Attached files

| file | filename |

|---|---|

| EX-99.1 - MEDIA RELEASE - IHS Markit Ltd. | exh991q218.htm |

| 8-K - 8-K - IHS Markit Ltd. | q2-18earningsrelease.htm |

Q2 2018 Earnings Supplemental Financials June 26, 2018

2

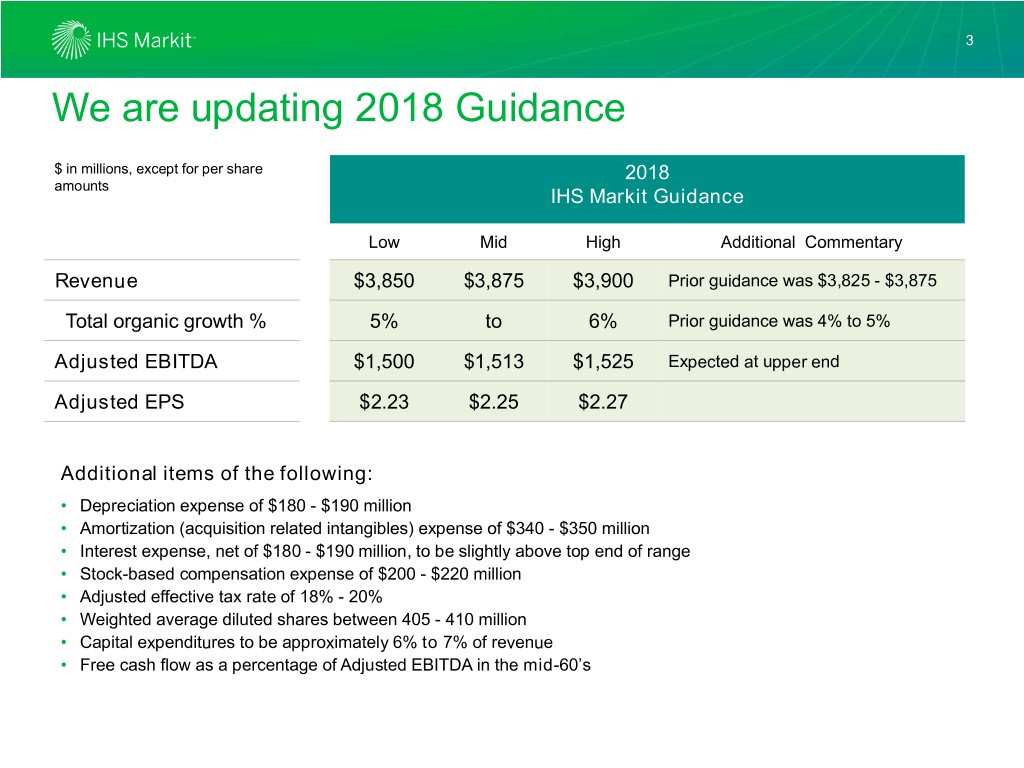

3 We are updating 2018 Guidance $ in millions, except for per share 2018 amounts IHS Markit Guidance Low Mid High Additional Commentary Revenue $3,850 $3,875 $3,900 Prior guidance was $3,825 - $3,875 Total organic growth % 5% to 6% Prior guidance was 4% to 5% Adjusted EBITDA $1,500 $1,513 $1,525 Expected at upper end Adjusted EPS $2.23 $2.25 $2.27 Additional items of the following: • Depreciation expense of $180 - $190 million • Amortization (acquisition related intangibles) expense of $340 - $350 million • Interest expense, net of $180 - $190 million, to be slightly above top end of range • Stock-based compensation expense of $200 - $220 million • Adjusted effective tax rate of 18% - 20% • Weighted average diluted shares between 405 - 410 million • Capital expenditures to be approximately 6% to 7% of revenue • Free cash flow as a percentage of Adjusted EBITDA in the mid-60’s

4 Quarterly Revenue by Reported Segment

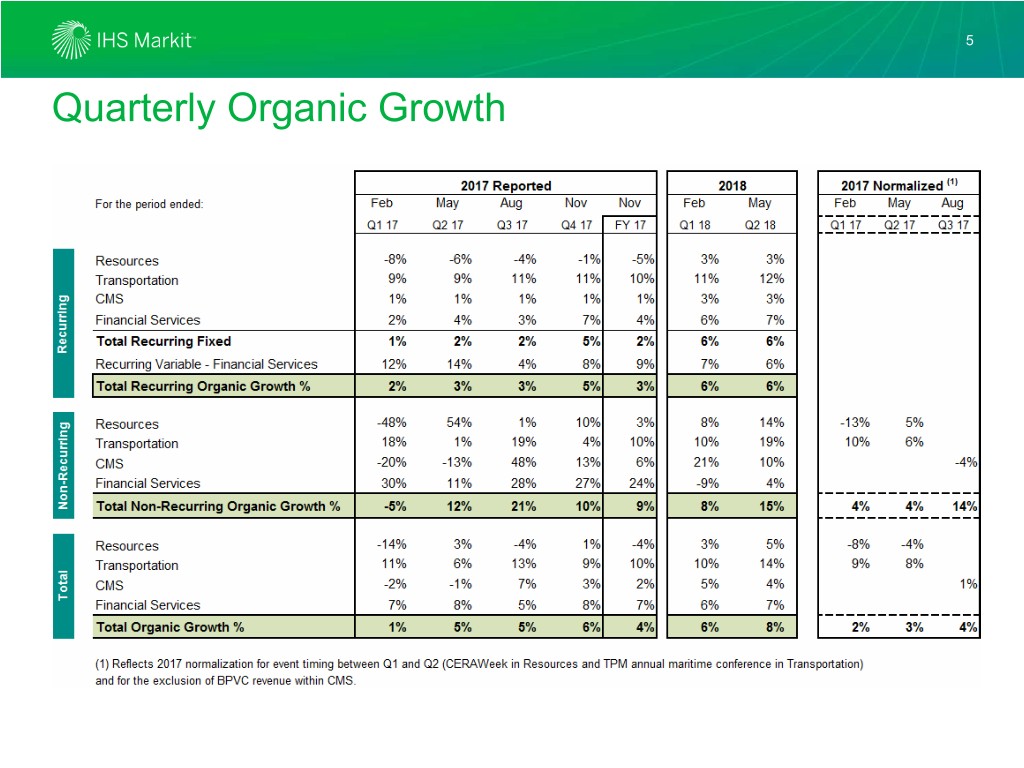

5 Quarterly Organic Growth

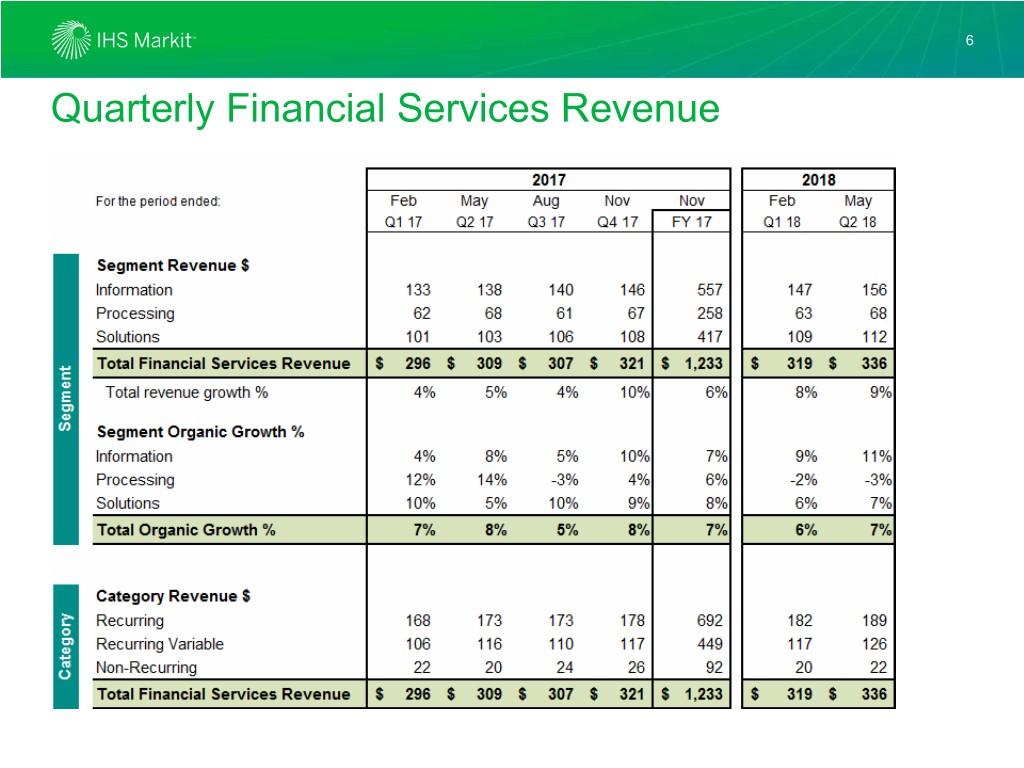

6 Quarterly Financial Services Revenue

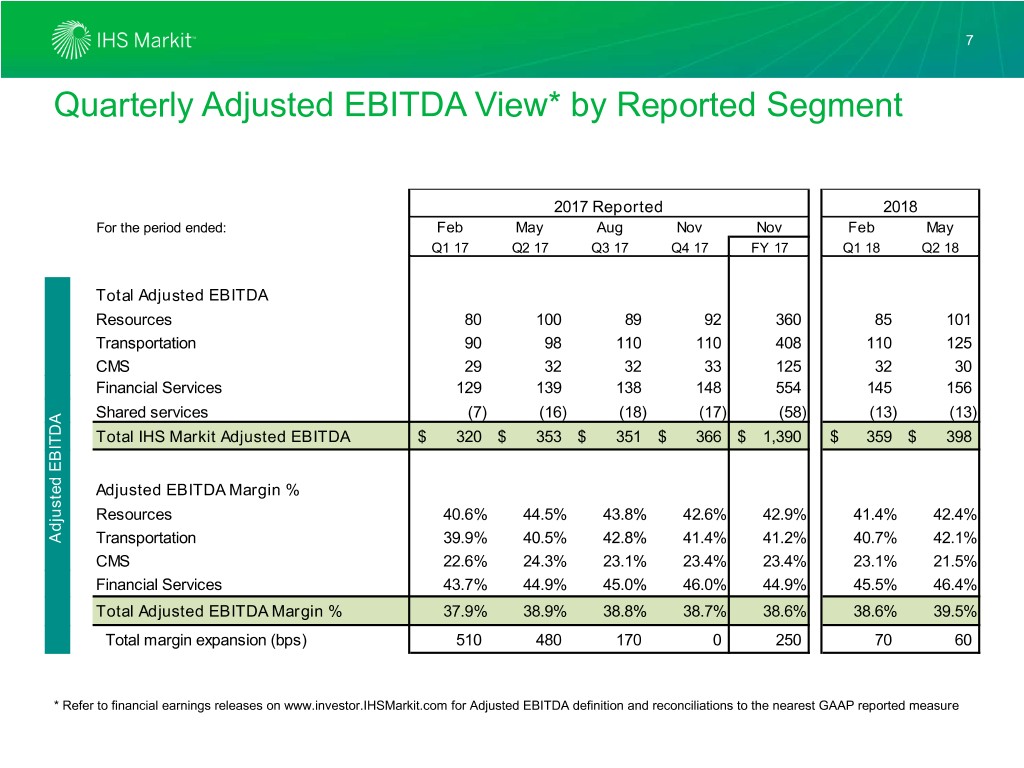

7 Quarterly Adjusted EBITDA View* by Reported Segment 2017 Reported 2018 For the period ended: Feb May Aug Nov Nov Feb May Q1 17 Q2 17 Q3 17 Q4 17 FY 17 Q1 18 Q2 18 Total Adjusted EBITDA Resources 80 100 89 92 360 85 101 Transportation 90 98 110 110 408 110 125 CMS 29 32 32 33 125 32 30 Financial Services 129 139 138 148 554 145 156 Shared services (7) (16) (18) (17) (58) (13) (13) Total IHS Markit Adjusted EBITDA $ 320 $ 353 $ 351 $ 366 $ 1,390 $ 359 $ 398 Adjusted EBITDA Margin % Resources 40.6% 44.5% 43.8% 42.6% 42.9% 41.4% 42.4% Adjusted EBITDA Transportation 39.9% 40.5% 42.8% 41.4% 41.2% 40.7% 42.1% CMS 22.6% 24.3% 23.1% 23.4% 23.4% 23.1% 21.5% Financial Services 43.7% 44.9% 45.0% 46.0% 44.9% 45.5% 46.4% Total Adjusted EBITDA Margin % 37.9% 38.9% 38.8% 38.7% 38.6% 38.6% 39.5% Total margin expansion (bps) 510 480 170 0 250 70 60 * Refer to financial earnings releases on www.investor.IHSMarkit.com for Adjusted EBITDA definition and reconciliations to the nearest GAAP reported measure