Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF PARITZ & COMPANY, P.A. - SPRING PHARMACEUTICAL GROUP, INC. | exh23-1.htm |

As filed with the Securities and Exchange Commission on July 13, 2018

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA YCT INTERNATIONAL GROUP, INC.

CHINA YCT INTERNATIONAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

2834

|

30-0781441

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

c/o Shandong Spring Pharmaceutical Co., Ltd.

Economic Development Zone, Gucheng Road,

Sishui County, Shandong Province 373200

People's Republic of China

+86 0537-4268271

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Harvard Business Services, Inc.

16192 Coastal Hwy,

Lewes, DE 19958

(302) 645-7400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Steven W. Schuster, Esq.

Xuan (Shane) Wu, Esq.

McLaughlin & Stern, LLP

260 Madison Avenue, 18 FL

New York, NY, 10016

Tel: (212) 448-1100

|

|

Mitchell Nussbaum, Esq.

Angela Dowd, Esq.Loeb & Loeb LLP

345 Park Avenue

New York, NY 10154

T: 212.407.4000

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

(Check one):

☐ Large accelerated filer

☐ Accelerated filer

☐ Non-accelerated filer (Do not check if a smaller reporting company)

☒ Smaller reporting company

☐ Emerging growth company

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

Proposed Maximum Aggregate Offering Price(1)

|

Amount of Registration Fee(1)

|

||||||

|

Shares of common stock, par value $0.001 (2) (3)(4)

|

$

|

8,625,000

|

$

|

1073.81

|

||||

|

Underwriter' warrants(4)

|

—

|

—

|

||||||

|

Shares of common stock underlying underwriter' warrants(3)(5)

|

$

|

603,750

|

$

|

75.17

|

||||

|

Total:

|

$

|

9,228,750

|

$

|

1148.98

|

||||

|

(1)

|

Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the "Securities Act").

|

|

(2)

|

Includes the total offering price of additional shares of common stock the underwriters have the option to purchase to cover over-allotments, if any.

|

|

(3)

|

Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

|

|

(4)

|

We have agreed to issue to Maxim Group LLC (the "Underwriter"), the underwriter for this offering, warrants representing 7% of the total number of securities issued in the offering, including any over-allotment securities (the "Underwriter's Warrants"). The Underwriter's Warrants will be exercisable beginning six months after the effective date of this registration statement at a per share price equal to 110% of the common stock public offering price and will expire three years from the date on which they are initially exercisable. Resales of the Underwriter's Warrants on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, are registered hereby. Resales of shares issuable upon exercise of the Underwriter's Warrants are also being similarly registered on a delayed or continuous basis hereby. See "Underwriting." In accordance with Rule 457(g) under the Securities Act, because the shares of the Registrant's common stock underlying the Underwriter's Warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby

|

|

(5)

|

The Registrant amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED JULY 13 , 2018

|

China YCT International Group, Inc.

We are offering [●] shares of our common stock in a firm commitment underwritten public offering at a public offering price of $[●] per share.

Prior to this offering, our stock has been quoted on the OTCQB under the symbol "CYIG". On July 13, 2018, the last reported sales prices of our common stock on the OTCQB was $0.82 per share. We intend to apply to list our common stock on The Nasdaq Capital Market under the symbol "CTYY". We cannot assure you that our application will be approved. The closing of this offering is contingent upon the successful listing of our common stock on The Nasdaq Capital Market.

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 8 of this prospectus to read about factors that you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

Per Common Share

|

Total

|

||||||

|

Public offering price

|

$

|

[●]

|

$

|

|||||

|

Underwriting discount (1)

|

$

|

[●]

|

$

|

|||||

|

Proceeds to us, before expenses

|

$

|

[●]

|

$

|

|||||

|

(1) The underwriter will receive compensation in addition to the underwriting discount. See "Underwriting" beginning on page 70 of this prospectus for a description of compensation payable to the underwriters. In addition, we have agreed to reimburse the underwriter for other out-of-pocket expenses relating to this offering up to a maximum of $150,000 for all such expenses.

|

We have granted the underwriter the option for a period of 45 days to purchase up to [●] additional shares of common stock (up to 15% of the number of shares of common sold in the primary offering) solely to cover over-allotments, if any. If the underwriter exercises its right to purchase additional shares of common stock to cover over-allotments in full, we estimate that we will receive gross proceeds of $ [●] from the sale of the common stock being offered and net proceeds of $[●] after deducting $[●] for underwriting discounts and commissions.

The underwriter expects to deliver the shares against payment in New York, New York, on or about [●], 2018.

Sole Book-Running Manager

Maxim Group LLC

The date of this Prospectus is [●]

1

TABLE OF CONTENTS

| Page | |

|

PROSPECTUS SUMMARY

|

3 |

|

RISK FACTORS

|

8 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

23 |

|

USE OF PROCEEDS

|

24 |

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

24 |

|

DIVIDEND POLICY

|

25 |

|

CAPITALIZATION

|

26 |

|

DILUTION

|

27 |

|

SELECTED CONSOLIDATED FINANCIAL DATA

|

27 |

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

29 |

|

DESCRIPTION OF BUSINESS

|

37 |

|

REGULATION

|

52 |

|

LEGAL PROCEEDINGS

|

57 |

|

DESCRIPTION OF PROPERTY

|

57 |

|

MANAGEMENT

|

58 |

|

EXECUTIVE COMPENSATION

|

64 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

66 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

66 |

|

DESCRIPTION OF CAPITAL STOCK

|

67 |

|

UNDERWRITING

|

70 |

|

LEGAL MATTERS

|

74 |

|

EXPERTS

|

74 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

74 |

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

F -1 |

2

Neither we nor the underwriter has authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor the underwriter takes responsibility for, or provides any assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

No action is being taken in any jurisdiction outside the U.S. to permit a public offering of our common stock or possession or distribution of this prospectus in any such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the U.S. are required to inform themselves about and to observe any restrictions on this offering and the distribution of this prospectus applicable to those jurisdictions.

Our logo and some of our trademarks and tradenames are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus may appear without the ®, TM and SM symbols, but those references are not intended to indicate in any way that we will not assert to the fullest extent under applicable law our rights or the rights of the applicable licensor to these trademarks, tradenames and service marks.

Industry and Market Data

This prospectus contains estimates and information concerning our industry, including market size and growth rates of the markets in which we participate, that are based on industry publications and reports. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in "Risk Factors," that could cause results to differ materially from those expressed in these publications and reports.

We have also relied on statistics provided by a variety of publicly-available sources regarding China's expectations of growth. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this prospectus other than to the extent specifically cited in this prospectus.

Information contained in, and that can be accessed through, our web site www.yctgroup.com shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the securities offered hereunder.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including "Risk Factors", "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision.

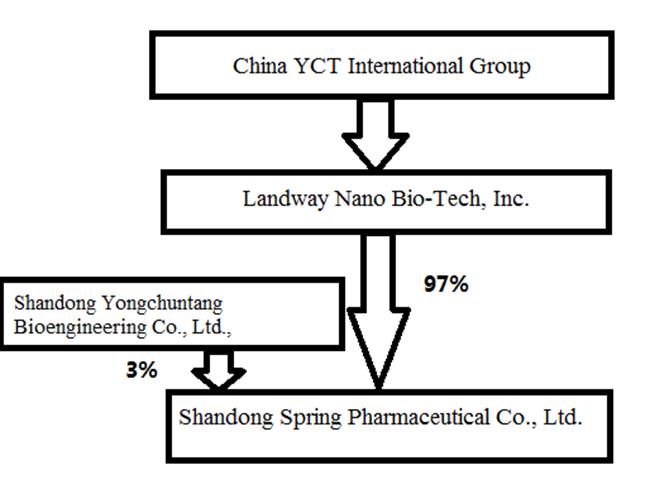

In this prospectus, unless otherwise noted or as the context otherwise requires, the "Company" ,"CYIG", "we", "us" and "our" refer to the combined business of China YCT International Group, Inc., a Delaware corporation, Landway Nano Bio-Tech Group, Inc. ("Landway Nano") a Delaware corporation, and Shandong Spring Pharmaceutical Co., Ltd. ("Shandong Spring Pharmaceutical"), which is our 97%-owned subsidiary formed under the laws of the People's Republic of China. "China" or "PRC" refers to the People's Republic of China, excluding Hong Kong Special Administrative Region of China, Macau Special Administrative Region of China and the Taiwan Region.

3

This prospectus contains translations of certain Chinese currency Renminbi or RMB amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. The relevant exchange rates are listed below:

|

|

For the years ended

March 31,

|

|||||||||||

|

|

2018

|

2017

|

2016

|

|||||||||

|

Period Ended RMB: USD exchange rate

|

6.2881

|

6.8993

|

6.4612

|

|||||||||

|

Period Average RMB: USD exchange rate

|

6.6254

|

6.7287

|

6.3214

|

|||||||||

Our Company

Overview

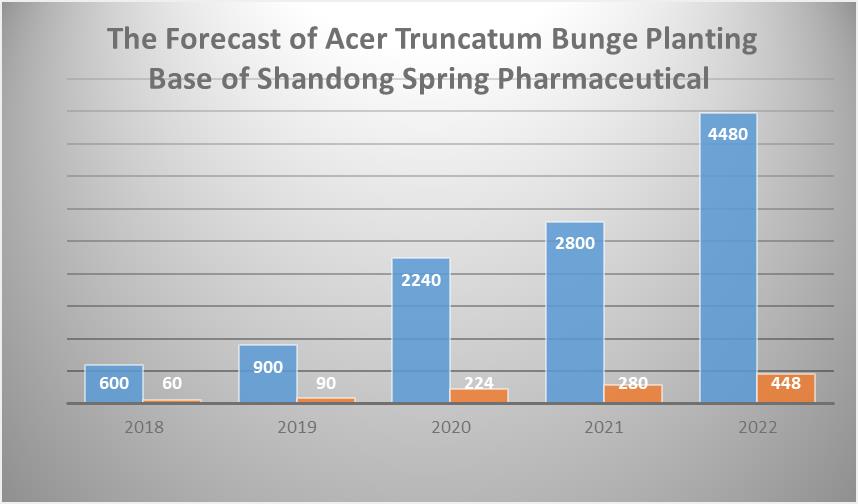

We are a vertically integrated and innovative health care company focusing on developing, manufacturing, marketing and distributing modernized Traditional Chinese Medicines ("TCM") and health care products in China. Our proprietary product, Huoliyuan capsule, is a China Food and Drug Administration ("CFDA") approved prescription TCM that has a wide range of therapeutic benefits. We believe that it is the only TCM of its kind made in slow-release capsule form for improved absorption rate and therapeutic effects. In addition, in an effort to capitalize on the initiative of developing plant-based oil products promulgated by the State Forestry Administration of China, we are actively engaging in research and development and production of acer truncatum bunge seed oil products. We currently have approximately 5,880 mu (approximately 968.65 acres) of acer truncatum bunge plantation base located in Sishui, Shandong Province coupled with modern production facilities. Production from acer truncatum bunge trees in 2018 will enable us to cease sole reliance on third party producers of our raw material and achieve cost savings and enhance control of raw material supplies. We believe we are the only company in China to have achieved industrial-scale production and vertically integrated capability for acer truncatum bunge seed oil products. We plan to continue increasing the breadth our acer truncatum bunge seed oil product portfolio and improving our capabilities to produce raw materials and finished products as we envision this particular business segment will become a major growth driver for us in the future.

We have three distinctive business segments:

|

·

|

developing, manufacturing and selling Huoliyuan capsules, a medicine made primarily from panax ginseng leaves extract,

|

|

·

|

developing, manufacturing and selling seed oil products from acer truncatum bunge trees, a maple tree native to China, and

|

|

·

|

distributing health care supplement products manufactured by another company in the PRC.

|

We conduct our sales and marketing activities for the acer truncatum bunge seed oil products and health care supplement products produced by Shandong Yongchuntang Group Co., Ltd. ("Shandong Yongchuntang") primarily through seven major distributors who collectively control a 200,000+ person direct sales force, covering 33 provinces throughout China. We also have an internal sales and marketing team responsible for developing key sales strategies and campaigns, and utilize independent distributors for sales of Huoliyuan capsules.

We have realized significant growth in revenue and net income in recent periods. We realized $64,942,737 in revenue, representing an increase of 15.0% or $8,479,573, for the year ended March 31, 2018, as compared to $56,463,164 for the prior year. We also realized net income of $11,738,488, representing a 16.7% or $1,683,834 increase, for the year ended March 31, 2018, compared to $10,054,654 for the prior year.

4

Our Growth Opportunity

We believe that sales of our diversified products are growing and evolving. Drivers of growth include:

|

·

|

Policies from several levels of the Chinese government which support and encourage development of acer truncatum bunge seed oil industry

|

|

·

|

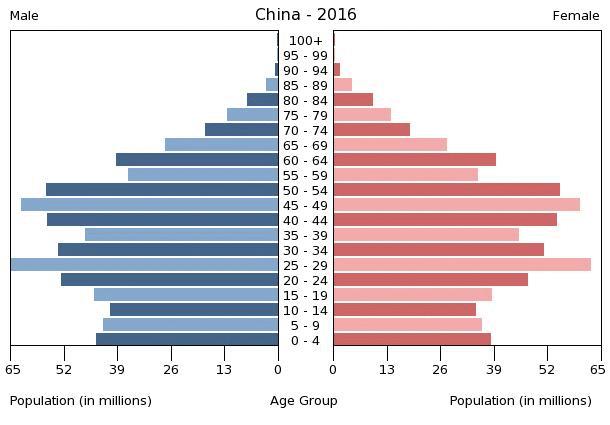

China's increasing expenditures on medicines and healthcare products due to China's increasing per capita disposable income and the growth of China's aging population

|

|

·

|

Use of the cost-effective licensed direct sales program and development of relationships with major distributors to increase the distribution and sales of our acer truncatum bunge seed oil products and health care products purchased from Shandong Yongchuntang as we expand geographically and add new products

|

The upcoming harvest of acer truncatum bunge pods and the establishment of a cooperative relationship with local farmers who plant the acer truncatum bunge trees is expected to increase our supply of acer truncatum bunge pods for processing the seeds into oil, which should lower the per unit cost and eliminate our reliance on third party suppliers for our raw material.

Our Competitive Strengths

We believe the following competitive strengths have contributed to, or will contribute to, our recent and ongoing growth:

Dominant Producer of Acer Truncatum Bunge Seed Oil

We believe that we are the largest producer of acer truncatum bunge seed oil in China, accounting for 47.7% of the market in China in 2017. We have also obtained a food production license for the production of edible vegetable oil from the Food and Drug Administration of Sishui County, and expect to produce blended edible oil products that contain acer truncatum bungee seed oil as one of the major ingredients. We believe that being the dominant producer and having stronger vertically integrated production capabilities will provide us with advantages in pricing, production and distribution of our products and spur further growth.

Diversified Revenue and Profit Stream

We generate revenue through the sales of diversified products, including prescription medicines, acer truncatum bunge seed oil products, and health care products purchased from Shandong Yongchuntang . With a diversified revenue stream, which can reduce financial stress during times of economic decline by relying on more than a single product, we believe alternative revenue sources provide the diversification to create a more financially stable company as well as additional opportunities for growth.

Strong Relationship with Key Distributors

We conduct our sales primarily through our seven distributors, who collectively control a person direct sales force of over 200,000 people and use person-to-person marketing to promote and sell our acer truncatum bunge seed oil products and nine products purchased from Shandong Yongchuntang. Compared to health and nutrition products that are distributed through traditional market means, these personal marketing efforts are supported by various mediums, including our marketing content, websites, events and social business solutions.

Reputable Brands

Our acer truncatum bunge seed oil products are distributed under the recognized brand name "Bao Feng San Yi". In addition, we believe that we are the largest producer of Huoliyuan capsules and tablets in China, that our Huoliyuan capsule is the only herbal medicine of its type made in the form of a capsule, and we believe that we are recognized by customers as a leader in the Huoliyuan market. Other peer products are produced in the form of tablets. The capsule permits the medication to be formulated for slow release. We believe that our reputable brand name will be of benefit to our future expansion and growth efforts.

5

Raw Materials Competitive Pricing

Our goal is to be a vertically integrated acer truncatum bunge seed oil and blended edible oil producer once our own trees begin production, which is expected to occur in the fall of 2018. While to date we have produced acer truncatum bunge seed oil from raw materials purchased from third parties, we began to develop and cultivate our own trees in June 2013. We have leased 5,880 mu (approximately 2,324.77 acres) of farmland for terms of 30 years and 14 years, respectively, and have planted approximately seven million trees at a cost of approximately $49 million through March 31, 2018. Having our own tree base will significantly reduce our cost to produce the seed oils compared to our competitors that purchase the acer truncatum bunge pods from third parties. The intended principal use of the proceeds that we will receive from this offering is to expand and further automate our manufacturing facilities.

Experienced Management

We are led by highly experienced and entrepreneurial executive officers. Mr. Tinghe Yan, our founder, Chairman and Chief Executive Officer, has over twenty years of experience in corporate management within the food and food supplements industries. Mr. Yan founded Shandong Spring Pharmaceutical in 2006. From 1998 to 2006, Mr. Yan was employed as the Chairman and General Manager of Shandong Yongchuntang, which manufactures a wide variety of food supplements and health care products and is currently the exclusive supplier of nine health care products distributed by Shandong Spring Pharmaceutical.

Corporate information

Our principal executive office is located at c/o Shandong Spring Pharmaceutical Co., Ltd., Economic Development Zone, Gucheng Road, Sishui County, Shandong Province 373200, People's Republic of China, and our telephone number is +86 0537-4268171. Our website address is www.yctgroup.com. The information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus or the registration statement of which it forms a part.

6

The Offering

The following summary contains basic information about the offering and the securities we are offering and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the securities we are offering, please refer to the section of this prospectus titled "Description of Capital Stock".

|

Securities being offered

|

[●] shares of common stock

|

|

Offering Price

|

$[●] per share.

|

|

Over-allotment option

|

We have granted the underwriter the option to purchase up to [●] additional shares of common stock, solely to cover over-allotments, if any, at the price to the public set forth on the cover page to this prospectus less the underwriting discounts and commissions. The over-allotment option is exercisable for 45 days from the date of this prospectus.

|

|

Common stock outstanding before this offering

|

29,839,168 shares of common stock(1)

|

|

Common stock outstanding after this offering

|

[●] shares of common stock (or [●] shares if the underwriter exercises its over-allotment option in full).(2)

|

|

Use of proceeds

|

We estimate that our net proceeds from this offering will be $[●] million (or approximately $[●] million if the underwriters' option to purchase additional shares of our common stock from us is exercised in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of the offering for (i) the expansion and automation of our manufacturing facilities for acer truncatum bunge seed oil products, (ii) the purchase of equipment and (iii) general working capital to meet the needs of our continued development. See "Use of Proceeds" for additional information

|

|

Risk factors

|

Investing in our securities involves a high degree of risk. You should read carefully the "Risk Factors" section beginning on page 8 of this prospectus for a discussion of factors that you should carefully consider before deciding to invest in our securities.

|

|

OTCQB

Marketplace ticker symbol

|

"CYIG"

|

|

Proposed Nasdaq Symbol and Listing

|

We intent to apply to list our common stock on The Nasdaq Capital Market under the symbol "CTYY". There can be no assurance that our application will be approved. The closing of this offering is contingent upon the successful listing of our common stock on The Nasdaq Capital Market.

|

|

Transfer Agent and Registrar:

|

Interwest Transfer Co., Inc.

|

|

(1)

|

The number of shares of our common stock outstanding is based on 29,839,168 shares outstanding as of July 13, 2018, which excludes:

|

|

●

|

3,000,000 shares of our common stock that have been reserved for future issuance under our 2018 Stock Incentive Plan.

|

|

●

|

500,000 restricted shares of common stock issuable to a consultant should our common stock be listed on The Nasdaq Stock Market.

|

|

●

|

400,000 restricted shares of common stock issuable upon the exercise of a warrant at an exercise prices of $2.00 per share, which warrant is exercisable six months after our common stock is listed on The Nasdaq Stock Market. For a discussion on the terms of the outstanding warrant, see "Description of Capital Stock—Warrants".

|

|

●

|

[●] shares of common stock issuable upon the exercise of warrants to be issued to the Underwriter in connection with this offering.

|

|

(2)

|

Except as otherwise stated herein, the information in this prospectus assumes no exercise by the underwriter of its over-allotment option.

|

7

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline, and you may lose all or part of your investment. You should read the section entitled "Cautionary Note Regarding Forward Looking Statements" for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

Risks Relating to Our Business and Industry

We are dependent on our relationship with Shandong Yongchuntang for a significant portion of our business.

Shandong Yongchuntang is currently the exclusive supplier of nine health care products distributed by Shandong Spring Pharmaceutical. Any problems with our relationship with Shandong Yongchuntang or with the operations of Shandong Yongchuntang could have a material adverse impact on our revenues and growth. The distribution of products manufactured by Shandong Yongchuntang accounted for $26,297,055, or 40.5% and $20,159,631, or 35.7%, of our revenue in the fiscal years ended March 31, 2018 and 2017, respectively. We sublicense Shandong Yongchuntang's license from the Chinese government to conduct direct sales marketing, which accounted for all of our sales of Shandong Yongchuntang's products. We also sell our acer truncatum bunge seed oil products under this sublicense, which accounted for $12,844,950, or 19.8% percent of our revenue in the fiscal year ended March 31, 2018.

We are dependent upon two lines of products for a majority of our revenues,

A substantial portion of our revenue is derived from sales of Huoliyuan capsules and acer truncatum bunge seed oil products. Any material problems in the manufacture, sale or distribution of acer truncatum bunge seed oil products or Huoliyuan capsules, some of which may be beyond our control, could have a material adverse effect on our revenues and growth. For example, in 2014, sales of Huoliyuan capsules were adversely affected by a crisis in China regarding a widespread quality failure in capsules materials, although the market demand for Huoliyuan capsules has since been stabilized. Sales of Huoliyuan capsules and acer truncatum bunge seed oil products, accounted for $38,645,682, or 59.5%, of our revenue in the fiscal year ended March 31, 2018, and for $36,303,533, or 64.3% in the fiscal year ended March 31, 2017, respectively.

We are dependent on the services of our executive officers, including Tinghe Yan, our Chief Executive Officer, Chuamin Li, our Chief Financial Officer, and Maogong Sun, our general manager. Any loss in their services without suitable replacement may adversely affect our operations.

Our success depends to a significant degree on the services rendered to us by our key employees, and our continued success will depend on our ability to retain their services. In particular, we rely on the services of Tinghe Yan, Chuanmin Li, and Maogang Sun, given their experience in the traditional healthcare and edible oils industries, in product development, and in sales and marketing and their relationships with our customers and suppliers. Mr. Yan has served as our Chairman and Chief Executive Officer since 2007. Mr. Yan founded Shandong Spring Pharmaceutical, and he has served as its Chairman since January 2006. Mr. Li has been our Chief Financial Officer since 2005. Mr. Sun has served as our general manager, deputy general manager and director of pharmaceutical production, quality management, marketing, for Shandong Spring Pharmaceutical since 2006. We do not have key man life insurance on any officers.

The loss of the services of any of key employees, including members of our senior management team, without suitable replacement or the inability to attract and retain qualified personnel with sufficient experience in our industry would adversely affect our operations and, hence, our revenue and profits.

8

Unexpected factors may hamper our efforts to implement our business plan.

Our business plan contemplates that we will become a fully integrated grower, manufacturer and marketer of various herbal products. We commenced manufacture of Huoliyuan capsules in 2010; and our business shifted from largely distributing health and beauty aids manufactured by Shandong Yongchuntang, to manufacturing and marketing Huoliyuan capsules and acer truncatum bunge based products. In order to fully implement our business plan, we will have to successfully complete the development of an agricultural facility and an industrial facility. The complexity of this undertaking means that we are likely to face many challenges, some of which are not yet foreseeable. Problems may occur with our raw material production and with the roll-out of efficient manufacturing processes. If we are not able to minimize the costs and delays that result, our business plan may fall short of its goals, and the current profitability of our distribution activities may be offset by losses from the herbal business.

Acer truncatum bunge seed oil is claimed to have nutritional and health benefits, but we cannot assure you that all or any of the claims made by others are accurate.

Studies and users of oil extracted from acer truncatum bunge seeds claim that use of the oil has health benefits. These users generally use acer truncatum products due to word-of-mouth or other advertising by manufacturers of the product. Additionally, there are little to no restrictions or health regulations on acer truncatum bunge seed oil in China at this time. Neither the Chinese Food and Drug Administration nor State Food and Drug Administration (SFDA) of China has opined on acer truncatum bunge seed oil at this time. While there are some research papers that claim that there are health benefits that support brain health by way of high levels of nervonic acid found in acer truncatum bunge seed oil, we cannot make any assurances that these claims are accurate.

The development of products based on acer truncatum bunge based products may not succeed.

We have devoted substantial resources to the development of products based on acer truncatum bunge and estimate that the development of the project which has taken five years with a total investment of approximately $49 million. However, there can be no assurance that such product development will be successful. While we intend to finance the development of our products from internally generated capital and the proceeds of this offering, there is no assurance that our other operations will generate sufficient capital to finance such development or, if insufficient, that alternate financing will be available.

Our business is currently dependent on our relationships with three suppliers.

Shandong Yongchuntang is the sole supplier of nine health care products that we distribute. We also currently depend on one vendor for 44.5% of the raw material we use for the production of Huoliyuan capsules and one vendor for 11.85% of the raw material we use for the production of acer truncatum bunge seed oil. If our relationship with any of these vendors is terminated, interrupted or materially modified or if the businesses of any of these vendors suffer adverse developments, our financial condition would be materially and adversely affected.

We are subject to the risk of natural disasters.

We eventually intend to produce most of the raw materials for our production of acer truncatum bunge seed oils. In particular, we are growing our own acer truncatum bunge trees. Those trees are very sensitive crops, which can be readily damaged by harsh weather, by disease, and by pests. If our crops are destroyed by drought, flood, storm, blight, or the other perils of farming, we will not be able to meet the demands of our manufacturing facility, which will then become inefficient and unprofitable. In addition, if we are unable to produce sufficient products to meet demand, our distribution network is likely to atrophy. This would result in an immediate loss of income and could also have a long term negative effect on our ability to grow our business,

If we lose control of our distribution network, our business will suffer.

We depend on our direct sales marketing distribution network, and particularly upon our seven largest distributors, which, together account for 40.2% of our sales, for the success of our business. Competitors may seek to disrupt or pull our distribution network away from us. In addition, if dominant members of our distribution network become dissatisfied with their relationship with Shandong Spring Pharmaceutical, a concerted effort by the distribution network could force us to accept less favorable financial terms from the distribution network. Any one of these possibilities, if realized, would have an adverse effect on our business.

9

Increased government regulation of our production and/or marketing operations could diminish our profits.

At present, there is no significant government regulation of the health claims that sellers in our industry make regarding their products. In addition, there is only limited government regulation of the conditions under which we manufacture our products, although the production of the Huoliyuan capsules, which is a prescription medicine, is subject to increasing regulations in China. Other developed countries, such as the United States and in particular, members of the European Community, have far more extensive regulation of the operations of nutraceuticals and plant-based cosmetics, including strict limitations on the health-related claims that can be made without scientifically-tested evidence. China may, increase its regulation of our activities. To the extent that new regulations require us to conduct a regimen of scientific tests of the efficacy of our products, the expense of such testing would reduce our profitability. In addition, to the extent that the health benefits of some of our products are not able to be fully supported by scientific evidence, our sales might be reduced.

Our business and growth will suffer if we are unable to hire and retain key personnel, who are in high demand.

Our future success depends on our ability to attract and retain highly skilled agronomists, biologists, chemists, industrial technicians, production supervisors, and marketing personnel. In general, qualified individuals are in high demand in China, and there are insufficient experienced personnel to fill the demand. In a specialized scientific field, such as ours, the demand for qualified individuals is even greater. If we are unable to successfully attract or retain the personnel we need to succeed, we will be unable to implement our business plan.

The production of traditional Chinese medicines depends on the supply of quality medicinal raw materials.

The production of traditional Chinese medicines depends on the supply of Chinese medicinal raw materials of suitable quality. For the fiscal years ended March 31, 2018 and 2017, the cost of raw materials used by us for our production accounted for 30.11% and 14.33%, respectively, of our total cost of revenues. While we expect the maturation of our acer truncatum bunge trees to mitigate our reliance on third parties for the supply of raw material for one of our products, the supply and market prices of these and other raw materials may be adversely affected by various factors such as weather conditions and the occurrence of natural disasters or sudden increases in demand that would impact our costs of production. There is no assurance that we would be able to pass on any resulting increase in costs to our customers, and therefore, any substantial fluctuation in supply or the market prices of raw materials may adversely affect our results of operations and profitability.

We may have difficulty establishing adequate management and financial controls in China.

The People's Republic of China has only recently begun to adopt the management and financial reporting concepts and practices that investors in the United States are familiar with. We may have difficulty in hiring and retaining employees in China who have the experience necessary to implement the kind of management and financial controls that are expected for a United States public company. If we cannot establish such controls, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S. standards.

We face intense competition that may prevent us from maintaining or increasing market share for our existing products and gaining market acceptance of our future products. Our competitors may develop or commercialize products before or more successfully than us.

The pharmaceutical and traditional Chinese medicine markets in China are intensely competitive, rapidly evolving and highly fragmented. Our competitors may develop products that are superior to or more affordable than ours or they may more effectively market products that compete with ours. We face direct competition from manufacturers of other traditional Chinese medicines that are similar to our products. We also face competition from manufacturers of western medicines, including multinational companies, that manufacture western medicines with similar effects and that can be used as substitutes for our products. Many of our existing and potential competitors have substantially greater financial, technical, manufacturing and other resources than we do. Our competitors' greater size in some cases provides them with a competitive advantage with respect to manufacturing costs because of their economies of scale and their ability to purchase raw materials at lower prices. Many of our competitors also have better brand name recognition, more established distribution networks and larger customer bases. In addition, many of our competitors have extensive knowledge of our target markets. As a result, they may be able to devote greater resources to the research, development, promotion and sale of their products or respond more quickly to evolving industry standards and changes in market conditions than we can. Alternative products may be developed that are more effective, work faster and are less costly than our products. Competitors may succeed in developing products earlier than us, obtaining approvals and clearances for such products more rapidly than us, or developing products that are more effective than those of our company. In addition, other forms of treatment may be competitive with our company's products. Over time, our products may become obsolete or uncompetitive. Our failure to adapt to changing market conditions and to compete successfully with existing or new competitors may materially and adversely affect our financial condition and results of operations.

10

Our success depends on collaborative partners, licensees and other third parties over whom we have limited control.

Due to the complexity of the process of developing pharmaceuticals, should we develop pharmaceutical products in addition to the Huoliyuan capsules, we may depend on arrangements with pharmaceutical institutes, corporate and academic collaborators, licensors, licensees and others for the research, development, clinical testing, technology rights, manufacturing, marketing and commercialization of our products. License agreements could obligate the parties to diligently bring potential products to market, make milestone payments and royalties that, in some instances, could be substantial, and incur the costs of filing and prosecuting patent applications. There are no assurances that we will be able to establish or maintain collaborations that are important to our business on favorable terms, or at all.

A number of risks arise from the Company's dependence on collaborative agreements with third parties. Product development and commercialization efforts could be adversely affected if any collaborative partner:

|

•

|

terminates or suspends its agreement with us;

|

|

•

|

causes delays;

|

|

•

|

fails to timely develop or manufacture in adequate quantities a substance needed in order to conduct clinical trials;

|

|

•

|

fails to adequately perform clinical trials;

|

|

•

|

determines not to develop, manufacture or commercialize a product to which it has rights; or

|

|

•

|

otherwise fails to meet its contractual obligations.

|

Our collaborative partners could pursue other technologies or develop alternative products that could compete with the products we are developing.

We may not be able to obtain the regulatory approvals or clearances that are necessary to commercialize our products.

The PRC imposes significant statutory and regulatory obligations upon the manufacture and sale of pharmaceutical and nutraceutical products. It typically has a lengthy approval process in which it examines pre-clinical and clinical data and the facilities in which the product is manufactured. Regulatory submissions must meet complex criteria to demonstrate the safety and efficacy of the ultimate products. Addressing these criteria requires considerable data collection, verification and analysis. We may spend time and money preparing regulatory submissions or applications without assurances as to whether they will be approved on a timely basis or at all.

Governmental and regulatory authorities may approve a product candidate for fewer indications or narrower circumstances than requested or may conditionally approve the performance of post-marketing studies for a product candidate. Even if a product receives regulatory approval and clearance, it may later exhibit adverse side effects that limit or prevent its widespread use or that force us to withdraw the product from the market.

11

Any marketed product and its manufacturer will continue to be subject to strict regulation after approval. Results of post-marketing programs may limit or expand the further marketing of products. Unforeseen problems with an approved product or any violation of regulations could result in restrictions on the product, including its withdrawal from the market and possible civil actions.

Manufacturing our products requires compliance with applicable good manufacturing practices regulations, which include requirements relating to quality control and quality assurance, as well as the maintenance of records and documentation. If we cannot comply with regulatory requirements, including applicable good manufacturing practices requirements, we may not be allowed to develop or market the product candidates. If we fail to comply with applicable regulatory requirements at any stage during the regulatory process, it may be subject to sanctions, including fines, product recalls or seizures, injunctions, refusal of regulatory agencies to review pending market approval applications or supplements to approve applications, total or partial suspension of production, civil penalties, withdrawals of previously approved marketing applications and criminal prosecution.

Sales of acer truncatum bunge based products are subject to seasonal fluctuations, which may cause our operating results to fluctuate from quarter to quarter. This may result in volatility in the price of our common stock.

The fourth quarter is our peak season for sales of acer truncatum bunge based products because of purchases related to the Chinese New Year holiday season that effectively lasts more than two weeks. Gift giving during the holiday season is customary. Because of these factors, we may experience quarterly fluctuations in our results of operations, which in turn may result in volatility in the price of our common stock.

We do not have product liability insurance. If we were successfully sued for product liability, we could face substantial liabilities that may exceed our resources.

We may be held liable if any product we or our suppliers develop causes injury or is found unsuitable during product testing, manufacturing, marketing, sale or use. These risks are inherent in the development of pharmaceutical and nutraceutical products. We do not have product liability insurance. If we choose to obtain product liability insurance but cannot obtain sufficient insurance coverage at an acceptable cost or otherwise protect against potential product liability claims, the commercialization of products that we develop may be prevented or inhibited. If we are sued for any injury caused by our products, our liability could exceed our total assets.

Direct-selling laws and regulations may prohibit or severely restrict our direct sales efforts and cause our revenue and profitability to decline, and regulators could adopt new regulations that harm our business.

Our direct selling system is subject to extensive laws, governmental regulations, administrative determinations, court decisions and similar constraints. These laws and regulations are generally intended to prevent fraudulent or deceptive schemes, often referred to as "pyramid" schemes, which compensate participants for recruiting additional participants irrespective of product sales, use high pressure recruiting methods and/or do not involve legitimate products.

Complying with these widely varying and sometimes inconsistent rules and regulations can be difficult and may require the devotion of significant resources on our part. There can be no assurance that we or our distributors are in compliance with all of these regulations. Our failure or our distributors' failure to comply with these regulations or new regulations could lead to the imposition of significant penalties or claims and could negatively impact our business. If we are unable to continue business in existing markets or commence operations in new markets because of these laws, our revenue and profitability may decline.

We are also subject to the risk that new laws or regulations might be implemented or that current laws or regulations might change, which could require us to change or modify the way we conduct our business in certain markets. This could be particularly detrimental to us if we have to change or modify the way we conduct business in markets that represent a significant percentage of our revenue.

12

Risks related to protection and infringement of intellectual property rights.

Our ability to compete depends, in part, on our ability to obtain and enforce intellectual property protection for our technology in China and internationally. We currently rely primarily on a combination of trade secrets, patents, copyrights, trademarks and licenses to protect our intellectual property. While the Chinese government is more supportive in recent years of the protection of intellectual property rights, if we fail to enforce our intellectual property rights, our business may suffer. We, or our suppliers, may be subject to third-party claims of infringement on intellectual property rights. These claims, if successful, may require us to redesign affected products, enter into costly settlement or license agreements, pay damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our products.

Risks related to lack of insurance.

We may be held liable if our operations or any product we or our suppliers develop causes injury or property damage to employees or others. We do not have property and casualty insurance and injury insurance. If we choose to obtain property and casualty insurance and injury insurance but cannot obtain sufficient insurance coverage at an acceptable cost or otherwise protect against potential claims, the commercialization of products that we develop may be prevented or inhibited. If we are sued for any property damage or injury caused by our operations or products, our liability could deplete our total assets.

Our future capital needs are uncertain and we may need to raise additional funds in the future.

We may require additional cash resources in the future due to:

|

Ÿ

|

changed business conditions or other future developments;

|

|

Ÿ

|

the time and expenses required to obtain regulatory clearances and approvals;

|

|

Ÿ

|

the resources we devote to developing, manufacturing, marketing and selling our products;

|

|

Ÿ

|

our ability to identify and our desire or need to pursue acquisitions or other investments; and

|

|

Ÿ

|

the extent to which our products generate market demand.

|

If we need to obtain external financing, we cannot assure you that financing will be available in the amounts or on the terms acceptable to us, if at all. Our future capital needs and other business reasons could require us to sell additional equity or debt securities or obtain credit facilities. The sale of additional equity or equity-linked securities could result in additional dilution to our then existing stockholders. The incurrence of indebtedness would result in an increase in our debt obligations and could result in operating and financing covenants that would restrict our operations.

Risks Related to Doing Business in China

If our land use rights are revoked, we would have no operational capabilities.

Under the PRC law, land is owned by the state or rural collective economic organizations. The state issues to tenants the rights to use property. Use rights can be revoked, and the tenants may be forced to vacate at any time when redevelopment of the land is in the public interest. The public interest rationale is interpreted quite broadly and the process of land appropriation may be less than transparent. If this happens, we may be forced to (i) delay the construction of facilities or (ii) curtail or cease planting on that land. We have relied on these land use rights as the cornerstone of our operations, and the loss or curtailment of such rights would have a material adverse effect on our business and results of operation.

Adverse changes in economic and political policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

All of Shandong Spring Pharmaceutical's business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. China's economy differs from the economies of most developed countries in many respects, including with respect to:

13

|

•

|

the amount of government involvement,

|

|

•

|

level of development,

|

|

•

|

growth rate,

|

|

•

|

control of foreign exchange, and

|

|

•

|

allocation of resources.

|

While the PRC economy has experienced significant growth in the past 30 years, growth has been uneven across different regions and among various economic sectors of China. The PRC government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. Since early 2004, the PRC government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition.

We rely principally on dividends paid by our PRC subsidiary to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiary to pay dividends to us could have a material adverse effect on our ability to conduct our business.

We are a holding company, and we rely principally on dividends paid by our PRC subsidiary for our cash and financing requirements, and to service any debt we may incur. If our PRC subsidiary incurs debt on its own behalf, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Under PRC laws and regulations, our PRC subsidiary, as a foreign-invested enterprise in the PRC, may pay dividends only out of accumulated profits as determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise is required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund certain statutory reserve funds, until the aggregate amount of such fund reaches 50% of its registered capital. At its discretion, it may allocate a portion of its after-tax profits based on PRC accounting standards to staff welfare and bonus funds. These reserve funds and staff welfare and bonus funds are not distributable as cash dividends.

Any limitation on the ability of our PRC subsidiary to pay dividends or make other distributions to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

Labor laws in the PRC may adversely affect our results of operations.

On June 29, 2007, the PRC's government promulgated the Labor Contract Law of the PRC, which became effective on January 1, 2008. The Labor Contract Law imposes greater liabilities on employers and significantly affects the cost of an employer's decision to reduce its workforce. Further, the law requires certain terminations be based upon seniority and not merit. In the event that we decide to significantly change or decrease our workforce, the Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost-effective manner, thus materially and adversely affecting our financial condition and results of operations.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

We are dependent on our relationship with the local government in the provinces in which we operate our business. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. We believe that Shandong Spring Pharmaceutical's operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

14

Future inflation in China may inhibit our ability to conduct business in China. In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the increase in the costs of supplies, it may have an adverse effect on profitability. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

Our sales and operating revenues could decline due to macro-economic and other factors outside of our control, such as changes in client confidence and declines in employment levels.

The medicine and health care products markets in China are susceptible to fluctuations in economic conditions. Our business substantially depends on the prevailing economic conditions in China. Changes in national and regional economic conditions, as well as local economic conditions where we conduct our operations and where prospective purchasers of our properties live, may result in more caution on the part of market participants and consequently fewer purchases. These economic uncertainties involve, among other things, conditions of supply and demand in local markets and changes in client confidence and income, employment levels, and government regulations. These risks and uncertainties could periodically have an adverse effect on consumer demand for and the pricing of our products, which could cause our operating revenues to decline. A reduction in our revenues could in turn negatively affect the market price of our securities.

Failure to comply with the individual foreign exchange rules relating to overseas direct investment or the engagement in the issuance or trading of securities overseas by our PRC resident stockholders may subject such stockholders to fines or other liabilities.

Other than Notice 37, our ability to conduct foreign exchange activities in the PRC may be subject to the interpretation and enforcement of the Implementation Rules of the Administrative Measures for Individual Foreign Exchange promulgated by SAFE in January 2007 (as amended and supplemented, the "Individual Foreign Exchange Rules"). Under the Individual Foreign Exchange Rules, any PRC individual seeking to make a direct investment overseas or engage in the issuance or trading of negotiable securities or derivatives overseas must make the appropriate registrations in accordance with SAFE provisions. PRC individuals who fail to make such registrations may be subject to warnings, fines or other liabilities.

We may not be fully informed of the identities of all our beneficial owners who are PRC residents. For example, because the investment in or trading of our shares will happen in an overseas public or secondary market where shares are often held with brokers in brokerage accounts, it is unlikely that we will know the identity of all of our beneficial owners who are PRC residents. Furthermore, we have no control over any of our future beneficial owners and we cannot assure you that such PRC residents will be able to complete the necessary approval and registration procedures required by the Individual Foreign Exchange Rules.

It is uncertain how the Individual Foreign Exchange Rules will be interpreted or enforced and whether such interpretation or enforcement will affect our ability to conduct foreign exchange transactions. Because of this uncertainty, we cannot be sure whether the failure by any of our PRC resident stockholders to make the required registration will subject our PRC subsidiary to fines or legal sanctions on its operations, delay or restriction on repatriation of proceeds of this offering into the PRC, restriction on remittance of dividends or other punitive actions that would have a material adverse effect on our business, results of operations and financial condition.

15

Because our funds are held in banks in the PRC that do not provide insurance, the failure of any bank in which we deposit our funds may affect our ability to continue to operate.

Banks and other financial institutions in the PRC do not provide insurance for funds held on deposit. As a result, in the event of a bank failure in the PRC, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank in the PRC that fails, our inability to have access to our cash may impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue to operate.

Under the enterprise income tax law, we may be classified as a "resident enterprise" of China. Such classification may result in unfavorable tax consequences to US and our non-PRC stockholders.

China passed a New Enterprise Income Tax Law, or the New EIT Law, which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with de facto management bodies within China is considered a resident enterprise, meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as "substantial and overall management and control over the production and operations, personnel, accounting, and properties" of the enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 clarified that dividends and other income paid by such resident enterprises will be considered to be the PRC's source income and subject to the PRC's withholding tax. This recent circular also subjects such resident enterprises to various reporting requirements with the PRC's tax authorities.

Although substantially all of our management is currently located in the PRC, it remains unclear whether the PRC's tax authorities would require or permit our overseas registered entities to be treated as PRC resident enterprises. We do not currently consider our company to be a PRC resident enterprise. However, if the PRC's tax authorities determine that we are a resident enterprise for the PRC's enterprise income tax purposes, a number of unfavorable PRC tax consequences may follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as the PRC's enterprise income tax reporting obligations. This would also mean that income such as interest on offering proceeds and non-China source income would be subject to the PRC's enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules, dividends paid to us from our PRC subsidiary would qualify as tax-exempt income, we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC authorities responsible for enforcing the withholding tax have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for the PRC's enterprise income tax purposes. Finally, dividends paid to stockholders with respect to their shares of our common stock or any gains realized from transfer of such shares may generally be subject to the PRC's withholding taxes on such dividends or gains at a rate of 10% if the stockholders are deemed to be non-resident enterprises or at a rate of 20% if the stockholders are deemed to be non-resident individuals.

Our PRC subsidiary has taken the position that it is compliant with the taxation, environmental, employment and social security rules of China, and if that position turns out to be wrong, it may face penalties imposed by the PRC government.

While we believe our PRC subsidiary has been in compliance with PRC taxation, environmental, employment and social security rules during its operations in China, we have not obtained letters from the PRC government authorities confirming such compliance. If any PRC government authority takes the position that there is non-compliance with the taxation, environmental protection, employment and/or social security rules by our PRC subsidiary, it may be exposed to penalties from PRC government authorities, in which case the operation of our PRC subsidiary may be adversely affected.

We may be adversely affected by complexity, uncertainties and changes in PRC regulation of pharmaceutical business and companies, including limitations on our abilities to own key assets.

The PRC government regulates the pharmaceutical industry including foreign ownership of, and the licensing and permit requirements pertaining to, companies in the pharmaceutical and nutraceutical industry. These laws and regulations are relatively new and evolving, and their interpretation and enforcement involve significant uncertainty. As a result, in certain circumstances it may be difficult to determine what actions or omissions may be deemed to be a violation of applicable laws and regulations.

16

The interpretation and application of existing PRC laws, regulations and policies and possible new laws, regulations or policies have created substantial uncertainties regarding the legality of existing and future foreign investments in, and the businesses and activities of, pharmaceutical businesses in China, including our business.

Any deterioration of political relations between the United States and the PRC could impair our financing activities and your investment in us.

The relationship between the United States and the PRC is subject to fluctuation and periodic tension. Changes in political conditions in the PRC and changes in the state of Sino-U.S. relations are difficult to predict and could adversely affect our financing activities. Such a change could lead to a decline in our profitability. Any weakening of relations between the United States and the PRC could have an adverse effect on our efforts to raise capital to expand our present business activities and your investment in us.

Price control may affect both our revenues and net income.

The laws of the PRC provide for the government to fix and adjust prices. To the extent that we are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our sales will be limited and, unless there is also price control on the products that we purchase from our suppliers, we may face no limitation on our costs. Further, if price controls affect both our revenue and our costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable regulatory authorities in the PRC.

We may have limited legal recourse under Chinese law if disputes arise under contracts with third parties.

Almost all of our agreements with our employees and third parties, including our suppliers and customers, are governed by the laws of the PRC. The legal system in the PRC is a civil law system based on written statutes. Unlike common law systems, such as we have in the United States, it is a system in which decided legal cases have little precedential value. The government of the PRC has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the PRC, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance or seek an injunction under Chinese law are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

Uncertainties with respect to the PRC legal system could adversely affect us.

Our operations in China are governed by PRC laws and regulations. We are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to wholly foreign-owned enterprises. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value.

Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their nonbinding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

17

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on United States or other foreign laws against us or our management.

All of our assets are located outside the United States and all of our current operations are conducted in China. Moreover, all but one of our directors and officers are nationals or residents of China. All or a substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult for our stockholders to effect service of process within the United States upon these persons. In addition, there is uncertainty as to whether the courts of China would recognize or enforce judgments of U.S. courts obtained against us or such officers and/or directors or assets predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in China against us or such persons predicated upon the securities laws of the United States or any state thereof.

Fluctuation in the value of RMB may have a material adverse effect our financial results as reported in US dollars.

The value of RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. All of our financial assets, revenues and costs are denominated in RMB. Any significant fluctuation in value of RMB may materially and adversely affect our cash flows, revenues, earnings and financial position, and the value of the payments to us by customers. For example, an appreciation of RMB against the U.S. dollar would make any new RMB denominated investments or expenditures costlier, to the extent that we might need to convert U.S. dollars into RMB for such purposes. An appreciation of RMB against the U.S. dollar would also result in foreign currency translation losses for financial reporting purposes when we translate our RMB denominated financial assets into USD, as USD is our reporting currency.

Restrictions on currency exchange may limit our ability to utilize our revenues effectively.

Our revenues and operating expenses are denominated in RMB. The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. Pursuant to the Foreign Currency Administration Rules, promulgated on January 29, 1996 and amended on January 14, 1997, and various regulations issued by SAFE and other relevant PRC government authorities, RMB is freely convertible only to the extent of current account items, such as trade-related receipts and payments, interest and dividends. Capital account items, such as direct equity investments, loans and repatriation of investments, require the prior approval from SAFE or its local branch for conversion of RMB into a foreign currency such as U.S. dollars, and remittance of the foreign currency outside the PRC. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiary to remit sufficient foreign currency to pay dividends or other payments to us, Our PRC subsidiary may purchase foreign exchange for settlement of "current account transactions," including payment of dividends to us should we decide to pay dividends to our stockholders, without the approval of SAFE. However, approval from the SAFE or its local branch is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign currencies.

Risks Related to Our Offering and Ownership of Our Common stock