Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CITY HOLDING CO | ex991.htm |

| EX-2.2 - EXHIBIT 2.2 - CITY HOLDING CO | ex22.htm |

| EX-2.1 - EXHIBIT 2.1 - CITY HOLDING CO | ex21.htm |

| 8-K - 8-K, CHCO TRAILBLAZER AND BLUEGRASS MERGER - CITY HOLDING CO | a8-k.htm |

Exhibit 99.2 Acquisitions of Poage Bankshares, Inc. & Farmers Deposit Bancorp, Inc. July 11, 2018

Forward Looking Statements This presentation contains certain forward-looking statements that are included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such information involves risks and uncertainties that could result in the Company's actual results differing from those projected in the forward-looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the business of City, Poage and Farmers Deposit may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the Mergers may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the Mergers, including adverse effects on relationships with employees, may be greater than expected; (4) the regulatory approvals required for the Mergers may not be obtained on the proposed terms or on the anticipated schedule; (5) the stockholders of Poage and Farmers Deposit may fail to approve the Mergers; (6) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which City, Poage and Farmers Deposit are engaged; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competition from other financial services companies in City’s, Poage’s and Farmers Deposit’s markets could adversely affect operations; (10) compliance risk involving risk to earnings or capital resulting from violations of or nonconformance with laws, rules, regulations, prescribed practices, or ethical standards; (11) the economic slowdown could continue to adversely affect credit quality and loan originations; and (12) other factors, which could cause actual results to differ materially from future results expressed or implied by such forward looking statements. Additional factors that could cause actual results to differ materially from those expressed in the forward- looking statements are discussed in City’s reports (such as its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available on the SEC’s Internet site (www.sec.gov). All forward-looking statements attributable to City’s, Poage’s or the combined company’s, or persons acting on City’s or Poage’s behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made and City and Poage do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions, or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If City or Poage update one or more forward-looking statements, no inference should be drawn that City or Poage will make additional updates with respect to those or other forward- looking statements. 2

Additional Information This presentation does not constitute an offer to sell or the solicitation of an offer to buy securities of City or a solicitation of any vote or approval. City will file a registration statement on Form S-4 and other documents regarding the proposed transaction referenced in this presentation related to the Poage transaction with the Securities and Exchange Commission (“SEC”) to register the shares of City’s common stock to be issued to the shareholders of Poage. The registration statement will include a proxy statement/prospectus, which will be sent to the shareholders of Poage in advance of its special meeting of shareholders to be held to consider the proposed Poage merger. Before making any voting or investment decision investors and security holders are urged to read the proxy statement/prospectus and any other relevant documents to be filed with the SEC in connection with the proposed Poage transaction because they contain important information about City, Poage and the proposed transaction. Shareholders are also urged to carefully review and consider each of City’s and Poage’s public filings with the SEC, including, but not limited to, their Annual Reports or Form 10-K, their Quarterly Reports or Form 10-Q, their Current Reports or Form 8-K and their proxy statements. Investors and security holders may obtain a free copy of these documents (when available) through the website maintained by the SEC at www.sec.gov. These documents may also be obtained, without charge, from City at www.bankatcity.com under the tab “Investors” or by directing a request to City Holding Company, 25 Gatewater Road P.O. Box 7520, Charleston, West Virginia 25356, Attn.: Investor Relations, or from Poage at www.townswquarebank.com under the tab “Investor Relations” or by directing a request to Poage Bankshares, Inc., 1500 Carter Avenue, Ashland, Kentucky 41101, Attn.: Investor Relations. Poage and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Poage in connection with the proposed Poage merger. Information about the directors and executive officers of Poage is set forth in the proxy statement for Poage’s 2018 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on April 13, 2018. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed Poage merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. 3

Overview of Pro Forma Company Pro Forma Highlights (1) CHCO PBSK Total Assets $4.8 billion PBSK LPO Total Loans $3.5 billion Farmers Deposit Total Deposits $3.9 billion Branch Locations 98 • Creates a $4.8 billion in assets bank with presence across West Virginia, Kentucky, Virginia, and Ohio • Opportunity to leverage scale in existing footprint and expand into adjacent markets • Builds upon solid core funding base Source: S&P Global 4 Data as of 3/31/18 (1) Excludes purchase accounting adjustments

Combined Transaction Rationale • In-market acquisition of an Ashland, Kentucky-based community bank – Further increases dominant share in the Huntington-Ashland MSA Strategic – Natural extension of branch network in the Lexington, Kentucky MSA Rationale • Opportunities to fill in growth markets • Core funded franchises bolster CHCO’s already solid deposit base • Immediately and meaningfully accretive to EPS • Excellent utilization of excess capital Financially – IRR exceeds internal thresholds Compelling • Maintains our well capitalized position • Minimal initial tangible book value dilution and short earn-back period • Shared customer bases and markets • Culturally aligned Low Risk • Comprehensive due diligence from CHCO management • Disciplined approach to integration 5

Pro Forma Market Demographics ’18-’23 Projected Median HHI Growth (%) Combined Counties Deposit Market Share (1) 10.0% Deposits Market Rank Institution ($mm) Share Branches 8.0% 1 BB&T Corp. $6,496 15.69 % 78 7.5% Pro Forma 3,799 9.18 97 2 City Holding Co. 3,320 8.02 85 3 JPMorgan Chase & Co. 2,961 7.15 33 4 United Bankshares Inc. 2,531 6.11 36 5.0% 5 Wells Fargo & Co. 2,097 5.07 22 3.6% 3.5% 4.0% 6 TowneBank 1,592 3.84 6 7 Fifth Third Bancorp 1,425 3.44 23 2.5% 8 Central Bancshares Inc. 1,382 3.34 14 9 PNC Financial Services Group Inc. 1,204 2.91 21 10 WesBanco Inc. 1,140 2.75 28 11 Traditional Bancorp. Inc. 971 2.34 11 0.0% 12 Union Bankshares Corp. 960 2.32 19 CHCO Farmers Deposit PBSK Pro Forma 13 Huntington Bancshares Inc. 945 2.28 13 14 Bank of America Corp. 932 2.25 9 15 SunTrust Banks Inc. 804 1.94 14 2023 Projected Median HHI ($) 16 MVB Financial Corp. 644 1.56 7 17 Premier Financial Bancorp Inc. 597 1.44 17 $55,000 18 First National Corp. 594 1.43 11 $52,527 19 Community Trust Bancorp Inc. 588 1.42 19 20 Putnam Bancshares Inc. 561 1.35 3 $48,553 $48,722 24 Poage Bankshares Inc. 373 0.90 9 $50,000 54 Farmers Deposit Bancorp Inc. 106 0.26 3 $45,000 $40,446 $40,000 $35,000 CHCO Farmers Deposit PBSK Pro Forma Source: S&P Global Deposit data as of 6/30/17 6 Population and median household income are deposit weighted by county (1) Includes all counties that City, Poage and Farmers Deposit operate in as of 6/30/17

Diversifying Our Markets Deposits by State ($mm) CHCO Standalone CHCO – Farmers Deposit – PBSK OH OH KY $86 $86 $350 3% 2% 11% KY $829 22% VA $444 13% VA $444 WV 12% $2,440 64% WV $2,440 73% 7 Source: S&P Global Deposit data as of 6/30/17

Overview of Transaction Terms Poage Bankshares, Inc. Acquirer City Holding Company (Nasdaq: CHCO) Seller Poage Bankshares, Inc. (Nasdaq: PBSK) Consideration 100% Stock Fixed Exchange Ratio 0.335 shares of CHCO for each common share of PBSK Indicative Price per Share (1) $26.27 Implied Market Premium (2) 32.0% Implied Aggregate Transaction Value (3) $93.5 million Price / Tangible 157% Book Value (4) Board Representation PBSK will receive 1 board seat at CHCO Management Consistency Key producers will be retained Conditions & Approvals Customary regulatory approvals and approval of PBSK Shareholders Expected Closing Q4 2018 (1) Based on CHCO’s 5-day average closing price of $78.43 as of 7/10/18 (2) Based on PBSK’s closing price of $19.90 as of 7/10/18 (3) Based on PBSK’s 3,497,243 shares outstanding as of 5/31/18; assumes PBSK’s 141,850 in-the-money options with weighted average 8 strike price of $14.99 are cashed out at close (4) Based on PBSK’s reported tangible book value per share of $16.70 as of 3/31/18

Overview of Poage Bankshares, Inc. Franchise Highlights Branch Footprint • Founded as a savings and loan association in 1889 • Long-standing ties to local communities • Strong market share in counties of operation • 4 PBSK branches within 1 mile of an existing CHCO branch; 5 within 2 miles • No estimated HHI divestitures PBSK Branch (9) PBSKUpdate LPO (1) Headquarters Ashland, KY Markets of Operation Standalone Deposits ($mm) Pro Forma Branch Locations 9 Total KY County Market PBSK CHCO Deposits Share Rank Total Assets $450 million Boyd $844 $183 $66 $249 29.5 % 1 Greenup 390 77 30 107 27.4 2 Total Loans $333 million Jessamine 590 57 -- 57 9.7 6 Lawrence 147 37 -- 37 25.4 2 Montgomery 588 18 -- 18 3.1 5 Total Deposits $375 million TCE / TA 13.05% 9 Source: S&P Global Financial data as of 3/31/18; deposit market share data as of 6/30/17

Transaction Assumptions: PBSK Key Transaction Assumptions Expense Savings • 45% Purchase • Gross Loan Credit Mark: $16.3 million Accounting • OREO Mark: $0.1 million Marks • Fixed Asset Mark: $2.0 million Revenue • Opportunities recognized but not modeled Synergies Core Deposit • 2.0% of transaction accounts Intangible 10

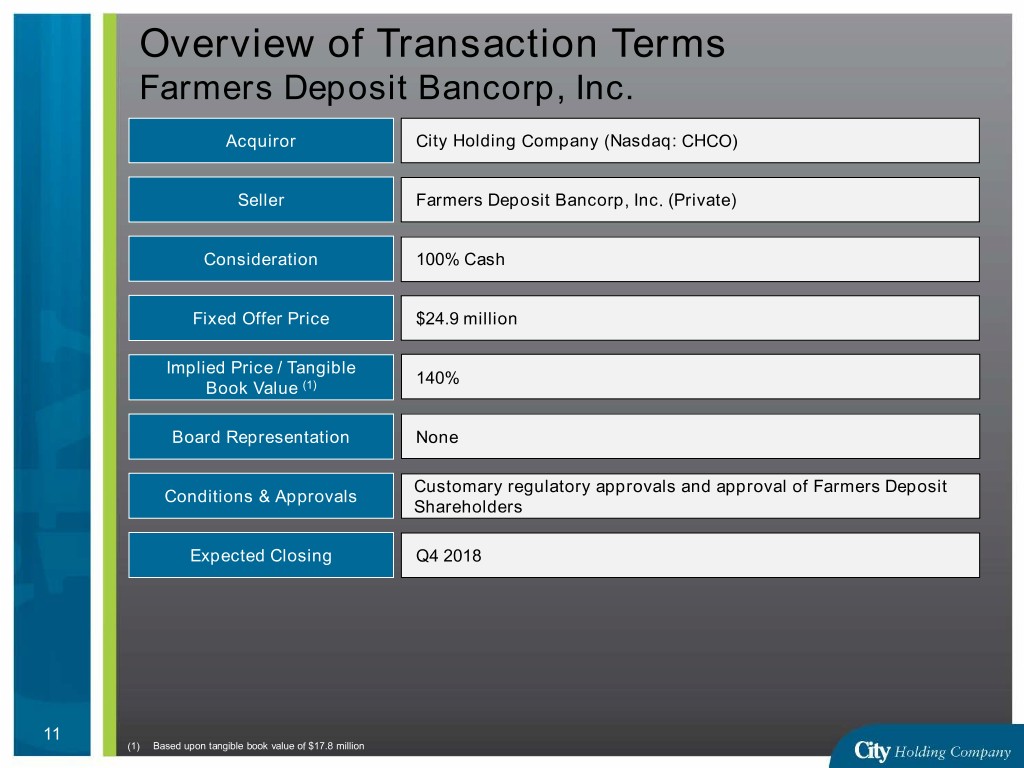

Overview of Transaction Terms Farmers Deposit Bancorp, Inc. Acquiror City Holding Company (Nasdaq: CHCO) Seller Farmers Deposit Bancorp, Inc. (Private) Consideration 100% Cash Fixed Offer Price $24.9 million Implied Price / Tangible 140% Book Value (1) Board Representation None Customary regulatory approvals and approval of Farmers Deposit Conditions & Approvals Shareholders Expected Closing Q4 2018 11 (1) Based upon tangible book value of $17.8 million

Overview of Farmers Deposit Bancorp, Inc. Franchise Highlights Branch Footprint • Founded in 1866 as a full service bank Update • Operates 3 branches around the Lexington, KY market • Solid core funding base – MRQ cost of deposits: 0.25% Farmers UpdateDeposit Branch (3) Headquarters Cynthiana, KY Markets of Operation Deposits Deposits Market Branch Locations 3 KY County Rank ($mm) ($mm) Share Total Assets $122 million Harrison 2 $58 $262 22.2 % Nicholas 1 45 45 100.0 Total Loans $60 million Total Deposits $98 million Source: S&P Global TCEFinancial / dataTA as of 3/31/18 14.43% 12 Source: S&P Global Financial data bank level as of 3/31/18; deposit market share data as of 6/30/17

Transaction Assumptions: Farmers Deposit Key Transaction Assumptions Expense Savings • 50% Purchase • Gross Loan Credit Mark: $2.0 million Accounting • OREO Mark: $0.4 million Marks • Fixed Asset Mark: $0.6 million Revenue • Opportunities recognized but not modeled Synergies Core Deposit • 2.0% of transaction accounts Intangible 13

Combined Financial Impact Pro Forma Impact • Immediate mid single digit EPS accretion • Minimal tangible book dilution, earned back in less than 3 years • IRR in excess of 20% Capital Ratios Standalone Today Pro Forma at Close TCE/ TA 10.0% 9.7% Leverage Ratio 10.9% 10.5% Total Risk-Based Ratio 16.3% 15.7% 14 Source: S&P Global Standalone financial data as of 3/31/18

Deal Metrics Regional National Comparables Comparables Median (1) Median (2) Deal Metrics Deal Value ($mm) $93.5 $24.9 -- $101.4 $89.8 Price / TBV 157 % 140 % 293 % 177 % 183 % Core Deposit Premium (3) 9.8 7.5 -- 12.3 12.1 Target Financials ($mm) Total Assets $450 $122 $4,200 $566 $541 Total Deposits 375 98 3,447 462 431 MRQ ROAA (4) 0.33 % 0.23 % 1.69 % 0.85 % 0.80 % Source: S&P Global Data as of or for the three months ended 3/31/18; pricing data based upon CHCO’s 5-day average closing price of $78.43 as of 7/10/18 (1) Regional comparables include transactions announced since 12/31/16 with deal values between $50.0 million and $200.0 million with targets headquartered in DC, DE, IN, KY, MD, OH, PA, VA and WV (2) National comparables include transactions announced nationwide since 12/31/16 with deal values between $50.0 million and $200.0 million (3) Equal to deal value minus target’s tangible common equity as a percentage of core deposits 15 Core deposits defined as total deposit’s less deposits greater than $250,000 (4) PBSK MRQ ROAA excludes nonrecurring expenses

Summary • Solid accretion for City which already has top of peer group earnings • Further positions the Huntington – Ashland MSA as City’s largest market by deposits • Source of stable, low cost funding • Improves demographic position • Strong market share in established markets • Proven regional banking franchise 16

Appendix

Pro Forma Loan Portfolio CHCO PBSK Farmers Deposit Pro Forma (1) Consumer Consumer Consumer Consumer C&I & Othe r & Other C&I & Othe r C&I & Othe r 7% 5% C&D C&D 7% C&D Non 2% C&D Non 16% Non 2% 11% 3% 2% 2% Ow ne r- 2% Owner- Ow ne r- Occupied Occupied Occupied CRE CRE CRE 24% 12% 1-4 Family 23% 36% C&I 23% Owner- Ow ne r- Occupied Ow ne r- Occupied CRE Occupied CRE 14% CRE 1-4 Family 6% 1-4 Family 7% 53% 53% Multifamily 1-4 Family 53% Multifamily Non Owner- Multifamily 6% 6% 3% Occupied Ow ne r- Multifamily CRE Occupied <1% 14% CRE 7% Loan Portfolio ($mm) Amount % of Total Loan Portfolio ($mm) Amount % of Total Loan Portfolio ($mm) Amount % of Total Loan Portfolio ($mm) Amount % of Total C&D $57.5 1.8 % C&D $9.1 2.7 % C&D $1.4 2.4 % C&D $68.0 1.9 % 1-4 Family 1,665.7 53.1 1-4 Family 176.3 53.0 1-4 Family 21.9 36.4 1-4 Family 1,863.9 52.8 Multifamily 190.7 6.1 Multifamily 9.0 2.7 Multifamily 0.5 0.8 Multifamily 200.2 5.7 Owner-Occupied CRE 199.9 6.4 Owner-Occupied CRE 45.1 13.6 Owner-Occupied CRE 3.9 6.5 Owner-Occupied CRE 248.9 7.0 Non Owner-Occupied CRE 763.0 24.3 Non Owner-Occupied CRE 40.1 12.1 Non Owner-Occupied CRE 8.6 14.3 Non Owner-Occupied CRE 811.7 23.0 C&I 206.6 6.6 C&I 35.8 10.8 C&I 14.0 23.2 C&I 256.4 7.3 Consumer & Other 54.4 1.7 Consumer & Other 17.1 5.1 Consumer & Other 9.9 16.4 Consumer & Other 81.4 2.3 Gross Loans & Leases $3,137.8 100.0 % Gross Loans & Leases $332.5 100.0 % Gross Loans & Leases $60.2 100.0 % Gross Loans & Leases $3,530.5 100.0 % Yield on Total Loans: 4.20% Yield on Total Loans: 4.99% Yield on Total Loans: 4.66% Source: S&P Global Dollars in millions 18 Data as of or for the three months ended 3/31/18; PBSK and Farmers Deposit data bank level (1) Excludes purchasing accounting adjustments

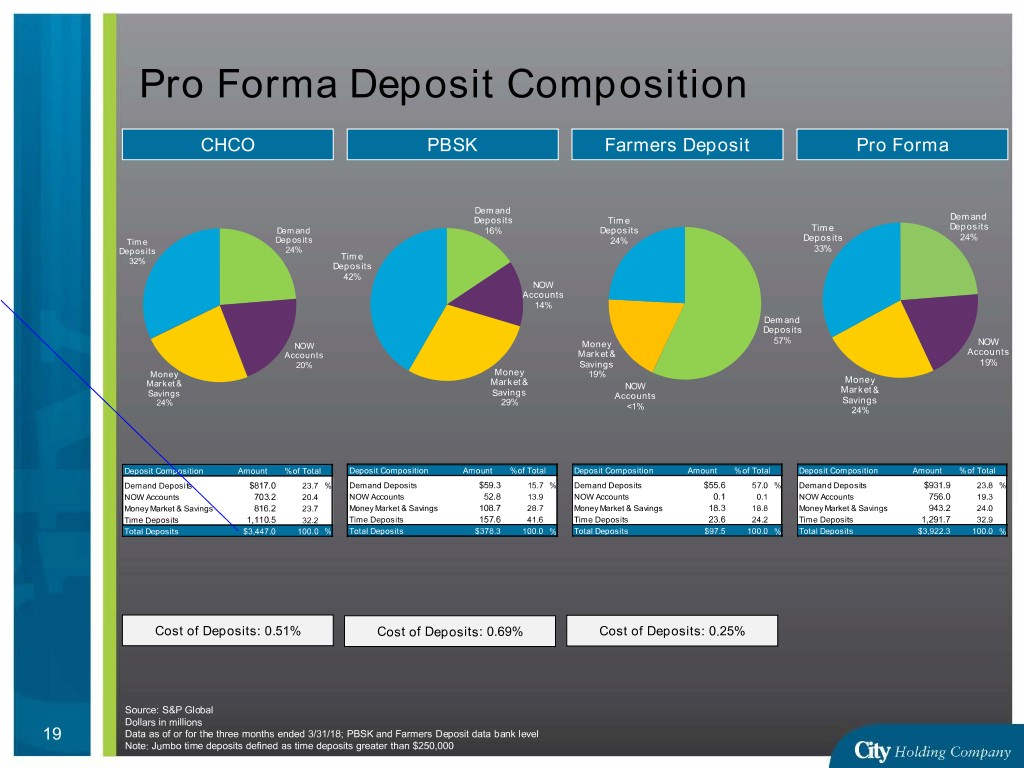

Pro Forma Deposit Composition CHCO PBSK Farmers Deposit Pro Forma Demand Deposits Time Demand Demand 16% Deposits Time Deposits 24% Time Deposits 24% Deposits Deposits 24% 33% Time 32% Deposits 42% NOW Accounts 14% Demand Deposits 57% NOW Money NOW Accounts Market & Accounts 20% Savings 19% Money Money 19% Market & Market & Money NOW Market & Savings Savings Accounts 24% 29% Savings <1% 24% Deposit Composition Amount % of Total Deposit Composition Amount % of Total Deposit Composition Amount % of Total Deposit Composition Amount % of Total Demand Deposits $817.0 23.7 % Demand Deposits $59.3 15.7 % Demand Deposits $55.6 57.0 % Demand Deposits $931.9 23.8 % NOW Accounts 703.2 20.4 NOW Accounts 52.8 13.9 NOW Accounts 0.1 0.1 NOW Accounts 756.0 19.3 Money Market & Savings 816.2 23.7 Money Market & Savings 108.7 28.7 Money Market & Savings 18.3 18.8 Money Market & Savings 943.2 24.0 Time Deposits 1,110.5 32.2 Time Deposits 157.6 41.6 Time Deposits 23.6 24.2 Time Deposits 1,291.7 32.9 Total Deposits $3,447.0 100.0 % Total Deposits $378.3 100.0 % Total Deposits $97.5 100.0 % Total Deposits $3,922.3 100.0 % Cost of Deposits: 0.51% Cost of Deposits: 0.69% Cost of Deposits: 0.25% Source: S&P Global Dollars in millions 19 Data as of or for the three months ended 3/31/18; PBSK and Farmers Deposit data bank level Note: Jumbo time deposits defined as time deposits greater than $250,000

Branch Overlap Detail Huntington-Ashland and Lexington MSAs 0.13 miles 0.77 miles 0.74 miles 0.46 miles 1.41 miles 0.44 miles CHCO PBSK Farmers Deposit 20