Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - TIER REIT INC | tierrietaustinoverviewbr.htm |

| 8-K - 8-K - TIER REIT INC | form8-k05312018.htm |

OFFICE BROUGHT TO LIFE Exhibit 99.1 C o m p a n y P r e s e n t a t i o n JUNE'18 Austin + Dallas + Houston + Charlotte + Nashville + Atlanta + Denver

Focused strategy Proven execution WHY High-quality portfolio TIER? Significant value creation opportunities Flexible balance sheet Experienced management team Austin + Dallas + Houston + Charlotte + Nashville + Atlanta + Denver

DOMAIN 8 Delivered 2017 3

Targeted Approach Focus + Strategy Experience + Innovation Service + Sustainability Legacy District One, Dallas Domain 11 & 12, Austin (Rendering) Bank of America Plaza, Charlotte Seven Target Growth Markets Value Creation TIER ONE Property Services High-growth, demand-driven Proven track record in publicly- Unparalleled customer service & markets traded real estate companies operational excellence Amenity-rich, high-density Successful history of investing & Operating & developing to highest submarkets – TIER1 submarkets creating value in target markets sustainability standards High-quality, Class A office Ability to complete complex A leader in BOMA 360 properties transactions designations Emphasis on LIVE.WORK.PLAY Demonstrated path toward long- Significant LEED & Energy Star environments term value creation certifications 4

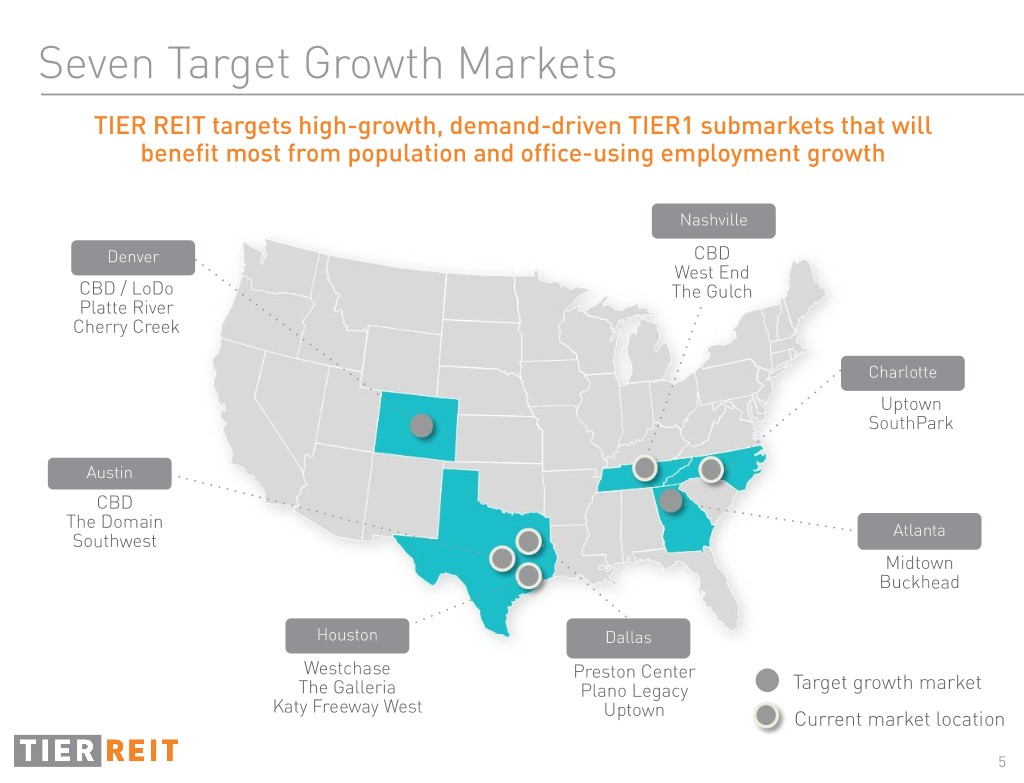

Seven Target Growth Markets TIER REIT targets high-growth, demand-driven TIER1 submarkets that will benefit most from population and office-using employment growth Nashville Denver CBD West End CBD / LoDo The Gulch Platte River Cherry Creek Charlotte Uptown SouthPark Austin CBD The Domain Atlanta Southwest Midtown Buckhead Houston Dallas Westchase Preston Center The Galleria Plano Legacy Target growth market Katy Freeway West Uptown Current market location 5

High-Quality Portfolio Approximately 96% of NOI derived from our high-growth, demand-driven target markets1 Other 4% Additional Quality Indicators1 Nashville 2% ~45% of NOI from properties Charlotte 12% constructed since 2012 NOI Enviable roster of investment- Houston 12% grade tenants by Austin 53% Market1 Weighted average lease life of approximately 6.5 years Dallas 17% Domain 7 Bank of America Plaza 1 March 31, 2018 operating portfolio GAAP NOI pro forma for Domain 8, Third + Shoal, Domain 11, and Domain 12 at stabilization and ownership share; and potential disposition of Eldridge Place 6

Acquired 2015 7

Current Development ~500K SF of letters of Creating ~$3.13 to $3.92/share of incremental value intent2 driving long-term cash flow growth1 Third + Shoal (Rendering) Domain 11 Domain 12 (Rendering) Third + Shoal, Austin, TX Domain 11, Austin, TX Domain 12, Austin, TX 345K net rentable SF 324K net rentable SF 320K net rentable SF >90% leased ~98% leased Leasing underway Aggregate Third + Shoal Domain 11 Domain 12 Value Creation: $151mm to $189mm1 2018 2019 Developments delivering at ~9%+ stabilized cash yields NAV + Dividend 1 Includes estimated value creation of Third + Shoal, Domain 11 and Domain 12 using estimated stabilized NOI, assuming a 5.5%-6.0% exit capitalization rate less actual or budgeted development costs, at ownership share for Third + Shoal 2 Includes executed and pending letters of intent 8

THIRD + SHOAL Delivering 2018 9

Creating Value: Austin Near-Term Development Opportunity to create ~$2.17 to $2.83/share of incremental value through near-term development1 >1.3mm SF of tenant demand2 Domain 10 (Rendering) Domain 9 (Rendering) Domain 10, Austin, TX Domain 9, Austin, TX ~300K net rentable SF ~330K net rentable SF Fully designed & permitted Fully designed & permitted Approximate 8.5%+ yield on near-term development opportunities Potential value creation: $105mm to $137mm1 NAV + Dividend 1 Development potential incremental value calculated using estimated stabilized NOI from above developments, assuming a 5.5%-6.0% exit capitalization rate less estimated development costs 10 2 Based on active discussions with tenants for space at Domain 9, Domain 10 and Domain 12 developments

THE DOMAIN Current Development 3 d 12 11 d d 4 9 10 d 8 d d D d d 7 d Near-term Development Rendering 11

Creating Value: Austin Expanded Redevelopment Potential to develop 4.2mm SF of mixed-use at The Domain1 Domain Point Austin, TX Acquired 2018 THE DOMAIN Mixed-Use Redevelopment Opportunity Acreage: 9.5 Today: 240K SF Potential: 1,200K SF Domain D & G Domain 3 & 4 Austin, TX Acquired 2015 Mixed-Use Development & Redevelopment Opportunity Acreage: 14.5 Today: 332K SF Potential: 3,000K SF 1 Includes 0.6mm SF of existing rentable square feet at Domain 3, Domain 4 and Domain Point 12

Creating Value: Austin Redevelopment Expanding Austin's Second Downtown TIER REIT SF at The Domain (000s) 6,000 5,000 3,628 4,000 3,000 7 8 Domain D & G and Domain 4 d 630 d (Future conceptual rendering) 2,000 The Domain 644 Potential mixed-use1 1,000 p Near-term development d Current development 1,200 Existing2 Domain Point 0 1 Shown net of 0.6mm SF of existing rentable square feet at Domain 3, Domain 4 and Domain Point 2 Domain Point shown at 100% 13

Creating Value: Dallas Future Development Opportunity to create ~$1.71 to $2.00/share of incremental value through future Dallas development1 Legacy District Three (Rendering) Legacy District, Plano, TX ~600K net rentable SF in two phases (Legacy District Two & Three) Legacy District Two fully designed & permitted Approximate 8.5%+ yield on future development opportunities Potential value creation: $82mm to $96mm1 Legacy District Two (Rendering) NAV + Dividend 1 Development potential incremental value calculated using estimated stabilized NOI from above developments, assuming a 5.5%-6.0% exit capitalization rate less estimated development costs 14

Rendering Acquired 2015 & 2017 15

Capital Structure1 Capital structure as of 3.31.18 ($mm) Debt Maturities ($mm) 350 Total estimated 41% 300 enterprise value: $2,052 59% 250 Mortgage debt Unsecured bank debt $300 200 150 $312 Mortgage Debt $ 249 Unsecured term loan & revolver 612 100 Cash (10) Total net debt $ 851 50 2 $90 $93 Estimated equity value 1,201 $66 Total est. enterprise value $ 2,052 $0 $0 0 3 2018 2019 2020 2021 2022 Thereafter Total net liquidity of $192mm 1 Data shown as of 3.31.18 pro forma for the pending disposition of Fifth Third Center 2 Estimated equity value is based on common stock, restricted stock, and restricted stock units outstanding multiplied by consensus NAV of $24.87 per share 16 3 Includes credit facility revolver ($37mm outstanding at 3.31.18) that is subject to a one-year extension option

Managing our Houston Presence Houston Class A office property sales since 2017 total over $4 billion Loop Central sold March 27, 2018 for $73 million Eldridge Place BriarLake Plaza POTENTIAL DISPOSITION Weighted average lease life of ~6 years & Properties fully operational following minimal lease expirations through 2019 Hurricane Harvey 66K SF of completed or pending leases New state-of-the-art lobbies being designed in all three buildings, primarily Historically highest net rents in prime funded by insurance Westchase submarket 17

Experienced Management Team Significant real estate & public company experience spanning 30+ years Scott Fordham Dallas Lucas Bill Reister Jim Sharp Heath Johnson Scott McLaughlin Chief Executive President & Chief EVP & Chief Chief Financial Managing Director Senior Vice President Officer & Director Operating Officer Investment Officer Officer & Treasurer Asset Management Investor Relations Our team is 100% committed to optimizing the value of TIER’s common stock through execution of our strategic plan or pursuing other strategic alternatives, including public or private execution 18

5950 SHERRY LANE Acquired 2014 19

Austin Office-Using Employment & Population Growth1 The Domain The Terrace Third + Shoal Portfolio Snapshot Market Commentary1 Top-tier market with a highly educated workforce combined with pro-business government policy 10.6% Class A vacancy, up from 8.2% in prior year YoY: 9.7% Class A rent growth / 1.2mm SF net absorption 1Q’18: 1.7% Class A rent growth / 0.1mm SF net absorption The Terrace Third+Shoal (Rendering) Domain 7 3.4mm SF under construction, ~67% pre-leased Five-year forecast of 1.0% avg. annual rent growth 1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’18 20

Dallas-Fort Worth Office-Using Employment & Population Growth1 Legacy District 5950 Sherry Lane Burnett Plaza Portfolio Snapshot Market Commentary1 DFW’s diversified economy, affordability, location and quality of labor have put it on many corporate relocation lists 18.3% Class A vacancy, up from 17.8% in prior year YoY: 2.7% Class A rent growth / 7.7mm SF net absorption 1Q’18: 1.1% Class A rent compression / 2.3mm SF net absorption 4.8mm SF under construction, ~59% pre-leased Legacy District Burnett Plaza 5950 Sherry Lane Five-year forecast of 1.7% avg. annual rent growth 1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’18 21

Houston Office-Using Employment & Population Growth1 Eldridge Place BriarLake Plaza Portfolio Snapshot Market Commentary1 Office demand will take time to return to normal following energy-related headwinds and Hurricane Harvey 25.5% Class A vacancy, up from 21.9% in prior year YoY: 0.4% Class A rent growth / (2.2mm) SF net absorption 1Q’18: 0.5% Class A rent growth / (1.1mm) SF net absorption BriarLake Plaza Eldridge Place Sublease inventory of 9.5mm SF as of 1Q’18 1.6mm SF under construction, ~64% pre-leased 1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’18 22

Charlotte Office-Using Employment & Population Growth1 Bank of America Plaza Portfolio Snapshot Market Commentary1 Charlotte’s central location, affordable living costs and young, educated workforce make it a banking and finance hub 12.4% Class A vacancy, up from 10.0% in prior year YoY: 6.5% Class A rent growth / 1.3mm SF net absorption 1Q’18: 0.7% Class A rent growth / <0.1mm SF net absorption Bank of America Plaza 1.6mm SF under construction, ~60% pre-leased Five-year forecast of 2.5% avg. annual rent growth 1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’18 for the Charlotte CBD 23

Nashville Office-Using Employment & Population Growth1 Plaza at MetroCenter Portfolio Snapshot Market Commentary1 Nashville's economic diversity, mix of private and public industry, and low costs of business fuel office demand 11.1% Class A vacancy, up from 6.6% in prior year YoY: 2.3% Class A rent compression / 1.3mm SF net absorption 1Q’18: 0.1% Class A rent growth / 0.3mm SF net absorption Plaza at MetroCenter 1.3mm SF under construction, ~40% pre-leased Five-year forecast of 0.5% avg. annual rent growth 1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’18 24

Forward-Looking Statements This presentation contains forward-looking statements, including discussion and analysis of the financial condition of us and our subsidiaries and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on their knowledge and understanding of our business and industry. Words such as “may,” "will," “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “outlook,” “would,” “could,” “should,” “objectives,” “strategies,” “opportunities,” “goals,” “position,” “future,” “vision,” “mission,” “strive,” “project” and variations of these words and similar expressions are intended to identify forward-looking statements. We intend that such forward-looking statements be subject to the safe harbor provisions created by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution you not to place undue reliance on forward-looking statements, which reflect our management's view only as of the date of this presentation. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. Factors that could cause actual results to differ materially from any forward-looking statements made in the presentation include but are not limited to: (i) market disruptions and economic conditions experienced by the economy or real estate industry as a whole and the local economic conditions in the markets in which our properties are located; (ii) our ability to renew expiring leases and lease vacant spaces at favorable rates or at all; (iii) the inability of tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business; (iv) the availability of cash flow from operating activities to fund distributions and capital expenditures; (v) our ability to raise capital in the future by issuing additional equity or debt securities, selling our assets or otherwise to fund our future capital needs; (vi) the availability and terms of financing, including the impact of higher interest rates on the cost and/or availability of financing; (vii) our ability to strategically acquire, develop or dispose of assets on favorable terms or at all; (viii) our level of debt and the terms and limitations imposed on us by our debt agreements; (ix) our ability to retain our executive officers and other key personnel; (x) unfavorable changes in laws or regulations impacting our business or our assets; and (xi) factors that could affect our ability to qualify as a real estate investment trust. The forward-looking statements should be read in light of these and other risk factors identified in the “Risk Factors” section of our most recent Form 10-K, as filed with the Securities and Exchange Commission. The modeling, projections, analyses, and other forward-looking information prepared by CoStar Portfolio Strategy, LLC (“CoStar”) and presented herein are based on financial and other information from public and proprietary sources, as well as various assumptions concerning future events and circumstances that are speculative, uncertain and subject to change without notice. Actual results and events may differ materially from the projections presented. All CoStar materials set forth herein (“CoStar Materials”) speak only as of the date referenced and may have materially changed since such date. CoStar does not purport that the CoStar Materials herein are comprehensive, and, while they are believed to be accurate, the CoStar Materials are not guaranteed to be free from error, omission or misstatement. CoStar has no obligation to update any of the CoStar Materials included in this document. All CoStar Materials are provided “as is,” without any guarantees, representations or warranties of any kind, including implied warranties of merchantability, non-infringement, title and fitness for a particular purpose. To the maximum extent permitted by law, CoStar disclaims any and all liability in the event any CoStar Materials prove to be inaccurate, incomplete or unreliable. CoStar does not sponsor, endorse, offer or promote an investment in the securities of TIER REIT, Inc. You should not construe any of the CoStar Materials as investment, tax, accounting or legal advice.

Focused strategy Proven execution High-quality portfolio INVESTMENT RATIONALE Significant value creation opportunities Flexible balance sheet ir@tierreit.com www.tierreit.com Experienced management team 972.483.2400 Austin + Dallas + Houston + Charlotte + Nashville + Atlanta + Denver