Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Tempest Therapeutics, Inc. | ovas-20180630xex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Tempest Therapeutics, Inc. | ovas-20180630xex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Tempest Therapeutics, Inc. | ovas-20180630xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Tempest Therapeutics, Inc. | ovas-20180630xex311.htm |

| EX-10.4 - EXHIBIT 10.4 - Tempest Therapeutics, Inc. | jgretentionamendment.htm |

| EX-10.3 - EXHIBIT 10.3 - Tempest Therapeutics, Inc. | jgretentionagreement.htm |

| EX-10.1 - EXHIBIT 10.1 - Tempest Therapeutics, Inc. | ckretentionagreement.htm |

| 10-Q - 10-Q - Tempest Therapeutics, Inc. | ovas-20180630x10q.htm |

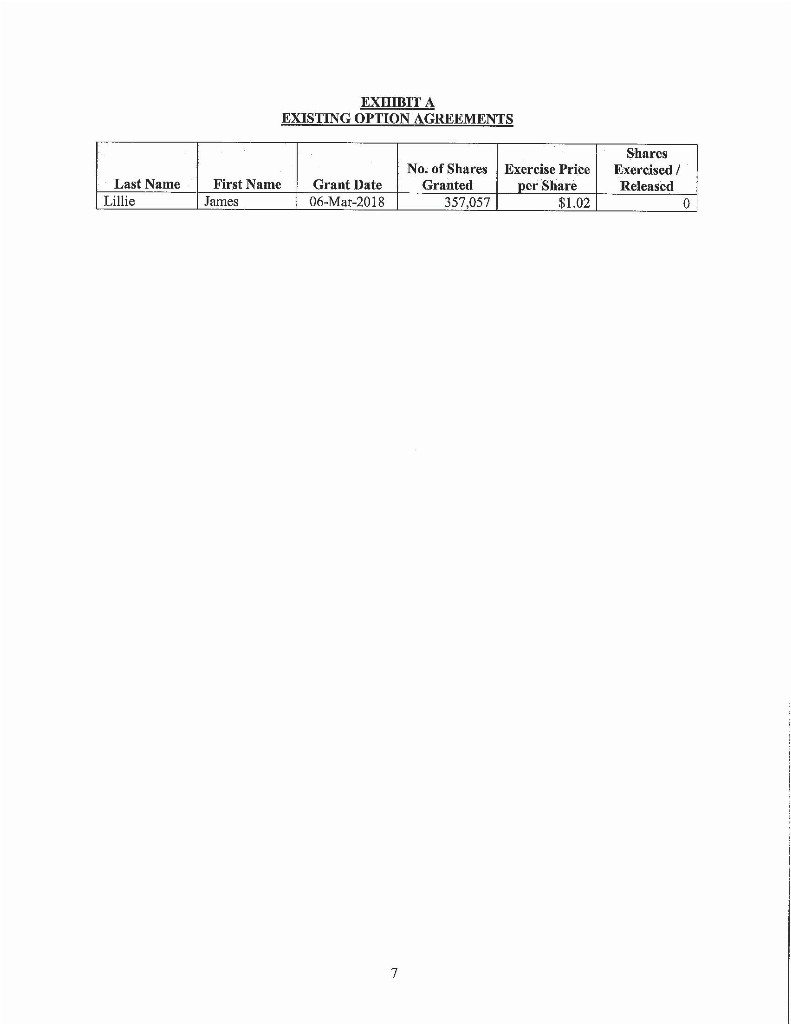

RETENTION AGREEMENT This Retention Agreement (this “Agreement”), between Dr. James Lillie (“Executive”) and OvaScience, Inc. (the “Company”), is entered into as of May 3, 2018 (the “Effective Date”). WHEREAS, the Company is entering into this Agreement with the Executive in order to further the economic interests of the Company and its shareholders and recognize the continued importance of the Executive to the Company’s long-term strategy. NOW THEREFORE, in consideration of the promises and the mutual agreements contained herein, the Company and the Executive hereby agree as follows: 1. Change in Control Bonus. In the event of a Change in Control with a Change in Control Date that occurs prior to the eighteen (18) month anniversary of the Effective Date, Executive shall be eligible to receive a payment equal to 0.40% of the Transaction Value (the “Change in Control Bonus”); provided, that (x) Executive is employed by the Company on the six (6) month anniversary of the Change in Control Date or (y) Executive is terminated in a Qualified Termination. The Change in Control Bonus will be paid to the Executive immediately following the earlier of: (i) the six (6) month anniversary of the Change in Control Date; or (ii) the Qualified Termination Date. 2. Enhanced Severance. In the event of a Qualified Termination, in addition to the benefits under Section 7 of the Employment Agreement, Executive shall be entitled to receive an amount equal to Executive’s full annual discretionary bonus opportunity, which is forty percent (40%) of Executive’s then current base salary (the “Enhanced Severance”), payable in accordance with Section 7 of the Employment Agreement and subject to the requirements of Section 7 of the Employment Agreement. 3. New Option Grant. Five business days following the Effective Date, the Company will grant to Executive a non-qualified stock option (the “New Option”) for the purchase of an aggregate of 125,000 shares of common stock of the Company, at a price per share equal to the closing sale price of the common stock on the Nasdaq Global Market on the date of grant. The New Option will vest in full on a Change in Control Date that occurs prior to the eighteen (18) month anniversary of the Effective Date; provided, however, that if the Change in Control Date does not occur prior to the eighteen (18) month anniversary of the Effective Date, then the New Option shall be forfeited in its entirety. To the extent vested, the New Option shall remain exercisable following Executive’s termination of employment (other than a termination for Cause) until the earlier of (a) the one (1) year anniversary of the Termination Date and (b) the ten (10) year anniversary of the date of grant. The New Option shall be subject to all other terms and provisions set forth in a separate option agreement to be provided by the Company under the Company’s 2012 Stock Incentive Plan. 4. Existing Option Grants. Notwithstanding anything in the stock option agreements described in Exhibit A (the “Existing Option Agreements”) to the contrary, with respect to all outstanding options under the Existing Option Agreements (the “Extended Options”), in the event of Executive’s termination of employment (other than a termination for Cause) within twelve (12) months following a Change in Control, the Extended Options that are vested and exercisable as of Executive’s Termination Date, to the extent not previously exercised, shall remain exercisable until the earlier of: (a) the one (1) year anniversary of the Termination Date; or (b) the Final Exercise Date (as defined in the applicable Existing Option Agreement). Executive acknowledges that the Existing Option Agreements represent the complete list of all of Executive’s outstanding options. 5. Definitions. For the purposes of this Agreement, the following capitalized terms shall have the following meanings:

“Affiliate” means with respect to any Person, any other Person that, directly or indirectly through one or more intermediaries controls, is controlled by, or is under common control with, such Person and/or one or more Affiliates thereof. As used in this definition, the term “control,” including the correlative terms “controlling,” “controlled by” and “under common control with,” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies (whether through the ownership of securities or any partnership or other ownership interests, by contract or otherwise) of a Person. “Cause” shall have the meaning set forth in the Employment Agreement. “Change in Control” shall be deemed to exist upon the sale of all or substantially all of the outstanding shares of capital stock, assets or business of the Company, by merger, consolidation, sale of assets or otherwise (other than a transaction in which all or substantially all of the individuals and entities who were beneficial owners of the capital stock of the Company immediately prior to such transaction beneficially own, directly or indirectly, more than 50% of the outstanding securities (on an as-converted to Common Stock basis) entitled to vote generally in the election of directors of the (a) resulting, surviving or acquiring corporation in such transaction in the case of a merger, consolidation or sale of outstanding shares, or (b) acquiring corporation in the case of a sale of assets); provided that, in each of the foregoing cases, the Change in Control also meets all of the requirements of a “change in the ownership of a corporation” within the meaning of Treasury Regulation §1.409A-3(i)(5)(v) or “a change in the ownership of a substantial portion of the corporation’s assets” within the meaning of Treasury Regulation §1.409A-3(i)(5)(vii). “Change in Control Date” means the effective date of a Change in Control. “Employment Agreement” means the Employment Agreement between the Company and Executive, dated December 21, 2017. “Good Reason” shall have the meaning set forth in the Employment Agreement. “Person” has the meaning as set forth in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended. “Transaction Value” means the product of: (a) the number of shares of the Company outstanding immediately prior to the Change in Control; and (b) the closing price of the Company’s common stock, as reported on the principal stock exchange on which the common stock is traded, on the Change in Control Date; provided, however, that the number of outstanding shares and the closing price shall be appropriately adjusted as necessary to reflect any stock split, reverse stock split or other structural reorganization; and provided, further, that in the event that the Change in Control is not in the form of a reverse merger, then the Transaction Value shall be determined by the Company’s Board of Directors prior to the Change in Control. “Qualified Termination” means a termination of Executive’s employment by the Company without Cause or by Executive for Good Reason within one (1) year following the Change in Control Date. “Subsidiary” means any corporation at least 50% of whose outstanding voting shares shall at the time be owned directly or indirectly by the Company. “Termination Date” means the effective date of Executive’s termination of employment from the Company. 2

6. Section 409A; Section 280G. (a) Section 409A. In the event that any payments under this Agreement constitute “non-qualified deferred compensation” subject to Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), then the following conditions apply to such payment: (i) Any termination of Executive’s employment triggering payments must constitute a “separation from service” under Section 409A(a)(2)(A)(i) of the Code and Treas. Reg. §1.409A-1(h) before distribution of such benefit can commence. To the extent that the termination of Executive’s employment does not constitute a separation of service, any such payment that constitutes deferred compensation under Section 409A of the Code shall be delayed until after the date of a subsequent event constituting a separation of service. (ii) Notwithstanding any other provision with respect to the timing of the payment under Section 2 if, at the time of Executive’s termination, Executive is deemed to be a “specified employee” of Company (within the meaning of Section 409A(a)(2)(B)(i) of the Code), then limited only to the extent necessary to comply with the requirements of Section 409A of the Code, any payments to which Executive may become entitled under Section 2 which are subject to Section 409A of the Code (and not otherwise exempt from its application) shall be withheld until the first (1st) business day of the seventh (7th) month following the Termination Date, at which time Executive shall be paid an aggregate amount equal to the accumulated, but unpaid, payments otherwise due to Executive under the terms of Section 2. (b) Acknowledgements. Notwithstanding any other provision of this Agreement to the contrary, this Agreement shall be interpreted and at all times administered in a manner that avoids the inclusion of compensation in income under Section 409A of the Code, or the payment of increased taxes, excise taxes or other penalties under Section 409A of the Code. The parties intend this Agreement to be in compliance with Section 409A of the Code. Executive acknowledges and agrees that the Company does not guarantee the tax treatment or tax consequences associated with any payment or benefit arising under this Agreement, including but not limited to consequences related to Section 409A of the Code. (c) Section 280G. (i) To the extent that any payment, benefit or distribution of any type to or for the benefit of the Executive by the Company or any of its affiliates, whether paid or payable, provided or to be provided, or distributed or distributable pursuant to the terms of this Agreement or otherwise (including, without limitation, any accelerated vesting of stock options or other equity- based awards) (collectively, the “Total Payments”) would be subject to the excise tax imposed under Section 4999 of the Code, then the Total Payments shall be reduced (but not below zero) so that the maximum amount of the Total Payments (after reduction) shall be one dollar ($1.00) less than the amount which would cause the Total Payments to be subject to the excise tax imposed by Section 4999 of the Code, but only if the Total Payments so reduced result in the Executive receiving a net after tax amount that exceeds the net after tax amount the Executive would receive if the Total Payments were not reduced and were instead subject to the excise tax imposed on excess parachute payments by Section 4999 of the Code. Unless the Executive shall have given prior written notice to the Company to effectuate a reduction in the Total Payments if such a reduction is required, any such notice consistent with the requirements of Section 409A of the Code to avoid the imputation of any tax, penalty or interest thereunder, the Company shall reduce or eliminate the Total Payments by first reducing or eliminating any cash severance benefits (with the payments to be made furthest in the future being reduced first), then by reducing or eliminating any accelerated vesting of stock options or similar awards, then by reducing or eliminating any accelerated vesting 3

of restricted stock or similar awards, then by reducing or eliminating any other remaining Total Payments. The preceding provisions of this Section 6(c) shall take precedence over the provisions of any other plan, arrangement or agreement governing the Executive’s rights and entitlements to any benefits or compensation. (ii) If the Total Payments to the Executive are reduced in accordance with Section 6(c), as a result of the uncertainty in the application of Section 4999 of the Code at the time of the initial reduction under Section 6(c), it is possible that Total Payments to the Executive which will not have been made by the Company should have been made (“Underpayment”) or that Total Payments to the Executive which were made should not have been made (“Overpayment”). If an Underpayment has occurred, the amount of any such Underpayment shall be promptly paid by the Company to or for the benefit of the Executive. In the event of an Overpayment, then the Executive shall promptly repay to the Company the amount of any such Overpayment together with interest on such amount (at the same rate as is applied to determine the present value of payments under Section 280G of the Code or any successor thereto), from the date the reimbursable payment was received by the Executive to the date the same is repaid to the Company. 7. Miscellaneous. (a) Entire Agreement. This Agreement and the other agreements referenced herein, including the Existing Option Agreements and Employment Agreement, constitute the complete understanding of the parties as to the subject matter hereof, superseding all prior understandings and agreements related hereto. No modification or amendment of the terms and conditions of this Agreement shall be effective unless in writing and signed by the parties or their respective duly authorized agents. (b) Successors and Assigns. This Agreement may be assigned by the Company upon a sale, transfer or reorganization of the Company. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their successors, permitted assigns, legal representatives and heirs. (c) No Right to Continued Employment. Nothing contained in this Agreement shall give the Executive the right to be retained in the employment of the Company or any Subsidiary, or affect the right of the Company or Subsidiary (as applicable) to terminate Executive’s employment. Unless the Executive and the Company or its Subsidiary have entered into a written agreement to the contrary, Executive is employed by the Company, or the Subsidiary (as applicable) at will, meaning either Company or the Subsidiary on the one hand and the Executive on the other hand may terminate the Executive’s employment for any reason and without notice. (d) No Alienation. No award, expectancy, benefit, payment, claim, or right of under this Agreement shall be: (a) subject in any manner to any claims of any creditor of the Executive; (b) subject to the debts, contracts, liabilities or torts of the Executive; or (c) subject to alienation by anticipation, sale, transfer, assignment, bankruptcy, pledge, attachment, charge or encumbrance of any kind. If any Person shall attempt to take any action contrary to this Section, such action shall be null and void and of no effect, and the Board and the Company shall disregard such action and shall not in any manner be bound thereby and shall suffer no liability on account of its disregard thereof. If the Executive shall become bankrupt or attempt to anticipate, alienate, sell, assign, pledge, encumber, or charge any right hereunder, then such right or benefit shall, in the discretion of the Board, cease and terminate, and in such event the Board may hold or apply the same or any part thereof for the benefit of the Executive in such manner and in such amounts and proportions as the Board may deem proper. (e) General Creditors. The Executive has no legal or equitable rights, claims, or interest in any specific property or assets of the Company or any of its Affiliates in connection with the 4

benefits otherwise payable under this Agreement. No assets of the Company or any of its Affiliates shall be held under any trust, or held in any way as collateral security, for the fulfilling of the obligations of the Company under this Agreement. Any and all of the Company’s and its Affiliates’ assets shall be, and remain, the general unpledged, unrestricted assets of the Company or the Affiliate, as applicable. The Company’s payment obligations under this Agreement are merely an unfunded and unsecured promise to pay benefits in the future to Executive (as determined in accordance with the terms of the Agreement), and the rights of Executive shall be no greater than those of the Company’s unsecured general creditors. (f) Withholding. The Company shall withhold or cause to be withheld, any and all federal, state and local income and payroll taxes required by law to be withheld from any payment made under this Agreement. Notwithstanding the foregoing, the Executive shall be responsible for all income, payroll and other taxes associated with the payments and benefits provided hereunder. (g) Non-ERISA Plan. This Agreement is a bonus plan and not an “employee benefit plan” within the meaning of that term as defined in Section 3(3) of the federal Employee Retirement Income Security Act of 1974, as amended. (h) Governing Law. The validity, performance and construction of this Agreement shall be governed by the laws of the Commonwealth of Massachusetts, without regard to any state’s conflict of laws principles. [Signature Page to Follow] 5