Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - COOPER TIRE & RUBBER CO | tv500157_ex99-1.htm |

| 8-K - 8-K - COOPER TIRE & RUBBER CO | tv500157_8k.htm |

Exhibit 99.2

Company Update Second Quarter 2018 August 6, 2018

Safe Harbor Statement This presentation contains what the company believes are forward - looking statements related to future financial results and business operations for Cooper Tire & Rubber Company. Actual results may differ materially from current management forecasts and projections as a result of factors over which the company may have limited or no control. Information on certain of these risk factors and additional information on forward - looking statements are included in the company’s reports on file with the Securities and Exchange Commission and set forth at the end of this presentation. 2

Available Information You can find Cooper Tire on the web at coopertire.com. Our company webcasts earnings calls and presentations from certain events that we participate in or host on the investor relations portion of our website (http://coopertire.com/investors.aspx). In addition, we also make available a variety of other information for investors on the site. Our goal is to maintain the investor relations portion of the website as a portal through which investors can easily find or navigate to pertinent information about Cooper Tire, including: • our annual report on Form 10 - K, quarterly reports on Form 10 - Q, current reports on Form 8 - K, and any amendments to those reports, as soon as reasonably practicable after we electronically file that material or furnish it to the Securities and Exchange Commission (“SEC”); • information on our business strategies, financial results and selected key performance indicators; • announcements of our participation at investor conferences and other events; • press releases on quarterly earnings, product and service announcements and legal developments; • corporate governance information; and • other news and announcements that we may post from time to time that investors may find relevant. The content of our website is not intended to be incorporated by reference into this presentation or in any report or document we file with or furnish to the SEC, and any references to our website are intended to be inactive textual references only. 3

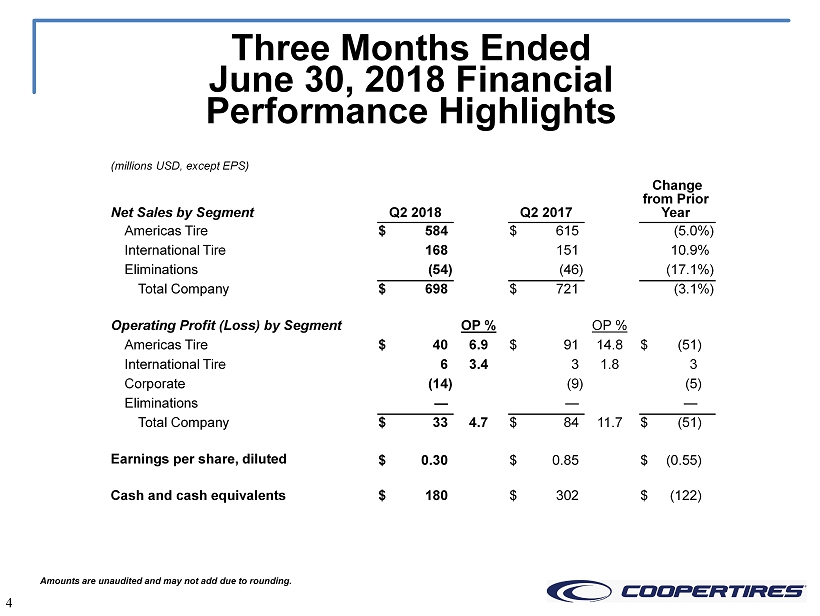

Three Months Ended June 30, 2018 Financial Performance Highlights 4 Amounts are unaudited and may not add due to rounding. (millions USD, except EPS) Net Sales by Segment Q2 2018 Q2 2017 Change from Prior Year Americas Tire $ 584 $ 615 (5.0 %) International Tire 168 151 10.9 % Eliminations (54 ) (46 ) (17.1 %) Total Company $ 698 $ 721 (3.1 %) Operating Profit (Loss) by Segment OP % OP % Americas Tire $ 40 6.9 $ 91 14.8 $ (51 ) International Tire 6 3.4 3 1.8 3 Corporate (14 ) (9 ) (5 ) Eliminations — — — Total Company $ 33 4.7 $ 84 11.7 $ (51 ) Earnings per share, diluted $ 0.30 $ 0.85 $ (0.55 ) Cash and cash equivalents $ 180 $ 302 $ (122 )

Six Months Ended June 30, 2018 Financial Performance Highlights 5 Amounts are unaudited and may not add due to rounding. (millions USD, except EPS) Net Sales by Segment Six Months Ended June 30, 2018 Six Months Ended June 30, 2017 Change from Prior Year Americas Tire $ 1,070 1,147 (6.7 %) International Tire 329 293 12.2 % Eliminations (99 ) (76 ) 29.8 % Total Company $ 1,300 $ 1,364 (4.7 %) Operating Profit (Loss) by Segment OP % OP % Americas Tire $ 72 6.7 $ 162 14.1 $ (90 ) International Tire 13 4.0 6 1.9 7 Corporate (26 ) (25 ) (1 ) Eliminations — (1 ) 1 Total Company $ 59 4.6 $ 142 10.4 $ (83 ) Earnings per share, diluted $ 0.46 $ 1.42 $ (0.96 ) Cash and cash equivalents $ 180 $ 302 $ (122 )

Operating Profit Walk Total Company Q2 2017 to Q2 2018 6 Amounts are unaudited and may not add due to rounding. * The adoption of ASU 2017 - 07 resulted in the reclassification of the 2017 net periodic benefit costs, excluding service costs, outside of operating profit to other pension and postretirement benefit expense. ($millions) $(20) million Net Price/Mix vs. Raw Materials $(51)

CTB Raw Material Price Index North America 7 Q2 2018 Average = 163.8 Q3 2018 is an estimate

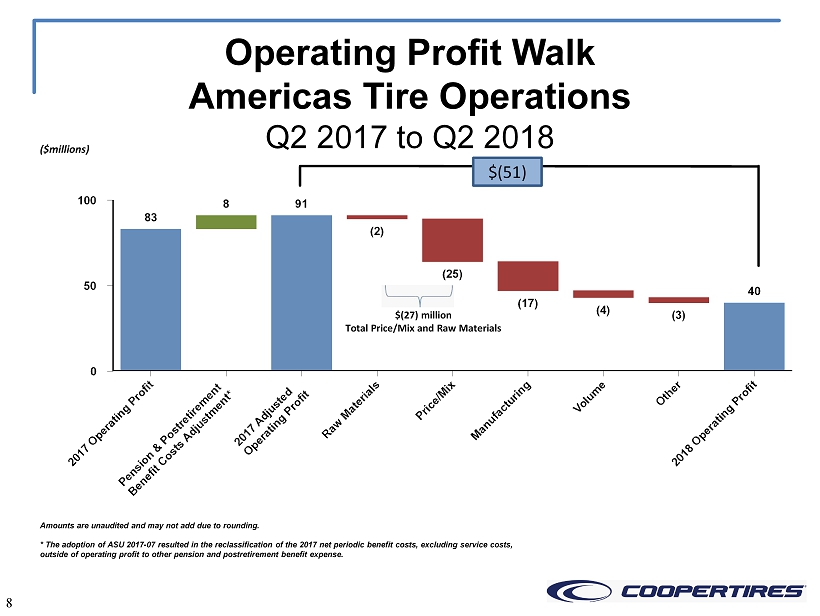

Operating Profit Walk Americas Tire Operations Q2 2017 to Q2 2018 8 Amounts are unaudited and may not add due to rounding. * The adoption of ASU 2017 - 07 resulted in the reclassification of the 2017 net periodic benefit costs, excluding service costs, outside of operating profit to other pension and postretirement benefit expense. ($millions) $(27) million Total Price/Mix and Raw Materials $(51)

Operating Profit Walk International Tire Operations Q2 2017 to Q2 2018 Amounts are unaudited and may not add due to rounding. * The adoption of ASU 2017 - 07 resulted in the reclassification of net periodic benefit costs, excluding service costs, outside of operating profit to other pension and postretirement benefit expense. 9 ($millions) $3 $6 million Net Price/Mix vs. Raw Materials

Non - GAAP Measures 10 Non - GAAP financial measures should be considered in addition to, not as a substitute for, other financial measures prepared in accordance with generally accepted accounting principles (“ GAAP”). The company’s methods of determining these non - GAAP financial measures may differ from the methods used by other companies for these or similar non - GAAP financial measures. Accordingly, these non - GAAP financial measures may not be comparable to measures used by other companies. Pursuant to the requirements of SEC Regulation G, detailed reconciliations between the company’s GAAP and non - GAAP financial results were posted, by incorporation within this presentation, on the company’s Investor Relations website at http://coopertire.com/investors.aspx on the day the company’s operating and financial results were announced for the quarter ended June 30, 2018 and management presented certain non - GAAP financial measures during a conference call with analysts and investors. Investors are advised to carefully review and consider this information as well as the GAAP financial results that are disclosed in the company’s earnings releases and annual and quarterly SEC filings.

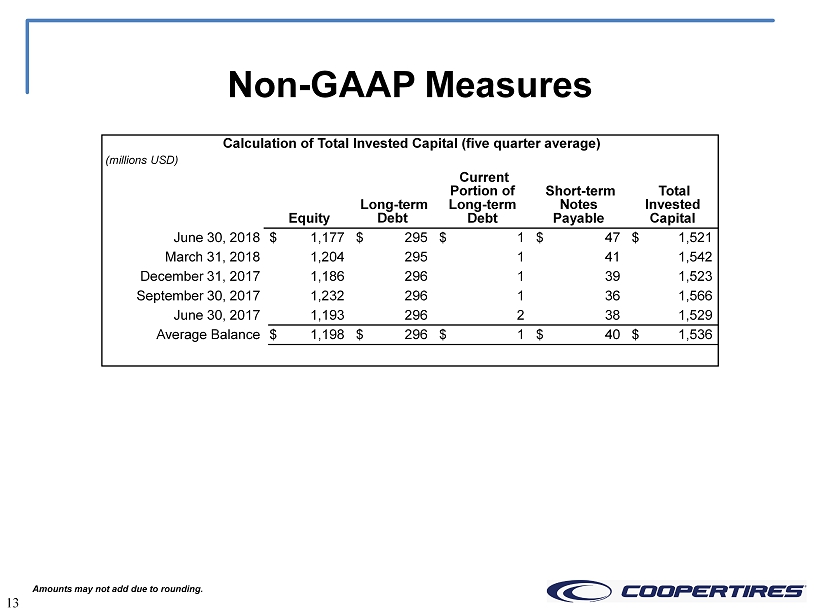

Non - GAAP Measures 11 Return on Invested Capital (ROIC) Management is using non - GAAP financial measures in this document because it considers them to be important supplemental measures of the company’s performance. Management also believes that these non - GAAP financial measures provide additional insight for analysts and investors in evaluating the company’s financial and operating performance. The company defines ROIC as the trailing four quarters’ after tax operating profit, utilizing the company's adjusted effective tax rate, excluding discrete Q4 2017 income tax items affecting comparability of results from period to period, divided by the total invested capital, which is the average of ending debt and equity for the last five quarters. The company believes ROIC is a useful measure of how effectively the company uses capital to generate profits. Calculation of Return on Invested Capital July 1, 2017 – June 30, 2018 (millions USD) Adjusted operating profit $ 226 Adjusted (non - GAAP) effective tax rate 30.2 % Income tax expense on adjusted operating profit 68 Adjusted operating profit after taxes $ 158 Total invested capital $ 1,536 Return on invested capital 10.3 % Amounts may not add due to rounding.

Non - GAAP Measures 12 Calculation of Trailing Four Quarter Income and Expense Inputs (millions USD) Quarter - ended: Operating profit as reported* ASU 2017 - 07 Reclassification* Adjusted operating profit Provision for income taxes as reported Adjustments to provision for income taxes** Adjusted (non - GAAP) provision for income taxes** Income before income taxes June 30, 2018 $ 33 $ — $ 33 $ 2 $ — $ 2 $ 18 March 31, 2018 26 — 26 3 — 3 12 December 31, 2017 47 9 56 80 68 12 39 September 30, 2017 101 9 111 32 — 32 95 Total $ 207 $ 19 $ 226 $ 118 $ 68 $ 50 $ 164 * - Prior to the adoption of ASU 2017 - 07 on January 1, 2018, all net periodic pension benefit costs were included within operati ng profit. Prior year quarters have been adjusted to reflect the adoption of the new accounting standard. ** - Fourth quarter 2017 provision for income taxes included $35 of deemed repatriation tax and $20 for the re - measurement of de ferred tax assets related to U.S. tax reform. Q4 2017 also included a U.K. valuation allowance charge of $19, less the reversal of an Asia val uat ion allowance of $7. These items have been excluded from the provision for income taxes as they are deemed to impact the comparability of results fro m period to period. Trailing Four Quarter Effective Tax Rate Adjusted (non - GAAP) provision for income taxes $ 50 Income before income taxes 164 Adjusted (non - GAAP) effective income tax rate 30.2 % Amounts may not add due to rounding.

Non - GAAP Measures 13 Calculation of Total Invested Capital (five quarter average) (millions USD) Equity Long - term Debt Current Portion of Long - term Debt Short - term Notes Payable Total Invested Capital June 30, 2018 $ 1,177 $ 295 $ 1 $ 47 $ 1,521 March 31, 2018 1,204 295 1 41 1,542 December 31, 2017 1,186 296 1 39 1,523 September 30, 2017 1,232 296 1 36 1,566 June 30, 2017 1,193 296 2 38 1,529 Average Balance $ 1,198 $ 296 $ 1 $ 40 $ 1,536 Amounts may not add due to rounding.

Risks 14 It is possible that actual results may differ materially from projections or expectations due to a variety of factors, includ ing but not limited to: • volatility in raw material and energy prices, including those of rubber, steel, petroleum - based products and natural gas or the unavailability of such raw materials or energy sources; • the failure of the company’s suppliers to timely deliver products or services in accordance with contract specifications; • changes to tariffs or trade agreements, or the imposition of new tariffs or trade restrictions, imposed on tires or materials or manufacturing equipment which the Company uses, including changes related to tariffs on automotive imports, as well as on tires, raw materials and tire - manufacturing equi pment imported into the U.S. from China; • changes in economic and business conditions in the world, including changes related to the United Kingdom’s decision to withd raw from the European Union; • the impact of the recently enacted tax reform legislation; • increased competitive activity including actions by larger competitors or lower - cost producers; • the failure to achieve expected sales levels; • changes in the Company’s customer or supplier relationships or distribution channels, including loss of particular business f or competitive, credit, liquidity, bankruptcy, restructuring or other reasons; • consolidation or other cooperation by and among the company’s competitors or customers; • the ultimate outcome of litigation brought against the company, including product liability claims, which could result in com mit ment of significant resources and time to defend and possible material damages against the company or other unfavorable outcomes; • a disruption in, or failure of, the company’s information technology systems, including those related to cybersecurity, could ad versely affect the company’s business operations and financial performance; • changes in pension expense and/or funding resulting from the company’s pension strategy, investment performance of the compan y’s pension plan assets and changes in discount rate or expected return on plan assets assumptions, or changes to related accounting regulations; • government regulatory and legislative initiatives including environmental, healthcare, privacy and tax matters; • volatility in the capital and financial markets or changes to the credit markets and/or access to those markets; • a variety of factors, including market conditions, may affect the actual amount expended on stock repurchases; the company’s abi lity to consummate stock repurchases; changes in the company’s results of operations or financial conditions or strategic priorities may lead to a modification, su spe nsion or cancellation of stock repurchases, which may occur at any time; • changes in interest or foreign exchange rates; • an adverse change in the company’s credit ratings, which could increase borrowing costs and/or hamper access to the credit ma rke ts; • failure to implement information technologies or related systems, including failure by the company to successfully implement ERP systems; • the risks associated with doing business outside of the U.S.; • the failure to develop technologies, processes or products needed to support consumer demand or changes in consumer behavior; • technology advancements; • the inability to recover the costs to develop and test new products or processes; • the impact of labor problems, including labor disruptions at the company, its joint ventures, or at one or more of its large cus tomers or suppliers; • failure to attract or retain key personnel; • inaccurate assumptions used in developing the company’s strategic plan or operating plans or the inability or failure to succ ess fully implement such plans or to realize the anticipated savings or benefits from strategic actions; • the costs and timing of restructuring actions and impairments or other charges resulting from such actions or from adverse in dus try, market or other developments; • risks relating to acquisitions including the failure to successfully integrate them into operations or their related financin gs may impact liquidity and capital resources; • changes in the company’s relationship with its joint - venture partners or suppliers, including any changes with respect to its fo rmer PCT joint venture’s production of Cooper - branded products; • the ability to find alternative sources for products supplied by PCT; • the inability to obtain and maintain price increases to offset higher production or material costs; • inability to adequately protect the company’s intellectual property rights; and • inability to use deferred tax assets.