Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ServisFirst Bancshares, Inc. | f8k_052318.htm |

Exhibit 99.1

ServisFirst Bancshares, Inc. NASDAQ: SFBS May 2018

Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . In addition, ServisFirst Bancshares, Inc . may file or furnish documents with the Securities and Exchange Commission which contain forward - looking statements and management may make forward - looking statements orally to analysts, investors, representatives of the media and others . These statements are based on the current beliefs and expectations of ServisFirst Bancshares, Inc . ’s management and are subject to significant risks and uncertainties . Actual results may differ from those set forth in the forward - looking statements . Factors that could cause ServisFirst Bancshares, Inc . ’s actual results to differ materially from those described in the forward - looking statements can be found in ServisFirst Bancshares, Inc . ’s Annual Report on Form 10 - K for the year ended December 31 , 2017 , and Quarterly Reports on Form 10 - Q for the quarters ended March 31 , 2018 , September 30 , 2017 , and June 30 , 2017 which have been filed with the Securities and Exchange Commission and which are available on ServisFirst Bancshares, Inc . ’s website ( www . servisfirstbank . com ) and on the Securities and Exchange Commission’s website ( www . sec . gov ) . ServisFirst Bancshares, Inc . does not undertake to update the forward - looking statements to reflect the impact of circumstances or events that may arise after the date of the forward - looking statements . ▪ Non - GAAP Financial Measures This presentation includes non - GAAP financial measures . Information about any such non - GAAP financial measures, including a reconciliation of those measures to GAAP, can be found in the presentation . 2

ServisFirst at a Glance Overview ▪ Founded in 2005 in Birmingham, AL ▪ Single bank BHC High - Performing Metropolitan Commercial Bank ▪ Total Assets (1) : $7 billion ▪ Stockholders’ Equity (1) : $629 million High Growth Coupled with Pristine Credit Metrics (3) ▪ Gross Loans CAGR: 20% ▪ Total Deposits CAGR: 19% ▪ Net Income for Common CAGR: 22% ▪ Diluted EPS CAGR: 16% 3 ▪ ROAA (2) : 1.91% ▪ Efficiency Ratio (2) : 34.93% 1) As of March 31, 2018 2) For three months ended March 31, 2018 3) 5 - year compounded annual growth rate calculated from December 31, 2012 to December 31, 2017 ▪ NPAs / assets (1) : 0.22% ▪ NPLs / loans (1) : 0.17%

Our Business Strategy ▪ Simple business model – Loans and deposits are primary drivers, not ancillary services ▪ Limited branch footprint – Technology provides efficiency ▪ Big bank products and bankers – With the style of service and delivery of a community bank ▪ Core deposit focus coupled with C&I lending emphasis ▪ Scalable, decentralized business model – Regional CEOs drive revenue ▪ Opportunistic expansion, attractive geographies – Teams of the best bankers in each metropolitan market ▪ Disciplined growth company that sets high standards for performance 4

Opportunistic Expansion ▪ Identify great bankers in attractive markets – Focus on people as opposed to places – Target minimum of $300 million in assets within 3 years – Best bankers in growing markets ▪ Market strategies – Regional CEOs execute simple business model – Back office support and risk management infrastructure – Non - legal board of directors comprised of key business people – Provide professional banking services to mid - market commercial customers that have been neglected or pushed down to branch personnel by national and other larger regional banks ▪ Opportunistic future expansion – Southern markets, metropolitan focus – Draw on expertise of industry contacts 5

Milestones 6 ▪ Founded in May 2005 with initial capital raise of $35 million ▪ Reached profitability during the fourth quarter of 2005 and have been profitable every quarter since ▪ Achieved total asset milestones of $1 billion in 2008, $2 billion in 2011, $3 billion in 2013, $4 billion in 2014, $5 billion in 2015, $6 billion in 2016, and $7 billion in 2017 2014 May ’05: Founded in Birmingham, AL June ’07: Montgomery, AL March ’11: Correspondent Banking April ’13: Mobile, AL May ’14: NASDAQ listed August ’06: Huntsville, AL September ’08: Dothan, AL April ’11: Pensacola, FL April ’13: Nashville, TN February ‘15: Metro Bank Acquisition January ’15: Charleston, SC 2015 2012 2013 2011 2010 2009 2008 2007 2006 2005 January ’16: Tampa Bay, FL 2017 2016 2018

Our Footprint 7 • ServisFirst Branches (20)

Our Regions 8 1) Represents metropolitan statistical areas (MSAs) 2) As of May 2018 3) As reported by the FDIC as of 6/30/2017 Total Branches (2) Total MSA Deposits (3) ($ in billions) Market Share (3) (%) 3 37.9 6.2 2 8.1 6.8 2 7.8 9.7 3 7.2 3.3 2 3.2 15.1 1 81.9 0.1 2 5.6 5.9 1 57.4 0.5 Atlanta - Sandy Springs - Roswell 3 166.9 0.2 Charleston 1 13.2 0.8 20 389.2Total Nashville Montgomery Dothan Mobile Florida Tampa - St. Petersburg - Clearwater Region (1) Alabama Georgia South Carolina Birmingham - Hoover Huntsville Pensacola - Ferry Pass - Brent Tennessee

Our Business Model ▪ “Loan making and deposit taking” – Traditional commercial banking services – No emphasis on non - traditional business lines ▪ Culture of cost control – “Branch light,” with $315 million (1) average deposits per banking center – Leverage technology and centralized infrastructure – Headcount focused on production and risk management – Key products; including remote deposit capture, cash management, remote currency manager – Outsource selected functions ▪ C&I lending expertise – 39% of gross loans – Target customers: privately held businesses $2 to $250 million in annual sales, professionals, affluent consumers 9 1) Includes banking centers that have been open for a minimum of one year

Scalable, Decentralized Structure ▪ Local decision - making – Emphasize local decision - making to drive customer revenue – Centralized, uniform risk management and support – Conservative local lending authorities, covers most lending decisions ▪ Geographic organizational structure (as opposed to line of business structure) ▪ Regional CEOs empowered and held accountable – Utilize stock based compensation to align goals ▪ Top - down sales culture – Senior management actively involved in customer acquisition 10

Correspondent Banking Footprint 11

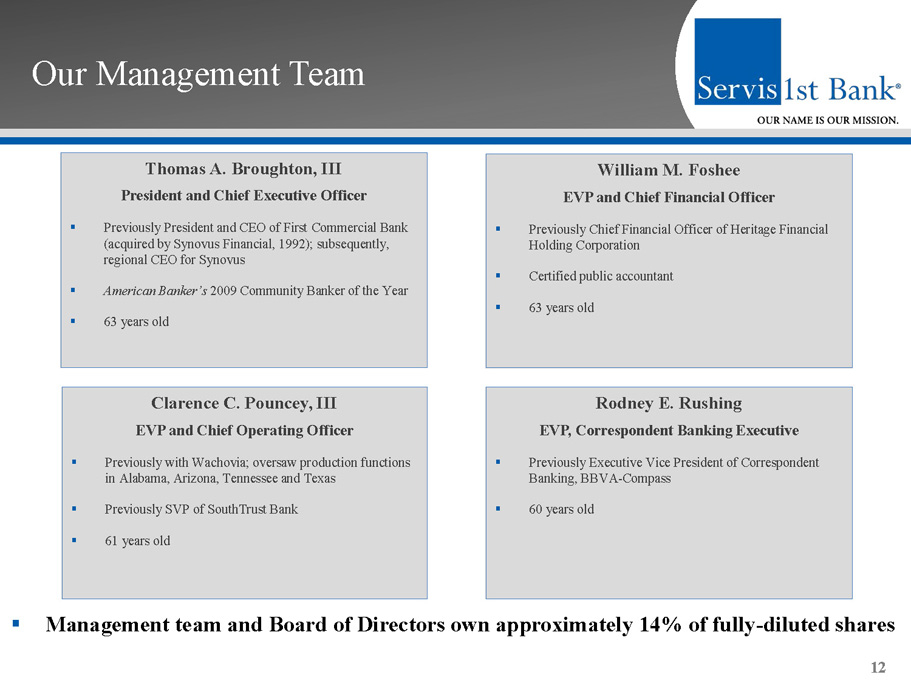

Our Management Team Thomas A. Broughton, III President and Chief Executive Officer ▪ Previously President and CEO of First Commercial Bank (acquired by Synovus Financial, 1992); subsequently, regional CEO for Synovus ▪ American Banker’s 2009 Community Banker of the Year ▪ 63 years old 12 William M. Foshee EVP and Chief Financial Officer ▪ Previously Chief Financial Officer of Heritage Financial Holding Corporation ▪ Certified public accountant ▪ 63 years old Clarence C. Pouncey , III EVP and Chief Operating Officer ▪ Previously with Wachovia; oversaw production functions in Alabama, Arizona, Tennessee and Texas ▪ Previously SVP of SouthTrust Bank ▪ 61 years old Rodney E. Rushing EVP, Correspondent Banking Executive ▪ Previously Executive Vice President of Correspondent Banking, BBVA - Compass ▪ 60 years old ▪ Management team and Board of Directors own approximately 14% of fully - diluted shares

Our Regions Rex D. McKinney EVP and Regional CEO Pensacola ▪ Previously EVP/Senior Commercial Lender for First American Bank/Coastal Bank and Trust ( Synovus ) ▪ 55 years old 13 Andrew N. Kattos EVP and Regional CEO Huntsville ▪ Previously EVP/Senior Lender for First Commercial Bank ▪ 49 years old J. Harold Clemmer EVP and Regional CEO Atlanta ▪ Previously President of Fifth Third Bank Tennessee and Fifth Third Bank Georgia ▪ 50 years old W. Bibb Lamar EVP and Regional CEO Mobile ▪ Previously CEO of BankTrust for over 20 years ▪ 74 years old G. Carlton Barker EVP and Regional CEO Montgomery ▪ Previously Group President for Regions Bank Southeast Alabama Bank Group ▪ 70 years old B. Harrison Morris EVP and Regional CEO Dothan ▪ Previously Market President of Wachovia’s operation in Dothan ▪ 41 years old Gregory W. Bryant EVP and Regional CEO Tampa Bay ▪ Previously President and CEO of Bay Cities Bank in Tampa Bay ▪ 54 years old Thomas G. Trouche EVP and Regional CEO Charleston ▪ Previously Executive Vice President Coastal Division for First Citizens Bank ▪ 54 years old Bradford A. Vieira EVP and Regional CEO Nashville ▪ Previously SVP and Commercial Banking Manager at ServisFirst Bank ▪ 42 years old

Financial Results

Balance Sheet Growth 15 5 - year (1) CAGR = 20% 5 - year (1) CAGR = 19% Gross Loans ($mm) Total Deposits ($mm) ▪ Organic growth of gross loans and total deposits in the 20% range ▪ 5 - year (1) CAGR of non - interest bearing deposits = 21% ▪ 5 - year (1) CAGR of C&I loans = 17% $2,363 $2,859 $3,360 $4,216 $4,912 $5,851 $5,928 2012 2013 2014 2015 2016 2017 3/31/2018 1) 5 – year CAGR = 12/31/2012 – 12/31/2017 $2,512 $3,020 $3,398 $4,224 $5,420 $6,092 $5,977 2012 2013 2014 2015 2016 2017 3/31/2018

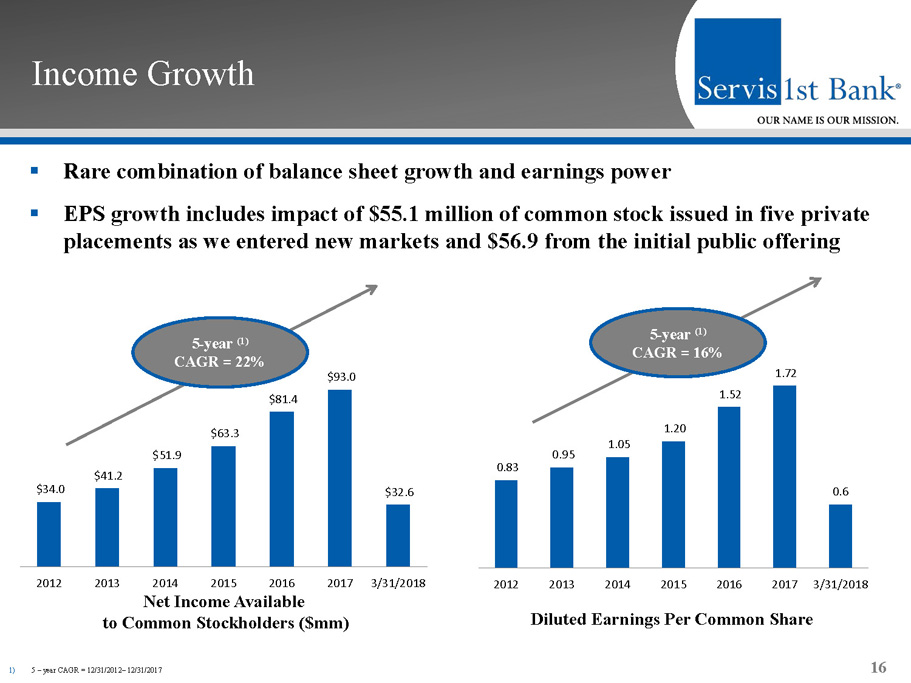

▪ Rare combination of balance sheet growth and earnings power ▪ EPS growth includes impact of $55.1 million of common stock issued in five private placements as we entered new markets and $56.9 from the initial public offering Income Growth 16 5 - year (1) CAGR = 22% 5 - year (1) CAGR = 16% Net Income Available to Common Stockholders ($mm) Diluted Earnings Per Common Share $34.0 $41.2 $51.9 $63.3 $81.4 $93.0 $32.6 2012 2013 2014 2015 2016 2017 3/31/2018 0.83 0.95 1.05 1.20 1.52 1.72 0.6 2012 2013 2014 2015 2016 2017 3/31/2018 1) 5 – year CAGR = 12/31/2012 – 12/31/2017

▪ Primary focus on building core deposits, highlighted by non - interest bearing accounts and non - reliance on CDs ▪ C&I lending expertise within a well balanced loan portfolio Balance Sheet Makeup 17 Deposit Mix (1) 0.86% Cost of Interest Bearing Deposits (2 ) Loan Portfolio (1) 4.80% Yield on Loans (2) 1) As of March 31, 2018 2) Average for the three months ended March 31, 2018 Non - interest bearing 24% CDs 9% NOW, Money market, and savings 67% Commercial & industrial 39% Consumer 1% Real estate - construction 8% Consumer mortgage 10% CRE non - owner occupied 19% CRE owner occupied 23%

Loan Growth by Region 18 12/31/2017 3/31/2018 YTD Growth YTD Annualized Growth Rate 130,456$ 154,366$ 23,910$ 74% 2,535,601$ 2,552,333$ 16,732$ 3% 550,896$ 564,104$ 13,208$ 10% 498,622$ 510,147$ 11,525$ 9% 366,066$ 375,534$ 9,468$ 10% 198,267$ 207,053$ 8,786$ 18% 372,146$ 377,345$ 5,199$ 6% 266,571$ 266,913$ 342$ 1% 547,478$ 541,532$ (5,946)$ -4% 385,158$ 379,000$ (6,158)$ -6% 5,851,261$ 5,928,327$ 77,066$ 5% Dollars in Thousands Region Total Loans Mobile, AL Atlanta, GA Charleston, SC Dothan, AL Tampa Bay, FL Huntsville, AL Pensacola, FL Montgomery, AL Birmingham, AL Nashville, TN

Loan Growth by Type 19 Dollars in Thousands Loan Type 12/31/2017 3/31/2018 2,279,366$ 2,329,904$ 50,538$ 66% 580,874$ 506,050$ (74,824)$ -97% Owner-Occupied Commercial 1,328,666$ 1,349,679$ 21,013$ 27% 1-4 Family Mortgage 603,063$ 581,498$ (21,565)$ -28% Other Mortgage 997,079$ 1,099,482$ 102,403$ 133% Subtotal: Real Estate - Mortgage 2,928,808$ 3,030,659$ 101,851$ 132% 62,213$ 61,714$ (499)$ -1% Total Loans 5,851,261$ 5,928,327$ 77,066$ YTD Growth by Loan Type % of YTD Growth Real Estate - Mortgage: Commercial, Financial and Agricultural Real Estate - Construction Consumer

Credit Trends 20 (In Thousands) 2012 2013 2014 2015 2016 2017 3/31/2018 1-4 Family Construction Speculative 24,962$ 16,403$ 13,608$ 25,794$ 27,835$ 31,230$ 37,380$ 1-4 Family Construction Sold 21,607$ 21,414$ 28,124$ 29,086$ 45,051$ 47,441$ 39,529$ Resi Acquisition & Development 20,949$ 20,474$ 20,009$ 18,693$ 17,681$ 40,956$ 31,122$ Multifamily Permanent 39,800$ 38,601$ 54,725$ 71,217$ 92,052$ 127,502$ 136,889$ Residential Lot Loans 25,160$ 20,418$ 25,630$ 27,844$ 23,138$ 20,059$ 21,340$ Commercial Lots 10,054$ 9,479$ 16,007$ 17,986$ 25,618$ 31,601$ 39,934$ Raw Land 27,063$ 24,686$ 30,124$ 60,360$ 37,228$ 44,145$ 37,741$ Commercial Construction 26,565$ 50,389$ 76,904$ 72,807$ 158,537$ 365,442$ 299,004$ Other CRE Income Property 219,873$ 273,806$ 341,262$ 517,416$ 640,793$ 748,630$ 840,396$ Total CRE (Excluding O/O CRE) 416,034$ 475,671$ 606,394$ 841,203$ 1,067,930$ 1,457,006$ 1,483,335$ Total Risk-Based Capital 287,136$ 343,904$ 458,073$ 530,688$ 616,415$ 718,151$ 746,206$ CRE as % of Total Capital 145% 138% 132% 159% 173% 203% 199% Total Gross Loans 2,363,182$ 2,858,868$ 3,359,858$ 4,216,375$ 4,911,770$ 5,851,261$ 5,928,327$ CRE as % of Total Portfolio 18% 17% 18% 20% 22% 25% 25% CRE Owner Occupied 568,041$ 710,372$ 793,917$ 1,014,669$ 1,171,719$ 1,328,666$ 1,349,679$ CRE OO as % of Total Portfolio 24% 25% 24% 24% 24% 23% 23% CRE OO as % of Total Capital 198% 207% 173% 191% 190% 185% 181% AD&C 158,361$ 151,868$ 208,769$ 243,267$ 335,085$ 580,874$ 506,050$ AD&C as % of Total Capital 55% 44% 46% 46% 54% 81% 68% AD&C as % of Total Portfolio 7% 5% 6% 6% 7% 10% 9% Year Ended December 31, Commercial Real Estate Trends Acquisition, Development, & Construction Trends

▪ Strong loan growth while maintaining asset quality discipline Credit Quality 21 Allowance for Loan Losses / Total Loans Net Charge Offs / Total Average Loans Non - Performing Assets / Total Assets Non - Performing Loans / Total Loans 0.69% 0.64% 0.41% 0.26% 0.34% 0.25% 0.22% 2012 2013 2014 2015 2016 2017 3/31/2018 0.44% 0.34% 0.30% 0.18% 0.34% 0.19% 0.17% 2012 2013 2014 2015 2016 2017 3/31/2018 0.24% 0.33% 0.17% 0.13% 0.11% 0.29% 0.10% 2012 2013 2014 2015 2016 2017 3/31/2018 1.11% 1.07% 1.06% 1.03% 1.06% 1.02% 1.05% 2012 2013 2014 2015 2016 2017 3/31/2018

▪ Consistent earnings results and strong momentum Profitability Metrics 22 Core Return on Average Assets (1) Core Return on Average Equity (1) Core Return on Average Common Equity (1) Net Interest Margin 1) For a reconciliation of these non - GAAP measures to the most comparable GAAP measure, see "GAAP Reconciliation and Management Exp lanation of Non - GAAP Financial Measures" included on page 33 of this presentation. . 1.30% 1.31% 1.44% 1.42% 1.42% 1.48% 1.91% 2012 2013 2014 2015 2016 2017 3/31/2018 19.41% 18.30% 18.30% 16.74% 15.73% 16.63% 21.40% 2012 2013 2014 2015 2016 2017 3/31/2018 3.80% 3.80% 3.68% 3.75% 3.42% 3.68% 3.81% 2012 2013 2014 2015 2016 2017 3/31/2018 15.81% 15.81% 15.54% 15.00% 14.96% 16.64% 21.40% 2012 2013 2014 2015 2016 2017 3/31/2018

▪ Our operating structure and business strategy enable efficient, profitable growth Efficiency 23 Core Efficiency Ratio (1) and Core Non - interest Expense / Average Assets (1) (1) (1) 45.54% 41.54% 38.78% 38.86% 40.73% 39.47 34.71% 34.93% 1.79% 1.64% 1.51% 1.47% 1.56% 1.41 1.32% 1.37% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2011 2012 2013 2014 2015 2016 2017 3/31/2018 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% Core Efficiency Ratio Core Non-interest Expense / Average Assets 1) For a reconciliation of these non - GAAP measures to the most comparable GAAP measure, see "GAAP Reconciliation and Management Explanation of Non - GAAP Financial Measures" included on page 33 of this presentation .

Interest Rate Risk Profile 24 Change in Net Interest Income Scenario Based on parallel shift in yield curve and a static balance sheet Variable - Rate Loans 48% of loans are variable rate Deposit Mix 24% of deposits are held in non - interest bearing demand deposit accounts 1.5% 2.5% 3.6% 5.3% 8.8% 12.5% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Up 100 bps Up 200 bps Up 300 bps Year 1 Year 2

Appendix

Our Regions: Centers for Continued Growth Birmingham, AL ▪ Key Industries: Metals manufacturing, finance, insurance, healthcare services and distribution ▪ Key Employers: Protective Life, HealthSouth Corporation, Vulcan Materials Company, AT&T, and University of Alabama at Birmingham Huntsville, AL ▪ Key Industries: U.S. government, aerospace/defense, commercial and university research ▪ Key Employers: U.S. Army/Redstone Arsenal, Boeing Company, NASA/Marshall Space Flight Center, Intergraph Corporation, ADTRAN, Northrop Grumman, Cinram, SAIC, DirecTV, Lockheed Martin, and Toyota Motor Manufacturing Montgomery, AL ▪ Key Industries : U.S. and state government, U.S. Air Force , automotive manufacturing ▪ Key Employers: Maxwell Gunter Air Force Base, State of Alabama, Baptist Health Systems, Hyundai Motor Manufacturing, and MOBIS Alabama 26

Our Regions: Centers for Continued Growth (cont.) Dothan, AL ▪ Key Industries: Agriculture, manufacturing, and healthcare services ▪ Key Employers: Southeast Alabama Medical Center, Wayne Farms, Southern Nuclear, Michelin Tire, Pemco World Air Services, Globe Motors, and AAA Cooper Transportation Pensacola, FL ▪ Key Industries: Military, health services, medical technology industries, and tourism ▪ Key Employers: Eglin Air Force Base, Hurlburt Field, Pensacola Whiting Field, Pensacola Naval Air Station and Corry Station, Sacred Heart Health System, West Florida Regional Hospital, Gulf Power Company, University of West Florida, Solutia, and GE Wind Energy Mobile, AL ▪ Key Industries: Aircraft assembly, aerospace, steel, ship building, maritime, construction, medicine, and manufacturing ▪ Key Employers: Port of Mobile, Infirmary Health Systems, Austal USA, Brookley Aeroplex , ThyssenKrupp, Infirmary Health Systems, University of South Alabama, ST Aerospace Mobile, and EADS 27

Our Regions: Centers for Continued Growth (cont.) Nashville, TN ▪ Key Industries: Healthcare, manufacturing, transportation, and technology ▪ Key Employers: HCA Holdings, Nissan North America, Dollar General Corporation, Asurion , and Community Health Systems Charleston, SC ▪ Key Industries: Maritime, information technology, higher education, military, manufacturing, and tourism ▪ Key Employers: Joint Base Charleston, Medical University of South Carolina, Roper St. Francis Healthcare, Boeing Company, Robert Bosch LLC, Blackbaud , and SAIC Atlanta, GA ▪ Key Industries: Logistics, media, information technology, and entertainment ▪ Key Employers: Coca - Cola Company, Home Depot, Delta Air Lines, AT&T Mobility, UPS, Newell - Rubbermaid, Cable News Network, and Cox Enterprises Tampa Bay, FL ▪ Key Industries: Defense, financial services, information technology, healthcare, transportation, manufacturing, and tourism ▪ Key Employers: Baycare Health System, University of South Florida, Tech Data, Raymond James Financial, Jabil Circuit, HSN, WellCare Health Plans, and Teco Energy 28

Tax Credit Partnership Investments The Bank has invested in three types of tax credit partnerships which provide loan opportunities and allow for the recognition of tax credits ▪ New Market Tax Credit – designed to encourage private sector equity investments in low income communities ▪ Low Income Housing Tax Credits – designed to encourage private sector investment in the development of affordable rental housing ▪ Historical Tax Credits – designed to encourage the preservation and reuse of historic buildings 29

Our Financial Performance: Key Operating and Performance Metrics 30 2010 2011 2012 2013 2014 2015 2016 2017 3/31/2018 Balance Sheet Total Assets $1,935 $2,461 $2,906 $3,521 $4.099 $5.096 $6.370 $7.082 $7.012 Net Loans $1,377 $1,809 $2,337 $2,828 $3.324 $4.173 $4.860 $5.792 $5.866 Deposits $1,759 $2,144 $2,512 $3,020 $3.398 $4.224 $5.420 $6.092 $5.977 Loans / Deposits 79% 85% 94% 95% 99% 99% 90% 95% 98% Total Equity $117 $196 $233 $297 $407 $449 $523 $608 $629 Profitability Net Income $17.4 $23.4 $34.4 $41.6 $52.3 $63.5 $81.5 $93.1 $32.6 Net Income Available to Common $17.4 $23.2 $34.0 $41.2 $51.9 $63.3 $81.4 $93.0 $32.6 Core Net Income Available to Common (1) $17.4 $23.2 $34.0 $41.2 $53.6 $65.0 $81.4 $96.3 $32.6 Core ROAA (1) 1.04% 1.12% 1.31% 1.32% 1.44% 1.42% 1.42% 1.48% 1.91% Core ROAE (1) 15.86% 14.86% 15.99% 15.70% 15.00% 14.96% 16.64% 16.96% 21.40% Core ROACE (1) 15.86% 17.01% 19.41% 18.30% 16.74% 15.73% 16.63% 16.95% 21.40% Net Interest Margin 3.94% 3.79% 3.80% 3.80% 3.68% 3.75% 3.42% 3.68% 3.81% Core Efficiency Ratio (1) 45.51% 45.54% 41.54% 38.78% 38.86% 40.73% 39.47% 34.71% 34.93% Capital Adequacy Tangible Common Equity to Tangible Assets (2) 6.05% 6.35% 6.65% 7.31% 8.96% 8.54% 7.99% 8.39% 8.78% Common Equity Tier 1 RBC Ratio NA NA NA NA NA 9.72% 9.78% 9.51% 9.87% Tier I Leverage Ratio 7.77% 9.17% 8.43% 8.48% 9.91% 8.55% 8.22% 8.51% 8.95% Tier I RBC Ratio 10.22% 11.39% 9.89% 10.00% 11.75% 9.73% 9.78% 9.52% 9.88% Total RBC Ratio 11.82% 12.79% 11.78% 11.73% 13.38% 11.95% 11.84% 11.52% 11.90% Asset Quality NPAs / Assets 1.10% 1.06% 0.69% 0.64% 0.41% 0.26% 0.34% 0.25% 0.22% NCOs / Average Loans 0.55% 0.32% 0.24% 0.33% 0.17% 0.13% 0.11% 0.29% 0.10% Loan Loss Reserve / Gross Loans 1.30% 1.20% 1.11% 1.07% 1.06% 1.03% 1.06% 1.02% 1.05% Per Share Information Common Shares Outstanding 33,164,892 35,593,092 37,612,872 44,100,072 49,603,036 51,945,396 52,636,896 52,992,586 53,147,169 Book Value per Share $3.53 $4.39 $5.14 $5.83 $7.41 $8.65 9.93 11.47 11.84 Tangible Book Value per Share (2) $3.53 $4.39 $5.14 $5.83 $7.41 $8.35 9.65 11.19 11.56 Diluted Earnings per Share $0.47 $0.59 $0.83 $0.95 $1.05 $1.20 1.52 1.72 0.60 Core Diluted Earnings per Share (1) $0.47 $0.59 $0.83 $0.95 $1.08 $1.23 1.52 1.78 0.60 Dollars in Millions Except per Share Amounts 1) For a reconciliation of these non - GAAP measures to the most comparable GAAP measure, see "GAAP Reconciliation and Management Exp lanation of Non - GAAP Financial Measures" included on page 33 of this presentation. 2) Non - GAAP financial measures. "Tangible Common Equity to Tangible Assets" and "Tangible Book value per Share" are not measures o f financial performance recognized by generally accepted accounting principles in the United States, or GAAP.

Our Financial Performance: Asset Quality 31 Dollars in Thousands 2010 2011 2012 2013 2014 2015 2016 2017 3/31/2018 Nonaccrual Loans: 1-4 Family 202 670 453 1,878 1,596 198 74 459 328 Owner-Occupied Commercial Real Estate 635 792 2,786 1,435 683 -- -- 556 306 Other Real Estate Loans -- 693 240 243 959 1,619 -- -- -- Commercial, Financial & Agricultural 2,164 1,179 276 1,714 172 1,918 7,282 9,712 8,599 Construction 10,722 10,063 6,460 3,749 5,049 4,000 3,268 -- -- Consumer 624 375 135 602 666 31 -- 38 38 Total Nonaccrual Loans 14,347 13,772 10,350 9,621 9,125 7,766 10,624 10,765 9,271 Total 90+ Days Past Due & Accruing -- -- 8 115 925 1 6,263 60 678 Total Nonperforming Loans 14,347 13,772 10,358 9,736 10,050 7,767 16,887 10,825 9,949 Other Real Estate Owned & Repossessions 6,966 12,305 9,721 12,861 6,840 5,392 4,988 6,701 5,748 Total Nonperforming Assets 21,313 26,077 20,079 22,597 16,890 13,159 21,875 17,526 15,697 Troubled Debt Restructurings (TDRs) (Accruing): 1-4 Family -- -- 1,709 8,225 -- -- -- 850 849 Owner-Occupied Commercial Real Estate -- 2,785 3,121 -- -- -- -- 3,664 3,664 Other Real Estate Loans -- 331 302 285 1,663 253 204 -- -- Commercial, Financial & Agricultural 2,398 1,369 1,168 962 6,632 6,618 354 11,438 10,328 Construction -- -- 3,213 217 -- -- -- 997 997 Consumer -- -- -- -- -- -- -- -- -- Total TDRs (Accruing) 2,398 4,485 9,513 9,689 8,295 6,871 558 16,949 15,838 Total Nonperforming Assets & TDRs (Accruing) 23,711 30,562 29,592 32,286 25,185 20,030 22,433 34,475 31,535 Total Nonperforming Loans to Total Loans 1.03% 0.75% 0.44% 0.34% 0.30% 0.18% 0.34% 0.19% 0.17% Total Nonperforming Assets to Total Assets 1.10% 1.06% 0.69% 0.64% 0.41% 0.26% 0.34% 0.25% 0.22% Total Nonperforming Assets & TDRs (Accruing) to Total Assets 1.23% 1.24% 1.02% 0.92% 0.61% 0.39% 0.35% 0.49% 0.45%

Our Financial Performance: Loan Loss Reserve and Charge - Offs 32 Dollars in Thousands 2010 2017 3/31/2018 Allowance for Loan Losses: Beginning of Year $ 14,737 $ 18,077 $ 22,030 $ 26,258 $ 30,663 $ 35,629 $ 43,419 $ 51,893 $ 59,406 Charge-Offs: Commercial, Financial and Agricultural (1,667) (1,096) (1,106) (1,932) (2,311) (3,802) (3,791) (13,910) (1,088) Real Estate - Construction (3,488) (2,594) (3,088) (4,829) (1,267) (667) (815) (56) 0 Real Estate - Mortgage: (1,775) (1,096) (660) (241) (1,965) (1,104) (380) (2,056) (381) Consumer (278) (867) (901) (210) (228) (171) (212) (310) (88) Total Charge-Offs (7,208) (5,653) (5,755) (9,012) (5,771) (5,744) (5,198) (16,332) (1,557) Recoveries: Commercial, Financial and Agricultural 97 361 125 66 48 279 49 337 4 Real Estate - Construction 53 180 58 296 322 238 76 168 7 Real Estate - Mortgage: 32 12 692 36 74 169 146 89 42 Consumer 16 81 8 11 34 1 3 26 9 Total Recoveries 198 634 883 409 478 687 274 620 62 Net Charge-Offs (7,010) (5,019) (4,872) (8,603) (5,293) (5,057) (4,924) (15,712) (1,495) Provision for Loan Losses Charged to Expense 10,350 8,972 9,100 13,008 10,259 12,847 13,398 23,225 4,139 Allowance for Loan Losses at End of Period $ 18,077 $ 22,030 $ 26,258 $ 30,663 $ 35,629 $ 43,419 $ 51,893 $ 59,406 $ 62,050 As a Percent of Year to Date Average Loans: Net Charge-Offs 0.55% 0.32% 0.24% 0.33% 0.17% 0.13% 0.11% 0.29% 0.10% Provision for Loan Losses 0.81% 0.57% 0.45% 0.50% 0.34% 0.34% 0.30% 0.43% 0.29% Allowance for Loan Losses As a Percentage of: Loans 1.30% 1.20% 1.11% 1.07% 1.06% 1.03% 1.06% 1.02% 1.05% 20162011 20142013 2012 2015

GAAP Reconciliation and Management Explanation of Non - GAAP Financial Measures 33 We recorded $3.1 million of additional tax expense as a result of revaluing our net deferred tax assets at December 31, 2017 due to lower corporate income tax rates provided by the Tax Cuts and Jobs Act passed into law in December 2017. We also recorded expenses of $347,000 related to terminating the lease agreement on our previous headquarters building in Birmingham, Alabama and expenses of moving into our new headquarters building. We recorded expenses of $2.1 million for the first quarter of 2015 re lat ed to the acquisition of Metro Bancshares, Inc. and the merger of Metro Bank with and into the bank, and recorded an expense of $50 0,0 00 resulting from the initial funding of reserves for unfunded loan commitments for the first quarter of 2015, consistent with g uid ance provided in the Federal Reserve Bank’s Interagency Policy Statement SR 06 - 17. Core financial measures included in this presenta tion are “core net income available to common stockholders,” “core earnings per share, basic,” “core earnings per share, diluted,” “c ore return on average assets,” “core return on average stockholders’ equity,” “core return on average common stockholders’ equity ” a nd “core efficiency ratio.” Each of these seven core financial measures excludes the impact of the non - routine expense attributabl e to the revaluing of our net deferred tax assets, lease termination, moving expenses, expenses related to the acquisition of Metro an d t he initial funding of reserves for unfunded loan commitments. In addition to these financial measures adjusting for non - routine expenses, t his presentation contains certain non - GAAP financial measures, including tangible book value per share and tangible common equity to total tangible assets, each of which excludes goodwill and core deposit intangibles associated with our acquisition of Metro Bancshares, Inc. in January 2015. We believe these non - GAAP financial measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAA P; however, we acknowledge that these non - GAAP financial measures have a number of limitations. As such, you should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non - GAAP financial measures that other companies, including those in our industry, use. The following reconciliation table provides a mo re detailed analysis of the non - GAAP financial measures for March 31, 2018 and the years ended December 31, 2017, 2016, 2015, and 2014. All amounts are in thousands, except share and per share data.

GAAP Reconciliation 34 Dollars in Thousands $ 44,258 $ 25,465 $ 21,601 Adjustments: Adjustment for non-routine expense -132 829 865 $ 44,126 $ 26,294 $ 22,466 1.43 % 1.38 % 1.39 % $ 93,092 $ 63,540 $ 52,377 Adjustments: Adjustment for non-routine expense 3,274 1,767 1,612 $ 96,366 $ 65,307 $ 53,989 $ 6,495,067 $ 4,591,861 $ 3,758,184 1.48 % 1.42 % 1.44 % 16.37 % 15.30 % 14.43 % $ 93,030 $ 63,260 $ 51,946 Adjustments: Adjustment for non-routine expense 3,274 1,767 1,612 $ 96,304 $ 65,027 $ 53,558 $ 568,228 $ 413,445 $ 320,005 16.95 % 15.73 % 16.74 % $ 1.72 $ 1.20 $ 1.05 54,161,788 52,885,108 49,636,442 $ 1.78 $ 1.23 $ 1.08 $ 11.84 $ 11.47 $ 9.93 $ 8.65 $ 7.41 629,297 607,604 522,889 449,147 367,255 Adjustments: Adjusted for goodwill and other identifiable intangible assets 14,652 14,787 14,996 15,330 - $ 614,645 $ 592,885 $ 507,893 $ 433,817 $ 367,255 $ 11.56 $ 11.19 $ 9.65 $ 8.35 $ 7.41 8.89 % 8.58 % 8.21 % 8.81 % 8.96 % $ 7,011,735 $ 7,082,384 $ 6,370,448 $ 5,095,509 $ 4,098,679 Adjustments: Adjusted for goodwill and other identifiable intangible assets 14,652 14,719 14,996 15,330 - $ 6,997,083 $ 7,067,665 $ 6,355,452 $ 5,080,179 $ 4,098,679 8.78 % 8.39 % 7.99 % 8.54 % 8.96 % Average common stockholders' equity Core return on average common stockholders' equity - non-GAAP Tangible book value per share - non-GAAP As Of and For the Year Ended December 31, 2014 Book value per share - GAAP As Of and For the Year Ended December 31, 2015 Provision for income taxes - GAAP Return on average assets - GAAP Core net income - non-GAAP As Of and For the Year Ended December 31, 2016 As Of and For the Period Ended December 31, 2017 As Of and For the Period Ended March 31, 2018 Stockholders' equity to total assets - GAAP Total assets - GAAP Total tangible assets - non-GAAP Tangible common equity to total tangible assets - non-GAAP Core provision for income taxes - non-GAAP Net income - GAAP Core diluted earnings per share - non-GAAP Total common stockholders' equity - GAAP Tangible common stockholders' equity - non-GAAP Average assets Core return on average assets - non-GAAP Return on average common stockholders' equity - GAAP Net income available to common stockholders - GAAP Diluted earnings per share - GAAP Weighted average shares outstanding, diluted - GAAP Core net income available to common stockholders - non-GAAP