Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - My Size, Inc. | f8k080718_mysizeinc.htm |

Exhibit 99.1

Nasdaq (MYSZ) TASE (MYSZ) 1 August 7, 2018

SAFE HARBOR statement MYSZ 2 • This presentation was prepared by My Size, Inc. (the "Company"), and is given to you only for the provision of concise inform ati on for the sake of convenience, and may not be copied or distributed to any other person. This presentation does not purport to be comprehensive or to contain any and all information which might be relevant in connection with the making of a decision on an investment in securities of the Co mpany. No explicit or implicit representation or undertaking is given by any person regarding the accuracy or integrity of any information incl ude d in this presentation. In particular, no representation or undertaking is given regarding the realization or reasonableness of any forecasts regardi ng the future chances of the Company. To obtain a full picture of the activities of the Company and the risks entailed thereby, see the full immedi ate and periodic reports filed by the Company with the Israel Securities Authority and the Tel Aviv Stock Exchange Ltd., including warnings regarding forward - looking information, as defined in the Securities Law, 5728 - 1968, included therein. In addition, the Company files periodic reports with the U.S. Sec urities and Exchange Commission (the “SEC”). It must be recognized that estimates of the Company’s performance are necessarily subject to a high degree of uncerta int y and may vary materially from actual results. • This presentation contains statements, including without limitation the projections, that constitute “forward - looking statements ” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this presentation and include, but ar e not limited to, statements regarding the Company’s plans, intentions, beliefs, expectations and assumptions, as well as other statements that are not necessarily his torical facts. The Company commonly uses words in this presentation such as “anticipates”, “believes”, “plans”, “expects”, “future”, “intends” and similar expres sio ns to identify forward - looking statements and projections. You are cautioned that these forward - looking statements and projections are not guarantees of future performanc e and involve risks and uncertainties. The Company’s actual results may differ materially from those in the forward - looking statements and projections due to various f actors, including competition, market factors and general economic conditions. The forward - looking information in the presentation may not materialize, in whole or in part, or may materialize differently than expected, or may be affected by factors that cannot be assessed in advance. • These forward - looking statements should, therefore, be considered in light of various important factors, including those stateme nts under “ Item 1A - Risk Factors” in the Company’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2017 filed with the SEC on March 21,2018. For the av oidance of doubt, it is clarified that the Company does not undertake to update and/or modify the information included in the presentation to reflect events and/or cir cumstances occurring after the date of preparation of the presentation. This presentation is not an offer or invitation to buy or subscribe for any securities. T his presentation and anything contained herein are not a basis for any contract or undertaking, and are not to be relied upon in such context. The information provided in t he presentation is not a basis for the making of any investment decision, nor a recommendation or an opinion, nor a substitute for the discretion of a potential investor.

Traded on Nasdaq and TASE Billion $ Verticals • Apparel e - commerce • DIY POS and online • Logistics Preliminary installations in all verticals Novel platform measurement technology Big data value added services • Personalization • Support retailing decisions Scaling up in 2018 with new customers 3 MYSZ Company HIGHLIGHTS

SIGNIFICANT EVENTS – CORPORATE MYSIZE 4 MYSZ January 2014 MySize founded July 2014 Raised ~ $1.35M (private investors) May - December 2015 Raised ~ $ 6.62 M (private investors) June 2016 Began trading on Nasdaq Capital Market August 2017 Won "Promising Startup" competition at Go eCommerce December 2017 Raised a $ 2.5 M February 2018 Raised ~ $ 6 M

SIGNIFICANT EVENTS – R& D MYSIZE 5 MYSZ March 2017 Launched " KatzID " for package measurement September 2015 Launched SizeUp – distance measurement app August 2017 TRUCCO launches TrueSize apparel measurement technology September - November 2017 Patent approval (USA, Japan and Russia) for measuring body parts tech January 2018 Launched body - measuring technology at CES March 2018 Launched SizeIT Smart Measuring Tape, SDK for Android June 2018 Launched QSize ™ Mobile Measurement Solution for QC in Apparel Manufacturing June 2018 Second USA patent approval

MYSIZE at a glance MYSZ 6 2014 Founded in Israel Patents granted in 3 regions 4 2 • Commercial agreements • Signed LOIs will foster 2018 growth 20 Employees in R&D, M&S and Management ~$18.5M Raised ~ 200 Retailer size charts supported Awards

The Executive TEAM Multidisciplinary and Seasoned Managers ELI WALLES COB • Manager of MS Berlin GMBH • Seasoned entrepreneur RONEN LUZON Founder & CEO • Serial entrepreneur • Founded Malers , global security company • Founded and led numerous startups • BSC in IT&BIS BILLY PARDO CPO • Senior Director of Product at Fourier Education • B.Sc. in computer sciences, MBA ODED SHUSHAN CTO • Founder/CEO MonkeyTech • Elite IDF Technology Unit • Officer of Computer Division IAF OR KLES CFO • Former KPMG Associate • CPA, MBA MYSZ 7

Double Award Winner for Innovation MYSZ 8

OPPORTUNITIES MARKETS MYSZ 9 TECHNOLOGY Apparel DIY Courier Utility Big Data Analytics Sensors Cloud Server Algorithms Consumer Retailer Consumer Courier Consumer The MySize proprietary, patented measurement algorithms are scalable to many different markets and can be deployed as customized solutions for a variety of markets to improve the customer experience

Innovative CUSTOMIZABLE PLATFORM TECHNOLOGY Serving Multi - billion $ Markets • White label solution • Integration with apparel e - tailers • Generates accurate size recommendations • Option for shared ID profiles • Downloadable app • Create measurement profiles of any space • Perfect for online/POS DIY market • White label solution • Integration with courier backoffice systems • Accurate, onsite DIM calculations TAM $ 3.6 B TAM $ 0.5 B TAM $ 3.25 B MYSZ 10

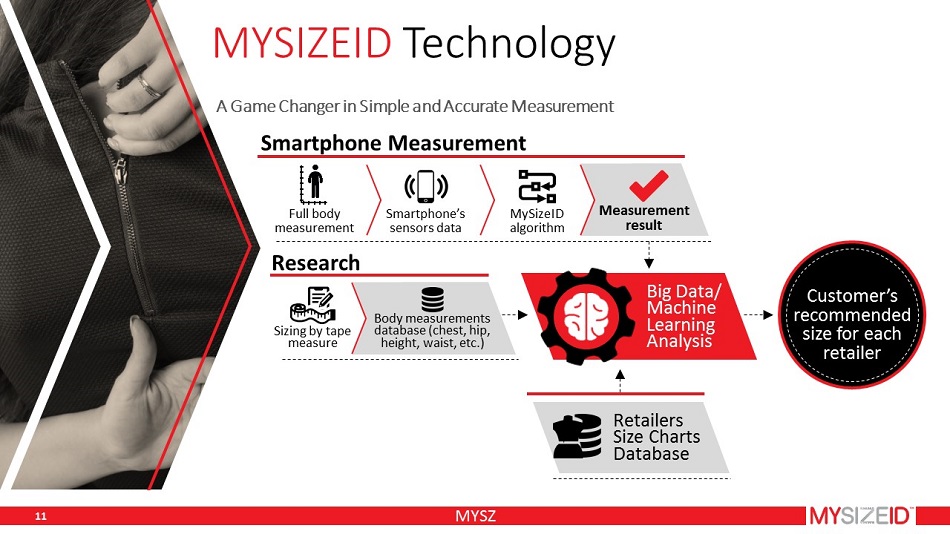

MYSIZEID Technology A Game Changer in Simple and Accurate Measurement Big Data/ Machine Learning Analysis Smartphone Measurement Full body measurement Smartphone’s sensors data MySizeID algorithm Measurement result Retailers Size Charts Database Sizing by tape measure Research Body measurements database (chest, hip, height, waist, etc.) Customer’s recommended size for each retailer 11 MYSZ

E - TAIL Industry Inaccurate measurements lead to lost revenue MEASUREMENT TECHNOLOGIES REDUCE RETURNS BY UP TO 50 % 80 % of returns are size related $ 19 B in size related returns in apparel in US alone ~ 70 % e - commerce shopping cart abandonment rate 30 % of all online purchases are returned $ 4 T lost revenue due to cart abandonment 12 MYSZ

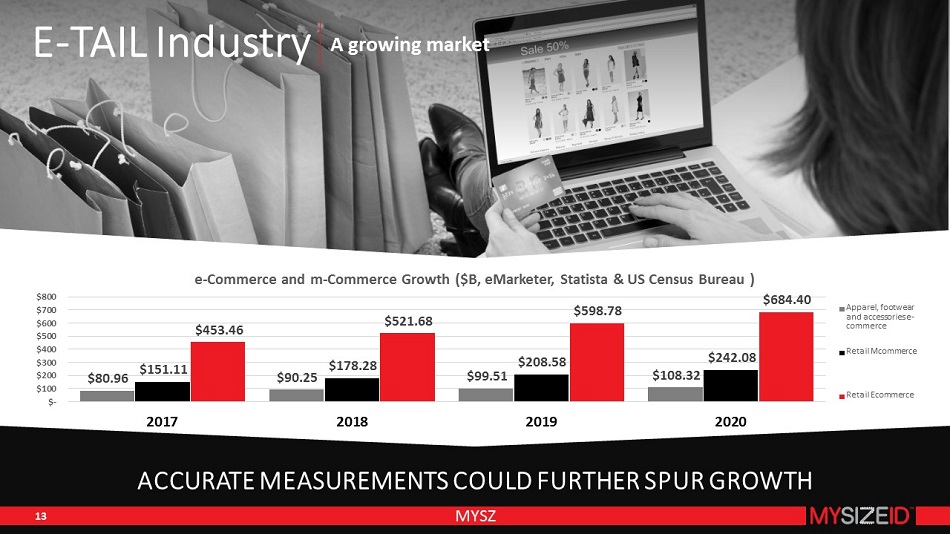

ACCURATE MEASUREMENTS COULD FURTHER SPUR GROWTH E - TAIL Industry A growing market 13 MYSZ $ 80.96 $ 90.25 $ 99.51 $ 108.32 $ 151.11 $ 178.28 $ 208.58 $ 242.08 $ 453.46 $ 521.68 $ 598.78 $ 684.40 $- $100 $200 $300 $400 $500 $600 $700 $800 2017 2018 2019 2020 Apparel, footwear and accessories e - commerce Retail Mcommerce Retail Ecommerce e - Commerce and m - Commerce Growth ($B, eMarketer , Statista & US Census Bureau )

MySizeID REVOLUTIONIZES Apparel e - Tailing Enabling e - tailers to focus on returning customers, not customer returns 14 MYSZ Big data and value added dashboard support customized offers, quality control and geo - location trend analysis Predictive 3 D measuring based on advanced algorithms with high accuracy User friendly measurement process takes less than a minute to complete Recommends a size match between partner retailers’ sizing charts and the customer’s generated sizing profile

MySizeID DIRECT Benefits Increase customer confidence INCREASE CONVERSIONS Improve sizing efficiencies REDUCE RETURN VOLUMES Improve customer experience INCREASE BRAND LOYALTY Valuable big data CUSTOMIZED OFFERINGS & IMPROVED QUALITY CONTROL 15 MYSZ Driving profitability through increased revenues and improved efficiencies

Data is the NEW OIL Customers Expect Personalization Relevant targeted communications drive revenue growth of 10 - 30 %, yet only 23 % of marketers are extremely satisfied with their ability to leverage data to create relevant experiences. 58 % of consumers place importance on personalized shopping experiences 57 % of consumers are willing to share personal data in exchange for personalized offers MySize Consumer Big Data offers Added Value Personalized retailing Logistics decisions Geo - location trend analysis Login My Accounts My Cart DASHBOARD Size by Location #Customers Item Size Location # 1003 # 1102 # 2289 # 2294 # 4942 L M 36 XL 52 1250 650 NYC Boston Keyword Search Conversion Item Conversion Rate Feb 2018 Items not in Size Garment Type #Users Real Size 52 28 52 28 38.5 ” 35 ” 38.5 ” 35 ” Pants T - Shirt Pants T - Shirt # of Return 40 30 20 10 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec # 1003 # 1102 # 2289 # 2294 223 298 Using MySizeID Without MySizeID MYSZ 16

MYSZ 17 Here’s how MYSIZEID works

Commercialization STRATEGY 18 1 6 11 16 21 26 31 Total e - commerce Sites on Platforms 6 M Pure play fashion sites account for 29 % of all websites creating a target market of over 1.7 M customer websites in apparel on 3 rd party platforms alone Partner with e - commerce 3 rd Party Platform Providers 01 Direct Partnerships with e - commerce Players 02 18 MYSZ % % % % % % % Sources: Twispay, Shopify, Digital Commerce 360

BUSINESS Model 19 MYSZ Model Customer MySize Revenue Commission to Partner MySize Net Revenue Monthly Subscription 3 rd Party Platform Websites $ 200 and up 20 % $ 160 and up Pay Per Click (“PPC”) Independent Websites $ 0.03 and up -- $ 0.03 PPC and up

A growing base of RETAIL PARTNERS MySizeID targets a $ 3.6 B Global TAM TRUCCO, LEADING SPANISH APPAREL RETAILER • MySize widget to be integrated on platform • Access to millions of users • Monthly license fee business model • Website integration pilot • Active in 20 countries • Over 240 shops • Beta site 3 rd party for small e - commerce PLATFORM 20 MYSZ

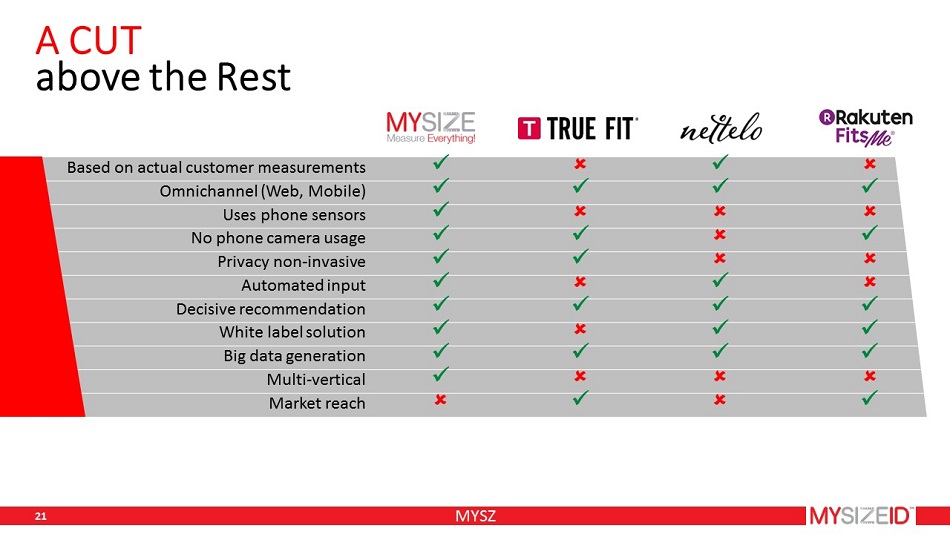

A CUT above the Rest x x Based on actual customer measurements x x x x Omnichannel (Web, Mobile) x Uses phone sensors x x x No phone camera usage x x Privacy non - invasive x x Automated input x x x x Decisive recommendation x x x White label solution x x x x Big data generation x Multi - vertical x x Market reach 21 MYSZ

SizeUp Air Measurement App with Machine Learning 850K downloads to date MYSZ 22

SizeUp Supports Online and Offline DIY Sales 23 MYSZ

SizeUp will Foster Growth of Online DIY Market Underserved Market poised for Growth DIY Market : $269B in 2016 to reach $341B in 2021 Currently 95.43 % offline 41 % growth in online sales ( 2016 - 2017 ) SizeUp Business Model royalties on sales 24 MYSZ

Here’s how SIZEUP works MYSZ 25

Introducing BoxSizeID DIM Measurement Tool MYSZ 26

LOGISTICS INDUSTRY ACCURATE MEASUREMENTS Combat Industry Inefficiencies 12 % of shipments arrive at logistical center with inaccurate measurements Billing errors can cost freight companies 3 - 7 % in additional costs Inaccurate measurements lead to 20 % sub - utilization of warehouse space due to inefficient slotting 27 MYSZ

BoxSizeID Streamlines DELIVERY MANAGEMENT ▪ Accurate parcel measurement and cost calculation ▪ Real - time DIM details for improved logistics ▪ Integration with ERP systems ▪ Barcode scan ▪ Image capture ▪ Geo - location tagging 28 MYSZ 28

BOXSIZEID Integrated at Israeli Courier Partner Revenues Increased by 2.5 % in Pilot • Parcel delivery service industry is growing 9 % annually • Projected to reach $ 343 B globally by 2020 • 43 % of global respondents in the warehousing and distribution space use parcel/ carton dimensioning • 30 % plan to support dimensioning of items in the future. 31 B 13 B 9 B Parcel shipping business is booming worldwide $ 60 B $ 96 B Units Parcel spend Shipped parcels worldwide 2014 2016 44 B 65 B TAM of $ 3.25 B based on $ 0.05 per package $ 22 B 29 MYSZ

Here’s how BOXSIZED works MYSZ 30

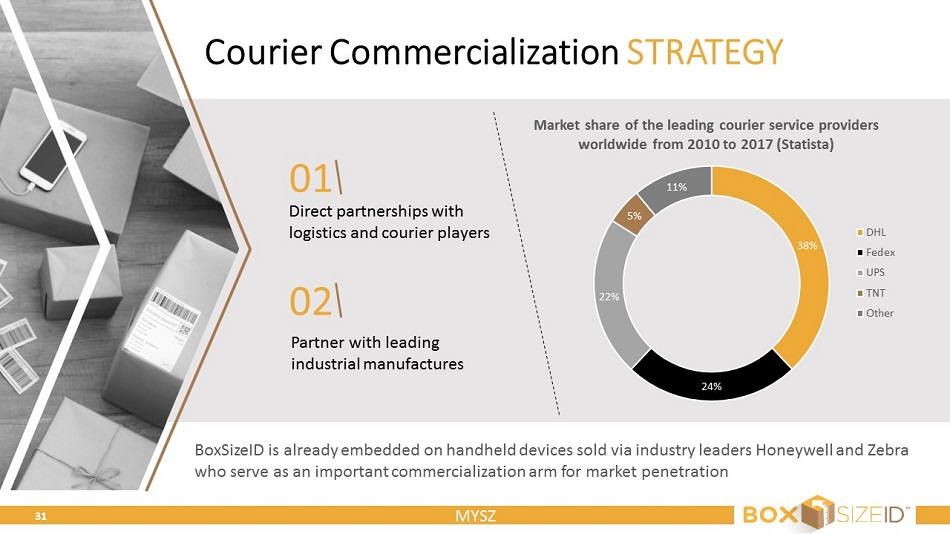

Courier Commercialization STRATEGY 31 01 Direct partnerships with logistics and courier players Partner with leading industrial manufactures 02 BoxSizeID is already embedded on handheld devices sold via industry leaders Honeywell and Zebra who serve as an important commercialization arm for market penetration 31 MYSZ 38 % 24 % 22 % 5 % 11 % Market share of the leading courier service providers worldwide from 2010 to 2017 (Statista) DHL Fedex UPS TNT Other

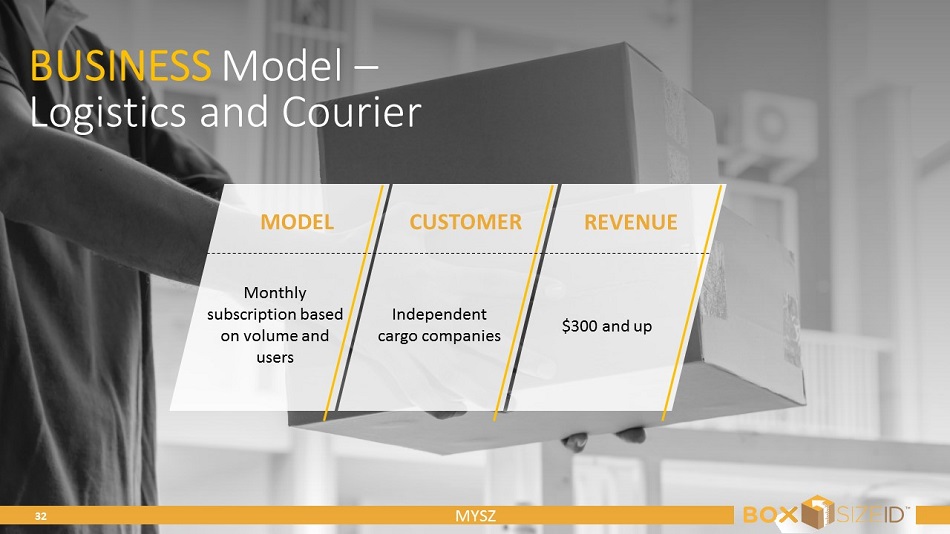

BUSINESS Model – Logistics and Courier 32 MYSZ MODEL CUSTOMER REVENUE Monthly subscription based on volume and users $ 300 and up Independent cargo companies

1 Growth Strategy Currently engaged in extensive beta - testing High volume, tier 1 prospects in North America and Western Europe Solutions for point of sale, e - commerce and logistics Expected commercialization in 12 month time frame Revenue sharing and licensing business models MYSZ 33

(in thousands) March 31 , 2018 December 31 , 2017 Cash and Cash Equivalents $ 9,395 $ 1,802 Current Assets 9,564 2,253 Long - term Assets 341 165 Total Assets $ 9,905 2,418 Total Current Liabilities* $4,943 $3,570 Long term Debt - - Other Long term liabilities - - Total Liabilities 4,943 3,570 Stockholders’ equity (deficit) 4,962 (1,152) Liabilities and stockholders’ equity $ 9,905 $2,418 Balance Sheet SNAPSHOT MYSZ 34 Traded on Nasdaq & TASE * Includes $4,307 in derivative liability with respect to warrants, options (see cap table, slide 35)

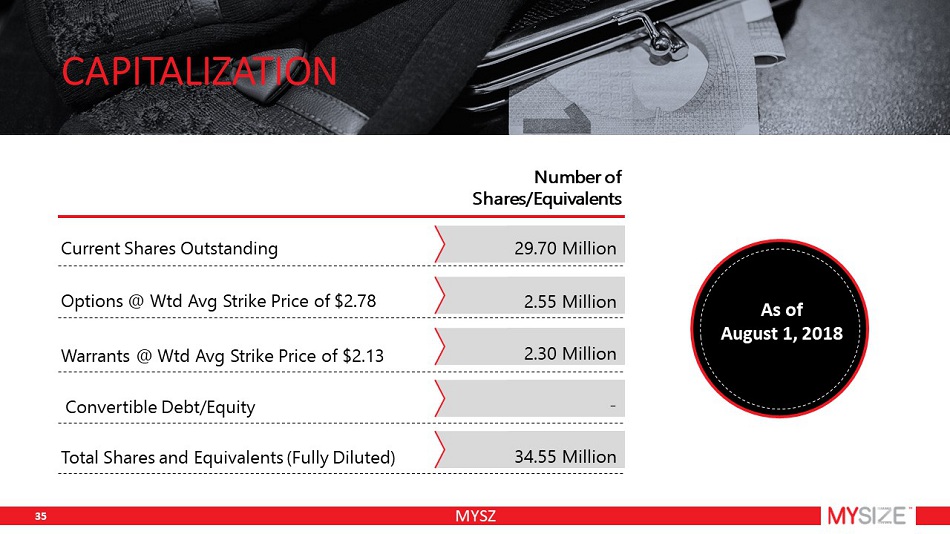

CAPITALIZATION Current Shares Outstanding Options @ Wtd Avg Strike Price of $2.78 Warrants @ Wtd Avg Strike Price of $2.13 Convertible Debt/Equity Total Shares and Equivalents (Fully Diluted) 29.70 Million 2.5 Million 2.3 Million - 34.55 Million Number of Shares/Equivalents As of August 1, 2018 MYSZ 35

MySize Brings NEXT GENERATION Measurements Driving profitability across multiple verticals ON TRACK FOR ADDITIONAL INTEGRATIONS IN 2018 Increasing revenues by fostering conversions Driving sales via valuable data and analytics Higher profitability due to reduced returns Increasing profitability with cost saving efficiencies MYSZ 36 Increasing margins via improved package measurement accuracy

THANK YOU! Contact At MySize Inc. Ronen Luzon/Eli Walles contact@mysizeid.com Contact At DarrowIR Peter Seltzberg 516 - 419 - 9915 pseltzberg@darrowir.com MYSZ 37

APPENDIX MYSZ 38

The Advisory BOARD DR. EREZ MORAG • Former Head of Nike's Athlete Performance Insight Group • CEO/Founder Acceler8 Performance MS. SIMCHA MUALEM • Senior lecturer at Shenkar College of Engineering, Design and Art • Collaborated with international designers MYSZ 39

The Sales TEAM MS. EMME STYLE

• Media, TV personality and model • Known advocate for positive body image MR. ARGUN ERSEN • Former Managing Partner of Deriva Location Based Analytics • Former Development Manager for PSC Scanning, Turkey Liaison office • Additional managerial positions at DataLogic and IBM MS. SUSAN MOSES • Leading expert on retail, advertising, fashion and media with a focus on plus sizes • Celebrity stylist and designer • Founder of Empowering Women NYC MR. CLAUDIO MENEGATTI • Former CEO of NJoy City • Highly experienced in e - commerce and online advertisements MYSZ 40