Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZAGG Inc | a201806308kcover.htm |

| EX-99.2 - EXHIBIT 99.2 - ZAGG Inc | a201806308kex992.htm |

| EX-99.1 - EXHIBIT 99.1 - ZAGG Inc | a201806308kex991.htm |

July 31, 2018

ZAGG Supplemental Financial Information - CFO Commentary

Document reference information

The commentary in this document can be referenced in the financial information found in the press release announcing the results of operations for the three and six months ended June 30, 2018, including certain supplemental financial information, issued earlier today. The release can be found at investors.ZAGG.com, or in the Form 8-K furnished to the Securities and Exchange Commission website at sec.gov (the URLs are included here in this exhibit as inactive textual references and information contained on, or accessible through, our websites is not a part of, and is not incorporated by reference into, this report).

Three months ended June 30, 2018, and 2017 Summary Results

(In millions, except per share amounts)

Second quarter results

| Three Months Ended | |||||||||||

| June 30, 2018 | June 30, 2017 | ||||||||||

| Net sales | $ | 118.6 | $ | 115.2 | |||||||

| Gross profit | $ | 37.7 | $ | 35.8 | |||||||

| Gross profit margin | 32 | % | 31 | % | |||||||

| Net income | $ | 3.2 | $ | 3.4 | |||||||

| Diluted earnings per share | $ | 0.11 | $ | 0.12 | |||||||

| Adjusted EBITDA | $ | 10.9 | $ | 12.1 | |||||||

Net sales by category

| Three Months Ended | |||||||||||||||||||||||

| June 30, 2018 | June 30, 2017 | ||||||||||||||||||||||

| (%) | ($) | (%) | ($) | ||||||||||||||||||||

| Screen Protection | 54 | % | $ | 64.8 | 51 | % | $ | 58.9 | |||||||||||||||

| Power Management | 27 | % | $ | 31.9 | 17 | % | $ | 19.9 | |||||||||||||||

| Power Cases | 7 | % | $ | 8.1 | 19 | % | $ | 21.5 | |||||||||||||||

| Keyboards | 7 | % | $ | 8.0 | 5 | % | $ | 6.0 | |||||||||||||||

| Audio | 4 | % | $ | 4.8 | 7 | % | $ | 7.7 | |||||||||||||||

| Other | 1 | % | $ | 1.0 | 1 | % | $ | 1.2 | |||||||||||||||

Net sales by channel

| Three Months Ended | |||||||||||||||||||||||

| June 30, 2018 | June 30, 2017 | ||||||||||||||||||||||

| (%) | ($) | (%) | ($) | ||||||||||||||||||||

| Indirect channel | 88 | % | $ | 104.3 | 89 | % | $ | 103.0 | |||||||||||||||

| Website | 8 | % | $ | 9.6 | 7 | % | $ | 8.5 | |||||||||||||||

| Franchisees | 4 | % | $ | 4.7 | 4 | % | $ | 3.7 | |||||||||||||||

1

Net sales by region

| Three Months Ended | |||||||||||||||||||||||

| June 30, 2018 | June 30, 2017 | ||||||||||||||||||||||

| (%) | ($) | (%) | ($) | ||||||||||||||||||||

| United States | 85 | % | $ | 100.5 | 87 | % | $ | 100.2 | |||||||||||||||

| Europe | 10 | % | $ | 12.0 | 8 | % | $ | 9.4 | |||||||||||||||

| Other | 5 | % | $ | 6.1 | 5 | % | $ | 5.6 | |||||||||||||||

2018 Second Quarter Results Discussion

(All comparisons are 2018 consolidated versus 2017 consolidated, unless otherwise noted)

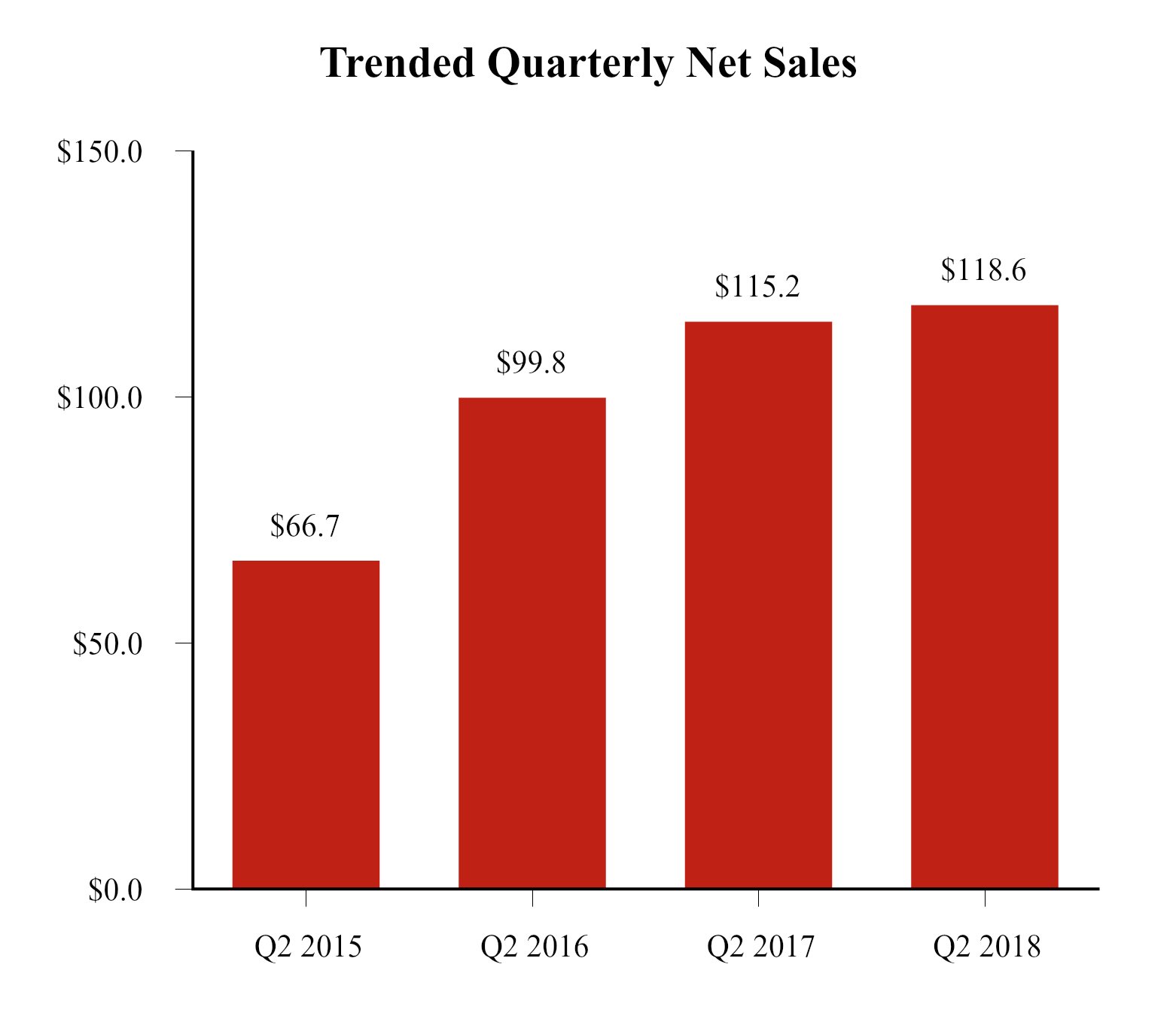

Net sales

Net sales for the three months ended June 30, 2018, were $118.6 million, compared to net sales of $115.2 million for the three months ended June 30, 2017, an increase of $3.4 million, or approximately 3%. The $3.4 million increase in net sales was primarily attributable to (1) the increase in sales of our power management products, specifically related to wireless charging accessories, and (2) increased sales of screen protection products in key wireless and retail accounts, particularly in international markets. These increases were partially offset by a decrease in sales of power cases.

2

Gross profit

Gross profit for the three months ended June 30, 2018, was $37.7 million, or approximately 32% of net sales, an increase of $1.9 million or 5%, compared to gross profit of $35.8 million, or approximately 31% of net sales for the three months ended June 30, 2017. The increase in gross profit margin was primarily attributable to (1) the mix of screen protection products, our highest margin product category, which increased to approximately 54% of net sales compared to approximately 51% of net sales during the three months ended June 30, 2017, and (2) improved margins on mophie-branded products.

Operating expenses

Operating expenses for the three months ended June 30, 2018, were $32.5 million, compared to operating expenses of $30.3 million for the three months ended June 30, 2017, an increase of $2.2 million, or approximately 7%. The $2.2 million increase was primarily attributable to (1) increases in headcount to support additional growth of the Company, and (2) increases in advertising and marketing spend.

Net income

As a result of the factors noted above, we reported net income of $3.2 million, or diluted earnings per share of $0.11, for the three months ended June 30, 2018, compared to net income of $3.4 million, or diluted earnings per share of $0.12, for the three months ended June 30, 2017.

Adjusted EBITDA

Adjusted EBITDA was $10.9 million compared to $12.1 million.

Six Months Ended June 30, 2018, and 2017 Summary Results

(In millions, except per share amounts)

Year-to-date results

| Six Months Ended | |||||||||||

| June 30, 2018 | June 30, 2017 | ||||||||||

| Net sales | $ | 230.6 | $ | 208.2 | |||||||

| Gross profit | $ | 75.3 | $ | 64.4 | |||||||

| Gross profit margin | 33 | % | 31 | % | |||||||

| Net income (loss) | $ | 10.2 | $ | (2.7) | |||||||

| Diluted earnings (loss) per share | $ | 0.36 | $ | (0.10) | |||||||

| Adjusted EBITDA | $ | 24.5 | $ | 14.8 | |||||||

Net sales by category

| Six Months Ended | |||||||||||||||||||||||

| June 30, 2018 | June 30, 2017 | ||||||||||||||||||||||

| (%) | ($) | (%) | ($) | ||||||||||||||||||||

| Screen Protection | 52 | % | $ | 120.4 | 49 | % | $ | 101.4 | |||||||||||||||

| Power Management | 30 | % | $ | 68.5 | 17 | % | $ | 35.6 | |||||||||||||||

| Power Cases | 6 | % | $ | 15.4 | 21 | % | $ | 43.9 | |||||||||||||||

| Keyboards | 6 | % | $ | 13.2 | 6 | % | $ | 12.2 | |||||||||||||||

| Audio | 5 | % | $ | 11.1 | 6 | % | $ | 13.6 | |||||||||||||||

| Other | 1 | % | $ | 2.0 | 1 | % | $ | 1.5 | |||||||||||||||

3

Net sales by channel

| Six Months Ended | |||||||||||||||||||||||

| June 30, 2018 | June 30, 2017 | ||||||||||||||||||||||

| (%) | ($) | (%) | ($) | ||||||||||||||||||||

| Indirect channel | 88 | % | $ | 203.0 | 88 | % | $ | 182.7 | |||||||||||||||

| Website | 8 | % | $ | 18.9 | 9 | % | $ | 18.5 | |||||||||||||||

| Franchisees | 4 | % | $ | 8.7 | 3 | % | $ | 7.0 | |||||||||||||||

Net sales by region

| Six Months Ended | |||||||||||||||||||||||

| June 30, 2018 | June 30, 2017 | ||||||||||||||||||||||

| (%) | ($) | (%) | ($) | ||||||||||||||||||||

| United States | 83 | % | $ | 191.8 | 86 | % | $ | 179.4 | |||||||||||||||

| Europe | 10 | % | $ | 21.8 | 8 | % | $ | 16.9 | |||||||||||||||

| Other | 7 | % | $ | 17.0 | 6 | % | $ | 11.9 | |||||||||||||||

4

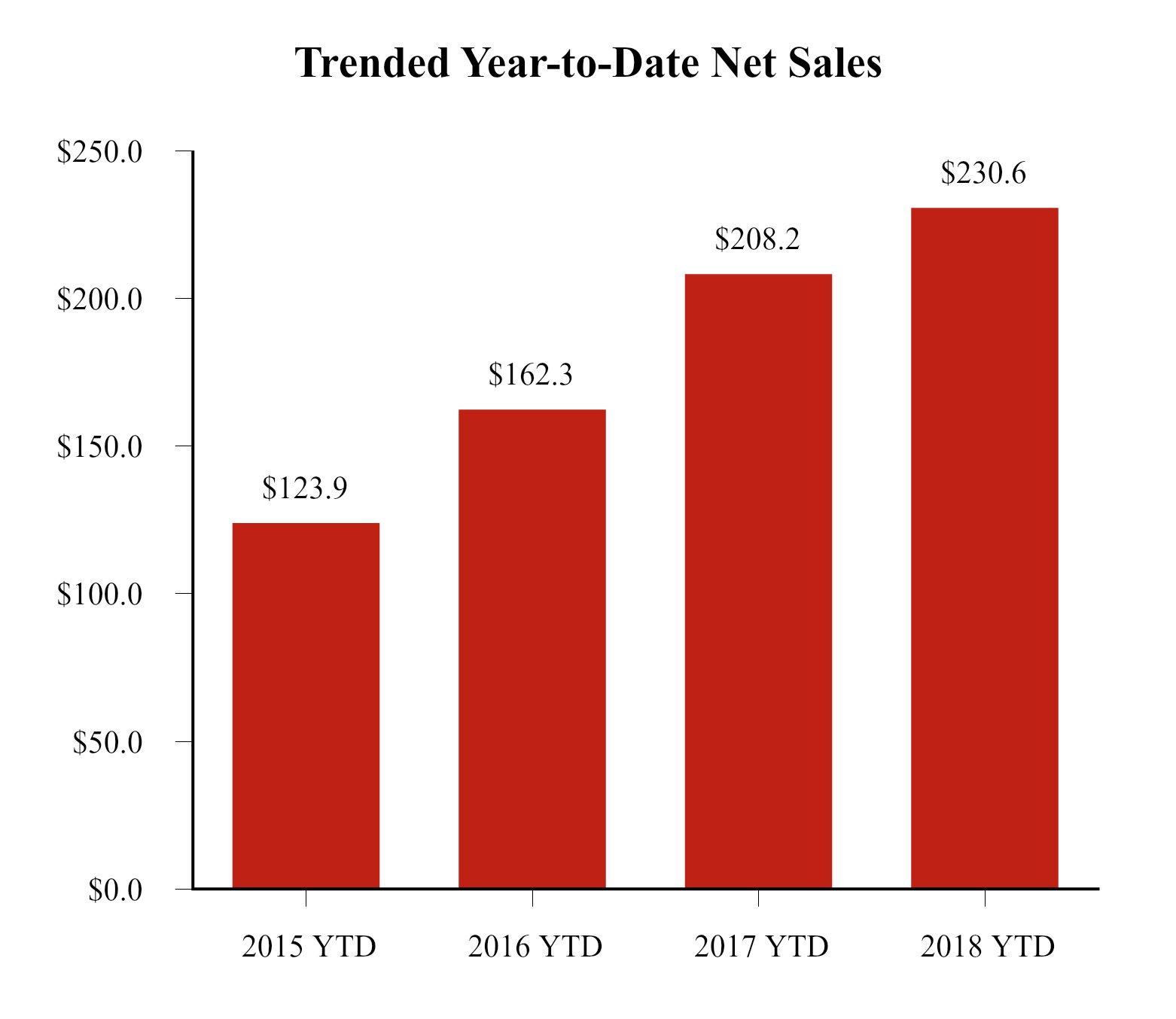

2018 Year-to-Date Results Discussion

(All comparisons are 2018 consolidated versus 2017 consolidated, unless otherwise noted)

Net sales

Net sales for the six months ended June 30, 2018, were $230.6 million, compared to net sales of $208.2 million for the six months ended June 30, 2017, an increase of $22.4 million, or approximately 11%. The $22.4 million increase in net sales was primarily attributable to (1) the increase in sales of our power management products, specifically related to wireless charging accessories, and (2) increases in screen protection products in key wireless and retail accounts, particularly in international markets. These increases were partially offset by a decrease in sales of power cases.

Gross profit

Gross profit for the six months ended June 30, 2018, was $75.3 million, or approximately 33% of net sales, an increase of $10.9 million or 17%, compared to gross profit of $64.4 million, or approximately 31% of net sales for the six months ended June 30, 2017. The increase in gross profit margin was primarily attributable to (1) the mix of screen protection products, our highest margin product category, which increased to approximately 52% of net sales compared to approximately 49% of net sales for the six months ended June 30, 2017, and (2) improved margins on mophie-branded products.

Operating expenses for the six months ended June 30, 2018, were $62.1 million, compared to operating expenses of $65.6 million for the six months ended June 30, 2017, a decrease of $3.5 million, or approximately 5%. The $3.5 million decrease was primarily attributable to (1) a $2.0 million charge in 2017 related to the impairment of a patent that did not recur in 2018, and (2) operating expense synergies realized related to the mophie integration. These decreases in operating expense were partially offset by (1) increases in headcount to support additional growth of the Company and (2) increases in advertising and marketing spend.

Net income (loss)

As a result of the factors noted above, we reported net income of $10.2 million, or diluted earnings per share of $0.36, for the six months ended June 30, 2018, compared to a net loss of $2.7 million, or diluted loss per share of $0.10, for the six months ended June 30, 2017.

5

Adjusted EBITDA

Adjusted EBITDA was $24.5 million compared to $14.8 million.

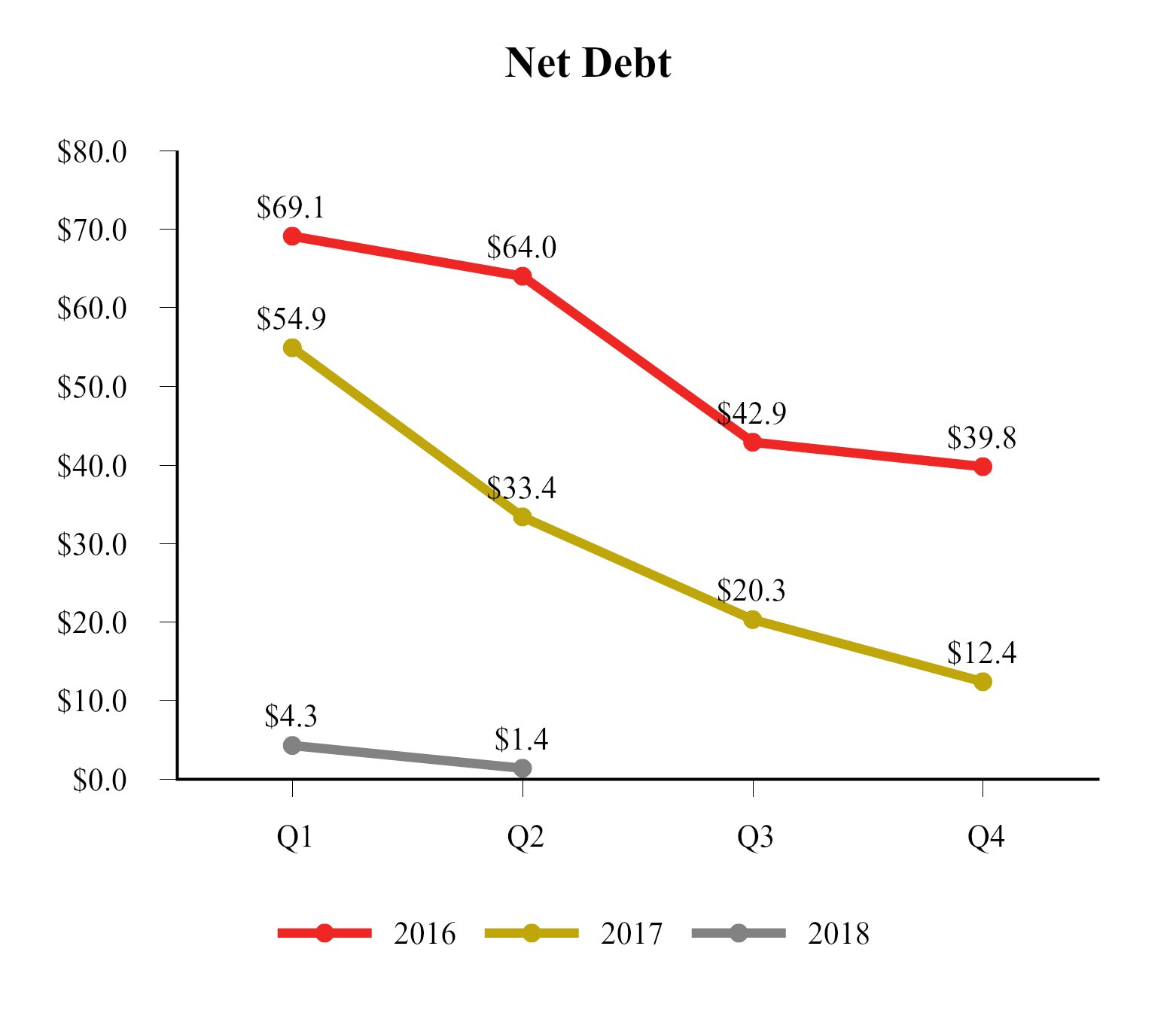

Balance Sheet Highlights (as of June 30, 2018, December 31, 2017, and June 30, 2017)

| June 30, 2018 | December 31, 2017 | June 30, 2017 | |||||||||||||||

| Cash and cash equivalents | $ | 18.6 | $ | 25.0 | $ | 14.3 | |||||||||||

| Accounts receivable, net of allowances | $ | 84.0 | $ | 123.2 | $ | 73.0 | |||||||||||

| Inventories | $ | 69.7 | $ | 75.0 | $ | 65.4 | |||||||||||

| Total debt outstanding | $ | 20.0 | $ | 37.4 | $ | 47.7 | |||||||||||

| Line of credit | $ | 20.0 | $ | 23.5 | $ | 30.7 | |||||||||||

| Long-term debt | $ | — | $ | 13.9 | $ | 17.0 | |||||||||||

| Net debt (Total debt less cash) | $ | 1.4 | $ | 12.4 | $ | 33.4 | |||||||||||

| Days sales outstanding (DSOs) | 65 | 64 | 58 | ||||||||||||||

| Inventory turns* | 7.8x | 6.9x | 6.8x | ||||||||||||||

| * Inventory turns defined as trailing 12-month sales divided by period-end inventory. | |||||||||||||||||

6

Debt

The Company has effectively managed its outstanding debt balance. At June 30, 2018, the net debt balance (total debt less cash) decreased to $1.4 million from $12.4 million at December 31, 2017.

7

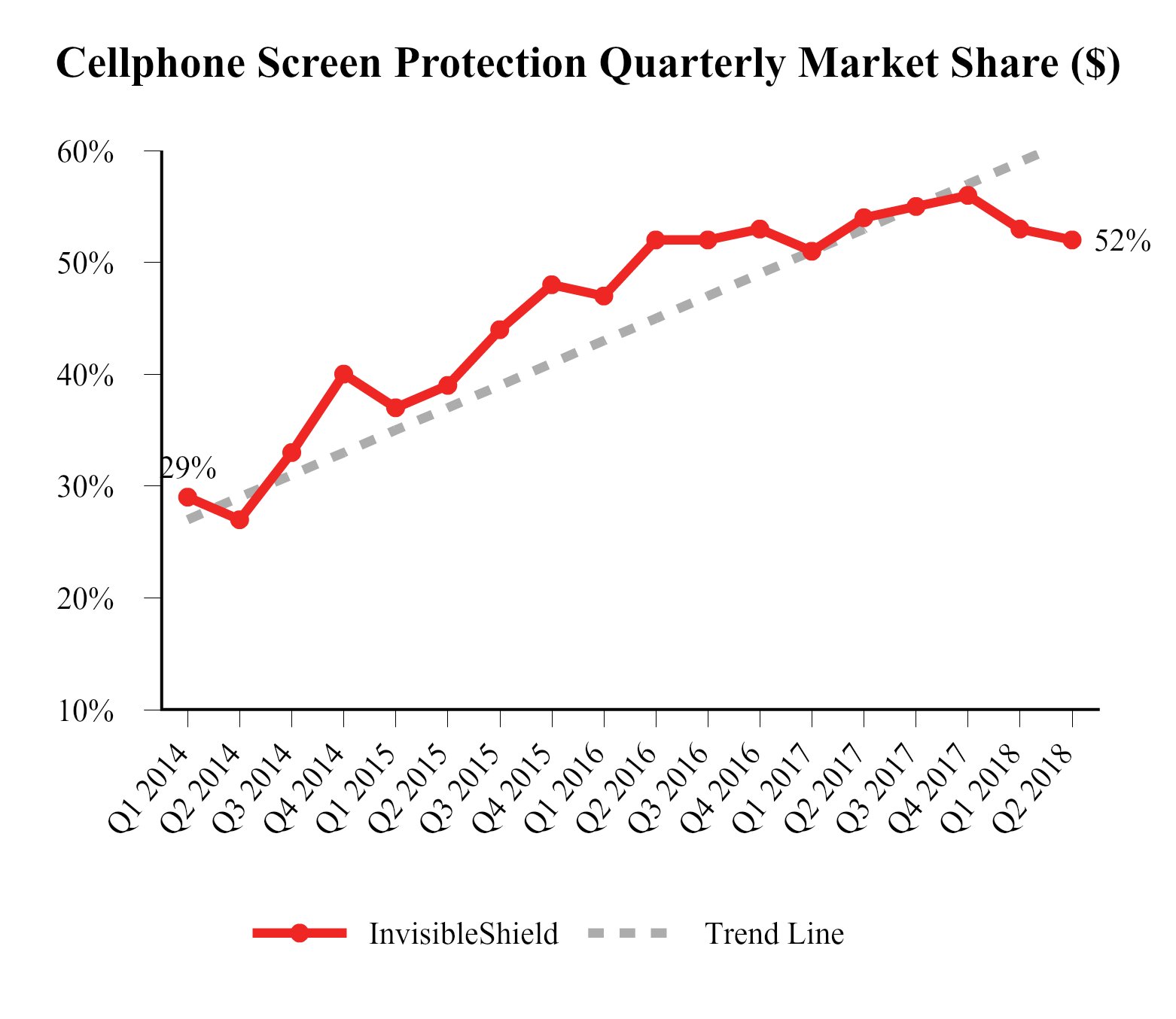

Market Share Information

Screen Protection

The Company continues to see strong and consistent growth in cellphone screen protection market share. From the first quarter of 2014 to the second quarter of 2018, InvisibleShield cellphone screen protection quarterly dollar market share has increased from 29% to 52%.

8

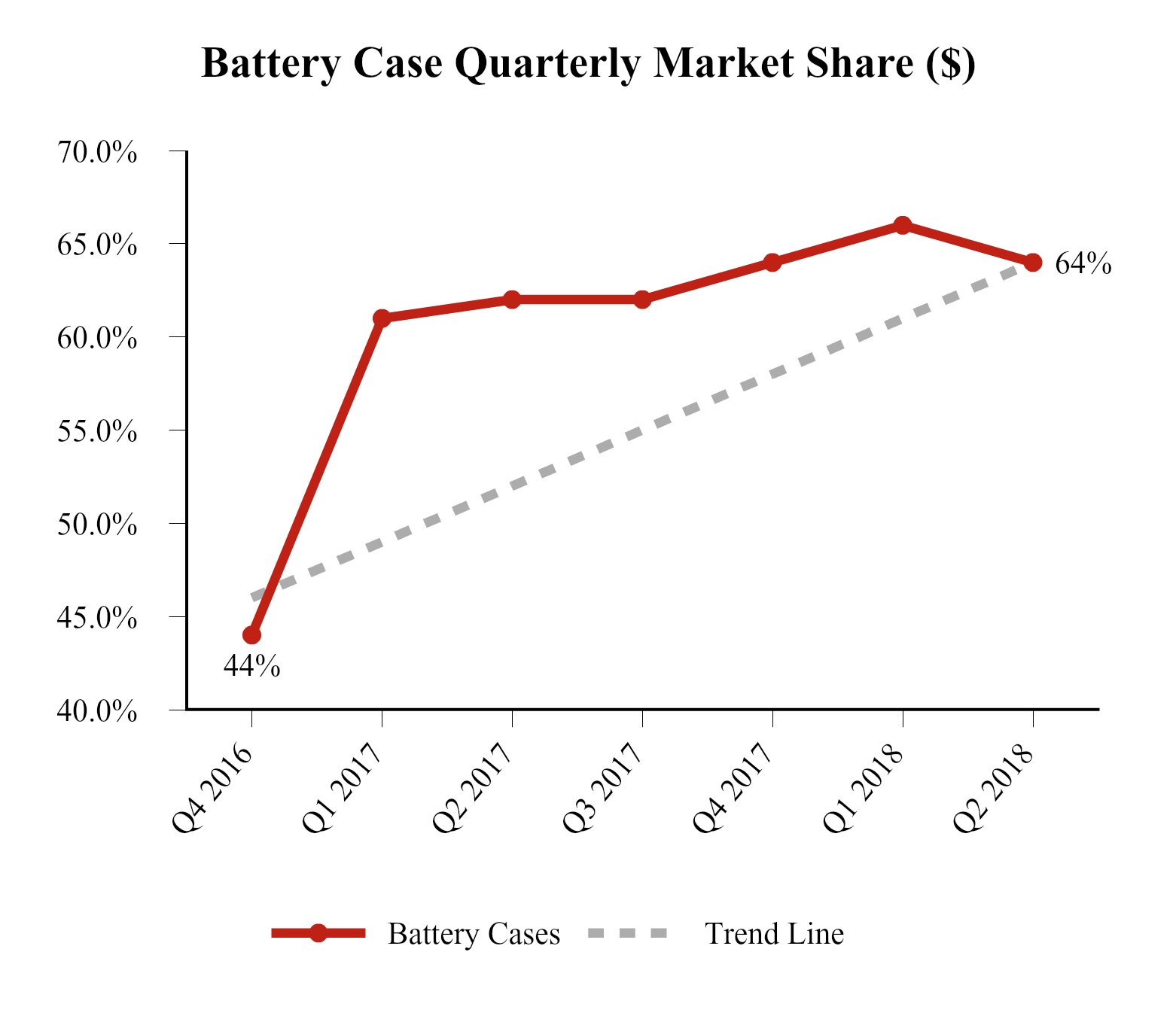

Battery Cases & Power Management

Since the fourth quarter of 2016, mophie branded battery cases and portable power packs have experienced significant growth in dollar market share due to a combination of (1) new and innovative product launches and (2) an unconstrained mophie supply chain. Quarterly battery case dollar market share increased from 44% to 64% from fourth quarter 2016 to second quarter 2018.

9

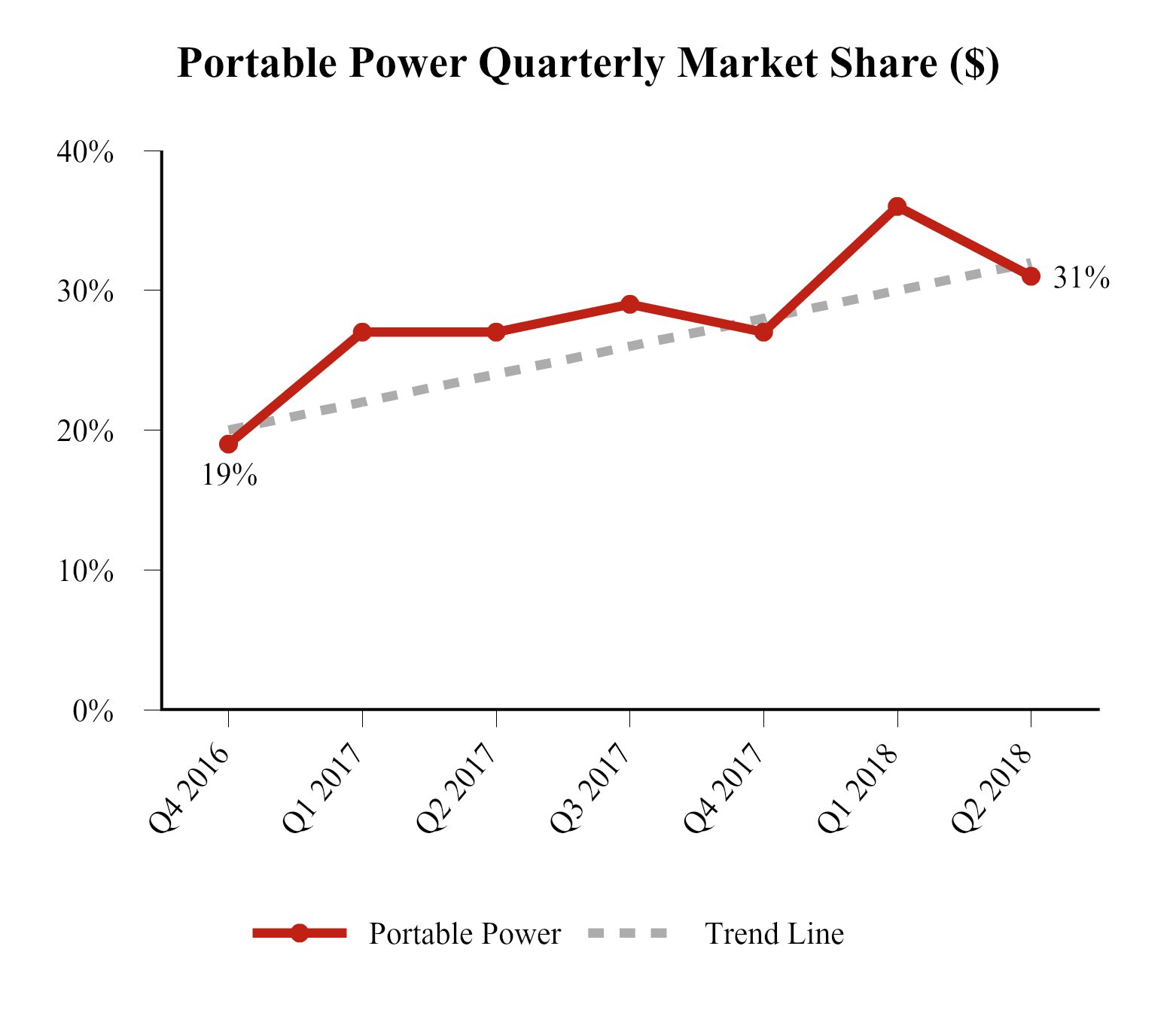

Portable power dollar market share increased from 19% to 31% from fourth quarter 2016 to second quarter 2018.

10

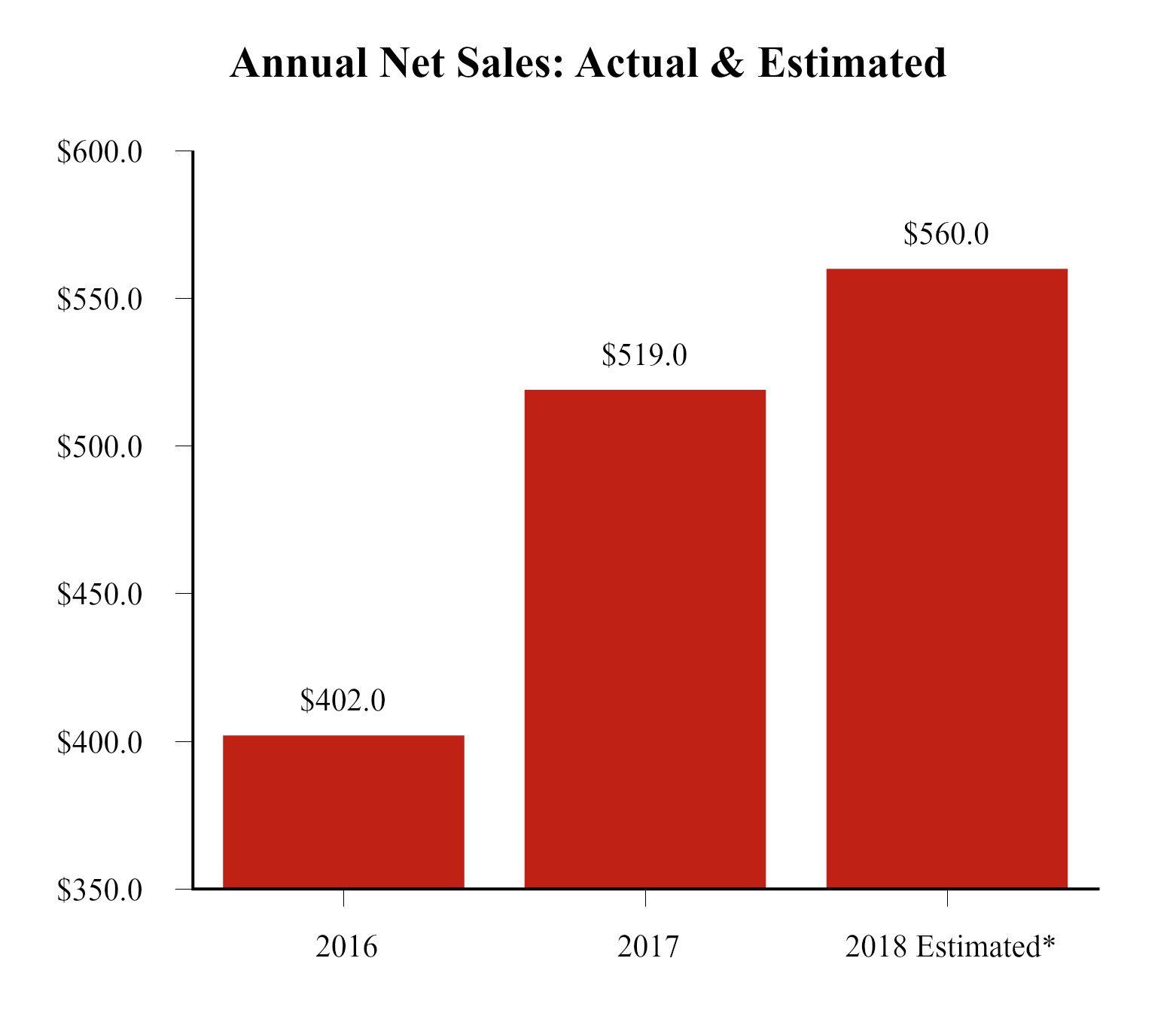

2018 Business Outlook

The Company updated its annual guidance for 2018 to reflect a lower projected annual effective tax rate:

• Net sales of $550 million to $570 million

• Gross profit margin as a percentage of net sales in the low to mid 30's range

• Adjusted EBITDA of $77 million to $80 million

• Diluted earnings per share of $1.30 to $1.50

• Annual effective tax rate of approximately 25% compared to approximately 27% in the last annual business outlook

* Represents the midpoint of guidance of $550 million to $570 million

About Non-GAAP Financial Information

This Supplemental Financial Information - CFO Commentary (“CFO Commentary”) includes Adjusted EBITDA as a non-GAAP financial measure. Readers are cautioned that Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization, stock-based compensation expense, other income (expense), transaction expenses, mophie restructuring charges, mophie employee retention bonus, consulting fee to former CEO, and impairment of intangible asset) is not a financial measure under US generally accepted accounting principles (GAAP). In addition, this financial information should not be construed as an alternative to any other measure of performance determined in accordance with GAAP, or as an indicator of operating performance, liquidity or cash flows generated by operating, investing and financing activities, is as there may be significant factors or trends that it fails to address. As such, it should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. We present Adjusted EBITDA because we believe that it is helpful to some investors as a measure of performance. We caution readers that non-GAAP financial information, by its nature, departs from traditional accounting conventions. Accordingly, its use can make it difficult to compare current results with results from other reporting periods and with the financial results of other companies. We have provided a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measures in the supplemental financial information attached to the press release to which this CFO Commentary is also attached.

11

Cautionary Note Regarding Forward-Looking Statements

This CFO Commentary contains (and oral communications made by us may contain) ““forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict,” “project,” “target,” “future,” “seek,” “likely,” “strategy,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our outlook for the Company and statements that estimate or project future results of operations or the performance of the Company.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

a. the ability to design, produce, and distribute the creative product solutions required to retain existing customers and to attract new customers;

b. building and maintaining marketing and distribution functions sufficient to gain meaningful international market share for our products;

c. the ability to respond quickly with appropriate products after the adoption and introduction of new mobile devices by major manufacturers like Apple, Samsung, and Google;

d. changes or delays in announced launch schedules for (or recalls or withdrawals of) new mobile devices by major manufacturers like Apple, Samsung, and Google;

e. the ability to successfully integrate new operations or acquisitions;

f. the impact of inconsistent quality or reliability of new product offerings;

g. the impact of lower profit margins in certain new and existing product categories, including certain mophie products;

h. the impacts of changes in economic conditions, including on customer demand;

i. managing inventory in light of constantly shifting consumer demand;

j. the failure of information systems or technology solutions or the failure to secure information system data, failure to comply with privacy laws, security breaches, or the effect on the Company from cyber-attacks, terrorist incidents, or the threat of terrorist incidents;

k. adoption of or changes in accounting policies, principles, or estimates; and

l. changes in tax laws and regulations.

Any forward-looking statement made by us in this CFO Commentary speaks only as of the date on which such statement is made. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Readers should also review the risks and uncertainties listed in our most recent Annual Report on Form 10-K and other reports we file with the U.S. Securities and Exchange Commission, including (but not limited to) Item 1A - “Risk Factors” in the Form 10-K and Management's Discussion and Analysis of Financial Condition and Results of Operations and the risks described therein from time to time. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. The forward-looking statements contained in this CFO Commentary are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

12