Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - FIRST DATA CORP | a993partiiitem7managements.htm |

| EX-99.4 - EXHIBIT 99.4 - FIRST DATA CORP | a994partiiitem8financialst.htm |

| EX-99.2 - EXHIBIT 99.2 - FIRST DATA CORP | a992partiiitem6selectedfin.htm |

| EX-23.1 - EXHIBIT 23.1 - FIRST DATA CORP | a231consentofindependentre.htm |

| 8-K - 8-K - FIRST DATA CORP | a0806188-k.htm |

ITEM 1. BUSINESS

General

First Data Corporation sits at the center of global electronic commerce. We believe we offer our clients the most complete array of integrated solutions in the industry, covering their needs across next-generation commerce technologies, merchant acquiring, issuing, and network solutions. We serve our clients in over 100 countries, reaching over 6 million business locations and over 4,000 financial institutions. We believe we have the industry’s largest distribution network, driven by our partnerships with many of the world’s leading financial institutions, our direct sales force, and a network of distribution partners. We are the largest merchant acquirer, issuer processor, and independent network services provider in the world, enabling businesses to accept electronic payments, helping financial institutions issue credit, debit and prepaid cards, and routing secure transactions between them. In 2017, we processed 93 billion transactions globally, or approximately 3,000 per second. In our largest market, the United States, we processed approximately $2.1 trillion of payment volume, which represents over 10% of United States gross domestic product (GDP) last year.

We have operations and offices located within the United States (U.S.) (domestic) and outside of the U.S. (international) where sales, customer service and/or administrative personnel are based. Total revenues from processing domestic and international transactions as a percentage of total revenues and total long lived assets attributable to domestic and international operations as a percentage of total long lived assets, are displayed in the below table.

Year ended December 31, | ||||||||

2017 | 2016 | 2015 | ||||||

Total generated from processing transactions: | ||||||||

Domestic | 85 | % | 85 | % | 86 | % | ||

International | 15 | % | 15 | % | 14 | % | ||

Long-lived assets attributable to operations: | ||||||||

Domestic | 89 | % | 89 | % | 89 | % | ||

International | 11 | % | 11 | % | 11 | % | ||

No country outside the US is greater than 10% of our total revenues or long-lived assets during any of the years presented in the above table. Further financial information relating to our international and domestic revenues and long-lived assets is set forth in note 7 "Segment Information" to our consolidated financial statements in Part II, Item 8 of this Form 10-K.

Our business is characterized by transaction and account related fees, multi-year contracts, and a diverse client base, which allows us to grow alongside our clients. Our multi-year contracts allow us to achieve a high level of recurring revenues with the same clients. While the contracts typically do not specify fixed revenues to be realized thereunder, they do provide a framework for revenues to be generated based on volume of services provided during such contract's term. Our business also generally requires minimal incremental capital expenditures and working capital to support additional revenue within our existing business lines.

Products and Services Segments Information

We provide a range of solutions to businesses and financial institutions across the value chain of commerce-enabling services and technologies. We deliver our value-added solutions from a suite of proprietary technology products, software, cloud-based applications, processing services, security offerings, and customer support programs that we configure to meet our clients' individual needs.

We operate three segments: Global Business Solutions (GBS), Global Financial Solutions (GFS), and Network & Security Solutions (NSS). Our segments are designed to establish global lines of businesses that support our global client base and allow us to further globalize our solutions while working seamlessly with our geographic teams across our regions: the United States and Canada (North America); Europe, Middle East, and Africa (EMEA); Latin America (LATAM); and Asia Pacific (APAC) and be supported by a corporate team focused on company-wide issues.

• | Global Business Solutions - GBS provides a wide-range of solutions to merchants. These solutions include retail point-of-sale merchant acquiring and eCommerce services as well as next-generation offerings such as mobile payment services, and our cloud-based Clover point-of-sale operating system, which includes a marketplace for proprietary and third-party business applications. |

1

• | Global Financial Solutions - GFS provides technology solutions for bank and non-bank issuers. These solutions include general purpose credit, retail private label, commercial card, and loan processing within the United States and international markets, as well as licensed financial software systems, such as our VisionPLUS processing application. GFS also provides financial institutions with a suite of account services including card personalization and embossing, customer communications, remittance processing, professional services, and customer servicing, including call center solutions and back office processing. |

• | Network & Security Solutions - NSS provides a wide range of value-added solutions that we sell to clients in our GBS and GFS segments, smaller financial institutions, and other enterprise clients. These solutions include our EFT network solutions, such as our STAR Network, our debit card processing solutions, our Stored Value Network solutions, such as Money Network, Gift Solutions and our Security and Fraud solutions, such as TransArmor and TeleCheck. NSS also supports our other digital strategies, including online and mobile banking, and our business supporting mobile wallets. |

See "Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations" for a detailed explanation of our operating results. Segment products and services are illustrated below:

The segments’ profit measure is a form of EBITDA (earnings before net interest expense, income taxes, depreciation, and amortization). A discussion of factors potentially affecting our operations is set forth in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K.

We do not have any significant customers that account for 10% or more of total consolidated revenues.

2

Overview of Payment Processing

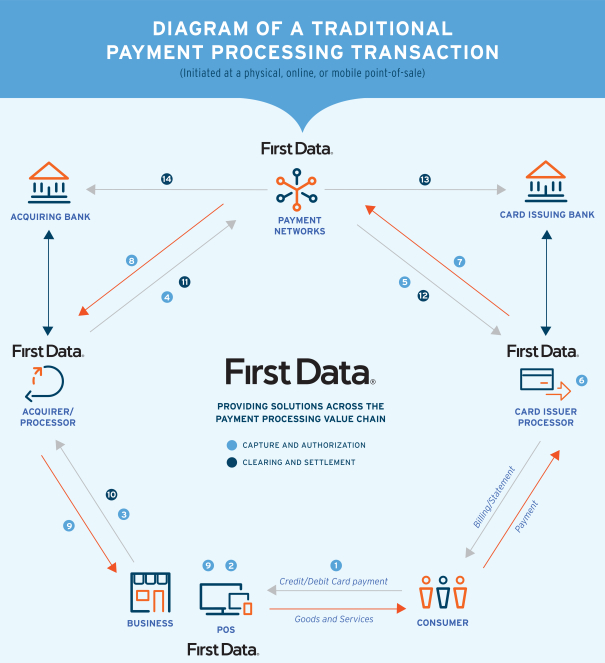

The processing of a traditional card transaction includes two sub-processes: (1) capture and authorization and (2) clearing and settlement. Below is an illustrative diagram of the flow of a typical card transaction and an explanation of each step in the process.

Capture and Authorization

In the capture and authorization process, the business obtains approval for payment from the card issuing bank. This process includes the following steps:

1. | Once the consumer is ready to make a purchase, he or she presents their card for payment; |

2. | The card is swiped in the Point-of-Sale (POS) device at the business location, which captures the account information contained on the card's magnetic stripe or Europay, MasterCard and Visa (EMV) - compliant chip; |

• | In a mobile commerce transaction facilitated by a mobile wallet, such as Apple Pay, the appropriate card details are stored virtually on an application on the phone and transmitted to the POS device through a chip equipped with near-field communication (NFC) technology; |

• | In an eCommerce transaction, the POS device is replaced by a virtual terminal application and the consumer types the card number into the check-out page of the online storefront. In some circumstances, an online wallet, such as PayPal, may be used to transmit the appropriate payment credentials; |

3. | The customer's card details are transmitted from the POS to the merchant acquirer, or the merchant acquirer's processor, via an internet connection or a phone line; |

3

• | In an eCommerce transaction, the information is encrypted and then transmitted to the merchant acquirer, or merchant acquirer's processor, via an online gateway; |

4. | The merchant acquirer, or the merchant acquirer's processor, identifies the appropriate payment network affiliated with the card, such as Visa, MasterCard, or STAR, and forwards the card details to the appropriate network; |

5. | The payment network receives the request for payment authorization, identifies the appropriate card issuing bank, and routes the transaction to the bank or its issuer processor; |

6. | The card issuing bank, or its issuer processor, receives the request and then executes a series of inquiries into its account systems to assess the potential risk of fraud for the transaction, establish that the account is in good standing, and verify that the cardholder has sufficient credit or adequate funds to cover the amount of the transaction; |

7. | The card issuing bank, or its issuer processor, approves or declines the transaction and sends back the response to the payment network. In this example the transaction is approved; |

8. | The payment network receives the approval and forwards the authorization to the merchant acquirer, or merchant acquirer's processor; and |

9. | The merchant acquirer, or merchant acquirer's processor, sends the authorization back to the POS device at the business location, which provides an approval confirmation and prints a receipt; |

• | In a mobile commerce transaction, the approval confirmation and receipt may also be transmitted to the consumer's mobile wallet application or to the consumer via email; |

• | In an eCommerce transaction, the authorization is sent to the online storefront, which communicates the approval to the consumer on the screen, and may provide the receipt for printing online or via email. |

Clearing and Settlement

In the clearing and settlement process, a request for payment is initiated, funds are transferred and the transaction is posted to the business owner's and the consumer's account statements. The clearing and settlement process includes the following steps:

10. | Typically at the end of the day, the business submits a batch of all of its approved authorizations to the merchant acquirer, or the merchant acquirer's processor, through a function on its POS device; |

• | In the case of an eCommerce business, the online storefront's gateway sends the batch to the merchant acquirer, or to the merchant acquirer's processor; |

11. | The merchant acquirer, or the merchant acquirer's processor, receives the batch, notes the final amounts due for settlement, and routes the batch of approved authorizations to each applicable payment network; |

12. | Each payment network sends the batch of approved authorizations to the applicable card issuing bank, or its issuer processor, which posts the transaction to the consumer's statement; |

13. | Typically within 48 hours, the payment network calculates net settlement positions for the merchant acquirer and the card issuing bank, sends advisements to the merchant acquirer and card issuing bank, and submits a fund transfer order to a settlement bank; and |

14. | The settlement bank facilitates the exchange of funds between the merchant acquirer and the card issuing bank; and the merchant acquirer transfers the funds to the business owner's account. |

Global Business Solutions Segment

The following table presents GBS information as a percentage of total segment revenue and segment EBITDA:

Year ended December 31, | |||||||||

2017 | 2016 | 2015 | |||||||

Segment revenue | 61 | % | 60 | % | 62 | % | |||

Segment EBITDA | 59 | % | 60 | % | 62 | % | |||

See note 7 "Segment Information" to our consolidated financial statements in Part II, Item 8 of this Form 10-K for a detail of segment revenue and segment EBITDA results.

Global Business Solutions Operations Our largest segment, GBS, provides businesses of all sizes and types with a wide range of solutions at the point of sale, including merchant acquiring, eCommerce, mobile commerce, POS, and other business solutions. We served approximately 3.6 million business locations in the United States and 2.7 million outside the United States. GBS' largest service is merchant acquiring, which facilitates the acceptance of commercial transactions at the POS, whether a retail transaction at a physical business location, a mobile commerce transaction through a mobile or tablet device, or an eCommerce transaction over the Internet. In 2017, we processed $2.1 trillion of payment volume in the United States and over $300 billion of payment volume outside the United States.

4

GBS employs a variety of go-to-market strategies. GBS operates direct sales teams and also partners with indirect non-bank sales forces, such as independent sales agents, independent sales organizations (ISOs), independent software vendors (ISVs), value added retailers (VARs), and payment services providers (PSPs) to sell our commerce solutions to Small and Medium Sized Business (SMBs). In addition, GBS leverages the powerful sales capabilities of its bank partners to go to market through several structures, including joint venture equity alliances, revenue sharing alliances, and referral agreements.

GBS segment revenues are primarily derived from processing credit and debit card transactions for merchants and other business clients and includes fees for providing processing, loyalty and software services, and sales and leases of POS devices. Revenues are generated from a variety of sources, including:

• | Discount fees charged to a merchant, net of credit and debit card interchange and assessment fees charged by the payment networks. The discount fee is typically either a percentage of the purchase amount or an interchange fee plus a fixed dollar amount; |

• | Processing fees charged to our alliances; |

• | Processing fees charged to merchant acquirers who have outsourced their transaction processing to us; |

• | Sales and leases of POS devices; |

• | Fees from providing reporting and other services; and |

• | Software fees such as security applications and Clover related fees. |

We typically provide these services as part of a broader commerce-enabling solution to our business clients across multiple channels, including:

• | Retail POS - Physical businesses or storefront locations, such as retailers, supermarkets, restaurants, and petroleum stations, with brick and mortar facilities; |

• | Mobile POS - Physical businesses with remote or wireless storefront locations, such as small retailers and service providers that use mobile devices to accept electronic payments; and |

• | Online POS (eCommerce) - Online businesses or website locations, such as retailers, digital content providers, and mobile app developers with Internet-based storefronts that can be accessed through a personal computer or a mobile device. |

Clover Operating System Clover is an open architecture, integrated POS operating system, with a full suite of integrated hardware and software offerings. With Clover, we have designed one of the largest open architecture platforms of commerce-enabling solutions and applications in the world. The family of Clover devices includes the Clover Station, Clover Mobile, Clover Mini, Clover Go, and now Clover Flex; each providing a broad range of next-generation features and software applications designed to help business clients conduct commerce.

Through December 31, 2017, we have shipped over 750,000 Clover devices and the current Clover platform processes approximately $50 billion in payment volume annually. Within Clover, we also offer a cloud-based Clover App Market for business applications. Our application marketplace is designed specifically to provide merchants with integrated software applications that they can download and install quickly and easily on their Clover devices. As of December 31, 2017, the Clover App Market has over 300 active applications. We already offer Clover throughout North America and within numerous countries in EMEA, and we are in the process of rolling Clover out to other international regions. Furthermore, we believe Clover improves client retention because it becomes core to our clients' businesses, and positions us as a value-added partner. For example, business owners may use applications in the Clover App Market to manage their employees' work schedules, operate customer loyalty programs, integrate transaction information directly into their accounting software, manage inventory, and provide analytics on their business.

Global Business Solutions Competition GBS competes with merchant acquirers that include Worldpay and Global Payments, in addition to financial institutions that provide acquiring and processing services to businesses on their own, such as Chase Paymentech Solutions, Elavon (a subsidiary of U.S. Bancorp), and Barclaycard. In many cases, our alliance and commercial partners compete against each other. Additionally, payment networks such as Visa and MasterCard are increasingly offering products and services that compete with our suite of solutions. Competitors of our next-generation services include PayPal, Braintree (a subsidiary of PayPal), CyberSource (a subsidiary of Visa Inc.), Adyen, and Stripe, along with integrated point of sale providers such as Micros, Square, and others.

The primary competitive factors impacting GBS are brand, data security, breadth of features and functionality, ease of technological integration, strength of financial institution partnerships, price, and servicing capability. Other factors impacting GBS include consolidation among large businesses and financial institutions, the pace of integrated point of sale solution development, and the creation of new payment methods and related technologies.

5

Global Business Solutions Seasonality GBS experiences a modest level of seasonality, with the first quarter representing the lowest level of sales and the fourth quarter representing the highest level of sales. Over the past eight quarters, GBS' quarterly revenue as a percentage of total yearly revenue has ranged between 24% and 26%.

Global Business Solutions Geographic Mix and Revenues GBS generates approximately 77% of its revenues from clients in our North America region, 13% from clients in the EMEA region, 6% from clients in our LATAM region, and 4% from clients in our APAC region. GBS revenues and earnings are impacted by the number of transactions and payment volume, the mix of consumer usage of credit cards, debit cards, and the size of the business.

Global Business Solutions Acquisitions and Dispositions On May 1, 2017, we acquired Accullink Inc. (Acculynk), a leading technology company that delivers eCommerce solutions for debit card acceptance, for $85 million, net of cash acquired. The acquisition included Acculynk's PaySecure debit routing technology and its range of other services.

On July 6, 2017, we acquired CardConnect Corp. (CardConnect) for $763 million, net of cash acquired. CardConnect is an innovative provider of payment processing and technology solutions and was one of our largest distribution partners. The transaction is expected to enable us to bring innovative partner management tools to improve merchant retention, accelerate our firm-wide independent software vendor (ISV) initiative and bring immediate capabilities in enterprise resource planning (ERP) integrated payment solutions to our customers.

On December 1, 2017, we acquired BluePay Holdings, Inc. (BluePay) for $759 million, net of cash acquired. BluePay is a provider of technology-enabled payment processing for merchants in the U.S. and Canada and was one of our largest distribution partners with a strong focus on software-enabled payments and card-not-present transactions. The transaction is expected to be highly complementary to our earlier acquisition of CardConnect and enhance our suite of innovative partner management tools to improve merchant retention, accelerate our firm-wide ISV initiative and bring immediate capabilities in ERP integrated payment solutions to our customers.

On September 30, 2016, we completed the sale of our Australian ATM business. Associated with the transaction, we recognized a $34 million loss on the sale.

See note 12 "Acquisitions and Dispositions" to our consolidated financial statements in Part II, Item 8 of this Form 10-K for more details relating to these acquisitions.

Global Financial Solutions Segment

The following table presents GFS information as a percentage of total segment revenue and segment EBITDA:

Year ended December 31, | ||||||||

2017 | 2016 | 2015 | ||||||

Segment revenue | 20 | % | 21 | % | 19 | % | ||

Segment EBITDA | 22 | % | 22 | % | 20 | % | ||

See note 7 "Segment Information" to our consolidated financial statements in Part II, Item 8 of this Form 10-K for a detail of segment revenue and segment EBITDA results.

Global Financial Solutions Operations GFS provides financial institutions, which include bank and non-bank issuers such as retailers with proprietary card portfolios, with a broad range of technology solutions that enable them to offer financial products and solutions to their customers. GFS serves over 1,400 clients globally and delivers value to clients through a variety of channels, including end-to-end outsourced processing, managed services, and various software delivery models utilizing our proprietary VisionPLUS solution. GFS services include credit card and loan account processing, commercial payments, customer communications, plastics solutions, remittance processing, customer servicing, and other products to support issuers. In 2017, we processed 11 billion transactions on our platforms. As of December 31, 2017, GFS managed 906 million card accounts on file in North America, up 6% over 2016 and 170 million card accounts on file outside North America, up 13% over 2016.

GFS clients include some of the world's largest financial institutions, which we serve in approximately 100 countries. Our largest service in GFS is outsourced issuer processing, which helps banks and non-bank issuers provide credit, commercial, and retail card programs to their account holders, as well as loan programs. GFS also provides licensed software solutions for financial processing activities to financial institutions globally. Depending on the market, our solutions are often bundled with related offerings, such as customer communications and personalization of plastic cards, settlement and back office support, outsourced

6

billing, remittance processing, and customer service support. As part of these solutions, we also provide professional services, including custom programming and development, to clients.

GFS revenues are primarily derived from outsourced processing services, print, plastics, and remittance services, and VisionPLUS software services provided to financial institutions. GFS' revenues are typically generated on the basis of number of total and active accounts on file, volume of customer communications, volume of plastics issued or license fees.

Outsourced Processing and Licensing Outsourced processing and licensing provide solutions to financial institutions and other issuers of credit, such as banks, group service providers, retailers, consumer finance companies, and credit unions. These services enable issuers to process transactions on behalf of customers. Depending on our clients' needs and the market, we deliver these solutions through our proprietary outsourced services platforms, software application licenses, or software-as-a-service hosted in the cloud. Services in our proprietary platform include transaction authorization and posting, account maintenance, and settlement. Our VisionPLUS software is used globally as both a processing solution and a licensed software solution that enables clients to process their own transactions, depending on the market. We also enable merchants and financial institutions to offer next generation payment solutions to their clients, such as Apple Pay, Android Pay, and Samsung Pay.

Revenues for outsourced issuer processing services are derived from fees payable under contracts that depend primarily on the number of cardholder accounts on file. More revenue is derived from active accounts (those accounts on file that had a balance or any monetary posting or authorization activity during a specified period) than inactive accounts. Revenues are also derived from licensing fees for our VisionPLUS application, as well as cardholder and data transactions and professional services such as custom programming and development.

Account Support Services Along with our processing and licensing solutions, we provide a variety of supporting services throughout the life cycle of each account. Services include processing a card application, initiating services for the cardholder to enable the cardholder to transact, accumulating the card's transactions into a monthly billing statement, and posting cardholder payments. Other services provided include customized communications to cardholders, plastics personalization and mailing, information verification associated with granting credit, debt collection, remittance processing, and customer service on behalf of financial institutions. We also provide programming and customization to enhance and tailor our solutions to clients' needs through professional services.

Global Financial Solutions Competition GFS competes with card issuer processors, such as Total System Services, Worldpay, Fidelity National Information Services, Fiserv, Worldline, and SIX Payment Services, as well as the card issuer processing businesses of the global payment networks such as Visa and Mastercard. In addition, we compete with various software or custom designed solutions that some financial institutions use to perform these services in-house.

The primary competitive factors impacting GFS are system performance and reliability, digital solutions, data security, breadth of features and functionality, disaster recovery capabilities and business continuity preparedness, platform scalability and flexibility, price, and servicing capability. Market events that impact GFS include financial institution consolidation and portfolio transactions between financial institutions.

Global Financial Solutions Seasonality GFS experiences a modest level of seasonality, with the first quarter representing the lowest level of sales and the fourth quarter representing the highest level of sales. Over the past eight quarters, GFS' quarterly revenue as a percentage of total yearly revenue has ranged between 24% and 26%.

Global Financial Solutions Geographic Mix and Revenues GFS generates 59% of its revenues from clients in our North America region, 27% from clients in our EMEA region, 8% from clients in our LATAM region, and 6% from clients in our APAC region. Within the United States, revenues are diversified across major financial institutions of various sizes and geographies across the country.

Global Financial Solutions Acquisitions and Dispositions On September 27, 2017, we divested all of our businesses in Lithuania, Latvia and Estonia for €73 million (approximately $85 million). Associated with the transaction, we recognized a $4 million loss on the sale.

See note 12 "Acquisitions and Dispositions" to our consolidated financial statements in Part II, Item 8 of this Form 10-K for more details relating to this disposition.

7

Network & Security Solutions Segment

The following table presents NSS information as a percentage of total segment revenue and segment EBITDA:

Year ended December 31, | ||||||||

2017 | 2016 | 2015 | ||||||

Segment revenue | 19 | % | 19 | % | 19 | % | ||

Segment EBITDA | 24 | % | 23 | % | 23 | % | ||

See note 7 "Segment Information" to our consolidated financial statements in Part II, Item 8 of this Form 10-K for a detail of segment revenue and segment EBITDA results.

Network & Security Solutions Operations NSS provides a range of network solutions and security, risk and fraud management solutions to business and financial institution clients in our GBS and GFS segments, and independently to financial institutions, businesses, governments, processors and other clients. Our EFT Network Solutions manages U.S. debit card and account processing solutions. Our STAR Network enables clients to encrypt, route, and decrypt PIN debit, PIN-less debit, and ATM transactions, and provide access to demand deposit accounts. In 2017, our STAR Network routed approximately 4.3 billion transactions in the United States. Our Stored Value Network Solutions facilitate stored value commerce, such as (1) closed-loop prepaid transactions, which are initiated by various types of prepaid cards issued by enterprises, such as retailers, that issue enterprise-branded cards that can generally be used only at the enterprise issuing the card or account, and (2) open-loop prepaid transactions, which are initiated by various types of prepaid cards issued by a bank and carry a network association brand, such as Visa, MasterCard and STAR, enabling them to be used at multiple merchant locations. NSS also includes our Online and Mobile Banking Solutions, Healthcare Solutions, and Government Solutions.

EFT Network Solutions enables our business and financial institution clients to route secure, encrypted data between themselves. Our STAR Network is connected to over 3,000 financial institutions and community banks, approximately 1.1 million POS and ATM locations, and numerous third-party payment processors, ATM processors, and card processors that participate in the network. When a business, a merchant acquirer, or an ATM owner acquires a STAR Network transaction, it sends the transaction data to the network switch, which is operated by us, which in turn routes the encrypted information to the appropriate financial institution for authorization. To be routed through the STAR Network, a transaction must be initiated with a card participating in the STAR Network at an ATM or POS device also participating in the STAR Network.

Revenues related to the STAR Network are derived from fees payable under contracts and negotiated rate structures but are driven more by the number of transactions processed than by accounts on file. In a situation in which a debit transaction uses our network and we are the debit card processor for the financial institution as well as the merchant acquirer for the business, we are eligible to receive one or more of the following:

• | a fee from the card issuing financial institution for running the transaction through the STAR Network; |

• | a fee from the card issuer for obtaining the authorization; |

• | a fee from the business for acquiring the transaction, recognized in GBS; and |

• | a network acquirer fee from the business for accessing the STAR Network. |

There are other possible configurations of transactions that result in us receiving multiple fees for a transaction, depending on the role we play.

Stored Value Network manages prepaid stored-value card issuance and processing services (i.e., gift cards) for retailers and others. The full-service stored-value/gift card program offers transaction processing services, card issuance, and customer service for over 200 national brands and several thousand small and mid-tier merchants. We also provide program management and processing services for association-branded, bank-issued, open loop (a card that can be used at multiple merchants), stored-value, reloadable, and one time prepaid card products. Revenues are generated from a variety of sources including processing fees for transactions processed and fees for card production and shipments.

Our commercial prepaid offerings are primarily sold to businesses and are comprised of:

• | Gift Solutions - Includes ValueLink, Gyft, and Transaction Wireless. |

◦ | ValueLink - Provides card and account issuing, program management, and transaction processing services for a range of prepaid card programs. Our closed-loop prepaid programs include gift, incentive, and rebate cards. We serve over 200 brands globally and several thousand SMBs. Our programs include reloadable and non- |

8

reloadable prepaid cards, and may be used with a variety of mobile applications.

◦ | Gyft - A leading digital platform that enables consumers to buy, send, manage, and redeem virtual closed-loop cards using mobile devices. The Gyft solution, combined with our leadership in prepaid issuing solutions, creates a unique combination to support growth in a rapidly expanding market for virtual cards. |

◦ | Transaction Wireless - A leading digital platform that enables businesses to sell virtual gift cards online, either to consumers through an integration with their eCommerce storefront, or to other businesses through a proprietary business-to-business solution. |

• | Payroll Solutions - Includes Money Network which provides open-loop electronic payroll distribution solutions that reduce or eliminate an employer's expense associated with traditional paper paychecks and helps employees without bank accounts avoid check cashing fees. The solution also provides important employee security as the funds are stored on the account, not as cash that can be lost or stolen. Money Network accounts can be used at any business location that accepts Visa, MasterCard, or STAR branded cards, includes a packet of checks to be used to pay bills and avoid the cost of money orders, and offers a web portal to track account activity. |

Security and Fraud Solutions provides a range of security, risk, and fraud management solutions that help businesses and financial institutions securely run and grow their business by protecting their data, managing risk, and preventing fraud. Our solutions include TransArmor, our encryption, tokenization, and PCI compliance solution for POS data in-transit, Fraud Predictor Plus, our solution to detect fraud at the POS through a machine-learning based predictive model, and TeleCheck, the industry-leading database of check-writers activity. Revenues for our security solutions are earned on a fee for licensed basis or per transaction.

TeleCheck offers check verification, settlement, and guarantee services using our proprietary database system to assist merchants in deciding whether accepting checks at the POS is a reasonable risk, or, further, to guarantee checks presented to merchants if they are approved. These services include risk management services, which utilize software, information, and analysis to assist the merchant in the decision process and include identity fraud prevention and reduction. Revenues are earned by charging merchant fees for check verification or guarantee services.

Network & Security Solutions Competition NSS competes with networks such as Visa, MasterCard, and Discover for debit network services, and with Fidelity National Information Services for debit network and check verification and guarantee services. We also face competition from regional operators of debit networks. Our portfolio of security and risk management solutions competes with a wide range of providers across multiple disciplines, including Visa, MasterCard, Voltage, Verisk, Equifax, Experian, TransUnion, and Fair Isaac.

The primary competitive factors impacting NSS are system performance and reliability, data security, breadth of features and functionality, platform scalability and flexibility, price, and financial institution consolidation. Other factors impacting NSS include increasingly powerful and affordable technology capacity, improved data management and analytic tools, and emergence of cloud-based delivery models.

Network & Security Solutions Seasonality NSS experiences a modest level of seasonality, with the first quarter representing the lowest level of sales and the fourth quarter representing the highest level of sales. Over the past eight quarters, NSS' quarterly revenue as a percentage of total yearly revenue has ranged between 23% and 26%.

Network & Security Solutions Geographic Mix and Revenues NSS is comprised of more than 95% domestic businesses.

Network & Security Solutions Acquisitions and Dispositions On October 2, 2017, we formed a digital banking joint venture, named Apiture, combining FDC and Live Oak Bancshares, Inc.'s digital banking platforms, products, and services, delivering innovative technology solutions tailored for financial institutions. Apiture is owned and managed equally between us and Live Oak Bancshares, Inc, as a result, the contributed digital banking business will no longer be consolidated into the our results.

In 2015, we acquired Transaction Wireless, Inc. (TWI) a provider of digital stored value products that offer gift card programs, loyalty incentives, and integrated marketing solutions for retailers, partners, and consumers.

See note 12 "Acquisitions and Dispositions" to our consolidated financial statements in Part II, Item 8 of this Form 10-K for more details relating to this acquisition and disposition.

9

Corporate

Corporate operations include corporate-wide governance functions such as our executive management team, tax, treasury, internal audit, corporate strategy, and certain accounting, human resources and legal costs related to supporting the corporate function. Costs incurred by Corporate that are attributable to a segment are allocated to the respective segment.

Global Regions

We currently have operations in 34 countries and serve businesses and financial institutions in over 100 countries around the world as illustrated on the following map:

We deliver our solutions throughout the world via four regions:

North America

North AmericaNorth America (United States and Canada) is our largest region. We are the largest merchant acquirer, issuer processor, and third largest U.S. debit network. The United States is our largest market and accounts for the majority of our activity in the region. In 2017, we processed approximately 77 billion commercial transactions and processed $2.1 trillion of payment volume in the United States, representing over 10% of U.S. GDP.

Europe, Middle East, and Africa (EMEA)

We have operations in 17 countries and serve clients in 66 countries in this region. We are a leading acquirer processor in EMEA and provide our suite of next-generation commerce-enabling solutions to businesses and financial institutions of all sizes and types.

Latin America (LATAM)

We have operations in 7 countries and serve clients in 32 countries in this region. We are a leading merchant acquirer, issuer processor, and eCommerce processor to businesses and financial institutions of all sizes and types in the region.

10

Asia Pacific (APAC)

We have operations in 8 countries and serve clients in 17 countries in this region. We are a leading merchant acquirer, issuer processor, and eCommerce processor to businesses and financial institutions of all sizes and types in the region and have begun to introduce other commerce-enabling solutions in selected markets.

Intellectual Property

We own a global portfolio of trademarks, trade names, patents, and other intellectual property that are important to our future success. The only intellectual property rights that are individually material to us are the First Data trademark and trade name, and the STAR trademark and trade name. The First Data trademark and trade name are associated with quality and reliable electronic commerce and payments solutions. The STAR trademark and trade name are used in NSS. Financial institutions and merchants associate the STAR trademark and trade name with quality and reliable debit network services and processing services. Loss of the proprietary use of the First Data or STAR trademarks and trade names or a diminution in the perceived quality associated with these names could harm the growth of our businesses.

Employees and Labor

As of December 31, 2017, we had approximately 22,000 employees. The majority of the employees of our subsidiaries outside of the United States are subject to the terms of individual employment agreements. One of our wholly owned subsidiaries has approximately 1,900 employees in the United Kingdom, a portion of whom are members of the Unite trade union. Employees of our subsidiaries in Vienna, Austria; Frankfurt, Germany; and Nürnberg, Germany are also represented by local work councils. The Vienna workforce and a portion of the Frankfurt workforce are also covered by a union contract. Certain employees of our Korean subsidiary are represented by a Labor-Management council. In Brazil, all employees are unionized and covered by the terms of industry-specific collective agreements. Employees in certain other countries are also covered by the terms of industry-specific national collective agreements. None of our employees are otherwise represented by any labor organization in the United States. We believe that our relations with our employees and the labor organizations identified above are in good standing.

Available Information

Our principal executive offices are located at 225 Liberty Street, 29th Floor, New York, NY 10281, telephone (800) 735-3362. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available free of charge to shareholders and other interested parties through the “Investor Relations” portion of our website at http://investor.firstdata.com as soon as reasonably practical after they are filed with the Securities and Exchange Commission (SEC). Information contained on, or that can be accessed through, our website is not incorporated by reference into this document, and you should not consider information on our website to be part of this document. The SEC maintains a website, www.sec.gov, which contains reports and other information filed electronically with the SEC by us. Various corporate governance documents, including our Audit Committee Charter, Governance, Compensation and Nominations Committee Charter, and Code of Ethics for Senior Financial Officers are available without charge through the “About Us” “Investor Relations” “Corporate Governance” portion of our investor relations website, listed above.

Government Regulations

Various aspects of our service areas are subject to U.S. federal, state, and local regulation, as well as regulation outside the United States. Failure to comply with regulations may result in the suspension or revocation of licenses or registrations, the limitation, suspension or termination of service, and/or the imposition of civil and criminal penalties, including fines. Certain of our services also are subject to rules promulgated by various payment networks and banking authorities as more fully described below.

The Dodd-Frank Act In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act) was signed into law in the United States. The Dodd-Frank Act has resulted in significant structural and other changes to the regulation of the financial services industry. Among other things, Title X of the Dodd-Frank Act established a new, independent regulatory agency known as the Consumer Financial Protection Bureau (CFPB) to regulate consumer financial products and services (including some offered by our clients). The CFPB may also have authority over us as a provider of services to regulated financial institutions in connection with consumer financial products. Recently the CFPB released rules amending federal Regulation E and Regulation Z. The rules clarify the regulatory prepaid landscape for consumer access to disclosures, fees and statements, error resolution, limited liability and overdrafts. The rules have an impact to our subsidiary Money Network Financial LLC (Money Network) for disclosure, fees and error resolution processing. Separately, under the Dodd-Frank Act, debit interchange transaction fees that a card issuer receives and are established by a payment card network for an electronic debit transaction are

11

now regulated by the Board of Governors of the Federal Reserve System (Federal Reserve Board), and must be “reasonable and proportional” to the cost incurred by the card issuer in authorizing, clearing, and settling the transaction. Effective October 1, 2011, the Federal Reserve Board capped debit interchange rates for card issuers operating in the United States with assets of $10 billion or more. In addition, the new regulations contain non-exclusivity provisions that ban debit payment card networks from prohibiting an issuer from contracting with any other payment card network that may process an electronic debit transaction involving an issuer’s debit cards and prohibit card issuers and payment networks from inhibiting the ability of merchants to direct the routing of debit card transactions over any network that can process the transaction. Beginning April 1, 2012, all debit card issuers in the United States were required to participate in at least two unaffiliated debit payment card networks. On April 1, 2013, the ban on network exclusivity arrangements became effective for prepaid card and healthcare debit card issuers, with certain exceptions for prepaid cards issued before that date.

Effective July 22, 2010, merchants were allowed to set minimum dollar amounts (not to exceed $10) for the acceptance of a credit card (while federal governmental entities and institutions of higher education may set maximum amounts for the acceptance of credit cards). They were also allowed to provide discounts or incentives to entice consumers to pay with an alternative payment method, such as cash, checks or debit cards. In addition, the Dodd-Frank Act created a new entity, the Financial Stability Oversight Council, and authorized it to require that a nonbank financial company that is deemed to pose a systemic risk to the U.S. financial system become subject to consolidated, prudential supervision by the Federal Reserve Board. At this point it is unclear whether we would be subject to additional systemic risk related oversight.

Association and Network Rules We are subject to rules of MasterCard, Visa, INTERAC, PULSE, and other payment networks. In order to provide processing services, a number of our subsidiaries are registered with Visa and/or MasterCard as service providers for member institutions. A number of subsidiaries outside the U.S. are direct members or associate members of Visa and MasterCard for purposes of conducting merchant acquiring. Various subsidiaries of ours are also processor level members of numerous debit and electronic benefits transaction networks or are otherwise subject to various network rules in connection with processing services and other services we provide. As such, we are subject to applicable card association, network, and national scheme rules that could subject us to fines or penalties. We are also subject to network operating rules promulgated by the National Automated Clearing House Association relating to payment transactions processed by us using the Automated Clearing House Network and to various state and federal laws regarding such operations, including laws pertaining to electronic benefits transaction.

Our subsidiary in Germany, TeleCash GmbH & Co. KG, is certified and regulated as a processor for domestic German debit card transactions by the Deutsche Kreditwirtschaft (DK), the German Banking Industry Committee. Failure to comply with the technical requirements set forth by the DK may result in suspension or termination of services.

Banking Regulations Because a number of our subsidiary businesses provide data processing services for financial institutions, we are subject to examination by the Federal Financial Institutions Examination Council (FFIEC), which examines large data processors in order to identify and mitigate risks associated with significant service providers.

FDR Limited is authorized and regulated in the United Kingdom by the Financial Conduct Authority, one of the two principal financial markets regulators in the United Kingdom. FDR Limited is authorized by the Financial Conduct Authority to arrange and advise on certain insurance contracts for the purpose of arranging insurance taken out by its issuer clients' cardholders. FDR Limited also has obtained permission from the Financial Conduct Authority in respect of certain consumer credit activities related to its issuer services and merchant terminal leasing businesses. As a firm authorized by the Financial Conduct Authority, FDR Limited is required to comply with certain prudential, conduct of business and reporting requirements.

As a result of the implementation of the Payment Services Directive (2007/64/EC) in the European Union (PSD), a number of our subsidiaries in GBS hold payment institution licenses in the European Union member states in which such subsidiaries do business. As payment institutions, we are subject to regulation and oversight in the applicable European Union member state, which includes (amongst other obligations) a requirement to maintain specified regulatory capital. The PSD was amended by a revised Payment Services Directive, known as PSD2 which was required to be transposed into national law by January 2018. Under PSD2, each subsidiary holding a payment institution license will need to submit by April 2018 a reauthorization application to the applicable regulatory authority and be approved to continue providing the licensed business activity.

First Data Trust Company, LLC (FDTC) engages in trust activities previously conducted by the trust department of a former banking subsidiary of ours and is subject to regulation, examination, and oversight by the Division of Banking of the Colorado Department of Regulatory Agencies. Since FDTC is not a “bank” under the Bank Holding Company Act of 1956, as amended (BHCA), our affiliation with FDTC does not cause us to be regulated as a bank holding company or financial holding company under the BHCA.

12

Further, several subsidiaries provide services such as factoring or settlement that make them subject to regulation by local banking agencies, including the National Bank of Slovakia, the National Bank of Poland, the Reserve Bank of Australia, and the German Federal Financial Supervision Agency.

Privacy and Information Security Regulations We provide services that may be subject to various state, federal, and foreign privacy laws and regulations, including, among others, the Gramm-Leach-Bliley Act, the Health Insurance Portability and Accountability Act, Directive 95/46/EC, the Australian Privacy Act, the Personal Information Protection and Electronic Documents Act in Canada, the Personal Data (Privacy) Ordinance in Hong Kong, the Malaysian Data Protection Act 2010, and the Singapore Data Protection Act 2012. These laws and their implementing regulations govern certain collection, processing, storage, use, and disclosure of personal information, can require notice to entities or individuals of privacy incidents, and provide individuals with certain rights relating to the use and disclosure of protected information. These laws also impose requirements for the safeguarding and proper destruction of personal information through the issuance of data security standards or guidelines. Certain federal and state laws impose similar privacy obligations and, in certain circumstances, obligations to notify affected individuals, state officers, the media, and consumer reporting agencies, as well as businesses and governmental agencies that own the information, of security breaches affecting personal information. In addition, there are state laws restricting the ability to collect and utilize certain types of information such as Social Security and driver’s license numbers. In February 2013, the European Commission proposed additional European Union-wide legislation regarding cyber security in the form of the proposed Network and Information Security Directive (NIS Directive). The NIS Directive is currently being considered by the two other main European Union legislative institutions, the Council of the European Union and the European Parliament. On June 29, 2015, the Council of the European Union announced that agreement had been reached in informal negotiations on the main principles of the NIS Directive. Similarly, the General Data Protection Regulation is slated to take effect throughout the European Union on May 25, 2018 and creates a range of new compliance obligations and increases financial penalties for non-compliance and extends the scope of the European Union data protection law to all companies processing data of European Union residents, regardless of the company’s location.

Credit Reporting and Debt Collections Regulations TeleCheck is subject to the Federal Fair Credit Reporting Act and various similar state laws based on TeleCheck’s maintenance of a database containing the check-writing histories of consumers and the use of that information in connection with its check verification and guarantee services.

The collection business within TRS Recovery Services, Inc. (TRS) is subject to the Federal Fair Debt Collection Practices Act and various similar state laws. TRS has licenses in a number of states in order to engage in collection in those states. In the United Kingdom, FDR Limited has a license under the Consumer Credit Act of 1974 (CCA) to enable it to undertake, among other things, credit administration and debt collections activities on behalf of its card issuing clients through calls and correspondence with the cardholders. FDR Limited is also licensed under the CCA to carry on the activity of a consumer hire business for the purpose of leasing point of sale devices to merchants.

TeleCheck and TRS are subject to regulation, supervision, and examination from the CFPB. Further regulations may be imposed in the future as state governments and federal agencies identify and consider supplementary consumer financial protection, including laws regulating activities with respect to current or emerging technology such as automated dialers or pre-recorded messaging or calls to cellular phones, which could impair the collection by TRS of returned checks and those purchased under TeleCheck’s guarantee services. Moreover, reducing or eliminating access to and use of information on drivers licenses, requiring blocking of access to credit reports or scores, mandating score or scoring methodology disclosure and proscribing the maintenance or use of consumer databases could reduce the effectiveness of TeleCheck’s risk management tools or otherwise increase its costs of doing business.

In addition, several of our subsidiaries are subject to comparable local laws regarding collection activities and obtaining credit reports.

Unfair Trade Practice Regulations We and our clients are subject to various federal, state, and international laws prohibiting unfair or deceptive trade practices, such as Section 5 of the Federal Trade Commission Act. Various regulatory enforcement agencies, including the Federal Trade Commission (FTC) and state attorneys general, have authority to take action against parties that engage in unfair or deceptive trade practices or violate other laws, rules, and regulations and to the extent we are processing payments for a client that may be in violation of laws, rules, and regulations, we may be subject to enforcement actions and incur losses and liabilities that may impact our business. For example, TeleCheck and TRS are subject to a consent decree with the FTC which, among other items, addresses the timeliness of certain actions that they take.

Anti-Money Laundering, Anti-Bribery, Sanctions, and Counter-Terrorist Regulations We are subject to anti-money laundering laws and regulations, including the Bank Secrecy Act, as amended by the USA PATRIOT Act of 2001 (collectively, BSA). Among other things, the BSA requires money services businesses (such as money transmitters, issuers of money orders and official checks, and providers of prepaid access) to develop and implement risk-based anti-money laundering programs, report

13

large cash transactions and suspicious activity, and to maintain transaction records. Money Network provides prepaid access for various open loop prepaid programs for which it is the program manager and therefore must meet the requirements of the Financial Crimes Enforcement Network (FinCEN), the agency that enforces the BSA. Recently FinCEN released rules requiring the collection and verification of beneficial owners holding equal to or greater than 25% equity interest. We will be required to comply with the new rules, which have a mandatory compliance date of May 2018.

We are also subject to anti-corruption laws and regulations, including the United States Foreign Corrupt Practices Act (FCPA) and other laws, that prohibit the making or offering of improper payments to foreign government officials and political figures and includes anti-bribery provisions enforced by the Department of Justice and accounting provisions enforced by the Securities and Exchange Commission (SEC). The FCPA has a broad reach and requires maintenance of appropriate records and adequate internal controls to prevent and detect possible FCPA violations. Many other jurisdictions where we conduct business also have similar anticorruption laws and regulations. We have policies, procedures, systems, and controls designed to identify and address potentially impermissible transactions under such laws and regulations.

We are also subject to certain economic and trade sanctions programs that are administered by the Treasury Department’s Office of Foreign Assets Control (OFAC), which prohibit or restrict transactions to or from or dealings with specified countries, their governments, and in certain circumstances, their nationals, and with individuals and entities that are specially-designated nationals of those countries, narcotics traffickers, and terrorists or terrorist organizations. Other group entities may be subject to additional local sanctions requirements in other relevant jurisdictions.

Similar anti-money laundering and counter terrorist financing and proceeds of crime laws apply to movements of currency and payments through electronic transactions and to dealings with persons specified in lists maintained by the country equivalents to OFAC lists in several other countries and require specific data retention obligations to be observed by intermediaries in the payment process. Our businesses in those jurisdictions are subject to those data retention obligations. In the European Union, for example, certain of our businesses are subject to requirements under the Third Money Laundering Directive (2005/60/EC) (MLD3) as implemented in relevant European Union member states. MLD3 was repealed and replaced by the Fourth Money Laundering Directive ((EU) 2015/849) (MLD4), when the latter entered into force on June 25, 2015. European Union member states were required to implement MLD4 into national law by June 26, 2017.

Money Transmission and Payment Instrument Licensing and Regulations We are subject to various U.S. federal, state, and foreign laws and regulations governing money transmission and the issuance and sale of payment instruments, including some of our prepaid products.

In the United States, most states license money transmitters and issuers of payment instruments. Many states exercise authority over the operations of our services related to money transmission and payment instruments and, as part of this authority, subject us to periodic examinations. Many states require, among other things, that proceeds from money transmission activity and payment instrument sales be invested in high-quality marketable securities before the settlement of the transactions. Such licensing laws also may cover matters such as regulatory approval of consumer forms, consumer disclosures and the filing of periodic reports by the licensee, and require the licensee to demonstrate and maintain levels of net worth. Many states also require money transmitters, issuers of payment instruments, and their agents to comply with federal and/or state anti-money laundering laws and regulations.

Escheatment Regulations We are subject to unclaimed or abandoned property (escheat) laws both in the United States and abroad that require us to turn over to certain government authorities the property of others held by us that has been unclaimed for a specified period of time such as, in the Integrated Payment Systems (IPS) business, payment instruments that have not been presented for payment or, in GBS, account balances that cannot be returned to a merchant following discontinuation of its relationship with us. A number of our subsidiaries hold property subject to escheat laws and we have an ongoing program to comply with those laws. We are subject to audit by individual U.S. states with regard to our escheatment practices.

Telephone Consumer Protection Act We are subject to the Federal Telephone Consumer Protection Act and various state laws to the extent we place telephone calls and short message service (SMS) messages to clients and consumers. The Telephone Consumer Protection Act regulates certain telephone calls and SMS messages placed using automatic telephone dialing systems or artificial or prerecorded voices. A number of our international subsidiaries are subject to equivalent laws in their jurisdictions.

Indirect Regulatory Requirements A number of our clients are financial institutions that are directly subject to various regulations and compliance obligations issued by the CFPB, the Office of the Comptroller of the Currency and other agencies responsible for regulating financial institutions. While these regulatory requirements and compliance obligations do not apply directly to us, many of these requirements materially affect the services we provide to our clients and us overall. To remain competitive, we expend significant resources to assist our clients in meeting their various compliance obligations, including the cost of updating our systems and services as necessary to allow our clients to comply with applicable laws and regulations, and the cost of dedicating sufficient

14

resources to assist our clients in meeting their new and enhanced oversight and audit requirements established by the CFPB, the Office of the Comptroller of the Currency and others. The banking agencies, including the Office of the Comptroller of the Currency, also have imposed requirements on regulated financial institutions to manage their third-party service providers. Among other things, these requirements include performing appropriate due diligence when selecting third-party service providers; evaluating the risk management, information security, and information management systems of third-party service providers; imposing contractual protections in agreements with third-party service providers (such as performance measures, audit and remediation rights, indemnification, compliance requirements, confidentiality and information security obligations, insurance requirements, and limits on liability); and conducting ongoing monitoring of the performance of third-party service providers. Accommodating these requirements applicable to our clients imposes additional costs and risks in connection with our financial institution relationships. We expect to expend significant resources on an ongoing basis in an effort to assist our clients in meeting their legal requirements.

Other Stored-value services we offer to issuers in the United States and internationally are subject to various federal, state, and foreign laws and regulations, which may include laws and regulations related to consumer and data protection, licensing, escheat, anti-money laundering, banking, trade practices and competition, and wage and employment. These laws and regulations are evolving, unclear, and sometimes inconsistent and subject to judicial and regulatory challenge and interpretation, and therefore the extent to which these laws and rules have application to, and their impact on, us, financial institutions, merchants or others is in flux. At this time we are unable to determine the impact that the clarification of these laws and their future interpretations, as well as new laws, may have on us, financial institutions, merchants or others in a number of jurisdictions. These services may also be subject to the rules and regulations of the various international, domestic and regional schemes, networks, and associations in which we and the card issuers participate.

In addition, the Housing Assistance Tax Act of 2008 included an amendment to the Internal Revenue Code that requires information returns to be made for each calendar year by merchant acquiring entities and third-party settlement organizations with respect to payments made in settlement of payment card transactions and third-party payment network transactions occurring in that calendar year. Reportable transactions are also subject to backup withholding requirements. We could be liable for penalties if we are not in compliance with these rules.

In December 2017, the United States enacted the Tax Cuts and Jobs Act of 2017. The new tax laws decrease the maximum corporate tax rate from 35% to 21% and more favorable tax treatment of earnings outside the U.S. that are repatriated to the U.S. The tax law also limits the amount of interest that may be deducted to determine taxable income to 30% of EBITDA until 2022 and 30% of EBIT after 2022. We expect the net result of the new tax law to be favorable as the benefit we receive from the reduction in the corporate tax rate is greater than the negative impact of the interest deductibility limit. We also expect that over time the amount of interest that is not deductible will decrease due to our efforts to reduce debt as well as increases in EBITDA and EBIT.

15