Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PRECIGEN, INC. | d568653dex991.htm |

| 8-K - 8-K - PRECIGEN, INC. | d568653d8k.htm |

1Q18 Call May 10, 2018 Exhibit 99.2

Safe Harbor Statement Some of the statements made in this presentation are forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe harbor Provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon Intrexon’s current expectations and projections about future events and generally relate to Intrexon’s plans, objectives and expectations for the development of Intrexon’s business and include target revenues, target EBITDA, and discussion of anticipated clinical trials and future collaborations. Although management believes that the plans and objectives reflected in or suggested by these forward-looking statements are reasonable, all forward-looking statements involve risks and uncertainties and actual future results may be materially different from the plans, objectives and expectations expressed in this presentation. These risks and uncertainties include, but are not limited to, (i) Intrexon’s current and future subsidiaries, collaborations and joint ventures; (ii) Intrexon’s ability to successfully enter new markets or develop additional products, whether with its collaborators or independently; (iii) actual or anticipated variations in Intrexon’s operating results; (iv) actual or anticipated fluctuations in Intrexon’s competitors’ or its collaborators’ operating results or changes in their respective growth rates; (v) Intrexon’s cash position; (vi) market conditions in Intrexon’s industry; (vii) the volatility of Intrexon’s stock price; (viii) Intrexon’s ability, and the ability of its collaborators, to protect Intrexon’s intellectual property and other proprietary rights and technologies; (ix) Intrexon’s ability, and the ability of its collaborators, to adapt to changes in laws or regulations and policies; (x) the outcomes of pending and future litigation; (xi) the rate and degree of market acceptance of any products developed by Intrexon, its subsidiaries, collaborations or joint ventures; (xii) Intrexon’s ability to retain and recruit key personnel; (xiii) Intrexon’s expectations related to the use of proceeds from its public offerings and other financing efforts; and (xiv) Intrexon’s estimates regarding expenses, future revenue, capital requirements and needs for additional financing. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Intrexon’s actual results to differ from those contained in the forward-looking statements, see the section entitled “Risk Factors” in Intrexon’s Annual Report on Form 10-K filed with the Securities and Exchange Commission. All information in this presentation is as of the date of the release, and Intrexon undertakes no duty to update this information unless required by law. © 2018 Intrexon Corp. All rights reserved. Intrexon Corporation is sharing the following materials for informational purposes only. Such materials do not constitute an offer to sell or the solicitation of an offer to buy any securities of Intrexon. Any offer and sale of Intrexon’s securities will be made, if at all, only upon the registration and qualification of such securities under all applicable federal and state securities laws or pursuant to an exemption from such requirements. The attached information has been prepared in good faith by Intrexon. However, Intrexon makes no representations or warranties as to the completeness or accuracy of any such information. Any representations or warranties as to Intrexon shall be limited exclusively to any agreements that may be entered into by Intrexon and to such representations and warranties as may arise under law upon distribution of any prospectus or similar offering document by Intrexon. Forward-Looking Statements

Intrexon’s Human Therapeutic Efforts are Now ActoBio Therapeutics & Precigen Bigger payloads, better control improved delivery

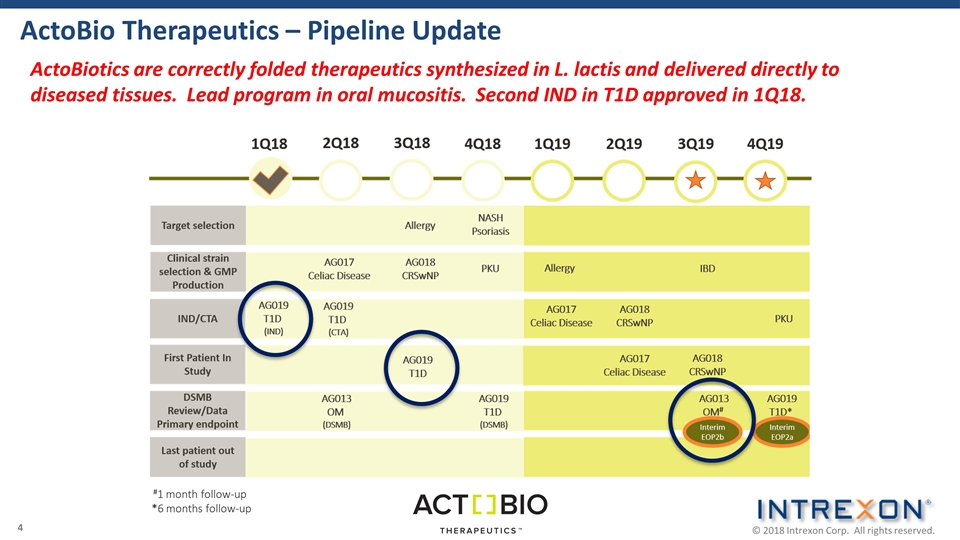

ActoBio Therapeutics – Pipeline Update ActoBiotics are correctly folded therapeutics synthesized in L. lactis and delivered directly to diseased tissues. Lead program in oral mucositis. Second IND in T1D approved in 1Q18. #1 month follow-up *6 months follow-up

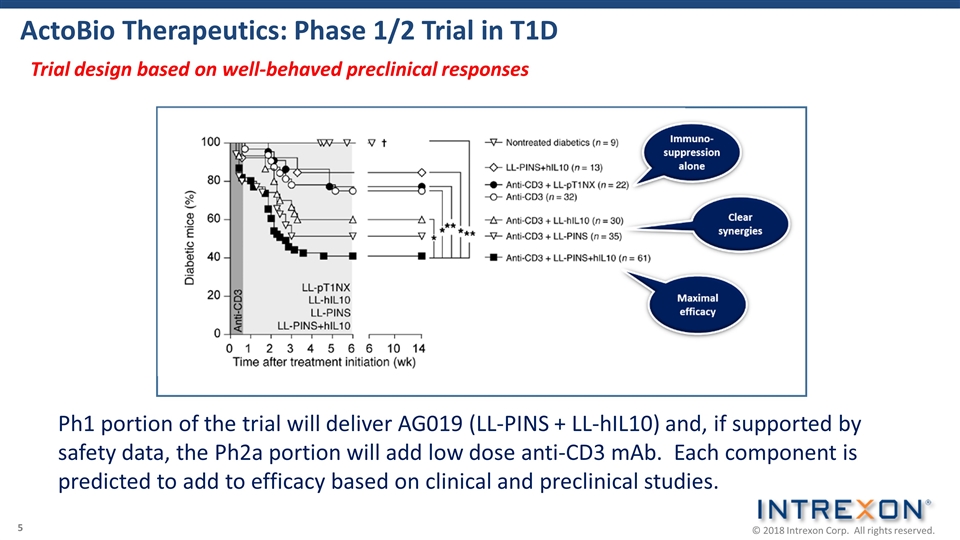

ActoBio Therapeutics: Phase 1/2 Trial in T1D Ph1 portion of the trial will deliver AG019 (LL-PINS + LL-hIL10) and, if supported by safety data, the Ph2a portion will add low dose anti-CD3 mAb. Each component is predicted to add to efficacy based on clinical and preclinical studies. Trial design based on well-behaved preclinical responses

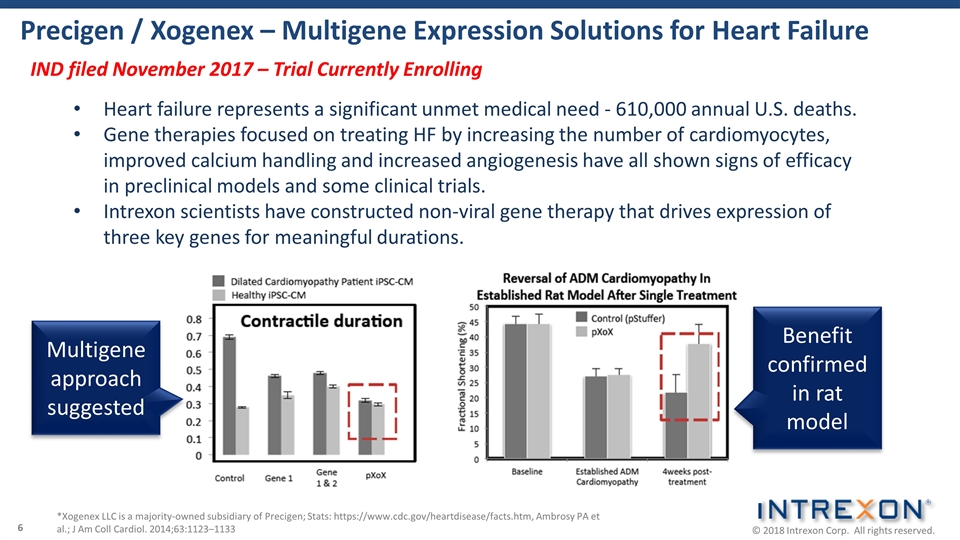

Precigen / Xogenex – Multigene Expression Solutions for Heart Failure *Xogenex LLC is a majority-owned subsidiary of Precigen; Stats: https://www.cdc.gov/heartdisease/facts.htm, Ambrosy PA et al.; J Am Coll Cardiol. 2014;63:1123–1133 Multigene approach suggested Benefit confirmed in rat model Heart failure represents a significant unmet medical need - 610,000 annual U.S. deaths. Gene therapies focused on treating HF by increasing the number of cardiomyocytes, improved calcium handling and increased angiogenesis have all shown signs of efficacy in preclinical models and some clinical trials. Intrexon scientists have constructed non-viral gene therapy that drives expression of three key genes for meaningful durations. IND filed November 2017 – Trial Currently Enrolling

Updated Scorecard – Human Therapeutics The AG019 IND has cleared and we expect dosing this summer. The trial will initially treat patients with AG019 and expand to Ph2 dosing of AG019 + anti-CD3 if safety allows. The Xogenex Heart Failure trial has started. Plasmid based delivery of the three major effector classes believed to improve function of the damaged heart. The CD19 POC IND was filed as scheduled. Trial will treat CD19-expressing tumors with a CAR-T cell produced with non-viral methods that does not require ex vivo amplification.

Intrexon’s Methane Bioconversion Platform (MBP) Engineering Microbes for Industrial Applications

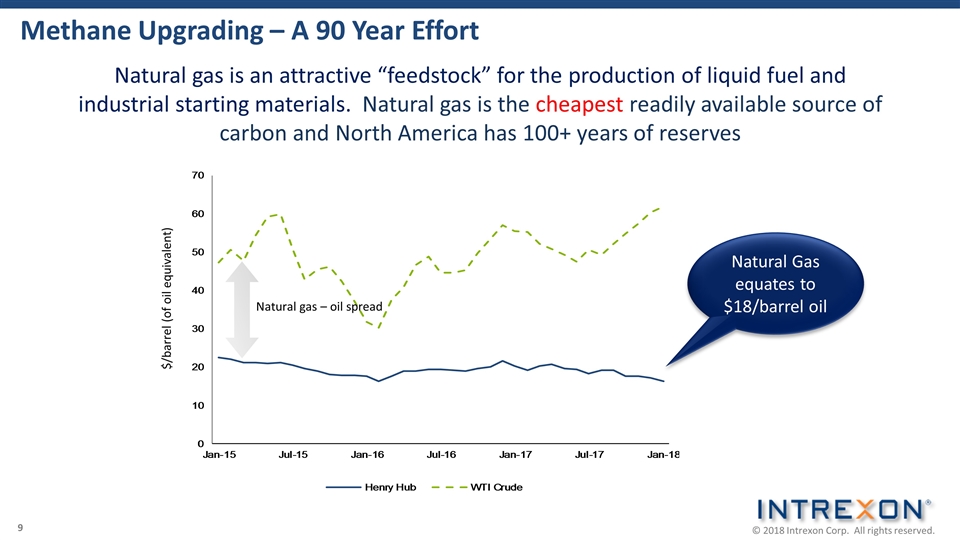

Methane Upgrading – A 90 Year Effort Natural gas is an attractive “feedstock” for the production of liquid fuel and industrial starting materials. Natural gas is the cheapest readily available source of carbon and North America has 100+ years of reserves Natural Gas equates to $18/barrel oil $/barrel (of oil equivalent) Natural gas – oil spread

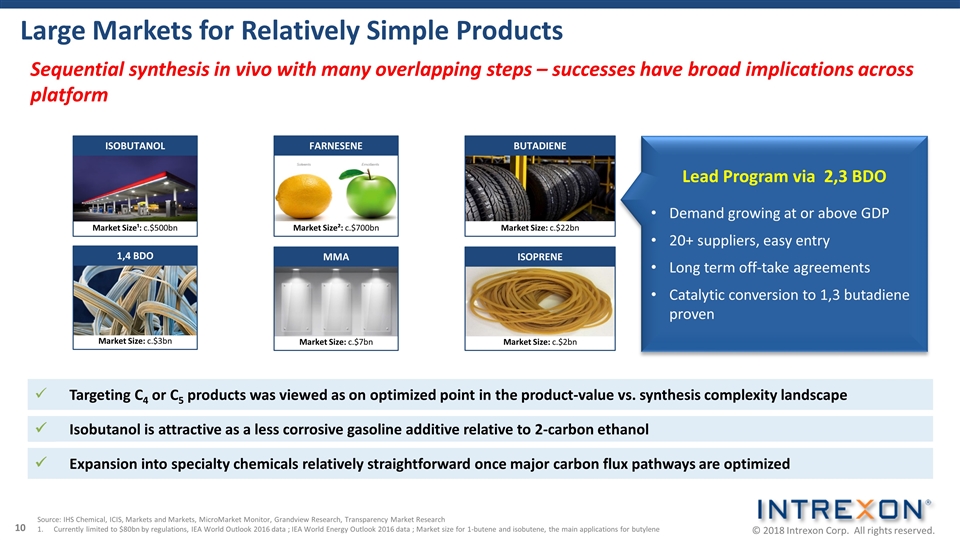

Source: IHS Chemical, ICIS, Markets and Markets, MicroMarket Monitor, Grandview Research, Transparency Market Research Currently limited to $80bn by regulations, IEA World Outlook 2016 data ; IEA World Energy Outlook 2016 data ; Market size for 1-butene and isobutene, the main applications for butylene Large Markets for Relatively Simple Products Market Size¹: c.$500bn ISOBUTANOL Market Size: c.$22bn BUTADIENE Market Size²: c.$700bn FARNESENE Market Size: c.$3bn 1,4 BDO Market Size: c.$7bn MMA Market Size: c.$2bn ISOPRENE Targeting C4 or C5 products was viewed as on optimized point in the product-value vs. synthesis complexity landscape ü Isobutanol is attractive as a less corrosive gasoline additive relative to 2-carbon ethanol ü Expansion into specialty chemicals relatively straightforward once major carbon flux pathways are optimized ü Lead Program via 2,3 BDO Demand growing at or above GDP 20+ suppliers, easy entry Long term off-take agreements Catalytic conversion to 1,3 butadiene proven Sequential synthesis in vivo with many overlapping steps – successes have broad implications across platform

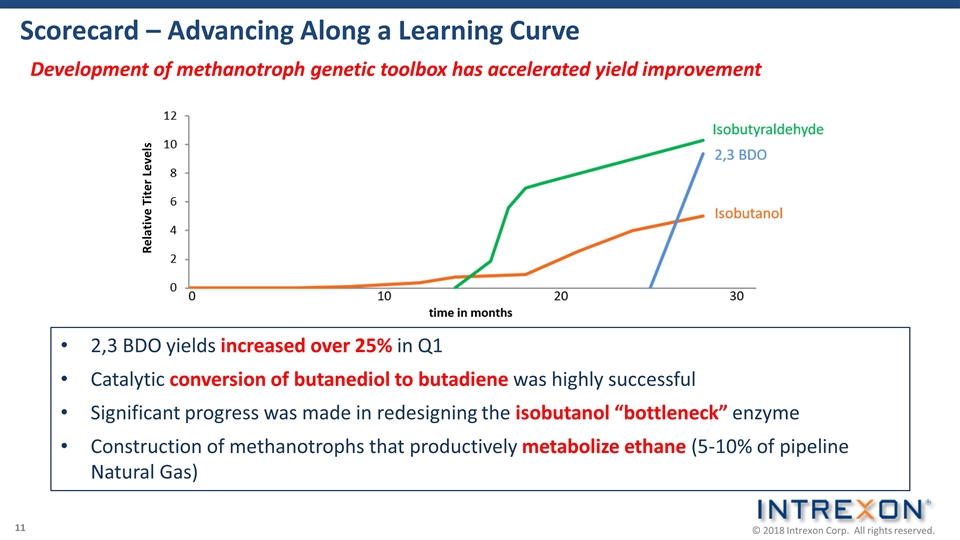

Development of methanotroph genetic toolbox has accelerated yield improvement Scorecard – Advancing Along a Learning Curve 2,3 BDO yields increased over 25% in Q1 Catalytic conversion of butanediol to butadiene was highly successful Significant progress was made in redesigning the isobutanol “bottleneck” enzyme Construction of methanotrophs that productively metabolize ethane (5-10% of pipeline Natural Gas) Relative Titer Levels

Oxitec: OX5034 Mosquito Exemplar and Trans Ova: MiniSwine and Elite Bovine Embryos Okanagan and AquaBounty: Apple and Salmon

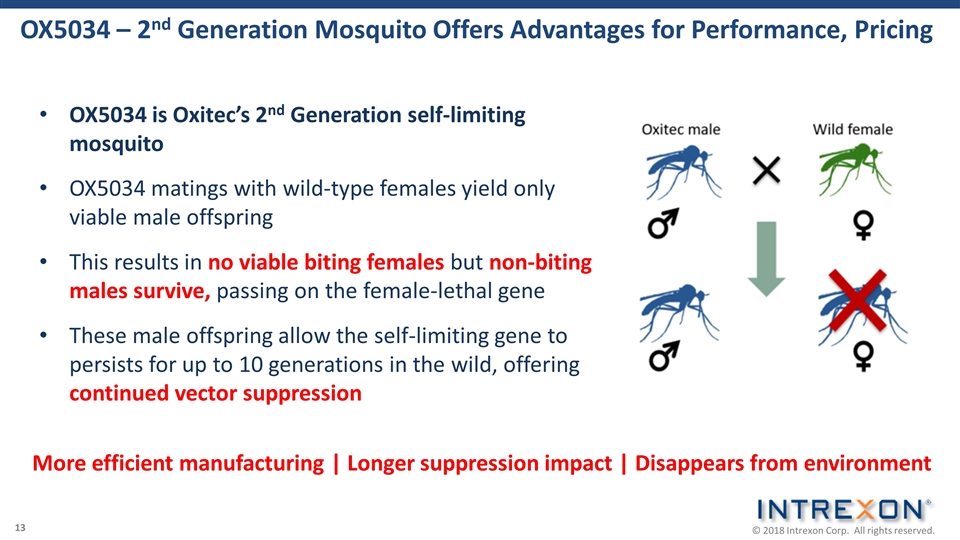

OX5034 is Oxitec’s 2nd Generation self-limiting mosquito OX5034 matings with wild-type females yield only viable male offspring This results in no viable biting females but non-biting males survive, passing on the female-lethal gene These male offspring allow the self-limiting gene to persists for up to 10 generations in the wild, offering continued vector suppression OX5034 – 2nd Generation Mosquito Offers Advantages for Performance, Pricing More efficient manufacturing | Longer suppression impact | Disappears from environment

Friendly Scorecard – Improving Technology, Operations and Focus OX5034: First field releases for Oxitec’s 2nd generation mosquito are scheduled to launch in Brazil in late May; regulatory approval for field trial granted. Caymans: Preparing to launch “combination” project at request of Cayman government; awaiting signatures on final contract. EPA progress: 2nd 30-day open comment period to begin May 7th. Anticipating an approval date in late July, 2018.

Novel MiniSwine Model and Elite Bovine Embryos During the first quarter Trans Ova Genetics launched a new subsidiary called ProGentus. ProGentus will focus on providing products to Dairy and Beef farmers by delivering embryos for the production of replacement females for the farmers’ herd. Exemplar Genetics – during the quarter, the FDA exercised enforcement discretion clearing for commercial use as a research model the ExeGen® ATM MiniSwine. The ATM MiniSwine is genetically engineered to more closely model ataxia telangiectasia (AT), a rare human neurological disease.

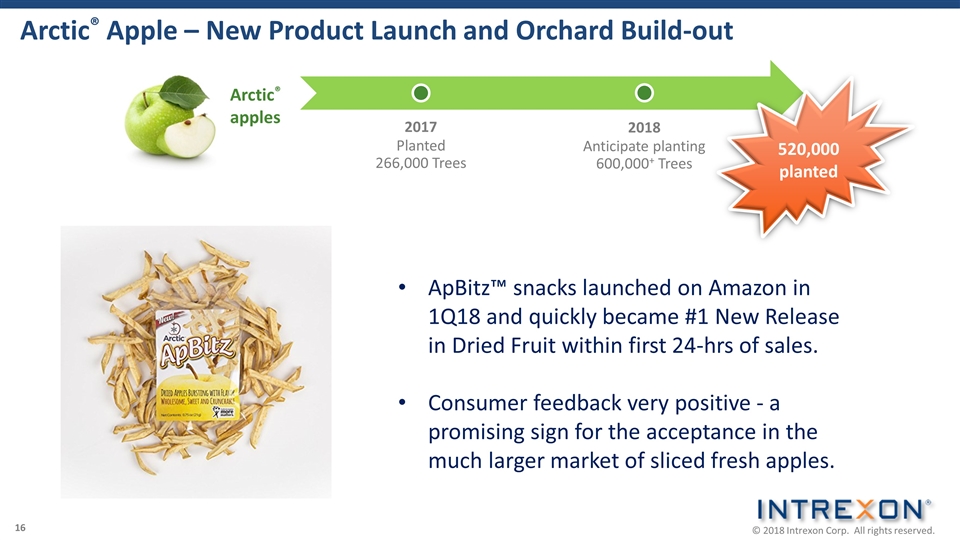

Arctic® Apple – New Product Launch and Orchard Build-out Arctic® apples 2017 Planted 266,000 Trees 2018 Anticipate planting 600,000+ Trees ApBitz™ snacks launched on Amazon in 1Q18 and quickly became #1 New Release in Dried Fruit within first 24-hrs of sales. Consumer feedback very positive - a promising sign for the acceptance in the much larger market of sliced fresh apples. 520,000 planted

AquaBounty Salmon – First U.S. Site Approved November 19, 2015 – FDA approval for production, sale, and consumption in the U.S. April 27, 2018 – FDA approval to raise AquAdvantage® Salmon at its land-based Indiana facility. AquAdvantage® Salmon awaits only official labeling guidelines by the FDA. Draft guidelines were recently published. Sustainable, domestically produced alternative to imported ocean cage reared salmon