Attached files

| file | filename |

|---|---|

| 8-K - 8-K FOR Q2 EARNINGS AND ACQ - Infrastructure & Energy Alternatives, Inc. | a8-k2ndquartererjune2018.htm |

| EX-99.1 - PRESS RELEASE FOR Q2 EARNINGS - Infrastructure & Energy Alternatives, Inc. | earningsrelease2ndqtr2018.htm |

Second Quarter 2018 Results and Strategic Acquisition of SAIIA and The ACC Companies AUGUST 9, 2018

DISCLAIMER • This presentation includes “forward looking statements” (within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995), including but not limited to those regarding the proposed acquisition by Infrastructure and Energy Alternatives, Inc. (the “Company” or “IEA”) of Consolidated Construction Solutions I LLC and Subsidiaries dba Saiia Construction (“Saiia”) and The ACC Companies (together “ACC”)(the “Acquisition”) and the transactions related thereto. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include projected financial information. Such forward looking statements with respect to projections, revenues, earnings, performance, strategies, prospects and other aspects of the businesses of the Company are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the ability of the parties to consummate the Acquisition in a timely manner or at all; (2) satisfaction of the conditions precedent to consummation of the Acquisition, including the ability to secure required consents and regulatory approvals in a timely manner or at all; (3) the reduction in value of production tax credits and investment tax credits due to the enactment of the Tax Cuts and Jobs Act in December 2017; (4) the adverse effect on our business and financial condition if we fail to comply with the regulations of The Occupational Safety and Health Act of 1970, as amended, and other state and local agencies that oversee transportation and safety compliance; (5) substantial liabilities that could result from physical hazards; (6) the inability to operate efficiently if we are unable to attract and retain qualified managers and skilled employees; (7) an inability to realize financial and strategic goals from acquisition and investment activity; (8) significant changes in tax and other economic incentives and political and governmental policies which could materially and adversely affect the U.S. wind and solar industries; and (9) other risks and uncertainties indicated in the Company’s Securities and Exchange Commission (the “SEC”) filings. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. • This presentation includes information based on independent industry publications and other sources. You should not construe the contents of this presentation as legal, accounting, business or tax advice and you should consult your own professional advisors as to the legal, accounting, business, tax, financial or other matters contained herein. • The estimates, forecasts and projections contained herein involve significant elements of subjective judgment and analysis and reflect numerous judgments, estimates and assumptions that are inherently uncertain in prospective financial information of any kind. As such, no representation can be made as to the attainability of such estimates, forecasts and projections. Investors are cautioned that such estimates, forecasts or projections have not been audited and have not been prepared in conformance with generally accepted accounting principles. For a listing of risks and other factors that could impact the combined company’s ability to attain its projected results, please refer to the “forward looking statements” above and the “Risk Factors” section of the Proxy Statement. • This presentation includes projections that are forward-looking and based on growth assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond IEA’s control. While all projections are necessarily speculative, IEA believes that projections relating to periods beyond 12 months from their date of preparation carry increasingly higher levels of uncertainty and should be read in that context. There will be differences between actual and projected results, and actual results may be materially greater or materially less than those contained in the projections. • This presentation includes non-GAAP financial measures. Definitions of these non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included elsewhere in this presentation. IEA believes that these non-GAAP financial measures provide useful information to management and investors regarding certain financial and business trends relating to IEA’s financial condition and results of operations. A more fulsome description of the nature of the adjustments from GAAP is provided elsewhere in this presentation. These non-GAAP financial measures may exclude items that are significant in understanding and assessing financial results. Therefore, these financial measures should not be considered in isolation or as an alternative to net income or other measures of profitability or performance under GAAP. Because these non-GAAP financial measures are not in conformity with GAAP, we urge you to review IEA’s audited financial statements, which have been filed with the SEC. For a full description of the risks and uncertainties which could cause actual results to differ from our forward-looking statements, please refer to IEA’s periodic filings with the Securities & Exchange Commission including those described as “Risk Factors” in IEA’s Proxy Statement on Schedule 14A filed on February 9, 2018 2

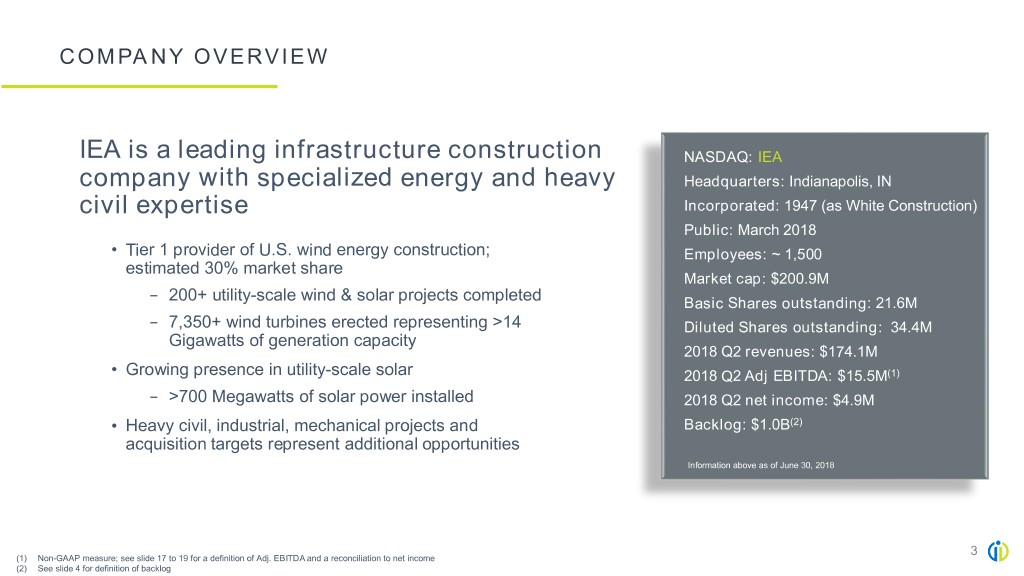

COMPANY OVERVIEW IEA is a leading infrastructure construction NASDAQ:As of 6/30/18IEA company with specialized energy and heavy Headquarters:NASDAQ: IEA Indianapolis, IN civil expertise Incorporated:Headquarters:1947Indianapolis, (as White IN Construction) Public:Incorporated:March 20181947 (as White Construction) • Tier 1 provider of U.S. wind energy construction; Employees:Public: March~ 1,5002018 estimated 30% market share ~ 1,500 MarketEmployees: cap: $200.9M − 200+ utility-scale wind & solar projects completed $200.9M BasicMarket Shares cap: outstanding: 21.6M Basic Shares outstanding: 21.6M − 7,350+ wind turbines erected representing >14 Diluted Shares outstanding: 34.4M Gigawatts of generation capacity Diluted Shares outstanding: 34.4M 2018 Q2 revenues: $174.1M 2018 Q2 revenues: $174.1M • Growing presence in utility-scale solar 2018 Q2 Adj EBITDA: $15.5M(1) 2018 Q2 Adj EBITDA: $15.5M(1) − >700 Megawatts of solar power installed 2018 Q2 net income: $4.9M 2018 Q2 net income: $4.9M • Heavy civil, industrial, mechanical projects and Backlog: $1.0B(2) acquisition targets represent additional opportunities Backlog: $1.0B(2) Information above as of June 30, 2018 3 (1) Non-GAAP measure; see slide 17 to 19 for a definition of Adj. EBITDA and a reconciliation to net income (2) See slide 4 for definition of backlog

INVESTMENT THESIS (1) • Publicly traded renewable energy engineering, procurement and construction (EPC) company accelerating growth through acquisition • Leading share of wind market with strong project controls, quality assurance, engineering management and self-perform capabilities • High barriers to entry in core wind business resulting from specialized capabilities • Renewables power generation is projected to grow ~139% by 2050(2) • Strong relationships with established, recurring base of blue-chip, investment grade customers and OEMs • Total backlog(3) of approximately $1.0 billion as of 6/30/18 • Opportunity to capture incremental annual EBITDA through self-performance of previously subcontracted high voltage electrical work • Strong adjusted free cash flow(4) supports investment in organic growth and M&A • Proven management team with extensive industry knowledge, and #1 safety record versus other Tier I renewable EPCs(5) (1) Investment thesis excludes acquisition of SAIIA and The ACC Companies (2) Source: U.S. Energy Information Administration (January 2018). (3) Backlog means the amount of revenue expected to be realized from the uncompleted portions of existing awards and contracts, including any contracts under which work has not begun and any awarded contracts for which the definitive project documentation is being prepared, as well as expected revenue from change orders and renewal options. Backlog data as of June 30, 2018. 4 (4) Adjusted free cash flow is defined as Adj. EBITDA less capital expenditures and capital lease payments, interest and taxes (5) Based on 2017 Experience Modification Rate (“EMR”) and Total Recordable Incident Rate (“TRIR”) which are released by the US Department of Labor.

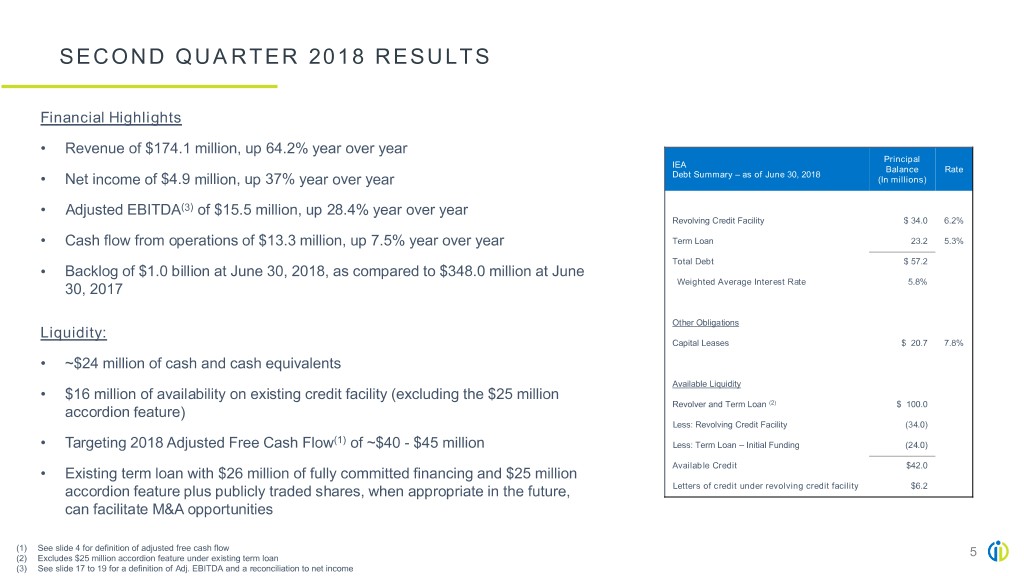

SECOND QUARTER 2018 RESULTS Financial Highlights • Revenue of $174.1 million, up 64.2% year over year Principal IEA Balance Rate Debt Summary – as of June 30, 2018 • Net income of $4.9 million, up 37% year over year (In millions) • Adjusted EBITDA(3) of $15.5 million, up 28.4% year over year Revolving Credit Facility $ 34.0 6.2% • Cash flow from operations of $13.3 million, up 7.5% year over year Term Loan 23.2 5.3% Total Debt $ 57.2 • Backlog of $1.0 billion at June 30, 2018, as compared to $348.0 million at June Weighted Average Interest Rate 5.8% 30, 2017 Other Obligations Liquidity: Capital Leases $ 20.7 7.8% • ~$24 million of cash and cash equivalents Available Liquidity • $16 million of availability on existing credit facility (excluding the $25 million Revolver and Term Loan (2) $ 100.0 accordion feature) Less: Revolving Credit Facility (34.0) (1) • Targeting 2018 Adjusted Free Cash Flow of ~$40 - $45 million Less: Term Loan – Initial Funding (24.0) Available Credit $42.0 • Existing term loan with $26 million of fully committed financing and $25 million accordion feature plus publicly traded shares, when appropriate in the future, Letters of credit under revolving credit facility $6.2 can facilitate M&A opportunities (1) See slide 4 for definition of adjusted free cash flow (2) Excludes $25 million accordion feature under existing term loan 5 (3) See slide 17 to 19 for a definition of Adj. EBITDA and a reconciliation to net income

MULTIPLE LEVERS TO DRIVE IEA GROWTH Multiple Growth Opportunities For IEA Beyond Executing ~$1.0 Billion Current Backlog Projects External Growth Organic Growth Robust platform for M&A growth Opportunities to grow presence across attractive markets with long-term growth potential Mergers & Acquisitions Grow Foothold in Civil, Build Solar Presence Industrial & Power Expand Self-Perform Capabilities • Active pursuit list of highly • Leverage 60+ years of experience strategic and actionable across petrochemical, targets • Large addressable market with pharmaceutical and other heavy • Increase medium and high voltage secular growth drivers through at industrial facilities • Potential to increase project least 2050 (1) electrical self-perform capabilities • Positive tailwinds exist for traditional diversification through work • Potential for over 300 bps Adjusted • Cross-selling opportunity with U.S. civil and industrial markets with conventional power, (2) existing wind customer base EBITDA margin increase over the ‒ The Fast Act and IDOT and downstream oil and gas- medium-term • Ability to capture incremental share INDOT budgets provide for related and other industrial • Initial self-perform projects have of the expanding utility-scale solar billions of dollars of funding for customers construction market civil/infrastructure projects commenced in 2018 • Accelerate share of currently ‒ $10 million incremental EBITDA • Solar PV installed capacity expected • IEA maintains a distinctive resume outsourced high voltage (2) and excellent reputation across projected for 2019 to grow at a ~10% CAGR from 2017 scope, including T-line – 2020(1) these diverse markets interconnect (1) Source: U.S. Energy Information Administration (January 2018). 6 (2) IEA management estimates, based upon industry and customer data available to IEA management. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenue.

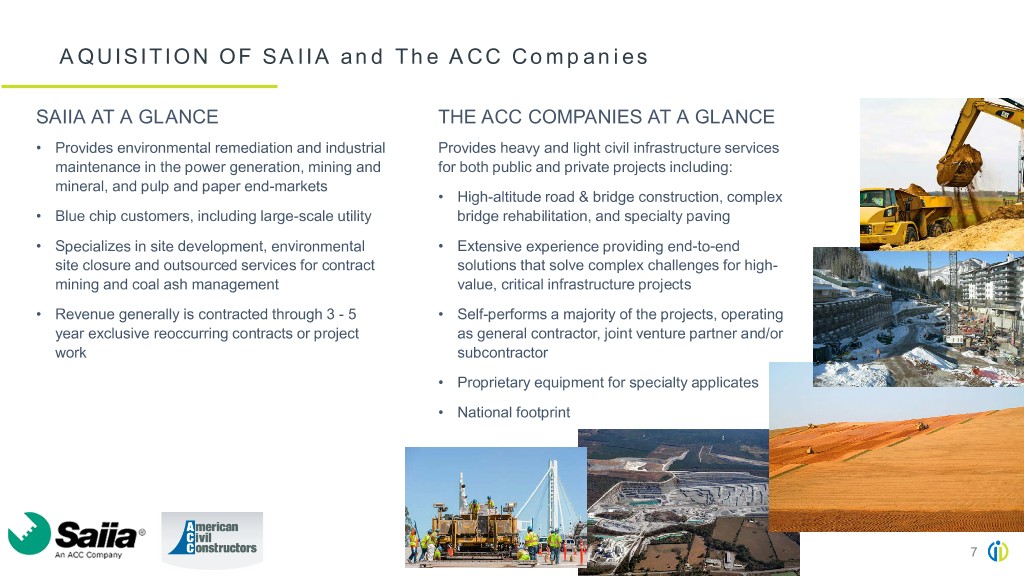

AQUISITION OF SAIIA and The ACC Companies SAIIA AT A GLANCE THE ACC COMPANIES AT A GLANCE • Provides environmental remediation and industrial Provides heavy and light civil infrastructure services maintenance in the power generation, mining and for both public and private projects including: mineral, and pulp and paper end-markets • High-altitude road & bridge construction, complex • Blue chip customers, including large-scale utility bridge rehabilitation, and specialty paving • Specializes in site development, environmental • Extensive experience providing end-to-end site closure and outsourced services for contract solutions that solve complex challenges for high- mining and coal ash management value, critical infrastructure projects • Revenue generally is contracted through 3 - 5 • Self-performs a majority of the projects, operating year exclusive reoccurring contracts or project as general contractor, joint venture partner and/or work subcontractor • Proprietary equipment for specialty applicates • National footprint 7

STRATEGIC RATIONALE OF ACQUISITION Expansion of Heavy and Light • Facilitates capture of greater portion of heavy and light civil infrastructure market Civil Infrastructure • Provides entry into the environmental remediation market, which is a natural extension for IEA services with existing utility customers 01 Entry into Environmental • Facilitates capture of a greater portion of energy industry spend and offers cross-selling Remediation Market opportunities • Opportunity to expand The ACC Companies’ services to IEA customers and vice versa 02 • Opportunities to further leverage existing equipment fleet Expansion of site development, closures, maintenance, and • Saiia and ACC have well respected, proven, successful and experienced management teams other outsourced services • Strong cultural fit with IEA (entrepreneurial, safety-focused, preferred employer, dedication to quality and customer service) 03 Enhanced financial support to • Strong financial profile complements IEA take advantage of new industrial and environmental • Saiia generally works under 3-5 year contracts, which provide predictable results opportunities • Saiia & The ACC Companies expected to provide accretive margin 04 Expansion of geographic • Further expands IEA footprint into the less-seasonal Southeast, West & Southwest US markets footprint 05 8

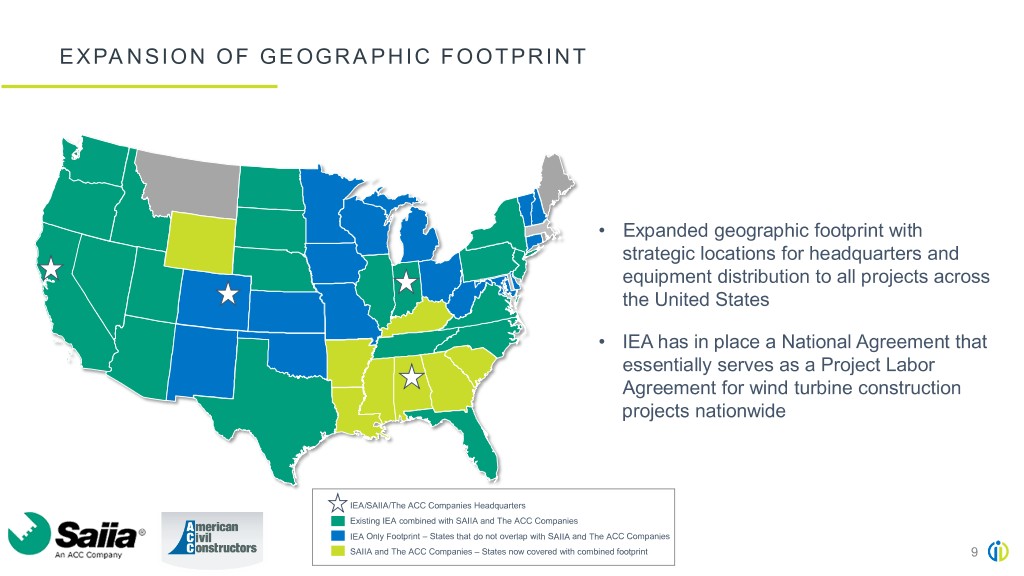

EXPANSION OF GEOGRAPHIC FOOTPRINT • Expanded geographic footprint with strategic locations for headquarters and equipment distribution to all projects across the United States • IEA has in place a National Agreement that essentially serves as a Project Labor Agreement for wind turbine construction projects nationwide IEA/SAIIA/The ACC Companies Headquarters Existing IEA combined with SAIIA and The ACC Companies IEA Only Footprint – States that do not overlap with SAIIA and The ACC Companies SAIIA and The ACC Companies – States now covered with combined footprint 9

TRANSACTION OVERVIEW • Cash transaction with approx. purchase price of $145 million, which equates to a 4.3x multiple of the projected midpoint of Adjusted EBITDA for 2018 (see slide 14) • Funded through a fully committed line of credit and term loan facility • Use of proceeds for new facilities include repayment of existing IEA indebtedness, purchase price of Saiia and ACC, and additional delayed draw funding capacity for future acquisitions. • Unanimously approved by both companies’ Boards of Directors • IEA Board and corporate management remain unchanged • Existing leadership teams at Saiia and ACC to continue in their existing roles • Expected to close in late Q3 2018 subject to certain closing conditions 10

TRANSACTION DELIVERS SIGNIFICANT FINANCIAL BENEFITS Annually, Saiia and The ACC Companies Within 18 months after closing IEA expects: businesses are expected to contribute • Additional annual cost savings of $5M approximately: through: • $285M - $300M of revenue • Benefits of equipment ownership compared to equipment leasing and • $32M - $36M in Adjusted EBITDA rentals • 11.2% - 12.0% Adjusted EBITDA Margin • Integrated insurance programs • Integration of financial and IT systems Addition of ~$265M to backlog(1) • Potential additional growth and cash generation through: • Monetization of real estate assets, and • Access to bonding capacity and credit support required for growth 11 (1) Estimate based on outstanding backlog as of June 30, 2018

2018 FINANCIAL GUIDANCE IEA Guidance without IEA Guidance with IEA Combined with SAIIA and The ACC SAIIA and The ACC Full Year SAIIA and Companies Companies(2) The ACC Companies $685 to $730 million Revenues $740 to $795 million $970 to $1,030 million (previously $775 to $835 million) $64 to $70 million Adjusted EBITDA (1) $69 to $77 million $96 to $106 million (previously $75 to $85 million) $40 to $45 million Adjusted Free Cash Flow (1) (previously $50 to $60 million) The 2018 financial guidance was updated due to the following: • Delay of commencement of two of our awarded wind projects from late year 2018 construction start to early 2019 construction start. • Revenue and Adjusted EBITDA were impacted by a previously disclosed one-time customer settlement • Reduction in gross margins caused by higher construction costs and compressed construction schedules (1) See slide 4 for definition of adjusted free cash flow and slide 17 to 19 for definition of adjusted EBITDA. 12 (2) Assumes acquisition of SAIIA and The ACC Companies closes late Q3 2018.

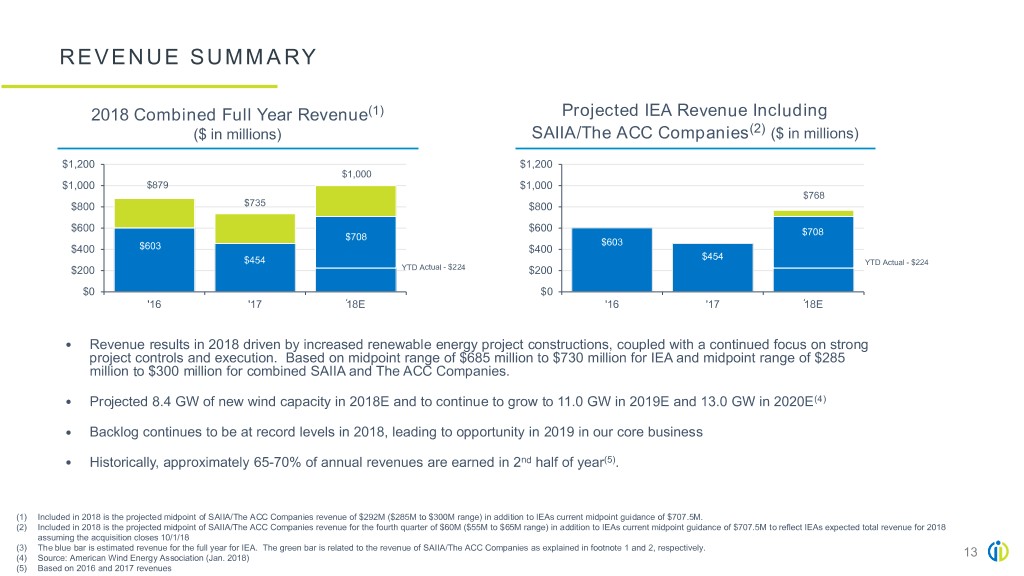

REVENUE SUMMARY 2018 Combined Full Year Revenue(1) Projected IEA Revenue Including ($ in millions) SAIIA/The ACC Companies(2) ($ in millions) $1,200 $1,200 $1,000 $1,000 $879 $1,000 $768 $800 $735 $800 $600 $600 $708 $708 $603 $400 $603 $400 $454 $454 YTD Actual - $224 $200 YTD Actual - $224 $200 $0 $0 '16 '17 ‘18E '16 '17 ‘18E • Revenue results in 2018 driven by increased renewable energy project constructions, coupled with a continued focus on strong project controls and execution. Based on midpoint range of $685 million to $730 million for IEA and midpoint range of $285 million to $300 million for combined SAIIA and The ACC Companies. • Projected 8.4 GW of new wind capacity in 2018E and to continue to grow to 11.0 GW in 2019E and 13.0 GW in 2020E(4) • Backlog continues to be at record levels in 2018, leading to opportunity in 2019 in our core business • Historically, approximately 65-70% of annual revenues are earned in 2nd half of year(5). (1) Included in 2018 is the projected midpoint of SAIIA/The ACC Companies revenue of $292M ($285M to $300M range) in addition to IEAs current midpoint guidance of $707.5M. (2) Included in 2018 is the projected midpoint of SAIIA/The ACC Companies revenue for the fourth quarter of $60M ($55M to $65M range) in addition to IEAs current midpoint guidance of $707.5M to reflect IEAs expected total revenue for 2018 assuming the acquisition closes 10/1/18 (3) The blue bar is estimated revenue for the full year for IEA. The green bar is related to the revenue of SAIIA/The ACC Companies as explained in footnote 1 and 2, respectively. (4) Source: American Wind Energy Association (Jan. 2018) 13 (5) Based on 2016 and 2017 revenues

ADJUSTED EBITDA SUMMARY 2018 Combined Full Year Adjusted EBITDA(1) ($ in millions) $120 $100 $101 $80 $90 $82 $60 $64 $67 $40 $53 $20 YTD Actual - $12 $0 '16 '17 '18E(3) Projected IEA Adjusted EBITDA Including SAIIA/The ACC Companies (2) ($ in millions) $120 $100 $80 $73 $60 $64 $67 $40 $53 $20 YTD Actual - $12 $0 (3) '16 '17 '18E (1) Included in 2018 is the projected midpoint of SAIIA/The ACC Companies Adjusted EBITDA of $34M ($32M to $36M range) combined with IEAs current midpoint guidance of $67M. (2) Included in 2018 is the projected midpoint of SAIIA/The ACC Companies Adjusted EBITDA for fourth quarter of 2018 of $6M ($5M to $7M range) combined with IEAs current midpoint guidance of $67M to reflect IEAs expected Adjusted EBITDA results for 2018 assuming the acquisition closes 10/1/18 14 (3) The blue bar is related to adjusted EBITDA for the full year from IEA. The green bar is related to the adjusted EBITDA of SAIIA/The ACC Companies as explained in footnote 1 and 2, respectively.

COMBINED BACKLOG PROVIDES UNPRECEDENTED VISIBILITY BACKLOG BRIDGE(1) ($ in millions) $1,400 $84 $1,226 • IEA backlog and pipeline of wind and solar project opportunities $561 continues to grow year-over-year $1,200 $1,000 – The Company is shortlisted on numerous targeted projects $800 $449 $581 $961 – Developers/owners open to awarding an entire project portfolio vs. individual $600 projects $400 $200 $428 • Entered 2018 with record backlog $0 2018 2019 2020 Total – ~$1.1 billion of revenue in total committed backlog and approximately $1.2 (2) billion of additional revenue in high-probability pipeline PROJECTED IEA REVENUE COMPARED TO CURRENT BACKLOG(1) ($ in millions) • Current visibility is the strongest in company history $1,050 $1,000 $581 – As of June 2018 (excluding acquisition): $652M of actual plus committed $900 revenue for 2018 against 2018 estimated total revenue of $685 million on the $750 low range and $730 million on the high range, or ~95.2% and ~89.3%, of total revenue, respectively ($707.5 million midpoint) $600 $428 $450 $251 – Additional visibility in outer years out, with over $530 million of committed $708 revenue for 2019/2020 (excluding acquisition) $300 $174 $150 $112 $50 $0 Q1'18 Actual Q2'18 Actual Remaining 2018 Target Revenue Revenue Revenue Backlog (midpoint) (1) Blue bars represent IEAs current backlog/revenue and green bars represent additional proforma backlog/revenue from SAIIA/The ACC Companies acquisition as of June 2018. The ‘projected IEA revenue compared to current backlog’ table is meant to show combined IEA and SAIIA/The ACC Companies results had the acquisition occurred 1/1/18. (2) High Probability Pipeline opportunities are projects that are with existing customers which fit our schedule and are in locations that are efficient for us to execute (close to an existing project) 15 that we have bid and in most cases have been short-listed and expect high probability of award.

APPENDIX

EBITDA ADJUSTMENTS 2018 Low 2018 High 2016 2017 Range(1) Range(1) SUMMARY OF EBITDA ADJUSTMENTS ($ in thousands) Total Revenue $602,655 $454,949 $685,000 $730,000 A. Discontinued Operations – in FY15, IEA began the process of winding down its Canadian operations. The Net Income $65,538 $16,525 $21,700 $25,200 operating results for Canadian operations have been reclassified as discontinued operations. A. Discontinued Operations (1,087) - - - 1. Diversification SG&A – reflects the costs, including recruiting, compensation and benefits for additional personnel, associated with IEA beginning to expand into electrical transmission work and corresponding services, which were Net Income from Cont. Operations $64,451 $16,525 $21,700 $25,200 historically subcontracted to third parties, U.S. utility scale solar, and heavy civil infrastructure. These costs currently Interest Expense, net 516 2,201 5,500 5,700 do not have a material amount of corresponding revenue, but management anticipates revenue beginning in FY18 Depreciation & amortization 3,433 5,044 8,000 8,500 2. Credit Support Fees – reflect payments to Oaktree for its guarantee of certain borrowings, which guarantees that Taxes (10,213) 13,863 6,300 7,100 do not continue post-combination. reflects an adjustment for bonus payments to IEA’s executive leadership EBITDA from Continuing Operations $58,187 $37,633 $41,500 $46,500 3. Canadian Wind-down Bonus Expense – % Margin 9.7% 8.3% 6.1% 6.4% team made in FY16 as a result of the successful wind down of IEA's Canadian solar operations. 4. Consulting Fees & Expenses – in 2014, 2015 and 2016, represents consulting fees and expenses related to the Adjustments wind down of IEA's Canadian operations and, in 2017, represents consulting and professional fees and expenses in 1. Diversification SG&A - 3,825 2,000 2,400 connection with the Proposed Transaction contemplated by the Merger Agreement. 2. Credit Support Fees 2,340 1,535 230 230 3. Canadian Wind-down Bonus Expense 2,000 - - - 5. Non-cash Stock Compensation Expenses – represents non-cash stock compensation expense. 4. Consulting Fees & Expenses 1,015 4,799 370 970 6. Full Year Impact of 2017 Capital Leasing Program – reflects the annualization of the EBITDA effects of the 5. Non-cash Stock Compensation Expenses 161 53 - - capital leasing program for cranes and yellow iron, which was implemented during 2017, consisting of (i) a $1.7 Full Year impact of 2017 Capital 6. - 4,700 - - million positive adjustment due to the elimination of cost of goods sold attributable to operating lease payments, (ii) Leasing program $1.6 million in reduction in cost of goods due to estimated operational efficiencies resulting from the program, and 7. Transaction costs - - 8,400 8,400 (iii) $1.4 million, representing a pro rata portion of the estimated gain due to estimated future residual value 8. Merger and Acquisition costs - - 3,000 3,000 9. Settlement of Customer Project Dispute - - 8,500 8,500 exceeding depreciated carrying value on the sale of the leased assets following the 48 month term of the lease. 7. Transaction costs – include legal, consulting, filing and other costs associated with the acquisition of IEA Energy Total Adjustments $5,516 $14,912 $22,500 $23,500 Services by M III Acquisition Corporation and the subsequent public listing of IEA securities on the NASDAQ stock exchange. Adjusted EBITDA $63,703 $52,545 $64,000 $70,000 8. Merger and Acquisition costs – include legal, consulting, travel and other costs associated with acquisition % Margin 10.6% 11.5% 9.3% 9.6% activity. 9. Settlement of Customer Project Dispute - related to a dispute regarding the $5.6 million in costs to be incurred to complete a project and the loss of revenue related to unbilled changed orders of $2.9 million for that specific project. The add back reflects the associated negative impact to gross margin. While IEA believed it had a strong legal position to support the charges, management determined that it was in the best interests of the Company to settle the dispute, retain the important customer relationship and secure the award of an additional Wind energy project with the customer, which will be built in 2018. 17 (1) IEA management’s 2018 low and high range for revenue, net income and adjusted EBITDA.

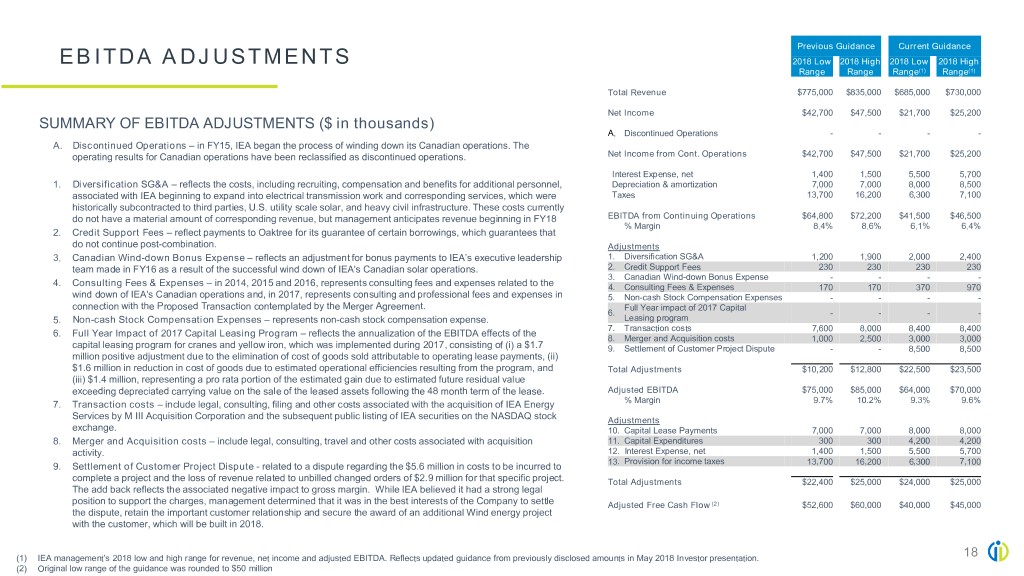

Previous Guidance Current Guidance EBITDA ADJUSTMENTS 2018 Low 2018 High 2018 Low 2018 High Range Range Range(1) Range(1) Total Revenue $775,000 $835,000 $685,000 $730,000 Net Income $42,700 $47,500 $21,700 $25,200 SUMMARY OF EBITDA ADJUSTMENTS ($ in thousands) A. Discontinued Operations - - - - A. Discontinued Operations – in FY15, IEA began the process of winding down its Canadian operations. The operating results for Canadian operations have been reclassified as discontinued operations. Net Income from Cont. Operations $42,700 $47,500 $21,700 $25,200 Interest Expense, net 1,400 1,500 5,500 5,700 1. Diversification SG&A – reflects the costs, including recruiting, compensation and benefits for additional personnel, Depreciation & amortization 7,000 7,000 8,000 8,500 associated with IEA beginning to expand into electrical transmission work and corresponding services, which were Taxes 13,700 16,200 6,300 7,100 historically subcontracted to third parties, U.S. utility scale solar, and heavy civil infrastructure. These costs currently do not have a material amount of corresponding revenue, but management anticipates revenue beginning in FY18 EBITDA from Continuing Operations $64,800 $72,200 $41,500 $46,500 % Margin 8.4% 8.6% 6.1% 6.4% 2. Credit Support Fees – reflect payments to Oaktree for its guarantee of certain borrowings, which guarantees that do not continue post-combination. Adjustments 3. Canadian Wind-down Bonus Expense – reflects an adjustment for bonus payments to IEA’s executive leadership 1. Diversification SG&A 1,200 1,900 2,000 2,400 team made in FY16 as a result of the successful wind down of IEA's Canadian solar operations. 2. Credit Support Fees 230 230 230 230 3. Canadian Wind-down Bonus Expense - - - - 4. Consulting Fees & Expenses – in 2014, 2015 and 2016, represents consulting fees and expenses related to the 4. Consulting Fees & Expenses 170 170 370 970 wind down of IEA's Canadian operations and, in 2017, represents consulting and professional fees and expenses in 5. Non-cash Stock Compensation Expenses - - - - connection with the Proposed Transaction contemplated by the Merger Agreement. Full Year impact of 2017 Capital 6. - - - - 5. Non-cash Stock Compensation Expenses – represents non-cash stock compensation expense. Leasing program 7. Transaction costs 7,600 8,000 8,400 8,400 – reflects the annualization of the EBITDA effects of the 6. Full Year Impact of 2017 Capital Leasing Program 8. Merger and Acquisition costs 1,000 2,500 3,000 3,000 capital leasing program for cranes and yellow iron, which was implemented during 2017, consisting of (i) a $1.7 9. Settlement of Customer Project Dispute - - 8,500 8,500 million positive adjustment due to the elimination of cost of goods sold attributable to operating lease payments, (ii) $1.6 million in reduction in cost of goods due to estimated operational efficiencies resulting from the program, and Total Adjustments $10,200 $12,800 $22,500 $23,500 (iii) $1.4 million, representing a pro rata portion of the estimated gain due to estimated future residual value exceeding depreciated carrying value on the sale of the leased assets following the 48 month term of the lease. Adjusted EBITDA $75,000 $85,000 $64,000 $70,000 % Margin 9.7% 10.2% 9.3% 9.6% 7. Transaction costs – include legal, consulting, filing and other costs associated with the acquisition of IEA Energy Services by M III Acquisition Corporation and the subsequent public listing of IEA securities on the NASDAQ stock Adjustments exchange. 10. Capital Lease Payments 7,000 7,000 8,000 8,000 8. Merger and Acquisition costs – include legal, consulting, travel and other costs associated with acquisition 11. Capital Expenditures 300 300 4,200 4,200 activity. 12. Interest Expense, net 1,400 1,500 5,500 5,700 13. Provision for income taxes 13,700 16,200 6,300 7,100 9. Settlement of Customer Project Dispute - related to a dispute regarding the $5.6 million in costs to be incurred to complete a project and the loss of revenue related to unbilled changed orders of $2.9 million for that specific project. Total Adjustments $22,400 $25,000 $24,000 $25,000 The add back reflects the associated negative impact to gross margin. While IEA believed it had a strong legal position to support the charges, management determined that it was in the best interests of the Company to settle Adjusted Free Cash Flow (2) $52,600 $60,000 $40,000 $45,000 the dispute, retain the important customer relationship and secure the award of an additional Wind energy project with the customer, which will be built in 2018. (1) IEA management’s 2018 low and high range for revenue, net income and adjusted EBITDA. Reflects updated guidance from previously disclosed amounts in May 2018 Investor presentation. 18 (2) Original low range of the guidance was rounded to $50 million

EBITDA ADJUSTMENTS Three Months Ended Six Months Ended June 30, June 30, SUMMARY OF EBITDA ADJUSTMENTS ($ in thousands) 2018 2017 2018 2017 A. Discontinued Operations – in FY15, IEA began the process of winding down its Canadian operations. The Total Revenue $174,073 $106,042 $224,208 $158,298 operating results for Canadian operations have been reclassified as discontinued operations. Net Income $4,915 $3,588 ($12,477) $4,978 1. Diversification SG&A – costs, including recruiting, compensation and benefits for additional personnel, associated A. Discontinued Operations - - - - with IEA beginning to expand into electrical transmission work and corresponding services, which were historically subcontracted to third parties, U.S. utility scale solar, and heavy civil infrastructure. These costs currently do not Net Income from Cont. Operations $4,915 $3,588 ($12,477) $4,978 have corresponding revenue, but management anticipates revenue to fiscal 2018. 2. Credit Support Fees – reflect payments to Oaktree for its guarantee of certain borrowings, which guarantees that Interest Expense, net 1,530 352 2,381 714 do not continue post-combination. Depreciation & amortization 2,005 1,192 3,977 2,149 Taxes 1,178 2,017 ($2,337) 2,774 3. Canadian Wind-down Bonus Expense – reflects an adjustment for bonus payments to IEA’s executive leadership team made in FY16 as a result of the successful wind down of IEA's Canadian solar operations. EBITDA from Continuing Operations $9,628 $7,149 ($8,456) $10,615 4. Consulting Fees & Expenses – represents consulting and professional fees and expenses in connection with the % Margin 5.5% 6.7% (3.8%) 6.7% Merger. 5. Non-cash Stock Compensation Expenses – represents non-cash stock compensation expense. Adjustments 1. Diversification SG&A 904 1,985 1,083 6. Full Year Impact of 2017 Capital Leasing Program – (7) Reflects the annualization of the impact on 798 EBITDA of the capital leasing program for cranes and yellow iron, which was implemented in 2017, consisting of a 2. Credit Support Fees - 430 231 855 (i) positive adjustment due to the elimination of cost of goods sold attributable to operating lease payments, (ii) 3. Canadian Wind-down Bonus Expense - - - - reduction in cost of goods due to estimated and operational efficiencies resulting from the program, and (iii) 4. Consulting Fees & Expenses 202 427 361 427 representing a pro rata portion of the estimated gain due to estimated future residual value exceeding depreciated 5. Non-cash Stock Compensation Expenses - 13 - 27 Full Year impact of 2017 Capital carrying value on the sale of the leased assets following the 48 month term of the lease. 6. - 3,133 - Leasing program 3,133 7. Transaction costs – include legal, consulting, filing and other costs associated with the acquisition of IEA Energy 7. Transaction costs 752 - 8,372 - Services by MIII Acquisition Corporation and the subsequent public listing of IEA securities on the NASDAQ stock 8. Merger and Acquisition costs 688 - 688 - exchange. 9. Settlement of Customer Project Dispute 3,413 - 8,500 - 8. Merger and Acquisition costs – include legal, consulting, travel and other costs associated with acquisition activity. Total Adjustments $5,853 $4,907 $20,137 $5,525 9. Settlement of Customer Project Dispute - related to a dispute regarding the costs to be incurred to complete a Adjusted EBITDA $15,481 $12,056 $11,681 $16,140 project and the loss of revenue related to unbilled change orders. The three and six months ended June 30, 2018, % Margin 8.9% 11.4% 5.2% 10.2% regarding the costs to finish the project were $0.9 million and $5.6 million respectively. The loss of revenue related to unbilled changed orders for the three and six months ended June 30, 2018, was $2.5 million and $2.9 million, respectively. The add back reflects the associated negative impact to gross margin. While IEA believed it had a strong legal position to support the charges, management determined that it was in the best interests of the Company to settle the dispute, retain the important customer relationship and secure the award of an additional Wind energy project with the customer, which will be built in 2018. 19

THANK YOU INFRASTRUCTURE AND ENERGY ALTERNATIVES, INC. Andrew Layman, Chief Financial Officer 765.828.2580 THE EQUITY GROUP, INC. Fred Buonocore, CFA fbuonocore@equityny.com 212.836.9607 Kevin Towle ktowle@equityny.com 212.836.9620