Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - My Size, Inc. | f10k2016ex32ii_mysizeinc.htm |

| EX-32.1 - CERTIFICATION - My Size, Inc. | f10k2016ex32i_mysizeinc.htm |

| EX-31.2 - CERTIFICATION - My Size, Inc. | f10k2016ex31ii_mysizeinc.htm |

| EX-31.1 - CERTIFICATION - My Size, Inc. | f10k2016ex31i_mysizeinc.htm |

| EX-23.2 - CONSENT OF WEINBERG & BAER LLC - My Size, Inc. | f10k2016ex23ii_mysizeinc.htm |

| EX-23.1 - CONSENT OF SOMEKH CHAIKIN - My Size, Inc. | f10k2016ex23i_mysizeinc.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - My Size, Inc. | f10k2016ex21i_mysizeinc.htm |

| EX-10.4 - SECURITIES PURCHASE AGREEMENT, DATED FEBRUARY 13, 2017 - My Size, Inc. | f10k2016ex10iv_mysizeinc.htm |

| EX-10.3 - CONSULTING AGREEMENT WITH PNO POLSKA S.P.Z.O.O. - My Size, Inc. | f10k2016ex10iii_mysizeinc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission file number 001-37370

MY SIZE, INC.

(Exact name of registrant as specified in charter)

| Delaware | N/A | |

| (State

or jurisdiction of Incorporation or organization) |

I.R.S

Employer Identification No. |

3 Arava St. P.O.B. 1026, Airport City, Israel, 7010000

[+972 72 3331002]

(Address, including zip code, and telephone number, including area code, of registrant’s principle executive offices)

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

(Name, address, including zip code, and telephone number, including area code, of agent for service)

(Issuer’s Telephone Number)

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.001 per share

Securities registered pursuant to Section 12(b) of the Act:

None

Title of Class

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒; No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10- K or any amendment to this Form 10- K. ☒;

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller Reporting Company ☒;

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes ☒ No ☐;

Number of shares of common stock outstanding as of April 12, 2017 was 17,605,359.

Documents Incorporated by Reference: None.

Table of Contents

General Background and Description of the Company

My Size Inc. (hereinafter: the “Company”) was incorporated and commenced operations in September 1999 as Topspin Medical, Inc., (“Topspin”), a private company registered in the State of Delaware. Topspin was engaged, through 2012, in research and development of a medical magnetic resonance imaging (“MRI”) technology for interventional cardiology and in the development of MRI technology for use in the diagnosis and treatment of prostate cancer.

On September 1, 2005, the Company issued securities to the public in Israel according to a prospectus and became publicly traded on the Tel Aviv Stock Exchange (“TASE”). In 2007, and until August 2012, the Company registered some of its securities with the U.S. Securities and Exchange Commission (“SEC”).

In January 2012, after having received the approval at the general meeting of shareholders of the company, the company consummated a transaction whereby it acquired Metamorefix Ltd. Pursuant to such transaction Metamorefix became wholly owned by the Company. Metamorefix Ltd. was incorporated in 2007, and was engaged in the development of innovative solutions for the rehabilitation of tissues, particularly skin tissues.

On August 21, 2012, the Company’s board of directors (the “Board”), approved the suspension of the Company’s reporting obligations under Section 13(a) and 15(d) of the Securities Exchange Act (the “De-Registration”). The Company thereafter filed a Form 15 with the SEC on September 5, 2012 to effect the De-Registration. Upon the filing of the Form 15, the Company’s obligation to file periodic and current reports with the SEC, including Forms 10-K, 10-Q and 8-K, was immediately suspended.

By the end of 2012, in view of the Company’s cash flow, the Company’s ceased its above operations and shortly thereafter the Company’s employees were laid off. In January 2013 the Company sold its entire ownership interest in Metamorefix Ltd..

In December 2013, the Company changed its name to Knowledgetree Ventures Inc. In January, 2014, the Board approved a transaction with Shoshana Zigdon, a related party, concerning the entering into of a technology venture through a new subsidiary, as discussed in “Shoshana Zigdon Agreement” below. On February 16, 2014, the Company changed its name to My Size, Inc.

On July 25, 2016, the Company’s common stock began publicly trading on the NASDAQ Capital Market (“NASDAQ”).

Transaction Involving Change in Control

In September 2013, Ronen Luzon, the Company’s current Chief Executive Officer, purchased control of the Company from Mr. Asher Shmuelevitch (the "Transaction"). Mr. Luzon purchased 1,755,950 shares from Mr. Shmuelevitch, which shares represented approximately 40% of the issued and outstanding share capital at such time, and thus he became a controlling shareholder of the Company.

Within the framework of the Transaction, Mr. Luzon reached a settlement with the Company's creditors pursuant to which the main creditor, Mr. Asher Shmuelevitch, was paid a total sum of New Israeli Shekel (“NIS”) 0.5 million, in consideration for a full and final waiver of any and all his claims that he may have relating to any monetary indebtedness of the Company to the creditors.

As a result of the various investment rounds in the Company, Mr. Luzon's holdings in the Company have been diluted and currently represent approximately 9.97% of the issued and outstanding shares of Common Stock of the Company.

| -1- |

Business Overview

The Company is a technology company whose strategy is based on the development of applications that can be utilized to accurately take measurements of a variety of items via a smartphone. By downloading the application to one’s smartphone, the user is then able to run the smartphone over the surface of an item the user wishes to measure. The information is then automatically sent to a cloud-based server where the dimensions are calculated through the company’s proprietary algorithms, and the accurate measurements (+ or - .78 of an inch) are then sent back to the users smartphone. We believe that the commercial applications for this technology are significant in many areas.

Currently, we are focusing on the following market segments:

| ● | E-commerce Apparel Industry – our main target-market; |

| ● | Courier Services; |

| ● | Do It Yourself (DIY) uses; and |

| ● | Usage as a Tape Measure. |

While we are currently devoting much of our focus on the applications for the apparel business, the Company believes that all of the above mentioned applications will be useful to users, retailers and vendors alike.

| -2- |

February 2014 Purchase Agreement

In February 2014, the Company entered into a Purchase Agreement (the “Agreement’) with Shoshana Zigdon (“Seller”), relating to the acquisition of certain rights in a venture for the accumulation of physical data of human beings by portable electronic devices (including smart phones, tablets and other portable devices) for the purpose of locating, based on the accumulated data, articles of clothing in internet apparel stores, which will fit the person whose measurements were so accumulated (the “Venture”). Prior to entering into the Agreement, in January 2014, the Agreement was approved by shareholders of the Company as the Seller was also a beneficial owner of over 20% of the Company.

Pursuant to the Agreement, the Company purchased the all of Seller’s rights, title and interest in and to the Venture, including but not limited to, the method (the “Method”) and the certain patent application that had been filed by Seller (PCT/IL2013/050056) (the “Patent”, and collectively with the Method, the “Assets”).

In consideration for the sale of the Assets, the Company agreed to pay to Seller, 18% of the Company's operating profit, directly or indirectly connected with the Venture and/or the Method and/or the commercialization of the Patent together with Value-added tax (“VAT”) in accordance with the law (the "Consideration") for a period of 7 years from the end of the development period of the Venture. The parties further agreed that Seller’s right to receive the Consideration will apply even in the event the Patent is revoked/rejected/expires and/or the non-receipt of the Patent for any reason. Down payments on account of the Consideration are to be paid to the Seller once quarterly, within 14 days from the approval of the reviewed financial reports of the Company, with the exception of the fourth quarter which will be paid after the approval of the audited financial reports of the Company. Payment will be made against a duly issued tax invoice as prescribed by law.

The Agreement may be terminated by either party in the event of a breach of the obligations of the other party and the failure to cure a default within a specified period of time. The Agreement further provides that Seller is entitled to repurchase the Assets from the Company upon the occurrence of one or more of the following events: (a) if an application for liquidation of the Company and/or an application for Appointment of a receiver for the Company and/or for a significant part of its assets has been filed, and/or an attachment has been imposed on a significant part of the Company's assets, and the application or attachment – as the case may be – has not been not canceled within 60 (sixty) days from the date on which they are filed; or (b) if upon the date that is 7 years from the date of execution of the Agreement, the amount of Company’s income, directly and/or indirectly accumulated from the Venture and/or the Method and/or the commercialization of the Patent is less than NIS 3.6 million (“Repurchase Events”).

In any such Repurchase Event occurs, Seller’s shall have a 90 day right, subject to delivery of written notice to the Company of Seller’s intention to exercise such right, to repurchase the Assets from the Company. The repurchase price will be based upon a market price to be determined by an external and independent valuer, who shall be chosen by agreement by the parties, and the audit committee shall conduct the negotiations on behalf of the Company to determine the identity of the valuer. In the absence of agreement on the identity of the valuer, the valuer shall be appointed by the president of the Institute of Certified Public Accountants in Israel. If one of the parties appeals against the valuation, with the Company's decision to appeal being made by the audit committee of the company, the parties shall approach another agreed valuer from one of the four large accounting firms in Israel (and in the absence of agreement he shall be chosen by the president of the Institute of Certified Public Accountants) and an average shall be taken of the two valuations which are received. The parties shall bear the valuers' fees and all the expenses of the valuation in equal shares. Unless Seller gives the Company written notice of the retraction of Seller’s intention to repurchase the Assets, the Seller shall be obligated to repurchase the Assets within 60 days from the date of receipt of the valuation. Seller shall have the right to retract its intention to repurchase the assets, provided Seller gives written notice to the Company within 30 days of receiving the valuation and subject to Seller refunding the Company the expenses borne by the Company in respect of the valuation (provided that the Company gives Seller details of the expenses borne by it).

In addition to the foregoing, the Agreement provides that all developments, improvements knowledge and know-how developed and/or accumulated by the Company after the execution of the Agreement will be owned by the Company. Further, the Seller agreed not to compete, directly or indirectly, with the Company in anything relating to the Assets and/or the Venture and/or the Method for a period of 7 years from the end of the development period of the Venture.

| -3- |

The Market - The Apparel Industry

The growth in online apparel shopping has been both a blessing and a curse for retailers. The blessing: what was a $60 billion apparel and accessories market in 2015 is projected to increase to $86.4 billion US dollars by 2018. The curse: while online apparel shopping is growing quickly, so too have customer returns, and nearly 20-30% of the time it is because of a bad fit.

For apparel retailers, both in retail and online, customer returns are a necessary pain point, backed by flexible return policies and in some instances, free return shipping. However, online retailers have higher operating costs as at least 30% of all products ordered online are returned, compared to 8.89% from retail stores, according to recent data. The U.S. Census Bureau estimated that total e-commerce sales for 2016 were $394.9 billion, an increase of 15.1% from 2015. Digging deeper, it can be learned that most online apparel retailers have average return rates of 15-20%, of which around 80% are fit-based. When translating these figures into hard currency, in the United States, online consumers returned $260 billion in merchandise to retailers last year, or 8% of all purchases (according to the National Retail Federation).

MySizeID

We are currently in development of an application (“MySizeID”) which assists the consumer to accurately take the measurements of his or her own body using a smartphone in order to fit clothing in the best way possible without the need to try the clothes on. The purpose of our application is to simplify the process of clothing acquisition through the internet and to significantly reduce the rate of returns of ill-fitting clothing which are acquired through the internet.

The app. is the result of a research and development effort that combines:

| ● | Anthropometric research – analyses of information pertaining to body measurements derived from a survey and the subsequent determination of correlations between body parts. | |

| ● | Body measurement algorithm research - an algorithm created by the Company to measure body parts. | |

| ● | Retailers size chart analyses – adopting a deep understanding of the size charts of retailers and the corresponding "body to garment size". |

MySizeID will operate based on the use of existing sensors in smart phones which enable, through a specific purpose application, the measurement of the body of consumers independently by moving the cellular phone along his or her body. The measurements will then be saved on the Company's cloud database, enabling the user to search for clothes in various retailer websites without worrying about size. When a search is made, the retailer will connect to the Company's cloud database and then only provides results based on the user's measurements and other parameters as he or she may have defined. This data will also be saved for use when a customer enters a brick and mortar store to help serve the customer more efficiently and to better the shopping experience.

As soon as the item is found and the acquisition is completed, the retailer will be charged a certain percentage of the acquisition price. The rate to be charged by MySize for the acquisition has not yet been fixed, and will be determined following negotiations with fashion companies, in a more advanced stage of the development.

How MySizeID Can be Utilized by the Apparel Industry

| 1. | MySizeID: This app. will let consumers create a secure, online profile of their personal measurements, which can then be utilized with partnered online retailers to insure that no matter the manufacturer or size chart, they will get the right fit. The MySizeID app. will utilize a patent-pending measurement technology that does not rely on user photographs or any additional hardware; all a user needs to do is scan their body with their smartphone and the app records their measurements. |

| 2. | In Store Shopping Tool: Users of MySizeID can allow brick and mortar merchants to access their profile to receive more personalized attention. This concierge like service enables a salesperson to better serve customers by accessing the user's size and style preferences to make the in-store shopping experience more pleasant, time efficient and satisfactory. |

| 3. | Cross Site Search Feature: The MySizeID profile will enable users to search for a specific product or item across multiple online retailers, but, unlike most shopping comparison shopping tools, MySizeID will deliver results that fit each individual user’s measurements. This feature can be customized for personalized filters that go beyond sizing and measurements, and can also include a user's favorite colors, brands, styles and more. |

| -4- |

The application is being designed to use a person’s body measurements to help determine correct apparel sizes when shopping on-line. To begin, the app will measure the hip breadth, and uses statistical, mathematical algorithms to recommend the most appropriate size trousers.

True Size

In November 2016, My Size introduced a new product called TrueSize.

TrueSize is a customizable, white-label, mobile application that empowers retailers to improve the online shopping experience of their customers by perfectly matching their true measurements with the retailer’s offerings. The level of accuracy and ease of use integrated into the retailer's website ensures that the customers will select the right size apparel every time, and we believe this will significantly reduce the amount of returns.

How Does TrueSize Work?

TrueSize has two components: a white label app. and a small application located on each page of the retailer's website. First, the customer downloads the TrueSize app., branded to a specific retailer’s website, and signs in, using the same credentials used for the online store. The application will then guide the customer through the process.

Using the TrueSize app., the customer next takes accurate measurements of an item of clothing from their wardrobe by placing the smartphone first on one end of the item and then on the other end. The app. will then prompt the user to take several different measurements to get a complete reading. The information pertaining to each item is then saved, but can be updated at any time.

Measurements are next stored in the cloud and a recommended size for the user is calculated. The user may continue shopping directly from the app. by clicking the “Go Shopping“ button, which will direct them to the retailer's mobile website.

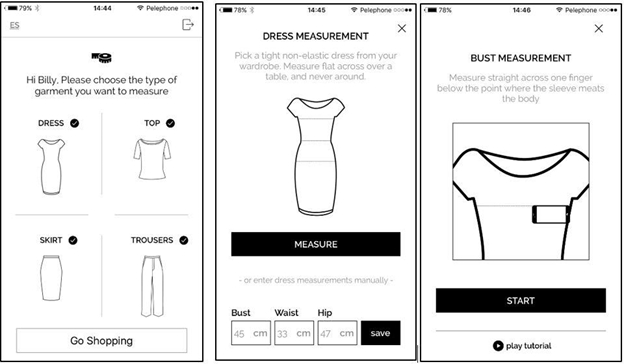

The chart below illustrates how consumers can interact with the prompts from the TrueSize app.

| -5- |

Shopping with TrueSize:

A “TrueSize” widget in the form of a button is located in proximity to the size selection feature on each product page of the retailer’s website. If the customer has signed in to the site and has already downloaded the TrueSize App and taken measurements, a recommended size will automatically appear in the widget. Users then have the option to manually update their size parameters – height, weight, and an item’s parameters – at any time by simply clicking on the widget.

If the customer has not yet signed, a prompt will appear requesting the customer to do so.

The first customer to use the TrueSize technology is IN SITU S.A., the owner of the rights to the fashion brand-name TRUCCO (the “Trucco Project”).

The Trucco Project is currently in the development stage and, and is being designed in conjunction with Trucco, so that Trucco customers can use it in the following manner:

Stage 1 – Trucco consumers will create their profile using our web service or through our mobile app by measuring garments out of their wardrobe.

Stage 2 – after creating their profile, the users will be able to log into Trucco online shop using their Trucco ID (received after creating their profile) and selecting the type of garment they would like to buy.

Stage 3 – Trucco servers will retrieve the user information from MySize servers and filter out only the items that match the users size.

Stage 4 – the users can then select the garments he or she like and proceed to checkout.

| -6- |

The launch of the Trucco Project is currently expected to take place in the second quarter of 2017. The Company’s success is currently substantially dependent upon the ongoing relationship with IN SITU S.A. and the achievement of the milestones for the Trucco project.

The Market - Courier Services

When an individual wishes to ship boxes from place to place, they often call a courier service. Currently, individuals will contact a courier service and request a pick up. The individual is then usually asked the dimensions of the package to be shipped. Unfortunately, the response given to the courier can be rather vague (big, medium small etc.). This is often the cause of much confusion between the individual shipper and the courier. This confusion can lead to the courier sending out the wrong vehicle for the pick-up and/or a large price differential than what was originally quoted by the courier causing customer dissatisfaction.

How MySize Can be Utilized for Courier Services

MySize operates based on the use of existing sensors in smart phones which enable, through a specific purpose application, to measure the dimensions of each package by moving the cellular phone along package (length, height and width) to be sent via courier. The measurements will then be saved on the Company's cloud database, and shared with the courier. This will allow for:

| ● | Courier services to provide accurate pricing to their consumers with little to no confusion. | |

| ● | Courier services can send the proper sized vehicle to pick up package(s). |

The courier service market in the United States alone had revenues of over $90 billion in 2014 (http:// marketrealist.com/2015/07/look-courier-service-industry-united-states/). Consequently, the Company views this as an excellent opportunity to create value in the courier market.

Agreement with Katz Delivery Services, LTD

On November 20, 2015, MySize entered into an agreement with Katz Deliveries, LTD (“Katz”), one of the largest courier services in Israel. Katz delivers about five million parcels per year (the most in Israel). Katz has more than 250 vehicles. Pursuant to our agreement with Katz, the parties have agreed to mutually work together to develop and integrate MySize technology with the technology of Katz to accurately monitor the volume of all parcels delivered to it for shipment by its clients. The goal is for Katz to use our technology to help with planning its distribution lines, thus reducing operational costs by adjusting the distribution vehicles to the volume of the shipments. MySize hopes to begin to see revenues from this endeavor by the second half of 2017, but is still in negotiations with Katz regarding terms of payment.

SizeUp

MySize is working on additional consumer applications. One of these applications is in the category of “Do It Yourself” (DIY). In this application, users will be able to visualize how an object or a piece of furniture will fit in an existing room in their home or office. As many people have difficulty with spatial recognition, the company hopes this will help alleviate the problem.

In the third quarter of 2015, My Size launched the SizeUp app, a smart tape measure for the Business to Consumer market. SizeUp is a project that MySize has already completed and launched. This application allows users to utilize their smartphone as a tape measurer. The application provides measurements with an accuracy +_- 2 cm. The SizeUp application is currently offered for free. In the first quarter of 2016, a 2nd version of SizeUp for the iOS operating system was released. It included the ability to measure both horizontal and vertical measurements. In January 2017, a 3rd version of SizeUp for the iOS operating system was released. It included an innovative air measurement algorithm which allows the user to measure over the air without the need to slide the phone over the surface during the measurement. Through February 2017, there have been over 200,000 downloads of the SizeUp app.

The first version of the SizeUp app for Android was released in March 2016. It included vertical measurement.

We expect to release an updated Android version by the third quarter of 2017 that will include also a very simple one-time calibration process for ensuring high accuracy.

Currently, the 3rd version of the SizeUp app. for iOS available for free. The Company’s plan, which has not been implemented, is for both versions of the SizeUp app (for Android and iOS) to be available for free for the first 30 days, where after a user will be required to pay to continue using it.

Research and Development

The Company has incurred research and development expenses of $727,000 in 2016 and $301,000 in 2015 relating to the development of its apps. and technologies. Most of the research and development expenses are for wages and for subcontractors. The Company expects to continue to incur these costs as continues to develop its products and technologies.

| -7- |

Income Sources - Projected Income

The Company business model currently contemplates four methods of producing revenue through its products:

| 1. | Fees - The Company intends to charge sellers a fee for every garment and clothing item purchased using its services, which fees are currently anticipated to be in the range of 1-3% of royalties on product sales, depending on volume, resulting from usage of the MySizeID platform. |

| 2. | Advertisements - the Company may generate revenue by using specialized ads using its database to identify the user's exact needs. |

| 3. | Second Hand Goods - the Company may offer its services for private sellers of garments and clothing, such as through "ebay" and the like. In this case, the seller will pay a fee if the purchase was made using the Company's application. |

| 4. | "Offline Shopping" - the Company may offer its services for clothing and fashion stores, for real-time use by their customers. The service may allow the store to immediately offer the customer a fitting garment suitable for his or her size. |

Competition

MySize believes that its technology and applications are a win-win solution for consumers, retailers, couriers and individuals. The Company's technology is protected by 4 patent-pending submissions, with a fifth patent application in process. MySize's products are designed to allow users to measure themselves simply by sliding a smartphone over their body, and the measurements are recorded by the MySize app.

Unlike other products claiming similar capabilities, there is no need for additional accessories (no webcam, photos, or measuring tape etc.). Users of the MySize apps will have their information protected and a unique id number is provided that matches personal sizes with retailer size charts. When consumers get the right size products, retailers get fewer returns.

My Size's advantage lies in its easy to use application in recording body measurements. Using special algorithmic equations, the software is able to determine which sizes will best fit the customer. The collection of this data, and tracking shoppers' preferences, allows for a unique shopping experience both online and in brick and mortar stores where the technology can instantly match clothes the customer likes in sizes that will fit them.

However, My Size does face competition in helping retailers increase conversation rate and reduce shipping costs.

Competitive Landscape

| Name | Technology | User Action | Product / Service | ||||

| True Fit | Algorithm driven engine matches manufacturer specs and data points with customer profile | Answer questions to create profile. | ● | True Fit Recommendation Engine | |||

| Fits.me | Software solution based on a personal avatar; Algorithm driven engine matches manufacturer specs and data points with customer profile | Answer questions to create profile | ● ● |

Virtual fitting room Size Recommendations

| |||

| Virtusize with | Compares a reference item the silhouette of the garment they are looking to buy | Reference items: a previous purchase or a favorite item | ● | garment-to-garment comparison. | |||

Some of our competitors have significantly greater financial, marketing, personnel and other resources than we do, and many of our competitors are well established in markets in which we have existing retailers or intend to locate new retailers. We may also need to evolve our concepts in order to compete with popular new retail formats or concepts that develop from time to time, and we cannot offer any assurance that we will be successful in doing so or that modifications to our concepts will not reduce our profitability.

Employees and Independent Contractors

We currently have 17 employees (some of which are independent contractors).

| -8- |

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors and the other information in this registration statement before investing in our common stock. Our business and results of operations could be seriously harmed by any of the following risks. The risks set out below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results. If any of the following events occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the value and trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Company and Our Business

We may never successfully develop any products or generate revenues.

We are a pre-revenue stage company with research, development, marketing and general and administrative expenses. We may be unable to successfully develop or market any of our current or proposed products or technologies, those products or technologies may not generate any revenues, and any revenues generated may not be sufficient for us to become profitable or thereafter maintain profitability. We have not generated any recurring revenues to date.

We have historically incurred significant losses and there can be no assurance when, or if, we will achieve or maintain profitability.

During the twelve months ended December 31, 2016, the Company realized a net loss of $4,334,000 compared with a net loss of $3,437,000 for the year ended December 31, 2015. Because of the numerous risks and uncertainties associated with the development of the Company’s products and business, we are unable to predict the extent of any future losses or when we will become profitable, if at all. Expected future operating losses will have an adverse effect on our cash resources, stockholders’ equity and working capital. Our failure to become and remain profitable could depress the value of our stock and impair our ability to raise capital, expand our business, maintain our development efforts, diversify our portfolio of staffing companies, or continue our operations. A decline in our value could also cause you to lose all or part of your investment in our Company.

For the purpose of financing its operating activities in the foreseeable future, the Company will need to rely on, in part, the collection of existing cash commitments from investors and the sale of marketable securities.

For the purpose of financing its operating activities in the foreseeable future, the Company will rely on the collection of existing cash commitments from investors, the sale of marketable securities and raising additional funds. The Company estimates that the committed investments will be adequate to fund its operations through the 12 months following the approval date of the financial statements. The Company fully expects to continue to collect on the committed investments however; the failure to collect these funds could give rise in the future to a situation regarding the Company's ability to continue its operation as a going concern. The financial statements include no adjustments for measurement or presentation of assets and liabilities, which may be required should the Company fail to operate as a going concern.

We will need to raise additional capital to meet our business requirements in the future, which is likely to be challenging, could be highly dilutive and may cause the market price of our common stock to decline.

In order to meet our business objectives, we will need to raise additional capital, which may not be available on reasonable terms or at all. Additional capital would be used to accomplish the following:

| ● | financing our current operating expenses; | |

| ● | pursuing growth opportunities; | |

| ● | hiring and retaining qualified management and key employees; | |

| ● | responding to competitive pressures; | |

| ● | complying with regulatory requirements; and | |

| ● | maintaining compliance with applicable laws. |

| -9- |

To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of those securities could result in substantial dilution for our current stockholders. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then-outstanding. We may issue additional shares of our common stock or securities convertible into or exchangeable or exercisable for our common stock in connection with hiring or retaining personnel, option or warrant exercises, future acquisitions or future placements of our securities for capital-raising or other business purposes. The issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common stock to decline further and existing stockholders may not agree with our financing plans or the terms of such financings.

In addition, we may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Furthermore, any additional debt or equity financing that we may need may not be available on terms favorable to us, or at all. If we are unable to obtain such additional financing on a timely basis, we may have to curtail our development activities and growth plans and/or be forced to sell assets, perhaps on unfavorable terms, which would have a material adverse effect on our business, financial condition and results of operations.

The success of our business is highly dependent on being able to predict which applications and technologies will be successful, and on the market acceptance and timely release of those applications and technologies. If we do not accurately predict which applications and technologies will be successful, our financial performance will be materially adversely affected.

We expect to derive most of our revenue by charging fees in connection with the usage of our applications and technologies. We must make product development decisions and commit significant resources well in advance of the anticipated introduction of new applications technologies. The release of our applications and technologies may be delayed, may not succeed or may have a shorter life cycle than anticipated. If the applications are not released when anticipated or do not attain wide market acceptance, our revenue growth may never materialize, we may be unable to fully recover the resources we have committed, and our financial performance will be harmed.

We are substantially dependent on assets we purchased from an affiliated party, and if we lose the rights to such assets or the assets are repurchased for any reason, our ability to develop existing and new applications based upon these assets would be harmed, and our business, financial condition and results of operations would be materially and adversely affected.

Our business is substantially dependent upon assets that we acquired from Shoshana Zigdon. Pursuant to the Purchase Agreement, we acquired certain rights in a venture for the accumulation of physical data of human beings by portable electronic devices (including smart phones, tablets and other portable devices) for the purpose of locating, based on the accumulated data, articles of clothing in internet apparel stores, which will fit the person whose measurements were so accumulated (the “Venture”). Under the Purchase Agreement, we acquired Seller’s rights, title and interest in and to the Venture, including but not limited to, the method (the “Method”) and the certain patent application that had been filed by Seller (the “Patent”, and collectively with the Method, the “Assets”). Therefore, our ability to develop and commercialize our applications depends upon the effectiveness and continuation of the Purchase Agreement. If we lose the right to the Assets, our ability to develop existing and new drug applications would be harmed.

The Agreement may be terminated by either party in the event of a breach of the obligations of the other party and the failure to cure the default within a specified period of time. Further, Seller has the right to repurchase the Assets from us upon the occurrence of one or more of the following events: (a) if an application for liquidation of the Company and/or an application for Appointment of a receiver for the Company and/or for a significant part of its assets has been filed, and/or an attachment has been imposed on a significant part of the Company's assets, and the application or attachment – as the case may be – has not been not canceled within 60 (sixty) days from the date on which they are filed; or (b) if upon the completion of 7 years from the date of execution of the Agreement, amount of Company’s income, directly and/or indirectly accumulated from the Venture and/or the Method and/or the commercialization of the Patent is less than NIS 3.6 million (“Repurchase Events”).

| -10- |

A more active, liquid trading market for our common stock may not develop, and the price of our common stock may fluctuate significantly.

Although our common stock is listed on the NASDAQ Capital Market, it has only been traded on the NASDAQ Capital Market since July 25, 2016. There has been relatively limited trading volume in the market for our common stock, and a more active, liquid public trading market may not develop or may not be sustained. Limited liquidity in the trading market for our common stock may adversely affect a stockholder’s ability to sell its shares of common stock at the time it wishes to sell them or at a price that it considers acceptable. If a more active, liquid public trading market does not develop, we may be limited in our ability to raise capital by selling shares of common stock and our ability to acquire other companies or assets by using shares of our common stock as consideration. In addition, if there is a thin trading market or “float” for our stock, the market price for our common stock may fluctuate significantly more than the stock market as a whole. Without a large float, our common stock would be less liquid than the stock of companies with broader public ownership and, as a result, the trading prices of our common stock may be more volatile and it would be harder for you to liquidate any investment in our common stock. Furthermore, the stock market is subject to significant price and volume fluctuations, and the price of our common stock could fluctuate widely in response to several factors, including:

| ● | our quarterly or annual operating results; | |

| ● | changes in our earnings estimates; | |

| ● | investment recommendations by securities analysts following our business or our industry; | |

| ● | additions or departures of key personnel; | |

| ● | changes in the business, earnings estimates or market perceptions of our competitors; | |

| ● | our failure to achieve operating results consistent with securities analysts’ projections; | |

| ● | changes in industry, general market or economic conditions; and | |

| ● | announcements of legislative or regulatory changes. |

The stock market has experienced extreme price and volume fluctuations in recent years that have significantly affected the quoted prices of the securities of many companies, including companies in the staffing industry. The changes often appear to occur without regard to specific operating performance. The price of our common stock could fluctuate based upon factors that have little or nothing to do with us and these fluctuations could materially reduce our stock price.

Changes in economic conditions, including continuing effects from the recent recession, could materially affect our business, financial condition and results of operations.

Because our customers are retailers, we, together with the rest of the retail industry, depend upon consumer discretionary spending. The recent recession, coupled with high unemployment rates, reduced home values, increases in home foreclosures, investment losses, personal bankruptcies and reduced access to credit and reduced consumer confidence, has impacted consumers’ ability and willingness to spend discretionary dollars. Economic conditions may remain volatile and may continue to repress consumer confidence and discretionary spending for the near term.

| -11- |

Damage to our reputation or lack of acceptance of our brand in existing and new markets could negatively impact our business, financial condition and results of operations.

We believe we are building a strong reputation for the quality of our technology, and we must protect and grow the value of our brand to continue to be successful in the future. Any incident that erodes consumer affinity for our brand could significantly reduce its value and damage our business. If guests perceive or experience a reduction in quality, or in any way believe we failed to deliver a consistently positive experience, our brand value could suffer and our business may be adversely affected.

In addition, our ability to successfully develop new retailers in new markets may be adversely affected by a lack of awareness or acceptance of our brand in these new markets. To the extent that we are unable to foster name recognition and affinity for our brand in new markets, our growth may be significantly delayed or impaired.

As a result, adverse economic conditions in any of these areas could have a material adverse effect on our overall results of operations. In recent years, certain of these states have been more negatively impacted by the housing decline, high unemployment rates and the overall economic crisis than other geographic areas. In addition, given our geographic concentration, negative publicity regarding any of our retailers in these areas could have a material adverse effect on our business and operations, as could other regional occurrences such as local strikes, terrorist attacks, increases in energy prices, adverse weather conditions, hurricanes, droughts or other natural or man-made disasters.

In particular, adverse weather conditions can impact guest traffic at our retailers, and, in more severe cases, cause temporary retail closures, sometimes for prolonged periods. Our business is subject to seasonal fluctuations, with retail sales typically higher during certain months, such as December. Adverse weather conditions during our most favorable months or periods may exacerbate the effect of adverse weather on guest traffic and may cause fluctuations in our operating results from quarter-to-quarter within a fiscal year.

Technology changes rapidly in our business, and if we fail to anticipate new technologies, the quality, timeliness and competitiveness of our products will suffer.

Rapid technology changes require us to anticipate which technologies and/or distribution platforms our products must take advantage of in order to make them competitive in the market at the time they are released. Therefore, we usually start our product development with a range of technical development goals that we hope to be able to achieve. We may not be able to achieve these goals, or our competition may be able to achieve them more quickly than we can. In either case, our products may be technologically inferior to competitive products, or less appealing to consumers, or both. If we cannot achieve our technology goals within the original development schedule of our products, then we may delay products until these technology goals can be achieved, which may delay or reduce revenue and increase our development expenses.

We rely upon third parties to provide distribution for our applications, and disruption in these services could harm our business.

We currently utilize, and plan on continuing to utilize over the current fiscal year, third party networking providers and distribution through companies including, but not limited to Apple and Google to distribute our technologies. If disruptions or capacity constraints occur, the Company may have no means of replacing these services, on a timely basis or at all. This could cause a material adverse condition for our operations and financial earnings.

We are dependent upon technology services, and if we experience damage, service interruptions or failures in our computer and telecommunications systems, our customer relationships and our ability to attract new customers may be adversely affected.

Our business could be interrupted by damage to or disruption of our computer and software systems, and we may lose data. Our customers’ businesses may be adversely affected by any system or equipment failure we experience. As a result of any of the foregoing, our relationships with our customers may be impaired, we may lose customers, our ability to attract new customers may be adversely affected and we could be exposed to contractual liability. Precautions in place to protect us from, or minimize the effect of, such events may not be adequate. If an interruption by damage to or disruption of our computer and telecommunications equipment and software systems occurs, we could be liable and the market perception of our services could be harmed.

We could be harmed by improper disclosure or loss of sensitive or confidential company, employee, associate or customer data, including personal data.

In connection with the operation of our business, we plan to store, process and transmit data, including personnel and payment information, about our employees, customers, associates and candidates, a portion of which is confidential and/or personally sensitive. Unauthorized disclosure or loss of sensitive or confidential data may occur through a variety of methods. These include, but are not limited to, systems failure, employee negligence, fraud or misappropriation, or unauthorized access to or through our information systems, whether by our employees or third parties, including a cyberattack by computer programmers, hackers, members of organized crime and/or state-sponsored organizations, who may develop and deploy viruses, worms or other malicious software programs.

Such disclosure, loss or breach could harm our reputation and subject us to government sanctions and liability under our contracts and laws that protect sensitive or personal data and confidential information, resulting in increased costs or loss of revenues. It is possible that security controls over sensitive or confidential data and other practices we and our third party vendors follow may not prevent the improper access to, disclosure of, or loss of such information. The potential risk of security breaches and cyberattacks may increase as we introduce new services and offerings, such as mobile technology. Further, data privacy is subject to frequently changing rules and regulations, which sometimes conflict among the various jurisdictions in which we provide services. Any failure or perceived failure to successfully manage the collection, use, disclosure, or security of personal information or other privacy related matters, or any failure to comply with changing regulatory requirements in this area, could result in legal liability or impairment to our reputation in the marketplace.

| -12- |

We might not be able to market our products.

We expend significant resources in our marketing efforts, using a variety of media, including social media venues. We expect to continue to conduct brand awareness programs and guest initiatives to attract and retain guests. These initiatives may not be successful, resulting in expenses incurred without the benefit of higher revenues. Additionally, some of our competitors have greater financial resources, which enable them to purchase significantly more advertising than we are able to purchase. Should our competitors increase spending on advertising and promotions or our advertising funds decrease for any reason, or should our advertising and promotions be less effective than our competitors, there could be a material adverse effect on our results of operations and financial condition.

Our business operations and future development could be significantly disrupted if we lose key members of our management team.

The success of our business continues to depend to a significant degree upon the continued contributions of our senior officers and key employees, both individually and as a group. Our future performance will be substantially dependent in particular on our ability to retain and motivate our Chief Executive Officer, and certain of our other senior executive officers. We currently do not have an employment agreement in place with these officers. The loss of the services of our CEO, senior officers or other key employees could have a material adverse effect on our business and plans for future development. We have no reason to believe that we will lose the services of any of these individuals in the foreseeable future; however, we currently have no effective replacement for any of these individuals due to their experience, reputation in the industry and special role in our operations. We also do not maintain any key man life insurance policies for any of our employees.

Our growth may strain our infrastructure and resources, which could slow our development of new retailers and adversely affect our ability to manage our existing retailers.

Our future growth may strain our retail management systems and resources, financial controls and information systems. Those demands on our infrastructure and resources may also adversely affect our ability to manage our existing retailers. If we fail to continue to improve our infrastructure or to manage other factors necessary for us to meet our expansion objectives, our operating results could be materially and adversely affected. Likewise, if sales decline, we may be unable to reduce our infrastructure quickly enough to prevent sales deleveraging, which would adversely affect our profitability.

Retailers have been the target of class-actions and other litigation alleging, among other things, violations of federal and state law.

Our customers are subject to a variety of lawsuits, administrative proceedings and claims that arise in the ordinary course of our business. In recent years, a number of retail companies have been subject to claims by guests, employees and others regarding issues such as safety, personal injury and premises liability, employment-related claims, harassment, discrimination, disability and other operational issues common to the retail industry. A number of these lawsuits have resulted in the payment of substantial damages by the defendants. We carry insurance programs with specific retention levels, for a significant portion of our risks and associated liabilities with respect to workers’ compensation, general liability, employer’s liability, health benefits and other insurable risks. The policy is limited to $3 million. Regardless of whether any claims against us are valid or whether we are ultimately determined to be liable, we could also be adversely affected by negative publicity, litigation costs resulting from the defense of these claims and the diversion of time and resources from our operations.

Our insurance policies may not provide adequate levels of coverage against all claims, and fluctuating insurance requirements and costs could negatively impact our profitability.

We believe our insurance coverage is customary for businesses of our size and type. However, there are types of losses we may incur that cannot be insured against or that we believe are not commercially reasonable to insure. These losses, if they occur, could have a material and adverse effect on our business and results of operations. In addition, the cost of workers’ compensation insurance, general liability insurance and directors and officers’ liability insurance fluctuates based on our historical trends, market conditions and availability. Additionally, health insurance costs in general have risen significantly over the past few years and are expected to continue to increase. These increases, as well as recently-enacted federal legislation requiring employers to provide specified levels of health insurance to all employees, could have a negative impact on our profitability, and there can be no assurance that we will be able to successfully offset the effect of such increases with plan modifications and cost control measures, additional operating efficiencies or the pass-through of such increased costs to our guests.

| -13- |

We may not be able to adequately protect our intellectual property, which, in turn, could harm the value of our brands and adversely affect our business.

Our ability to implement our business plan successfully depends in part on our ability to further build brand recognition using our trademarks, service marks and other proprietary intellectual property, including our names and logos and the unique ambiance of our retailers. We plan to register a number of our trademarks. We cannot assure you that our trademark applications will be approved. Third parties may also oppose our trademark applications, or otherwise challenge our use of the trademarks. In the event that our trademarks are successfully challenged, we could be forced to rebrand our goods and services, which could result in loss of brand recognition, and could require us to devote resources to advertising and marketing new brands.

If our efforts to register, maintain and protect our intellectual property are inadequate, or if any third party misappropriates, dilutes or infringes on our intellectual property, the value of our brands may be harmed, which could have a material adverse effect on our business and might prevent our brands from achieving or maintaining market acceptance. We may also face the risk of claims that we have infringed third parties’ intellectual property rights. If third parties claim that we infringe upon their intellectual property rights, our operating profits could be adversely affected. Any claims of intellectual property infringement, even those without merit, could be expensive and time consuming to defend, require us to rebrand our services, if feasible, divert management’s attention and resources or require us to enter into royalty or licensing agreements in order to obtain the right to use a third party’s intellectual property.

Any royalty or licensing agreements, if required, may not be available to us on acceptable terms or at all. A successful claim of infringement against us could result in our being required to pay significant damages, enter into costly license or royalty agreements, or stop the sale of certain products or services, any of which could have a negative impact on our operating profits and harm our future prospects.

Information technology system failures or breaches of our network security could interrupt our operations and adversely affect our business.

We will rely on our computer systems and network infrastructure across our operations. Our operations depend upon our ability to protect our computer equipment and systems against damage from physical theft, fire, power loss, telecommunications failure or other catastrophic events, as well as from internal and external security breaches, viruses, worms and other disruptive problems. Any damage or failure of our computer systems or network infrastructure that causes an interruption in our operations could have a material adverse effect on our business and subject us to litigation or actions by regulatory authorities. Although we employ both internal resources and external consultants to conduct auditing and testing for weaknesses in our systems, controls, firewalls and encryption and intend to maintain and upgrade our security technology and operational procedures to prevent such damage, breaches or other disruptive problems, there can be no assurance that these security measures will be successful.

We will incur increased costs and obligations as a result of being a public company in the United States.

We will incur significant legal, accounting and other expenses that we were not required to incur in the recent past. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time consuming and costly. We estimate that we will incur additional incremental costs per year associated with being a publicly-traded company; however, it is possible that our actual incremental costs of being a publicly-traded company will be higher than we currently estimate. In estimating these costs, we took into account expenses related to insurance, legal, accounting and compliance activities.

Furthermore, the need to establish the corporate infrastructure demanded of a public company may divert management’s attention from implementing our growth strategy, which could prevent us from improving our business, results of operations and financial condition. We have made, and will continue to make, changes to our internal controls and procedures for financial reporting and accounting systems to meet our reporting obligations as a publicly traded company. However, the measures we take may not be sufficient to satisfy our obligations as a publicly traded company.

Our compliance with complicated regulations concerning corporate governance and public disclosure has resulted in additional expenses. Moreover, our ability to comply with all applicable laws, rules and regulations is uncertain given our management’s relative inexperience with operating public companies.

We are faced with expensive, complicated and evolving disclosure, governance and compliance laws, regulations and standards relating to corporate governance and public disclosure. New or changing laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing compliance work.

Our failure to comply with all laws, rules and regulations applicable to U.S. public companies could subject us or our management to regulatory scrutiny or sanction, which could harm our reputation and stock price. Our efforts to comply with evolving laws, regulations and standards are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

| -14- |

Federal, state and local or Israeli tax rules may adversely impact our results of operations and financial position.

We are subject to federal, state and local taxes in the U.S., as well as local taxes in Israel in respect to our operations in Israel. Although we believe our tax estimates are reasonable, if the Internal Revenue Service (“IRS”) or other taxing authority disagrees with the positions we have taken on our tax returns, we could face additional tax liability, including interest and penalties. If material, payment of such additional amounts upon final adjudication of any disputes could have a material impact on our results of operations and financial position. In addition, complying with new tax rules, laws or regulations could impact our financial condition, and increases to federal or state statutory tax rates and other changes in tax laws, rules or regulations may increase our effective tax rate. Any increase in our effective tax rate could have a material impact on our financial results.

We may require additional capital to finance our operations in the future, but that capital may not be available when it is needed and could be dilutive to existing stockholders.

We may require additional capital for future operations. We plan to finance anticipated ongoing expenses and capital requirements with funds generated from the following sources:

| ● | cash provided by operating activities; |

| ● | available cash and cash investments; and |

| ● | capital raised through debt and equity offerings. |

Current conditions in the capital markets are such that traditional sources of capital may not be available to us when needed or may be available only on unfavorable terms. Our ability to raise additional capital, if needed, will depend on conditions in the capital markets, economic conditions and a number of other factors, many of which are outside our control, and on our financial performance. Accordingly, we cannot assure you that we will be able to successfully raise additional capital at all or on terms that are acceptable to us. If we cannot raise additional capital when needed, it may have a material adverse effect on our liquidity, financial condition, results of operations and prospects. Further, if we raise capital by issuing stock, the holdings of our existing stockholders will be diluted.

If we raise capital by issuing debt securities, such debt securities would rank senior to our common stock upon our bankruptcy or liquidation. In addition, we may raise capital by issuing equity securities that may be senior to our common stock for the purposes of dividend and liquidating distributions, which may adversely affect the market price of our common stock. Finally, upon bankruptcy or liquidation, holders of our debt securities and shares of preferred stock and lenders with respect to other borrowings will receive a distribution of our available assets prior to the holders of our common stock. Additional equity offerings may dilute the holdings of our existing stockholders or reduce the market price of our common stock, or both.

Our business is dependent upon continued market acceptance by consumers.

We are substantially dependent on continued market acceptance of our products by customers, and such customers are dependent upon regulatory and legislative forces. We cannot predict the future growth rate and size of this market.

If we are able to expand our operations, we may be unable to successfully manage our future growth.

Since inception, we have been planning for the expansion of our brand. Any such growth could place increased strain on our management, operational, financial and other resources, and we will need to train, motivate, and manage employees, as well as attract management, sales, finance and accounting, international, technical, and other professionals. In addition, we will need to expand the scope of our infrastructure and our physical resources. Any failure to expand these areas and implement appropriate procedures and controls in an efficient manner and at a pace consistent with our business objectives could have a material adverse effect on our business and results of operations.

Any future or current litigation could have a material adverse impact on our results of operations, financial condition and liquidity.

From time to time we may be subject to litigation, including potential stockholder derivative actions. Risks associated with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date have obtained directors and officers liability (“D&O”) insurance to cover some of the risk exposure for our directors and officers. Such insurance generally pays the expenses (including amounts paid to plaintiffs, fines, and expenses including attorneys’ fees) of officers and directors who are the subject of a lawsuit as a result of their service to the Company. There can be no assurance that we will be able to continue to maintain this insurance at reasonable rates or at all, or in amounts adequate to cover such expenses should such a lawsuit occur. While neither Delaware law nor our Certificate of Incorporation or bylaws require us to indemnify or advance expenses to our officers and directors involved in such a legal action, we expect that we would do so to the extent permitted by Delaware law. Without D&O insurance, the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service to the Company could have a material adverse effect on our financial condition, results of operations and liquidity.

| -15- |

Our prior operating results may not be indicative of our future results.

You should not consider prior operating results to be indicative of our future operating results. The timing and amount of future revenues will depend almost entirely on our ability to open new retailers while maintaining consistency in our existing retail. Our future operating results will depend upon many other factors, including:

| - | the level of product and price competition, |

| - | our success in expanding our business network and managing our growth, |

| - | the ability to hire qualified employees, and |

| - | the timing of such hiring and our ability to control costs. |

Requirements associated with being a reporting public company will require significant company resources and management attention.

Once the registration statement is effective by the SEC, we will be subject to the reporting requirements of the Exchange Act and the other rules and regulations of the SEC relating to public companies. We are working with independent legal, accounting and financial advisors to identify those areas in which changes should be made to our financial and management control systems to manage our growth and our obligations as an SEC reporting company. These areas include corporate governance, internal control, internal audit, disclosure controls and procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas, including our internal control over financial reporting. However, we cannot assure you that these and other measures we may take will be sufficient to allow us to satisfy our obligations as an SEC reporting company on a timely basis.

In addition, compliance with reporting and other requirements applicable to SEC reporting companies will create additional costs for us, will require the time and attention of management and will require the hiring of additional personnel and legal, audit and other professionals. We cannot predict or estimate the amount of the additional costs we may incur, the timing of such costs or the impact that our management’s attention to these matters will have on our business.

Our management controls a large block of our common stock that will allow them to control us.

As of the date of this prospectus, members of our management team beneficially own approximately 9.97% of our outstanding common stock. As such, management owns approximately 9.97% of our voting power. As a result, management may have the ability to control substantially all matters submitted to our stockholders for approval including:

| a) | election of our board of directors; |

| b) | removal of any of our directors; |

| c) | amendment of our Certificate of Incorporation or bylaws; and |

| d) | adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

| -16- |

In addition, management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Any additional investors will own a minority percentage of our common stock and will have minority voting rights.

Risks Related to the Common Stock

Our stock price is likely to be extremely volatile and our common stock is not listed on a stock exchange; as a result, stockholders may not be able to resell their shares at or above the price paid for them.

The market price of our common stock is likely to be extremely volatile and could be subject to significant fluctuations due to changes in sentiment in the market regarding our operations or business prospects, among other factors.

Among the factors that could affect our stock price are:

| ● | industry trends and the business success of our customers; |

| ● | actual or anticipated fluctuations in our quarterly financial and operating results that vary from the expectations of our management or of securities analysts and investors; |

| ● | our failure to meet the expectations of the investment community and changes in investment community recommendations or estimates of our future operating results; |

| ● | announcements of strategic developments, acquisitions, dispositions, financings, product developments and other materials events by us or our competitors; |

| ● | regulatory and legislative developments concerning our technology; |

| ● | litigation; |

| ● | general market conditions; |

| ● | other domestic and international macroeconomic factors unrelated to our performance; and |

| ● | additions or departures of key personnel. |

Sales by our stockholders of a substantial number of shares of our common stock in the public market could adversely affect the market price of our common stock.

A substantial portion of our total outstanding shares of common stock may be sold into the market at any time. While most of these shares are held by our principal stockholder, who is also an executive officer, and we believe that such holder has no current intention to sell a significant number of shares of our stock, if he were to decide to sell large amounts of stock over a short period of time (presuming such sales were permitted, given his affiliate status) such sales could cause the market price of our common stock to drop significantly, even if our business is doing well.

Further, the market price of our common stock could decline as a result of the perception that such sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and price that we deem appropriate.

| -17- |

Our preferred stock may have rights senior to those of our common stock which could adversely affect holders of common stock.

Although no preferred stock has been issued, Delaware law, and our Certificate of Incorporation give our Board of Directors the authority to issue additional series of preferred stock without a vote or action by our stockholders. The Board also has the authority to determine the terms of preferred stock, including price, preferences and voting rights. The rights granted to holders of preferred stock in the future may adversely affect the rights of holders of our common stock. Any such authorized class of preferred stock may have a liquidation preference – a pre-set distribution in the event of a liquidation – that would reduce the amount available for distribution to holders of common stock or superior dividend rights that would reduce the amount of dividends that could be distributed to common stockholders. In addition, an authorized class of preferred stock may have voting rights that are superior to the voting right of the holders of our common stock. Currently the Company has no issued or outstanding preferred stock.

We are a smaller reporting company and, as a result of the reduced disclosure and governance requirements applicable to such companies, our common stock may be less attractive to investors.

We are a smaller reporting company, (i.e. a company with less than $75 million of its voting equity held by affiliates) and we are eligible to take advantage of certain exemptions from various reporting requirements applicable to other public companies We have elected to adopt these reduced disclosure requirements. We cannot predict if investors will find our common stock less attractive as a result of our taking advantage of these exemptions. If some investors find our common stock less attractive as a result of our choices, there may be a less active trading market for our common stock and our stock price may be more volatile. There is currently no active market for our common stock.

We do not expect to pay any cash dividends in the foreseeable future.

We intend to retain our future earnings, if any, in order to reinvest in the development and growth of our business and, therefore, do not intend to pay dividends on our common stock for the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, and such other factors as our board of directors deems relevant. Accordingly, you may need to sell your shares of our common stock to realize a return on your investment, and you may not be able to sell your shares at or above the price you paid for them.

We can sell additional shares of common stock without consulting stockholders and without offering shares to existing stockholders, which would result in dilution of stockholders’ interests in MY SIZE, INC. and could depress our stock price.

Our Certificate of Incorporation authorizes 50,000,000 shares of common stock, of which 17,605,359 are currently outstanding, and our Board of Directors is authorized to issue additional shares of our common stock and preferred stock. Although our Board of Directors intends to utilize its reasonable business judgment to fulfill its fiduciary obligations to our then existing stockholders in connection with any future issuance of our capital stock, the future issuance of additional shares of our common stock or preferred stock convertible into common stock would cause immediate, and potentially substantial, dilution to our existing stockholders, which could also have a material effect on the market value of the shares.

Further, our shares do not have preemptive rights, which means we can sell shares of our common stock to other persons without offering purchasers in this offering the right to purchase their proportionate share of such offered shares. Therefore, any additional sales of stock by us could dilute your ownership interest in our Company.

| -18- |

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Form 10K contains certain forward- looking statements as defined by federal securities laws. For this purpose, forward- looking statements are any statements contained herein that are not statements of historical fact and include, but are not limited to, those preceded by or that include the words, “estimate”, “could”, “should”, “would”, “likely”, “may”, “will”, “plan”, “intend”, “believes”, “expects”, “anticipates”, “projected”, or similar expressions. Those statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those contemplated by such statements. The forward looking information is based on various factors and was derived using numerous assumptions. For these statements, we claim the protection of the “bespeaks caution” doctrine. Such forward-looking statements include, but are not limited to:

statements regarding our anticipated financial and operating results, including anticipated sources of revenues