Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - KERYX BIOPHARMACEUTICALS INC | d604908dex991.htm |

| 8-K - 8-K - KERYX BIOPHARMACEUTICALS INC | d604908d8k.htm |

KERYX 2Q18 Financial results August 8, 2018 Exhibit 99.2

Agenda Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Topic Speakers Welcome Amy Sullivan, SVP, Corporate Affairs Opening Remarks Jodie Morrison, Interim CEO Business Highlights Scott Holmes, CFO Question & Answer All

Forward-Looking Statements Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Some of the statements included in this presentation, particularly those regarding the commercialization of and demand for Auryxia, the asset-based revolving credit facility and the proposed merger with Akebia Therapeutics, Inc., including the expected timing of the closing of the merger and the expected benefits thereof to us and our shareholders, may contain forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Among the factors that could cause our actual results to differ materially are the following: our ability to successfully transition the chief executive role to Ms. Morrison and, if needed, to a permanent chief executive; the risk that the borrowing base we may utilize at any one time under the asset-based revolving credit facility may be significantly lower than the total commitment; our ability to successfully market Auryxia and whether we can increase adoption of Auryxia in patients with CKD on dialysis and successfully launch Auryxia for the treatment of iron deficiency anemia in patients with chronic kidney disease, not on dialysis; whether we can maintain our operating expenses to projected levels while continuing our current clinical, regulatory and commercial activities; our ability to continue to supply Auryxia to the market; the risk that increased utilization by Medicare Part D subscribers will increase our gross-to-net adjustment greater than we anticipate; the risk that the proposed merger with Akebia Therapeutics, Inc. does not close due to the failure to obtain stockholder or regulatory approval or otherwise; the risk that Akebia’s or Keryx’s respective businesses may suffer as a result of uncertainty surrounding the merger and disruption of management’s attention due to the merger; risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; the risk that the expected benefits of the proposed merger or other commercial opportunities may otherwise not be fully realized or may take longer to realize than expected; and other risk factors identified from time to time in our reports filed with the Securities and Exchange Commission. Any forward-looking statements set forth in this presentation speak only as of the date of this presentation. We do not undertake to update any of these forward-looking statements to reflect events or circumstances that occur after the date hereof. This presentation and prior releases are available at http://www.keryx.com. The information found on our website is not incorporated by reference into this presentation and is included for reference purposes only.

Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Additional Information and Where to Find It In connection with the proposed merger, Akebia and Keryx plan to file with the SEC and mail or otherwise provide to their respective stockholders a joint proxy statement/prospectus regarding the proposed transaction. BEFORE MAKING ANY VOTING DECISION, AKEBIA’S AND KERYX’S RESPECTIVE STOCKHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY EACH OF AKEBIA AND KERYX WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and stockholders will be able to obtain a free copy of the joint proxy statement/prospectus and other documents containing important information about Akebia and Keryx, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Akebia and Keryx make available free of charge at www.akebia.com and www.keryx.com, respectively (in the “Investors” section), copies of materials they file with, or furnish to, the SEC. Participants in the Solicitation This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Akebia, Keryx and their respective directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the stockholders of Akebia and Keryx in connection with the proposed merger. Security holders may obtain information regarding the names, affiliations and interests of Akebia’s directors and officers in Akebia’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which was filed with the SEC on March 12, 2018 and its definitive proxy statement for the 2018 annual meeting of stockholders, which was filed with the SEC on April 30, 2018. Security holders may obtain information regarding the names, affiliations and interests of Keryx’s directors and officers in Keryx’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which was filed with the SEC on February 21, 2018, and the Amendment No. 1 on Form 10-K/A, which was filed with the SEC on April 30, 2018, and its definitive proxy statement for the 2018 annual meeting of stockholders, which was filed with the SEC on May 31, 2018. To the extent the holdings of Akebia securities by Akebia’s directors and executive officers or the holdings of Keryx securities by Keryx’s directors and executive officers have changed since the amounts set forth in Akebia’s or Keryx’s respective proxy statement for its 2018 annual meeting of stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed merger will be included in the joint proxy statement/prospectus relating to the proposed merger when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov, Akebia’s website at www.akebia.com and Keryx’s website at www.keryx.com.

Opening remarks Jodie Morrison, Interim CEO

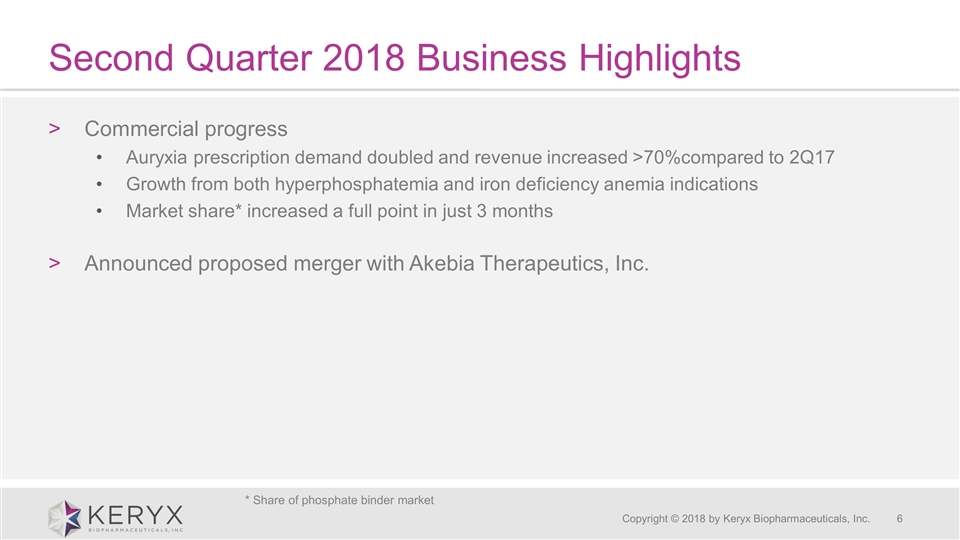

Second Quarter 2018 Business Highlights Commercial progress Auryxia prescription demand doubled and revenue increased >70%compared to 2Q17 Growth from both hyperphosphatemia and iron deficiency anemia indications Market share* increased a full point in just 3 months Announced proposed merger with Akebia Therapeutics, Inc. Copyright © 2018 by Keryx Biopharmaceuticals, Inc. * Share of phosphate binder market

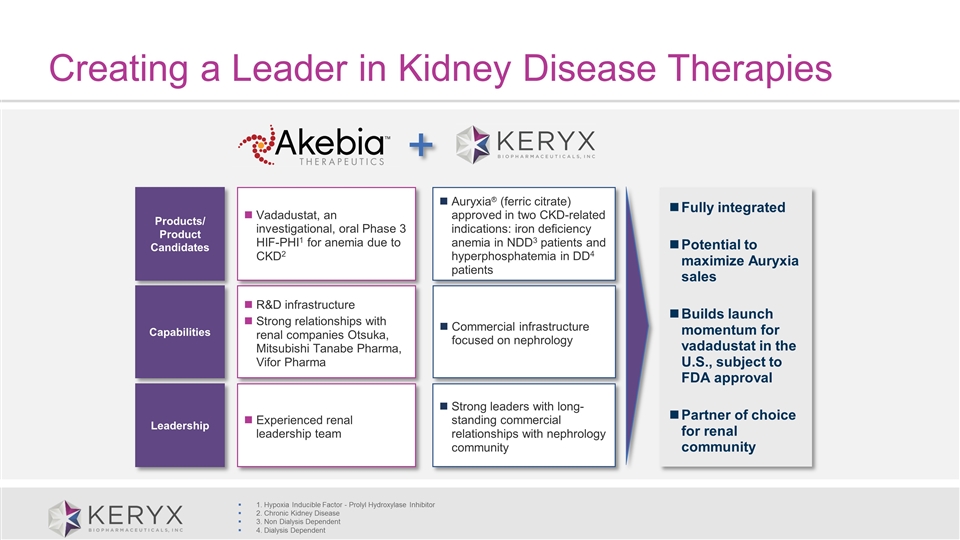

Creating a Leader in Kidney Disease Therapies Fully integrated Potential to maximize Auryxia sales Builds launch momentum for vadadustat in the U.S., subject to FDA approval Partner of choice for renal community 1. Hypoxia Inducible Factor - Prolyl Hydroxylase Inhibitor 2. Chronic Kidney Disease 3. Non Dialysis Dependent 4. Dialysis Dependent Products/ Product Candidates Capabilities Leadership R&D infrastructure Strong relationships with renal companies Otsuka, Mitsubishi Tanabe Pharma, Vifor Pharma Experienced renal leadership team Vadadustat, an investigational, oral Phase 3 HIF-PHI1 for anemia due to CKD2 Auryxia® (ferric citrate) approved in two CKD-related indications: iron deficiency anemia in NDD3 patients and hyperphosphatemia in DD4 patients Commercial infrastructure focused on nephrology Strong leaders with long-standing commercial relationships with nephrology community

2Q18 Business Highlights Scott Holmes, CFO

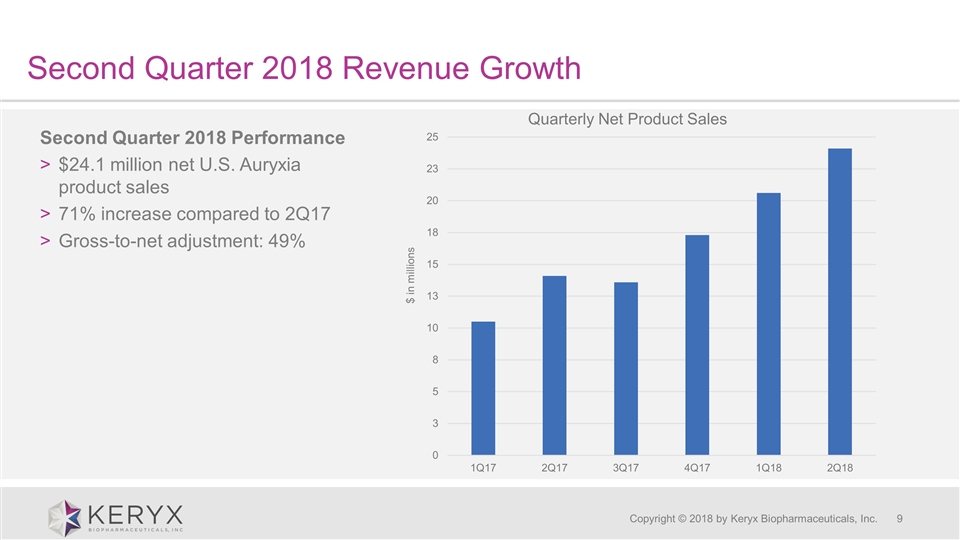

Second Quarter 2018 Revenue Growth Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Second Quarter 2018 Performance $24.1 million net U.S. Auryxia product sales 71% increase compared to 2Q17 Gross-to-net adjustment: 49%

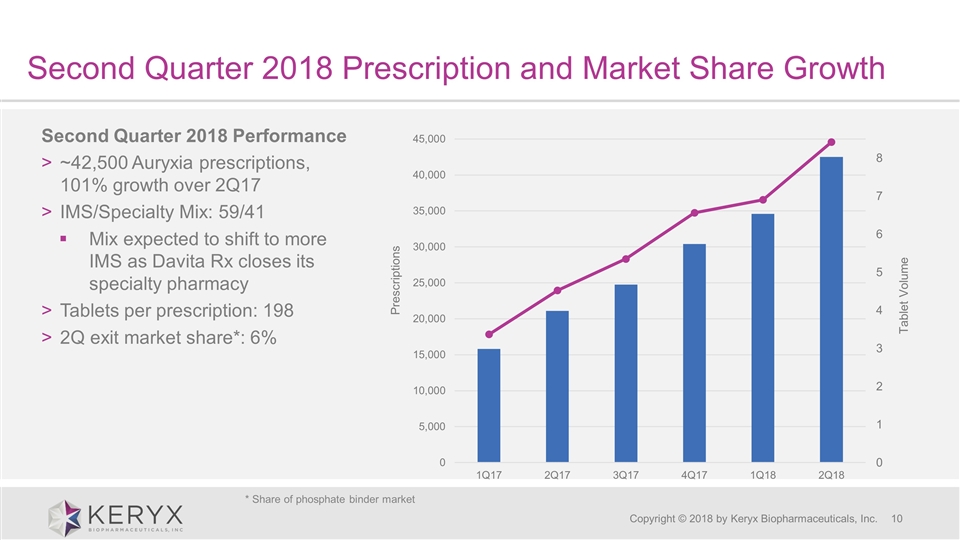

Second Quarter 2018 Prescription and Market Share Growth Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Second Quarter 2018 Performance ~42,500 Auryxia prescriptions, 101% growth over 2Q17 IMS/Specialty Mix: 59/41 Mix expected to shift to more IMS as Davita Rx closes its specialty pharmacy Tablets per prescription: 198 2Q exit market share*: 6% * Share of phosphate binder market

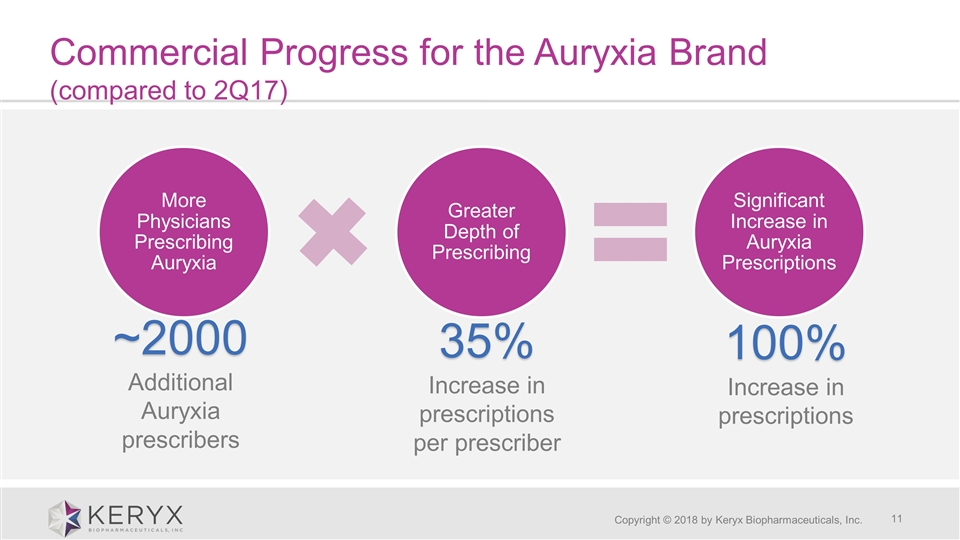

Commercial Progress for the Auryxia Brand (compared to 2Q17) Copyright © 2018 by Keryx Biopharmaceuticals, Inc. ~2000Additional Auryxia prescribers 35% Increase in prescriptions per prescriber 100% Increase in prescriptions More Physicians Prescribing Auryxia Greater Depth of Prescribing Significant Increase in Auryxia Prescriptions

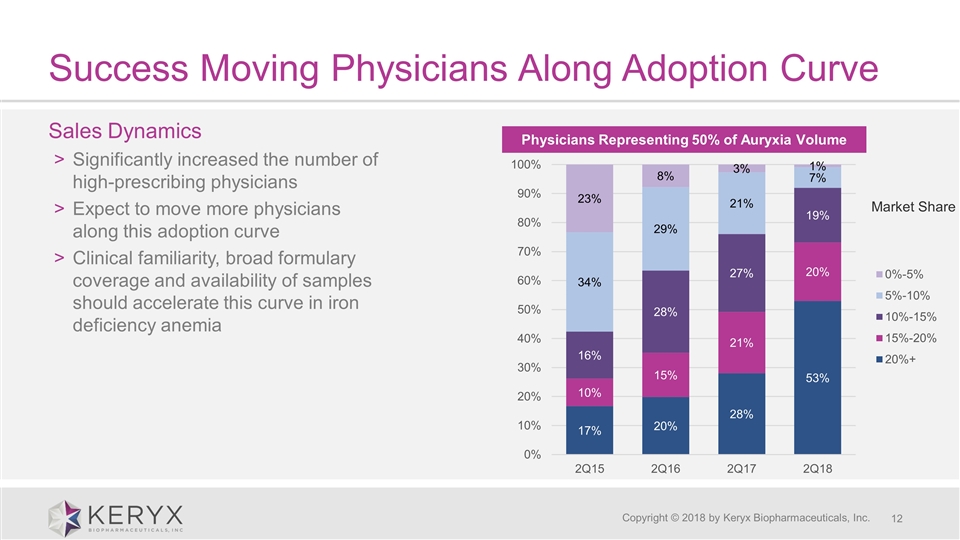

Success Moving Physicians Along Adoption Curve Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Sales Dynamics Significantly increased the number of high-prescribing physicians Expect to move more physicians along this adoption curve Clinical familiarity, broad formulary coverage and availability of samples should accelerate this curve in iron deficiency anemia Physicians Representing 50% of Auryxia Volume Market Share

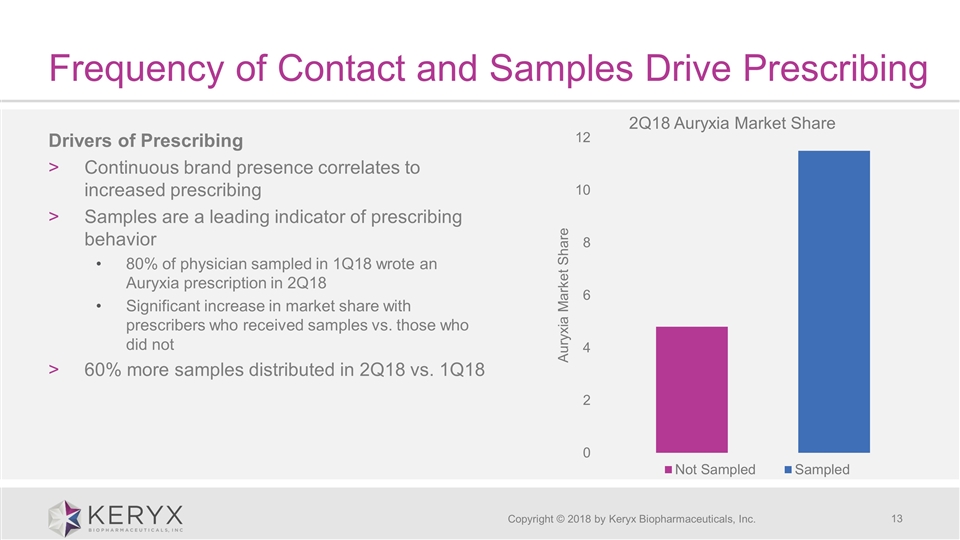

Frequency of Contact and Samples Drive Prescribing Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Drivers of Prescribing Continuous brand presence correlates to increased prescribing Samples are a leading indicator of prescribing behavior 80% of physician sampled in 1Q18 wrote an Auryxia prescription in 2Q18 Significant increase in market share with prescribers who received samples vs. those who did not 60% more samples distributed in 2Q18 vs. 1Q18

Closing remarks Jodie Morrison, Interim CEO

In Summary Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Good progress commercially Prescriber base broadened Depth of prescribing increased Intend to build on current momentum to drive continued strong growth of Auryxia and create shareholder value Proposed merger with Akebia Therapeutics tracking to 4Q vote/close

Strong Foundation to Build a Leading Kidney Care Company Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Phosphate Management Anemia Management Q&A Session