Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - KERYX BIOPHARMACEUTICALS INC | d579857dex991.htm |

| EX-10.3 - EX-10.3 - KERYX BIOPHARMACEUTICALS INC | d579857dex103.htm |

| EX-10.2 - EX-10.2 - KERYX BIOPHARMACEUTICALS INC | d579857dex102.htm |

| EX-10.1 - EX-10.1 - KERYX BIOPHARMACEUTICALS INC | d579857dex101.htm |

| 8-K - FORM 8-K - KERYX BIOPHARMACEUTICALS INC | d579857d8k.htm |

Keryx biopharmaceuticals First Quarter 2018 Financial Results Call May 10, 2018 Exhibit 99.2

Agenda Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Topic Speakers Welcome Amy Sullivan, SVP, Corporate Affairs Opening Remarks Jodie Morrison, Interim CEO 1Q 2018 Results Scott Holmes, CFO Commercial Progress Doug Jermasek, VP, Marketing & Strategy Question & Answer All

Forward-Looking Statements Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Some of the statements included in this presentation, particularly those regarding the commercialization of and demand for Auryxia and the potential asset-based revolving credit facility, including the expectation to close such facility and the impact it may have on us, may be forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Among the factors that could cause our actual results to differ materially are the following: our ability to successfully transition the chief executive role to Ms. Morrison and to a permanent chief executive; our ability to successfully negotiate and enter into definitive agreements with respect to the asset-based revolving credit facility; the risk that the borrowing base we may utilize at any one time under the asset-based revolving credit facility, if successfully entered into, may be significantly lower than the total commitment; our ability to successfully market Auryxia and whether we can increase adoption of Auryxia in patients with CKD on dialysis and successfully launch Auryxia for the treatment of iron deficiency anemia in patients with chronic kidney disease, not on dialysis; whether we can maintain our operating expenses to projected levels while continuing our current clinical, regulatory and commercial activities; our ability to continue to supply Auryxia to the market; the risk that increased utilization by Medicare Part D subscribers will increase our gross-to-net adjustment greater than we anticipate; and other risk factors identified from time to time in our reports filed with the Securities and Exchange Commission. Any forward-looking statements set forth in this presentation speak only as of the date of this presentation. We do not undertake to update any of these forward-looking statements to reflect events or circumstances that occur after the date hereof. The first quarter 2018 press release and prior releases are available at http://www.keryx.com. The information found on our website is not incorporated by reference into this presentation and is included for reference purposes only.

Opening remarks Jodie Morrison, Interim CEO

Objectives During Interim CEO Role Review the business; enhance understanding of functional operations Accelerate growth of Auryxia ® and create shareholder value Capture value of investments made for iron deficiency anemia launch Capitalize on the energy and enthusiasm for our medicine, both internally and externally Copyright © 2018 by Keryx Biopharmaceuticals, Inc.

1Q18 REsults Scott Holmes, CFO

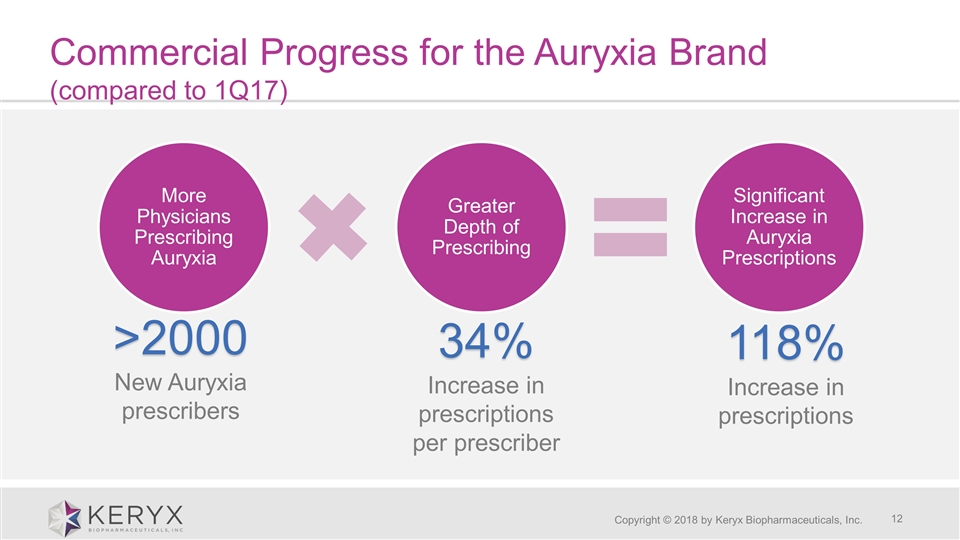

First Quarter 2018 Business Highlights Commercial progress Auryxia prescription demand increased 118% compared to 1Q17; revenue increased 96% Significant investment of time and effort toward iron deficiency anemia launch in first quarter of 2018 Promotionally sensitive market Frequency of contact and samples are drivers of prescribing Exchanged Baupost convertible senior notes due 2020 in debt restructuring $10 million of additional capital; extends maturity date to 2021 Now allows for up to $40 million asset-based revolving line of credit facility Copyright © 2018 by Keryx Biopharmaceuticals, Inc.

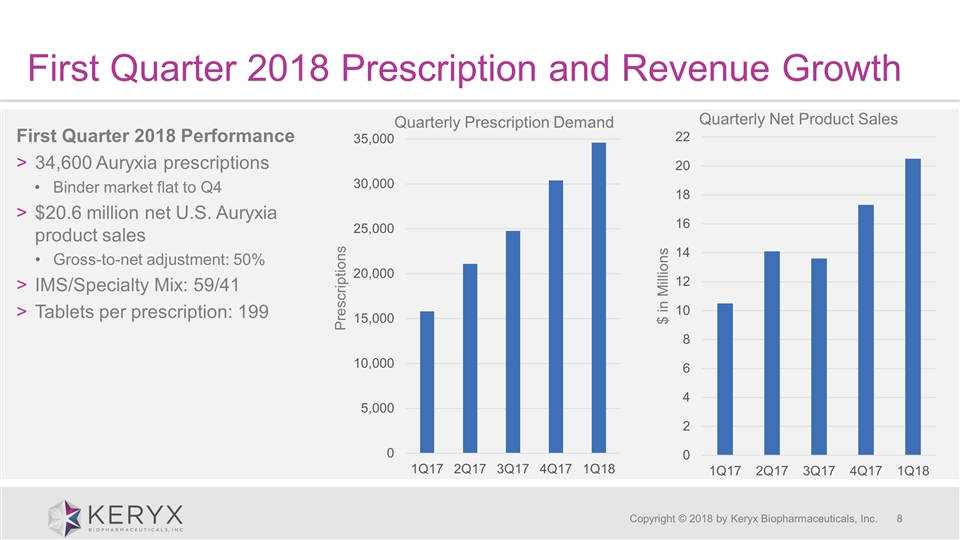

First Quarter 2018 Prescription and Revenue Growth Copyright © 2018 by Keryx Biopharmaceuticals, Inc. First Quarter 2018 Performance 34,600 Auryxia prescriptions Binder market flat to Q4 $20.6 million net U.S. Auryxia product sales Gross-to-net adjustment: 50% IMS/Specialty Mix: 59/41 Tablets per prescription: 199

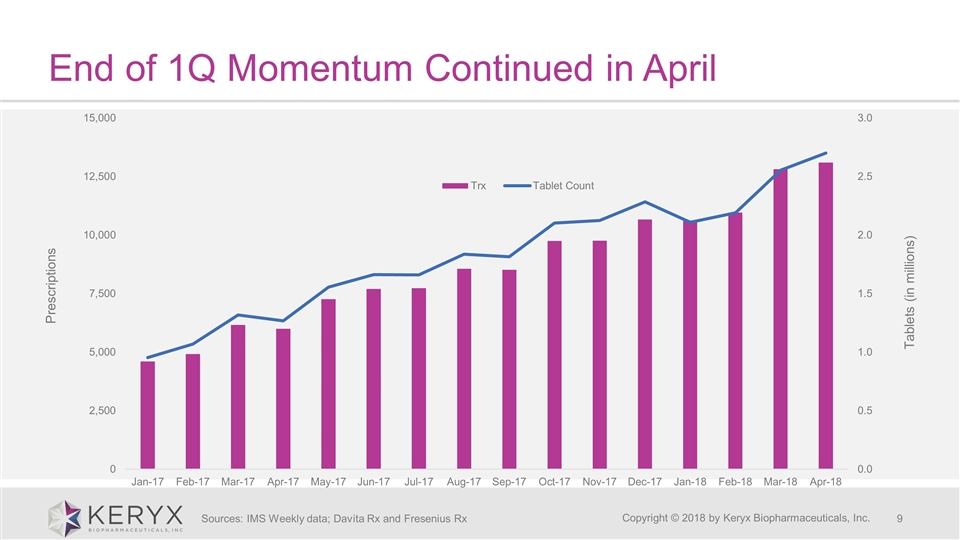

End of 1Q Momentum Continued in April Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Sources: IMS Weekly data; Davita Rx and Fresenius Rx

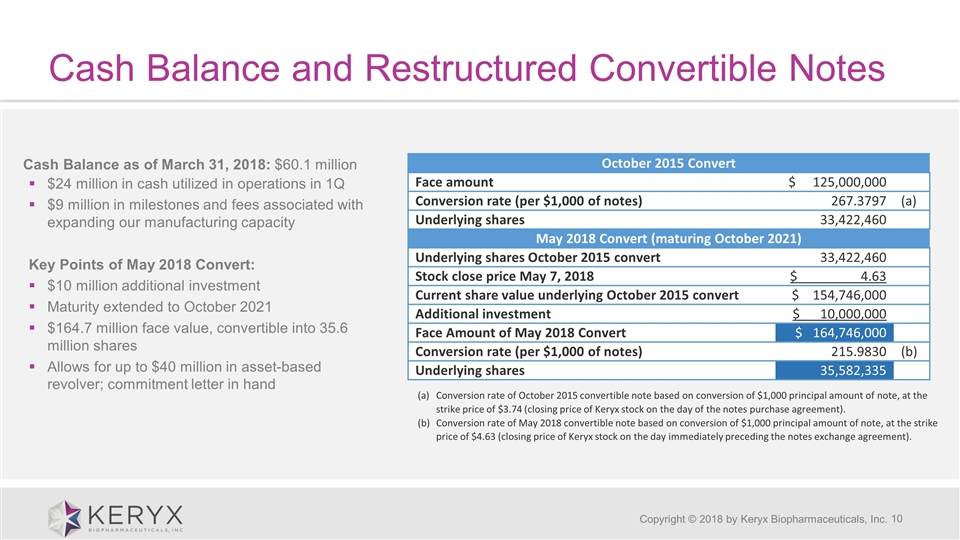

Cash Balance and Restructured Convertible Notes Copyright © 2018 by Keryx Biopharmaceuticals, Inc. October 2015 Convert Face amount $ 125,000,000 Conversion rate (per $1,000 of notes) 267.3797 (a) Underlying shares 33,422,460 May 2018 Convert (maturing October 2021) Underlying shares October 2015 convert 33,422,460 Stock close price May 7, 2018 $ 4.63 Current share value underlying October 2015 convert $ 154,746,000 Additional investment $ 10,000,000 Face Amount of May 2018 Convert $ 164,746,000 Conversion rate (per $1,000 of notes) 215.9830 (b) Underlying shares 35,582,335 Conversion rate of October 2015 convertible note based on conversion of $1,000 principal amount of note, at the strike price of $3.74 (closing price of Keryx stock on the day of the notes purchase agreement). Conversion rate of May 2018 convertible note based on conversion of $1,000 principal amount of note, at the strike price of $4.63 (closing price of Keryx stock on the day immediately preceding the notes exchange agreement). Cash Balance as of March 31, 2018: $60.1 million $24 million in cash utilized in operations in 1Q $9 million in milestones and fees associated with expanding our manufacturing capacity Key Points of May 2018 Convert: $10 million additional investment Maturity extended to October 2021 $164.7 million face value, convertible into 35.6 million shares Allows for up to $40 million in asset-based revolver; commitment letter in hand

Commercial Progress Doug Jermasek, VP of Marketing and Strategy

Commercial Progress for the Auryxia Brand (compared to 1Q17) Copyright © 2018 by Keryx Biopharmaceuticals, Inc. >2000New Auryxia prescribers 34% Increase in prescriptions per prescriber 118% Increase in prescriptions More Physicians Prescribing Auryxia Greater Depth of Prescribing Significant Increase in Auryxia Prescriptions

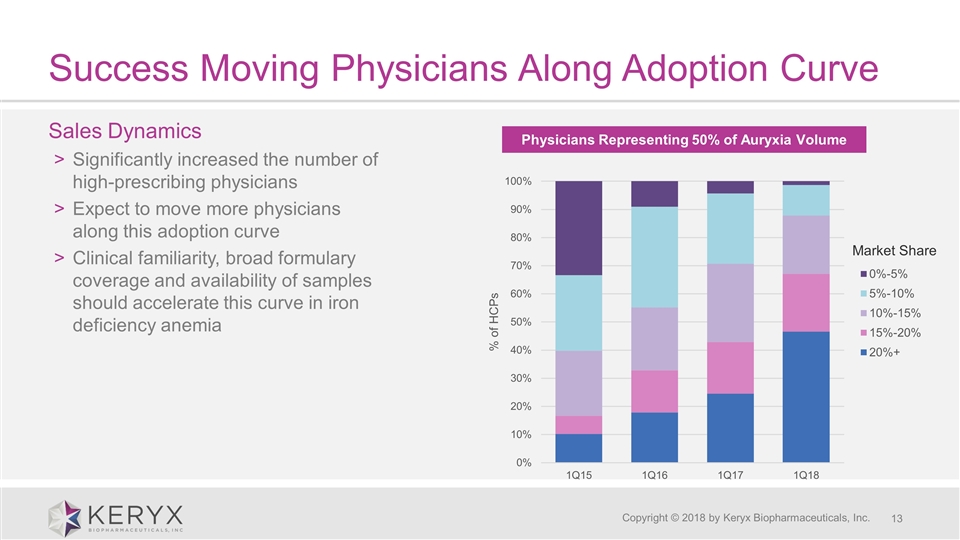

Success Moving Physicians Along Adoption Curve Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Sales Dynamics Significantly increased the number of high-prescribing physicians Expect to move more physicians along this adoption curve Clinical familiarity, broad formulary coverage and availability of samples should accelerate this curve in iron deficiency anemia Physicians Representing 50% of Auryxia Volume Market Share

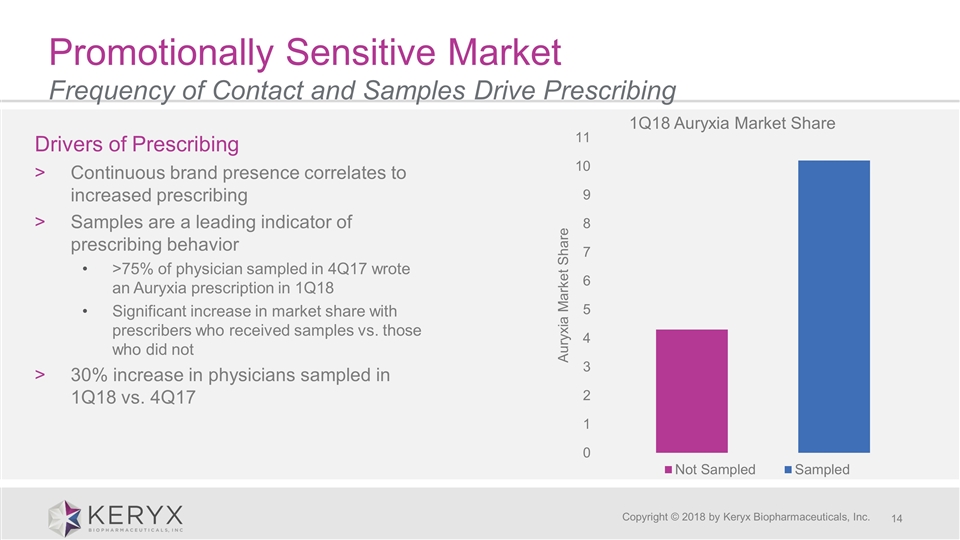

Promotionally Sensitive Market Frequency of Contact and Samples Drive Prescribing Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Drivers of Prescribing Continuous brand presence correlates to increased prescribing Samples are a leading indicator of prescribing behavior >75% of physician sampled in 4Q17 wrote an Auryxia prescription in 1Q18 Significant increase in market share with prescribers who received samples vs. those who did not 30% increase in physicians sampled in 1Q18 vs. 4Q17

Commercial Summary Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Laid the foundation for trial and adoption in iron deficiency anemia, executing against our launch objectives Driving rapid awareness of the iron deficiency anemia indication ~90% of surveyed nephrologists* are aware of Aurxyia’s indication for iron deficiency anemia Differentiating Auryxia from existing treatment options Majority of surveyed nephrologists* who have used Auryxia as a treatment for IDA report that they are satisfied with Auryxia and rate it better than traditional oral iron on efficacy and tolerability Working diligently to grow hyperphosphatemia business while gaining traction in iron deficiency anemia *Sources: Spherix Global Anemia 1Q Pulse; aided awareness data

Closing remarks Jodie Morrison, Interim CEO

In Summary Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Good progress commercially Prescriber base broadened Depth of prescribing increased Applied key learnings from our hyperphosphatemia experience to our launch in iron deficiency anemia and are seeing positive results Intend to build on current momentum to accelerate growth of Auryxia and create shareholder value

Strong Foundation to Build a Leading Kidney Care Company Copyright © 2018 by Keryx Biopharmaceuticals, Inc. Phosphate Management Anemia Management Q&A Session