Attached files

| file | filename |

|---|---|

| 8-K - FIRST CONNECTICUT BANCORP, INC. 8-K 5 14 18 - First Connecticut Bancorp, Inc. | fcb8k-051418.htm |

Q1 2018 Investor Presentation NASDAQ: FBNK

Forward Looking Statements Disclaimer & Forward-Looking StatementsStatements in this document and presented orally at the conference, if any, concerning future results, performance, expectations or intentions are forward-looking statements. Actual results, performance or developments may differ materially from forward-looking statements as a result of known or unknown risks, uncertainties and other factors, including those identified from time to time in the Company’s filings with the Securities and Exchange Commission, press releases and other communications. Actual results also may differ based on the Company’s ability to successfully maintain and integrate customers from acquisitions.The Company intends any forward-looking statements to be covered by the Litigation Reform Act of 1995 and is including this statement for purposes of said safe harbor provisions. Readers and attendees are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this presentation. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances that occur after the date as of which such statements are made.The Company’s capital strategy includes deployment of excess capital, the success of which efforts cannot be guaranteed.

Who We Are Assets: $3.1 billion Loans: $2.8 billion Deposits: $2.4 billionCapital: $277 millionBranches: 25Headquarters: Farmington, ConnecticutNASDAQ: FBNK A Community Bank in central Connecticut and western Massachusetts which has consistently delivered strong organic loan growth with a focus on increasing earnings and building long-term shareholder value. As of March 31, 2018

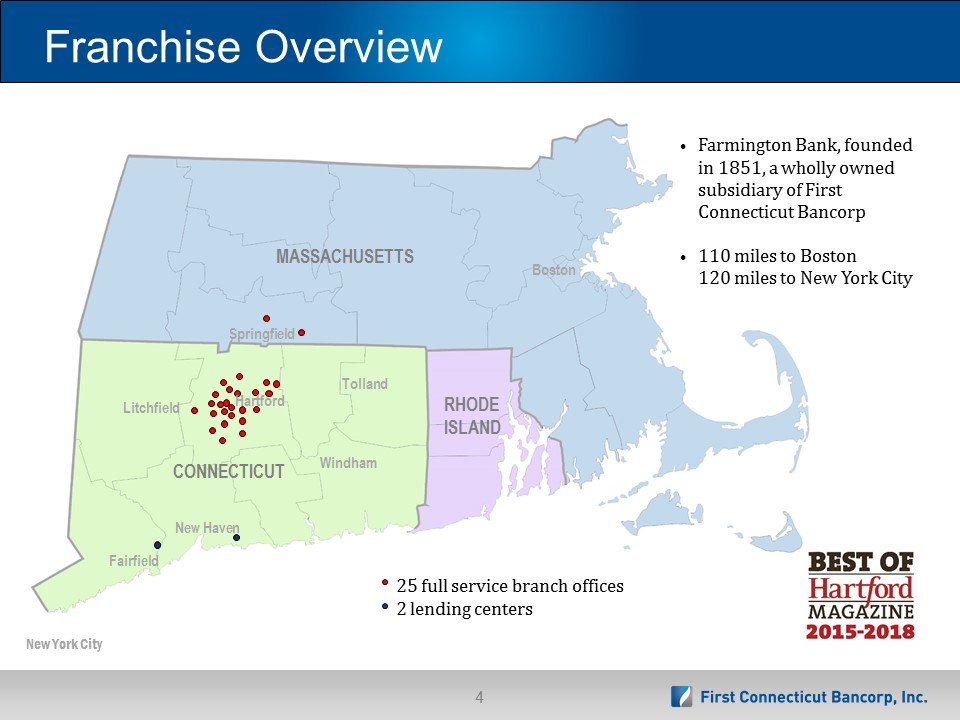

Franchise Overview 25 full service branch offices2 lending centers Farmington Bank, founded in 1851, a wholly owned subsidiary of First Connecticut Bancorp110 miles to Boston120 miles to New York City Boston Hartford Springfield New Haven Fairfield Litchfield Windham Tolland New York City MASSACHUSETTS CONNECTICUT RHODE ISLAND

Connecticut Marketplace Focus on Fundamentals Source: SNL 2018 data Population - 29th largest in the US at 3.6 millionMedian Income - 7th highest at $76,633Bank & Thrift Deposits (2017 data) - 24th highest at $133.2 billionHouseholds - 1,373,068Median Age - 41

Strategic Direction Prudent controlled growth – Commercial focusDeposits – growing footprint with diversification in depositsBalance sheet management Asset sensitive balance sheetOperational efficiencyCapital managementAsset qualityBuilding shareholder value

Q1 Highlights and Results Efficiency ratio of 65.06%Core Return on Average Assets of 0.78%Core Return on Equity of 8.68%Dividend increase of $0.01Continued core deposit growth Tangible Book Value increased to $17.32Core noninterest expense to average assets of 2.10% Net interest income of $20.9 millionOrganic loan growth increased to $2.8 billion, an increase of $69 million

Strong Capital Structure Common shares outstanding: 15,984,932Market capitalization: $409 millionTangible book value per share: $17.32Repurchased 2,863,527 shares of FBNK stock (since IPO 6/29/11) at an average cost of $14.38 As of March 31, 2018 unless otherwise noted.

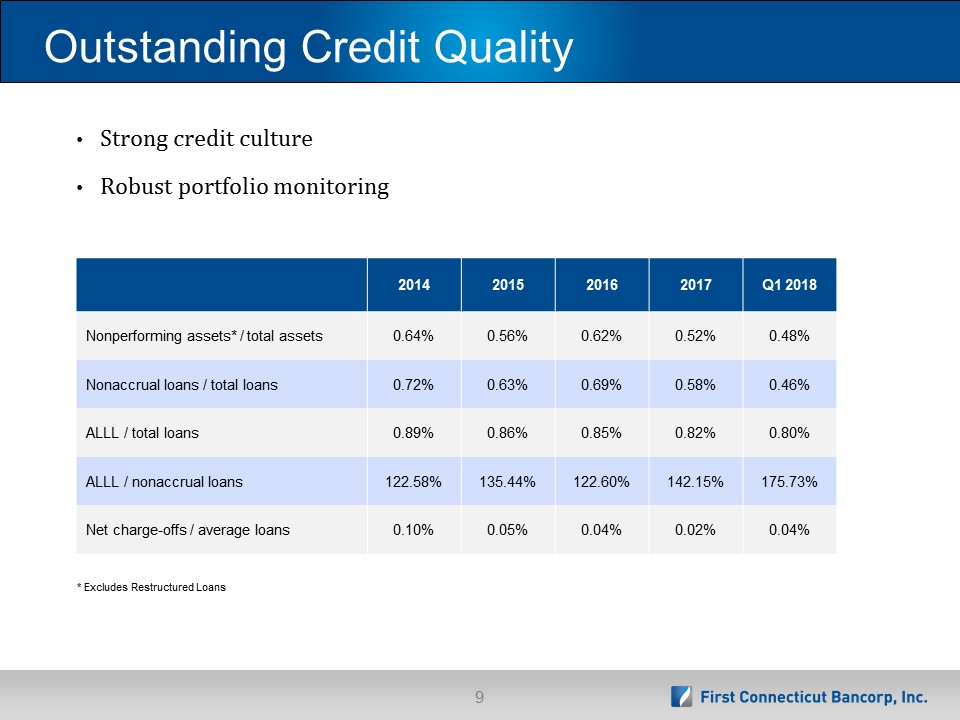

Outstanding Credit Quality Strong credit cultureRobust portfolio monitoring 2014 2015 2016 2017 Q1 2018 Nonperforming assets* / total assets 0.64% 0.56% 0.62% 0.52% 0.48% Nonaccrual loans / total loans 0.72% 0.63% 0.69% 0.58% 0.46% ALLL / total loans 0.89% 0.86% 0.85% 0.82% 0.80% ALLL / nonaccrual loans 122.58% 135.44% 122.60% 142.15% 175.73% Net charge-offs / average loans 0.10% 0.05% 0.04% 0.02% 0.04% * Excludes Restructured Loans

Solid Loan Growth $ millions As of March 31, 2018 | *annualized Growth Rate 10.4% 7.9% 7.8% 9.9%* 17.5%

Diversified Loan Portfolio As of March 31, 2018 Commercial 56%Residential 38%Consumer 6% 100%

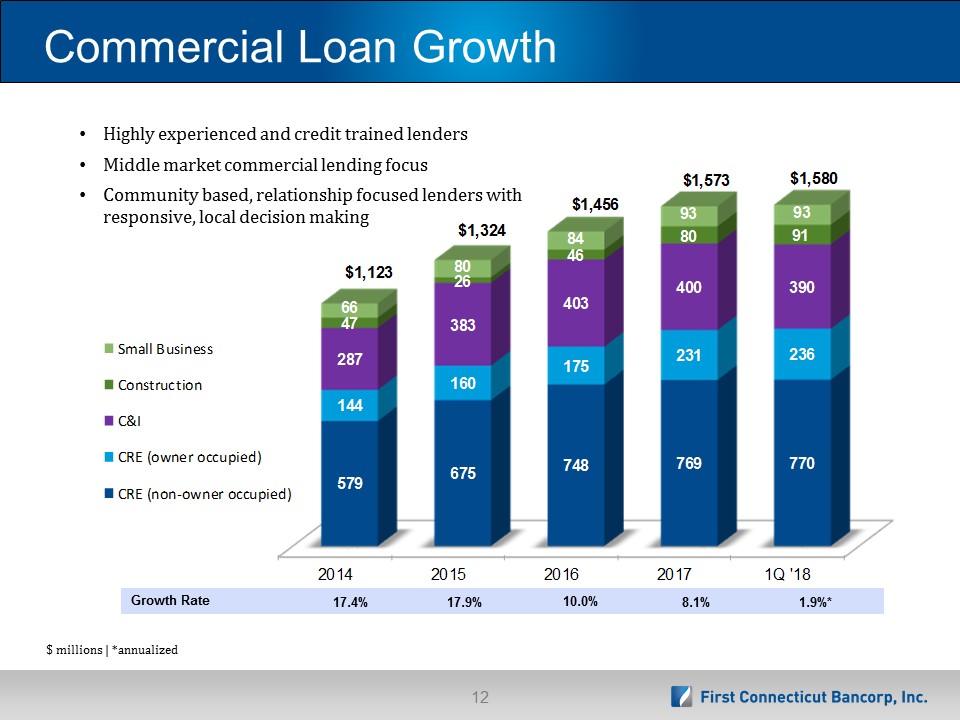

Commercial Loan Growth $ millions | *annualized Growth Rate 17.4% 17.9% 1.9%* 10.0% 8.1% Highly experienced and credit trained lenders Middle market commercial lending focusCommunity based, relationship focused lenders with responsive, local decision making

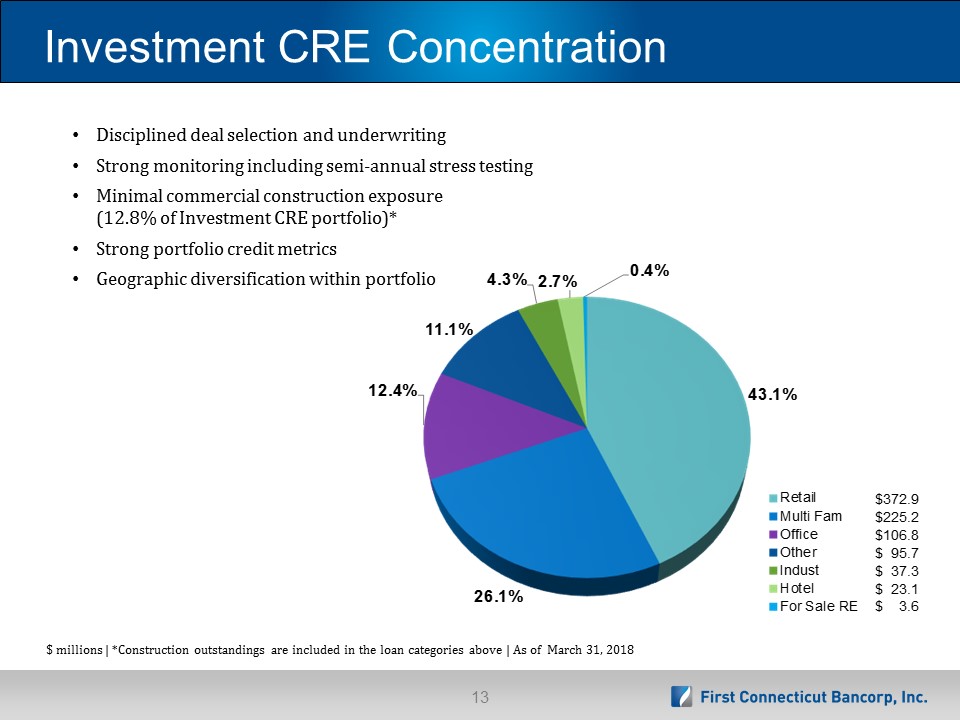

Investment CRE Concentration Disciplined deal selection and underwritingStrong monitoring including semi-annual stress testingMinimal commercial construction exposure (12.8% of Investment CRE portfolio)*Strong portfolio credit metricsGeographic diversification within portfolio $ millions | *Construction outstandings are included in the loan categories above | As of March 31, 2018

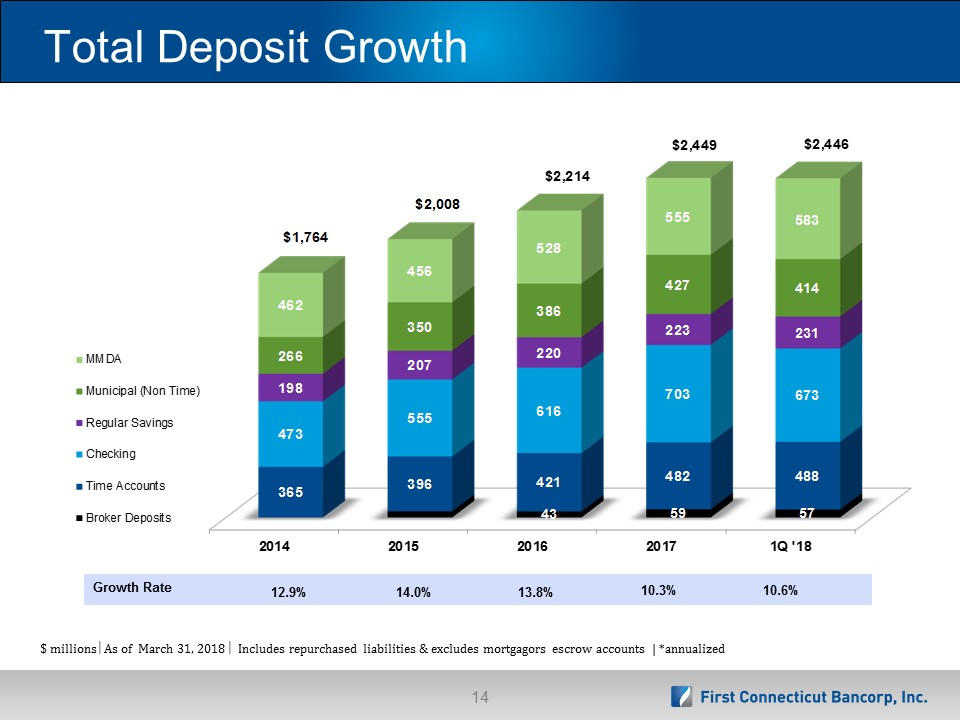

Total Deposit Growth $ millions As of March 31, 2018 Includes repurchased liabilities & excludes mortgagors escrow accounts | *annualized Growth Rate 12.9% 14.0% 10.6% 13.8% 10.3%

Diversified Deposit Base As of March 31, 2018 Includes repurchased liabilities & excludes mortgagors escrow accounts Favorable deposit mix of core deposits and municipal deposits

ROA, ROE & EPS

Controlled Expenses

Efficiency Ratio

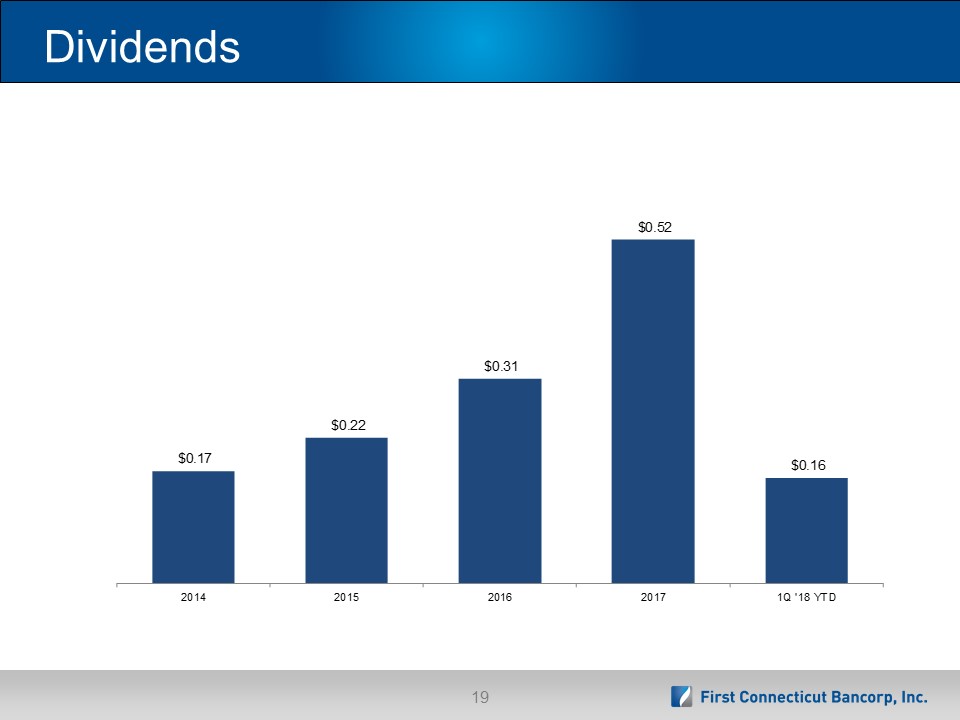

Dividends

Financial Highlights

Financial Highlights

Appendix Supplemental Information

Select Financial Data Statement of Income 2014 – 1Q 2018 $ thousands

Select Financial Data Statement of Income Rolling Five Quarters $ thousands

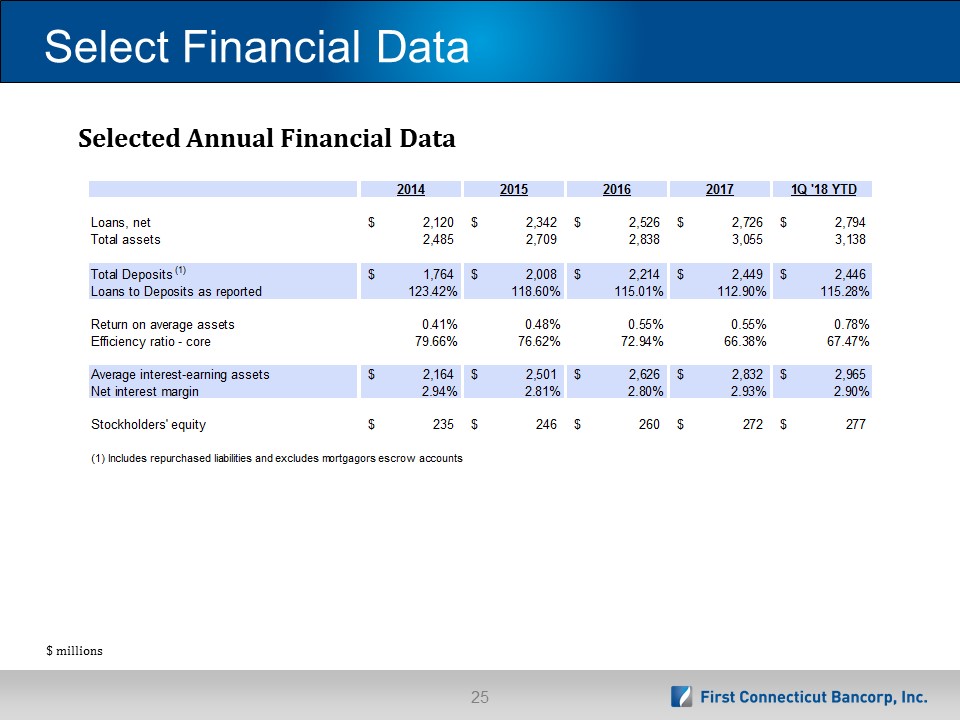

Select Financial Data Selected Annual Financial Data $ millions

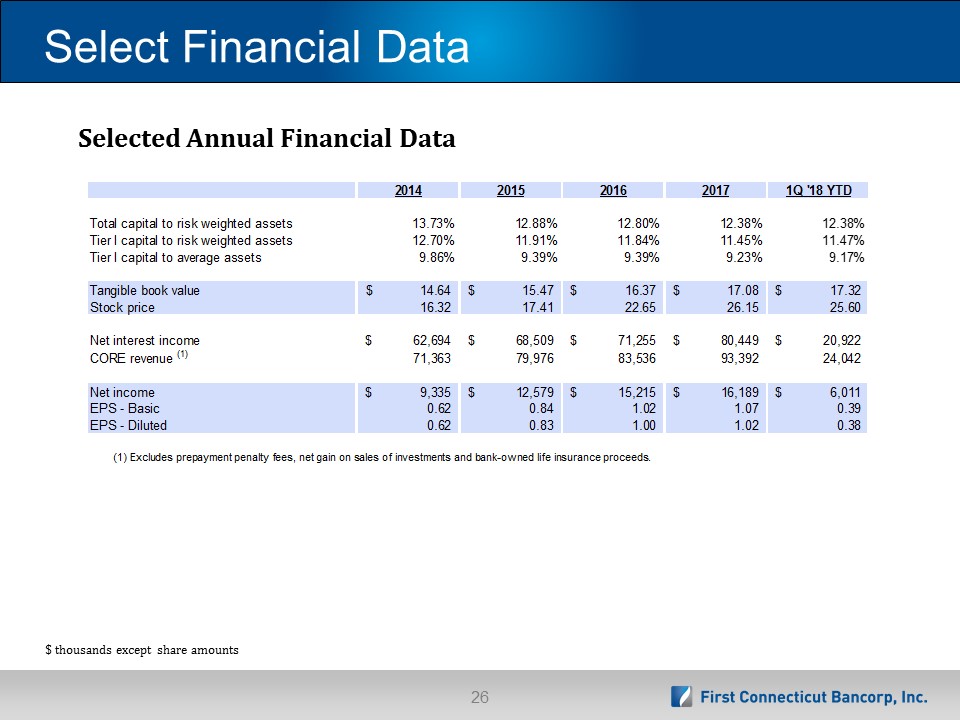

Select Financial Data Selected Annual Financial Data $ thousands except share amounts

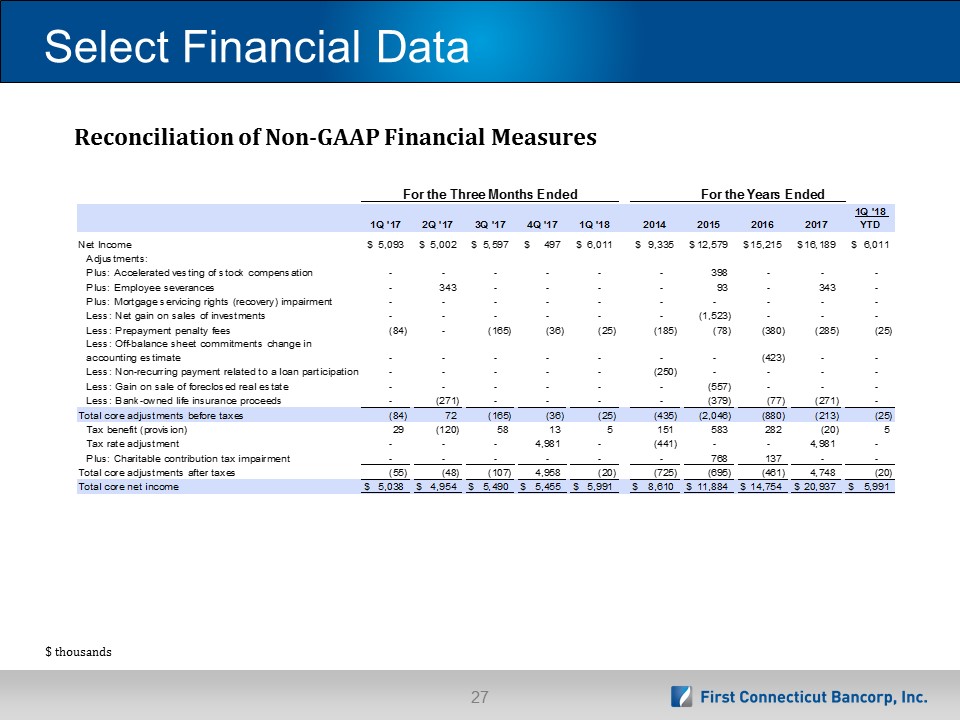

Select Financial Data Reconciliation of Non-GAAP Financial Measures $ thousands

Select Financial Data Quarterly Net Interest Income and Core Revenue* Annual Net Interest Income and Core Revenue* $ millions *Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds.

Select Financial Data Annual Average Earning Assets and NIM Quarterly Average Earning Assets and NIM $ billions

Asset Sensitivity As of March 31, 2018

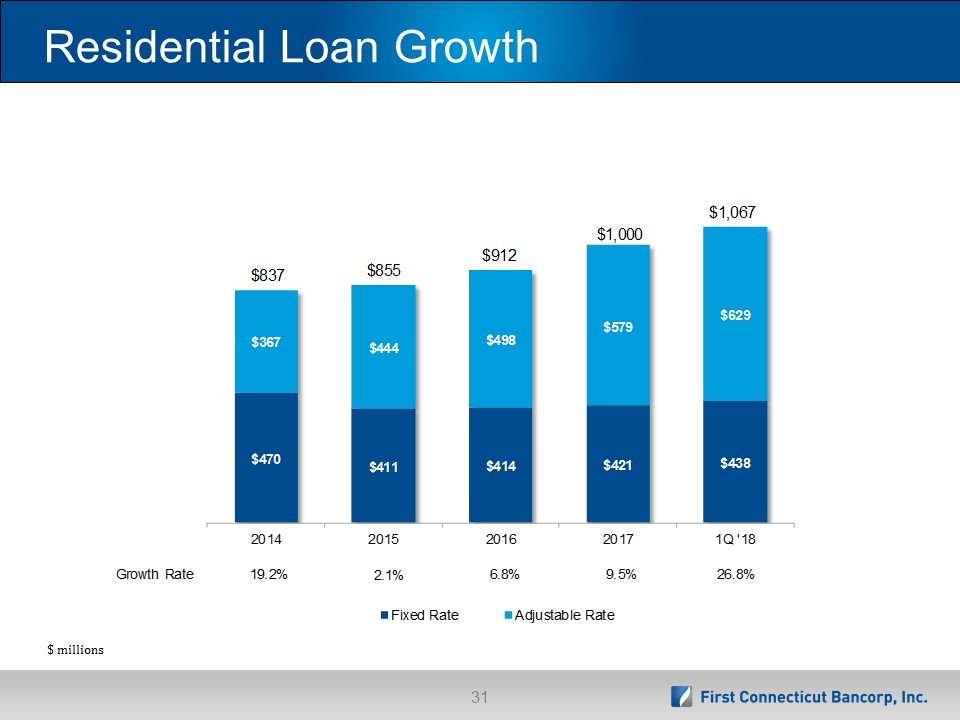

Residential Loan Growth $ millions

Residential Portfolio Composition Fixed Variable $ thousands

Consumer Loan Growth $ millions

Asset Quality Metrics Non-Performing Loans / Total Loans Loan Loss Reserves / Non-Accrual Loans

Asset Quality Metrics Loan Loss Reserves / Total Loans Net Charge-Offs / Average Net Loans *annualized

Deposit Market Share Source: SNL Financial, deposit data as of 6/30/2017.Note: Market Share is for US Territories only and non-retail branches and credit unions are not included. Includes limited service branches.

Consumer Checking Growth $ thousands

Business Checking Growth $ thousands

De Novo Branch Growth Total Deposit Growth Total Checking Balances # Checking Accounts (Cons. & Bus.) # Branch Growth $ millions

Leadership Team Name Title Years in Industry Prior Experience John J. Patrick, Jr. Chairman, President and Chief Executive Officer 38 TD Banknorth CT, President and CEO Gregory A. White Executive Vice President, Chief Financial Officer and Treasurer 31 Rockville Bank, Chief Financial Officer and Treasurer Michael T. Schweighoffer Executive Vice President, Chief Lending Officer 30 TD Banknorth, CT State President Kenneth F. Burns Executive Vice President, Director of Retail Banking & Marketing 29 Eagle Bank - EVP, Retail Banking & Marketing Catherine M. Burns Executive Vice President,Chief Risk Officer 37 TD Banknorth, Head of Community BankingCommercial Lending; Credit Manager

Corporate Contacts John J. Patrick, Jr. Chairman, President and Chief Executive OfficerGregory A. White Executive Vice President, Chief Financial OfficerInvestor Information:Jennifer H. Daukas Senior Vice President, Investor Relations Officer 860-284-6359 or jdaukas@farmingtonbankct.com