Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - IHS Markit Ltd. | dp91158_ex9901.htm |

| 8-K - FORM 8-K - IHS Markit Ltd. | dp91158_8k.htm |

Exhibit 99.2

IHS Markit Acquisition of Ipreo 21 May 2018 Repositioning our Financial Services Businesses

Forward - looking statements This presentation contains “forward - looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward - looking statements often address expected future business and financial performanc e and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan ,” “project,” “estimate,” “believe,” “seek,” “see,” “may,” “will ,” “intend,” “would ,” “should,” “could,” “target ,” “aim” and similar expressions, variations or negatives of these words, and the use of future tense. Forward - looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the co nsu mmation of the proposed transactions and the anticipated benefits thereof. Without limiting the generality of the foregoing, forward - looking statements contained in this presentation may include the expectations of manag ement regarding plans, strategies, objectives and anticipated financial and operating results of IHS Markit. IHS Markit’s estimates and forward - looking statements are mainly based on its current expectations and estimates of the proposed transactions and of future events and trends, which affect or may affect its businesses and operations. Although IHS Markit believes that these estimates and forward - looking statements are based upon r easonable assumptions, they are subject to several risks and uncertainties and are made in light of information currently available to IHS Markit. These and other forward - looking statements, including the failure to consummate the proposed transactions or to make or take any filing or other action required to consummate such transactions on a timely matter or at all, are not guarantees of future results and are subject to risks, unc ert ainties and assumptions that could cause actual results to differ materially from those expressed in any forward - looking statements. Important risk factors that may cause such a difference include, but are not limited to, those risks discussed in IHS Markit’ s m ost recent annual report on Form 10 - K and subsequent quarterly reports on Form 10 - Q, along with its other filings with the US Securities and Exchange Commission (the “SEC ”), which are available at www.sec.gov or on the investor relations section of its website, www.ihsmarkit.com, and (i) the completion of the proposed transactions on anticipated terms and timing, including obtaining regulatory approvals, potential accretion, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, benefits, operating efficiencies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of IHS Markit’s operations, and other conditions to the completion of the proposed transactions; (ii) expectations regarding continued availability and terms of capital and financing, including financing required to consummate the proposed transactions, rating agency actions, and debt repayments; (iii) the risk that disruptions from the proposed transactions will harm IHS Markit’s business, including current plans and operations; (iv) the ability of IHS Markit to complete the integration or separation of the proposed transactions, including retaining and hiring key personnel; (v) potential business uncertainty, including changes or adverse reactions to existing business and customer relationships, from the announcement, during the pendency and after completion of the proposed transactions; and (vi) the potential negative effects of the announcement of the proposed transactions on the market price of IHS Markit’s common shares. While the list of factors presented here and in IHS Markit’s filings is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Other factors may present significant additio nal obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward - looking statements could include, among other things, b usiness disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on IHS Markit’s consolidated financial condition, results of op erations, credit rating or liquidity. IHS Markit does not assume any obligation to publicly provide revisions or updates to any forward - looking statements, whether as a result of new information, future developments or otherwise , should circumstances change, except as otherwise required by securities and other applicable laws. You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the d ate of this presentation. All forward - looking statements are qualified in their entirety by this cautionary statement. Non - GAAP measures Non - GAAP financial information is presented only as a supplement to IHS Markit’s financial information based on GAAP. Non - GAAP f inancial information is provided to enhance the reader’s understanding of the financial performance of IHS Markit, but none of these non - GAAP financial measures are recognized terms under GAAP and should not be consi dered in isolation from, or as a substitute for, financial measures calculated in accordance with GAAP. Definitions of IHS Markit non - GAAP measures to the most directly comparable GAAP measures are provided wi th the schedules to the most recent IHS Markit quarterly earnings release and are available on IHS Markit’s website (www.ihsmarkit.com ). This presentation also includes certain forward looking non - GAAP financial measures. IHS Markit is unable to present a reconc iliation of this forward looking non - GAAP financial information because management cannot reliably predict all of the necessary components of such measures. Accor din gly, investors are cautioned not to place undue reliance on this information. IHS Markit uses non - GAAP measures, such as adjusted EBITDA, adjusted EBITDA margin, and adjusted diluted earnings per share (EPS), in its operational and financial decision making, and believes that it is useful to exclude certain items in order to focus on what it regards to be a more reliable indicator of the underlying operating performance of th e business and its ability to generate cash flow from operations. As a result, internal management reports used during monthly operating reviews feature non - GAAP measures, which are also used to prepare strategic plans and annual budgets and review management compensation . IHS Markit also believes that investors may find non - GAAP financial measures for IHS Markit useful for the same reasons, although investors are cautioned that non - GAAP financial measures are not a substitute for GAAP disclosures. Non - GAAP measures are frequently used by securities analysts, investors and other interested parties in their evaluation of companies com parable to IHS Markit, many of which present non - GAAP measures when reporting their results. These measures can be useful in evaluating IHS Markit’s performance against its peer companies becau se it believes he measures provide users with valuable insight into key components of GAAP financial disclosures. However, non - GAAP measures have limitations as an analytical tool. Non - GAAP measures are not necessarily comparable to similarly titled measures used by other companies. They are not presentations made in accordance with GAAP, are not measures of financial condition or liquidity and should not be considered as an alternative to profit or loss for the period determined in accordance with GAAP or operating cash flows determined in accordance with GAAP. As a result, you should not consider such performance measures in is ola tion from, or as a substitute analysis for, results of operations as determined in accordance with GAAP. This presentation also includes certain forward - looking non - GAAP financial measures, such as adjusted EPS and Adjusted EBITDA Margin. We are unable to present a quantitative reconciliation of this forward - looking non - GAAP financial information because management cannot reliably predict all of the necessary components of such measures. Accordingl y, investors are cautioned not to place undue reliance on this information. The combined historical financial information set forth in this presentation has not been prepared in accordance with SEC rul es, including Article 11 of Regulations S - X, and therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S - X. Trademarks, Service Marks and Copyrights IHS Markit owns or has rights to use the trademarks, service marks and trade names that it uses in connection with the operat ion of its business; other trademarks, service marks and trade names referred to in this presentation are, to its knowledge, the property of their respective owners. IHS Markit also owns or has the rights to copyri ght s that protect aspects of its products and services. Solely for convenience, the trademarks, service marks, tradenames and copyrights referred to in this presentation are listed without the ®, TM and © symbols, but IHS Markit will assert, to th e fullest extent under applicable law, its rights or the rights of the applicable licensors to these trademarks, service marks and tradenames . 2

Transaction highlights 3 x Ipreo is a high growth business with highly complementary Financial Services business lines x Leading provider of workflow tools, data and content for over 3,500 clients globally x Expands the size of our addressable market, including increasing our presence in the primary and secondary capital markets, particularly in the rapidly growing alternatives sector (including private equity, private debt and real estate) x Significant cost and revenue synergies across all business lines enhance value creation x Financially compelling $1.855 billion transaction x Increases our target organic growth rate range from 4 - 6% to 5 - 7% x Delivers Adjusted EPS accretion in 2019 and strengthens our ability to deliver double - digit Adjusted EPS growth x Repositions our Financial Services businesses when combined with our planned sale of MarkitSERV

2013 2014 2015 2016 2017 Ipreo is a leading brand providing software solutions and data to participants in the global capital markets COMPANY SNAPSHOT IPREO SITS AT THE CORE OF THE CAPITAL MARKETS ECOSYSTEM • Deep expertise in workflow tools, data and content • Over 3,500 clients globally with 100,000+ individual users • Global operation serving customers in every major financial center around the world • 93% recurring revenue (65% recurring – fixed, 28% recurring – variable) Ipreo at a glance Inve stors 138,000+ contacts at 53,000+ firms profiled in the Ipreo database ~8,500 non - financial users 25,000 Private Capital Markets Users ~100,000 Sell Side users Sell Side Companies Institutional Investors Private Capital Private Companies Public Companies Institutional Investors Investment Banks Private Capital Private Companies Public Companies Financial Market Participants 4 $189mm $290mm

Capital Markets Workflow • Primary markets origination and syndication workflow + • Deep and unique asset class expertise covering secondary markets and buy side = • Cross asset end - to - end solutions covering pre and post trade workflows Corporates • Investor relations offerings for corporate CFOs and Treasurers + • 50,000 corporate customers = • Integrated data and intelligence solutions for corporate CFOs, treasurers and IR Private Capital Markets • Leading PCM offerings to General and Limited Partners, with first mover advantage + • Large credit - focused customer base • Strong portfolio valuations offering = • Fully integrated PCM solutions across data management, reporting and independent valuations Data • Deep data capabilities across the complete capital formation lifecycle + • Broad multi asset class pricing, reference data, indices and analytics = • Actionable intelligence and decision making tools Highly complementary businesses Ipreo presents a unique opportunity to acquire a high growth business with highly complementary business lines 5 STRONG STRATEGIC RATIONALE x Provides IHS Markit with a broad, cross asset class business in the primary markets x Deep expertise across the capital markets, private markets and corporate solutions x Expanded footprint in rapidly growing alternatives market x Ipreo operates strong “network effect” businesses with large customer bases x Large cross - selling opportunities into IHS Markit’s corporate customer base and opportunities to monetize Ipreo’s data

Financially compelling acquisition 6 Drives Organic Growth Ipreo standalone organic growth of 10%+ Increases IHS Markit’s overall organic growth profile from 4 - 6% to 5 - 7% Increases Financial Services growth profile to the mid - to high - single digits Meaningful Financial Impact 2019 Revenue of $ 370 million 2019 Adjusted EBITDA contribution of $115 million > Ipreo has made substantial investments in new growth initiatives > Significant operating leverage expected to drive outsized margin expansion from these growth investments over the next few years Adj. EPS Accretive Maintain forward target of double - digit Adjusted EPS growth Synergies Significant run - rate synergies of approximately $55 million > Run - rate cost synergies of $20 million expected to be achieved by the end of 2019 > Run - rate revenue synergies of $35 million expected to be achieved by the end of 2021 The acquisition of Ipreo is expected to increase IHS Markit’s organic growth rate and create significant value • Purchase price of $1.855 billion > Purchase price represents a multiple of 16x expected 2019 Adjusted EBITDA of $115 million ( 15 x adjusted for tax step - up) (1) • Pro forma bank leverage of approximately 3.6x at close, delevering to below 3.0x by Q3 2019 Financial Services 37% Resources 22% Transportation 27% CMS 14% Financial Services 34% Resources 23% Transportation 28% CMS 15% INFO Standalone FY 2017 INFO Pro Forma FY 2017 (2) Total Revenue: $3.6bn Total Revenue: $3.7bn 1. Tax basis step - up benefit of ~$125 million. 2. 2017 revenue pro forma for acquisition of Ipreo and divestiture of MarkitSERV .

Well - positioned across business verticals Ipreo is a leading player across its businesses Global Markets Group Fixed Income • Fixed Income bookbuilding platforms (IssueBook) • Market standard communication network for Fixed Income issuances (IssueNet) Loans • Market standard in European, APAC and LatAm loan syndication software • Growing base in North America Municipals • U.S. municipal bond new issuance solutions • Investing in innovation to deepen existing client relationships Equity & Retail • Equity and Retail bookbuilding products, with a strength in North America Research, Sales & Trading • Investor profiles and holdings data increase product dependencies Corporate • Shareholder intelligence and workflow for the corporate suite • Corporate business consistently delivering outsized growth Private Capital Markets • Provides solutions to many of the most meaningful private markets investors: > 13 of the 20 largest private equity firms > 9 of the 20 largest real estate firms > 21 of the 50 largest venture capital firms 7

Increased Need for Automated Workflow Solutions Increased Regulation and Compliance Trend Towards Outsourcing Increased complexity of the capital markets More sophisticated investment vehicles High level of regulatory scrutiny Increasing focus on compliance and risk management High costs associated with building in - house systems Industry cost pressures Acquisition of Ipreo provides IHS Markit with increased exposure to rapidly growing alternatives sector > Over $10 trillion of assets under management invested in alternatives (including private equity, private debt and real estate), which is expected to grow to $21 trillion by 2025 (1) > Significantly underpenetrated market for workflow, reporting and analytics solutions > Increasing demand for portfolio management, reporting and data management solutions SECULAR TAILWINDS DRIVING GROWTH ACROSS IPREO’S BUSINESSES EXPANDS CAPABILITIES IN ALTERNATIVES, A LARGE AND GROWING MARKET SEGMENT Large addressable markets with strong tailwinds 8 1. PwC, 2017. “Asset & Wealth Management Revolution: Embracing Exponential Change.”

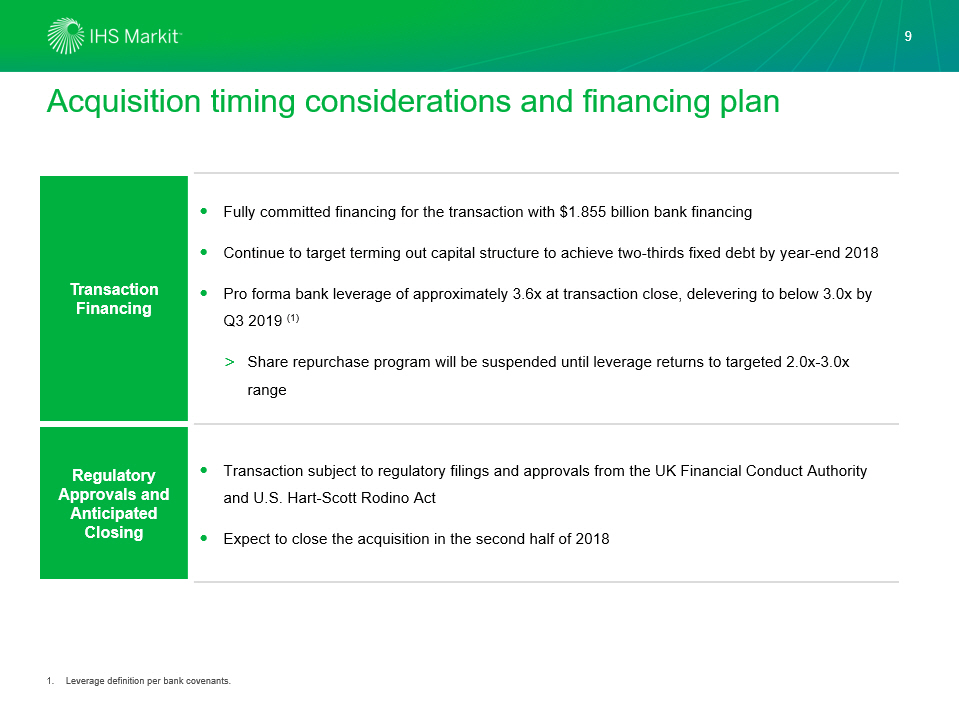

9 Acquisition timing considerations and financing plan Transaction Financing Fully committed financing for the transaction with $1.855 billion bank financing Continue to target terming out capital structure to achieve two - thirds fixed debt by year - end 2018 Pro forma bank leverage of approximately 3.6x at transaction close, delevering to below 3.0x by Q3 2019 (1) > Share repurchase program will be suspended until leverage returns to targeted 2.0x - 3.0x range Regulatory Approvals and Anticipated Closing Transaction subject to regulatory filings and approvals from the UK Financial Conduct Authority and U.S. Hart - Scott Rodino Act Expect to close the acquisition in the second half of 2018 1. Leverage definition per bank covenants.

10 Planned divestiture of MarkitSERV Following detailed review of the business as part of disciplined capital allocation strategy, we are initiating a process to divest our derivatives processing business, MarkitSERV MarkitSERV is a leading provider of end - to - end trade processing and workflow solutions across OTC derivatives asset classes In FY2017, MarkitSERV generated approximately $150 million in revenue The divestiture supports IHS Markit’s increase in target organic growth profile from 4 - 6% to 5 - 7% Provides incremental opportunity to accelerate delevering below 3.0x

11 Conclusion Acquisition of Ipreo is attractive across all key metrics Unique Strategic Opportunity Large Market Opportunity Significant Synergies Financial Compelling • Highly complementary businesses • Large cross - selling and data monetization opportunities • Expected to increase IHS Markit’s organic growth rate to 5 - 7% • Adjusted EPS accretive • 2019 Adjusted EBITDA contribution of $115 million • Approximately $20 million in run - rate cost synergies by 2019 and $35 million in run - rate revenue synergies by 2021 • Increases the size of IHS Markit’s addressable market • Increases exposure to rapidly growing alternatives sector (including private equity, private debt and real estate) • Strong secular tailwinds driving growth across Ipreo’s business verticals