Attached files

| file | filename |

|---|---|

| 8-K - Entegra Financial Corp. | e18231_enfc-8k.htm |

May, 2018 Investor Presentation

The discussions included in this document may contain “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , including Section 21 E of the Securities Exchange Act of 1934 and Section 27 A of the Securities Act of 1933 . Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially . For the purposes of these discussions, any statements that are not statements of historical fact may be deemed to be “forward - looking statements . ” Such statements are often characterized by the use of qualifying words such as “expects,” “anticipates,” “believes,” “estimates,” “plans,” “projects,” or other statements concerning opinions or judgments of the Company and its management about future events . The accuracy of such forward looking statements could be affected by factors including, but not limited to, the financial success or changing conditions or strategies of the Company’s customers or vendors, fluctuations in interest rates, actions of government regulators, the availability of capital and personnel or general economic conditions . These forward looking statements express management’s current expectations, plans or forecasts of future events, results and condition, including financial and other estimates . Additional factors that could cause actual results to differ materially from those anticipated by forward looking statements are discussed in the Company’s filings with the Securities and Exchange Commission, including without limitation its annual report on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K . The Company undertakes no obligation to revise or update these statements following the date of this presentation . Forward Looking Statements 2

Statements included in this document include non - GAAP financial measures and should be read along with the accompanying tables in Appendix A to our quarterly earnings release, which provide a reconciliation of non - GAAP financial measures to GAAP financial measures . This document discusses financial measures, such as core return on average equity and core efficiency ratio, which are non - GAAP measures . We believe that such non - GAAP measures are useful because they enhance the ability of investors and management to evaluate and compare the Company’s operating results from period to period in a meaningful manner . Non - GAAP measures should not be considered as an alternative to any measure of performance as promulgated under GAAP . Investors should consider the Company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company . Non - GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company’s results or financial condition as reported under GAAP . All financial numbers included in this presentation are shown in thousands ( 000 ’s) unless otherwise noted, excluding per share data and percentages . All Mar, 2018 numbers are unaudited . Non - GAAP / Financial Basis 3

Who We Are 4

Headquartered in Beautiful WNC 5

96 Years of History … And Counting 6

What’s In A Name? Integrity (Noun) “the quality of being honest and having strong moral principles ; moral uprightness . ” 7

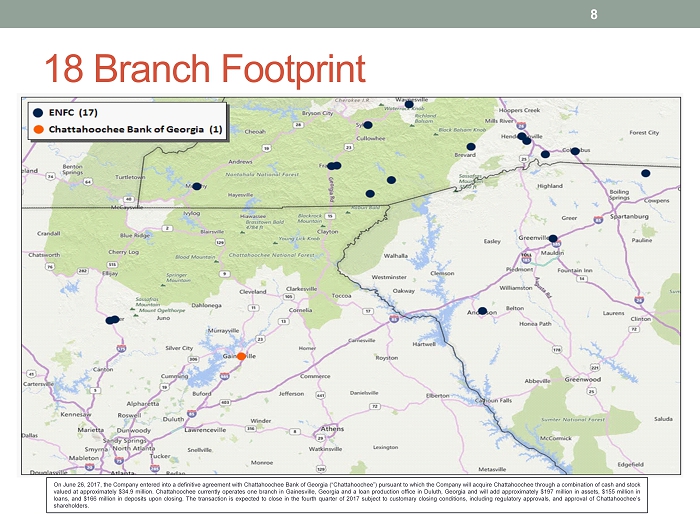

18 Branch Footprint 8 On June 26 , 2017 , the Company entered into a definitive agreement with Chattahoochee Bank of Georgia (“Chattahoochee”) pursuant to which the Company will acquire Chattahoochee through a combination of cash and stock valued at approximately $ 34 . 9 million . Chattahoochee currently operates one branch in Gainesville, Georgia and a loan production office in Duluth, Georgia and will add approximately $ 197 million in assets, $ 155 million in loans, and $ 166 million in deposits upon closing . The transaction is expected to close in the fourth quarter of 2017 subject to customary closing conditions, including regulatory approvals, and approval of Chattahoochee’s shareholders .

#5 NC Community Bank 9 1 . First Bank $5,642,000 2 . HomeTrust Bank $3,271,000 3 . Southern Bancshares $2,655,000 4 . The Fidelity Bank $1,898,000 5 . Entegra Financial Corp $1,625,000

Major Employers 10

Focused on Technology 11 47% 47% 49% 52% 54% 52% 55% 54% 56% 16% 17% 20% 21% 22% 22% 23% 24% 25% 0% 10% 20% 30% 40% 50% 60% Mar, 2016 Jun, 2016 Sep, 2016 Dec, 2016 Mar, 2017 Jun, 2017 Sep, 2017 Dec, 2017 Mar, 2018 Online banking Mobile banking

Experienced Executive Team Name Position Banking Experience ( Yrs ) Entegra Service ( Yrs ) Carolyn Huscusson EVP, Chief Retail Officer 43 21 Roger Plemens President, CEO 40 40 Charles Umberger EVP, Chief Lending Officer 40 2 David Bright EVP, Chief Financial Officer 26 5 Laura Clark EVP, Chief Risk Officer 26 26 Ryan Scaggs EVP, Chief Operating Officer 20 12 Bobby Sanders EVP, Chief Credit Admin Officer 15 15 Totals 210 121 12

Strong Employment and GDP Growth 13

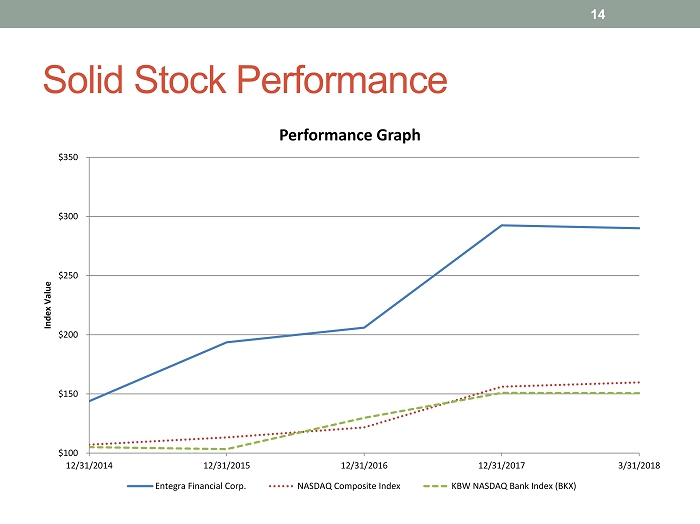

Solid Stock Performance 14 $100 $150 $200 $250 $300 $350 12/31/2014 12/31/2015 12/31/2016 12/31/2017 3/31/2018 Index Value Performance Graph Entegra Financial Corp. NASDAQ Composite Index KBW NASDAQ Bank Index (BKX)

Stock Dashboard 15 15.94 16.39 17.08 19.42 19.99 19.88 20.54 20.73 20.90 20.10 19.41 20.21 20.75 17.90 17.98 10.00 14.39 15.51 17.55 17.34 19.36 17.37 17.49 18.38 20.60 23.65 22.75 24.95 29.25 29.00 9 11 13 15 17 19 21 23 25 27 29 IPO Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Tangible Book Market Value 161% o f TB

Research Coverage 16

Strategy Summary 17

Continued Execution of Strategic Plan Strong ROE 18 Core / Rural Deposits High Growth Contiguous Market Lending SBA / Mortgage Business Small Bank M&A Proper Capital Usage Strong ROE

Diverse Footprint 19 Rural Deposit Markets High Growth Lending Markets

Proper Capital Usage Holding Company Leverage Ratios 20 13.97% 14.46% 14.12% 13.85% 13.38% 11.84% 11.75% 11.28% 10.32% 10.20% 10.36% 8.68% 8.90% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% Mar, 2015 Jun, 2015 Sep, 2015 Dec, 2015 Mar, 2016 Jun, 2016 Sep, 2016 Dec, 2016 Mar, 2017 Jun, 2017 Sep, 2017 Dec, 2017 Mar, 2018 Chattahoochee Stearns Oldtown Arthur State

ROTE Targets (Core) 21 10% 8% 6% 0% 2% 4% 6% 8% 10% 12% 2018 2017 2016

Financial Overview 22

Bank Capital Ratios 23 8.99% 12.49% 12.49% 13.49% 5.00% 6.50% 8.00% 10.00% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% Leverage CET I RBC Tier 1 RBC Total RBC Actual Well-Capitalized

Steady Asset Growth 24 1,114,528 1,078,537 1,021,777 874,706 769,939 784,893 903,648 1,031,416 1,292,877 1,581,449 1,625,444 - 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1,800,000 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Mar., 2018 CAGR – 19%

815,959 770,448 715,313 615,540 560,717 521,874 540,479 624,072 744,361 1,005,139 1,035,649 - 200,000 400,000 600,000 800,000 1,000,000 1,200,000 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Mar., 2018 Focus on Loan Growth CAGR – 18% 25

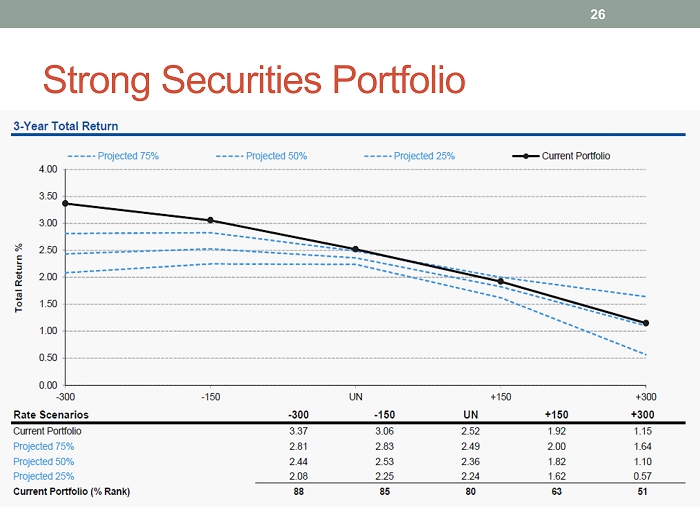

Strong Securities Portfolio 26

Ongoing Re - Mix To Loans 27 - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 Mar, 2016 Jun, 2016 Sep, 2016 Dec, 2016 Mar, 2017 Jun, 2017 Sep, 2017 Dec, 2017 Mar, 2018 294,084 322,241 322,710 398,291 431,737 427,831 401,226 342,863 339,816

Lower ADC Risk Profile 28 27.0% 24.7% 21.5% 18.3% 13.6% 13.0% 9.7% 9.2% 8.1% 10.1% 9.3% 47.5% 47.0% 47.8% 50.0% 53.2% 55.2% 53.2% 49.7% 46.2% 38.7% 38.7% 22.1% 25.4% 28.0% 29.4% 31.0% 29.6% 32.8% 34.4% 39.1% 44.8% 46.0% 3.4% 2.9% 2.7% 2.2% 2.2% 2.3% 4.3% 6.8% 6.7% 6.4% 5.9% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Mar., 2018 ADC Res RE Comm RE C&I / Other

113,300 27,335 29,287 18,870 17,657 41,561 43,844 64,819 141,381 200,210 96,419 - 50,000 100,000 150,000 200,000 250,000 2007 Prior 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Significantly Different Risk Profile Significant Majority of Portfolio Now Post - Recession Vintage Post 2007 Loans = 86%

ADC / CRE Concentrations CRE Concentrations Remain Below Regulatory Guidance 30 91% 100% 260% 300% 0% 50% 100% 150% 200% 250% 300% 350% Entegra Reg Guidance ADC Total

Diversified CRE Portfolio 31 7% 3% 3% 3% 5% 2% 5% 14% 2% 8% 22% 10% 15% Multi-family Automotive Churches Convenience Stores Hotels Industrial Medical Office Office Recreation Restaurant Retail Storage / Warehouse Other

Limited “High Risk” Retail Exposure 32 1,185 6,733 680 2,693 3,949 1,323 6,983 9,956 12,893 9,435 8,432 9,129 1,286 552 Auto, Parts, Service, & Repair Cell Phones & Electronics Clothing, Shoes, & Accessories Crafts & Hobbies Financial Services, Real Estate, & Insurance Furniture & Home Décor General Home Goods Grocery Home Improvement & Building Supply Other Pharmacy, Medical Supply & Clinics Restuarants Salon & Beauty Vetinary & Pet Supply

New Markets Driving Loan Growth 33 New Markets: 65% of YTD 2018 Loan Production 65,092 35,571 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% New Markets Legacy

Top 10 Lending Relationships 34 Borrower Commit ment # Loans Purpose 1 Real estate developer $16.8M 4 Retail shopping centers 2 Construction company $13.1M 3 Commercial construction 3 Real estate investor $12.5M 3 Multifamily / apartments 4 Real estate investor $8.4M 3 Retail shopping centers 5 Real estate developer $8.4M 2 Retail shopping centers 6 Local county $8.0M 1 Landfill 7 Building supply company $8.0M 7 Owner - occupied lumber yards and retail locations 8 Hotel ier real estate investor $7.6M 2 Hotel and convenience stores 9 Real estate developer $7.4M 5 Residential development and commercial rental property 10 Construction company $7.1M 19 Speculative 1 - 4 family residences Total $97.3M 49

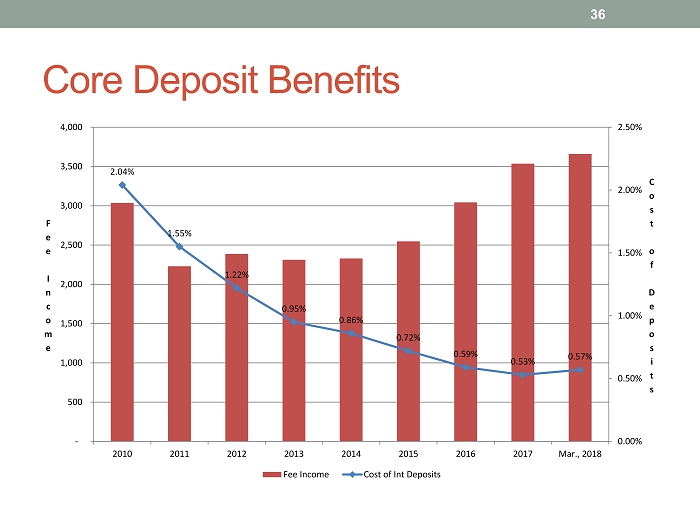

Focus on Core Deposits Core Deposits = Total Deposits Less Certificates of Deposits 29% 71% Dec, 2008 Core Non-Core 35 65% 35% Mar, 2018 Core Non-Core

Core Deposit Benefits 36 2.04% 1.55% 1.22% 0.95% 0.86% 0.72% 0.59% 0.53% 0.57% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2010 2011 2012 2013 2014 2015 2016 2017 Mar., 2018 C o s t o f D e p o s i t s F e e I n c o m e Fee Income Cost of Int Deposits

Earnings Performance 37 0.50% 0.59% 0.54% 0.79% 0.61% 0.68% 0.73% 0.94% 0.94% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 CORE ROA 77.3% 72.4% 73.3% 68.4% 71.6% 69.8% 65.55% 60.79% 65.18% 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 CORE EFFICIENCY 3.90% 5.29% 4.75% 7.43% 6.50% 7.31% 7.72% 11.37% 12.18% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 CORE ROTE 0.20 0.27 0.25 0.38 0.31 0.36 0.39 0.54 0.53 - 0.10 0.20 0.30 0.40 0.50 0.60 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 CORE EPS

Bigger or Better? Core Rev = FTE Rev – Excl Investment Gains / Losses Core Exp = Excludes REO Cost / Trans Expenses / FHLB Prepayment 38 187 179 165 168 155 176 193 208 143 116 111 111 118 122 123 133 44 63 54 57 38 54 70 75 - 50 100 150 200 250 2011 2012 2013 2014 2015 2016 2017 YTD Mar. 2018 Core Revenue per FTE Core Operating Exp per FTE Core Pre-Tax Profit per FTE

Margin Income Driving Higher Earnings 39 24,463 25,872 27,421 34,488 42,845 49,572 3.42% 3.32% 3.11% 3.28% 3.39% 3.49% 2.90% 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 3.60% - 10,000 20,000 30,000 40,000 50,000 60,000 2013 2014 2015 2016 2017 Q1 2018 N e t I n t M a r g i n ( % ) N e t I n t I n c o m e Net Int Income Margin

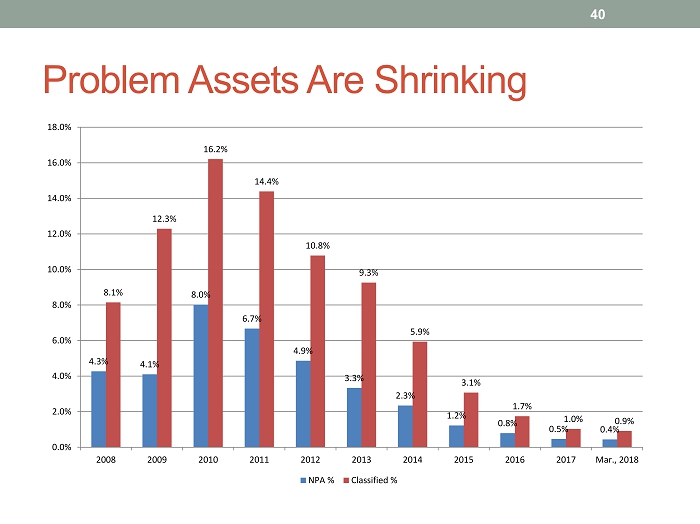

Problem Assets Are Shrinking 40 4.3% 4.1% 8.0% 6.7% 4.9% 3.3% 2.3% 1.2% 0.8% 0.5% 0.4% 8.1% 12.3% 16.2% 14.4% 10.8% 9.3% 5.9% 3.1% 1.7% 1.0% 0.9% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Mar., 2018 NPA % Classified %

Re - focused on SBA 41

Neutral Interest Rate Risk Position 42 Change in Interest Rates (basis points) % Change in Pretax Net Interest Income + 300 0.2 +200 0.2 +100 0.2 - 100 (2.7)

NOL Protection Plan Limits 5% Investors To Protect Deferred Tax Asset 43 35,406 43,203 30,713 37,998 24,458 28,425 16,702 24,060 13,975 21,706 - 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 Federal State Dec, 2014 Dec, 2015 Dec, 2016 Dec, 2017 Mar, 2018

Summary 44

Summary 96 year o ld bank w/ deep relationships Experienced management team Culture of integrity Attractive entry price Disciplined M&A Growing assets and earnings 45

Summary Strong Carolinas economy Dominant legacy deposit market share Excellent asset quality Disciplined focus on core deposits History of utilizing capital 46

GAAP Appendix 47

48 GAAP Ratios 4.10% 2.57% 5.21% 6.91% 3.87% 6.09% 6.95% - 8.59% 9.48% -10.00% -5.00% 0.00% 5.00% 10.00% 15.00% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 GAAP ROE 76.63% 85.86% 71.53% 70.34% 80.43% 72.96% 66.62% 81.58% 66.64% 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 GAAP Efficiency 0.53% 0.29% 0.60% 0.75% 0.39% 0.61% 0.71% - 0.83% 0.90% -1.00% -0.50% 0.00% 0.50% 1.00% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 GAAP ROA 0.21 0.13 0.28 0.36 0.20 0.32 0.38 (0.48) 0.51 (0.60) (0.40) (0.20) - 0.20 0.40 0.60 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 GAAP EPS