Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Avaya Holdings Corp. | ex993avayaq2fy18erpresen.htm |

| EX-99.1 - EXHIBIT 99.1 - Avaya Holdings Corp. | ex991avayaq2fy18errevfin.htm |

| 8-K - 8-K - Avaya Holdings Corp. | form8-k_may102018xq2fy2018.htm |

May 10, 2018 CFO Commentary on Second Quarter Fiscal 2018 Financial Results Note: This document should be read in conjunction with the Second Quarter Fiscal 2018 earnings and includes a discussion of certain non-GAAP(1) results Second Quarter Fiscal 2018(2): Income Statement: GAAP revenue for Q2 FY’18 was $672 million, including $1 million related to Avaya’s former Networking business, which was sold on July 14, 2017. Revenue for the combined period from October 1, 2017 through December 31, 2017 (the “Combined First Quarter Fiscal 2018” (2)), was $752 million, including $3 million related to the Networking business. Revenue for Q2 FY’17 was $804 million, including $51 million related to the Networking business. Non-GAAP revenue for Q2 FY’18 was $757 million, down $47 million year-over-year, primarily as a result of the sale of the Networking business which represented $51 million of the revenue in Q2 FY’17, and $18 million lower compared to Q1 FY’18 (on a combined basis), which is well above typical seasonality in the business. In constant currency, non-GAAP revenue declined 8% year-over-year, and was 3% lower from Q1 FY’18. Information in constant currency is calculated by translating current year and prior year translations at fixed plan exchange rates. Management reviews and analyzes business results excluding the effect of foreign currency translation because the company believes this better represents underlying business trends. Excluding the revenue related to Avaya’s former Networking business, non-GAAP revenue grew slightly compared to Q2 FY’17, and declined approximately 2% from Q1 FY’18 (on a combined basis). In constancy currency, non-GAAP revenue declined 2% year-over-year and was 3% lower from Q1 FY’18 (on a combined basis). GAAP product revenue for Q2 FY’18 was $293 million. Non-GAAP product revenue of $317 million for Q2 FY’18 decreased 9% year-over-year and decreased 4% from Q1 FY’18 (on a combined basis). Excluding the impact of the sale of the Networking business, product revenue increased 2% year-over-year and decreased 4% sequentially. GAAP service revenue for Q2 FY’18 was $379 million. Non-GAAP service revenue of $440 million decreased 4% year-over-year, and was down 1% from Q1 FY’18 (on a combined basis). Excluding the impact of the sale of the Networking business, service revenue decreased 1% sequentially and year-over-year. GAAP gross margin for Q2 FY’18 was 48.1%.

Non-GAAP gross margin of 62.4% was a record percentage for an Avaya second quarter result, and improved year-over-year by 150 basis points and was up 60 basis points sequentially, reflecting better product mix as a result of the exit from the Networking business and improved productivity offset by lower volumes. Compared to Q1 FY’18 (on a combined basis), non-GAAP gross margin was higher mostly as a result of product mix. GAAP Product gross margin for Q2 FY’18 was 48.5%. Non-GAAP Product gross margin for Q2 FY’18 was 68.1%, up 400 basis points compared to the same period in the prior year, which is attributable to improved product mix and productivity, and up 330 basis points sequentially which also reflects improved product mix and productivity. GAAP Services gross margin for Q2 FY’18 was 47.8%. Non-GAAP Services gross margin of 58.2% decreased by 40 basis points compared to the same period during the prior year, and was 140 basis points lower than the prior quarter reflecting lower volume and product mix resulting from legacy maintenance declines. Cost structure: GAAP operating expenses, R&D plus SG&A for Q2 FY’18 were $332 million. Non-GAAP operating expenses, R&D plus SG&A, of $315 million decreased $16 million year-over-year and increased $8 million sequentially (on a combined basis). SG&A expense of $265 million was $9 million lower than the same period during the prior year and $5 million higher compared to Q1 FY’18 (on a combined basis). The reductions year-over-year reflect ongoing cost structure improvements and are also a result of the sale of the Networking business in Q4 FY’17. The sequential increase in Q2’18 reflects higher compensation expenses related to employee benefits that are generally higher at the start of the calendar year and the effects of foreign exchange rates. GAAP and Non-GAAP R&D expense totaled $50 million for Q2 FY’18. R&D expense represented an increase of $3 million year-over-year excluding the Networking business, and an increase of $3 million from Q1 FY’18 (on a combined basis). We continue to deliver a steady pipeline of innovations across the product portfolio and now have additional R&D spending related to the Spoken Communications acquisition. GAAP operating loss for Q2 FY’18 was $89 million, compared to operating income of $38 million in Q1 FY’18 (on a combined basis), and operating income of $75 million for Q2 FY’17. Non-GAAP operating income was $157 million or 20.7% of non-GAAP revenue, a record percentage for a second quarter result, and compares to $159 million or 19.8% of revenue for Q2 FY’17 and $172 million (on a combined basis) or 22.2% of non-GAAP revenue Q1 FY’18. Non-GAAP operating income for Q2 FY’18 reflects the continued success of our cost reduction efforts which have contributed to the improvement of the operational efficiency of the company.

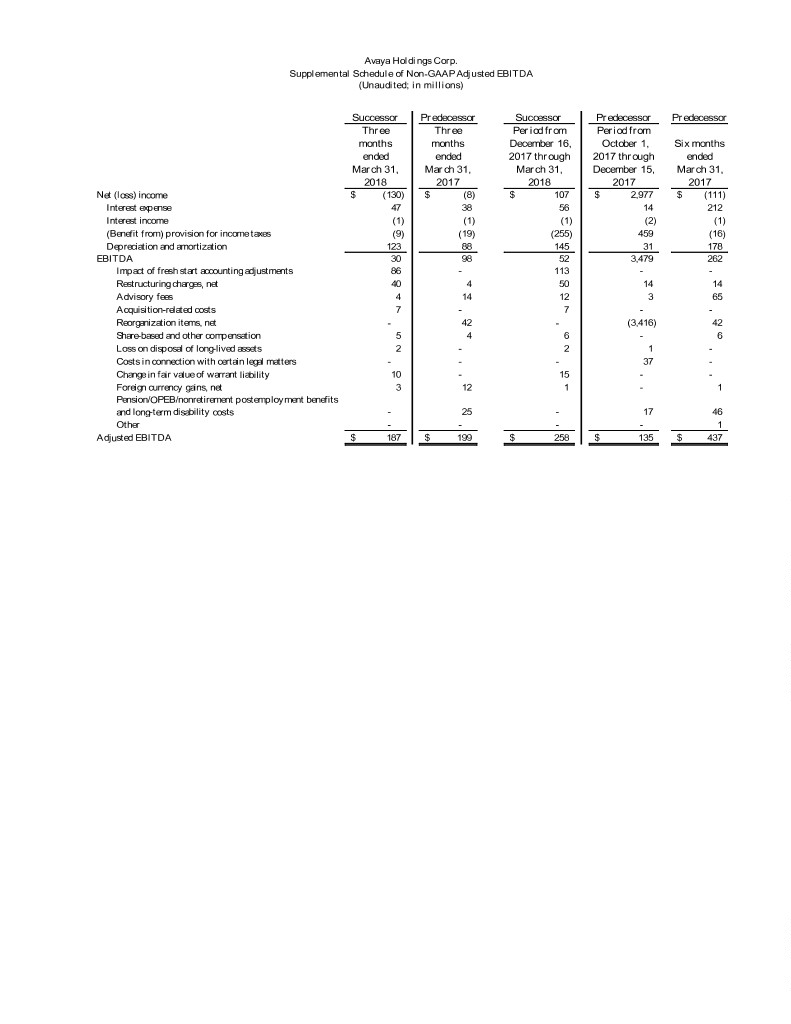

Adjusted EBITDA, including the OCI amortization addback, was $187 million or 24.7% of non-GAAP revenue for Q2 FY’18, and compares to $199 million or 24.8% of non-GAAP revenue for Q2 FY’17, and $206 million or 26.6% of non-GAAP revenue for Q1 FY’18 (on a combined basis). Balance sheet: Cash and cash equivalents were $311 million as of March 31, 2018 compared to $417 million at December 31, 2017 and $764 million at March 31, 2017. The sequential change in cash and cash equivalents is primarily due to cash provided by operating activities of $54 million Q2 FY’18 offset primarily by payments of approximately $158 million for the acquisition of Spoken Communications, interest and principal payments for the term loan of $53 million, $14 million of restructuring charges, and $26 million of pension contributions. Inventory of $106 million decreased by about $18 million sequentially and Q2’18 days of inventory stood at of 31 days, flat from the level reported for Q1 FY’18. This level of inventory represents consistent operating levels. Accounts receivable totaled $366 million at the end of Q2 FY’18, compared to $413 million on a sequential basis. Days sales outstanding (based on non-GAAP revenue) was approximately 59 days, which includes AR deferred revenue netting as a result of fresh start accounting, using the same approach it would have been 57 days in Q1 FY’18 vs. the 48 days reported. On a go forward basis we will continue to use this approach as the effects of fresh start accounting roll through the subsequent quarters. Capital expenditures were approximately $16 million in Q2 FY’18, up slightly from $15 million reported in Q1 FY’18 and a decrease from the $20 million reported during Q2 FY’17. Depreciation and amortization in Q2 FY’18 was approximately $123 million, up from $53 million reported on a sequential basis and from $88 million during Q2 FY‘17. The increase in D&A on a sequential basis is a result of the full quarter impact of fresh start accounting, which required that we increase intangible and fixed assets to their fair values as of December 15, 2017. Demand indicators for Q2 FY’18: Total bookings for the company increased year-over-year and on a sequential basis as the business continued to recover since emerging as a public company. Bookings improved 2% from the prior year, and were up 6% from Q1 FY’18. In constant currency, bookings were flat from the prior year, and improved 5% from Q1 FY’18. Bookings Excluding the Networking business, on a year-over-year basis improved 7%, while on a sequential basis bookings increased by 6%. Excluding the Networking business, in constant currency, bookings improved 5% year-over-year, while increasing 5% on a sequential basis. Product revenue for Q2 FY’18 was $317 million, $31 million lower than the prior year and $13 million lower Q1 FY’18 (on a combined basis). The decrease year-over-year is primarily as a result of the sale of the Networking business, which constituted $39 million of product revenue in Q2 FY’17. Excluding the Networking business, product revenue increased by $8 million year-over-year and decreased by $11 million sequentially (on a combined basis).

Service revenue of $440 million in Q2 FY’18 was down $16 million from the prior year, $12 million as a result of the sale of Networking business, and the remainder from lower maintenance revenue as a result of continued decline of our legacy service business. We saw stabilization of service revenue on a sequential basis during Q2 FY’18, with only a $5 million difference from the immediately preceding quarter (on a combined basis) as we had our third sequential quarter of growth in one-time professional services. Both cloud and managed services revenue and professional services revenue each accounted for 10 percent of total company revenue. Distribution channel: Reported product revenue to the channel excluding Networking was $223 million and grew 3% year- over-year, and was 1% lower sequentially. As a reminder, channel product revenue is recognized when we sell-in to the distributor and continues to account for more than 2/3 of our total product revenue. Distributor reported inventories of $111 million were $5 million higher from Q2 FY’17 and flat from Q1 FY’18 to Q2 FY’18. We remain committed to continuing to increase the operational efficiency and productivity of the organization. Moving forward as a software and services company, we are focused on driving additional cost structure improvements while continuing to invest in our product portfolio and maintaining outstanding customer support and satisfaction. We expect an increasing proportion of revenue to come from software and services and from recurring revenue. Taking into consideration Avaya’s acquisition of Spoken, continued investment in R&D, sales enablement, tools and people, and our ongoing efforts to improve Avaya’s operating efficiencies; we are now targeting the following forecast for Q3 Fiscal Year 2018: Financial Outlook - Q3 Fiscal 2018 Revenue of $690-$705 million, non-GAAP revenue of $750-$770 million GAAP operating loss of 8-8.5% of revenue, non-GAAP operating profit of 20-21% of non-GAAP revenue GAAP operating loss of $55-60 million, non-GAAP operating income $150-$160 million Cash taxes of approximately $9 million GAAP net loss $0.89-$0.97 per diluted share Adjusted EBITDA of $170-$190 million or adjusted EBITDA margin of approximately 23-25% of non- GAAP revenue, includes impact of Spoken acquisition Approximately 111 million shares outstanding Total cash requirements for restructuring, pension & OPEB, cash taxes, capital spending and interest expense in the third quarter fiscal 2018 are expected to be:

Details: o Restructuring: $25M o Pension/OPEB: $20M o Cash Taxes: $9M o CapEx: $20-$25M o Interest expense: $50M Avaya’s outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments, or other significant transactions that may be completed after May 10, 2018. Actual results may differ materially from Avaya’s outlook as a result of, among other things, the factors described under “Forward-Looking Statements” below. 1 The results for the period from October 1, 2017 through December 31, 2017, or March 31, 2018, as applicable, represent the sum of the reported amounts for the Predecessor period from October 1, 2017 through December 15, 2017 and the Successor period from December 16, 2017 through December 31, 2017 or March 31, 2018, as applicable (each, a “Successor” period). Refer to Supplemental Financial Information accompanying this press release for more information, including a reconciliation of combined results to our Predecessor and Successor results. 2 Non-GAAP revenue, Non-GAAP gross margin, Non-GAAP operating income and Adjusted EBITDA are not measures calculated in accordance with generally accepted accounting principles in the U.S. (“GAAP”). Refer to Supplemental Financial Information accompanying this press release for more information, including a reconciliation of these measures to the most closely comparable measure calculated in accordance with GAAP. Cautionary Note Regarding Forward-Looking Statements This document contains certain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking” statements for purposes of the U.S. federal and state securities laws. These statements may be identified by the use of forward looking terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," “our vision,” "plan," "potential," "preliminary," "predict," "should," "will," or “would” or the negative thereof or other variations thereof or comparable terminology and include, but are not limited to, the outlook for the third quarter of fiscal 2018. The company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond its control. These factors are discussed in Amendment No. 3 to the company’s Registration Statement on Form 10 filed with the Securities and Exchange Commission (the “SEC”), and may cause its actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. For a further list and description of such risks and uncertainties, please refer to the company’s filings with the SEC that are available at www.sec.gov. The company cautions you that the list of important factors included in the company’s SEC filings may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this report may not in fact occur. The company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Revision of Prior Period Amounts During the second quarter of fiscal 2018 ended March 31, 2018, the company identified and corrected a cut- off error as of December 15, 2017, the date the company emerged date from Chapter 11 proceedings, related to an understatement of cash and a corresponding overstatement of accounts receivable of $26 million. These accounts were correctly reported as of December 31, 2017. Because of the application of fresh start accounting as of December 15, 2017, Stockholder’s Equity and Goodwill were also each understated by the same amount but not corrected as of December 31, 2017. The company determined that these errors were not material and corrected the errors in the applicable period of the consolidated financial statements included elsewhere in this release and will correct them in the March 31, 2018 Form 10-Q. Use of non-GAAP (Adjusted) Financial Measures The information furnished in this release includes non-GAAP financial measures that differ from measures calculated in accordance with generally accepted accounting principles in the United States of America (“GAAP”), including the combined three month period ending December 31, 2017, combined six month period ending March 31, 2018 and financial measures labeled as “non-GAAP” or “adjusted.” Although GAAP requires that we report on our results for the periods October 1, 2017 through December 15, 2017 and December 16, 2017 through December 31, 2017 or March 31, 2018 as applicable, separately, management reviews the company’s operating results for the three and six months ended December 31, 2017 and March 31, 2018 by combining the results of these two periods because such presentation provides the most meaningful comparison of our results. The company cannot adequately benchmark the operating results of the 16-day period ended December 31, 2017 against any of the previous periods reported in its condensed consolidated financial statements and does not believe that reviewing the results of this period in isolation would be useful in identifying any trends regarding the company’s overall performance. Management believes that the key performance metrics such as revenue, gross margin and operating income when combined for the three and six months ended December 31, 2017 and March 31, 2018, respectively, provide meaningful comparisons to other periods and are useful in identifying current business trends. We also present the measures non-GAAP revenue, non-GAAP gross margin and non-GAAP operating income, as a supplement to our unaudited condensed consolidated financial statements presented in accordance with GAAP. We believe these non-GAAP measures are the most meaningful for comparisons to prior periods because they exclude the impact of the earnings and charges noted in the applicable tables below that resulted from matters that we consider not to be indicative of our ongoing operations. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and maybe different from the non-GAAP financial measures used by other companies. In addition, these non- GAAP measures have limitation in that they do not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP.

EBITDA is defined as net income (loss) before income taxes, interest expense, interest income and depreciation and amortization. Adjusted EBITDA is EBITDA further adjusted to exclude certain charges and other adjustments described in our SEC filings and the tables below. We believe that including supplementary information concerning adjusted EBITDA is appropriate because it serves as a basis for determining management and employee compensation. In addition, we believe adjusted EBITDA provides more comparability between our historical results and results that reflect purchase accounting and our current capital structure. We also present EBITDA and Adjusted EBITDA because we believe analysts and investors utilize these measures in analyzing our results. Accordingly, adjusted EBITDA measures our financial performance based on operational factors that management can impact in the short-term, such as our pricing strategies, volume, costs and expenses of the organization and it presents our financial performance in a way that can be more easily compared to prior quarters or fiscal years. EBITDA and adjusted EBITDA have limitations as analytical tools. EBITDA measures do not represent net income (loss) or cash flow from operations as those terms are defined by GAAP and do not necessarily indicate whether cash flows will be sufficient to fund cash needs. While EBITDA measures are frequently used as measures of operations and the ability to meet debt service requirements, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation. Adjusted EBITDA excludes the impact of earnings or charges resulting from matters that we consider not to be indicative of our ongoing operations. In particular, our formulation of adjusted EBITDA allows adjustment for certain amounts that are included in calculating net income (loss), however, these are expenses that may recur, may vary and are difficult to predict. We do not provide a forward-looking reconciliation of expected third quarter of fiscal 2018 Adjusted EBITDA, Non-GAAP operating income or Non-GAAP revenue guidance as the amount of significance of special items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These special items could be meaningful. The following tables present Successor, Predecessor and combined results and reconcile historical GAAP measures to non-GAAP measures.

Avaya Holdings Corp. Supplemental Schedule of Non-GAAP Adjusted EBITDA (Unaudited; in millions) Successor Predecessor Successor Predecessor Predecessor Three Three Period from Period from months months December 16, October 1, Six months ended ended 2017 through 2017 through ended March 31, March 31, March 31, December 15, March 31, 2018 2017 2018 2017 2017 Net (loss) income $ (130) $ (8) $ 107 $ 2,977 $ (111) Interest expense 47 38 56 14 212 Interest income (1) (1) (1) (2) (1) (Benefit from) provision for income taxes (9) (19) (255) 459 (16) Depreciation and amortization 123 88 145 31 178 EBITDA 30 98 52 3,479 262 Impact of fresh start accounting adjustments 86 - 113 - - Restructuring charges, net 40 4 50 14 14 Advisory fees 4 14 12 3 65 Acquisition-related costs 7 - 7 - - Reorganization items, net - 42 - (3,416) 42 Share-based and other compensation 5 4 6 - 6 Loss on disposal of long-lived assets 2 - 2 1 - Costs in connection with certain legal matters - - - 37 - Change in fair value of warrant liability 10 - 15 - - Foreign currency gains, net 3 12 1 - 1 Pension/OPEB/nonretirement postemployment benefits and long-term disability costs - 25 - 17 46 Other - - - - 1 Adjusted EBITDA $ 187 $ 199 $ 258 $ 135 $ 437

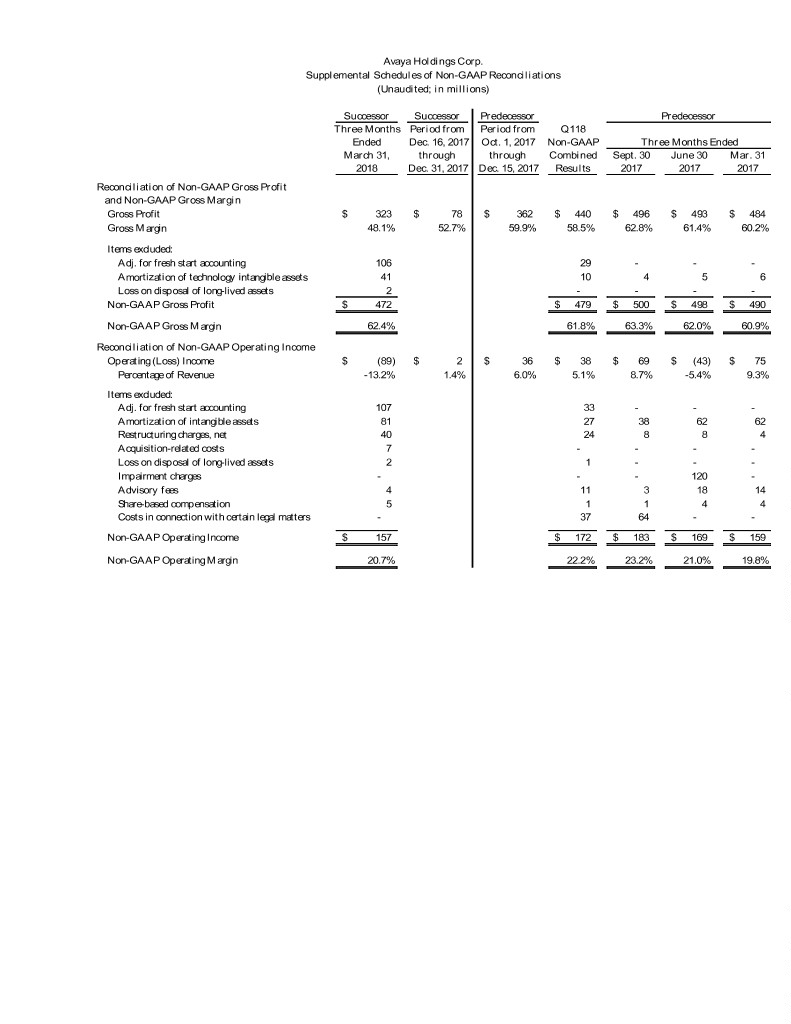

Avaya Holdings Corp. Supplemental Schedules of Non-GAAP Reconciliations (Unaudited; in millions) Successor Successor Predecessor Predecessor Three Months Period from Period from Q118 Ended Dec. 16, 2017 Oct. 1, 2017 Non-GAAP Three Months Ended March 31, through through Combined Sept. 30 June 30 Mar. 31 2018 Dec. 31, 2017 Dec. 15, 2017 Results 2017 2017 2017 Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin Gross Profit $ 323 $ 78 $ 362 $ 440 $ 496 $ 493 $ 484 Gross Margin 48.1% 52.7% 59.9% 58.5% 62.8% 61.4% 60.2% Items excluded: Adj. for fresh start accounting 106 29 - - - Amortization of technology intangible assets 41 10 4 5 6 Loss on disposal of long-lived assets 2 - - - - Non-GAAP Gross Profit $ 472 $ 479 $ 500 $ 498 $ 490 Non-GAAP Gross Margin 62.4% 61.8% 63.3% 62.0% 60.9% Reconciliation of Non-GAAP Operating Income Operating (Loss) Income $ (89) $ 2 $ 36 $ 38 $ 69 $ (43) $ 75 Percentage of Revenue -13.2% 1.4% 6.0% 5.1% 8.7% -5.4% 9.3% Items excluded: Adj. for fresh start accounting 107 33 - - - Amortization of intangible assets 81 27 38 62 62 Restructuring charges, net 40 24 8 8 4 Acquisition-related costs 7 - - - - Loss on disposal of long-lived assets 2 1 - - - Impairment charges - - - 120 - Advisory fees 4 11 3 18 14 Share-based compensation 5 1 1 4 4 Costs in connection with certain legal matters - 37 64 - - Non-GAAP Operating Income $ 157 $ 172 $ 183 $ 169 $ 159 Non-GAAP Operating Margin 20.7% 22.2% 23.2% 21.0% 19.8%

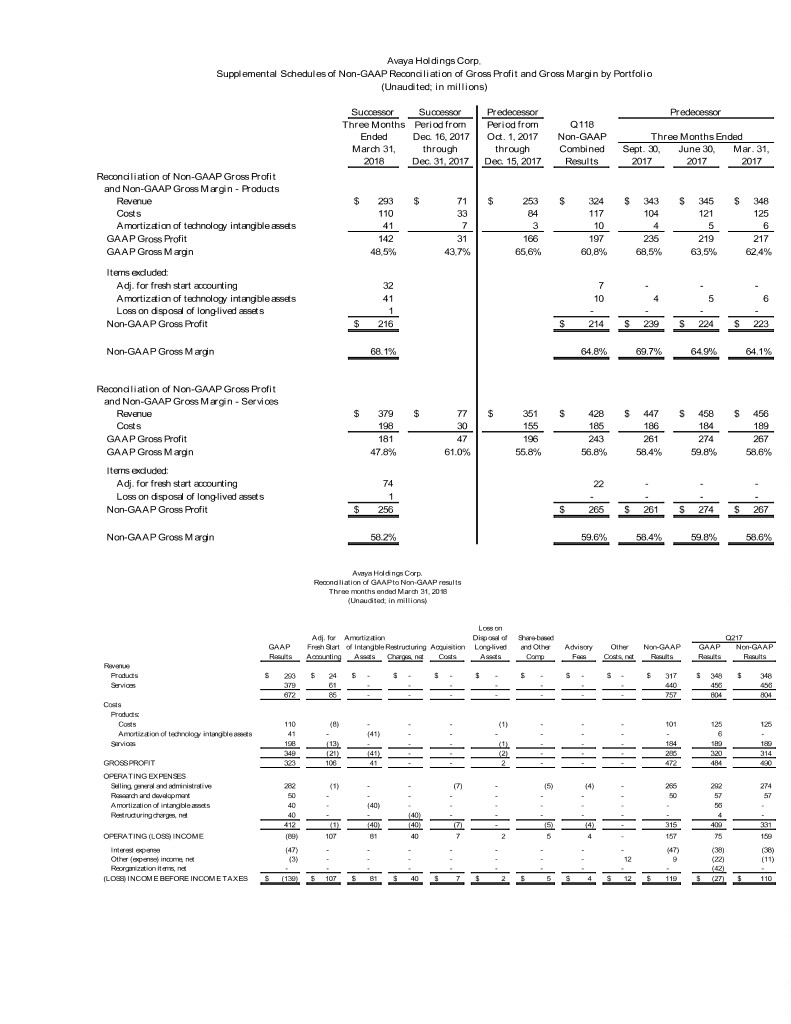

Avaya Holdings Corp. Supplemental Schedules of Non-GAAP Reconciliation of Gross Profit and Gross Margin by Portfolio (Unaudited; in millions) Successor Successor Predecessor Predecessor Three Months Period from Period from Q118 Ended Dec. 16, 2017 Oct. 1, 2017 Non-GAAP Three Months Ended March 31, through through Combined Sept. 30, June 30, Mar. 31, 2018 Dec. 31, 2017 Dec. 15, 2017 Results 2017 2017 2017 Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Products Revenue $ 293 $ 71 $ 253 $ 324 $ 343 $ 345 $ 348 Costs (exclusive of amortization of technology intangible assets) 110 33 84 117 104 121 125 Amortization of of technology technology intangible intangible assets assets 41 7 3 10 4 5 6 GAAP Gross Profit 142 31 166 197 235 219 217 GAAP Gross Margin 48.5% 43.7% 65.6% 60.8% 68.5% 63.5% 62.4% Items excluded: Adj. for fresh start accounting 32 7 - - - Amortization of technology intangible assets 41 10 4 5 6 Loss on disposal of long-lived assets 1 - - - - Non-GAAP Gross Profit $ 216 $ 214 $ 239 $ 224 $ 223 Non-GAAP Gross Margin 68.1% 64.8% 69.7% 64.9% 64.1% Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Services Revenue $ 379 $ 77 $ 351 $ 428 $ 447 $ 458 $ 456 Costs 198 30 155 185 186 184 189 GAAP Gross Profit 181 47 196 243 261 274 267 GAAP Gross Margin 47.8% 61.0% 55.8% 56.8% 58.4% 59.8% 58.6% Items excluded: Adj. for fresh start accounting 74 22 - - - Loss on disposal of long-lived assets 1 - - - - Non-GAAP Gross Profit $ 256 $ 265 $ 261 $ 274 $ 267 Non-GAAP Gross Margin 58.2% 59.6% 58.4% 59.8% 58.6% Avaya Holdings Corp. Reconciliation of GAAP to Non-GAAP results Three months ended March 31, 2018 (Unaudited; in millions) Loss on Adj. for Amortization Disposal of Share-based Q217 GAAP Fresh Start of Intangible Restructuring Acquisition Long-lived and Other Advisory Other Non-GAAP GAAP Non-GAAP Results Accounting Assets Charges, net Costs Assets Comp Fees Costs, net Results Results Results Revenue Products $ 293 $ 24 $ - $ - $ - $ - $ - $ - $ - $ 317 $ 348 $ 348 Services 379 61 - - - - - - - 440 456 456 672 85 - - - - - - - 757 804 804 Costs Products: Costs 110 (8) - - - (1) - - - 101 125 125 Amortization of technology intangible assets 41 - (41) - - - - - - - 6 - Services 198 (13) - - - (1) - - - 184 189 189 349 (21) (41) - - (2) - - - 285 320 314 GROSS PROFIT 323 106 41 - - 2 - - - 472 484 490 OPERATING EXPENSES Selling, general and administrative 282 (1) - - (7) - (5) (4) - 265 292 274 Research and development 50 - - - - - - - - 50 57 57 Amortization of intangible assets 40 - (40) - - - - - - - 56 - Restructuring charges, net 40 - - (40) - - - - - - 4 - 412 (1) (40) (40) (7) - (5) (4) - 315 409 331 OPERATING (LOSS) INCOME (89) 107 81 40 7 2 5 4 - 157 75 159 Interest expense (47) - - - - - - - - (47) (38) (38) Other (expense) income, net (3) - - - - - - - 12 9 (22) (11) Reorganization items, net - - - - - - - - - - (42) - (LOSS) INCOME BEFORE INCOME TAXES $ (139) $ 107 $ 81 $ 40 $ 7 $ 2 $ 5 $ 4 $ 12 $ 119 $ (27) $ 110

### Follow Avaya