Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENCORE CAPITAL GROUP INC | q220188-kxearningsslides.htm |

Exhibit 99.1 Encore Capital Group, Inc. Q2 2018 EARNINGS CALL

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS The statements in this presentation that are not achievements of the Company and its subsidiaries historical facts, including, most importantly, those to be materially different from any future results, statements preceded by, or that include, the words performance or achievements expressed or implied “will,” “may,” “believe,” “projects,” “expects,” by such forward-looking statements. These risks, “anticipates” or the negation thereof, or similar uncertainties and other factors are discussed in the expressions, constitute “forward-looking reports filed by the Company with the Securities statements” within the meaning of the Private and Exchange Commission, including its most Securities Litigation Reform Act of 1995 (the recent reports on Form 10-K and Form 10-Q, as “Reform Act”). These statements may include, but they may be amended from time to time. The are not limited to, statements regarding our future Company disclaims any intent or obligation to operating results, earnings per share, and update these forward-looking statements. growth. For all “forward-looking statements,” the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. Such forward-looking statements involve risks, uncertainties and other factors which may cause actual results, performance or 2

ENCORE HIGHLIGHTS In Q2 2018 we set records for portfolio purchases, collections, revenues, and ERC We completed the Cabot acquisition, transforming Encore into a clear leader in the U.S. and the U.K., the world’s two largest markets for our industry Proprietary and Confidential 3

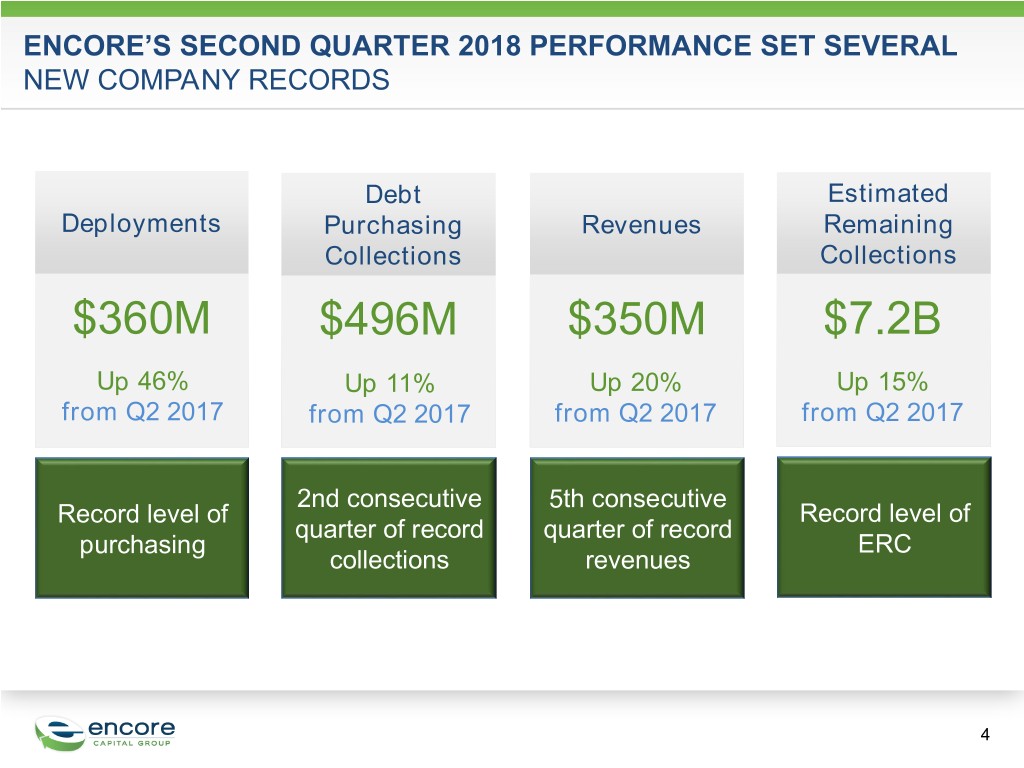

ENCORE’S SECOND QUARTER 2018 PERFORMANCE SET SEVERAL NEW COMPANY RECORDS Debt Estimated Deployments Purchasing Revenues Remaining Collections Collections $360M $496M $350M $7.2B Up 46% Up 11% Up 20% Up 15% from Q2 2017 from Q2 2017 from Q2 2017 from Q2 2017 2nd consecutive 5th consecutive Record level of Record level of quarter of record quarter of record purchasing ERC collections revenues 4

ENCORE’S SECOND QUARTER 2018 GAAP EPS WAS $1.00 GAAP EPS1 GAAP Net Income1 Economic EPS2 Adjusted Income2 $1.00 $26.3M $1.33 $35.1M 1) From continuing operations attributable to Encore 2) Please refer to Appendix for reconciliation of Economic EPS and Adjusted Income to GAAP 5

OUR ADJUSTED EBITDA OVER THE LAST 12 MONTHS HAS ACHIEVED A NEW RECORD LEVEL, AN INDICATION OF OUR STRONG CASH GENERATION (in $000’s) Adjusted EBITDA + Collections applied to principal balance Encore Adjusted EBITDATrailing 12 --MonthsTrailing 12-Months $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Adjusted EBITDA - TTM Collections applied to principal balance - TTM Note: See appendix for reconciliation of Adjusted EBITDA to GAAP net income. 6

CABOT IS A MARKET LEADER AND STRONG PERFORMER WITH CONSIDERABLE GROWTH POTENTIAL Cabot is the industry leader in the U.K. and Compelling Geographic Ireland, with operations in Spain, Portugal and Footprint France and further growth opportunities in Europe Consumer unsecured, mortgages, REO, Diverse Product and SME/corporate debt, telco, utilities debt, and auto Servicing Expertise Meaningful capital-light servicing revenue post- Wescot acquisition Operational and litigation expertise, combined 2500+ people Operational with use of data analytics and behavioral Excellence science, leading to best-in-class performance Owns more than 9M accounts Cash collections CAGR of 20% from 2012 to Profitable Growth 20 years of operating experience 2017 Largest Credit Management Seasoned back book, resilient to macro Servicing Business in the U.K. Attractive Back Book economic effects with 72% of U.K. collections from affordable payment plans in 2017 A consumer-centric operator and trusted partner Market-Leading of banks and other credit providers who place a Reputation high value on their reputation First large debt buyer to be licensed by the FCA 7

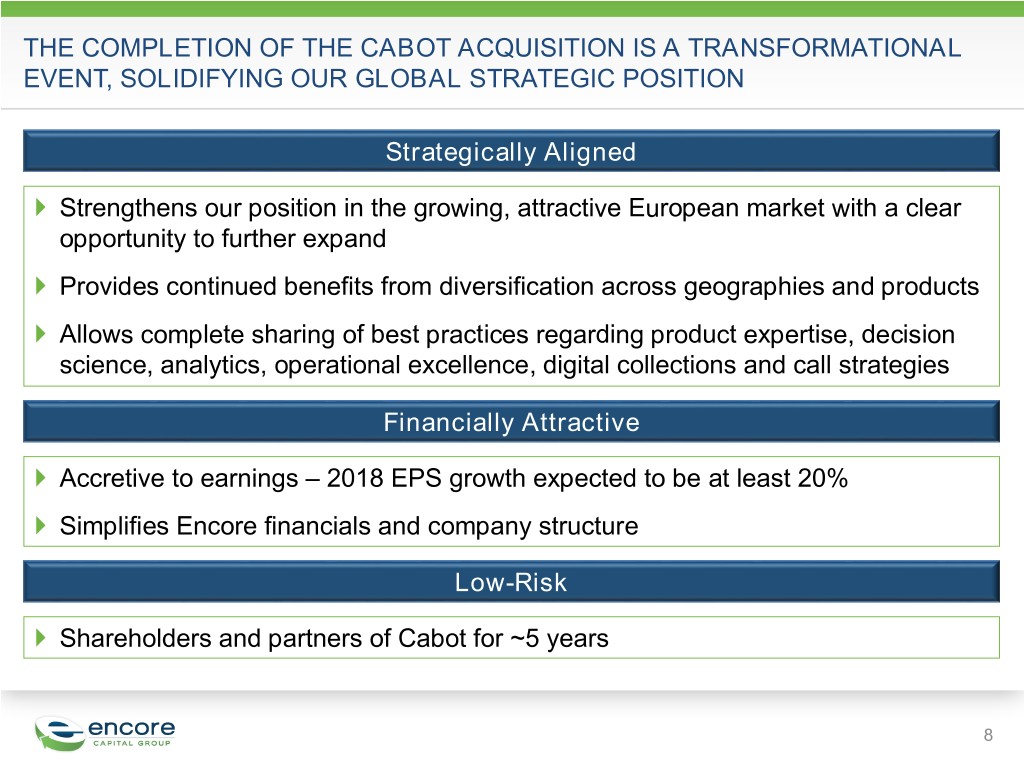

THE COMPLETION OF THE CABOT ACQUISITION IS A TRANSFORMATIONAL EVENT, SOLIDIFYING OUR GLOBAL STRATEGIC POSITION Strategically Aligned Strengthens our position in the growing, attractive European market with a clear opportunity to further expand Provides continued benefits from diversification across geographies and products Allows complete sharing of best practices regarding product expertise, decision science, analytics, operational excellence, digital collections and call strategies Financially Attractive Accretive to earnings – 2018 EPS growth expected to be at least 20% Simplifies Encore financials and company structure Low-Risk Shareholders and partners of Cabot for ~5 years 8

U.S. MARKET FOR DEBT PURCHASING REMAINS STRONG U.S. Market Supply in the U.S. on track for continued growth in 2018 and beyond Federal Reserve reports revolving credit in the U.S. reached another all-time high in May 2018 Pricing environment remains favorable Encore’s U.S. Business Q2 was a record quarter of purchasing from issuers as Encore deployed $203M We continue to nearly exclusively purchase fresh paper, which will comprise more than 80% of the available market in 2018 Operational innovation continues to drive better collections We are on track to deploy more capital in the U.S. in 2018 than in any prior year in our history 9

Detailed Financial Discussion 10

WORLDWIDE DEPLOYMENTS IN Q2 WERE UP 46% COMPARED TO Q2 2017, A NEW RECORD IN A NON-ACQUISITION QUARTER Q2 2018 Deployments $M Europe United $147 States $203 Other $10 Total $360 11

RECORD COLLECTIONS IN THE SECOND QUARTER WERE UP 11%, REFLECTING GROWTH IN THE U.S. AND EUROPE Collections by Geography Collections by Channel Collection Sites Legal Collections Collection Agencies $M United States Europe Other $M 496 500 489 496 500 489 443 438 441 446 443 438 441 446 407 397 407 397 400 400 300 300 200 200 100 100 0 2017 2016 2017 2017 2018 2017 2018 0 2016 2016 2017 2016 2017 2017 2018 2017 2018 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 12

Q2 REVENUE GROWTH OF 20% REFLECTS IMPROVED COLLECTIONS AND ADDITIONAL SERVICING REVENUE Revenue by Geography $M 400 350 350 327 307 317 291 300 271 272 250 179 200 150 100 50 0 -50 2016 2017 2016 2017 2017 2018 2017 2018 Q3 Q4 Q1 Q2 United States Europe Other 13

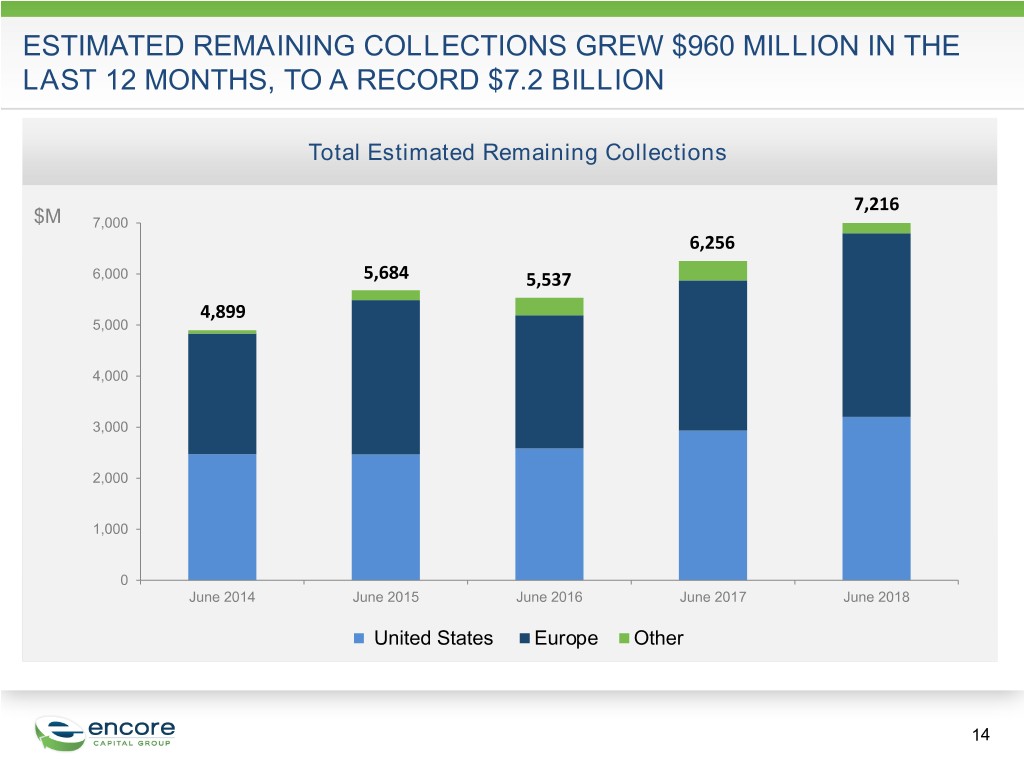

ESTIMATED REMAINING COLLECTIONS GREW $960 MILLION IN THE LAST 12 MONTHS, TO A RECORD $7.2 BILLION Total Estimated Remaining Collections 7,216 $M 7,000 6,256 6,000 5,684 5,537 4,899 5,000 4,000 3,000 2,000 1,000 0 June 2014 June 2015 June 2016 June 2017 June 2018 United States Europe Other 14

ENCORE DELIVERED GAAP EPS OF $1.00 AND ECONOMIC EPS OF $1.33 IN THE SECOND QUARTER OF 2018 Three Months Ended June 30, 2018 $1.75 $0.25 ($0.09) ($0.18) $1.50 $0.09 $1.33 $1.33 $0.14 $1.25 $0.12 $1.00 $1.00 No $0.75 shares deducted in $0.50 Q2 2018 $0.25 $0.00 Net income per Convertible notes Acquisition, Amortization of Loss on derivatives Gain on fair value Income tax effect of Adjusted income Adjusted income diluted share from non-cash interest integration and certain acquired in connection with adjustments to the adjustments per diluted share per diluted share continuing and issuance cost restructuring related intangible assets the Cabot contingent from continuing from continuing operations amortization expenses Transaction consideration operations operations attributable to attributable to attributable to Encore Encore - Encore - (Accounting)* (Economic)* • Please refer to Appendix for reconciliation of Adjusted EPS / Economic EPS measurements to GAAP. 15

SUMMARY AND 2018 EXPECTATIONS Encore’s Q2 2018 results include records for portfolio purchases, collections, revenues, and ERC We completed the acquisition of Cabot, transforming Encore into a clear leader in the U.S. and the U.K., the world’s two largest markets for our industry U.S. market for debt purchasing remains strong Encore’s 2018 EPS growth expected to be at least 20% Encore has solidified its position as a global leader in our industry 16

Q&A 17

Appendix 18

NON-GAAP FINANCIAL MEASURES This presentation includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The Company has included information concerning Adjusted EBITDA because management utilizes this information in the evaluation of its operations and believes that this measure is a useful indicator of the Company’s ability to generate cash collections in excess of operating expenses through the liquidation of its receivable portfolios. The Company has included information concerning Adjusted Operating Expenses in order to facilitate a comparison of approximate cash costs to cash collections for the portfolio purchasing and recovery business in the periods presented. The Company has included Adjusted Income Attributable to Encore and Adjusted Income Attributable to Encore per Share (also referred to as Economic EPS when adjusted for certain shares associated with our convertible notes that will not be issued but are reflected in the fully diluted share count for accounting purposes) because management uses these measures to assess operating performance, in order to highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. The Company has included impacts from foreign currency exchange rates to facilitate a comparison of operating metrics that are unburdened by variations in foreign currency exchange rates over time. Adjusted EBITDA, Adjusted Operating Expenses, Adjusted Income Attributable to Encore, Adjusted Income Attributable to Encore per Share/Economic EPS, and impacts from foreign currency exchange rates have not been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, net income, net income per share, and total operating expenses as indicators of the Company’s operating performance. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this presentation a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. 19

RECONCILIATION OF ADJUSTED INCOME AND ECONOMIC / ADJUSTED EPS Reconciliation of Adjusted Income and Economic / Adjusted EPS to GAAP EPS (Unaudited, In Thousands, except per share amounts), Three Months Ended June 30, 2018 2017 Per Diluted Per Diluted Per Diluted Per Diluted $ Share – Share – $ Share – Share – Accounting Economic Accounting Economic GAAP net income from continuing operations attributable to Encore, as $ 26,298 $ 1.00 $ 1.00 $ 20,255 $ 0.77 $ 0.77 reported Adjustments: Convertible notes non-cash interest and issuance cost amortization 3,070 0.12 0.12 3,078 0.12 0.12 Acquisition, integration and restructuring related expenses1 3,655 0.14 0.14 3,520 0.13 0.14 Gain on fair value adjustments to contingent consideration2 (2,378) (0.09) (0.09) (2,773) (0.10) (0.10) Amortization of certain acquired intangible assets3 2,436 0.09 0.09 588 0.02 0.02 Loss on derivatives in connection with the Cabot Transaction4 6,578 0.25 0.25 --- --- --- Income tax effect of the adjustments5 (4,618) (0.18) (0.18) (943) (0.04) (0.04) Adjustments attributable to noncontrolling interest6 10 --- --- (812) (0.03) (0.03) Adjusted income from continuing operations attributable to Encore $ 35,051 $ 1.33 $ 1.33 $ 22,913 $ 0.87 $ 0.88 1) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 2) Amount represents the net gain recognized as a result of fair value adjustments to contingent considerations that were established for our acquisitions of debt solution service providers in Europe. We have adjusted for this amount because we do not believe this is indicative of ongoing operations. 3) As we continue to acquire debt solution service providers around the world, the acquired intangible assets, such as trade names and customer relationships, have grown substantially. These intangible assets are valued at the time of the acquisition and amortized over their estimated lives. We believe that amortization of acquisition-related intangible assets, especially the amortization of an acquired company’s trade names and customer relationships, is the result of pre-acquisition activities. In addition, the amortization of these acquired intangibles is a non-cash static expense that is not affected by operations during any reporting period. As a result, the amortization of certain acquired intangible assets is excluded from our adjusted income from continuing operations attributable to Encore and adjusted income from continuing operations per share. 4) Amount represents the loss recognized on the forward contract we entered into in anticipation of the completion of the Cabot Transaction. We adjust for this amount because we believe the loss is not indicative of ongoing operations; therefore adjusting for this loss enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) Amount represents the total income tax effect of the adjustments, which is generally calculated based on the applicable marginal tax rate of the jurisdiction in which the portion of the adjustment occurred. 6) Certain of the above pre-tax adjustments include expenses recognized by our partially-owned subsidiaries. This adjustment represents the portion of the non-GAAP adjustments that are attributable to noncontrolling interest. 20

RECONCILIATION OF ADJUSTED EBITDA Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Three Months Ended 12/31/12 03/31/13 06/30/13 09/30/13 12/31/13 03/31/14 06/30/14 09/30/14 GAAP net income (loss), as reported $ 20,167 $ 19,448 $ 11,012 $ 21,064 $ 22,216 $ 18,830 $ 21,353 $ 30,138 (Income) loss from discontinued operations, net of tax (1,337) (388) (323) (836) 463 (967) (1,212) (2,068) Interest expense 6,540 6,854 7,482 29,186 29,747 37,962 43,218 43,498 Interest income1 - - - - - (168) (238) (258) Provision (Benefit) for income taxes 12,627 12,191 6,950 9,707 14,805 11,275 13,100 8,636 Depreciation and amortization 1,523 1,732 2,057 4,395 4,873 5,897 6,619 6,725 Stock-based compensation expense 2,084 3,001 2,179 3,983 3,486 4,836 4,715 4,009 Acquisition, integration and restructuring related expenses2 - 1,162 16,148 7,703 4,003 10,943 4,616 1,000 Settlement fees and related administrative expenses - - - - - - - - Gain on fair value adjustments to contingent considerations3 - - - - - - - - Expenses related to Cabot IPO4 - - - - - - - - Loss on derivatives in connection with Cabot Transaction5 - - - - - - - - Adjusted EBITDA $ 41,604 $ 44,000 $ 45,505 $ 75,202 $ 79,593 $ 88,608 $ 92,171 $ 91,680 Collections applied to principal balance6 90,895 129,487 131,044 157,262 116,861 159,106 161,048 155,435 1) In the fourth quarter of 2016, we made a change to our presentation of adjusted EBITDA to adjust for interest income. In previous years we did not include interest income as an adjustment because it was immaterial. We have updated prior periods for comparability. 2) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) Amounts represent the gain recognized as a result of fair value adjustments to contingent considerations that were established for our acquisitions of debt solution service providers in Europe. We have adjusted for these amounts because we do not believe these are indicative of ongoing operations. Refer to Note 3 “Fair Value Measurement - Contingent Consideration” in the notes to our condensed consolidated financial statements for further details. 4) Amount in Q1 2018 represents expenses related to our previous consideration of a potential initial public offering by our subsidiary Cabot. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) Amount represents the loss recognized on the forward contract we entered into in anticipation of the completion of the Cabot Transaction. We adjust for this amount because we believe the loss is not indicative of ongoing operations; therefore adjusting for this loss enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 6) Collections applied to principal balance represents (a) gross collections from receivable portfolios less (b) revenue from receivable portfolios, net, and (c) allowance charges or allowance reversals on receivable portfolios. 21

RECONCILIATION OF ADJUSTED EBITDA (continued) Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Three Months Ended 12/31/14 03/31/15 06/30/15 09/30/15 12/31/15 03/31/16 06/30/16 09/30/16 GAAP net income (loss), as reported $ 27,957 $ 29,967 $ 25,185 $ (9,364) $ 1,596 $ 26,607 $ 30,833 $ (51,946) (Income) loss from discontinued operations, net of tax (958) (1,880) (1,661) (2,286) 29,214 3,182 - - Interest expense 42,264 42,303 46,250 47,816 50,187 50,691 50,597 48,632 Interest income1 (298) (414) (370) (407) (473) (499) (620) (694) Provision (Benefit) for income taxes 15,558 14,614 14,921 (6,361) 3,988 10,148 13,451 (13,768) Depreciation and amortization 7,860 8,137 7,878 8,043 9,102 9,861 8,235 8,032 Stock-based compensation expense 3,621 5,905 6,198 5,156 4,749 3,718 5,151 633 Acquisition, integration and restructuring related expenses2 2,212 2,766 7,892 2,235 2,635 2,141 3,271 3,843 Settlement fees and related administrative expenses - - - 63,019 - 2,988 698 2,613 Gain on fair value adjustments to contingent considerations3 - - - - - - - - Expenses related to Cabot IPO4 - - - - - - - - Loss on derivatives in connection with Cabot Transaction5 - - - - - - - - Adjusted EBITDA $ 98,216 $ 101,398 $ 106,293 $ 107,851 $ 100,998 $ 108,837 $ 111,616 $ (2,655) Collections applied to principal balance6 139,076 160,961 167,024 156,229 144,075 177,711 166,648 247,427 1) In the fourth quarter of 2016, we made a change to our presentation of adjusted EBITDA to adjust for interest income. In previous years we did not include interest income as an adjustment because it was immaterial. We have updated prior periods for comparability. 2) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) Amounts represent the gain recognized as a result of fair value adjustments to contingent considerations that were established for our acquisitions of debt solution service providers in Europe. We have adjusted for these amounts because we do not believe these are indicative of ongoing operations. Refer to Note 3 “Fair Value Measurement - Contingent Consideration” in the notes to our condensed consolidated financial statements for further details. 4) Amount in Q1 2018 represents expenses related to our previous consideration of a potential initial public offering by our subsidiary Cabot. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) Amount represents the loss recognized on the forward contract we entered into in anticipation of the completion of the Cabot Transaction. We adjust for this amount because we believe the loss is not indicative of ongoing operations; therefore adjusting for this loss enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 6) Collections applied to principal balance represents (a) gross collections from receivable portfolios less (b) revenue from receivable portfolios, net, and (c) allowance charges or allowance reversals on receivable portfolios. 22

RECONCILIATION OF ADJUSTED EBITDA (continued) Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Three Months Ended 12/31/16 03/31/17 06/30/17 09/30/17 12/31/17 03/31/18 06/30/18 GAAP net income (loss), as reported $ 11,323 $ 14,979 $ 19,076 $ 42,144 $ 2,779 $ 23,713 $ 26,974 (Income) loss from discontinued operations, net of tax (829) 199 - - - - - Interest expense 48,447 49,198 50,516 52,755 51,692 57,462 60,536 Interest income1 (725) (779) (919) (943) (994) (1,017) (1,082) Provision (Benefit) for income taxes 28,374 12,067 13,531 17,844 8,607 9,470 11,308 Depreciation and amortization 8,740 8,625 8,672 8,522 14,158 10,436 10,923 Stock-based compensation expense 3,125 750 2,760 3,531 3,358 2,276 3,169 Acquisition, integration and restructuring related expenses2 7,457 855 3,520 342 7,245 572 3,655 Settlement fees and related administrative expenses - - - - - - - Gain on fair value adjustments to contingent considerations3 (8,111) - (2,773) - (49) (2,274) (2,378) Expenses related to Cabot IPO4 - - - - 15,339 2,984 - Loss on derivatives in connection with Cabot Transaction5 - - - - - - 6,578 Adjusted EBITDA $ 97,801 $ 85,894 $ 94,383 $ 124,195 $ 102,135 $ 103,622 $ 119,683 Collections applied to principal balance6 147,203 188,893 173,946 159,408 150,788 198,282 185,799 1) In the fourth quarter of 2016, we made a change to our presentation of adjusted EBITDA to adjust for interest income. In previous years we did not include interest income as an adjustment because it was immaterial. We have updated prior periods for comparability. 2) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) Amounts represent the gain recognized as a result of fair value adjustments to contingent considerations that were established for our acquisitions of debt solution service providers in Europe. We have adjusted for these amounts because we do not believe these are indicative of ongoing operations. Refer to Note 3 “Fair Value Measurement - Contingent Consideration” in the notes to our condensed consolidated financial statements for further details. 4) Amount in Q1 2018 represents expenses related to our previous consideration of a potential initial public offering by our subsidiary Cabot. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) Amount represents the loss recognized on the forward contract we entered into in anticipation of the completion of the Cabot Transaction. We adjust for this amount because we believe the loss is not indicative of ongoing operations; therefore adjusting for this loss enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 6) Collections applied to principal balance represents (a) gross collections from receivable portfolios less (b) revenue from receivable portfolios, net, and (c) allowance charges or allowance reversals on receivable portfolios. 23

RECONCILIATION OF ADJUSTED OPERATING EXPENSES Reconciliation of Adjusted Operating Expenses to GAAP Operating Expenses (Unaudited, In $ Thousands) Three Months Ended 9/30/16 12/31/16 3/31/17 6/30/17 9/30/17 12/31/17 3/31/18 6/30/18 GAAP total operating expenses, as reported $ 200,597 $ 183,939 $ 196,100 $ 210,323 $ 202,829 $ 253,246 $ 238,336 $ 246,314 Adjustments: Operating expenses related to non-portfolio (26,446) (29,291) (27,946) (26,984) (28,934) (41,164) (46,614) (56,052) purchasing and recovery business1 Acquisition, integration and restructuring related (3,843) (7,457) (855) (3,520) (342) (11,911) (572) (3,655) expenses2 Stock-based compensation expense (633) (3,125) (750) (2,760) (3,531) (3,358) (2,276) (3,169) Gain on fair value adjustments to contingent --- 8,111 --- 2,773 --- 49 2,274 2,378 consideration3 Settlement fees and related administrative (2,613) --- --- --- --- --- --- --- expenses4 Expenses related to Cabot IPO5 --- --- --- --- --- (15,339) (2,984) --- Adjusted operating expenses related to portfolio $ 167,062 $ 152,177 $ 166,549 $ 179,832 $ 170,022 $ 181,523 $ 188,164 $ 185,816 purchasing and recovery business 1) Operating expenses related to non-portfolio purchasing and recovery business include operating expenses from other operating segments that primarily engage in fee-based business, as well as corporate overhead not related to our portfolio purchasing and recovery business. 2) Amount represents acquisition, integration and restructuring related operating expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) Amount represents the gain recognized as a result of fair value adjustments to contingent considerations that were established for our acquisitions of debt solution service providers in Europe. We have adjusted for this amount because we do not believe this is indicative of ongoing operations. 4) Amount consists of settlement and administrative fees related to certain TCPA settlements. We believe these fees and expenses are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) Amount in Q1 2018 represents expenses related to our previous consideration of a potential initial public offering by our subsidiary Cabot. Amount in Q4 2017 represents expenses related to the preparation of an initial public offering by our subsidiary Cabot that was withdrawn in November 2017. We adjust for these amounts because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 24

IMPACT OF FLUCTUATIONS IN FOREIGN CURRENCY EXCHANGE RATES (Unaudited, In Millions, except per share amounts) Constant Three Months Ended 6/30/18 As Reported Currency Revenue, adjusted by net allowances $ 350 $ 341 Operating expenses $ 246 $ 241 Net income* $ 26 $ 26 Adjusted net income* $ 35 $ 34 GAAP EPS* $ 1.00 $ 0.97 Economic EPS* $ 1.33 $ 1.30 Collections $ 496 $ 486 ERC $ 7,216 $ 7,180 * from continuing operations attributable to Encore. Note: Constant Currency figures are calculated by employing Q2 2017 foreign currency exchange rates to recalculate Q2 2018 results. All constant currency values are calculated based on the average exchange rates during the respective periods, except for ERC, which is calculated using the changes in the period-ending exchange rates. Management refers to operating results on a constant currency basis so that the operating results can be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of the company's operating performance. Constant currency financial results are calculated by translating current period financial results in local currency using the prior period’s respective currency conversion rate. Certain foreign subsidiaries’ local currency financial results in our calculation include the translation effect from their foreign operating results. 25

ENCORE’S Q2 2018 COST-TO-COLLECT WAS 37.5% COMPARED TO 40.3% IN Q2 2017 Overall Cost-to-Collect1 45% 2 41.1% 41.5% 40.3% 40% 38.4% 38.4% 37.8% 38.5% 37.5% 35% Q2 2018 Q2 2017 Location 30% CTC CTC 25% United States 40.8% 44.5% 20% Europe 29.1% 29.7% 15% 10% Other 46.7% 48.1% 5% Encore total 37.5% 40.3% 0% 2016 2017 2016 2017 2017 2018 2017 2018 Q3 Q4 Q1 Q2 1. Cost-to-Collect = Adjusted operating expenses / collections. See appendix for reconciliation of Adjusted operating expenses to GAAP. 2. Cost-to-Collect in Q3 2016 includes the impact of $11 million adjustment to deferred court cost receivable in Europe. 26