Attached files

| file | filename |

|---|---|

| 8-K - 8-K_08142018_INVESTOR_PRESENTATION - MID PENN BANCORP INC | mpb-8k_20180814.htm |

Investor Presentation August 14, 2018 Exhibit 99.1

Rory G. Ritrievi President & CEO Michael D. Peduzzi, CPA Executive Vice President & Chief Financial Officer

This presentation and management’s related discussion may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts and include expressions about management's confidence and strategies and management's current views and expectations about new and existing programs and products, relationships, opportunities, technology and market conditions. These statements may be identified by such forward-looking terminology as "continues," "expect," "look," "believe," "anticipate," "may," "will," "should," "projects," "strategy" or similar statements. Actual results may differ materially from such forward-looking statements, and no reliance should be placed on any forward-looking statement. Factors that may cause results to differ materially from such forward-looking statements include, but are not limited to, changes in interest rates, spreads on earning assets and interest-bearing liabilities, and interest rate sensitivity; prepayment speeds, loan originations, credit losses and market values on loans, collateral securing loans, and other assets; sources of liquidity; common shares outstanding; common stock price volatility; fair value of and number of stock-based compensation awards to be issued in future periods; the impact of changes in market values on securities held in Mid Penn’s portfolio; legislation affecting the financial services industry as a whole, and Mid Penn and Mid Penn Bank individually or collectively, including tax legislation; regulatory supervision and oversight, including monetary policy and capital requirements; changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or regulatory agencies; increasing price and product/service competition, including new competitors; (Cont.) Cautionary Notice Regarding Forward-Looking Statements

(Cont.) rapid technological developments and changes; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; the mix of products/services; containing costs and expenses; governmental and public policy changes; protection and validity of intellectual property rights; reliance on large customers; technological, implementation and cost/financial risks in large, multi-year contracts; the outcome of future litigation and governmental proceedings, including tax-related examinations and other matters; continued availability of financing; financial resources in the amounts, at the times and on the terms required to support Mid Penn and Mid Penn Bank’s future businesses; the impact of Mid Penn’s completed acquisitions of The Scottdale Bank and Trust Company, and First Priority Financial Corp.; and material differences in the actual financial results of merger, acquisition and investment activities compared with Mid Penn’s initial expectations, including the full realization of anticipated cost savings and revenue enhancements. For a list of other factors which would affect our results, see Mid Penn’s filings with the SEC, including those risk factors identified in the "Risk Factors" section and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2017, and in our Form 10-Q for the period ended June 30, 2018. The statements made during this presentation are as of the date of this presentation, even if subsequently made available by Mid Penn on its website or otherwise. Mid Penn assumes no obligation for updating any such forward-looking statements at any time, except as required by law. Cautionary Notice Regarding Forward-Looking Statements

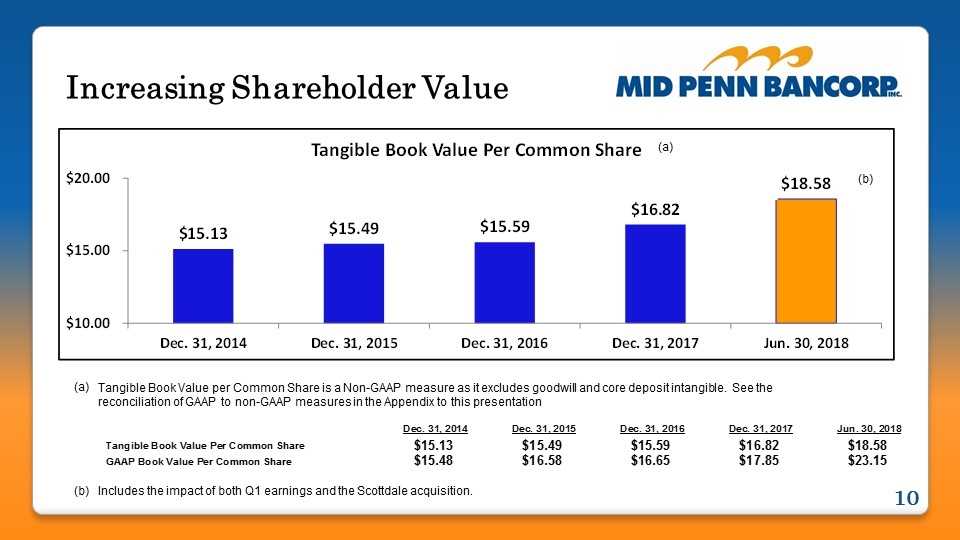

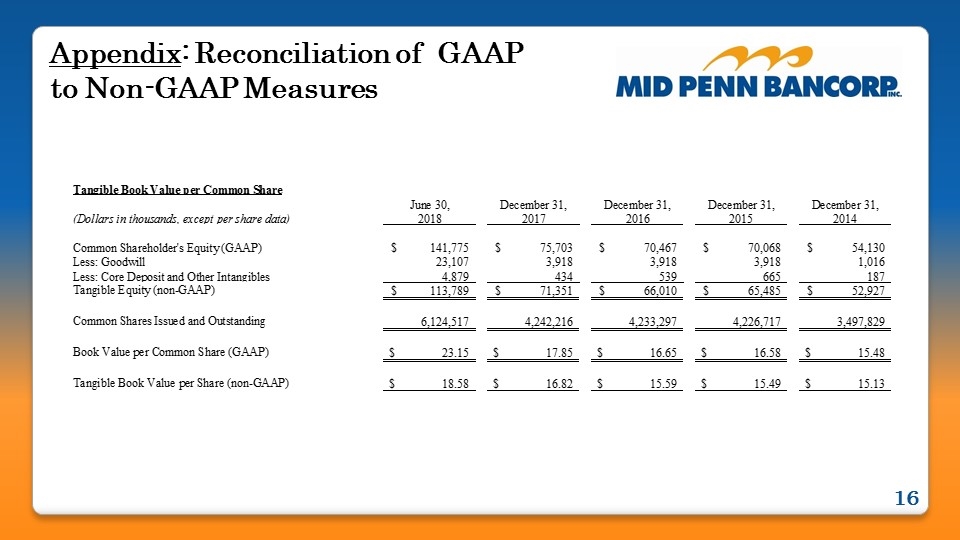

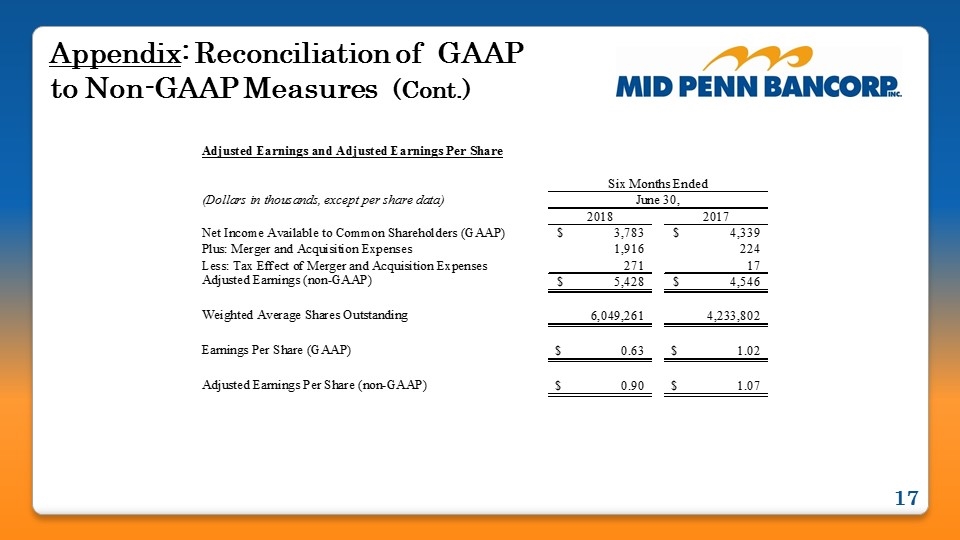

This presentation contains financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"). For tangible book value, the most directly comparable financial measure calculated in accordance with GAAP is our book value. We believe that this measure is important to many investors in the marketplace who are interested in changes from period to period in book value per common share exclusive of changes in intangible assets. Goodwill and other intangible assets have the effect of increasing total book value while not increasing our tangible book value. We believe earnings per share excluding the after-tax impact of merger-related expenses and the adjustment of the deferred tax asset provides important supplemental information in evaluating Mid Penn’s operating results because these charges are not incurred as a result of ongoing operations. Income tax effects of non-GAAP adjustments are calculated using the applicable statutory tax rate for the jurisdictions in which the charges (benefits) are incurred, while taking into consideration any valuation allowances or non-deductible portions of the non-GAAP adjustments. This non-GAAP disclosure has limitations as an analytical tool, should not be viewed as a substitute for financial measures determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of Mid Penn’s results and financial condition as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies. Management believes that this non-GAAP supplemental information will be helpful in understanding Mid Penn’s ongoing operating results. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are set forth in the Appendix. This supplemental presentation should not be construed as an inference that Mid Penn’s future results will be unaffected by similar adjustments to be determined in accordance with GAAP. Cautionary Notice Regarding Non-GAAP Measures

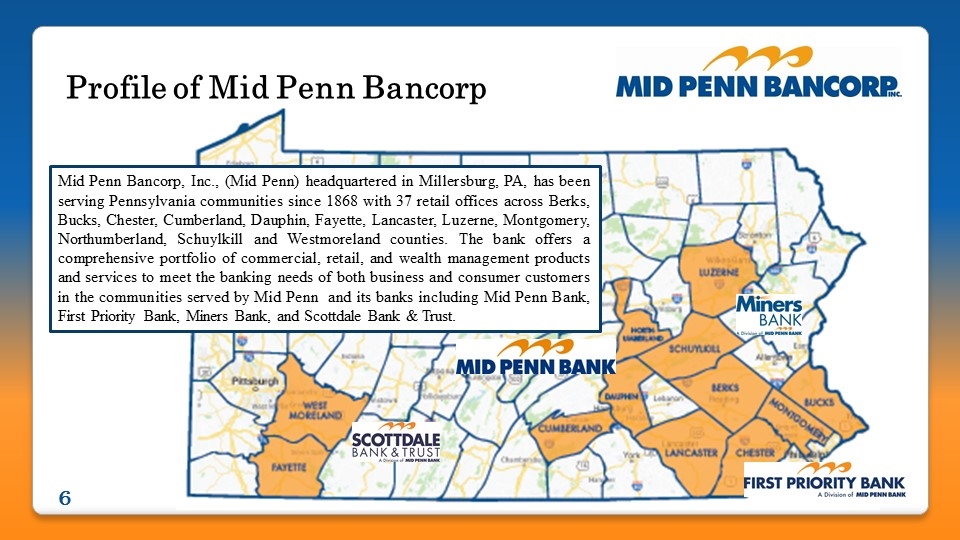

Profile of Mid Penn Bancorp Mid Penn Bancorp, Inc., (Mid Penn) headquartered in Millersburg, PA, has been serving Pennsylvania communities since 1868 with 37 retail offices across Berks, Bucks, Chester, Cumberland, Dauphin, Fayette, Lancaster, Luzerne, Montgomery, Northumberland, Schuylkill and Westmoreland counties. The bank offers a comprehensive portfolio of commercial, retail, and wealth management products and services to meet the banking needs of both business and consumer customers in the communities served by Mid Penn and its banks including Mid Penn Bank, First Priority Bank, Miners Bank, and Scottdale Bank & Trust.

In 2017, Mid Penn Bank was named one of the “Top 200 Community Banks” for 5 consecutive years, and… We were honored to be recognized as one of the “Best Banks to Work For” by American Banker. Recipient of the “Grow Your Community Award” from the Pennsylvania Association of Community Bankers (4 consecutive years). Industry Recognition

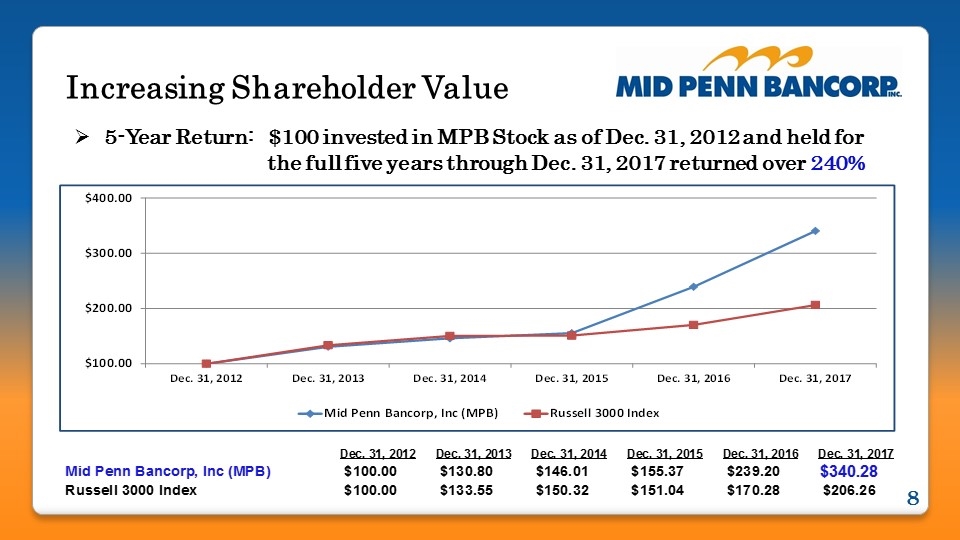

5-Year Return: $100 invested in MPB Stock as of Dec. 31, 2012 and held for the full five years through Dec. 31, 2017 returned over 240% Increasing Shareholder Value 2017 Total Return was 42%

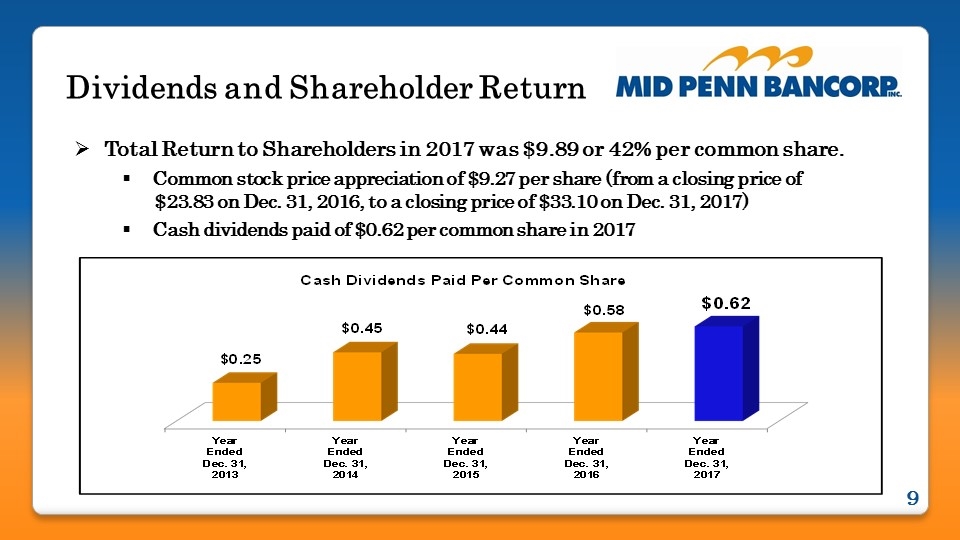

Total Return to Shareholders in 2017 was $9.89 or 42% per common share. Common stock price appreciation of $9.27 per share (from a closing price of $23.83 on Dec. 31, 2016, to a closing price of $33.10 on Dec. 31, 2017) Cash dividends paid of $0.62 per common share in 2017 Dividends and Shareholder Return

Increasing Shareholder Value Includes the impact of both Q1 earnings and the Scottdale acquisition. (a) (a) (b) (b) Tangible Book Value per Common Share is a Non-GAAP measure as it excludes goodwill and core deposit intangible. See the reconciliation of GAAP to non-GAAP measures in the Appendix to this presentation

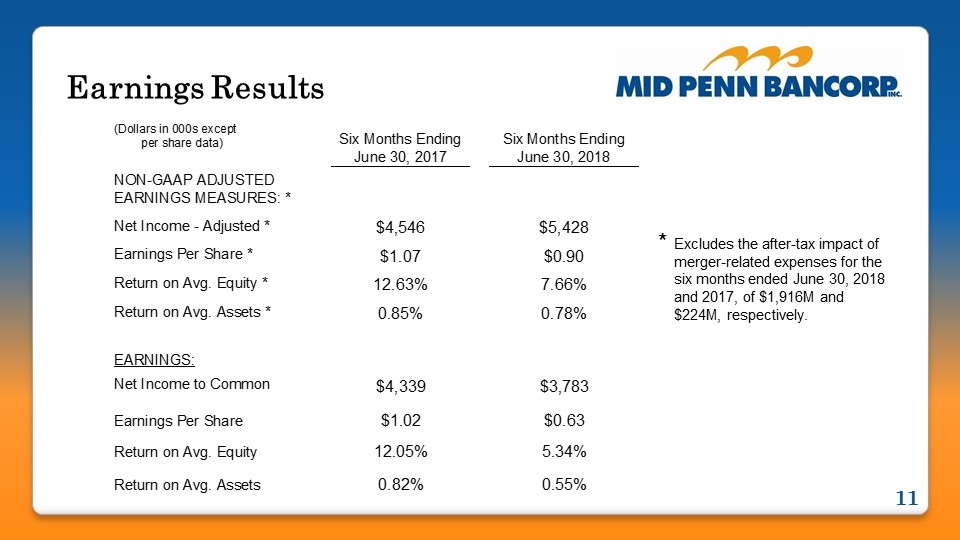

Earnings Results Excludes the after-tax impact of merger-related expenses for the six months ended June 30, 2018 and 2017, of $1,916M and $224M, respectively. *

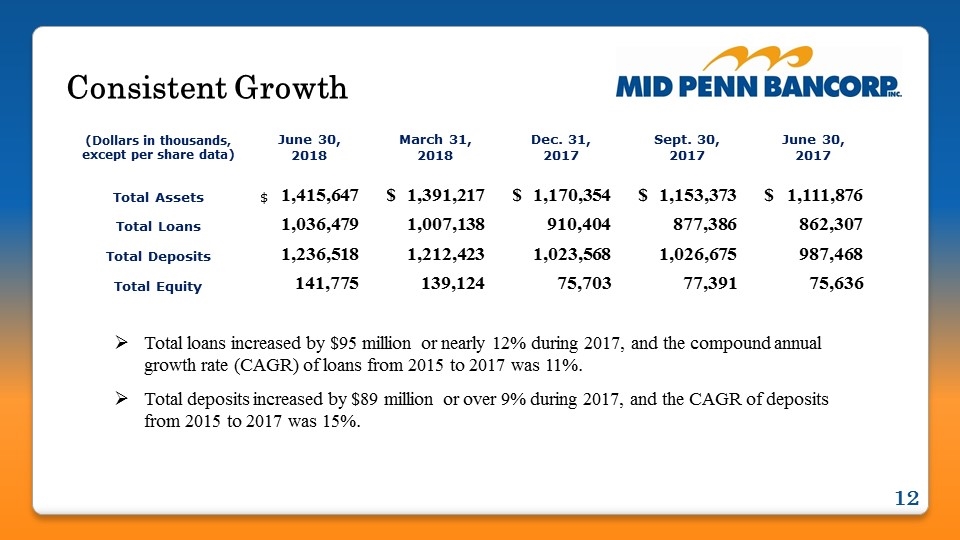

Total loans increased by $95 million or nearly 12% during 2017, and the compound annual growth rate (CAGR) of loans from 2015 to 2017 was 11%. Total deposits increased by $89 million or over 9% during 2017, and the CAGR of deposits from 2015 to 2017 was 15%. Consistent Growth (Dollars in thousands, except per share data) June 30, 2018 March 31, 2018 Dec. 31, 2017 Sept. 30, 2017 June 30, 2017 Total Assets $ 1,415,647 $ 1,391,217 $ 1,170,354 $ 1,153,373 $ 1,111,876 Total Loans 1,036,479 1,007,138 910,404 877,386 862,307 Total Deposits 1,236,518 1,212,423 1,023,568 1,026,675 987,468 Total Equity 141,775 139,124 75,703 77,391 75,636

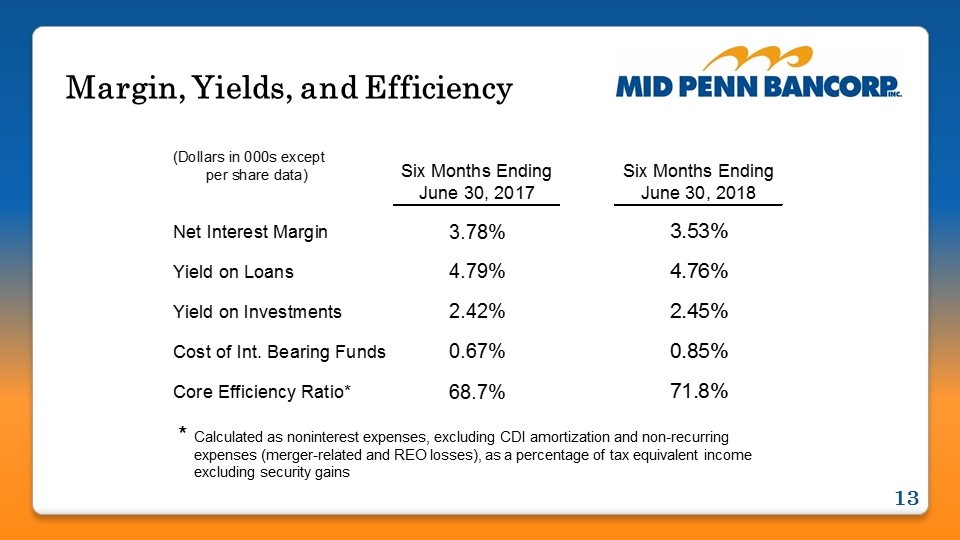

Margin, Yields, and Efficiency Calculated as noninterest expenses, excluding CDI amortization and non-recurring expenses (merger-related and REO losses), as a percentage of tax equivalent income excluding security gains *

On January 8, 2018, Mid Penn announced the successful completion of the legal acquisition of The Scottdale Bank & Trust Company. Mid Penn acquired $70,752,000 in loans, $114,039,000 of investments, and assumed $209,981,000 of deposits from Scottdale. Mid Penn also recorded goodwill of $19,189,000 and a core deposit intangible asset of $4,940,000 as a result of the acquisition. Franchise Expansion

On July 31, 2018, Mid Penn completed its acquisition of First Priority Financial Corp. (“First Priority”), through the merger of First Priority with and into Mid Penn pursuant to the previously announced Agreement and Plan of Merger (the “Merger Agreement”), dated as of January 16, 2018, among Mid Penn, Mid Penn Bank, and First Priority. Pursuant to the Merger Agreement, shareholders of First Priority received 0.3481 shares of Mid Penn common stock for each share of First Priority common stock they owned, and outstanding options to purchase First Priority common stock at the time of the merger were converted to the right to receive cash at a per-option value of $11.07 less the exercise price, without interest. As a result, Mid Penn issued approximately 2.3 million shares of Mid Penn common stock and paid cash of approximately $3.9 million. The transaction was valued at approximately $79,904,000. At June 30, 2018, and thirty days prior to the acquisition transaction, First Priority reported total assets of $627,428,000, total loans of $522,036,000, and total deposits of $513,582,000 on a Call Report filed with federal banking regulators. Given that the initial purchase accounting for the acquisition in accordance with generally accepted accounting principles for this business combination is not yet completed, Mid Penn is not yet able to disclose the preliminary fair value of the First Priority assets acquired and liabilities assumed. Franchise Expansion

Appendix: Reconciliation of GAAP to Non-GAAP Measures

Appendix: Reconciliation of GAAP to Non-GAAP Measures (Cont.)