Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k_investorpresentation05.htm |

Piper Jaffray Financial Institution Conference Gregory Dufour | President & Chief Executive Officer Deborah Jordan | Chief Operating & Financial Officer Michael Archer | SVP Corporate Controller May 15-16, 2018 0

Forward Looking Statements This presentation contains certain statements that may be considered forward-looking statements under the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including certain plans, exceptions, goals, projections, and statements, which are subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “plan,” “target,” or “goal” or future or conditional verbs such as “will,” “may,” “might,” “should,” “could” and other expressions which predict or indicate future events or trends and which do not relate to historical matters. Forward-looking statements should not be relied on, because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of Camden National Corporation (the “Company”). These risks, uncertainties and other factors may cause the actual results, performance or achievements of the Company to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements. The following factors, among others, could cause the Company’s financial performance to differ materially from the Company’s goals, plans, objectives, intentions, expectations and other forward-looking statements: weakness in the United States economy in general and the regional and local economies within the New England region and Maine, which could result in a deterioration of credit quality, an increase in the allowance for loan losses or a reduced demand for the Company’s credit or fee-based products and services; changes in trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market, and monetary fluctuations; competitive pressures, including continued industry consolidation and the increased financial services provided by non-banks; volatility in the securities markets that could adversely affect the value or credit quality of the Company’s assets, impairment of goodwill, the availability and terms of funding necessary to meet the Company’s liquidity needs, and could lead to impairment in the value of securities in the Company's investment portfolio; changes in information technology that require increased capital spending; changes in consumer spending and savings habits; changes in tax, banking, securities and insurance laws and regulations; and changes in accounting policies, practices and standards, as may be adopted by the regulatory agencies as well as the Financial Accounting Standards Board ("FASB"), and other accounting standard setters. You should carefully review all of these factors, and be aware that there may be other factors that could cause differences, including the risk factors listed in the Company’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2017, as updated by the Company's quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission. You should carefully review the risk factors described therein and should not place undue reliance on our forward-looking statements. These forward-looking statements were based on information, plans and estimates at the date of this report, and we undertake no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes, except to the extent required by applicable law or regulation. 1

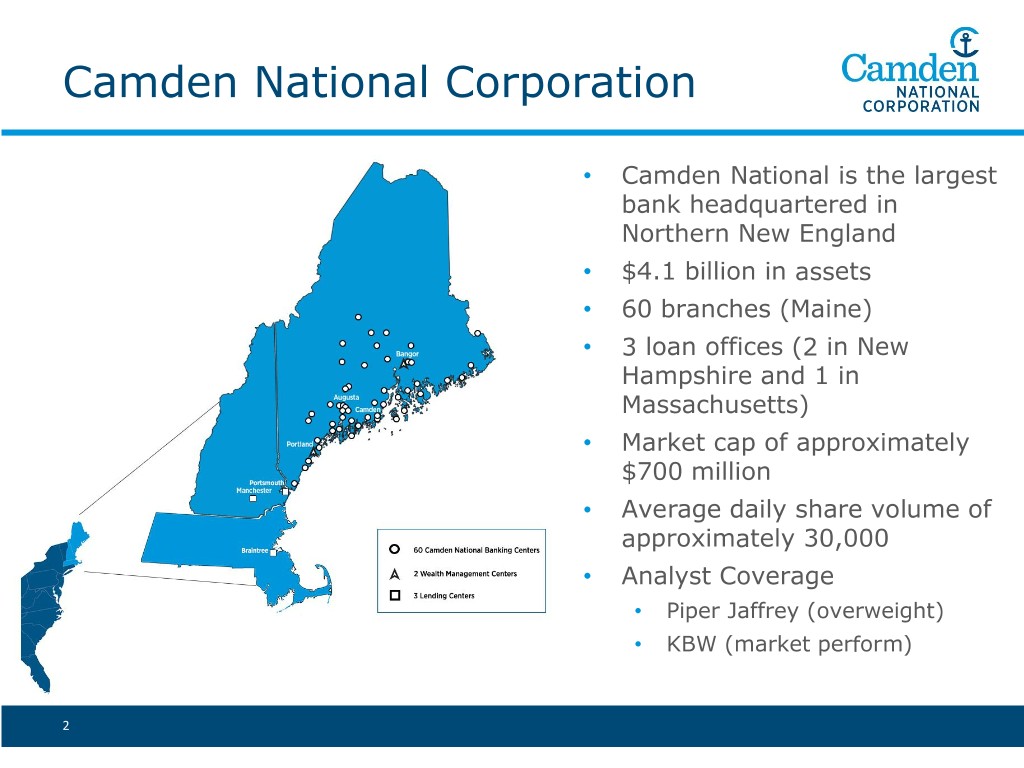

Camden National Corporation • Camden National is the largest bank headquartered in Northern New England • $4.1 billion in assets • 60 branches (Maine) • 3 loan offices (2 in New Hampshire and 1 in Massachusetts) • Market cap of approximately $700 million • Average daily share volume of approximately 30,000 • Analyst Coverage • Piper Jaffrey (overweight) • KBW (market perform) 2

Q1 2018 Financial Highlights Strong earnings performance • Net income of $12.8 million • Return on tangible equity: 17.35%(a) • Return on assets: 1.28% • Efficiency ratio: 58.76%(a) • Tangible common equity ratio: 7.59%(a) Solid growth • Total loans of $2.8 billion; LTM growth of 5% • Total deposits of $3.0 billion; LTM growth of 3% a) This is a non-GAAP measure. Refer to the Company’s first quarter 2018 Form 10-Q filed on May 4, 2018. 3

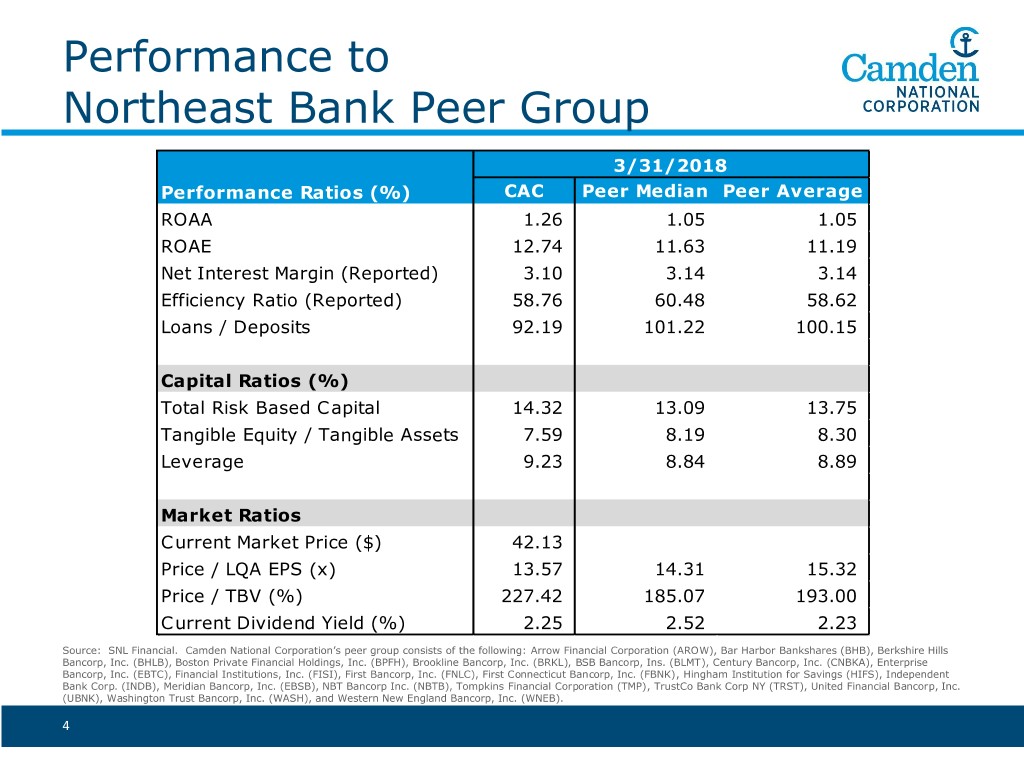

Performance to Northeast Bank Peer Group 3/31/2018 Performance Ratios (%) CAC Peer Median Peer Average ROAA 1.26 1.05 1.05 ROAE 12.74 11.63 11.19 Net Interest Margin (Reported) 3.10 3.14 3.14 Efficiency Ratio (Reported) 58.76 60.48 58.62 Loans / Deposits 92.19 101.22 100.15 Capital Ratios (%) Total Risk Based Capital 14.32 13.09 13.75 Tangible Equity / Tangible Assets 7.59 8.19 8.30 Leverage 9.23 8.84 8.89 Market Ratios Current Market Price ($) 42.13 Price / LQA EPS (x) 13.57 14.31 15.32 Price / TBV (%) 227.42 185.07 193.00 Current Dividend Yield (%) 2.25 2.52 2.23 Source: SNL Financial. Camden National Corporation’s peer group consists of the following: Arrow Financial Corporation (AROW), Bar Harbor Bankshares (BHB), Berkshire Hills Bancorp, Inc. (BHLB), Boston Private Financial Holdings, Inc. (BPFH), Brookline Bancorp, Inc. (BRKL), BSB Bancorp, Ins. (BLMT), Century Bancorp, Inc. (CNBKA), Enterprise Bancorp, Inc. (EBTC), Financial Institutions, Inc. (FISI), First Bancorp, Inc. (FNLC), First Connecticut Bancorp, Inc. (FBNK), Hingham Institution for Savings (HIFS), Independent Bank Corp. (INDB), Meridian Bancorp, Inc. (EBSB), NBT Bancorp Inc. (NBTB), Tompkins Financial Corporation (TMP), TrustCo Bank Corp NY (TRST), United Financial Bancorp, Inc. (UBNK), Washington Trust Bancorp, Inc. (WASH), and Western New England Bancorp, Inc. (WNEB). 4

Why Camden National? Organic franchise growth, opportunistic acquisitions Focused: Consistent Performance: • Gaining market share • Profitability achieved through • Adherence to strategic plan organic growth • Opportunistically reviewing • Improved productivity complementary acquisitions • Disciplined expense structure • Solid core funding and sticky • Diversified revenue stream deposit base Culture: Credit Quality: • Experienced, consistent • Strong credit culture and leadership history • Strong community-spirit • Disciplined structure and • Continued branch optimization process • Simple product sets • Low charge-offs 5

Focused on Building Market Share: Asset Growth History Total Assets $ in Billions Organic Growth: $1.2 billion $4.1 Acquired Growth: $1.7 billion $3.9 15 Year CAGR: 8.4% $3.7 $2.8 $2.6 $2.6 $2.3 $2.2 $2.3 $2.3 $1.8 $1.7 $1.7 $1.5 $1.4 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Acquisitions 2008 Union Bankshares 2012 Bank of America (14 branches) 2015 The Bank of Maine 6

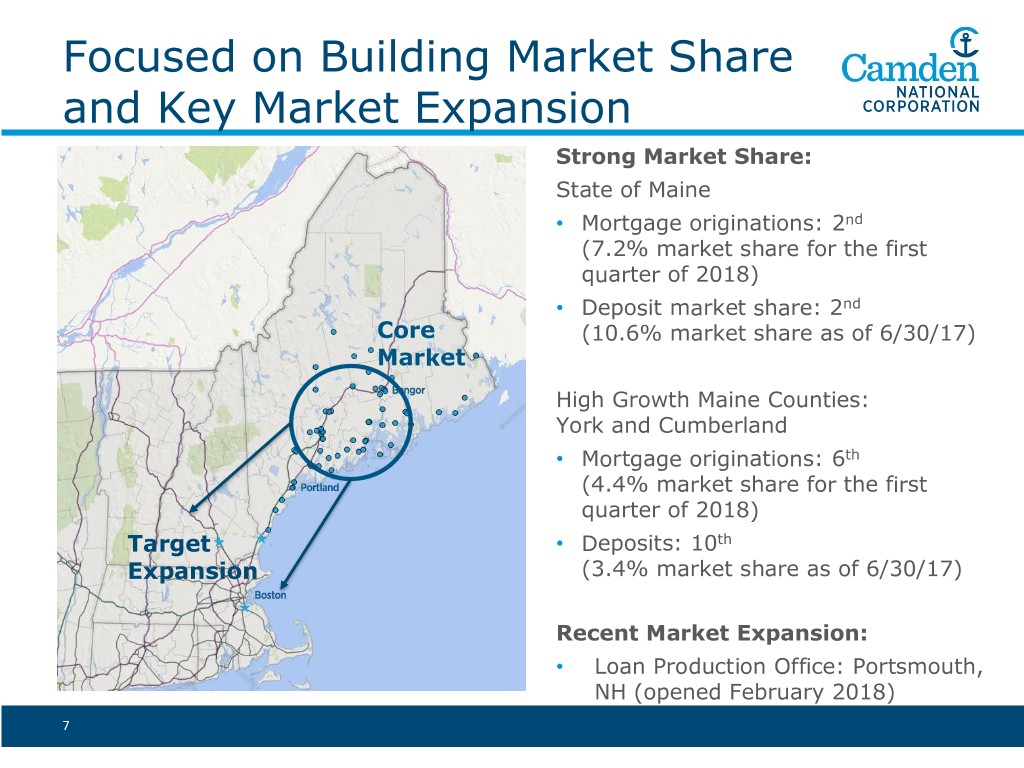

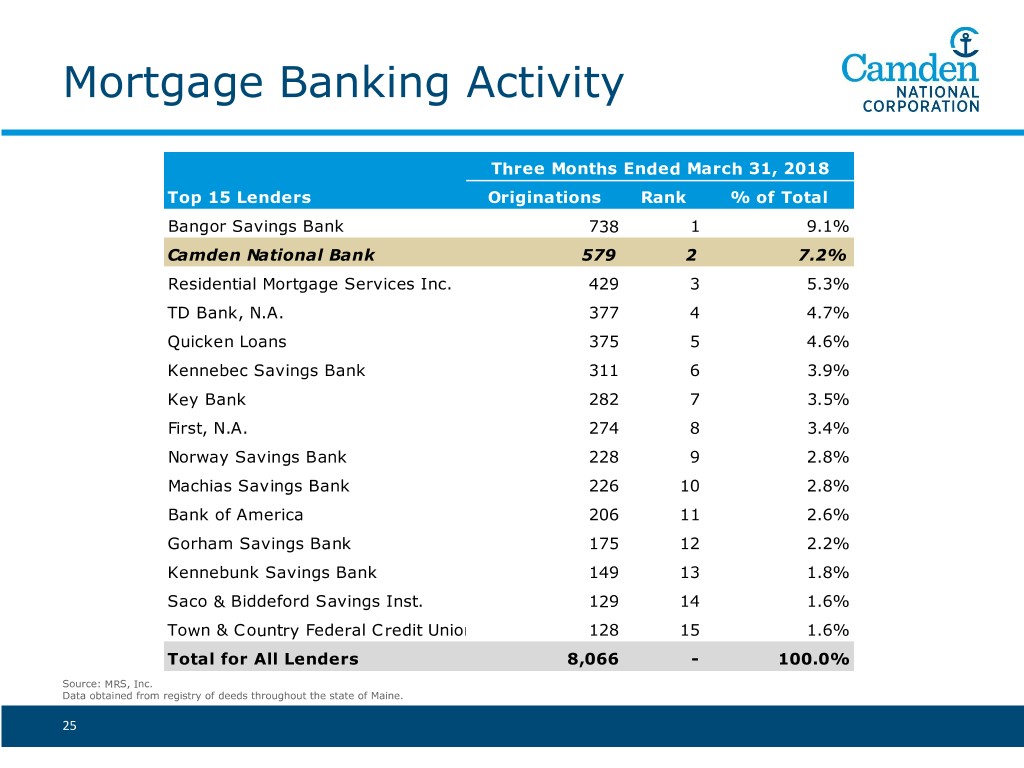

Focused on Building Market Share and Key Market Expansion Strong Market Share: State of Maine • Mortgage originations: 2nd (7.2% market share for the first quarter of 2018) • Deposit market share: 2nd Core (10.6% market share as of 6/30/17) Market High Growth Maine Counties: York and Cumberland • Mortgage originations: 6th (4.4% market share for the first quarter of 2018) Target • Deposits: 10th Expansion (3.4% market share as of 6/30/17) Recent Market Expansion: • Loan Production Office: Portsmouth, NH (opened February 2018) 7

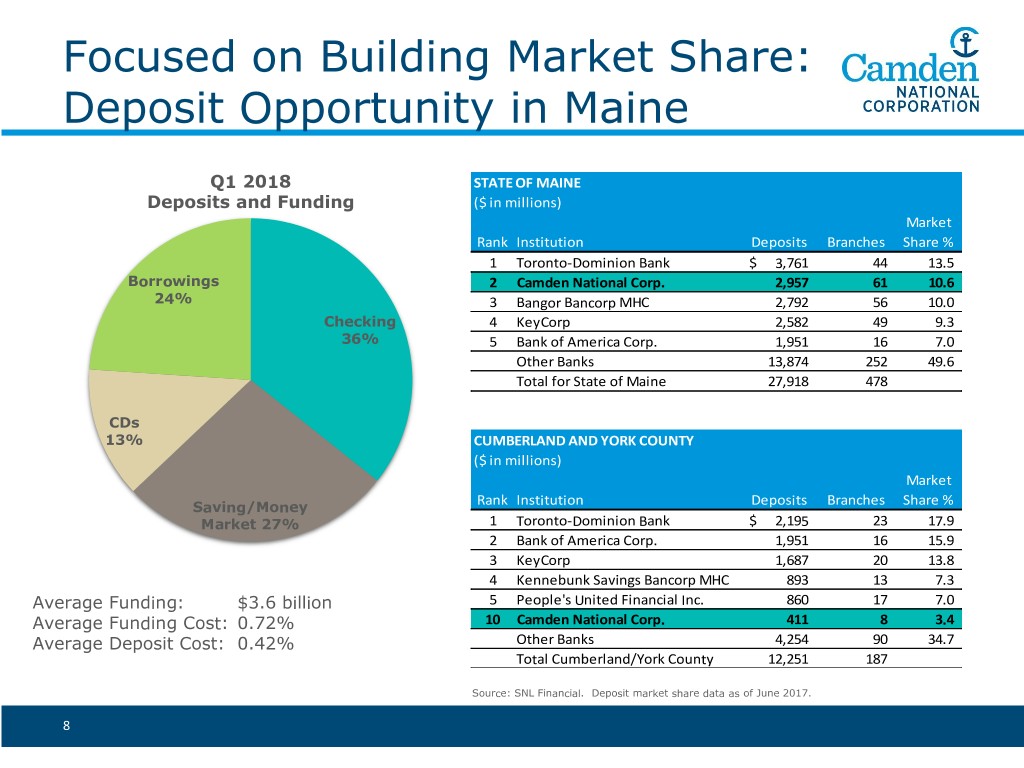

Focused on Building Market Share: Deposit Opportunity in Maine Q1 2018 STATE OF MAINE Deposits and Funding ($ in millions) Market Rank Institution Deposits Branches Share % 1 Toronto-Dominion Bank $ 3,761 44 13.5 Borrowings 2 Camden National Corp. 2,957 61 10.6 24% 3 Bangor Bancorp MHC 2,792 56 10.0 Checking 4 KeyCorp 2,582 49 9.3 36% 5 Bank of America Corp. 1,951 16 7.0 Other Banks 13,874 252 49.6 Total for State of Maine 27,918 478 CDs 13% CUMBERLAND AND YORK COUNTY ($ in millions) Market Saving/Money Rank Institution Deposits Branches Share % Market 27% 1 Toronto-Dominion Bank $ 2,195 23 17.9 2 Bank of America Corp. 1,951 16 15.9 3 KeyCorp 1,687 20 13.8 4 Kennebunk Savings Bancorp MHC 893 13 7.3 Average Funding: $3.6 billion 5 People's United Financial Inc. 860 17 7.0 Average Funding Cost: 0.72% 10 Camden National Corp. 411 8 3.4 Average Deposit Cost: 0.42% Other Banks 4,254 90 34.7 Total Cumberland/York County 12,251 187 Source: SNL Financial. Deposit market share data as of June 2017. 8

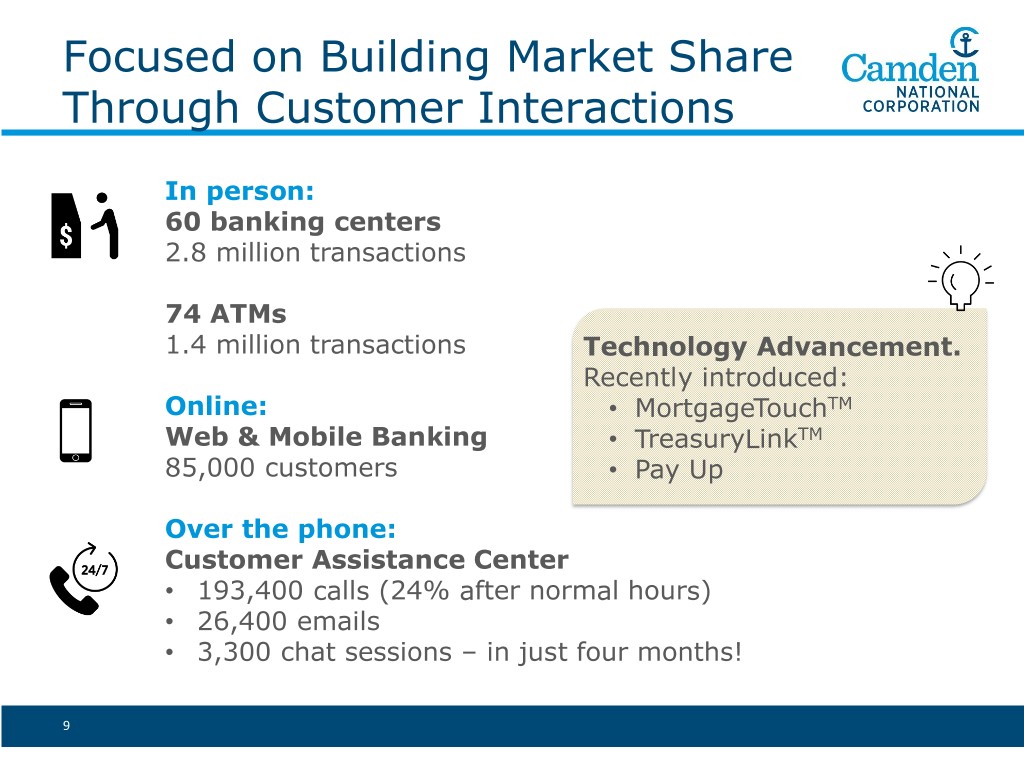

Focused on Building Market Share Through Customer Interactions In person: 60 banking centers 2.8 million transactions 74 ATMs 1.4 million transactions Technology Advancement. Recently introduced: Online: • MortgageTouchTM Web & Mobile Banking • TreasuryLinkTM 85,000 customers • Pay Up Over the phone: Customer Assistance Center • 193,400 calls (24% after normal hours) • 26,400 emails • 3,300 chat sessions – in just four months! 9

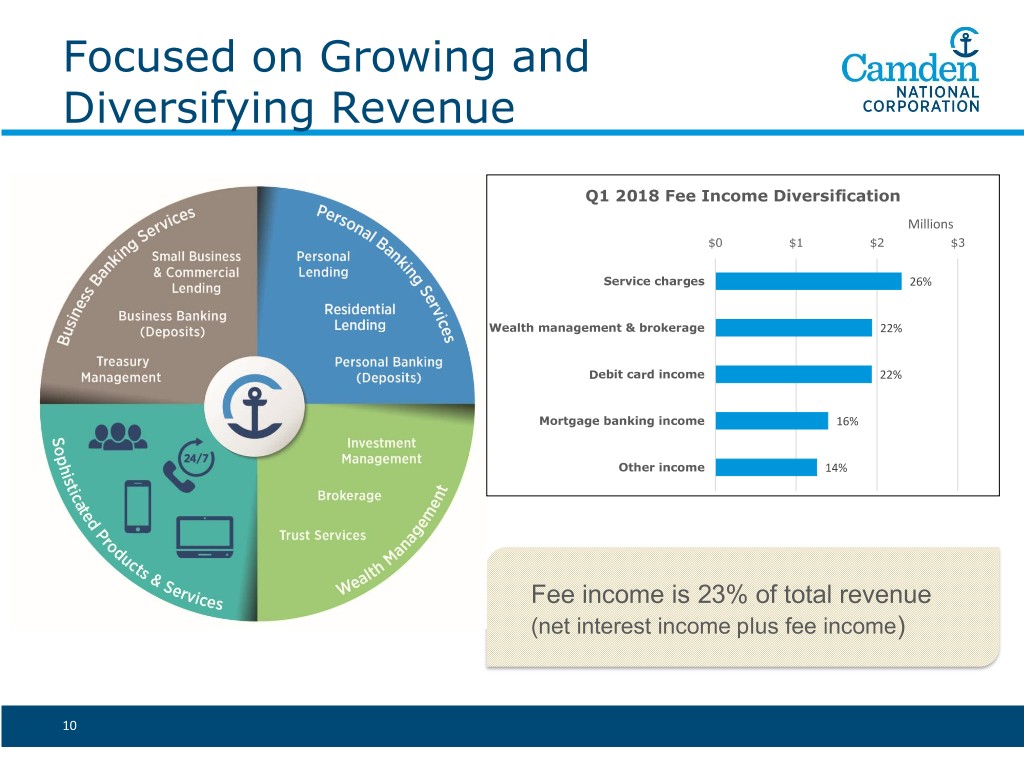

Focused on Growing and Diversifying Revenue Q1 2018 Fee Income Diversification Millions $0 $1 $2 $3 Service charges 26% Wealth management & brokerage 22% Debit card income 22% Mortgage banking income 16% Other income 14% Fee income is 23% of total revenue (net interest income plus fee income) 10

Focused on Improving Productivity and Creating Efficiencies Expense and Efficiency ratio(1) Deposits per Branch $100 $47 Millions Millions $80 $44 61.13% $60 58.76% $41 57.53% 58.00% 57.75% 57.05% 56.76% 55.72% $40 $38 $20 $35 44 44 64 61 60 $0 $32 2015 2016 2017 1Q17 2Q17 3Q17 4Q17 1Q18 2013 2014 2015 2016 2017 Operating Expenses Efficiency Ratio Deposits per Branch • Targeted annual efficiency ratio of 58%. • Branch Optimization: Consolidated/sold 14 branches over past 5 years. 1) This is a non-GAAP measure. Refer to the Company’s financial information filed with the SEC for the respective period. 11

Balanced Loan Mix & Strong Credit Culture Q1 2018 • Internal lending limit of $37 million Home Equity/ Commercial • Four credit relationships over $25 million Consumer 15% 12% Business Type: 1. Assisted Living (relationship A) 2. Insurance Residential 3. Assisted Living (relationship B) Mortgages 31% 4. Business Office Commercial Real Estate 42% • Commercial Diversification: $310 million Nonresidential Building Operator Average Loans: $2.8 billion Average Yield (FTE): 4.30% $236 million Hotels and Motels Q1 2018 2017 2016 $208 million Apartment Building Nonperforming assets / total assets 0.47% 0.50% 0.67% Operators 30-89 days past due loans / total loans 0.21% 0.32% 0.24% Provision for loan losses / average loans N.M.(1) 0.11% 0.21% Net charge-offs / average loans 0.10% 0.07% 0.13% 1) Not meaningful as a negative credit loss provision was recorded for the first quarter of 2018 of $497,000. 12

Prudent Investments Q1 2018 Investments FRB/FHLB Stock Agency/Sub. 3% SBAs 2% Notes/Other 1% Municipals 11% Duration Shock Agency CMO 30% Rate Shock Duration +100bps 4.41 +200bps 4.45 +300bps 4.44 MBS 54% Average Investments: $926 million Average Yield (FTE): 2.35% Duration: 4.10 13

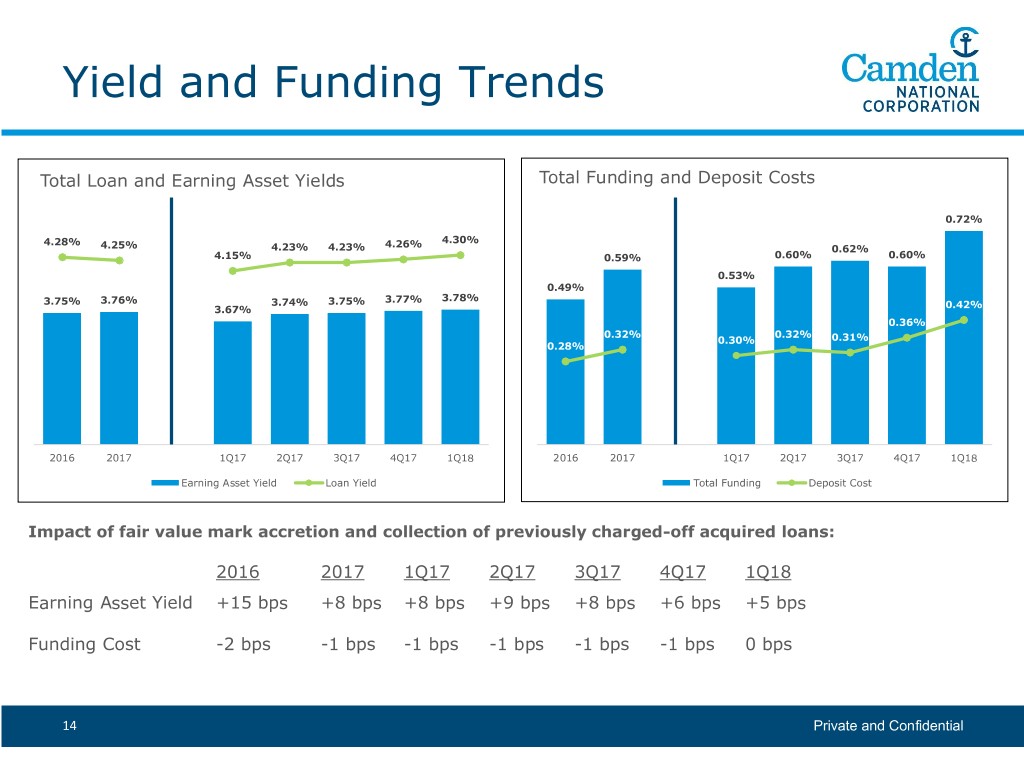

Yield and Funding Trends Total Loan and Earning Asset Yields Total Funding and Deposit Costs 0.72% 4.28% 4.30% 4.25% 4.23% 4.23% 4.26% 0.62% 4.15% 0.59% 0.60% 0.60% 0.53% 0.49% 3.77% 3.78% 3.75% 3.76% 3.74% 3.75% 0.42% 3.67% 0.36% 0.32% 0.32% 0.30% 0.31% 0.28% 2016 2017 1Q17 2Q17 3Q17 4Q17 1Q18 2016 2017 1Q17 2Q17 3Q17 4Q17 1Q18 Earning Asset Yield Loan Yield Total Funding Deposit Cost Impact of fair value mark accretion and collection of previously charged-off acquired loans: 2016 2017 1Q17 2Q17 3Q17 4Q17 1Q18 Earning Asset Yield +15 bps +8 bps +8 bps +9 bps +8 bps +6 bps +5 bps Funding Cost -2 bps -1 bps -1 bps -1 bps -1 bps -1 bps 0 bps 14 Private and Confidential

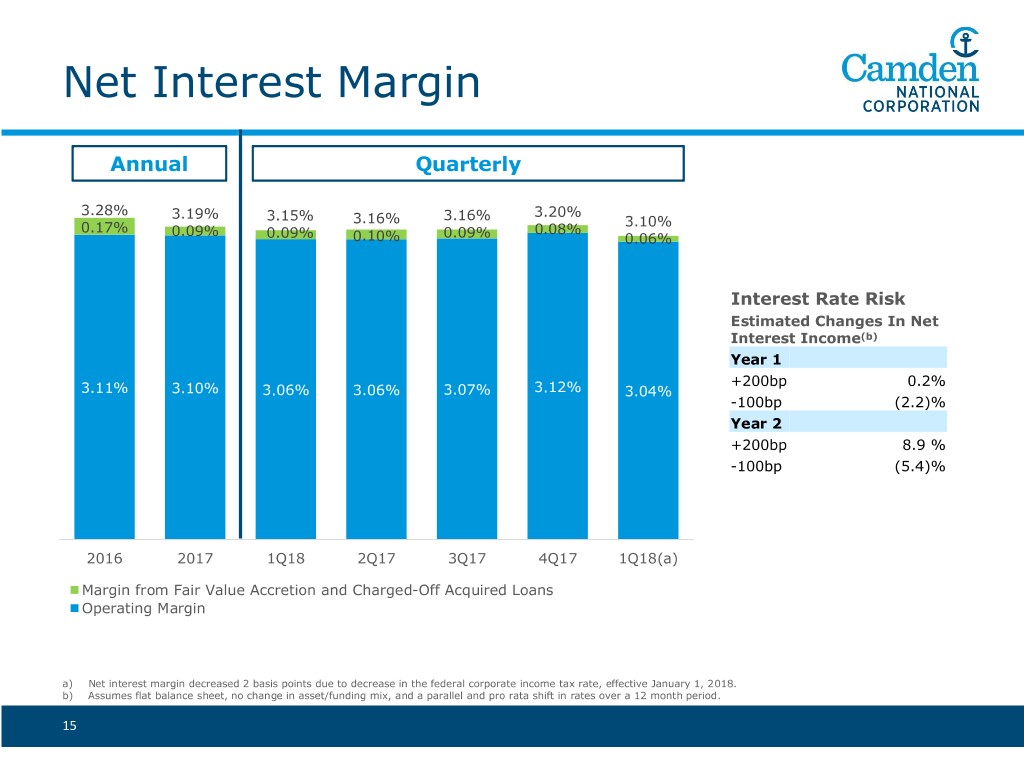

Net Interest Margin Annual Quarterly 3.28% 3.19% 3.20% 3.15% 3.16% 3.16% 3.10% 0.17% 0.09% 0.08% 0.09% 0.10% 0.09% 0.06% Interest Rate Risk Estimated Changes In Net Interest Income(b) Year 1 +200bp 0.2% 3.11% 3.10% 3.06% 3.06% 3.07% 3.12% 3.04% -100bp (2.2)% Year 2 +200bp 8.9 % -100bp (5.4)% 2016 2017 1Q18 2Q17 3Q17 4Q17 1Q18(a) Margin from Fair Value Accretion and Charged-Off Acquired Loans Operating Margin a) Net interest margin decreased 2 basis points due to decrease in the federal corporate income tax rate, effective January 1, 2018. b) Assumes flat balance sheet, no change in asset/funding mix, and a parallel and pro rata shift in rates over a 12 month period. 15

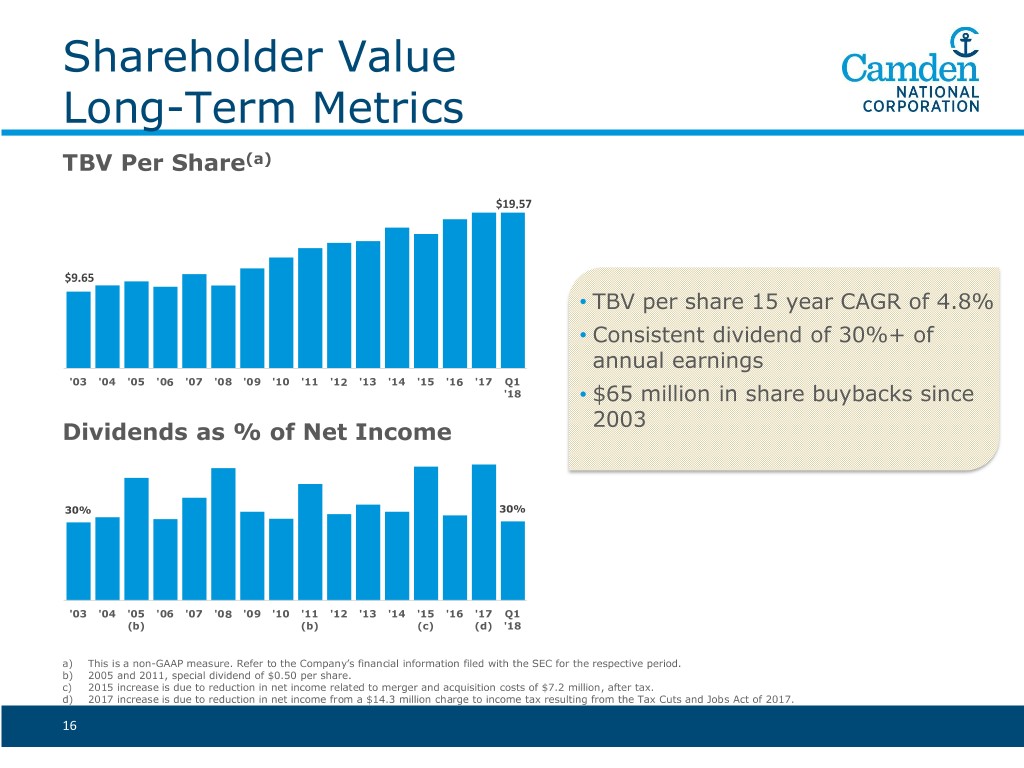

Shareholder Value Long-Term Metrics TBV Per Share(a) $19.57 $9.65 • TBV per share 15 year CAGR of 4.8% • Consistent dividend of 30%+ of annual earnings '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Q1 '18 • $65 million in share buybacks since 2003 Dividends as % of Net Income 30% 30% '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Q1 (b) (b) (c) (d) '18 a) This is a non-GAAP measure. Refer to the Company’s financial information filed with the SEC for the respective period. b) 2005 and 2011, special dividend of $0.50 per share. c) 2015 increase is due to reduction in net income related to merger and acquisition costs of $7.2 million, after tax. d) 2017 increase is due to reduction in net income from a $14.3 million charge to income tax resulting from the Tax Cuts and Jobs Act of 2017. 16

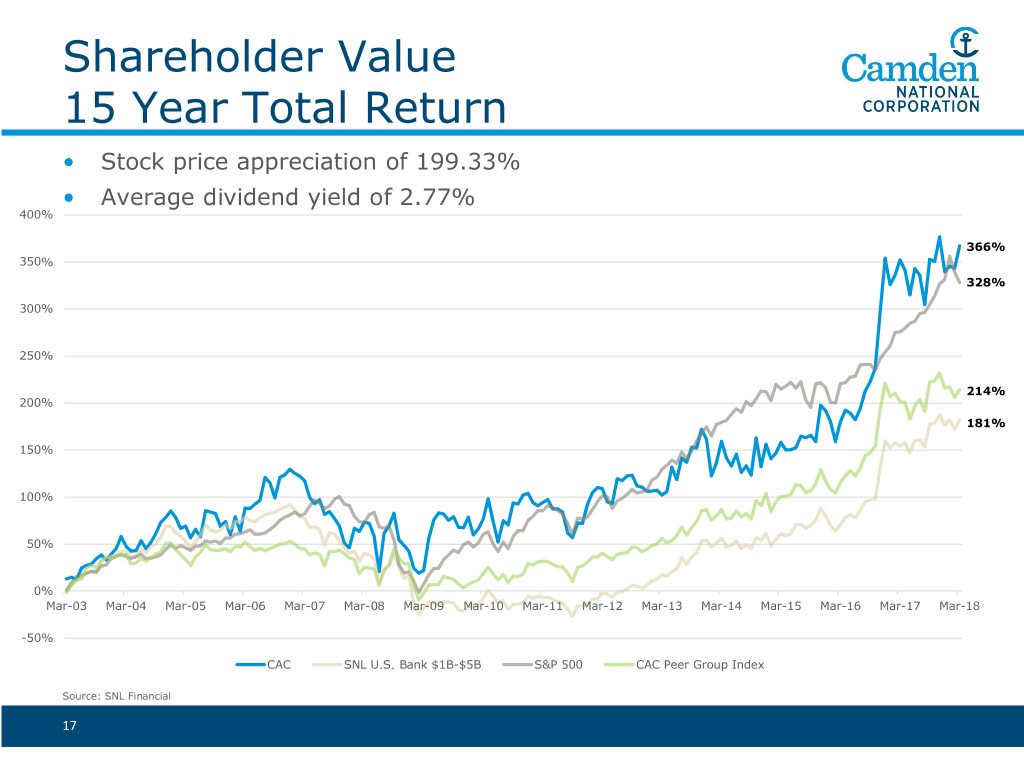

Shareholder Value 15 Year Total Return • Stock price appreciation of 199.33% • Average dividend yield of 2.77% 400% 366% 350% 328% 300% 250% 214% 200% 181% 150% 100% 50% 0% Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 -50% CAC SNL U.S. Bank $1B-$5B S&P 500 CAC Peer Group Index Source: SNL Financial 17

Investment Summary Proven Management Team • Delivered on previous acquisition commitments • Diverse experience from community and large bank perspectives Strong Market Share and Brand Recognition • 140+ year operating history • 2nd overall deposit market share in Maine • #2 mortgage originator in Maine, with 7.2% of all mortgage originations in the state Quality Growth • Consistent long-term growth both organically and through acquisitions • Expanded presence in higher growth Southern Maine markets and enhanced scale, density, and deposit costs in existing markets Strong Fundamental Operating Metrics • Historically strong credit quality with nonperforming assets consistently less than 1% of total assets • Solid Efficiency ratio, ROAA and ROAE 18

Appendix 19

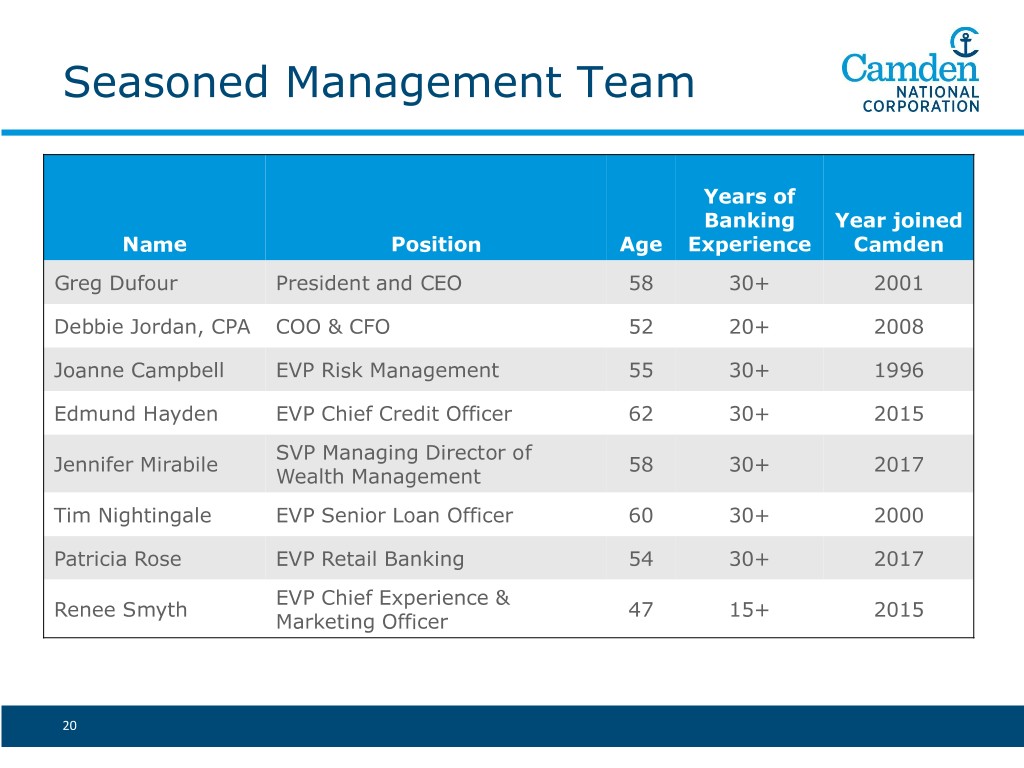

Seasoned Management Team Years of Banking Year joined Name Position Age Experience Camden Greg Dufour President and CEO 58 30+ 2001 Debbie Jordan, CPA COO & CFO 52 20+ 2008 Joanne Campbell EVP Risk Management 55 30+ 1996 Edmund Hayden EVP Chief Credit Officer 62 30+ 2015 SVP Managing Director of Jennifer Mirabile 58 30+ 2017 Wealth Management Tim Nightingale EVP Senior Loan Officer 60 30+ 2000 Patricia Rose EVP Retail Banking 54 30+ 2017 EVP Chief Experience & Renee Smyth 47 15+ 2015 Marketing Officer 20

Financial Highlights Balance Sheet (in million’s) Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Loans $2,789 $2,782 $2,748 $2,736 $2,645 Investment Securities 914 908 916 932 943 Total Assets 4,113 4,065 4,040 4,036 3,938 Deposits 3,026 3,000 2,956 2,941 2,937 Borrowings 622 611 609 642 557 Shareholders’ Equity 404 403 414 407 398 Tier 1 Leverage Ratio 9.23% 9.07% 9.01% 8.92% 8.90% 21

Financial Highlights Net Income and Key Ratios Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 GAAP Net Income (Loss) $12.8 ($3.2) $11.3 $10.2 $10.1 (in millions) Diluted Earnings per Share $0.82 ($0.20) $0.72 $0.66 $0.64 Return on Tangible Equity(1) 17.35% (1.00%) 14.85% 13.96% 14.37% Return on Assets 1.28% (0.31%) 1.12% 1.03% 1.05% Efficiency Ratio(1) 58.76% 57.75% 55.72% 56.76% 58.00% Net Interest Margin (Fully- 3.10% 3.20% 3.16% 3.16% 3.15% Taxable Equivalent) Q4 2017 Adjusted results that remove the impact of a $14.3 million income tax expense charge resulting from the Tax Cuts and Jobs Act of 2017 were as follows: • Adjusted Net Income (in millions): $11.1 • Adjusted Return on Tangible Equity: 14.20% • Adjusted Diluted Earnings per Share: $0.71 • Adjusted Return on Assets: 1.09%. 1) This is a non-GAAP measure. Refer to the Company’s financial information filed with the SEC for the respective period. 22

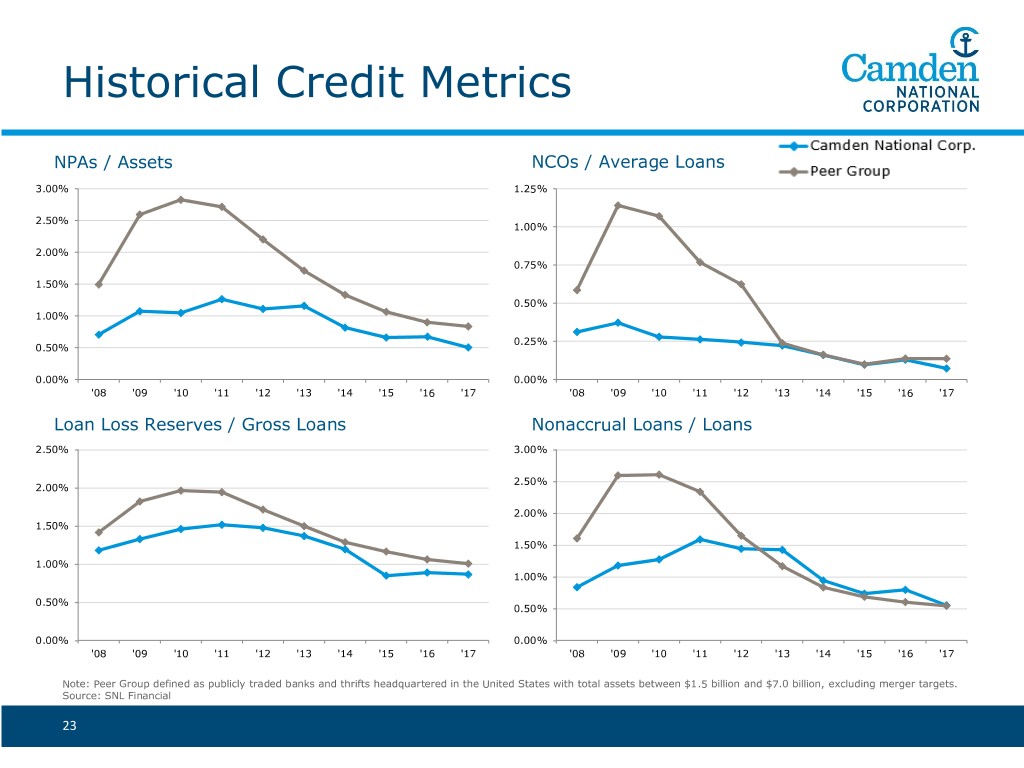

Historical Credit Metrics NPAs / Assets NCOs / Average Loans 3.00% 1.25% 2.50% 1.00% 2.00% 0.75% 1.50% 0.50% 1.00% 0.25% 0.50% 0.00% 0.00% '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Loan Loss Reserves / Gross Loans Nonaccrual Loans / Loans 2.50% 3.00% 2.50% 2.00% 2.00% 1.50% 1.50% 1.00% 1.00% 0.50% 0.50% 0.00% 0.00% '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Note: Peer Group defined as publicly traded banks and thrifts headquartered in the United States with total assets between $1.5 billion and $7.0 billion, excluding merger targets. Source: SNL Financial 23

Profitability Trends ROAA ROAE 1.20% 14.00% 12.00% 1.00% 10.00% 0.80% 8.00% 0.60% 6.00% 0.40% 4.00% 0.20% 2.00% 0.00% 0.00% '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Net Interest Margin Efficiency Ratio 4.00% 70.00% 3.75% 65.00% 3.50% 60.00% 3.25% 55.00% 3.00% 50.00% 2.75% 45.00% 2.50% 40.00% '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Note: Peer Group defined as publicly traded banks and thrifts headquartered in the United States with total assets between $1.5 billion and $7.0 billion, excluding merger targets. Source: SNL Financial 24

Mortgage Banking Activity Three Months Ended March 31, 2018 Top 15 Lenders Originations Rank % of Total Bangor Savings Bank 738 1 9.1% Camden National Bank 579 2 7.2% Residential Mortgage Services Inc. 429 3 5.3% TD Bank, N.A. 377 4 4.7% Quicken Loans 375 5 4.6% Kennebec Savings Bank 311 6 3.9% Key Bank 282 7 3.5% First, N.A. 274 8 3.4% Norway Savings Bank 228 9 2.8% Machias Savings Bank 226 10 2.8% Bank of America 206 11 2.6% Gorham Savings Bank 175 12 2.2% Kennebunk Savings Bank 149 13 1.8% Saco & Biddeford Savings Inst. 129 14 1.6% Town & Country Federal Credit Union 128 15 1.6% Total for All Lenders 8,066 - 100.0% Source: MRS, Inc. Data obtained from registry of deeds throughout the state of Maine. 25

Market Overview Maine New Hampshire Massachusetts Population in Millions 1.33 1.34 6.86 (Dec 2017) Population Increase 0.3% 1.8% 4.9% (2010-2018) Projected Population Change 0.4% 1.4% 3.0% (2018-2023) Median Household Income $55,679 $75,742 $77,248 (2018) Demographics Projected HH Income Change 8.9% 11.2% 11.2% (2018-2023) Unemployment Rate 2.7% 2.9% 3.8% (Mar 2018) GDP Growth 1.4% 1.9% 2.6% Economics (2016-2017) Sources: SNL Financial, U.S. Census, Bureau of Economic Analysis, me.gov, nh.gov, detma.org 26

Capital Position and Payout Capital Position EPS and Dividend Payout 14.32% 14.05% 13.87% 14.09% 14.14% $0.82 $0.72 $0.66 $0.64 7.98% 7.74% 7.79% 7.66% 7.59% $0.23 $0.23 $0.23 $0.25 $0.25 1Q17 2Q17 3Q17 4Q17 (2) 1Q18 1Q17 2Q17 3Q17 4Q17 (2) 1Q18 $(0.20) Total RBC Ratio Tangible Common Equity Ratio(1) Diluted EPS Dividend Per Share 1) This is a non-GAAP measure. Refer to the Company’s financial information filed with the SEC for the respective period. 2) Q4 2017 loss due to a $14.3 million charge to income tax resulting from the Tax Cuts and Jobs Act of 2017. 27