Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Altra Industrial Motion Corp. | aimc-ex991_7.htm |

| 8-K - 8-K - Altra Industrial Motion Corp. | aimc-8k_20180726.htm |

Second Quarter 2018 Results Exhibit 99.2

Live Webcast July 26, 2018 at 10:00 AM ET 877-407-8293 Domestic 201-689-8349 International Webcast at www.altramotion.com Replay Through August 9, 2018 877-660-6853 Domestic 201-612-7415 International Conference ID: # 13681715 www.altramotion.com Q2 2018 Conference Call Details

SEC Disclosure Rules Additional Information This communication does not constitute an offer to buy, or a solicitation of an offer to sell, any securities of Fortive Corporation (“Fortive”), Stevens Holding Company, Inc. (“Newco”) or Altra Industrial Motion Corp. (“Altra”). In connection with the proposed transaction, Newco filed a registration statement on Form S-4/S-1 containing a prospectus and Altra filed a registration statement on Form S-4 containing a prospectus (together, the “registration statements”) and a preliminary proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”), in each case on May 8, 2018. Each of Altra and Newco have filed, and expect to file, amendments to these filings before they become effective. Investors and security holders are urged to read the registration statements and Altra’s preliminary proxy statement and any further amendments to these filings when they become available as well as any other relevant documents to be filed with the SEC when they become available because such documents contain or will contain important information about Altra, Fortive, Newco and the proposed transaction. Altra’s preliminary proxy statement, the registration statements and any further amendments to these filings as well as any other relevant documents relating to the proposed transaction can be obtained free of charge from the SEC’s website at www.sec.gov. Such documents can also be obtained free of charge from Fortive upon written request to Fortive Corporation, Investor Relations, 6920 Seaway Blvd., Everett, WA 98203, or by calling (425) 446-5000 or upon written request to Altra Industrial Motion Corp., Investor Relations, 300 Granite St., Suite 201, Braintree, MA 02184, or by calling (781) 917-0527. Participants in the Solicitation This communication is not a solicitation of a proxy from any security holder of Altra. However, Fortive, Altra and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders of Altra in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Fortive may be found in its Annual Report on Form 10-K filed with the SEC on February 28, 2018 and its definitive proxy statement relating to its 2018 Annual Meeting filed with the SEC on April 16, 2018. Information about the directors and executive officers of Altra may be found in its Annual Report on Form 10-K filed with the SEC on February 23, 2018, its definitive proxy statement relating to its 2018 Annual Meeting filed with the SEC on March 23, 2018 and its preliminary proxy statement relating to the proposed transaction filed with the SEC on May 8, 2018.

Safe Harbor Statement Cautionary Statement Regarding Forward Looking Statements All statements, other than statements of historical fact included in this release are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. Forward-looking statements can generally be identified by phrases such as "believes," "expects," "potential," "continues," "may," "should," "seeks," "predicts," "anticipates," "intends," "projects," "estimates," "plans," "could," "designed,” "should be," and other similar expressions that denote expectations of future or conditional events rather than statements of fact. Forward-looking statements also may relate to strategies, plans and objectives for, and potential results of, future operations, financial results, financial condition, business prospects, growth strategy and liquidity, and are based upon financial data, market assumptions and management's current business plans and beliefs or current estimates of future results or trends available only as of the time the statements are made, which may become out of date or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could differ significantly from our expectations. These statements include, but may not be limited to, the statements under “Business Outlook,” our expectations regarding our tax rate, our expectations regarding our acquisition of Fortive’s A&S Platform, and the Company’s guidance for full year 2018. In addition to the risks and uncertainties noted in this release, there are certain factors that could cause actual results to differ materially from those anticipated by some of the statements made. These include: (1) competitive pressures, (2) changes in economic conditions in the United States and abroad and the cyclical nature of our markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on our customers, (7) risks associated with a disruption to our supply chain, (8) fluctuations in the costs of raw materials used in our products, (9) product liability claims, (10) work stoppages and other labor issues, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) risks associated with compliance with environmental laws, (14) the ability to successfully execute, manage and integrate key acquisitions and mergers, (15) failure to obtain or protect intellectual property rights, (16) risks associated with impairment of goodwill or intangibles assets, (17) failure of operating equipment or information technology infrastructure, (18) risks associated with our debt leverage and operating covenants under our debt instruments, (19) risks associated with restrictions contained in our Credit Facility, (20) risks associated with compliance with tax laws, (21) risks associated with the global recession and volatility and disruption in the global financial markets, (22) risks associated with implementation of our ERP system, (23) risks associated with the Svendborg and Stromag acquisitions and integration and other acquisitions, (24) risks associated with certain minimum purchase agreements we have with suppliers, (25) risks associated with our exposure to variable interest rates and foreign currency exchange rates, (26) risks associated with interest rate swap contracts, (27) risks associated with our exposure to renewable energy markets, (28) risks related to regulations regarding conflict minerals, (29) risks related to restructuring and plant consolidations, (30) risks related to our pending acquisition of Fortive A&S, including (a) the possibility that the conditions to the consummation of the proposed transaction will not be satisfied, (b) failure to obtain, delays in obtaining or adverse conditions related to obtaining stockholder or regulatory approvals, (c) the ability to obtain the anticipated tax treatment of the proposed transaction and related proposed transactions, (d) risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects, (e) the possibility that we may be unable to achieve expected synergies and operating efficiencies in connection with the proposed transaction within the expected time-frames or at all and to successfully integrate Fortive A&S, (f) expected or targeted future financial and operating performance and results, (g) operating costs, customer loss and business disruption (including, without limitation, difficulties in maintain relationships with employees, customers, clients or suppliers) being greater than expected following the proposed transaction, (h) failure to consummate or delay in consummating the proposed transaction for other reasons, (i) our ability to retain key executives and employees, (j) slowdowns or downturns in economic conditions generally and in the markets Fortive A&S’s businesses participate specifically, (k) slowdowns or downturns in the industrial economy, (l) lower than expected investments and capital expenditures in equipment that utilizes components produced by us or Fortive A&S, (m) lower than expected demand for our or Fortive A&S’s repair and replacement businesses, (n) our relationships with strategic partners, (o) the presence of competitors with greater financial resources than us and their strategic response to our products, (p) our ability to offset increased commodity and labor costs with increased prices, (q) our ability to successfully integrate the merged assets and the associated technology and achieve operational efficiencies, and (r) the integration of Fortive A&S being more difficult, time-consuming or costly than expected and (31) other risks, uncertainties and other factors described in the Company's quarterly reports on Form 10-Q and annual reports on Form 10-K and in the Company's other filings with the SEC or in materials incorporated therein by reference. Except as required by applicable law, Altra Industrial Motion Corp. does not intend to, update or alter its forward looking statements, whether as a result of new information, future events or otherwise.

Executive Overview Q2 Financial Review Market Review Q&A Agenda and Speakers Carl Christenson Chairman & Chief Executive Officer Christian Storch Vice President & Chief Financial Officer

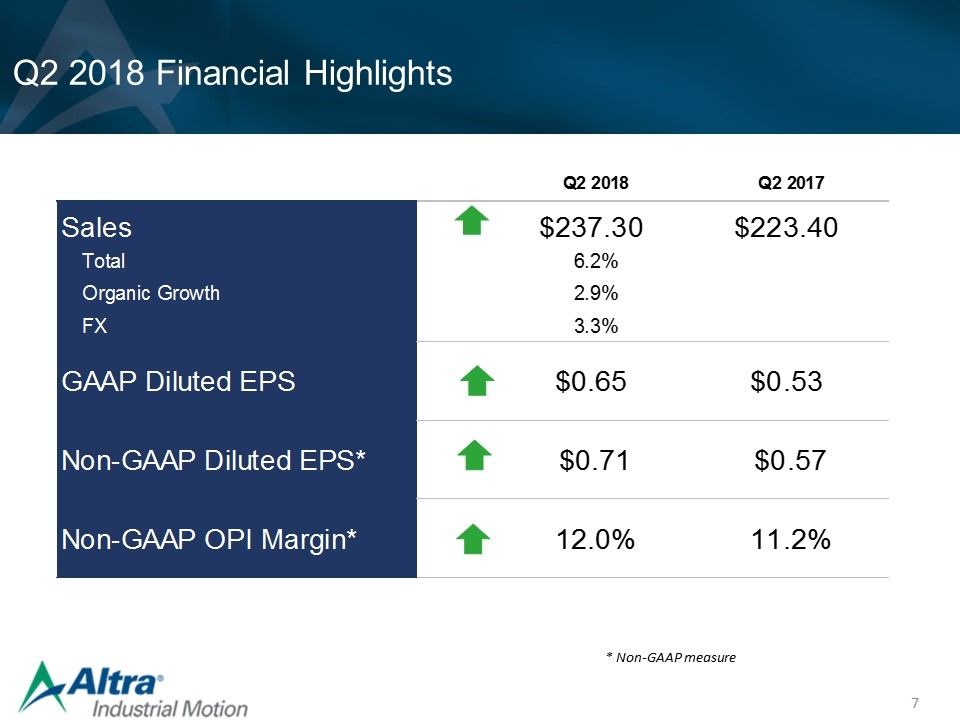

Achieves record EPS; Raising FY2018 guidance as growth momentum continues 6.2% increase in net sales to $237.3 million; 2.9% organic growth Net income increased 23.4% to $19.0 million, or $0.65 per diluted share, from $15.4 million, or $0.53 per diluted share, in the second quarter of 2017. Non-GAAP net income grew 25.3% to $20.8 million, or $0.71 per diluted share, from $16.6 million, or $0.57 per diluted share, a year ago.* Fortive A&S Business integration on track; Expect to close on acquisition in fourth quarter Second-Quarter 2018 Highlights

Q2 2018 Financial Highlights * Non-GAAP measure Q2 2018 Q2 2017 Sales $237.3 $223.4 Total 6.2% Organic Growth 2.9% FX 3.3% GAAP Diluted EPS $0.65 $0.53 Non-GAAP Diluted EPS* $0.71 $0.56999999999999995 Non-GAAP OPI Margin* 0.12 0.112

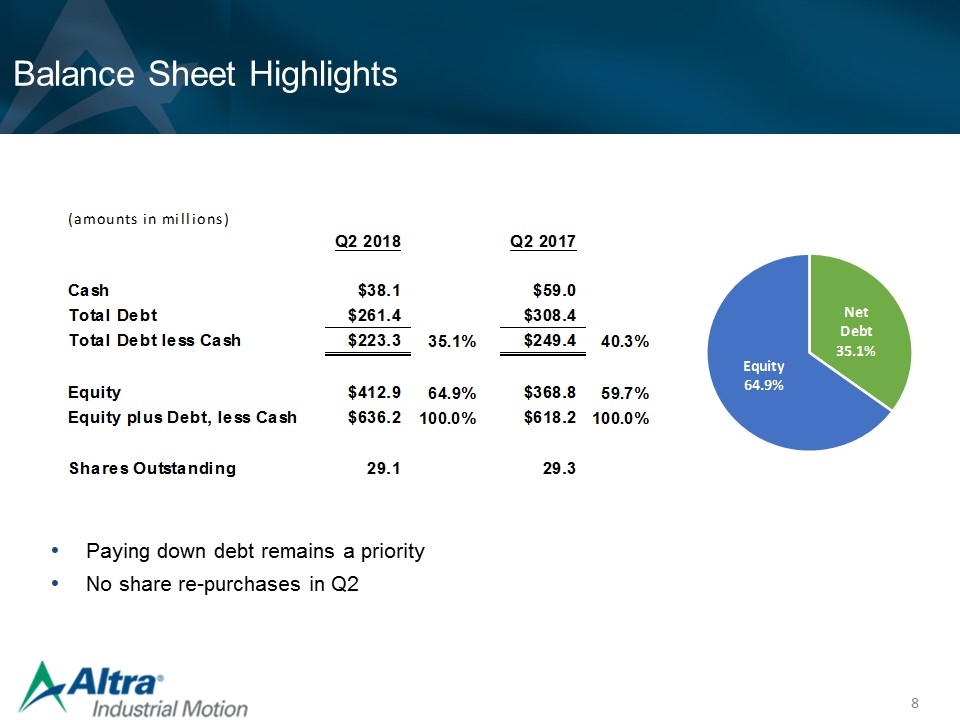

Balance Sheet Highlights Paying down debt remains a priority No share re-purchases in Q2 (amounts in millions) Q2 2018 Q2 2017 Cash $38.1 $59 Total Debt $261.39999999999998 $308.39999999999998 Total Debt less Cash $223.29999999999998 0.35099025463690664 $249.39999999999998 0.40342931090262046 Equity $412.9 0.64900974536309342 $368.8 0.59657068909737943 Equity plus Debt, less Cash $636.19999999999993 100.0% $618.20000000000005 100.0% Shares Outstanding 29.1 29.3 Net Debt 0.35099025463690664 Equity 0.64900974536309342

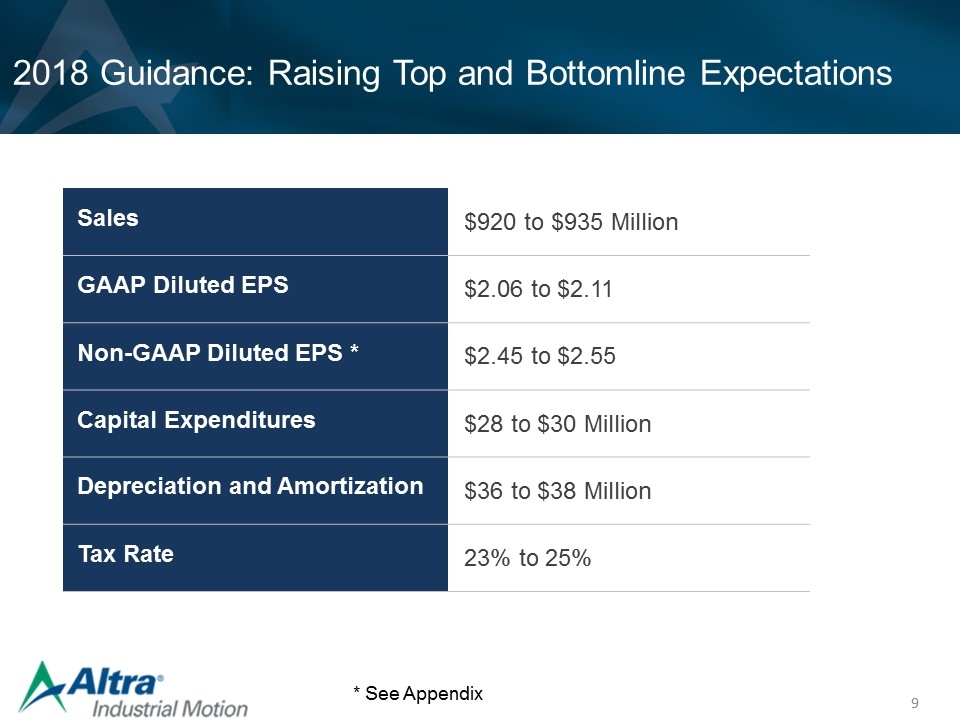

2018 Guidance: Raising Top and Bottomline Expectations Sales $920 to $935 Million GAAP Diluted EPS $2.06 to $2.11 Non-GAAP Diluted EPS * $2.45 to $2.55 Capital Expenditures $28 to $30 Million Depreciation and Amortization $36 to $38 Million Tax Rate 23% to 25% * See Appendix

End Market Review Distribution Sales up double digits year over year Strength in global economy Turf and Garden Sales flat with year-ago quarter Expect 2018 sales to be up from strong 2017 and 2016 Farm and Ag YOY decrease due to difficult comparison with Q2’17 Sales up for 1H’18; Expect sales increase for full year 2018 Material Handling Robust sales across forklift, cranes and hoist markets Demand driven by rebound in oil & gas and metals markets Energy Sales up slightly Strength in oil & gas, partially offset by weakness in power generation and wind Wind sales strong in June; expect continued growth in Q3 Metals Market Double-digit sales growth due to strength in overall industry and steel tariffs Expect strong 2018 Mining Double-digit sales growth due to mining distribution demand Continue to see signs of new equipment builds for mine expansions

Summary Capitalizing on strength across virtually all end markets Seeing benefits of strategic initiatives; Significant upside for bottom-line improvement Creating organic growth opportunities through product development activities Creating premium global industrial company through combination with Fortive A&S businesses Raising guidance for full year 2018

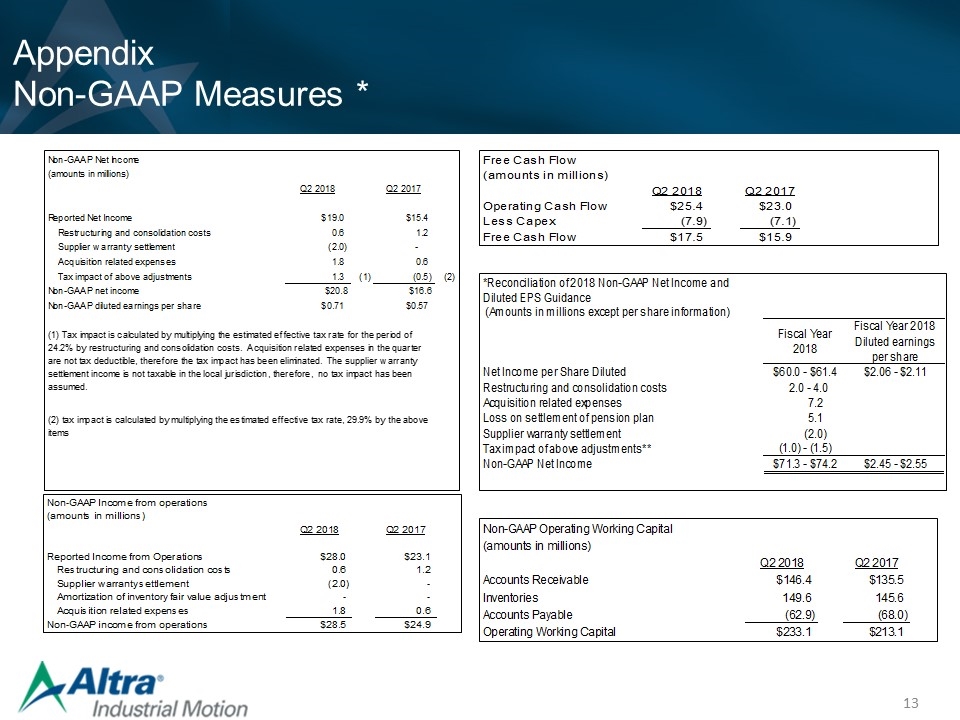

Discussion of Non-GAAP Measures * As used in this release and the accompanying slides posted on the Company's website, non-GAAP diluted earnings per share, non-GAAP income from operations and non-GAAP net income are each calculated using either net income or income from operations that excludes acquisition related costs, restructuring costs, and other income or charges that management does not consider to be directly related to the Company's core operating performance. Non-GAAP gross profit is calculated using gross profit that excludes income or charges that management does not consider to be directly related to the Company's core operating performance. Non-GAAP diluted earnings per share is calculated by dividing non-GAAP net income by GAAP weighted average shares outstanding (diluted). Non-GAAP free cash flow is calculated by deducting purchases of property, plant and equipment from net cash flows from operating activities. Non-GAAP operating working capital is calculated by deducting accounts payable from net trade receivables plus inventories. Altra believes that the presentation of non-GAAP net income, non-GAAP income from operations, non-GAAP gross profit, non-GAAP diluted earnings per share, non-GAAP free cash flow and non-GAAP operating working capital provides important supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations.

Appendix Non-GAAP Measures * Appendix Non-GAAP Measures * Non-GAAP Net Income (amounts in millions) Q2 2018 Q2 2017 Reported Net Income $19 $15.4 Restructuring and consolidation costs 0.6 1.2 Supplier warranty settlement -2 - Acquisition related expenses 1.8 0.6 Tax impact of above adjustments 1.3 -1 -0.5 -2 Non-GAAP net income $20.8 $16.600000000000001 Non-GAAP diluted earnings per share $0.71 $0.56999999999999995 (1) Tax impact is calculated by multiplying the estimated effective tax rate for the period of 24.2% by restructuring and consolidation costs. Acquisition related expenses in the quarter are not tax deductible, therefore the tax impact has been eliminated. The supplier warranty settlement income is not taxable in the local jurisdiction, therefore, no tax impact has been assumed. (2) tax impact is calculated by multiplying the estimated effective tax rate, 29.9% by the above items Non-GAAP Income from operations (amounts in millions) Q2 2018 Q2 2017 Reported Income from Operations $28 $23.1 Restructuring and consolidation costs 0.6 1.2 Supplier warranty settlement -2 - Amortization of inventory fair value adjustment - - Acquisition related expenses 1.8 0.6 Non-GAAP income from operations $28.5 $24.900000000000002 Free Cash Flow (amounts in millions) Q2 2018 Q2 2017 Operating Cash Flow $25.400000000000002 $23 Less Capex -7.9 -7.1000000000000005 Free Cash Flow $17.5 $15.899999999999999 *Reconciliation of 2018 Non-GAAP Net Income and Diluted EPS Guidance (Amounts in millions except per share information) Fiscal Year 2018 Fiscal Year 2018 Diluted earnings per share Net Income per Share Diluted $60.0 - $61.4 $2.06 - $2.11 Restructuring and consolidation costs 2.0 - 4.0 Acquisition related expenses 7.2 Loss on settlement of pension plan 5.0999999999999996 Supplier warranty settlement -2 Tax impact of above adjustments** (1.0) - (1.5) Non-GAAP Net Income $71.3 - $74.2 $2.45 - $2.55 * Adjustments are pre tax, with net tax impact listed separatrely ** Tax impact is calculated by multiplying the effective tax rate for the period of 26.0% by the above items. Non-GAAP Operating Working Capital (amounts in millions) Q2 2018 Q2 2017 Accounts Receivable $146.4 $135.5 Inventories 149.6 145.6 Accounts Payable -62.9 -68 Operating Working Capital $233.1 $213.10000000000002

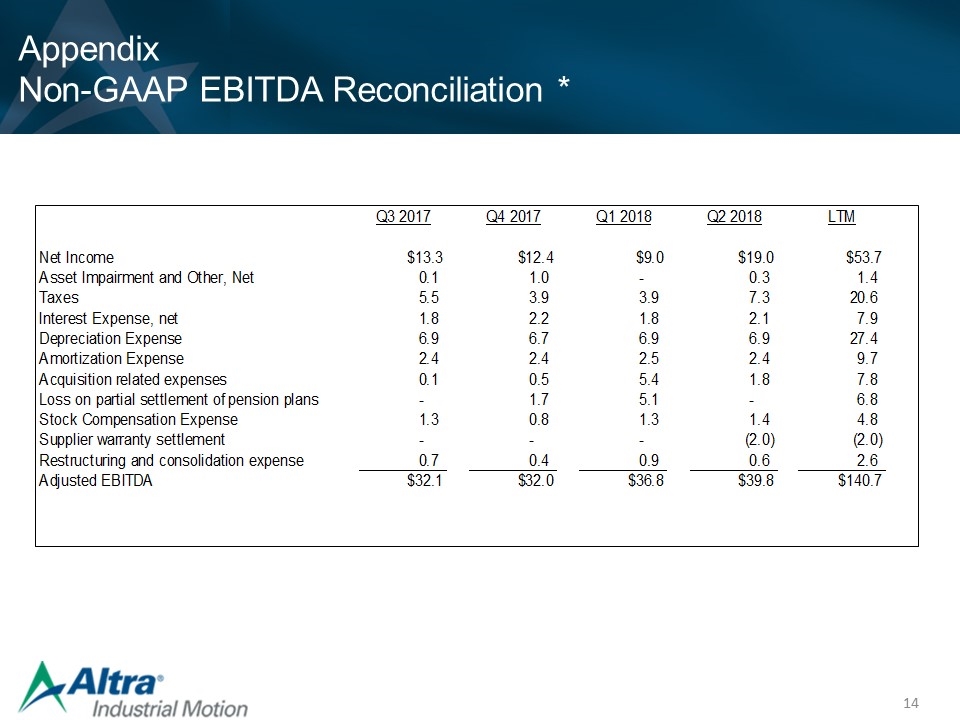

Appendix Non-GAAP EBITDA Reconciliation * EBITDA Reconciliation (amounts in millions) Q3 2017 Q4 2017 Q1 2018 Q2 2018 LTM Net Income $13.3 $12.4 $9 $19 $53.7 Asset Impairment and Other, Net 0.13600000000000001 1 0 0.3 1.4360000000000002 Taxes 5.5 3.9 3.9 7.3 20.6 Interest Expense, net 1.8 2.2000000000000002 1.8 2.1 7.9 Depreciation Expense 6.9 6.7000000000000011 6.9 6.9 27.4 Amortization Expense 2.3999999999999995 2.4000000000000004 2.5 2.4000000000000004 9.6999999999999993 Acquisition related expenses 0.1 0.5 5.4 1.8 7.8 Loss on partial settlement of pension plans 0 1.7 5.0999999999999996 0 6.8 Stock Compensation Expense 1.2999999999999996 0.7999999999999996 1.3 1.4000000000000001 4.8 Supplier warranty settlement 0 0 0 -2 -2 Restructuring and consolidation expense 0.7 0.4 0.9 0.6 2.6 Adjusted EBITDA $32.136000000000003 $32 $36.799999999999997 $39.799999999999997 $140.73600000000002