Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SELECT BANCORP, INC. | tv494731_8k.htm |

Exhibit 99.1

Disclosure This presentation contains forward - looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995 ) . Such statements are not historical facts, but rather are based on our current expectations, estimates and projections about our industry, our company, and our company’s operation and financial condition . Words including “may,” “will,” “could,” “would,” “should,” “anticipate,” “expect,” “intend,” “plan,” “project,” “believe,” “seek,” “estimate” and similar expressions are intended to identify forward - looking statements . These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which remain beyond our control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward - looking statements . Such risk factors are disclosed from time to time in filings made by Select Bancorp , Inc . with the Securities and Exchange Commission . We caution you not to place undue reliance on these forward - looking statements, which reflect management’s view only as of the date of this presentation . We are not obligated to update these statements or publicly release the result of any revisions to them to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events .

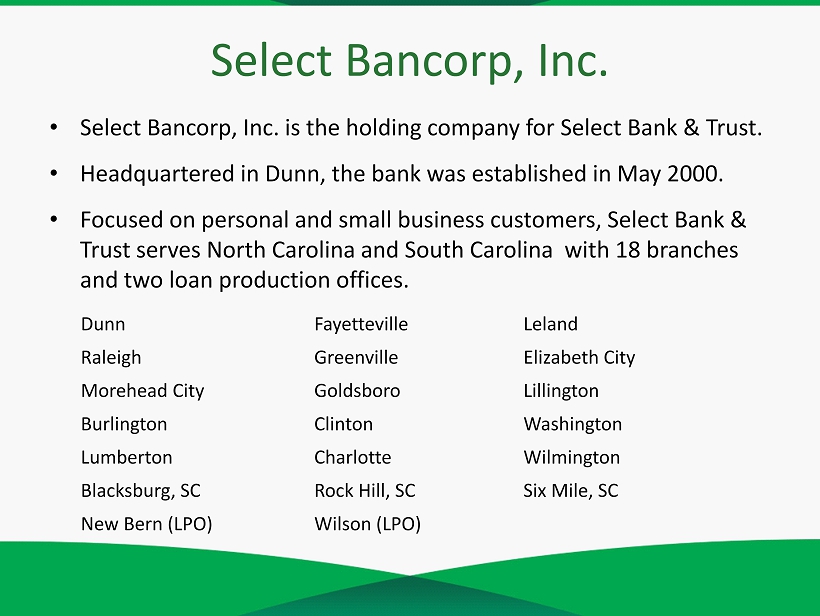

Select Bancorp, Inc. • Select Bancorp, Inc. is the holding company for Select Bank & Trust. • Headquartered in Dunn, the bank was established in May 2000 . • Focused on personal and small business customers, Select Bank & Trust serves North Carolina and South Carolina with 18 branches and two loan production offices. Dunn Fayetteville Leland Raleigh Greenville Elizabeth City Morehead City Goldsboro Lillington Burlington Clinton Washington Lumberton Charlotte Wilmington Blacksburg, SC Rock Hill, SC Si x Mile, SC New Bern (LPO) Wilson (LPO)

Mission Statement To be the bank of choice in the communities we serve, by providing exceptional customer service, superior products and experienced bankers using a "common sense" approach to banking.

Markets We Serve (Wilmington area)

Experienced Management Team William L. Hedgepeth II A native of North Carolina, Bill has been in the banking industry since 1983. Bill has served as President and Chief Executive Officer of Select Bank & Trust since 2014. He served as President and Chief Executive Officer of New Century Bank from 2007 – 2014 and as Chief Executive Officer of the former New Century Bank of Fayetteville from 2004 - 2007. He is a graduate of the University of North Carolina in Chapel Hill, N.C. W. Keith Betts A native of Delaware, Keith has been in the banking industry since 1980. He has served as Chief Banking Officer since January 2017. He previously served as Regional Executive for the bank’s New Hanover and Brunswick County, North Carolina markets. He founded Port City Capital Bank in Wilmington in 2001 and served as the bank’s President and Chief Executive Officer until the bank was sold in 2006. He is a graduate of St. Andrews Presbyterian College in Laurinburg, N.C. Mark A. Jeffries A native of Georgia, Mark has been in the banking industry since 2004. Mark has served as chief financial officer of Select Bank since 2014. He served as chief financial officer of Millennium Bank from 2009 - 2014 and as chief financial officer of Asheville Savings Bank from 2007 - 2008. He also served as controller and interim chief financial officer of Gateway Bank from 2004 - 2007. He is a graduate of East Carolina University in Greenville, N.C. Lynn H. Johnson A native of North Carolina, Lynn has been in the banking industry since 2003. Lynn has served as chief administrative officer for Select Bank & Trust since 2014 and as Chief Operating Officer since 2017. She served as Corporate Ethics Officer and Human Resources Director from 2011 - 2014 and as the Human Resources Director from 2003 - 2014. Lynn is certified as a Senior Professional of Human Resources (SPHR) and as a Corporate Compliance Ethics Professional (CCEP). She is a graduate of Wake Technical Community College in Raleigh, N.C. David Richard “Rick” Tobin Jr. A native of Virginia, Rick has been in the banking industry since 1981. He has served as Chief Credit officer for Select Bank & Trust since 2014. He served as Chief Credit Officer for New Century Bank from 2012 - 2014 and as a Senior Credit Administrator from 2008 - 2012. He is a graduate of Appalachian State University in Boone, N.C.

2017 Highlights A Year of Important Progress and Growth ✓ Soli d earnings in 2017 with significant momentum into 2018 ✓ Expanded footprint with access to high growth markets ✓ Successful acquisition strategy and steady organic growth vaulted the institution to $1.2 billion in assets as of December 31, 2017 ✓ Conservative underwriting standards have led to excellent asset quality

✓ Achieved 45% loan growth in 2017 ✓ Earned $3.2 million in 2017 ✓ Strong capital levels to support future growth, through both organic and acquisitive strategies ✓ Completed the merger with Carolina Premier Bank 12 - 15 - 2017 ✓ Started a mortgage division ✓ Acquired a SBA department from Carolina Premier Bank ✓ Expanded into Wilmington 2017 Highlights Continued

Total Deposits $651 $680 $995 $1,009 $- $200 $400 $600 $800 $1,000 $1,200 2015 2016 2017 (Merger Occurred) 1st Qtr. 2018 (in millions)

Total Assets $817 $847 $1,194 $1,223 $- $200 $400 $600 $800 $1,000 $1,200 $1,400 2015 2016 2017 (Merger Occurred) 1st Qtr. 2018 (in millions)

Total Loans $617 $677 $983 $978 $- $200 $400 $600 $800 $1,000 $1,200 2015 2016 2017 (Merger Occurred) 1st Qtr. 2018 (in millions)

Net Income $6,553 $6,754 $3,185 $1,897 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 2015 2016 2017 (Merger Occurred) 1st Qtr. 2018 (in thousands)

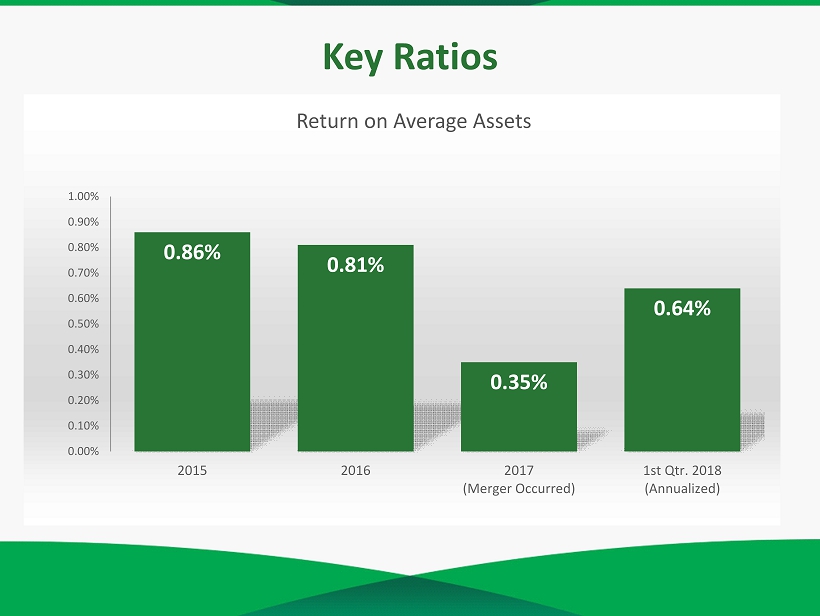

Key Ratios 0.86% 0.81% 0.35% 0.64% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 2015 2016 2017 (Merger Occurred) 1st Qtr. 2018 (Annualized) Return on Average Assets

Key Ratios 6.42% 6.61% 2.93% 5.61% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 2015 2016 2017 (Merger Occurred) 1st Qtr. 2018 (Annualized) Return on Average Equity

Margin and Spread 4.34% 4.06% 4.14% 4.45% 4.18% 4.04% 4.09% 4.22% 3.80% 3.90% 4.00% 4.10% 4.20% 4.30% 4.40% 4.50% 2015 2016 2017 (Merger Occurred) 1st Qtr. 2018 (Annualized) Net Interest Margin Interest Rate Spread

Efficiency Ratio 67.18% 65.15% 72.69% 65.72% 60.00% 62.00% 64.00% 66.00% 68.00% 70.00% 72.00% 74.00% 2015 2016 2017 (Merger Occurred) 1st Qtr. 2018

Focuses in 2018 Building Blocks to Success □ We plan to continue to explore new markets through either branch or bank acquisition. □ Place an additional emphasis on our existing growth markets such as those in the Charlotte and South Carolina area markets. □ We intend to continue to attract and retain small business prospects and customers through proactive business development and by providing quality customer service.

□ We will focus on growth of non - interest income to improve revenue. □ Invest in innovative technology to grow revenue and reduce cost. □ We will continue to hire experienced and knowledgeable bankers to provide our customers with exceptional customer service. Focuses in 2018 Building Blocks to Success

Thank you for your attendance and support.