Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kennedy-Wilson Holdings, Inc. | kw201806308kq2earningsrele.htm |

Kennedy-Wilson Holdings, Inc.

Supplemental Financial Information

For the Quarter Ended June 30, 2018

TABLE OF CONTENTS

Supplemental Financial Information (unaudited) | ||

Components of Value | ||

Components of Value Summary | ||

All Property Multifamily and Commercial Investment Summary by Ownership | ||

Multifamily Investment Detail | ||

Commercial Investment Detail | ||

Unstabilized and Development Detail | ||

Debt Schedule | ||

Other Portfolio and Financial Information | ||

Appendix | ||

Cover

The property depicted on the cover of this earnings release and supplemental financial information is The Elysian in Cork, Ireland.

Certain terms used in this release are defined below under the caption "Common Definitions". Certain information included in

this release constitutes non-GAAP financial measures. For a definition of the non-GAAP financial measures used in this release, see "Common Definitions" below, and for a reconciliation of those measures to their most comparable GAAP measure, see the tables set forth in the Company's supplemental financial information available at www.kennedywilson.com.

| ||

Contact: Daven Bhavsar, CFA | ||

Director of Investor Relations | ||

(310) 887-3431 | ||

dbhavsar@kennedywilson.com | 151 S. El Camino Drive | |

www.kennedywilson.com | Beverly Hills, CA 90212 | |

NEWS RELEASE

KENNEDY WILSON REPORTS RECORD SECOND QUARTER 2018 RESULTS

BEVERLY HILLS, Calif. (August 1, 2018) - Kennedy-Wilson Holdings, Inc. (NYSE: KW) today reported results for 2Q-2018:

2Q | YTD | ||||||||||||||

(Amounts in millions, except per share data) | 2018 | 2017 | 2018 | 2017 | |||||||||||

GAAP Results | |||||||||||||||

GAAP Net Income to Common Shareholders | $109.6 | $9.4 | $107.2 | $10.2 | |||||||||||

Per Diluted Share | 0.77 | 0.08 | 0.74 | 0.09 | |||||||||||

Non-GAAP Results | |||||||||||||||

Adjusted EBITDA | $270.5 | $102.2 | $393.1 | $179.5 | |||||||||||

Adjusted Net Income | 170.9 | 51.0 | 234.1 | 93.7 | |||||||||||

*Please refer to pages 9-10 for a reconciliation of GAAP to Non-GAAP results.

"We are pleased to complete a record quarter that resulted in the highest level of profits in our Company's history" said William McMorrow, Chairman and CEO of Kennedy Wilson. "Our global team remains focused on completing our key development and value-add initiatives while growing our investment management platform both in the US and Europe."

2Q Highlights

• | Strong Same Property Performance with NOI up 6%: |

2Q - 2018 vs 2Q - 2017 | YTD - 2018 vs YTD - 2017 | |||||||||

Occupancy | Revenue | NOI | Occupancy | Revenue | NOI | |||||

Multifamily - Market Rate | (0.4)% | 4.7% | 5.6% | —% | 5.2% | 6.7% | ||||

Multifamily - Affordable | (0.1)% | 4.7% | 5.2% | (0.4)% | 5.3% | 6.3% | ||||

Commercial | 0.4% | 4.1% | 4.1% | 0.3% | 3.6% | 3.0% | ||||

Hotel | N/A | 8.8% | 15.5% | NA | 3.8% | 9.1% | ||||

Total | 5.3% | 5.6% | 4.3% | 4.9% | ||||||

3

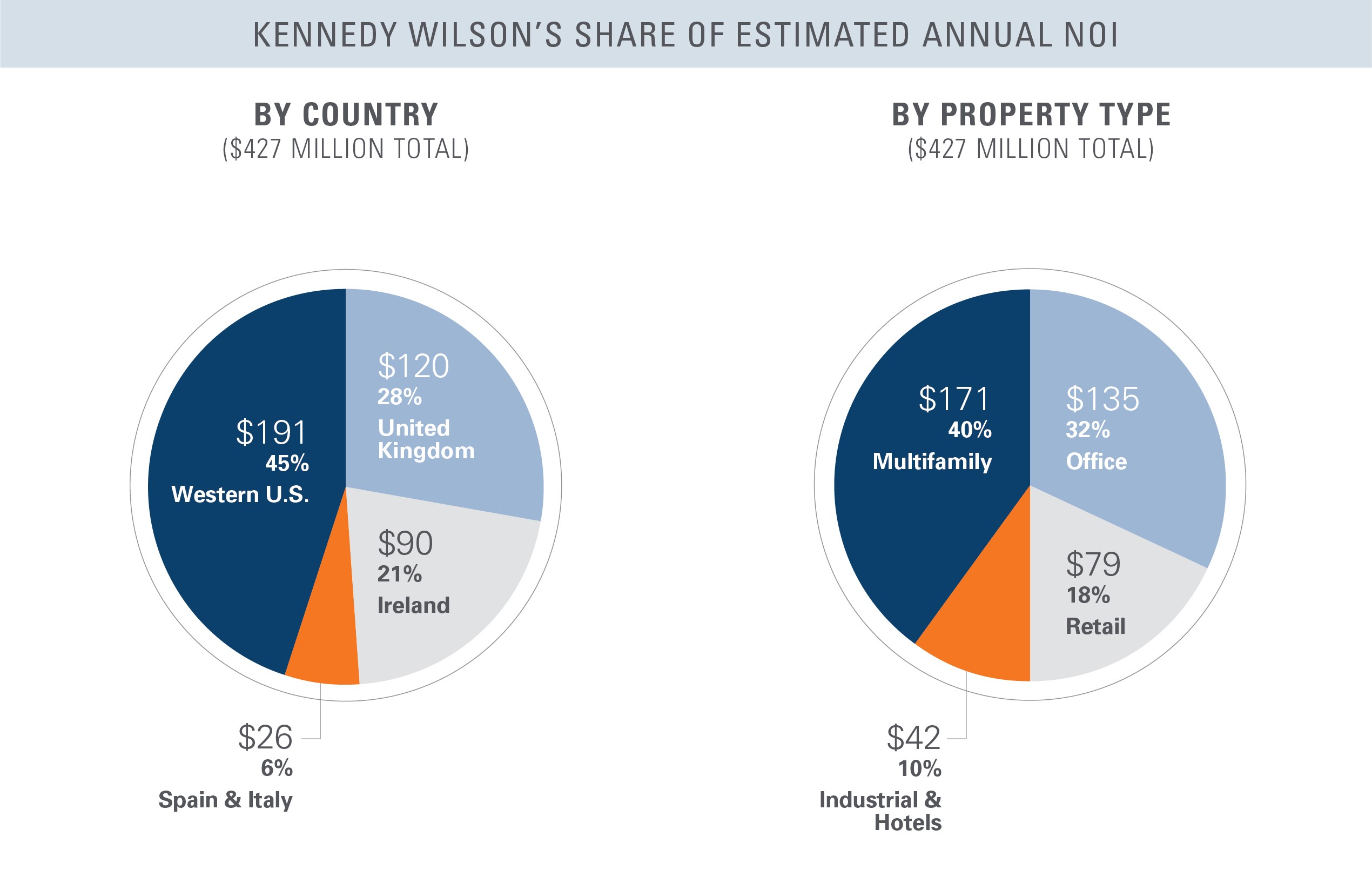

• | In-place Estimated Annual NOI of $427 million with an Additional $52 Million Expected from Unstabilized and Development Assets by 2021: |

◦ | Estimated Annual NOI from the stabilized portfolio decreased by 3% to $427 million from $439 million at year-end 2017. The decrease is due to the net sale of assets for the six months ended June 30, 2018 as well as a decrease of $6 million due to changes in foreign currency exchange rates. |

◦ | An additional $36 million of Estimated Annual NOI is expected to be in place by the end of 2019 (of which 67% is either multifamily or pre-leased office development), and an incremental $16 million is expected to be in place by the end of 2021, through the planned completion of development and stabilization initiatives. |

• | New Irish Multifamily Platform with Leading Global Insurance Company: Formed and closed first transaction in a new joint-venture platform with AXA Investment Managers - Real Assets to further grow its multifamily/PRS portfolio in Ireland. The Company is currently pursuing multiple new investment opportunities for this platform. |

• | Asset Sales and New Platform Generate Gains and Fees of $184 million to KW: |

◦ | Sold a six-property multifamily portfolio in the Western U.S. generating cash of $104 million, gains and performance fees of $71 million, an IRR of 35% and an equity multiple of 3.0x to KW. |

◦ | Contributed its existing 50% interest in three multifamily properties in Dublin, Ireland into its new Irish multifamily joint-venture platform resulting in gains and fees of $93 million. |

• | $133 Million of Share Repurchases in 2Q1: 7.4 million shares were repurchased for $133 million and canceled under the Company's $250 million share repurchase plan. Year to date, the Company has repurchased and retired 8.6 million shares for $153 million at an average price of $17.85. |

Investment Activity: $786M in 2Q; $1.3 billion YTD

• | Acquisitions: The Company, together with its equity partners, completed the following acquisitions: |

($ in millions) | Gross | Kennedy Wilson's Share | |||||||||||||||||

Acquisitions | Aggregate Purchase Price | Income Producing | Estimated Annual NOI | Cap Rate(2) | Est. Forward Return on Cost (2) | Non-income Producing / Development | Total | ||||||||||||

2Q - 2018 | $ | 211.6 | $ | 119.6 | $ | 5.2 | 4.4% | 6.3% | $ | 0.8 | $ | 120.4 | |||||||

YTD - 2018 | 510.3 | 232.7 | 11.4 | 4.9% | 6.2% | 39.2 | 271.9 | ||||||||||||

• | The majority of the acquisitions completed in 2Q and YTD have significant value-add components which, once completed, are expected to significantly increase net operating income. |

• | Dispositions: The Company, together with its equity partners, completed the following dispositions: |

($ in millions) | Gross | Kennedy Wilson's Share | |||||||||||||||||

Dispositions | Aggregate Sale Price | Income Producing | Estimated Annual NOI | Cap Rate(2) | Non-income Producing / Development | Total | |||||||||||||

2Q - 2018 | $ | 574.0 | $ | 291.2 | $ | 17.4 | 6.0% | $ | 30.6 | $ | 321.8 | ||||||||

YTD - 2018 | 743.1 | 412.3 | 23.6 | 5.7% | 42.1 | 454.4 | |||||||||||||

• | Total cash of $327 million to KW from YTD dispositions. |

• | NOI growth averaged 29% for assets sold YTD from the time of acquisition. |

4

• | Capital Allocation: In the quarter, the Company invested $195 million of capital, allocating 68% to share repurchases, 20% to new acquisitions, and 12% to value-add capital expenditures. For the first half of the year, the Company invested $317 million of capital, allocating 48% to share repurchases, 33% to new acquisitions, and 19% to value-add capital expenditures. |

Investment Management and Real Estate Services Business

• | Adjusted Fees: For the quarter, adjusted fees were $31 million, an increase of $13 million from 2Q-2017. The increase is primarily related to $19 million of promote fees earned from the sale of assets during the quarter. |

Balance Sheet and Liquidity

• | Liquidity: Liquidity totaled $947 million, including cash of $447 million(3) and $500 million of undrawn capacity on its revolving line of credit. |

• | Debt Profile: Kennedy Wilson's debt had a weighted average interest rate of 3.8% and a weighted average remaining maturity of 5.8 years, with 77% of total debt (at share) fixed and another 14% hedged against increases in interest rates. |

Foreign Currency Fluctuations and Hedging

• | Income Statement |

◦ | 2Q Impact: For 2Q-2018, changes in foreign currency rates increased both consolidated revenue and Adjusted EBITDA by 3% compared to foreign currency rates as of June 30, 2017. |

◦ | YTD Impact: For FY-2018, changes in foreign currency rates increased both consolidated revenue and Adjusted EBITDA by 3% compared to foreign currency rates as of June 30, 2017. |

• | Shareholders' Equity |

◦ | During the first half of the year, GBP and EUR foreign currency rates decreased by 2% on average against the USD. The net decrease in shareholders' equity related to fluctuations in foreign currency and related hedges (in the GBP and EUR) was $13 million, equating to less than 1% of total Kennedy-Wilson Holdings, Inc. shareholders' equity. |

5

Footnotes

(1) Future purchases under the program may be made in the open market, in privately negotiated transactions, through the net settlement of the company's restricted stock grants or otherwise, with the amount and timing of the repurchases dependent on market conditions and subject to the Company's discretion.

(2) Excludes non-income producing and unstabilized properties. Please see "common definitions" for definitions.

(3) Includes $79.2 million of restricted cash, which is included in cash and cash equivalents.

Conference Call and Webcast Details

Kennedy Wilson will hold a live conference call and webcast to discuss results at 7:00 a.m. PT/ 10:00 a.m. ET on Thursday, August 2. The direct dial-in number for the conference call is (844) 340-4761 for U.S. callers and (412) 717-9616 for international callers.

A replay of the call will be available for one week beginning two hours after the live call and can be accessed by (877) 344-7529 for U.S. callers and (412) 317-0088 for international callers. The passcode for the replay is 10121783.

The webcast will be available at: https://services.choruscall.com/links/kw180802IiuXW7KM.html. A replay of the webcast will be available one hour after the original webcast on the Company’s investor relations web site for three months.

About Kennedy Wilson

Kennedy Wilson (NYSE:KW) is a leading global real estate investment company. We own, operate, and invest in real estate both on our own and through our investment management platform. We focus on multifamily and office properties located in the Western U.S., UK, and Ireland. For further information on

Kennedy Wilson, please visit www.kennedywilson.com.

Tables Follow

6

Kennedy-Wilson Holdings, Inc.

Consolidated Balance Sheets

(Unaudited)

(Dollars in millions)

June 30, 2018 | December 31, 2017 | |||||||

Assets | ||||||||

Cash and cash equivalents | $ | 447.1 | $ | 351.3 | ||||

Accounts receivable | 64.6 | 62.7 | ||||||

Loan purchases and originations | 28.9 | 84.7 | ||||||

Real estate and acquired in place lease values, net of accumulated depreciation and amortization | 6,097.7 | 6,443.7 | ||||||

Unconsolidated investments | 613.7 | 519.3 | ||||||

Other assets | 253.4 | 263.1 | ||||||

Total assets | $ | 7,505.4 | $ | 7,724.8 | ||||

Liabilities | ||||||||

Accounts payable | $ | 25.8 | $ | 19.5 | ||||

Accrued expenses and other liabilities | 491.1 | 465.9 | ||||||

Mortgage debt | 2,993.9 | 3,156.6 | ||||||

KW unsecured debt | 1,249.9 | 1,179.4 | ||||||

KWE unsecured bonds | 1,295.0 | 1,325.9 | ||||||

Total liabilities | 6,055.7 | 6,147.3 | ||||||

Equity | ||||||||

Common stock | — | — | ||||||

Additional paid-in capital | 1,747.7 | 1,883.3 | ||||||

Accumulated deficit | (40.7 | ) | (90.6 | ) | ||||

Accumulated other comprehensive loss | (436.7 | ) | (427.1 | ) | ||||

Total Kennedy-Wilson Holdings, Inc. shareholders’ equity | 1,270.3 | 1,365.6 | ||||||

Noncontrolling interests | 179.4 | 211.9 | ||||||

Total equity | 1,449.7 | 1,577.5 | ||||||

Total liabilities and equity | $ | 7,505.4 | $ | 7,724.8 | ||||

7

Kennedy-Wilson Holdings, Inc.

Consolidated Statements of Operations

(Unaudited)

(Dollars in millions, except share amounts and per share data)

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Revenue | ||||||||||||||||

Rental | $ | 134.9 | $ | 123.8 | $ | 269.2 | $ | 248.1 | ||||||||

Hotel | 37.8 | 29.0 | 74.1 | 58.5 | ||||||||||||

Sale of real estate | 32.8 | 12.8 | 42.2 | 13.6 | ||||||||||||

Investment management, property services and research fees | 12.3 | 10.3 | 22.4 | 21.3 | ||||||||||||

Loan purchases, loan originations and other | 0.5 | 4.5 | 1.1 | 6.5 | ||||||||||||

Total revenue | 218.3 | 180.4 | 409.0 | 348.0 | ||||||||||||

Operating expenses | ||||||||||||||||

Rental operating | 39.7 | 36.6 | 81.3 | 72.6 | ||||||||||||

Hotel operating | 29.4 | 22.8 | 60.2 | 47.2 | ||||||||||||

Cost of real estate sold | 31.4 | 9.6 | 39.8 | 10.3 | ||||||||||||

Commission and marketing | 2.1 | 1.7 | 3.5 | 3.7 | ||||||||||||

Compensation and related | 44.9 | 45.5 | 84.5 | 78.2 | ||||||||||||

General and administrative | 13.5 | 10.0 | 24.9 | 19.9 | ||||||||||||

Depreciation and amortization | 51.5 | 52.1 | 107.2 | 101.8 | ||||||||||||

Total operating expenses | 212.5 | 178.3 | 401.4 | 333.7 | ||||||||||||

Income from unconsolidated investments, net of depreciation and amortization | 10.9 | 10.8 | 36.9 | 39.8 | ||||||||||||

Operating income | 16.7 | 12.9 | 44.5 | 54.1 | ||||||||||||

Non-operating income (expense) | ||||||||||||||||

Gain on sale of real estate | 236.8 | 66.3 | 264.8 | 71.7 | ||||||||||||

Acquisition-related expenses | (0.2 | ) | (0.9 | ) | (0.2 | ) | (1.2 | ) | ||||||||

Interest expense | (67.2 | ) | (52.1 | ) | (126.1 | ) | (102.1 | ) | ||||||||

Other income | 10.6 | 4.4 | 10.1 | 4.9 | ||||||||||||

Income before provision for income taxes | 196.7 | 30.6 | 193.1 | 27.4 | ||||||||||||

Provision for income taxes | (29.4 | ) | (8.8 | ) | (26.8 | ) | (4.6 | ) | ||||||||

Net income | 167.3 | 21.8 | 166.3 | 22.8 | ||||||||||||

Net income attributable to noncontrolling interests | (57.7 | ) | (12.4 | ) | (59.1 | ) | (12.6 | ) | ||||||||

Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | $ | 109.6 | $ | 9.4 | $ | 107.2 | $ | 10.2 | ||||||||

Basic earnings per share(1) | ||||||||||||||||

Income per basic | $ | 0.77 | $ | 0.08 | $ | 0.74 | $ | 0.09 | ||||||||

Weighted average shares outstanding for basic | 141,483,445 | 111,723,952 | 144,696,059 | 111,945,354 | ||||||||||||

Diluted earnings per share(1) | ||||||||||||||||

Income per diluted | $ | 0.77 | $ | 0.08 | $ | 0.74 | $ | 0.09 | ||||||||

Weighted average shares outstanding for diluted | 142,707,159 | 111,723,952 | 145,872,617 | 111,945,354 | ||||||||||||

Dividends declared per common share | $ | 0.19 | $ | 0.17 | $ | 0.38 | $ | 0.34 | ||||||||

(1) Includes impact of the Company allocating income and dividends per basic and diluted share to participating securities.

8

Kennedy-Wilson Holdings, Inc.

Adjusted EBITDA

(Unaudited)

(Dollars in millions)

The table below reconciles Adjusted EBITDA to net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders, using Kennedy Wilson’s pro-rata share amounts for each adjustment item.

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | $ | 109.6 | $ | 9.4 | $ | 107.2 | $ | 10.2 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back (Kennedy Wilson's Share)(1): | ||||||||||||||||

Interest expense | 70.2 | 43.1 | 132.2 | 83.6 | ||||||||||||

Depreciation and amortization | 52.5 | 32.2 | 108.2 | 63.4 | ||||||||||||

Provision for income taxes | 29.4 | 8.1 | 26.8 | 2.2 | ||||||||||||

Share-based compensation | 8.8 | 9.4 | 18.7 | 20.1 | ||||||||||||

Adjusted EBITDA | $ | 270.5 | $ | 102.2 | $ | 393.1 | $ | 179.5 | ||||||||

(1) See Appendix for reconciliation of Kennedy Wilson's Share amounts.

The table below provides a detailed reconciliation of Adjusted EBITDA to net income.

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Net income | $ | 167.3 | $ | 21.8 | $ | 166.3 | $ | 22.8 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back: | ||||||||||||||||

Interest expense | 67.2 | 52.1 | 126.1 | 102.1 | ||||||||||||

Kennedy Wilson's share of interest expense included in unconsolidated investments | 6.1 | 6.0 | 11.2 | 11.5 | ||||||||||||

Depreciation and amortization | 51.5 | 52.1 | 107.2 | 101.8 | ||||||||||||

Kennedy Wilson's share of depreciation and amortization included in unconsolidated investments | 3.1 | 4.4 | 6.6 | 8.7 | ||||||||||||

Provision for income taxes | 29.4 | 8.7 | 26.8 | 4.6 | ||||||||||||

Share-based compensation | 8.8 | 9.4 | 18.7 | 20.1 | ||||||||||||

EBITDA attributable to noncontrolling interests(1) | (62.9 | ) | (52.3 | ) | (69.8 | ) | (92.1 | ) | ||||||||

Adjusted EBITDA | $ | 270.5 | $ | 102.2 | $ | 393.1 | $ | 179.5 | ||||||||

(1) EBITDA attributable to noncontrolling interest includes $2.1 million and $24.3 million of depreciation and amortization, $3.1 million and $15.0 million of interest, and $0.0 million and $0.6 million of taxes, for the three months ended June 30, 2018 and 2017, respectively. EBITDA attributable to noncontrolling interest includes $5.6 million and $47.1 million of depreciation and amortization, $5.1 million and $30.0 million of interest, and $0.0 million and $2.4 million of taxes, for the six months ended June 30, 2018 and 2017, respectively.

9

Kennedy-Wilson Holdings, Inc.

Adjusted Net Income

(Unaudited)

(Dollars in millions, except share data)

The table below reconciles Adjusted Net Income to net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders, using Kennedy Wilson’s pro-rata share amounts for each adjustment item.

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | $ | 109.6 | $ | 9.4 | $ | 107.2 | $ | 10.2 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back (Kennedy Wilson's Share)(1): | ||||||||||||||||

Depreciation and amortization | 52.5 | 32.2 | 108.2 | 63.4 | ||||||||||||

Share-based compensation | 8.8 | 9.4 | 18.7 | 20.1 | ||||||||||||

Adjusted Net Income | $ | 170.9 | $ | 51.0 | $ | 234.1 | $ | 93.7 | ||||||||

Weighted average shares outstanding for diluted | 142,707,159 | 111,723,952 | 145,872,617 | 111,945,354 | ||||||||||||

(1) See Appendix for reconciliation of Kennedy Wilson's Share amounts.

The table below provides a detailed reconciliation of Adjusted Net Income to net income.

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Net income | $ | 167.3 | $ | 21.8 | $ | 166.3 | $ | 22.8 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back (less): | ||||||||||||||||

Depreciation and amortization | 51.5 | 52.1 | 107.2 | 101.8 | ||||||||||||

Kennedy Wilson's share of depreciation and amortization included in unconsolidated investments | 3.1 | 4.4 | 6.6 | 8.7 | ||||||||||||

Share-based compensation | 8.8 | 9.4 | 18.7 | 20.1 | ||||||||||||

Net income attributable to the noncontrolling interests, before depreciation and amortization(1) | (59.8 | ) | (36.7 | ) | (64.7 | ) | (59.7 | ) | ||||||||

Adjusted Net Income | $ | 170.9 | $ | 51.0 | $ | 234.1 | $ | 93.7 | ||||||||

Weighted average shares outstanding for diluted | 142,707,159 | 111,723,952 | 145,872,617 | 111,945,354 | ||||||||||||

(1) Includes $2.1 million and $24.3 million of depreciation and amortization for the three months ended June 30, 2018 and 2017, respectively, and $5.6 million and $47.1 million of depreciation and amortization for the six months ended June 30, 2018 and 2017.

10

Forward-Looking Statements

Statements made by us in this report and in other reports and statements released by us that are not historical facts constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are necessarily estimates reflecting the judgment of our senior management based on our current estimates, expectations, forecasts and projections and include comments that express our current opinions about trends and factors that may impact future operating results. Disclosures that use words such as "believe," "anticipate," "estimate," "intend," "may," "could," "plan," "expect," "project" or the negative of these, as well as similar expressions, are intended to identify forward-looking statements. These statements are not guarantees of future performance, rely on a number of assumptions concerning future events, many of which are outside of our control, and involve known and unknown risks and uncertainties that could cause our actual results, performance or achievement, or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties may include the factors and the risks and uncertainties described elsewhere in this report and other filings with the Securities and Exchange Commission (the "SEC"), including the Item 1A. "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2017, as amended by our subsequent filings with the SEC. Any such forward-looking statements, whether made in this report or elsewhere, should be considered in the context of the various disclosures made by us about our businesses including, without limitation, the risk factors discussed in our filings with the SEC. Except as required under the federal securities laws and the rules and regulations of the SEC, we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, changes in assumptions, or otherwise.

Common Definitions

· “KWH,” "KW," “Kennedy Wilson,” the "Company," "we," "our," or "us" refers to Kennedy-Wilson Holdings, Inc. and its wholly-owned subsidiaries. The consolidated financial statements of the Company include the results of the Company's consolidated subsidiaries.

· “KWE” refers to Kennedy Wilson Europe Real Estate plc, which was a London Stock Exchange-listed company that we externally managed through a wholly-owned subsidiary. On October 20, 2017 we acquired KWE, which is now a wholly-owned subsidiary. Prior to the acquisition, we owned approximately 24% and in accordance with U.S. GAAP, the results of KWE were consolidated in our financial statements due to our role as asset manager.

· “Adjusted EBITDA” represents net income before interest expense, our share of interest expense included in income from investments in unconsolidated investments, depreciation and amortization, our share of depreciation and amortization included in income from unconsolidated investments, loss on early extinguishment of corporate debt and income taxes, share-based compensation expense for the Company and EBITDA attributable to noncontrolling interests.

Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com. Our management uses Adjusted EBITDA to analyze our business because it adjusts net income for items we believe do not accurately reflect the nature of our business going forward or that relate to non-cash compensation expense or noncontrolling interests. Such items may vary for different companies for reasons unrelated to overall operating performance. Additionally, we believe Adjusted EBITDA is useful to investors to assist them in getting a more accurate picture of our results from operations. However, Adjusted EBITDA is not a recognized measurement under GAAP and when analyzing our operating performance, readers should use Adjusted EBITDA in addition to, and not as an alternative for, net income as determined in accordance with GAAP. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Furthermore, Adjusted EBITDA is not intended to be a measure of free cash flow for our management’s discretionary use, as it does not remove all non-cash items (such as acquisition-related gains) or consider certain cash requirements such as tax and debt service payments. The amount shown for Adjusted EBITDA also differs from the amount calculated under

11

similarly titled definitions in our debt instruments, which are further adjusted to reflect certain other cash and non-cash charges and are used to determine compliance with financial covenants and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments.

· “Adjusted fees’’ refers to Kennedy Wilson’s gross investment management, property services and research fees adjusted to include Kennedy Wilson's share of fees eliminated in consolidation, Kennedy Wilson’s share of fees in unconsolidated service businesses and performance fees included in unconsolidated investments. Effective January 1, 2018, we adopted new GAAP guidance on revenue recognition and implemented a change in accounting principles related to performance allocations, which resulted in us now accounting for performance allocations (commonly referred to as “performance fees” or “carried interest”) under the GAAP guidance for equity method investments and presenting performance allocations as a component of income from unconsolidated investments. Our management uses Adjusted fees to analyze our investment management and real estate services business because the measure removes required eliminations under GAAP for properties in which the Company provides services but also has an ownership interest. These eliminations understate the economic value of the investment management, property services and research fees and makes the Company comparable to other real estate companies that provide investment management and real estate services but do not have an ownership interest in the properties they manage. Our management believes that adjusting GAAP fees to reflect these amounts eliminated in consolidation presents a more holistic measure of the scope of our investment management and real estate services business.

· “Adjusted Net Income” represents net income before depreciation and amortization, our share of depreciation and amortization included in income from unconsolidated investments, share-based compensation and net income attributable to noncontrolling interests, before depreciation and amortization. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· “Cap rate” represents the net operating income of an investment for the year preceding its acquisition or disposition, as applicable, divided by the purchase or sale price, as applicable. Cap rates set forth in this presentation only includes data from income-producing properties. We calculate cap rates based on information that is supplied to us during the acquisition diligence process. This information is not audited or reviewed by independent accountants and may be presented in a manner that is different from similar information included in our financial statements prepared in accordance with GAAP. In addition, cap rates represent historical performance and are not a guarantee of future NOI. Properties for which a cap rate is provided may not continue to perform at that cap rate.

· "Consolidated investment account" refers to the sum of Kennedy Wilson’s equity in: cash held by consolidated investments, consolidated real estate and acquired in-place leases gross of accumulated depreciation and amortization, net hedge asset or liability, unconsolidated investments, consolidated loans, and net other assets.

· "Equity partners" refers to non-wholly-owned subsidiaries that we consolidate in our financial statements under U.S. GAAP and third-party equity providers.

· "Estimated annual NOI" is a property-level non-GAAP measure representing the estimated annual net operating income from each property as of the date shown, inclusive of rent abatements (if applicable). The calculation excludes depreciation and amortization expense, and does not capture the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures, tenant improvements, and leasing commissions necessary to maintain the operating performance of our properties. Any of the enumerated items above could have a material effect on the performance of our properties. Also, where specifically noted, for properties purchased in 2018, the NOI represents estimated Year 1 NOI from our original underwriting. Estimated year 1 NOI for properties purchased in 2018 may not be indicative of the actual results for those properties. Estimated annual NOI is not an indicator of the actual annual net operating income that the Company will or expects to realize in any period. Please also see the definition of "Net operating income" below. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are

12

out of the company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors.

· "Estimated Forward Return on Cost” represents the Company’s estimate of future net operating income once it has completed its value-add asset management initiatives divided by the purchase price plus additional capital expenditure costs that are expected to be incurred in accordance with the Company’s original underwriting at the time of acquisition. This information is not audited or reviewed by independent accountants and may be presented in a manner that is different from similar information included in our financial statements prepared in accordance with GAAP. Estimated Forward Return on Cost is based on management’s current expectations and are based on assumptions that may prove to be inaccurate and involve known and unknown risks. Accordingly, the actual return on cost of an investment made by the Company may differ materially and adversely from the Estimated Forward Return on Cost figure set forth in this release.

· "Gross Asset Value” refers to the gross carrying value of assets, before debt, depreciation and amortization, and net of noncontrolling interests.

· "Investment account” refers to the consolidated investment account presented after noncontrolling interest on invested assets gross of accumulated depreciation and amortization.

· | "Investment Management and Real Estate Services Assets under Management" ("IMRES AUM") generally refers to the properties and other assets with respect to which we provide (or participate in) oversight, investment management services and other advice, and which generally consist of real estate properties or loans, and investments in joint ventures. Our IMRES AUM is principally intended to reflect the extent of our presence in the real estate market, not the basis for determining our management fees. Our IMRES AUM consists of the total estimated fair value of the real estate properties and other real estate related assets either owned by third parties, wholly owned by us or held by joint ventures and other entities in which our sponsored funds or investment vehicles and client accounts have invested. Committed (but unfunded) capital from investors in our sponsored funds is not included in our IMRES AUM. The estimated value of development properties is included at estimated completion cost. |

· "Net operating income" or " NOI” is a non-GAAP measure representing the income produced by a property calculated by deducting operating expenses from operating revenues. Our management uses net operating income to assess and compare the performance of our properties and to estimate their fair value. Net operating income does not include the effects of depreciation or amortization or gains or losses from the sale of properties because the effects of those items do not necessarily represent the actual change in the value of our properties resulting from our value-add initiatives or changing market conditions. Our management believes that net operating income reflects the core revenues and costs of operating our properties and is better suited to evaluate trends in occupancy and lease rates. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· "Noncontrolling interests" represents the portion of equity ownership in a consolidated subsidiary not attributable to Kennedy Wilson.

· "Pro-Rata" represents Kennedy Wilson's share calculated by using our proportionate economic ownership of each asset in our portfolio, including our approximate 24% ownership in KWE immediately prior to our acquisition of KWE. Please also refer to the pro-rata financial data in our supplemental financial information.

· "Property net operating income" or "Property NOI" is a non-GAAP measure calculated by deducting the Company's Pro-Rata share of rental and hotel operating expenses from the Company's Pro-Rata rental and hotel revenues. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· “Same property” refers to properties in which Kennedy Wilson has an ownership interest during the entire span of both periods being compared. The same property information presented throughout this report is shown on a

13

cash basis and excludes non-recurring expenses. This analysis excludes properties that are either under development or undergoing lease up as part of our asset management strategy.

Note about Non-GAAP and certain other financial information included in this presentation

In addition to the results reported in accordance with U.S. generally accepted accounting principles ("GAAP") included within this presentation, Kennedy Wilson has provided certain information, which includes non-GAAP financial measures (including Adjusted EBITDA, Adjusted Net Income, Net Operating Income, and Adjusted Fees, as defined above). Such information is reconciled to its closest GAAP measure in accordance with the rules of the SEC, and such reconciliations are included within this presentation. These measures may contain cash and non-cash acquisition-related gains and expenses and gains and losses from the sale of real-estate related investments. Consolidated non-GAAP measures discussed throughout this report contain income or losses attributable to non-controlling interests. Management believes that these non-GAAP financial measures are useful to both management and Kennedy Wilson's shareholders in their analysis of the business and operating performance of the Company. Management also uses this information for operational planning and decision-making purposes. Non-GAAP financial measures are not and should not be considered a substitute for any GAAP measures. Additionally, non-GAAP financial measures as presented by Kennedy Wilson may not be comparable to similarly titled measures reported by other companies. Annualized figures used throughout this release and supplemental financial information, and our estimated annual net operating income metrics, are not an indicator of the actual net operating income that the Company will or expects to realize in any period.

KW-IR

Supplemental Financial Information | ||

14

Kennedy-Wilson Holdings, Inc.

Capitalization Summary

(Unaudited)

(Dollars in millions, except per share data)

June 30, 2018 | December 31, 2017 | |||||||

Market Data | ||||||||

Common stock price per share | $ | 21.15 | $ | 17.35 | ||||

Common stock shares outstanding | 144,405,875 | 151,561,284 | ||||||

Equity Market Capitalization | $ | 3,054.2 | $ | 2,629.6 | ||||

Kennedy Wilson's Share of Debt | ||||||||

Kennedy Wilson's share of property debt | 3,355.2 | 3,534.0 | ||||||

Senior notes payable | 1,150.0 | 900.0 | ||||||

Kennedy Wilson Europe bonds | 1,303.9 | 1,335.2 | ||||||

Credit Facility | 125.0 | 300.0 | ||||||

Total Kennedy Wilson's share of debt | 5,934.1 | 6,069.2 | ||||||

Total Capitalization | $ | 8,988.3 | $ | 8,698.8 | ||||

Less: Kennedy Wilson's share of cash | (462.9 | ) | (345.7 | ) | ||||

Total Enterprise Value | $ | 8,525.4 | $ | 8,353.1 | ||||

15

Kennedy-Wilson Holdings, Inc.

Components of Value Summary

As of June 30, 2018

(Unaudited, Dollars in millions)

Below are key valuation metrics provided to assist in the calculation of a sum-of-the-parts valuation of the Company as of June 30, 2018. Please note that excluded below is the potential value of the Company's future promoted interest as well as the value of the Company's team and brand. A sum of the parts can be calculated by adding together KW’s share of the value of its investments (#1-#6), the value of KW’s services business (#7-#9) and subtracting KW’s net liabilities (#10-#11).

Kennedy Wilson's Share | ||||||||||||||

Investments | Description | Occupancy | Est. Annual NOI(1)(2) | Common Valuation Approach | Page # | |||||||||

Income Producing Assets | ||||||||||||||

1 | Multifamily | 22,844 units | 94.5% | $ | 171.3 | Cap rate | ||||||||

2 | Commercial | 16.5 million square feet | 95.5% | 225.5 | Cap rate | |||||||||

3 | Hotels | 11 Hotels / 1,717 Hotel Rooms | N/A | 30.4 | Cap rate | |||||||||

Total Estimated Annual NOI | $ | 427.2 | ||||||||||||

Unstabilized, Development, and Non-income Producing Assets | KW Gross Asset Value | |||||||||||||

4 | Unstabilized(5) | 634 multifamily units 1.4 million commercial sq.ft. | 40.9% | $ | 519.4 | Multiple of gross asset value | ||||||||

5 | Development(5) | 2,480 multifamily units 0.7 million commercial sq. ft. One five-star resort | N/A | 430.1 | Multiple of gross asset value | |||||||||

6 | Loans, residential, and other(5) | 21 investments, 6 unresolved loans | N/A | 220.1 | Multiple of gross asset value | |||||||||

Total Gross Asset Value | $ | 1,169.6 | ||||||||||||

Investment Management and Real Estate Services | TTM Adj. Fees(3) | TTM Adj. EBITDA(3) | ||||||||||||

7 | Investment management | Management and promote fees | $ | 50.3 | $ | 39.0 | Adj. EBITDA or Adj. Fees Multiple | |||||||

8 | Property services | Fees and commissions | 21.3 | 2.8 | Adj. EBITDA or Adj. Fees Multiple | |||||||||

9 | Meyers Research | Subscription revenue and consulting fees | 14.8 | (3.0 | ) | Adj. Fees Multiple | ||||||||

Total | $ | 86.4 | $ | 38.8 | ||||||||||

Net Debt | Total | |||||||||||||

10 | KW Share of Debt(4) | Secured and Unsecured Debt | $ | 6,139.8 | Face Value | |||||||||

11 | KW Share of Cash | Cash | (462.9 | ) | Book Value | |||||||||

Total Net Debt | $ | 5,676.9 | ||||||||||||

(1) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors.

(2) Based on weighted-average ownership figures held by KW.

16

(3) TTM figures are representative of the trailing 12 months (excluding fees for the management of KWE) and are not indicators of the actual results that the Company will or expects to realize in any period.

(4) Includes Kennedy Wilson's share of debt at Vintage Housing Holdings of $229.3 million, based on economic ownership

(5) See additional detail related to Unstabilized, Development, and Non-income Producing Assets, as of June 30, 2018. KW Share of Debt below is included in the Net Debt amounts within the Components of Value Summary above.

KW Gross Asset Value | KW Share of Debt | Investment Account | ||||||||||

Unstabilized - Multifamily and Commercial | $ | 519.4 | $ | 157.3 | $ | 362.1 | ||||||

Development - Multifamily, Commercial, and Hotel | 430.1 | 102.2 | 327.9 | |||||||||

Loans, residential, and other | 220.1 | 5.4 | 214.7 | |||||||||

Unstabilized, Development, and Non-income Producing Assets | $ | 1,169.6 | $ | 264.9 | $ | 904.7 | ||||||

17

Kennedy-Wilson Holdings, Inc.

Incoming Producing Properties

As of June 30, 2018

(Unaudited, Dollars in millions)

The pie charts below reflect Kennedy Wilson's Pro-rata share of Estimated Annual NOI (from income-producing properties) by country and property type, as of June 30, 2018, of which 82% is derived from wholly-owned assets.

The following summarizes Kennedy Wilson's pro-rata share of estimated annual NOI from its income-producing portfolio by property type and geography.

Pacific Northwest | Southern California | Northern California | Mountain States | Hawaii | U.K. | Ireland | Italy | Spain | Total | |||||||||||||||||||||

Multifamily - Market Rate | $ | 53.4 | $ | 22.1 | $ | 28.7 | $ | 24.3 | $ | — | $ | — | $ | 25.2 | $ | — | $ | — | $ | 153.7 | ||||||||||

Multifamily - Affordable | 12.6 | 1.4 | 1.9 | 1.7 | — | — | — | — | — | 17.6 | ||||||||||||||||||||

Office | 16.0 | 10.7 | — | 0.5 | — | 60.4 | 33.3 | 14.1 | — | 135.0 | ||||||||||||||||||||

Retail | 0.9 | 2.7 | 1.0 | 9.8 | — | 40.8 | 11.4 | — | 12.1 | 78.7 | ||||||||||||||||||||

Industrial | — | — | — | — | — | 11.8 | — | — | — | 11.8 | ||||||||||||||||||||

Hotel | — | — | 3.4 | — | 0.2 | 6.7 | 20.1 | — | — | 30.4 | ||||||||||||||||||||

Total Estimated Annual NOI | $ | 82.9 | $ | 36.9 | $ | 35.0 | $ | 36.3 | $ | 0.2 | $ | 119.7 | $ | 90.0 | $ | 14.1 | $ | 12.1 | $ | 427.2 | ||||||||||

18

Kennedy-Wilson Holdings, Inc.

All-Property Investment Summary by Ownership

As of June 30, 2018

(Unaudited)

(Dollars in millions)

The following summarizes Kennedy Wilson's income-producing multifamily and commercial portfolio by ownership category. Excluded below are unstabilized, development, loans, and residential and other investments.

Total Portfolio | ||||||||||||

June 30, 2018 | December 31, 2017 | |||||||||||

KW Ownership Category | Multifamily Units | Commercial Rentable Sq. Ft. | Hotel Rooms | KW Share of Est. Annual NOI(1) | Ownership(2) | Estimated Annual NOI Change | Multifamily Units | Commercial Rentable Sq. Ft. | Hotel Rooms | KW Share of Est. Annual NOI(1) | Ownership(2) | |

~100% Owned | 9,694 | 10.9 | 1,475 | $352.2 | 99.5% | (2.7 | )% | 9,841 | 12.3 | 611 | $362.0 | 99.5% |

~50% owned | 9,615 | 0.8 | 170 | 58.2 | 44.9% | (3.2 | )% | 9,452 | 0.9 | 363 | 60.1 | 48.2% |

Minority-owned | 3,535 | 4.8 | 72 | 16.8 | 14.3% | 0.6 | % | 4,572 | 3.9 | N/A | 16.7 | 14.5% |

Total | 22,844 | 16.5 | 1,717 | $427.2 | 71.1% | (2.6 | )% | 23,865 | 17.1 | 974 | $438.8 | 72.6% |

(1) | Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors. |

(2) | Weighted average ownership figures based on the Company’s share of NOI and are presented on a pre-promote basis. |

19

Kennedy-Wilson Holdings, Inc.

Multifamily Investment Summary

As of June 30, 2018

(Unaudited)

(Dollars in millions, except average rents per unit)

Multifamily | # of Assets | # of Units | Occupancy | Average Monthly Rents Per Unit(2)(3) | Kennedy Wilson's Share of Estimated Annual NOI(1) | |||||||||||

Pacific Northwest | 43 | 10,347 | 94.9 | % | $ | 1,565 | $ | 66.0 | ||||||||

Southern California | 9 | 2,968 | 95.3 | % | 1,835 | 23.5 | ||||||||||

Northern California | 9 | 3,057 | 92.9 | % | 1,800 | 30.6 | ||||||||||

Mountain States | 17 | 4,803 | 93.8 | % | 1,097 | 26.0 | ||||||||||

Total Western US | 78 | 21,175 | 94.4 | % | $ | 1,531 | $ | 146.1 | ||||||||

Ireland(4) | 7 | 1,669 | 95.9 | 2,299 | 25.2 | |||||||||||

Total Stabilized | 85 | 22,844 | 94.5 | % | $ | 1,608 | $ | 171.3 | ||||||||

Unstabilized/Development | 13 | 3,114 | See Page 23 for more information | |||||||||||||

Total Multifamily | 98 | 25,958 | ||||||||||||||

(1) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors. Amounts are based on weighted-average ownership figures held by KW.

(2) Average Monthly Rents Per Unit is defined as the total potential monthly rental revenue (actual rent for occupied units plus market rent for vacant units) divided by the number of units, and are weighted-averages based on the Company's ownership percentage in the underlying properties.

(3) Average Monthly Rents Per Unit for the market rate portfolio based on Kennedy Wilson's share of units. Average Monthly Rents Per Unit for the affordable portfolio are $792, $827, $819, and $740 for Pacific Northwest, Southern California, Northern California, and Mountain States, respectively.

(4) Estimated foreign exchange rates is €0.86 = $1 USD, related to NOI.

20

Kennedy-Wilson Holdings, Inc.

Commercial Investment Summary

As of June 30, 2018

(Unaudited)

(Dollars and Square Feet in millions, except average rent per sq. ft.)

Commercial | # of Assets | Rentable Sq. Ft. | Occupancy | Average Annual Rent per Sq. Ft.(2) | Kennedy Wilson's Share of Estimated Annual NOI(1) | |||||||||||

Pacific Northwest | 7 | 1.9 | 96.9 | % | $ | 20.7 | $ | 16.9 | ||||||||

Southern California(3) | 7 | 0.8 | 92.0 | % | 44.1 | 13.4 | ||||||||||

Northern California | 1 | 0.1 | 88.5 | % | 10.5 | 1.0 | ||||||||||

Mountain States | 14 | 2.4 | 89.9 | % | 11.3 | 10.3 | ||||||||||

Total Western US | 29 | 5.2 | 92.7 | % | $ | 20.7 | $ | 41.6 | ||||||||

United Kingdom(4) | 122 | 8.1 | 96.2 | 18.4 | 113.0 | |||||||||||

Ireland(4) | 14 | 1.3 | 99.2 | 37.0 | 44.7 | |||||||||||

Spain(4) | 15 | 0.8 | 94.8 | 16.5 | 12.1 | |||||||||||

Italy(4) | 9 | 1.1 | 100.0 | 15.3 | 14.1 | |||||||||||

Total Europe(4) | 160 | 11.3 | 96.8 | % | $ | 20.2 | $ | 183.9 | ||||||||

Total Stabilized | 189 | 16.5 | 95.5 | % | $ | 20.3 | $ | 225.5 | ||||||||

Unstabilized/Development | 21 | 2.1 | See page 23 for more information | |||||||||||||

Total Commercial | 210 | 18.6 | ||||||||||||||

(1) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors. Amounts are based on weighted-average ownership figures held by KW.

(2) Average Annual Rent per Sq. Ft. represents contractual rents as in-place as of June 30, 2018 and are weighted-averages based on the Company's ownership percentage in the underlying properties.

(3) The information presented in this row for Southern California commercial assets includes our corporate headquarters wholly owned by KW comprising 58,000 sq. ft., $35 million of debt, 100% occupancy, $3.0 million in annual NOI and investment account balance of $33.1 million as of June 30, 2018.

(4) Estimated foreign exchange rates are €0.86 = $1 USD, and £0.76 = $1 USD, related to NOI.

21

Kennedy-Wilson Holdings, Inc.

Hotel, Loans, Residential and Other Investment Summary

As of June 30, 2018

(Unaudited)

(Dollars in millions, except for Average Daily Rate)

Hotel | # of Assets | Hotel Rooms | Average Daily Rate(2) | Kennedy Wilson's Share of Estimated Annual NOI(1) | |||||||||

Northern California | 1 | 170 | $ | 546.2 | $ | 3.4 | |||||||

Hawaii | 1 | 72 | 154.1 | 0.2 | |||||||||

Total Western US | 2 | 242 | $ | 497.3 | $ | 3.6 | |||||||

United Kingdom(3) | 7 | 1,075 | 97.5 | 6.7 | |||||||||

Ireland(3) | 2 | 400 | 293.8 | 20.1 | |||||||||

Total Europe | 9 | 1,475 | $ | 160.5 | $ | 26.8 | |||||||

Total Hotel | 11 | 1,717 | $ | 179.1 | $ | 30.4 | |||||||

Development | 1 | 150 | See page 23 for more information | ||||||||||

Total Hotel | 12 | 1,867 | |||||||||||

(1) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors. Amounts are based on weighted-average ownership figures held by KW.

(2) Average Daily Rate data is based on the most recent 12 months and is weighted based on the Company's ownership percentage in the underlying properties.

(3) Estimated foreign exchange rates are €0.86 = $1 USD, and £0.76 = $1 USD, related to NOI.

Residential, Loans and Other | # of Investments | Residential Units/Lots | Total Acres | # of Unresolved Loans | KW Gross Asset Value | ||||||||||

Southern California | 8 | 156 | 758 | 1 | $ | 72.1 | |||||||||

Northern California | 2 | 1 | 4 | — | 4.1 | ||||||||||

Hawaii | 4 | 254 | 3,242 | — | 95.1 | ||||||||||

Total Western US | 14 | 411 | 4,004 | 1 | $ | 171.3 | |||||||||

Ireland(1) | 1 | — | — | 5 | 27.1 | ||||||||||

Total Residential and Loans | 15 | 411 | 4,004 | 6 | $ | 198.4 | |||||||||

Other Investments | 6 | — | — | — | $ | 21.7 | |||||||||

Total Residential, Loans and Other | 21 | 411 | 4,004 | 6 | $ | 220.1 | |||||||||

(1) Estimated foreign exchange rate is €0.86 = $1 USD, related to Gross Asset Value.

22

Kennedy-Wilson Holdings, Inc.

Unstabilized and Development Detail

As of June 30, 2018

(Unaudited)

(Dollars in millions)

Unstabilized Assets

This section includes the Company's unstabilized assets that are undergoing lease-up. There is no certainty that these assets will reach stabilization in the time periods shown. In addition, the cost to complete unstabilized assets is subject to many uncertainties that are beyond our control, and the actual costs may be significantly higher than the estimates shown below. All dollar amounts are Kennedy Wilson's share.

Property(1) | Location | Type | KW Ownership % | # of Assets | Commercial Sq. Ft. | MF Units | Est. Stabilization Date | KW Share Est Stabilized NOI | KW Est. Costs to Complete(3) | KW Gross Asset Value(1) | |||||||||

2018-2019 | |||||||||||||||||||

Pioneer Point | United Kingdom(2) | Multifamily | 100% | 1 | — | 294 | 2018 | $ | 5.4 | $ | — | $ | 114.2 | ||||||

Northbank(4) | Ireland(2) | Multifamily | 100% | 1 | — | 124 | 2018 | 3.4 | 3.9 | 53.0 | |||||||||

Vintage at Mill Creek | Pacific Northwest | Multifamily | 36% | 1 | — | 216 | 2018 | 0.7 | — | 14.7 | |||||||||

The Oaks | Southern California | Office | 100% | 1 | 355,000 | 2019 | 5.4 | 22.0 | 115.1 | ||||||||||

Civic Court | United Kingdom(2) | Office | 100% | 1 | 22,000 | — | 2019 | 0.6 | 3.0 | 4.6 | |||||||||

Malibu Sands | Southern California | Retail | 50% | 1 | 16,000 | — | 2019 | 0.6 | 0.6 | 10.2 | |||||||||

Colossus | United Kingdom(2) | Industrial | 100% | 1 | 188,000 | — | 2019 | 1.2 | 0.1 | 13.0 | |||||||||

Merlin Park | United Kingdom(2) | Industrial | 100% | 1 | 63,000 | 2019 | 0.5 | — | 5.3 | ||||||||||

2018-2019 Subtotal | 8 | 644,000 | 634 | $ | 17.8 | $ | 29.6 | $ | 330.1 | ||||||||||

2020-2022 | |||||||||||||||||||

Various | Mountain States | Retail | 87%-97% | 3 | 415,000 | — | 2020 | $ | 2.8 | $ | 6.6 | $ | 33.8 | ||||||

Various | United Kingdom(2) | Office | 100% | 2 | 281,000 | 2022 | 8.2 | 16.7 | 137.7 | ||||||||||

Total Unstabilized | 13 | 1,340,000 | 634 | $ | 28.8 | $ | 52.9 | $ | 501.6 | ||||||||||

(1) Excludes two office development sites totaling 56,000 commercial sq.ft. and KW Gross Asset Value of $17.8 million that are expected to sell before the end of 2018. There is no certainty that these assets will sell before the end of 2018.

(2) Estimated foreign exchange rates are €0.86 = $1 USD and £0.76 = $1 USD, related to NOI.

(3) | Figures shown in this column are an estimate of KW's remaining costs to develop to completion or to complete the entitlement process, as applicable, as of June 30, 2018. Total remaining costs may be financed with third-party cash contributions, proceeds from projected sales, and/or debt financing. These figures are budgeted costs and are subject to change. There is no guarantee that the Company will be able to secure the project-level debt financing that is assumed in the figures above. If the Company is unable to secure such financing, the amount of capital that the Company will have to invest to complete the projects above may significantly increase. |

(4) | It is assumed that Northbank will reach 80% occupancy in 2018. The figures quoted are in respect of the entire business plan which extends to 2022. These figures are projections. There can be no assurances that such projections will be realized, and actual results may be higher or lower than those indicated. |

23

Kennedy-Wilson Holdings, Inc.

Unstabilized and Development Detail (continued)

As of June 30, 2018

(Unaudited)

(Dollars in millions)

Development Projects

This section includes the development or redevelopment projects that the Company is undergoing or considering, and excludes residential investments. The scope of these projects may change. There is no certainty that the Company will develop or redevelop any or all of these potential projects. In addition, the cost to complete development projects is subject to many uncertainties that are beyond our control, and the actual costs may be significantly higher than the estimates shown below. All dollar amounts are Kennedy Wilson's share.

If Completed | Current | ||||||||||||||||||||||||||

Property | Location | Type | Status | KW Ownership % | Est. Completion Date(1) | Est. Stabilization Date | Commercial Sq. Ft. | MF Units / Hotel Rooms | KW Share Est. Stabilized NOI | KW Share Total Capitalization | KW Gross Asset Value | KW Est. Costs to Complete(2) | KW Est. Cash to Complete | ||||||||||||||

2018-2019 | |||||||||||||||||||||||||||

Capital Dock | Ireland(3) | Mixed-Use | Under Construction | 43% | 2018 | 2019-2020 | 240,000 | 190 | $ | 10.0 | $ | 131.6 | $ | 103.0 | $ | 28.6 | $ | 12.9 | (4) | ||||||||

Vintage Housing Holdings | WA and NV | Multifamily - Affordable | 4 Under Construction | 36% | 2018-2019 | 2018-2019 | — | 1,071 | 2.8 | 52.3 | (7) | 34.8 | 17.5 | — | (5) | ||||||||||||

Puerta del Sol | Spain(3) | Retail | In Planning | 100% | 2019 | 2019 | 37,000 | — | 3.7 | 64.8 | 60.2 | 4.6 | 4.6 | ||||||||||||||

Santa Rosa | Nor Cal | Multifamily | In Design | 80% | 2019 | 2019 | — | 120 | 1.9 | 30.0 | 1.2 | 28.8 | 13.3 | ||||||||||||||

2018-2019 Subtotal | 277,000 | 1,381 | $ | 18.4 | $ | 278.7 | $ | 199.2 | $ | 79.5 | $ | 30.8 | |||||||||||||||

2020-2021 | |||||||||||||||||||||||||||

Vintage Housing Holdings | WA and NV | Multifamily - Affordable | 2 Under Construction | 36% | 2020 | 2020 | — | 458 | $ | 1.3 | 22.9 | (8) | $ | 4.6 | $ | 18.3 | $ | — | (5) | ||||||||

Vintage Housing Holdings | WA and NV | Multifamily - Affordable | In Design | 36% | 2020 | 2021 | — | 382 | 1.9 | 34.2 | (9) | 3.0 | 31.2 | — | (5) | ||||||||||||

Clancy Quay - Phase 3 | Ireland(3) | Multifamily | Under Construction | 50% | 2020 | 2021 | 6,000 | 259 | 3.2 | 69.5 | 23.8 | 45.7 | 11.5 | ||||||||||||||

Hanover Quay | Ireland(3) | Office | Received Planning | 60% | 2020 | 2021 | 68,000 | — | 2.5 | 44.3 | 14.0 | 30.3 | 15.2 | (6) | |||||||||||||

Kildare | Ireland(3) | Office | In Planning | 100% | 2021 | 2021 | 64,000 | — | 4.0 | 54.9 | 10.4 | 44.5 | 22.2 | (6) | |||||||||||||

2020-2021 Subtotal | 138,000 | 1,099 | $ | 12.9 | $ | 225.8 | $ | 55.8 | $ | 170.0 | $ | 48.9 | |||||||||||||||

2022-2024 | |||||||||||||||||||||||||||

400/430 California | Nor Cal | Office | Under Construction | 10% | 2020 | 2022 | 247,000 | — | 1.3 | 23.8 | 16.3 | 7.5 | 7.5 | ||||||||||||||

Kona Village Resort | Hawaii | Hotel | Under Construction | 50% | 2021 | 2024 | — | 150 | NA | TBD | 63.5 | TBD | TBD | ||||||||||||||

Other | Various | Various | In Design | 100% | TBD | TBD | TBD | — | NA | TBD | 80.5 | TBD | TBD | ||||||||||||||

Total Development | 662,000 | 2,630 | $ | 32.6 | $ | 528.3 | $ | 415.3 | $ | 257.0 | $ | 87.2 | |||||||||||||||

Note: 200 Capital Dock, which was sold in May 2017 in a forward-funding sale agreement with JPMorgan and has a KW Gross Asset Value of $14.8 million, is excluded from the table above.

(1) The actual completion date for projects is subject to several factors, many of which are not within our control. Accordingly, the projects identified may not be completed when expected, or at all.

(2) | Figures shown in this column are an estimate of KW's remaining costs to develop to completion or to complete the entitlement process, as applicable, as of June 30, 2018. Total remaining costs may be financed with third-party cash contributions, proceeds from projected sales, and/or debt financing. These figures are budgeted costs and are subject to change. There is no guarantee that the Company will be able to secure the project-level debt financing that is assumed in the figures above. If the Company is unable to secure such financing, the amount of capital that the Company will have to invest to complete the projects above may significantly increase. KW cost to complete differs from KW share total capitalization as the latter includes costs that have already been incurred to date while the former relates to future estimated costs. |

(3) Estimated foreign exchange rates are €0.86 = $1 USD and £0.76 = $1 USD, related to NOI.

24

(4) Will be partially financed with the proceeds from the forward-funding sale agreement of 200 Capital Dock, which was executed with JPMorgan during 2Q-2017. We still have $35.0 million still available under the project's $146.1 million construction loan as of June 30, 2018.

(5) We anticipate these development projects to be financed with tax-exempt bonds and tax-credit equity.

(6) We anticipate being able to secure construction financing at a 50% leverage of KW Estimated Costs to Complete. These figures reflect this leverage assumption and are budgeted costs and are subject to change.

(7) Excludes $85.4 million of tax-credit equity.

(8) Excludes $38.1 million of tax-credit equity.

(9) Excludes $35.1 million of tax-credit equity.

25

Kennedy-Wilson Holdings, Inc.

Debt and Liquidity Schedule

As of June 30, 2018

(Unaudited)

(Dollars in millions)

Maturity | Consolidated Secured(1) | Kennedy Wilson Europe Unsecured Bonds(2) | Unconsolidated Secured | KW Unsecured Debt | KW Share(3) | ||||||||||||||

2018 | $ | 12.6 | $ | — | $ | 207.7 | $ | — | $ | 73.2 | |||||||||

2019 | 305.4 | — | 255.8 | — | 274.7 | ||||||||||||||

2020 | 147.2 | — | 137.9 | — | 187.6 | ||||||||||||||

2021 | 171.1 | — | 159.9 | 125.0 | (4) | 306.0 | |||||||||||||

2022 | 420.4 | 660.2 | 195.2 | — | 1,107.9 | ||||||||||||||

2023 | 383.2 | — | 260.9 | — | 405.6 | ||||||||||||||

2024 | 196.5 | — | 190.0 | 1,150.0 | (5) | 1,354.7 | |||||||||||||

2025 | 447.7 | 643.7 | 288.6 | — | 1,187.4 | ||||||||||||||

2026 | 356.4 | — | 170.2 | — | 397.0 | ||||||||||||||

2027 | 250.2 | — | 146.6 | — | 318.2 | ||||||||||||||

Thereafter | 321.6 | — | 503.0 | — | 321.8 | ||||||||||||||

Total | $ | 3,012.3 | $ | 1,303.9 | $ | 2,515.8 | $ | 1,275.0 | $ | 5,934.1 | |||||||||

Cash | (251.2 | ) | (78.9 | ) | (110.4 | ) | (117.0 | ) | (462.9 | ) | |||||||||

Net Debt | $ | 2,761.1 | $ | 1,225.0 | $ | 2,405.4 | $ | 1,158.0 | $ | 5,471.2 | |||||||||

(1) Excludes $20.4 million of unamortized loan fees and unamortized net premium of $2.0 million, as of June 30, 2018.

(2) Excludes $4.9 million of unamortized loan fees and unamortized net discount of $4.0 million, as of June 30, 2018.

(3) Includes Kennedy Wilson's share of debt at Vintage Housing Holdings based on contractual ownership.

(4) Represents principal balance of credit facility.

(5) Represents principal balance of senior notes.

Weighted average interest rate (KW Share): 3.8% per annum

Weighted average remaining maturity in years (KW Share): 5.8 years

26

Kennedy-Wilson Holdings, Inc.

Debt and Liquidity Schedule (continued)

As of June 30, 2018

(Unaudited)

(Dollars in millions)

Kennedy Wilson has exposure to fixed and floating rate debt through its corporate debt along with debt encumbering its consolidated properties and its joint venture investments. The table below details Kennedy Wilson's total consolidated and unconsolidated debt by interest rate type.

KW Share of Debt(1) | |||||||||||||||

Fixed Rate Debt | Floating with Interest Rate Caps | Floating without Interest Rate Caps | Total KW Share of Debt | ||||||||||||

Secured Investment Level Debt | $ | 2,094.4 | $ | 824.3 | $ | 436.5 | $ | 3,355.2 | |||||||

Kennedy Wilson Europe Unsecured Bonds | 1,303.9 | — | — | 1,303.9 | |||||||||||

KW Unsecured Debt | 1,150.0 | — | 125.0 | 1,275.0 | |||||||||||

Total | $ | 4,548.3 | $ | 824.3 | $ | 561.5 | $ | 5,934.1 | |||||||

% of Total Debt | 77 | % | 14 | % | 9 | % | 100 | % | |||||||

(1) Includes Kennedy Wilson's share of debt at Vintage Housing Holdings of $23.7 million, based on contractual ownership.

KW Share of Secured Investment Debt(1) | ||||||||||||||||||||||

Multifamily | Commercial | Hotels | Residential, Loans and Other | Total | % of KW Share | |||||||||||||||||

Pacific Northwest | $ | 614.1 | $ | 104.9 | $ | — | $ | — | $ | 719.0 | 22 | % | ||||||||||

Southern California | 251.7 | 211.4 | — | 2.9 | 466.0 | 14 | % | |||||||||||||||

Northern California | 334.5 | 6.4 | 19.2 | — | 360.1 | 11 | % | |||||||||||||||

Mountain States | 277.8 | 118.9 | — | — | 396.7 | 12 | % | |||||||||||||||

Hawaii | — | — | 1.5 | 2.5 | 4.0 | — | % | |||||||||||||||

Total Western US | $ | 1,478.1 | $ | 441.6 | $ | 20.7 | $ | 5.4 | $ | 1,945.8 | 59 | % | ||||||||||

United Kingdom | $ | — | $ | 564.4 | $ | — | $ | — | $ | 564.4 | 17 | % | ||||||||||

Ireland | 276.0 | 392.4 | 84.1 | — | 752.5 | 22 | % | |||||||||||||||

Spain | — | 92.5 | — | — | 92.5 | 3 | % | |||||||||||||||

Italy | — | — | — | — | — | — | % | |||||||||||||||

Total Europe | $ | 276.0 | $ | 1,049.3 | $ | 84.1 | $ | — | $ | 1,409.4 | 42 | % | ||||||||||

Total | $ | 1,754.1 | $ | 1,490.9 | $ | 104.8 | $ | 5.4 | $ | 3,355.2 | 100 | % | ||||||||||

% of Total Debt | 53 | % | 44 | % | 3 | % | — | % | 100 | % | ||||||||||||

(1) Includes Kennedy Wilson's share of debt at Vintage Housing Holdings of $23.7 million, based on contractual ownership.

27

Kennedy-Wilson Holdings, Inc.

Investment Management and Real Estate Services Platform

(Unaudited, Dollars in millions)

Kennedy Wilson's investment management and real estate services platform offers a comprehensive line of real estate services for the full lifecycle of real estate ownership. Kennedy Wilson has approximately $16 billion in IMRES AUM(1) and 51 million square feet under management as of June 30, 2018

Below are other key statistics related to our platform:

Adjusted Fees | ||||||||||||||||

2Q | YTD | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Investment management, property services and research fees | $ | 12.3 | $ | 10.3 | $ | 22.4 | $ | 21.3 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back: | ||||||||||||||||

KW share of fees eliminated in consolidation(1)(2) | 11.7 | 7.4 | 12.6 | 14.6 | ||||||||||||

Performance fees included in unconsolidated investments | 6.9 | (2.6 | ) | 17.2 | 3.9 | |||||||||||

KW share of fees in unconsolidated service businesses(3) | — | 2.9 | — | 5.9 | ||||||||||||

Adjusted Fees | $ | 30.9 | $ | 18.0 | $ | 52.2 | $ | 45.7 | ||||||||

(1) The three months ended June 30, 2018 and 2017 includes $11.2 million and $4.7 million, respectively, and the six months ended June 30, 2018 and 2017 includes $12.3 million and $9.2 million , respectively, of fees recognized in net (income) loss attributable to noncontrolling interests relating to portion of fees paid by noncontrolling interest holders in KWE and equity partner investments.

(2) The three months and six months ended June 30, 2017 include $4.9 million and $9.7 million, respectively, of fees earned from KWE.

(2) Included in income from unconsolidated investments relating to the Company's investment in a servicing platform in Spain. This investment was sold in 4Q-2017.

Adjusted Fees - Detail | ||||||||||||||||

2Q | YTD | |||||||||||||||

Fee Description | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Investment Management - Base | $ | 2.7 | $ | 9.7 | $ | 6.0 | $ | 19.4 | ||||||||

Investment Management - Performance | 16.5 | (2.7 | ) | 26.8 | 3.8 | |||||||||||

Investment Management - Acquisition/ Disposition | 2.3 | 0.5 | 2.3 | 0.5 | ||||||||||||

Property Services | 5.2 | 7.7 | 9.0 | 16.4 | ||||||||||||

Research | 4.2 | 2.8 | 8.1 | 5.6 | ||||||||||||

Total Adjusted Fees | $ | 30.9 | $ | 18.0 | $ | 52.2 | $ | 45.7 | ||||||||

Investment Management and Real Estate Services | |||||||

Investment Management | Property Services | Research | Total | ||||

YTD 2018 Adjusted Fees(1) | $35.1 million | $9.0 million | $8.1 million | $52.2 million | |||

YTD 2018 Adjusted EBITDA(1)(2) | $25.5 million | $0.7 million | $(1.4) million | $24.8 million | |||

Description | $4.7 billion in total Invested Capital(3) | ||||||

(1) As defined in "Common Definitions" section of the earnings release.

(2) See reconciliation of Adjusted EBITDA in Adjusted EBTDA by Segment section.

(3) Represents total investment level equity on which we earn fee income, of which $3.0 billion relates to Kennedy Wilson.

28

Kennedy-Wilson Holdings, Inc.

Multifamily Same Property Analysis

(Unaudited)

(Dollars in millions)

Same Property Analysis By Region - Kennedy Wilson's Pro-Rata Share

The Same Property analysis below reflects Kennedy Wilson's ownership in each underlying property and is shown to provide greater clarity of the impact of the Same Property(1) changes to Kennedy Wilson.

Three Months Ended June 30, | Same Property Units | Average % Leased | Total Revenues(2) | Net Operating Income(2) | ||||||||||||||||||||||||||||||

2018 vs. 2017 | 2018 | 2018 | 2017 | % Change | 2018 | 2017 | % Change | 2018 | 2017 | % Change | ||||||||||||||||||||||||

Market Rate Portfolio | ||||||||||||||||||||||||||||||||||

Region: | ||||||||||||||||||||||||||||||||||

Pacific Northwest | 5,036 | 94.1 | % | 94.3 | % | (0.1 | )% | $ | 15.3 | $ | 14.5 | 5.2 | % | $ | 10.2 | $ | 9.6 | 5.4 | % | |||||||||||||||

Southern California | 2,500 | 94.9 | 95.0 | (0.1 | ) | 9.1 | 8.7 | 4.3 | 6.1 | 5.7 | 7.9 | |||||||||||||||||||||||

Northern California | 2,381 | 92.3 | 94.2 | (2.0 | ) | 11.1 | 10.8 | 2.5 | 7.4 | 7.0 | 4.6 | |||||||||||||||||||||||

Mountain States | 1,512 | 95.0 | 94.6 | 0.4 | 5.7 | 5.3 | 8.4 | 3.9 | 3.6 | 8.0 | ||||||||||||||||||||||||

Western US | 11,429 | 94.0 | % | 94.4 | % | (0.5 | )% | $ | 41.2 | $ | 39.3 | 4.7 | % | $ | 27.6 | $ | 25.9 | 6.1 | % | |||||||||||||||

Ireland | 1,300 | 96.8 | 96.6 | 0.1 | 6.1 | 5.8 | 4.5 | 4.8 | 4.6 | 2.7 | ||||||||||||||||||||||||

Total | 12,729 | 94.3 | % | 94.7 | % | (0.4 | )% | $ | 47.3 | $ | 45.1 | 4.7 | % | $ | 32.4 | $ | 30.5 | 5.6 | % | |||||||||||||||

Affordable Portfolio | ||||||||||||||||||||||||||||||||||

Region: | ||||||||||||||||||||||||||||||||||

Pacific Northwest | 4,099 | 96.4 | % | 97.1 | % | (0.8 | )% | $ | 4.4 | $ | 4.1 | 5.4 | % | $ | 2.9 | $ | 2.8 | 6.0 | % | |||||||||||||||

Southern California | 468 | 96.6 | 92.3 | 4.7 | 0.5 | 0.5 | 3.0 | 0.3 | 0.3 | 0.7 | ||||||||||||||||||||||||

Northern California | 492 | 89.7 | 90.3 | (0.6 | ) | 0.6 | 0.5 | 3.1 | 0.4 | 0.3 | 6.5 | |||||||||||||||||||||||

Mountain States | 714 | 97.5 | 96.6 | 0.9 | 0.7 | 0.6 | 3.2 | 0.4 | 0.4 | 2.4 | ||||||||||||||||||||||||

Western US | 5,773 | 96.0 | % | 96.1 | % | (0.1 | )% | $ | 6.2 | $ | 5.7 | 4.7 | % | $ | 4.0 | $ | 3.8 | 5.2 | % | |||||||||||||||

Note: Percentage changes are based on whole numbers while revenues and net operating income are shown in millions.

(1) As defined in "Common definitions" section of the earnings release.

(2) Please see the appendix for a reconciliation of same property revenues and NOI to its closest GAAP measure.

29

Kennedy-Wilson Holdings, Inc.

Multifamily Same Property Analysis (continued)

(Unaudited)

(Dollars in millions)

Six Months Ended June 30, | Same Property Units | Average % Leased | Total Revenues(2) | Net Operating Income(2) | ||||||||||||||||||||||||||||||

2018 vs. 2017 | 2018 | 2018 | 2017 | % Change | 2018 | 2017 | % Change | 2018 | 2017 | % Change | ||||||||||||||||||||||||

Market Rate Portfolio | ||||||||||||||||||||||||||||||||||

Region: | ||||||||||||||||||||||||||||||||||

Pacific Northwest | 4,754 | 94.0 | % | 93.7 | % | 0.3 | % | $ | 28.2 | $ | 26.6 | 6.2 | % | $ | 19.0 | $ | 17.7 | 7.3 | % | |||||||||||||||

Southern California | 2,500 | 94.7 | 95.1 | (0.4 | ) | 17.9 | 17.1 | 4.5 | 12.0 | 11.2 | 6.6 | |||||||||||||||||||||||

Northern California | 2,381 | 92.2 | 93.8 | (1.7 | ) | 22.0 | 21.4 | 2.8 | 14.7 | 14.1 | 4.3 | |||||||||||||||||||||||

Mountain States | 1,512 | 95.1 | 94.8 | 0.3 | 11.3 | 10.5 | 7.7 | 7.7 | 7.0 | 9.0 | ||||||||||||||||||||||||

Western US | 11,147 | 93.9 | % | 94.2 | % | (0.3 | )% | $ | 79.4 | $ | 75.6 | 5.1 | % | $ | 53.4 | $ | 50.0 | 6.5 | % | |||||||||||||||

Ireland | 1,300 | 96.8 | 94.1 | 2.8 | 12.2 | 11.5 | 6.4 | 9.6 | 8.9 | 7.5 | ||||||||||||||||||||||||

Total | 12,447 | 94.2 | % | 94.2 | % | — | % | $ | 91.6 | $ | 87.1 | 5.2 | % | $ | 63.0 | $ | 58.9 | 6.7 | % | |||||||||||||||

Affordable Portfolio | ||||||||||||||||||||||||||||||||||

Region: | ||||||||||||||||||||||||||||||||||

Pacific Northwest | 4,099 | 96.5 | % | 96.9 | % | (0.4 | )% | $ | 8.7 | $ | 8.2 | 6.7 | % | $ | 6.0 | $ | 5.5 | 8.5 | % | |||||||||||||||

Southern California | 468 | 95.4 | 94.8 | 0.7 | 1.1 | 1.0 | 0.1 | 0.7 | 0.7 | (2.5 | ) | |||||||||||||||||||||||

Northern California | 492 | 89.2 | 90.9 | (1.9 | ) | 1.1 | 1.0 | 2.8 | 0.7 | 0.7 | 5.3 | |||||||||||||||||||||||

Mountain States | 714 | 96.2 | 96.3 | (0.1 | ) | 1.3 | 1.2 | 2.9 | 0.8 | 0.8 | 0.6 | |||||||||||||||||||||||

Western US | 5,773 | 95.8 | % | 96.2 | % | (0.4 | )% | $ | 12.2 | $ | 11.4 | 5.3 | % | $ | 8.2 | $ | 7.7 | 6.3 | % | |||||||||||||||

Note: Percentage changes are based on whole numbers while revenues and net operating income are shown in millions.

(1) As defined in "Common definitions" section of the earnings release.

(2) Please see the appendix for a reconciliation of same property revenues and NOI to its closest GAAP measure.

30

Kennedy-Wilson Holdings, Inc.

Commercial Same Property Analysis

(Unaudited)

(Dollars and Square Feet in millions)

Same Property Analysis By Region - Kennedy Wilson's Pro-Rata Share

The Same Property analysis below reflects Kennedy Wilson's ownership in each underlying property and is shown to provide greater clarity of the impact of the Same Property(1) changes to Kennedy Wilson. The analysis below excludes the effects of straight line rent.

Three Months Ended June 30, | Same Property Square Feet | Average % Occupancy | Total Revenues(2) | Net Operating Income(2) | ||||||||||||||||||||||||||||||

2018 vs. 2017 | 2018 | 2018 | 2017 | % Change | 2018 | 2017 | % Change | 2018 | 2017 | % Change | ||||||||||||||||||||||||

Region: | ||||||||||||||||||||||||||||||||||

Pacific Northwest | 0.4 | 94.6 | % | 97.2 | % | (2.7 | )% | $ | 0.4 | $ | 0.3 | 15.6 | % | $ | 0.3 | $ | 0.2 | 19.1 | % | |||||||||||||||

Southern California(3) | 0.3 | 93.2 | 90.4 | 3.1 | 3.1 | 2.5 | 23.0 | 2.2 | 1.7 | 34.3 | ||||||||||||||||||||||||

Northern California | 0.1 | 88.5 | 84.4 | 4.8 | 0.4 | 0.3 | 16.0 | 0.2 | 0.2 | 10.9 | ||||||||||||||||||||||||

Mountain States | 1.3 | 92.5 | 93.9 | (1.5 | ) | 1.8 | 1.8 | 1.5 | 1.6 | 1.7 | (4.1 | ) | ||||||||||||||||||||||

Western US | 2.1 | 92.3 | % | 92.0 | % | 0.4 | % | 5.7 | 4.9 | 14.3 | % | 4.3 | 3.8 | 14.9 | % | |||||||||||||||||||

United Kingdom(4) | 7.1 | 98.1 | 97.6 | 0.6 | 25.7 | 25.3 | 1.8 | 24.0 | 23.4 | 2.5 | ||||||||||||||||||||||||

Ireland(5) | 1.1 | 99.0 | 98.5 | 0.5 | 10.0 | 9.3 | 7.0 | 9.4 | 9.0 | 5.2 | ||||||||||||||||||||||||

Spain | 0.5 | 100.0 | 100.0 | — | 1.6 | 1.6 | 0.6 | 1.6 | 1.6 | 0.5 | ||||||||||||||||||||||||

Italy | 1.1 | 100.0 | 100.0 | — | 4.1 | 4.1 | 0.8 | 3.6 | 3.5 | 2.0 | ||||||||||||||||||||||||

Europe | 9.8 | 98.5 | % | 98.1 | % | 0.5 | % | 41.4 | 40.3 | 2.9 | % | 38.6 | 37.5 | 3.0 | % | |||||||||||||||||||