Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RGC RESOURCES INC | a8k3rdquarterearningscall-.htm |

Third Quarter 2018 John S. D’Orazio, CEO Earnings conference call Paul W. Nester, CFO

Forward-Looking Statements The statements in this presentation by RGC Resources, Inc. (the "company") that are not historical facts constitute “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding earnings per share, EBITDA, future expansion opportunities, natural gas reserves and potential discoverable natural gas reserves, technological advances in natural gas production, comparison of natural gas consumption and natural gas production, cost of natural gas, including relativity to other fuel sources, demand for natural gas, possibility of system expansion, general potential for customer growth, relationship of company with primary regulator, future capital expenditures, current and future economic growth, estimated completion dates for Mountain Valley Pipeline ("MVP") milestones, potential of MVP to provide additional source of natural gas, additional capacity to meet future demands, increased capital spending and area expansion opportunity, potential new customers and rate growth in potential expansion area. Management cautions the reader that these forward- looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results may differ materially from those expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, financial challenges affecting expected earnings per share and EBITDA, technical, political or regulatory issues with natural gas exploration, production or transportation, impact of increased natural gas demand on natural gas price, relative cost of alternative fuel sources, lower demand for natural gas, regulatory, legal, technical, political or economic issues frustrating system or area expansion, regulatory, legal, technical, political or economic issues that may affect MVP, delay in completion of MVP, increase in cost to complete MVP, including by an increase in cost of raw materials or labor to due economic factors or regulatory issues such as tariffs, economic challenges that may affect the service area generally and customer growth or demand and deterioration of relationship with primary regulator, and those risk factors described in the company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which is available at www.sec.gov and on the company’s website at www.rgcresources.com. The statements made in this presentation are based on information available to the company as of the first day of the month set forth on the cover of this presentation and the company undertakes no obligation to update any of the forward-looking statements after the date of this presentation. 2

Agenda Key Operational and Financial Highlights 2018 Outlook Questions 3

Key Highlights Earnings per Share (EPS): Year-to-date ended June 30: 2018 2017 Basic: $0.88 $0.84 Diluted: $0.87 $0.84 4

Roanoke Gas Q3 Capital Expenditures Other Capital $0.2 $7.5 $6.5 Millions $5.5 SAVE Rider $4.5 $1.9 $3.5 2018 $2.5 2017 Customer Growth & System $1.5 Expansion $4.9 $0.5 Total Capital Expenditures $2.0 million, or 40% increase in capital spending 5

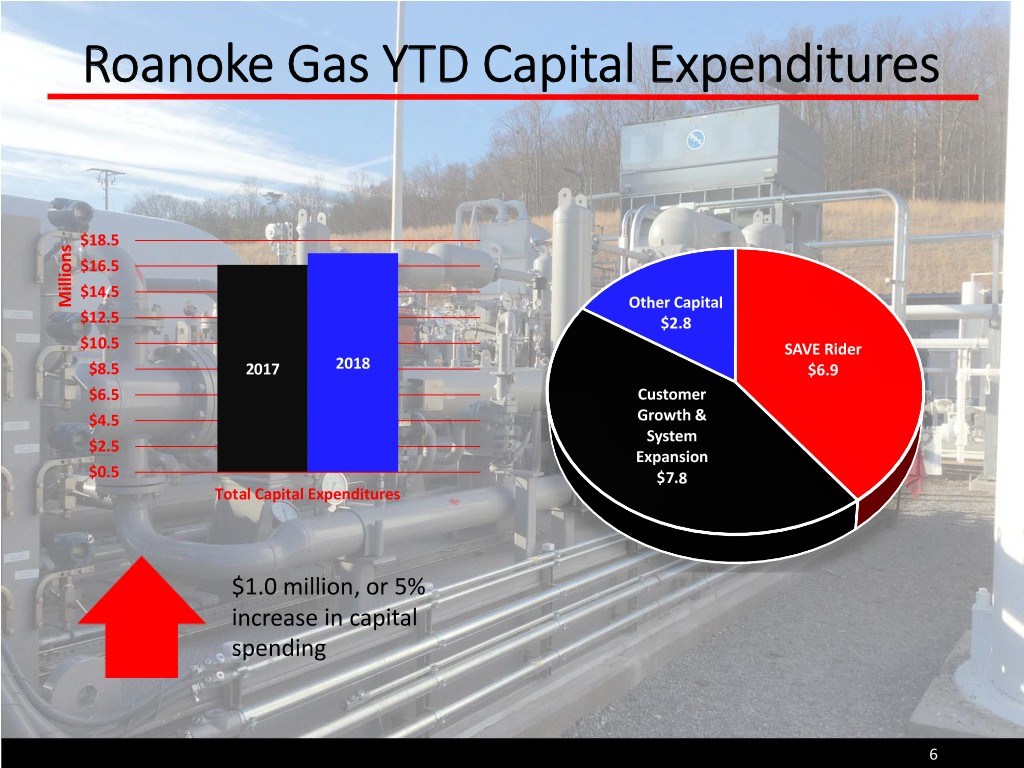

Roanoke Gas YTD Capital Expenditures $18.5 $16.5 $14.5 Millions Other Capital $12.5 $2.8 $10.5 SAVE Rider $8.5 2017 2018 $6.9 $6.5 Customer $4.5 Growth & System $2.5 Expansion $0.5 $7.8 Total Capital Expenditures $1.0 million, or 5% increase in capital spending 6

Customer Growth Average Customers (twelve-months ended June 30) 60,800 60,600 60,400 60,200 60,000 59,800 59,600 59,400 59,200 59,000 58,800 58,600 2015 2016 2017 2018 Consistent customer growth year over year since 2015 129 new customers in the third fiscal quarter 489 total new customers YTD ended June 30, 2018 7

Q3 Volume Growth Volumes Sold (DTH) 700 600 500 Thousands 400 300 200 100 - Residential Commercial Industrial Q3 2017 Q3 2018 2018 vs 2017 Residential 35% C&I 13% 8

YTD Volume Growth Volumes Sold (DTH) 4,000 3,500 3,000 2,500 Thousands 2,000 1,500 1,000 500 - Residential Commercial Industrial YTD 2017 YTD 2018 2018 vs 2017 Commercial 20% Industrial 4% Top 10 Customers 9% 9

Update . RGC Midstream investment up to $37 million . FERC approved and construction in progress . Targeted in-service first quarter 2019 . MVP Southgate Project RGC Midstream CapEx $20 $17 $15 $15 $10 $5 ($mm) $5 $0 2017A 2018E 2019E 10

Consolidated Financial Results 11

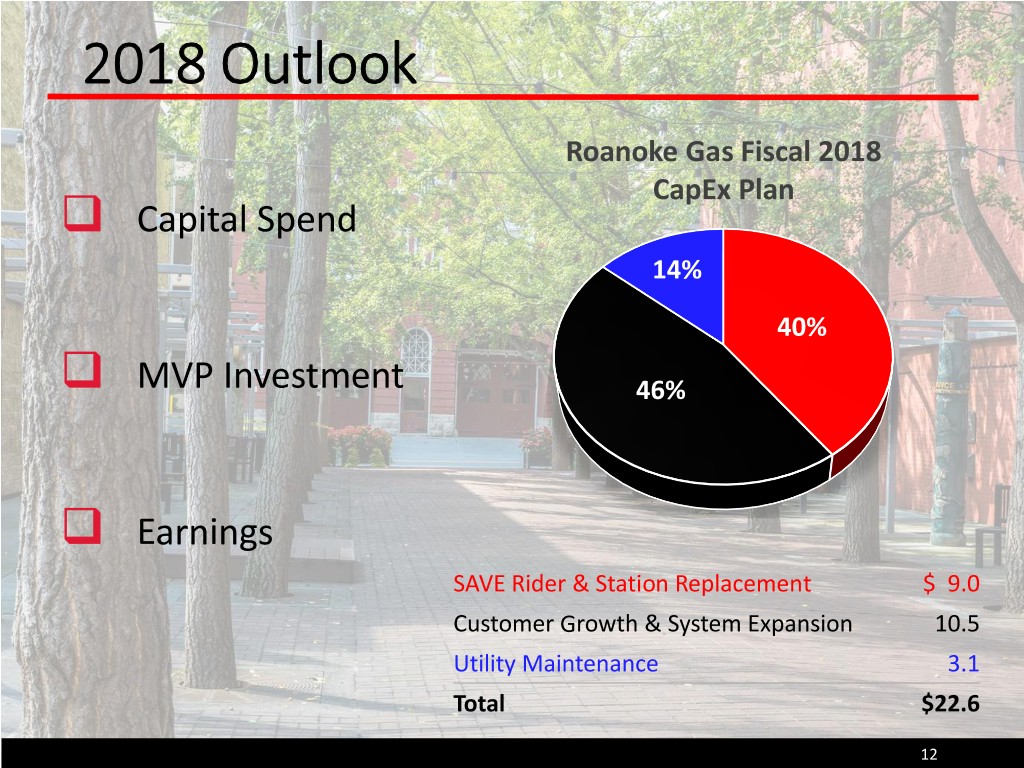

2018 Outlook Roanoke Gas Fiscal 2018 CapEx Plan Capital Spend 14% 40% MVP Investment 46% Earnings SAVE Rider & Station Replacement $ 9.0 Customer Growth & System Expansion 10.5 Utility Maintenance 3.1 Total $22.6 12

13