preferred stock, in fiscal 2017, in settlement of the note payable to EIG resulting in a loss in the amount of approximately $389,000 and in settlement of the advance due EIG resulting in a loss in the amount of approximately $39,000.

Gain on settlement of liabilities, Series B decreased to $0 for the year ended April 30, 2018 as compared to approximately $11,000 for the year ended April 30, 2017 due to the issuance of Series B preferred stock, in fiscal 2017, in settlement of the note payable due AMREFA.

Loss on settlement of liabilities, common stock increased to approximately $45,000 for the year ended April 30, 2018 as compared to $0 for the year ended April 30, 2017.

| 18 |

Derivatives gain increased from a loss of approximately $8,000 in the comparable prior year to a gain of approximately $1,114,000 for the year ended April 30, 2018 due to derivative gain on valuation of convertible debt.

LIQUIDITY

At April 30, 2018, we had total assets of approximately $1,951,000 compared to total assets of approximately $2,395,000 at April 30, 2017. The decrease in total assets was primarily due to: a decrease in Cash of approximately $183,000, Accounts Receivable decreased approximately $5,000 due the write off of rent due from tenants, Rental Property decreased approximately $732,000 due to the sale of ten remaining properties during the year ended April 30, 2018 and Notes Receivable Land Contract decreased approximately $87,000 due to the Company’s issuance of land contracts to the buyers of three of the properties sold in the year ended April 30, 2018, offset by an increase in allowance for uncollectible accounts of approximately $216,000.

These decreases were partially offset by: Other Assets increased approximately $66,000 due to an increase in activities carried on by Procon of approximately $70,000, offset by a decrease in miscellaneous assets of approximately $4,000, and Notes Receivable-Related Party increased by approximately $497,000 due to a net $497,000 loan ($50,000 was repaid) to Contel for operations of the agriculture activity.

Cash decreased approximately $183,000 for the year ended April 30, 2018. Cash used in operating activities was approximately $887,000 for the year ended April 30, 2018, as compared with cash used in operating activities of approximately $617,000 in fiscal 2017. During fiscal 2018, the Company loaned approximately $547,000 to Contel and purchased fixed assets in the amount of approximately $3,000, which were offset by proceeds from the sale of properties of approximately $505,000, proceeds from related party loan repayment of $50,000 and proceeds from notes receivable in the amount of approximately $4,000.

The Company received: approximately $705,000 in proceeds from the sale of common stock, approximately $480,000 in proceeds from advances from a related party, approximately $49,000 in proceeds note payable and approximately $1,140,000 in proceeds from convertible debentures and repaid: approximately $53,000 of notes payable to a related party, approximately $907,000 of convertible debentures, approximately $682,000 on the line of credit, and approximately $3,000 on obligations under capital leases .

At April 30, 2018, we had stockholders’ deficit of approximately $1,531,000.

In the current fiscal year, to expand the agricultural operation and to commence the Cielo Mar development activities in Baja California, we estimate that we will be required to find investment partners to provide financing in the range of $5 million to $25 million over the next 12-24 months. In order to fund the agricultural operations and the Cielomar Project, the Company executed a Letter of Intent with Global Capital Partners Fund Limited for a $5,000,000 loan secured by the Cielo Mar land.

Credit Lines

Credit Line 1

On August 2, 2016, the Company entered into a credit line promissory note (“Credit Line 1”) with its President and Chief Executive Officer (“President”) whereby the Company may borrow up to $250,000 with interest at a rate of five (5%) percent per annum. The Credit Line is unsecured and is due upon demand. During the fiscal year ended April 30, 2017 the Company borrowed $250,000 under the Credit Line. Notes payable related parties includes the amount due under the Credit Line with a balance outstanding of $250,000 less the unamortized discount of $0 and $14,947 as of April 30, 2018 and 2017, respectively.

Amortization of the related discount totaled $14,947 and $24,352 for the years ended April 30, 2018 and 2017, respectively. The Company recorded interest expense in connection with the Credit Line in the amount of $13,907 and $5,061 for the years ended April 30, 2018 and 2017, respectively. Accrued interest due under the Credit Line totaled $18,968 and $5,061 as of April 30, 2018 and April 30, 2017, respectively.

| 19 |

In connection with Credit Line 1, the Company issued the President common stock purchase warrants. The warrants entitle the President to purchase ten shares of common stock for each one ($1.00) dollar of total disbursements by the President to the Company, of up to 2,500,000 shares of common stock at an exercise price of $0.05. During the year ended April 30, 2017, 250,000 of these warrants were issued in various denominations between August 2, 2016 through February 21, 2017, resulting in a total number of warrant shares of 2,500,000 as of April 30, 2018 and 2017. The warrants have a five year term. See Notes 14 and 15.

Credit Line 2

On February 21, 2017 the Company’s President entered into an additional one year 5% Promissory Note credit line agreement (“Credit Line 2”) whereby the Company may borrow up to $250,000 with interest at a rate of five (5%) percent per annum with an original due date of February 22, 2018. Credit Line 2 is unsecured and is now due upon demand. During the fiscal year ended April 30, 2017 the Company borrowed $205,000 under Credit Line 2 and during the fiscal year ended April 30, 2018 the Company borrowed the remaining $45,000 under the Credit Line 2. Notes payable related parties includes the amount due under the Credit Line 2 with a balance outstanding of $250,000 and $205,000 less the unamortized discount of $0 and $43,058 as of April 30, 2018 and 2017, respectively.

Amortization of the related discount totaled $50,648 and $8,245 for the years ended April 30, 2018 and 2017, respectively. The Company recorded interest expense in connection with the Credit Line in the amount of $9,554 and $1,581 for the years ended April 30, 2018 and 2017, respectively. Accrued interest due under the Credit Line 2 totaled $11,135 and $1,581 as of April 30, 2018 and April 30, 2017, respectively.

In connection with the Credit Line 2, the Company issued the President common stock purchase warrants. The warrants entitle the President to purchase ten shares of common stock for each one ($1.00) dollar of total disbursements by the President to the Company, of up to 2,500,000 shares of common stock at an exercise price of $0.05. During the year ended April 30, 2017, 205,000 of these warrants were issued in various denominations between February 22, 2017 through March 20, 2017, resulting in a total number of warrant shares of 2,050,000 as of April 30, 2017. During the year ended April 30, 2018 the remaining 450,000 warrants were issued in three 150,000 increments between July 5, 2017 and July 13, 2017 resulting in a total number of warrant shares of 2,500,000 as of April 30, 2018. The warrants have a five year term. See Notes 14 and 15.

Credit Line 3

On July 19, 2017 the Company’s President entered into a one year unsecured 5% Promissory Note (“Credit Line 3”) whereby the Company may borrow up to $250,000 with interest at a rate of five (5%) percent per annum due on July 19, 2018. During the year ended April 30, 2018 the Company borrowed $250,000 under Credit Line 3 and repaid $20,100. Notes payable related parties includes the amount due under Credit Line 3 with a balance outstanding of $229,900 and $0 as of April 30, 2018 and 2017, respectively. The Company recorded interest expense in connection with Credit Line 3 in the amount of $13,784 and $0 for the years ended April 30, 2018 and 2017, respectively. Accrued interest due under the Credit Line 3 totaled $13,784 and $0 as of April 30, 2018 and April 30, 2017, respectively.

Credit Line 4

During the year ended the Company’s President entered into an unsecured 5% Promissory Note (“Credit Line 4”) whereby the Company borrowed a total of $185,155 with interest at a rate of five (5%) percent per annum, which is payable on July 19, 2018. During the year ended April 30, 2018 the Company repaid $32,500 of Credit Line 4. Notes payable related parties includes the amount due under these notes, with a balance outstanding of $152,655 and $0 as of April 30, 2018 and 2017, respectively. The Company recorded interest expense in connection with these notes in the amount of $6,730 and $0 for the year ended April 30, 2018 and 2017, respectively. Accrued interest due under the Credit Line totaled $6,730 and $0 as of April 30, 2018 and 2017, respectively.

| 20 |

Equity Line Financing

On June 23, 2016, the Company entered into $5,000,000 equity line financing agreement (“Investment Agreement”) with Tangiers Global, LLC, Dorado, Puerto Rico. The financing is over a maximum of 36 months. A maximum of 75 million (75,000,000) shares of our common stock has been registered for this financing.

The registration statement filed with the SEC for the equity line financing was declared effective by the SEC on January 31, 2017. The Company has not yet utilized this financing.

We issued to the Tangiers in connection with the execution of the Investment Agreement a commitment fee of a five-year warrant to purchase 4,000,000 shares of common stock, at an exercise price of $.02 per share, and Tangiers provided financing to us for our legal costs in connection with the filing of the Registration Statement through a one-year $22,000 convertible debenture, which the Company paid off in January 2017.

Convertible Note Financings

On September 13, 2016, the Company sold a private investor a 7% convertible promissory note in the principal amount of $105,000, due March 13, 2017.

On January 20, 2017, the Company sold a private investor a 7% convertible promissory note in the principal amount of $105,000, due July 20, 2017, convertible in the event of an event of default.

On February 21, 2017, the Company sold to Power Up Lending Group, Ltd. a convertible note in the amount of $103,500, bearing interest at the rate of 12% per annum, and due November 30, 2017.

On March 15, 2017, the Company issued to Bellridge Capital, LP an institutional lender a $5,000 Original Issue Discount 10% Convertible Debenture in the principal amount of $105,000, due March 15, 2018.

On March 21, 2017, the Company issued a 7% Fixed Convertible Promissory Note in the principal amount of $105,000 due September 21, 2018 to Tangiers Global, LLC.

On March 30, 2017, the Company issued a 7% Fixed Convertible Promissory Note in the principal amount of $100,000 due September 22, 2017 to Silo Equity Partners Venture Fund, LLC.

On April 27, 2017, the Company issued a 10% Fixed Convertible Promissory Note in the principal amount of $113,000 due April 3, 2018 to EMA Financial, LLC.

On May 3, 2017, the Company issued an 8% Fixed Convertible Promissory Note in the principal amount of $110,000 due November 29, 2017 to Vista Capital Investments, LLC. Additionally, we issued 2,000,000 warrants pursuant to the terms of the securities purchase agreement with an exercise price of $0.05 per share.

On May 15, 2017, the Company issued a 12% Fixed Convertible Promissory Note in the principal amount of $46,500 due February 15, 2018 to Power Up Lending Group, Ltd.

On May 10, 2017, the Company issued a 12% Fixed Convertible Promissory Note in the principal amount of $113,000 due February 10, 2018 to JSJ Investments Inc.

On August 25, 2017, the Company issued to Power Up Lending Group, Ltd. a convertible Promissory Note in the principal amount of $78,000 due May 20, 2018.

Pursuant to a Securities Purchase Agreement, dated November 8, 2017, between the Company and Power Up Lending Group Ltd., the Company issued a 12% Convertible Promissory Note in the principal amount of $51,500 due August 15, 2018 to the lender.

| 21 |

On October 17, 2017, the Company issued to Tangiers Global LLC a 12% Fixed Convertible Promissory Note in the principal amount of $306,804 due July 13, 2018. In connection with the Tangiers Convertible Note, the Company entered into a Forbearance Agreement, dated as of April 27, 2018 (the “Forbearance Agreement”), pursuant to which Tangiers agreed to refrain and forbear from exercising and enforcing its remedies under the Outstanding Note, or any of the other agreements entered into in connection with the transactions contemplated thereby, until July 16, 2018, and to extend the Maturity Date of the Outstanding Note to July 16, 2018. Tangiers agreed to extend the prepayment schedule as to provide for the Company’s prepayment right in under 90 days at 115% of Principal Amount of the Outstanding Note. Tangiers further agreed to refrain from exercising its conversion rights under the Outstanding Note until July 16, 2018. Contemporaneously with the execution of the Forbearance Agreement, the Company agreed to make a $122,721.60 cash payment to Tangiers as a Forbearance Payment.

On May 7, 2018, as a part of the Forbearance Agreement modification to the October 17, 2017 Tangiers Convertible Note, we issued Tangiers a 12% Fixed Convertible Promissory Note dated April 27, 2018 in the principal amount of $236,085 due November 27, 2018. The amount of $13,363.40 was retained by the Tangiers through an original issue discount for due diligence and legal bills related to this transaction, and the Company received net proceeds of $222,721.60. The Company paid $122,721.60 to Tangiers to make the required payment in that amount under the Forbearance Agreement described above. In connection with the Forbearance Agreement, on April 27, 2018 the Company issued Tangiers a five-year common stock purchase warrant to purchase 1,000,000 shares of the Company’s Common Stock, exercisable at a price of $0.05 per share.

On November 24, 2017, the Company issued to Blue Hawk Capital, LLC a 12% Fixed Convertible Promissory Note in the principal amount of $65,000 due August 20, 2018. Pursuant to a June 14, 2018 amendment to the Convertible Note, Blue Hawk Capital agreed to extend the Maturity Date of the Convertible Note to July 10, 2018, in exchange for increasing the applicable prepayment penalty under the Convertible Note from 125% to 135%.

On December 4, 2017, the Company issued to Auctus Fund, LLC a 12% Convertible Promissory Note in the principal amount of $110,875 due August 29, 2018. We entered into an agreement with Auctus Fund to amend the Note effective May 31, 2018, which provided for the following amendments to the Note: in consideration of the Company’s having made a cash payment of $5,000 by before June 4, 2018, which does not reduce the balance owed under the Note, (i) Auctus Fund is entitled to effectuate a conversion under the Note on or after July 10, 2018, (ii) the “125%” prepayment amount in Section 1.9(b) of the Auctus Note is increased to “135%”, and (iii) the Company is permitted to exercise its right to prepay the Note at any time before July 10, 2018.

Effective on January 17, 2018, the Company Power Up Lending, Ltd. a convertible note in the amount of $63,000, bearing interest at the rate of 12% per annum, and due October 30, 2018.

Effective on February 17, 2018, the Company issued Power Up Lending Group Ltd. a convertible note in the principal amount of $83,000, bearing interest at the rate of 12% per annum. The Convertible Note is payable, along with interest thereon on November 30, 2018.

On March 14, 2018, issued to Adar Bays, LLC an 8% Convertible Redeemable Note in the principal amount of $78,750 and due on March 12, 2019. In connection with the issuance of the Adar Bays Note, the Company issued two back end notes (“Back End Note”) each in the principal amount of $78,750, where the Company has the option to have Adar Bays fund the notes.

Effective on April 6, 2018, the Company issued a convertible note in the principal amount of $113,000, bearing interest at the rate of 12% per annum, to JSJ Investments Inc. The Maturity Date of the Note is April 6, 2019.

The Company issued on May 24, 2018 a 12% Fixed Convertible Promissory Note in the original principal amount of $105,000 due November 22, 2018 to Tangiers Global, LLC.

On May 30, 2018 the Company entered into a financing commitment agreement with Global Capital Partners Fund Limited (the “Lender”) for a 12 month and one 12 month extension $5,000,000 financing secured by a first mortgage lien on our Cielo Mar property in Baja California, Mexico. The financing commitment is subject to execution of definitive agreements and fulfillment of the closing conditions in such agreements. The Lender’s fee is 3%, or $150,000, of which the Company paid $55,000, the balance being due at closing. The Company also paid for appraisal costs of $19,795. The initial Loan term is one year, with the option of the Company at the end of the first year to extend the term of the Loan for an additional year.

| 22 |

Pursuant to the terms of a Securities Purchase Agreement, dated June 14, 2018, the Company issued to Bellridge Capital, LP a $7,500 Original Issue Discount 12% Convertible Debenture in the principal amount of $157,500, due June 14, 2019.

Critical Accounting Policies

The summary of critical accounting policies below should be read in conjunction with the discussion of the Company’s accounting policies included in the financial statements in this report. We consider the following accounting policies to be the most critical going forward:

Basis of Presentation - The Company’s financial statements for the year ended April 30, 2018, have been prepared on a going concern basis which contemplates the realization of assets and settlement of liabilities and commitments in the normal course of business. The consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of uncertainties.

Estimates - The preparation of financial statements required us to make estimates and judgments that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported periods. We based our estimates and judgments on historical experience and on various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There can be no assurances that actual results will not differ from those estimates. On an ongoing basis, we will evaluate our accounting policies and disclosure practices as necessary.

Basis of consolidation - The consolidated financial statements include the accounts and records of the Company and its wholly-owned subsidiaries: ProGreen Realty, ProGreen Farms US LLC, Progreen Properties Management, ProGreen Construction, ARG, LLC, 21000 Westover LLC, 20210 Westover LLC, 21112 Evergreen LLC, 21421 Greenview LLC, 21198 Berg LLC, 23270 Helen LLC, Progreen Properties VII LLC, Progreen Properties XI LLC, Progreen Properties II, LLC, Franklin Pointe Drive LLC, 20351 Lacrosse LLC, Progreen Properties III LLC, 25825 Lahser Unit Two LLC and 24442 Kinsel LLC and its 51% controlling interest in Procon Baja JV, S.R.L. DE C..V . All significant intercompany accounts and transactions have been eliminated. FASB Accounting Standards Codification (“ASC”) Topic 810, “Consolidation,” requires a company’s consolidated financial statements to include subsidiaries in which the company has a controlling financial interest. This requirement usually has been applied to subsidiaries in which a company has a majority voting interest.

Notes Receivable - Land Contracts - The notes receivable land contracts are carried at amortized cost. Interest income on the notes receivable is recognized on the accrual basis based on the principal balances outstanding. An allowance for doubtful accounts in the amount of $221,080 and $4,800 has been recorded at April 30, 2018 and 2017.

Notes receivable are considered impaired when, based on current information and events, it is probable that the Company will not be able to collect all principal and interest amounts due according to the contractual terms. The Company assesses the credit quality of the notes receivable and adequacy of notes receivable loss reserves on a quarterly basis or more frequently as necessary. Significant judgment of the Company is required in this analysis. The Company considers the estimated net recoverable value of the notes receivable as well as other factors, including but not limited to the fair value of any collateral, the amount and the status of any senior debt, the quality and financial condition of the borrower and the competitive situation of the area where the underlying collateral is located. Because this determination is based on projections of future economic events, which are inherently subjective, the amount ultimately realized may differ materially from the carrying value as of the balance sheet date.

| 23 |

If upon completion of the assessment, the estimated fair value of the underlying collateral is less than the net carrying value of the notes receivable, notes receivable loss reserve is recorded with a corresponding charge to provision for notes receivable losses.

The notes receivable loss reserve for each note is maintained at a level that is determined to be adequate by management to absorb probable losses.

Income recognition is suspended for a note receivable when full recovery, according to the contractual terms, of income and principal becomes doubtful. When the ultimate collectability of the principal of an impaired note receivable is in doubt, all payments are applied to principal under the cost recovery method.

When the ultimate collectability of the principal of an impaired note receivable is not in doubt, contractual interest is recorded as interest income when received, under the cash basis method until an accrual is resumed when the note receivable becomes contractually current and performance is demonstrated to be resumed. Interest accrued and not collected will be reversed against interest income. A note receivable is written off when it is no longer realizable and/or legally discharged. As of April 30, 2018 and 2017, the Company had four and two impaired notes receivable, respectively.

Property sales revenue recognition - Property sales revenue and related profit are generally recognized at the time of the closing of the sale, when title to and possession of the property are transferred to the buyer. In situations where the buyer’s financing is provided by the Company and the buyer has not made an adequate initial or continuing investment as required by ASC 360-20, “Property, Plant, and Equipment - Real Estate Sales” (“ASC 360-20”), the profit on such sales is deferred or recognized under the installment method, unless there is a loss on the sale in which case the loss on such sale would be recognized at the time of closing. In in connection with the sale of three properties, which the Company financed, at April 30, 2018 and 2017, deferred profit on such sales totaled approximately $64,000 and $42,000, respectively, which is offset against the notes receivable balance on the face of balance sheet. See Note 5.

Emerging growth company status - As an emerging growth company under the JOBS Act, we have elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act. This election is irrevocable.