Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - GAIN Capital Holdings, Inc. | exhibit99_1pressrelease.htm |

| 8-K - 8-K - GAIN Capital Holdings, Inc. | form8kplymouth.htm |

GAIN Capital to Sell GTX ECN Business May 30, 2018 1

SAFE HARBOR STATEMENT Forward Looking Statements In addition to historical information, this earnings presentation contains "forward-looking" statements that reflect management's expectations for the future. A variety of important factors could cause results to differ materially from such statements. These factors are noted throughout GAIN Capital's annual report on Form 10-K for the year ended December 31, 2017, as filed with the Securities and Exchange Commission on March 14, 2018, and include, but are not limited to, the actions of both current and potential new competitors, fluctuations in market trading volumes, financial market volatility, evolving industry regulations, errors or malfunctions in GAIN Capital’s systems or technology, rapid changes in technology, effects of inflation, customer trading patterns, the success of our products and service offerings, our ability to continue to innovate and meet the demands of our customers for new or enhanced products, our ability to successfully integrate assets and companies we have acquired, our ability to effectively compete, changes in tax policy or accounting rules, fluctuations in foreign exchange rates and commodity prices, adverse changes or volatility in interest rates, as well as general economic, business, credit and financial market conditions, internationally or nationally, and our ability to continue paying a quarterly dividend in light of future financial performance and financing needs. The forward-looking statements included herein represent GAIN Capital’s views as of the date of this release. GAIN Capital undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law. Non-GAAP Financial Measures This presentation contains various non-GAAP financial measures, including adjusted EBITDA, adjusted net income, and adjusted EPS. These non-GAAP financial measures have certain limitations, including that they do not have a standardized meaning and, therefore, our definitions may be different from similar non-GAAP financial measures used by other companies and/or analysts. Thus, it may be more difficult to compare our financial performance to that of other companies. We believe our reporting of these non-GAAP financial measures assists investors in evaluating our historical and expected operating performance. However, because these are not measures of financial performance calculated in accordance with GAAP, such measures should be considered in addition to, but not as a substitute for, other measures of our financial performance reported in accordance with GAAP, such as net income. See the Appendix for a reconciliation of the non-GAAP financial measures used herein to the most directly comparable GAAP measure. 2

TRANSACTION OVERVIEW • GAIN Capital reached a definitive agreement to sell the Company’s GTX ECN business, an institutional platform for trading foreign exchange, to Acquirer for $100 million • Transaction expected to result in proceeds of approximately $85 million for GAIN, net of taxes and transaction-related expenses and fees • The transaction is expected to close in the second quarter of 2018, subject to customary closing conditions • GAIN will retain GTX’s Swap Dealer/voice business and SEF as these businesses were not sold as part of the transaction • GAIN initially launched GTX in 2010 as a venue for trading in FX and precious metals by institutional investors • GTX has grown to over 150 unique clients, including banks, brokers, hedge funds, non-bank market makers, commodities trading advisors, asset managers and retail aggregators and over 700 users at the end of 2017 • For full year 2017, GAIN’s institutional business represented approximately 10% of the Company’s total revenue and 14% of EBITDA 3

USE OF PROCEEDS GAIN intends to use the approximately $85 million of net proceeds to… • Invest in organic growth and M&A opportunities • Focus on organic growth of direct business and enhancing products and services • Focus on M&A opportunities that grow share in existing and new markets • Maintain additional flexibility to fund active share repurchase program and/or repay portion of outstanding debt 4

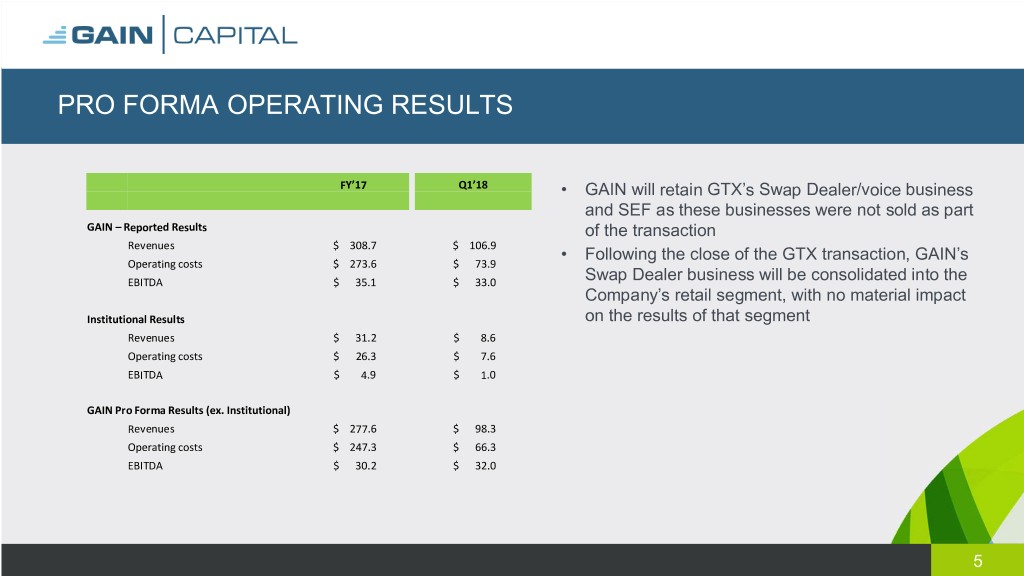

PRO FORMA OPERATING RESULTS FY’17 Q1’18 • GAIN will retain GTX’s Swap Dealer/voice business and SEF as these businesses were not sold as part GAIN – Reported Results of the transaction Revenues $ 308.7 $ 106.9 • Following the close of the GTX transaction, GAIN’s Operating costs $ 273.6 $ 73.9 EBITDA $ 35.1 $ 33.0 Swap Dealer business will be consolidated into the Company’s retail segment, with no material impact Institutional Results on the results of that segment Revenues $ 31.2 $ 8.6 Operating costs $ 26.3 $ 7.6 EBITDA $ 4.9 $ 1.0 GAIN Pro Forma Results (ex. Institutional) Revenues $ 277.6 $ 98.3 Operating costs $ 247.3 $ 66.3 EBITDA $ 30.2 $ 32.0 5

POSITIONED TO DELIVER LONG-TERM VALUE Proven Leader in a Large, Attractive and Growing Market Highly Diverse and Scalable Business Model Multiple Levers to Drive Growth and Operational Efficiency Risk Management Controls Limit Market Volatility Headwinds Strong Financial and Credit Profile 6