Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | a8-kpressreleasejune302018.htm |

| EX-99.1 - EXHIBIT 99.1 - Prestige Consumer Healthcare Inc. | exhibit991fy19-q1earningsr.htm |

| EX-3.2 - EXHIBIT 3.2 - Prestige Consumer Healthcare Inc. | exhibit32pbhbylaws.htm |

| EX-3.1 - EXHIBIT 3.1 - Prestige Consumer Healthcare Inc. | exhibit31certofamendment.htm |

Exhibit 99.2

This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements regarding the Company’s expected financial performance, including revenue growth, adjusted EPS, and adjusted free cash flow; the market position and consumption trends for the Company’s brands; the Company’s focus on brand-building; the timing and impact of the packaging rollout for BC & Goody’s and the impact of the divestiture of the Household Cleaning business. Words such as “trend,” “continue,” “will,” “expect,” “project,” “anticipate,” “likely,” “estimate,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, general economic and business conditions, regulatory matters, competitive pressures, supplier issues, consumer acceptance of new packaging, disruptions to distribution, unexpected costs or liabilities, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2018. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. All adjusted GAAP numbers presented are footnoted and reconciled to their closest GAAP measurement in the attached reconciliation schedules or in our August 2, 2018 earnings release in the “About Non-GAAP Financial Measures” section.

Q1 Revenue of $254.0 million (1.0%) versus PY Q1 – In-line with expectations – Consumption continues to meaningfully outpace revenue growth As expected, impacted by shipment timing of new BC/Goody’s packaging and change in revenue recognition accounting policies Adjusted EPS of $0.68(2), up 3.0% versus PY Q1 Gross Margin of 55.4%(2) up 20 bps sequentially versus Q4 FY 18 and up 80 bps since Q3 FY 18 – Continued progress on improving freight and warehouse costs Continued solid Adjusted Free Cash Flow of $53.6 million(2) Completed $50 million stock buyback program Completed transformation into focused consumer healthcare company with the divestiture of Household Cleaning – Enhances financial profile and further concentrates efforts around leading consumer healthcare brands – Proceeds used for debt paydown; enables future capital allocation optionality

Continues Brand-Building Efforts Launch of new packaging demonstrates on-going commitment to brand building efforts Packaging is a by-product of extensive studies, research, consumer insights and feedback Expect Revenue and Gross Margin headwinds from rollout to continue into Q2 – Impacted by gradual customer rollout and continued inventory build Began building inventory Products begin to arrive on Launch marketing of new product shelves of top customers campaign Q1 FY 19 Q2 FY 19 2H FY 19 First shipments of new Continue rollout to major Final Conversion of products accounts Remaining Customers Rollout of New Product to be Largely Complete by the End of FY 19

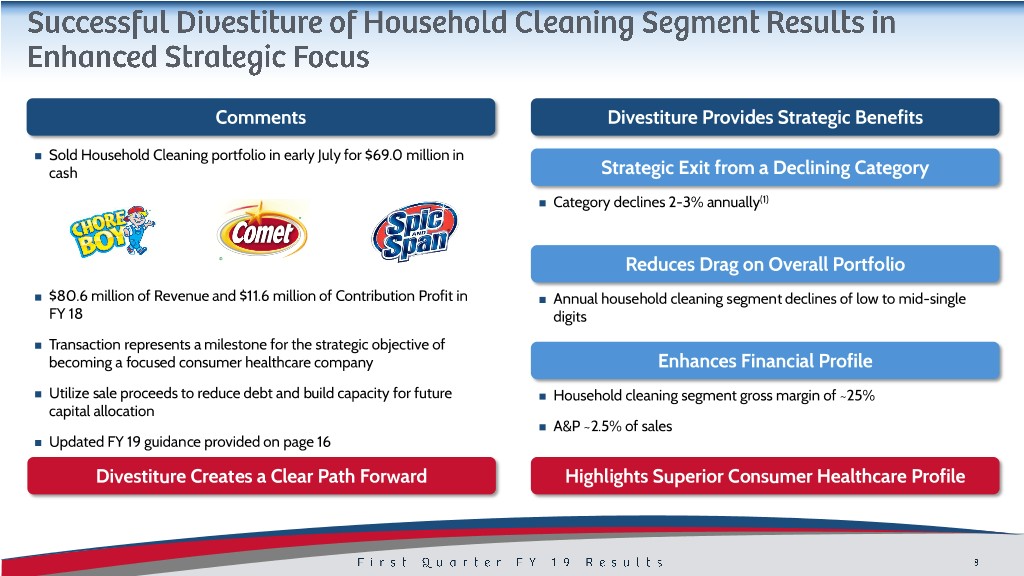

Comments Divestiture Provides Strategic Benefits Sold Household Cleaning portfolio in early July for $69.0 million in cash Strategic Exit from a Declining Category Category declines 2-3% annually(1) Reduces Drag on Overall Portfolio $80.6 million of Revenue and $11.6 million of Contribution Profit in Annual household cleaning segment declines of low to mid-single FY 18 digits Transaction represents a milestone for the strategic objective of becoming a focused consumer healthcare company Enhances Financial Profile Utilize sale proceeds to reduce debt and build capacity for future Household cleaning segment gross margin of ~25% capital allocation A&P ~2.5% of sales Updated FY 19 guidance provided on page 16 Divestiture Creates a Clear Path Forward Highlights Superior Consumer Healthcare Profile

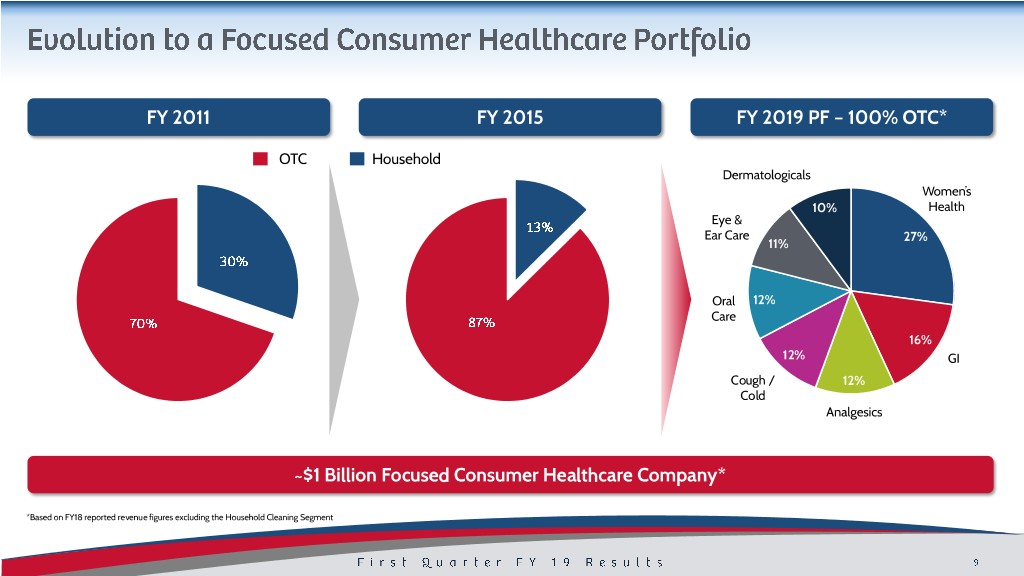

FY 2011 FY 2015 FY 2019 PF – 100% OTC* OTC Household Dermatologicals Women’s 10% Health Eye & Ear Care 27% 11% Oral 12% Care 16% 12% GI Cough / 12% Cold Analgesics ~$1 Billion Focused Consumer Healthcare Company* *Based on FY18 reported revenue figures excluding the Household Cleaning Segment

Overall financial performance in-line with expectations in the quarter: Needed? − Revenue of $254.0 million, a decrease of (1.0%) − Adjusted EPS(2) of $0.68, up 3.0% − Adjusted Free Cash Flow(2) decrease of (5.2%) to $53.6 million Q1 FY 19 Q1 FY 18 (1.0%) $254.0 $256.6 (9.2%) 3.0% (5.2%) $90.7 $82.4 $0.68 $0.66 $53.6 $56.5 Total Revenue Adjusted EBITDA(2) Adjusted EPS (2) Adjusted Free Cash Flow(2) Dollar values in millions, except per share data.

Q1 FY 19 Q1 FY 18 % Chg Revenue decline of (1.0)% Total Revenue 254.0$ 256.6$ (1.0%) (2) Adjusted Gross Profit 140.8 146.1 (3.6%) – Revenue growth impacted by transition to new BC / Goody’s % Margin 55.4% 56.9% packaging and change in revenue recognition accounting policies (2) Adjusted A&P 37.1 36.9 0.6% – Continue to expect revenue growth concentrated in 2H FY 19 % Total Revenue 14.6% 14.4% (2) (2) Adjusted G&A 22.5 19.8 13.6% Gross Margin of 55.4% % Total Revenue 8.9% 7.7% – Continued improvement efforts partially offset by BC / Goody’s D&A (ex. COGS D&A) 7.1 7.2 (1.2%) transition and revenue recognition % Total Revenue 2.8% 2.8% (2) Adjusted A&P(2) up $0.2 million from Q1 FY 18 Adjusted Operating Income 74.1$ 82.2$ (9.8%) % Margin 29.2% 32.0% Adjusted G&A(2) of 8.9% of Revenue (2) Adjusted Earnings Per Share 0.68$ 0.66$ 3.0% (2) – Timing-related; full-year expectation unchanged Adjusted EBITDA 82.4$ 90.7$ (9.2%) (2) % Margin 32.4% 35.4% Adjusted EPS up 3.0% from Q1 FY 18 Dollar values in millions, except per share data.

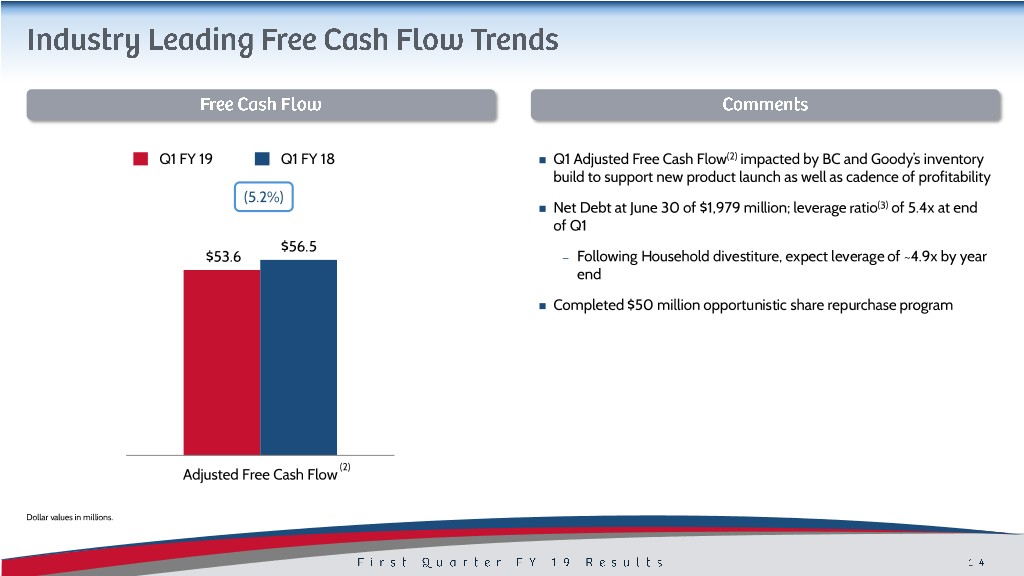

Q1 FY 19 Q1 FY 18 Q1 Adjusted Free Cash Flow(2) impacted by BC and Goody’s inventory build to support new product launch as well as cadence of profitability (5.2%) Net Debt at June 30 of $1,979 million; leverage ratio(3) of 5.4x at end of Q1 $56.5 $53.6 – Following Household divestiture, expect leverage of ~4.9x by year end Completed $50 million opportunistic share repurchase program (2) Adjusted Free Cash Flow Dollar values in millions.

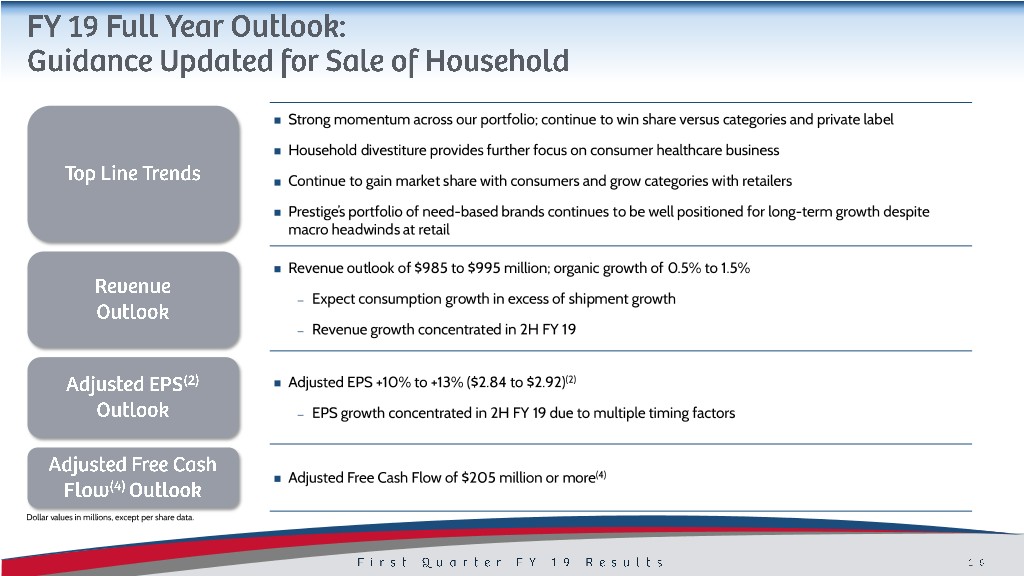

Strong momentum across our portfolio; continue to win share versus categories and private label Household divestiture provides further focus on consumer healthcare business Continue to gain market share with consumers and grow categories with retailers Prestige’s portfolio of need-based brands continues to be well positioned for long-term growth despite macro headwinds at retail Revenue outlook of $985 to $995 million; organic growth of 0.5% to 1.5% – Expect consumption growth in excess of shipment growth – Revenue growth concentrated in 2H FY 19 Adjusted EPS +10% to +13% ($2.84 to $2.92)(2) – EPS growth concentrated in 2H FY 19 due to multiple timing factors Adjusted Free Cash Flow of $205 million or more(4) Dollar values in millions, except per share data.

(1) Total category consumption is based on domestic IRI multi-outlet + C-Store retail dollar sales for the three year period ending 6- 17-18. (2) Adjusted Gross Profit, Adjusted Gross Margin, Adjusted A&P, Adjusted G&A, Adjusted EBITDA, Adjusted Operating Income, Adjusted Net Income, Adjusted EPS and Adjusted Free Cash Flow are Non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in the attached Reconciliation Schedules and / or in our earnings release in the “About Non-GAAP Financial Measures” section. (3) Leverage ratio reflects net debt / covenant defined EBITDA. (4) Adjusted Free Cash Flow for FY 19 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash Provided by Operating Activities in the attached Reconciliation Schedules and / or in our earnings release in the “About Non- GAAP Financial Measures” section and is calculated based on projected Net Cash Provided by Operating Activities less projected capital expenditures plus payments associated with acquisitions and the household divestiture.

Three Months Ended Jun. 30, Three Months Ended Jun. 30, 2018 2017 2018 2017 (In Thousands) (In Thousands) GAAP Total Revenues $ 253,980 $ 256,573 GAAP Advertising and Promotion Expense $ 37,111 $ 36,944 GAAP Advertising and Promotion Expense as a Percentage of GAAP Gross Profit $ 140,623 $ 143,476 GAAP Total Revenue 14.6% 14.4% GAAP Gross Profit as a Percentage of GAAP Total Revenue 55.4% 55.9% Adjustments: Adjustments: Integration, transition and other costs associated with Integration, transition and other costs associated with acquisitions - 39 assets held for sale and acquisitions 170 2,576 Total adjustments - 39 Total adjustments 170 2,576 Non-GAAP Adjusted Advertising and Promotion Expense $ 37,111 $ 36,905 Non-GAAP Adjusted Gross Margin $ 140,793 $ 146,052 Non-GAAP Adjusted Gross Margin as a Percentage of GAAP Total Non-GAAP Adjusted Advertising and Promotion Expense as a Revenues 55.4% 56.9% Percentage of GAAP Total Revenues 14.6% 14.4%

Three Months Ended Jun. 30, 2018 2017 (In Thousands) Three Months Ended Jun. 30, GAAP Net Income $ 34,466 $ 33,759 2018 2017 Interest expense, net 25,940 26,341 (In Thousands) Provision for income taxes 11,994 18,929 GAAP General and Administrative Expense $ 23,941 $ 20,410 Depreciation and amortization 8,372 8,507 GAAP General and Administrative Expense as a Percentage of Non-GAAP EBITDA 80,772 87,536 GAAP Total Revenue 9.4% 8.0% Non-GAAP EBITDA Margin 31.8% 34.1% Adjustments: Adjustments: Integration, transition and other costs associated with assets held for sale and acquisitions in Cost of Goods Sold 170 2,576 Integration, transition and other costs associated with Integration, transition and other costs associated with acquisitions assets held for sale and acquisitions 1,422 584 in Advertising and Promotion Expense - 39 Total adjustments 1,422 584 Integration, transition and other costs associated with assets held Non-GAAP Adjusted General and Administrative Expense $ 22,519 $ 19,826 for sale and acquisitions in General and Administrative Expense 1,422 584 Non-GAAP Adjusted General and Administrative Expense Total adjustments 1,592 3,199 Percentage as a Percentage of GAAP Total Revenues 8.9% 7.7% Non-GAAP Adjusted EBITDA $ 82,364 $ 90,735 Non-GAAP Adjusted EBITDA Margin 32.4% 35.4%

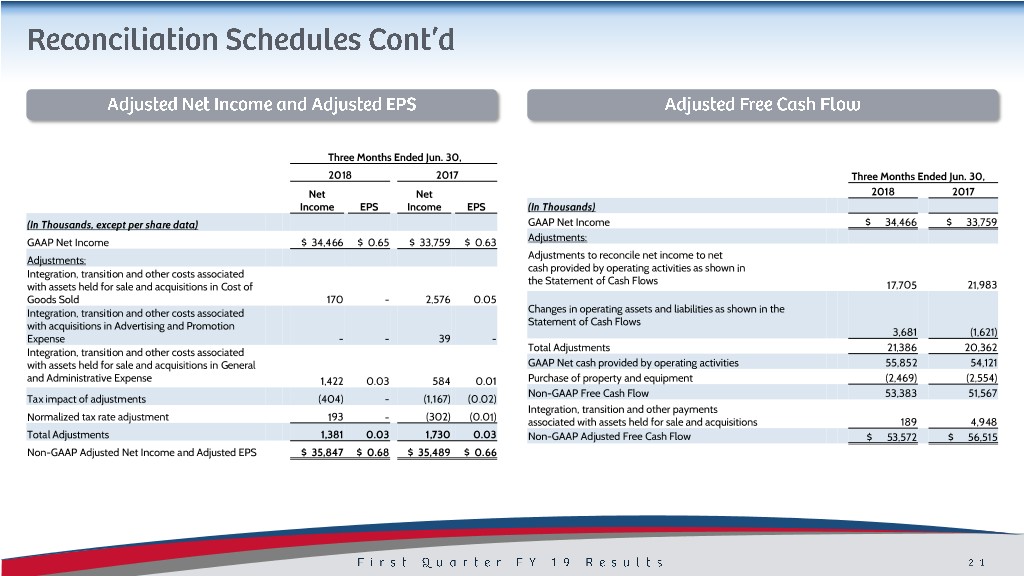

Three Months Ended Jun. 30, 2018 2017 Three Months Ended Jun. 30, Net Net 2018 2017 Income EPS Income EPS (In Thousands) (In Thousands, except per share data) GAAP Net Income $ 34,466 $ 33,759 GAAP Net Income $ 34,466 $ 0.65 $ 33,759 $ 0.63 Adjustments: Adjustments: Adjustments to reconcile net income to net cash provided by operating activities as shown in Integration, transition and other costs associated the Statement of Cash Flows with assets held for sale and acquisitions in Cost of 17,705 21,983 Goods Sold 170 - 2,576 0.05 Changes in operating assets and liabilities as shown in the Integration, transition and other costs associated with acquisitions in Advertising and Promotion Statement of Cash Flows 3,681 (1,621) Expense - - 39 - Integration, transition and other costs associated Total Adjustments 21,386 20,362 with assets held for sale and acquisitions in General GAAP Net cash provided by operating activities 55,852 54,121 and Administrative Expense 1,422 0.03 584 0.01 Purchase of property and equipment (2,469) (2,554) Non-GAAP Free Cash Flow 53,383 51,567 Tax impact of adjustments (404) - (1,167) (0.02) Integration, transition and other payments Normalized tax rate adjustment 193 - (302) (0.01) associated with assets held for sale and acquisitions 189 4,948 Total Adjustments 1,381 0.03 1,730 0.03 Non-GAAP Adjusted Free Cash Flow $ 53,572 $ 56,515 Non-GAAP Adjusted Net Income and Adjusted EPS $ 35,847 $ 0.68 $ 35,489 $ 0.66

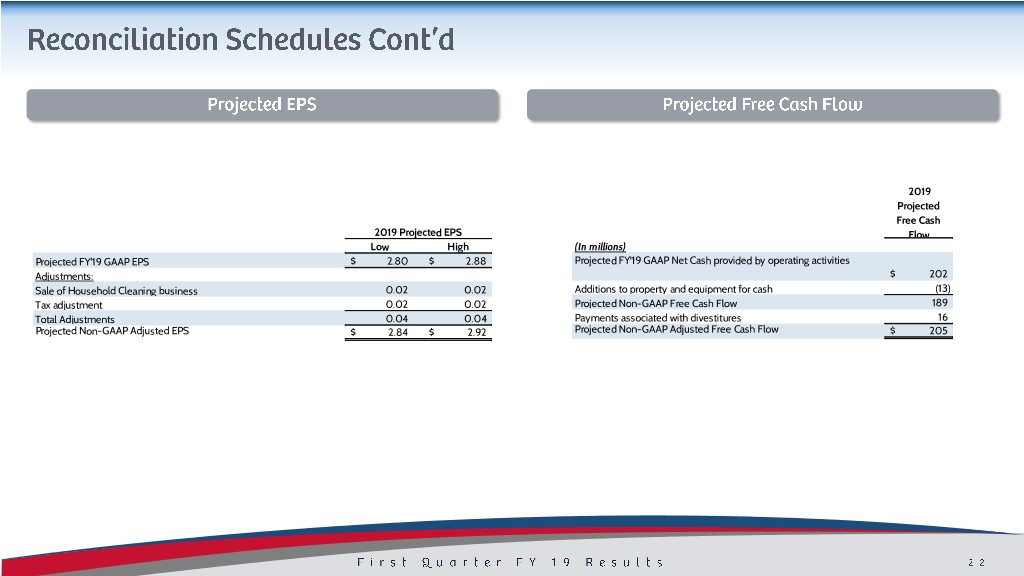

2019 Projected Free Cash 2019 Projected EPS Flow Low High (In millions) Projected FY'19 GAAP EPS $ 2.80 $ 2.88 Projected FY'19 GAAP Net Cash provided by operating activities Adjustments: $ 202 Sale of Household Cleaning business 0.02 0.02 Additions to property and equipment for cash (13) Tax adjustment 0.02 0.02 Projected Non-GAAP Free Cash Flow 189 Total Adjustments 0.04 0.04 Payments associated with divestitures 16 Projected Non-GAAP Adjusted EPS $ 2.84 $ 2.92 Projected Non-GAAP Adjusted Free Cash Flow $ 205