Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - CA, INC. | ca-ex23_20180331.htm |

| EX-32 - CERTIFICATION PURSUANT TO 906 - CA, INC. | ca-ex32_20180331.htm |

| EX-31.2 - CERTIFICATION OF THE CFO PURSUANT TO 302 - CA, INC. | ca-ex312_20180331.htm |

| EX-31.1 - CERTIFICATION OF THE CEO PURSUANT TO 302 - CA, INC. | ca-ex311_20180331.htm |

| EX-24 - POWER OF ATTORNEY - CA, INC. | ca-ex24_20180331.htm |

| EX-21 - SUBSIDIARIES OF THE REGISTRANT - CA, INC. | ca-ex21_20180331.htm |

| EX-12 - STATEMENT OF RATIOS OF EARNINGS TO FIXED CHARGES - CA, INC. | ca-ex12_20180331.htm |

| EX-10.58 - FORM OF EXECUTIVE RESTRICTED STOCK AGREEMENT UNDER CA, INC. 2011 INCENTIVE PLAN - CA, INC. | ca-ex1058_20180331.htm |

| EX-10.52 - AMENDED AND RESTATED TERM LOAN AGREEMENT - CA, INC. | ca-ex1052_20180331.htm |

| EX-10.49 - SCHEDULES A, B AND C TO CA, INC. CHANGE IN CONTROL SEVERANCE POLICY - CA, INC. | ca-ex1049_20180331.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One) | |

ü | Annual Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended March 31, 2018 | |

OR | |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

Commission file number 1-9247

CA, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 13-2857434 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

520 Madison Avenue, New York, New York | 10022 | |

(Address of Principal Executive Offices) | (Zip Code) | |

1-800-225-5224

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

(Title of each class) | (Name of each exchange on which registered) | |

Common Stock, par value $0.10 per share Stock Purchase Rights Preferred Stock, Class A | The NASDAQ Stock Market LLC The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ü No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ü No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ü Accelerated filer Non-accelerated filer Smaller reporting company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ü

The aggregate market value of the common stock held by non-affiliates of the registrant as of September 29, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $10.3 billion based on the closing price of $33.38 on the NASDAQ Stock Market LLC on that date.

The number of shares of each of the registrant’s classes of common stock outstanding at May 2, 2018 was 416,617,226 shares of common stock, par value $0.10 per share.

Documents Incorporated by Reference:

Part III: Portions of the Proxy Statement to be issued in conjunction with the registrant’s 2018 Annual Meeting of Stockholders.

CA, Inc.

Table of Contents

Part I | |

Part II | |

Part III | |

Part IV | |

2

This Annual Report on Form 10-K (“Form 10-K”) contains certain forward-looking information relating to CA, Inc. (which we refer to as the “Company,” “Registrant,” “CA Technologies,” “CA,” “we,” “our,” or “us”) that is based on the beliefs of, and assumptions made by, our management as well as information currently available to management. When used in this Form 10-K, the words “believes,” “plans,” “anticipates,” “expects,” “estimates,” “targets,” and similar expressions relating to the future are intended to identify forward-looking information. Forward-looking information includes, for example, not only the statements relating to the future made under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under Item 7, but also statements relating to the future that appear in other parts of this Form 10-K. This forward-looking information reflects our current views with respect to future events and is subject to certain risks, uncertainties, and assumptions, some of which are described under the caption “Risk Factors” in Part I, Item 1A and elsewhere in this Form 10-K. Should one or more of these risks or uncertainties occur, or should our assumptions prove incorrect, actual results may vary materially from the forward-looking information described in this Form 10-K as believed, planned, anticipated, expected, estimated, targeted or similarly identified. We do not intend to update these forward-looking statements.

The product and service names mentioned in this Form 10-K are used for identification purposes only and may be protected by trademarks, trade names, service marks and/or other intellectual property rights of the Company and/or other parties in the United States and/or other jurisdictions. The absence of a specific attribution in connection with any such mark does not constitute a waiver of any such right. All other trademarks, trade names, service marks and logos referenced herein belong to their respective companies.

References in this Form 10-K to fiscal 2018, fiscal 2017, fiscal 2016, fiscal 2015, etc. are to our fiscal years ended on March 31, 2018, 2017, 2016, 2015, etc., respectively.

3

Part I

Item 1. Business.

Overview

CA Technologies is a global leader in software solutions that simplify complex enterprise environments. Our solutions enable customers to plan, develop, automate, manage and secure applications across mobile, cloud, distributed and mainframe platforms. Many of the largest companies in the world, including most of the Fortune 500 and many government agencies, rely on CA software to help manage and secure their hybrid cloud environments.

Our mission is to eliminate the barriers between ideas and business outcomes. To achieve this, we have built a portfolio of solutions that enable customers to leverage the benefits of agility, automation, insights and security in managing business processes and technology investments. Customers are transforming their businesses to better manage the market demands for speed, exceptional customer experience and rich analytics. We believe this journey, broadly referred to as digital transformation, is fueled by software.

Operating Segments

In fiscal 2018, our business was organized in three distinct but highly complementary operating segments: Enterprise Solutions, Mainframe Solutions and Services. These also represented the operating segments used by our Chief Executive Officer for evaluating our performance and allocating resources.

• | Our Enterprise Solutions segment includes a broad range of software planning, development, and management tools. More specifically, our solutions help customers with secure application development, infrastructure management, automation, and identity-centric security solutions. These products are designed for mobile, cloud, and distributed computing environments and run on industry standard servers. |

• | Our Mainframe Solutions segment includes solutions for the IBM z Systems® platform, which runs many of our largest customers’ mission critical business applications. Our Mainframe Solutions help customers improve economics by increasing throughput and lowering cost per transaction, increasing business agility through DevOps tooling and processes, increasing reliability and availability of operations through machine intelligence and automation solutions, and protecting enterprise data with security and compliance. |

• | Our Services segment helps customers reach their information technology (“IT”) and business goals primarily by enabling the rapid implementation and adoption of our software solutions. Our Services team consists of experienced professionals who provide a variety of services, such as consulting, implementation, application management services, education and support services, to both commercial and government customers. With approximately 900 certified consultants, architects, project managers and advisors located in 31 countries and an extensive partner ecosystem, CA Services works with customers to navigate complex business and technology challenges. |

Our segments strengthen each other in several ways. Our customers benefit from the ability of CA solutions to span their entire infrastructure stack, across mobile, cloud, distributed, and mainframe. This is critical as customers focus on their end users’ experiences on their apps and the underlying transactions that traverse their heterogeneous environments. CA is one of the few companies positioned to deliver solutions that span mobile, cloud, open systems and mainframe environments. This hybrid cloud capability helps customers remove the barriers between ideas and business outcomes. We are able to bidirectionally leverage our core strengths and development efforts in our products within the Enterprise Solutions segment to bring new innovations to the Mainframe Solutions segment and vice versa. Our strong market position enables our investment in development, innovation and support of the mainframe platform to be among the largest in the industry, which sustains ongoing customer commitment to our Mainframe Solutions. We leverage our core strengths and development efforts across platforms, allowing customers to apply automation that improves quality and efficiency while enabling flexibility to optimize their technology assets. Our solutions help customers bridge their historical investments to the frameworks and architectures they are building for the future. Our Services segment leverages our expertise across our Mainframe Solutions and Enterprise Solutions segments and helps customers deploy and maintain our solutions. Refer to Note 16, “Segment and Geographic Information,” in the Notes to the Consolidated Financial Statements for financial data pertaining to our segment and geographic operations.

Focus of Our Business

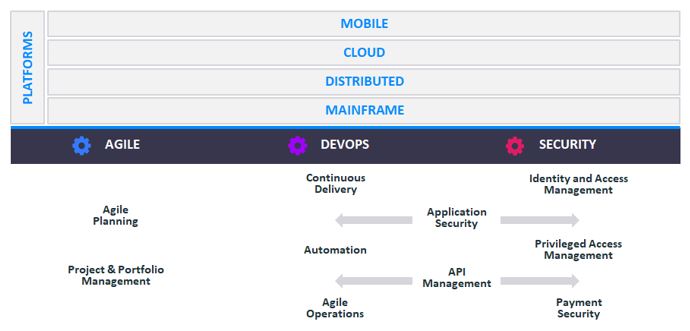

The focus of our business is aligned around three strategic pillars: Agile, DevOps and Security, each of which contain portfolios of solutions spanning the continuum of platforms, from mobile to mainframe.

4

Agile

Our Agile portfolio defines how work is planned, executed and serviced to deliver rapid value to our customers, and enables customers to plan, deliver, manage and optimize application development and project management. Our capabilities within Agile include:

• | Agile Planning helps customers transform their development practices from traditional to modern agile methodologies. Agile development utilizes an iterative work cadence with a feedback loop that decreases time-to-market, increases product quality and, most importantly, maintains a focus on generating rapid business value. CA’s cloud-based solutions in this space help customers to collaboratively plan, prioritize and track agile software development at scale. |

• | Project & Portfolio Management, which is highly complementary to Agile Planning, enables customers to collect, prioritize, plan and deliver products, services and customer experiences. CA’s solutions improve decision making processes and resource optimizations, and decrease project execution risk. |

DevOps

Our DevOps portfolio accelerates software delivery and enables customers to more efficiently deliver and manage applications and infrastructure. The portfolio empowers developers with a rich set of tools that help simplify, automate, and make their processes and applications more robust. They enable better experiences for developers and for the end users of their higher quality applications. Our DevOps portfolio strategy is platform agnostic, providing customers the flexibility to optimize workloads across mobile, cloud, on-premise, and mainframe environments. Our capabilities within DevOps include:

• | Continuous Delivery optimizes the application development processes by automating the deployment of applications across all stages of their lifecycles. Continuous delivery is key to transforming the technical aspects of software delivery. Our solutions enable the development, testing and release teams to work concurrently and continuously to remove the excess overhead and delays that come with traditional software development. |

• | Automation solutions help customers transform business processes. They automate, orchestrate and accelerate the entire application delivery process. Our unified platform provides end-to-end automation capabilities that cover service orchestration, workload automation and release automation capabilities. |

• | Agile Operations helps customers correlate end-user, application and infrastructure data from cloud-hosted containers to mainframes. Our solutions help customers see application dependencies and provide intelligent analytics, comprehensive coverage, and an open, extensible architecture that improves end-user experience. |

• | API (Application Programming Interface) Management facilitates the creation, security and management of APIs through their lifecycle, enabling customers to connect more directly with end-users via mobile apps, cloud platforms and “Internet of Things” devices. |

Security

Our Security portfolio provides customers, employees and partners seamless access to the right data, regardless of the underlying platform. Our Security portfolio is designed to minimize the risk of data breaches and alleviate the increased pressures faced by chief information security officers. Our capabilities within Security include:

• | Application Security offers a holistic and scalable way to manage security risk across an application lifecycle. Through our acquisition of Veracode, we provide a wide range of security testing and threat mitigation techniques. Our solution is hosted on a unified application security testing platform and integrates into existing development toolchains. This enables users to quickly identify and remediate security flaws earlier in the development process and supports the development of high-quality, secure code. |

• | Identity & Access Management provides enterprise-grade identity management and governance capabilities, including broad provisioning support for on-premises and cloud-based applications, extensibility and flexibility to integrate with other IT systems and consumer-grade scale. |

• | Privileged Access Management enables organizations to control and monitor the access and activity of privileged users, or users with elevated access or administrator rights. Our solutions help detect and prevent the threat of internal and external attacks leveraging both network and host-based controls for the enterprise and hybrid cloud. |

• | Payment Security is a software as a service (“SaaS”)-based payment authentication service to help banks protect against fraud and ensure a hassle-free online shopping experience for their customers. |

5

Figure 1 - Portfolio and Platform Overview

Business Strategy

Our goal is to be the world’s leading independent enterprise software provider that helps organizations and enterprises plan, develop, manage, and secure modern software environments, across mainframe, distributed, cloud and mobile platforms. To accomplish this, key elements of our strategy include:

• | Drive organic innovation. Our product development strategy is built around key growth areas, where we are focused on innovating and delivering differentiated products and solutions across both distributed and mainframe platforms. We are focused on developing solutions that are easy to use, easy to implement and have a low total cost of ownership. A key element of our organic innovation approach is the broad adoption of the Agile methodology to govern our software development process, which we believe improves our product development time-to-market, quality and relevance, and supports our customer success initiatives. |

• | Incubate technology for next generation products. We are researching and dedicating resources to the development of emerging technologies that are logical extensions of our core areas of focus. We are working on opportunities in areas such as containers, data analytics, big data, artificial intelligence, machine learning and open source, some of which may enhance or extend our current product portfolio and others of which may evolve into new product categories. |

• | Pursue new business models and expanded routes to market. While our traditional on-premise software delivery remains relevant to many enterprise customers, we see cloud-based and try-and-buy models as attractive to both our existing and potential customers. These models simplify decision-making and accelerate the value customers can derive from new solution investments. New delivery models allow us to extend our market reach, speed adoption of our solutions, improve our efficiencies and compete more effectively for a larger number of customers globally. As such, our new product development is focused on our customers’ need for solutions that are simple and cost-effective to buy, install, deploy, manage and secure. |

• | Expand relationships with our global customer base and address opportunities with new and underserved customers. We are focused on maintaining and expanding the strong relationships with our established customer base, and will proactively target growth with other potential customers that we do not currently serve. In parallel, we seek to broaden our customer base to new buyers in geographic regions we have underserved. The emerging roles of chief information security officers and chief development officers impact who and where IT environment purchasing decisions are made within our customers. This shift aligns with the product portfolio decisions we are making across our solutions set to meet our customers’ accelerating need for speed and agility. We are refining our sales, services, marketing and customer success resources to reach beyond the customers’ chief information officer and IT department to serve these new customer roles and respond to changes in customer buying behaviors. |

6

• | Execute strategic and disciplined technology acquisitions. We intend to supplement our organic innovation efforts with key technology acquisitions that are within or adjacent to our core areas of focus. We conduct a thorough acquisition process, which includes build vs. buy analysis and opportunity identification, detailed business case modeling, rigorous due diligence and extensive integration, to fully realize the value of our acquisitions. We also focus on organically developing nascent technologies from companies we have acquired to provide them with the necessary interoperability, resilience and security to operate at scale in the large, heterogeneous IT environments utilized by our customers. |

Fiscal 2018 Developments and Highlights

The following are significant developments and highlights relating to our business during fiscal 2018:

• | In November 2017, we held our user conference, CA World ‘17. This event showcased the most extensive list of products in recent Company history, with more than 20 new offerings and enhancements designed to help customers leverage agile practices, intelligent automation, data insights and end-to-end security for better and faster business outcomes. |

• | In February 2018, Jean M. Hobby was elected as a member of the Company’s Board of Directors. |

• | In February 2018, Ethisphere Institute named CA Technologies one of the World’s Most Ethical Companies. |

• | In fiscal 2018, CA Technologies was recognized as a leader in 20 industry analyst reports. |

Organizational Update

Effective May 3, 2018, Adam Elster no longer serves as our President, Global Field Operations. Mr. Elster will remain employed through August 17, 2018 in order to be available to assist with an orderly transition. We have inserted interim leadership as an external search for Mr. Elster’s replacement is underway.

Seasonality

Some of our business results are seasonally weighted toward the second half of our fiscal year, including cash flow from operations and total bookings. However, these business results may not always follow this pattern during a fiscal year. Given the varying durations and dollar amounts of the contracts being renewed, year-over-year comparisons of total bookings and collections associated with these bookings, financial results are not always indicative of the overall total bookings trend.

Customers

We currently serve customers across most major industries worldwide, including banks, insurance companies, other financial services providers, government agencies, global IT service providers, telecommunication providers, transportation companies, manufacturers, technology companies, retailers, educational organizations and health care institutions. Our traditional customers generally consist of large enterprises that have computing environments from multiple vendors and are highly complex. As the emergence of cloud computing has democratized the technology landscape, we have increased our focus on addressing a broader customer set.

No single customer accounted for 10% or more of our total revenue for fiscal 2018, 2017 or 2016. Approximately 7% and 6% of our total revenue backlog at March 31, 2018 and 2017, respectively, is associated with multi-year contracts signed with the U.S. federal government and other U.S. state and local government agencies, which are generally subject to annual fiscal funding approval and/or renegotiation or termination at the discretion of the government.

Sales and Marketing

We offer our solutions through our direct and digital sales forces as well as indirectly through our partners. We remain focused on strengthening relationships and increasing penetration within our core customers and partners - approximately our top 2,000 accounts. We refer to this key group of customers as “Enterprise” accounts. We believe maintaining and expanding our relationships within our traditional customer base of large enterprises with multi-year agreements will continue to drive renewals and provide opportunities to increase account penetration to help drive revenue growth. We address our “Commercial” account opportunities through partners and our digital sales efforts. We believe this group of customers and potential customers represents an opportunity for us to leverage a cost-effective distribution network to sell to net new customers and increase our share of wallet at customers where we have lower levels of penetration.

We are working to accelerate the velocity of our sales transactions and are implementing initiatives to drive consistent improvement in sales execution. We are continuing to shift to a more solutions-driven sales approach, using real-time data and intelligence to drive on-going evolution of our go-to-market strategy towards the highest potential and highest-yielding opportunities. We continue to increase investment in our digital sales and marketing organization to drive additional new land and expand opportunities. This enables us to cost effectively scale our reach to a broader set of buyers.

7

Our sales organization operates globally, with groups serving the North America (“NA”), Europe, the Middle East and Africa (“EMEA”), Latin America (“LA”), and Asia Pacific and Japan (“APJ”) geographies. We operate through branches, subsidiaries and partners around the world. Approximately 37% and 36% of our revenue in fiscal 2018 and 2017, respectively, was from operations outside of the United States. At March 31, 2018 and 2017, we had approximately 2,800 and 3,000, respectively, of sales and sales support personnel.

Marketing has played a key role in the ongoing transformation of our Company. It has helped to reshape perceptions of CA and to build capability that enables us to better serve our customers’ digital transformation. The critical role we play in enabling companies to compete and service customers in a software-defined era is now better understood and is driving interest in our offerings. The concept of the “Modern Software Factory” is resonating with customers and helps to reinforce the value proposition of CA’s portfolio of solutions. Operationally, to accelerate the role marketing plays in creating demand, we have sharpened our talent, tools and processes to better reach new customers to drive a higher velocity of opportunity creation for sales via digital marketing. Our marketing and sales organizations utilize common systems and analytics to initiate and respond to market opportunities, optimize resources, maximize efficiency and drive awareness and consideration of our brand and portfolio capabilities across our broad base of customers and prospects.

Partners

Our partners represent a foundational component of our go-to-market strategy. Our objective is to leverage our solutions and our partners’ strengths to deliver exceptional customer experiences, create greater value for our customers, and drive profitable and sustainable growth for both us and our partners. At the core of our global partner strategy, we aim to align our products, routes to market, customer segments and our strategic partners. Our data-driven approach of aligning our global partner strategy with market opportunities, channel trends and dynamic changes in the industry enables us to match our offerings and investments to specific markets.

We jointly build business with our partners in all our geographic regions through five key routes to market:

• | Resellers derive revenue primarily from the resale of third-party products. We work with a number of key strategic national and regional reseller partners to expand our global reach. |

• | Global Service Providers provide a platform for application infrastructure or cloud-based service offerings. We seek to establish long-term partnerships, usually via outsourcing arrangements, to support the development of innovative, differentiated service offerings. |

• | Global System Integrators offer our software within their business practices, leveraging their process design, planning, and vertical expertise to provide holistic solutions and implementation services to our joint customers. |

• | Managed Service Providers leverage our solutions to power their subscription-based IT services. We work together to deliver differentiated, high-value managed services. |

• | Global Technology Partners (including Independent Software Vendors and Infrastructure and Public Cloud Vendors) offer an opportunity for joint solutions, innovative business models, and CA brand awareness. |

Global Customer Success

The Global Customer Success (“GCS”) organization is made up of customer experience designers, customer advocates, technical support engineers, community managers and an advanced customer data analytics team that share a common goal to deliver a superior end-to-end customer experience that creates and sustains satisfaction and loyalty, and serves as a source of competitive advantage for CA.

The Customer Success team within GCS works with customers to understand their unique business challenges to help maximize the value of their investments in our solutions. The Customer Success team aligns with members from education, support, services, partners and development to drive customer adoption, facilitate product expansion and to provide maximum return in minimal time.

CA Support engineers within GCS work with customers during trials and after the sale to assist in migration and upgrades, resolve issues 24/7, create self-help knowledge documentation, and proactively mitigate risks to prevent issues before they occur. CA Support operates in 42 locations worldwide, providing assistance in 16 languages while consistently earning industry-leading customer satisfaction ratings.

Throughout the customer experience, customers are encouraged to join online communities to interact and engage with their peers, partners, and our CA experts. We have more than 61,000 community members in our 50 most active communities who network, ask and answer questions, and share knowledge about our solutions.

Research and Development

We have approximately 5,100 employees globally who design, develop, and support our software. We operate principal research and development centers across the United States, including California, Colorado, Illinois, Massachusetts, New York, Pennsylvania, and Texas. Internationally, we have principal centers in Austria, Canada, Czech Republic, India, and Israel.

8

In fiscal 2018, research and development continued to focus on developing solutions that are easy for customers to buy, install, use and maintain, and improving the quality and stability in our broadly deployed products which allows us to focus investment towards innovation initiatives.

We are advancing our Agile, DevOps and Security solutions while endeavoring to build a common technology stack across several of our product lines. We are making strides towards this shared component approach to make it easier, faster and more efficient for new solutions to be built.

We are also accelerating innovation with our CA Accelerator, which uses an incubator model to apply lean start-up best practices to grow new businesses. We are interested in areas of increasing importance to enterprises, such as big data, analytics, containerization, developer productivity, security and the “Internet of Things”. This model helps ensure we are making appropriate investments and building technology that customers value, using a small-batch, cost-efficient approach. We are also utilizing university partnerships to support and advance development.

Our research and development activities include a number of efforts to support our technical community in its pursuit of creating leading solutions for customers. We continue to use our Office of the Chief Technology Officer Research and Open Source and Open Standards initiatives to strengthen our relationships with research communities by working with academia, professional associations, industry standards bodies, customers and partners to explore novel products and emerging technologies. We also engage with universities to conduct product-focused research to create solutions for emerging opportunities.

We have charged to operations $642 million, $586 million, and $560 million in fiscal 2018, 2017 and 2016, respectively, for product development and enhancements.

Our product offerings and go-to-market strategy continue to evolve to include solutions that may be delivered either on-premise or via SaaS or cloud platforms. We expect our product offerings to continue to become available to customers at more frequent intervals than our historical release cycles. Over the last few years, we have continued to leverage Agile development methodologies, which are characterized by a dynamic development process with more frequent revisions to a product release’s features and functions as the software is being developed. In addition, we have implemented a holistic product strategy and portfolio management process, which has improved transparency and efficiency across the portfolio through a quarterly cadence of business reviews.

Intellectual Property

Our products and technology are generally proprietary. We rely on U.S. and foreign intellectual property laws, including patent, copyright, trademark and trade secret laws, to protect our proprietary rights. However, the extent and duration of protection given to different types of intellectual property rights vary under different countries' legal systems. In some countries, full-scale intellectual property protection for our products and technology may be unavailable, and the laws of other jurisdictions may not protect our proprietary technology rights to the same extent as the laws of the United States. We also maintain contractual restrictions in our agreements with customers, employees and others to protect our intellectual property rights. These restrictions generally bind our customers and employees to confidentiality regarding our intellectual property and limit our customers’ use of our software and prohibit certain disclosures to third parties.

We regularly license software and technology from third parties, including some competitors, and incorporate them into our own software products. We include third-party technology in our products in accordance with contractual relationships that specify our rights.

We believe that our patent portfolio differentiates our products and services from those of our competitors, enhances our ability to access third-party technology and helps protect our investment in research and development. We continue to enhance our internal patent program to increase our ability to capture patents, strengthen their quality and increase the pace at which we are able to move our innovations through the patent process. At March 31, 2018, our patent portfolio included more than 1,500 issued patents and more than 950 pending applications in the United States and abroad. The patents generally expire at various times over the next 20 years. Although the durations and geographic intellectual property protection coverage for our patents may vary, we believe our patent portfolio adequately protects our interests. Although we have a number of patents and pending applications that may be of value to various aspects of our products and technology, we are not aware of any single patent that is essential to us or to any of our reportable segments.

The source code for our products is protected both as trade secrets and as copyrighted works. Our customers do not generally have access to the source code for our products. Rather, on-premise customers typically access only the executable code for our products, and SaaS customers access only the functionality of our SaaS offerings. Under certain contingent circumstances, some of our customers are beneficiaries of a source code escrow arrangement that enables them to obtain a limited right to access our source code.

We continue to be engaged in efforts to more fully employ our intellectual property by strategically licensing and/or assigning selected assets within our portfolio. This effort is intended to better position us in the marketplace and allow us the flexibility to reinvest in improving our overall business.

9

Licensing and Engagements with Customers

For traditional, on-premise licensing, we typically license to customers either perpetually or on a subscription basis for a specified term. Our customers also purchase maintenance and support services that provide technical support and any general product enhancements released during the maintenance period.

Under a perpetual license, the customer has the right to use the licensed program for an indefinite period of time, typically upon payment of a one-time license fee. If the customer wants to receive maintenance, the customer is required to pay an additional annual maintenance fee.

Under a subscription license, the customer has the right to usage and maintenance of the licensed products during the term of the agreement. Under our licensing terms, customers can license our software products under multi-year licenses, with most customers choosing one to five-year terms, although some large customers may negotiate longer terms. Thereafter, the license generally renews for the same period of time on the same terms and conditions.

Within these license categories, our contracts provide customers with the right to use our products under a variety of models including, but not limited to:

• | A typical designated central processing unit (“CPU”) license, under which the customer may use the licensed product on a single, designated CPU. |

• | A license based on millions of instructions per second (“MIPS”), which allows the customer to use the licensed product on one or more CPUs, limited by the aggregate MIPS rating of the CPUs covered by the license. |

• | A user-based license, under which the customer may use the licensed product by or for the agreed number of licensed users. |

• | A designated server license, under which the customer may use a certain distributed product on a single, designated server. The licensed products must be licensed for use with a specific operating system. |

Customers can obtain licenses to our products through individual discrete purchases to meet their immediate needs or through the adoption of enterprise license agreements. Enterprise license agreements are comprehensive licenses that cover multiple products and also provide for maintenance and support.

For our mainframe solutions, the majority of our licenses provide customers with the right to use one or more of our products up to a specific license capacity, generally measured in MIPS. For these products, customers may acquire additional capacity during the term of a license by paying us an additional license fee and maintenance fee. For our enterprise solutions, our licenses may provide customers with the right to use one or more of our products limited to a number of servers, users or copies, among other things. Customers may license these products for additional servers, users or copies, etc., during the term of a license by paying us an additional license fee and maintenance fee.

Our services are typically delivered on a time-and-materials basis, but alternative pay arrangements, such as fixed fee or staff augmentations, could be offered as well.

SaaS is another delivery model we offer for certain products when a customer prefers to use our technology off-premises with little or no infrastructure required. Our SaaS offerings are typically licensed for a designated term using a subscription fee. Some of our SaaS business is transaction or usage-based. Our SaaS products, which are becoming a larger part of our Enterprise Solutions portfolio, typically have a shorter average duration and smaller initial contract values compared to the more traditional on-premise delivery model.

Competition

Our industry is extremely competitive and characterized by: continually changing customer needs, rapid technological change; frequent emergence of new companies and products; evolving industry standards, computing platforms, go-to-market approaches and business models.

Our competition can generally be categorized into the following groups:

• | A broad set of point product vendors in a number of our markets, many of which lack near-term profit expectations; |

• | Larger, vertically integrated technology companies that can bundle software to generate other revenue capture tied to hardware, platform, and services offerings; |

• | Continued expansion of cloud service provider offerings from Amazon Web Services, Microsoft Azure, and Google Cloud Platform embedded with management and security capabilities; and |

• | Increasing adoption of open source solutions that may substitute for commercial spend. |

Among the companies with which we compete are: AppDynamics, Inc. (acquired by Cisco); Atlassian Corporation, Plc; BMC Software Inc.; BeyondTrust; Compuware Corporation; CyberArk Software, Ltd.; International Business Machines Corporation; Micro Focus; Microsoft Corporation; MuleSoft, Inc. (acquired by Salesforce.com, Inc. in May 2018); New Relic, Oracle Corporation; SailPoint, Inc.; ServiceNow, Inc.; SolarWinds, Inc.; Splunk, Inc.; and VMware, Inc.

10

We believe the combination of our breadth of portfolio of enterprise management tools, our platform and hardware independence, and our deep customer relationships set us apart from other established competitors in the market. Further, we believe we are differentiated from emerging point-product providers by our global reach, breadth and synergy of offerings, deep industry experience, and strong balance sheet.

Employees

We believe that innovation and invention are the by-products of an inclusive and diverse workplace. Diversity of perspective, experience and thought are key to driving creativity, innovation, and results. We are committed to providing equitable opportunities and giving employees avenues for success - both personally and professionally. We believe that workforce diversity is an important topic in the technology sector, and we are dedicated to moving the conversation on diversity forward.

We had approximately 11,300 and 11,800 employees at March 31, 2018 and 2017, respectively.

Fiscal 2018 Employee Highlights

• | In May 2017, we were named one of America’s Best Employers by Forbes Magazine. |

• | In May 2017, we were named a Best Company for Multicultural Women by Working Mother Magazine. |

• | In September 2017, we were named one of Working Mother Magazine’s 100 Best Companies. |

• | In November 2017, we received a perfect score of 100 percent on the 2018 Corporate Equality Index, a national benchmarking survey and report on corporate policies and practices related to LGBT workplace equality, administered by the Human Rights Campaign Foundation. |

• | In December 2017, we were named one of Fortune’s Best Workplaces for Diversity by Great Places to Work®. |

• | In January 2018, we were included in Bloomberg’s first Sector-Neutral Gender-Equality Index. |

• | In March 2018, we were named one of NAFE’s Top Companies for Executive Women by the National Association for Female Executives. |

Financial Information About Geographic Areas

Refer to Note 16 “Segment and Geographic Information,” in the Notes to the Consolidated Financial Statements for financial data pertaining to our segment and geographic operations.

Corporate Information

The Company was incorporated in Delaware in 1974, began operations in 1976 and completed an initial public offering of common stock in December 1981. Our common stock is traded on The NASDAQ Global Select Market tier of The NASDAQ Stock Market LLC under the symbol “CA.”

Our corporate website address is www.ca.com. All filings we make with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, our proxy statements and any amendments thereto filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available for free in the Investor Relations section of our website (www.ca.com/invest) as soon as reasonably practicable after they are filed with or furnished to the SEC. Our SEC filings are available to be read or copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information about the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. Our filings can also be obtained for free on the SEC’s website at www.sec.gov. The reference to our website address does not constitute inclusion or incorporation by reference of the information contained on our website in this Form 10-K or other filings with the SEC, and the information contained on our website is not part of this document.

The Investor Relations section of our website (www.ca.com/invest) also contains information about our initiatives in corporate governance, including: our Corporate Governance Principles; information about our Board of Directors (including specific procedures for communicating with them); information concerning our Board of Directors Committees; and our Code of Conduct (which qualifies as a “code of ethics” under applicable SEC regulations and is applicable to all of our employees, including our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer, and our directors are expected to act consistently with the underlying ethical principles of such code). These documents can also be obtained in print by writing to our Corporate Secretary at CA, Inc., 520 Madison Avenue, New York, New York 10022.

Item 1A. Risk Factors.

Current and potential stockholders should consider carefully the risk factors described below. Any of these risks, some of which are beyond our control, could materially adversely affect our business, financial condition, operating results and cash flow, which could negatively impact our stock price.

11

Failure to execute our growth strategy could materially adversely affect our business, financial condition, operating results and cash flow.

Our business strategy is to create long-term sustainable growth, both organically and through acquisitions, while selling products and services that address customer needs and capitalize on current and next-generation market opportunities. The success of this strategy could be affected by our ability to:

• | Ensure that any new offerings address the needs of a rapidly changing market while not adversely affecting demand for our traditional products; |

• | Execute renewals within our existing customer base at acceptable renewal rates; |

• | Expand relationships with our global customer base and address opportunities with new customers (e.g., in geographic regions where we have underserved, or with chief information security officers and chief development officers, who have not been our traditional customers) at levels sufficient to offset any declines in revenue in our Mainframe Solutions segment, which is subject to an industry-wide decline due to new technologies, and in mature product lines in our Enterprise Solutions segment; |

• | Effectively manage the strategic shift in our business model to increase sales through our digital sales forces and indirectly through our partners, as well as provide additional SaaS offerings, offer try-and-buy models and refocus our professional services and education engagements on those engagements that are connected to new product sales, without affecting our financial performance to an extent greater than anticipated; and |

• | Effectively manage our pricing and other go-to-market strategies, as well as improve the CA Technologies brand, technology and innovation awareness in the marketplace. |

If we are unable to successfully execute our growth strategy, there could be a material adverse effect on our business, financial condition, operating results and cash flow.

We are subject to intense competition in product and service offerings and pricing, and we expect this to continue in the future, which could either diminish demand for, or inhibit growth of, our products and reduce our sales, revenue and market presence.

Our business strategy is based upon our ability to develop and acquire products and services that are accepted by the market better than those of our competitors. There can be no assurance that we will effectively meet these competitive demands. The markets for our products and services are intensely competitive, and we expect product and service offerings and pricing competition to continue. Some of our competitors have longer operating histories, greater name recognition, a larger installed base of customers in any particular market niche, larger technical staffs, established relationships with hardware vendors, or greater financial, technical and marketing resources than us. We also face competition from numerous start-ups and smaller companies that specialize in specific aspects of the highly fragmented software industry, and from open source authors who may provide software and intellectual property for free, competitors who may offer their products through try-and-buy or freemium models, and customers who may develop competing products. Competition from any of these sources could also result in price reductions or displacement of our products, which could materially adversely affect our financial results.

Our competitors also include large vendors of hardware and operating system software and cloud service providers, who continue to both expand their product and service offerings, and consolidate offerings into broad product lines. The widespread inclusion of products that perform the same or similar functions as our products bundled within computer hardware or other companies’ software products, or the provision of services similar to those provided by us, could reduce the perceived need for our products and services, or render our products obsolete and unmarketable. In addition, the software industry is currently undergoing consolidation as software companies seek to offer more extensive suites and broader arrays of software products and services, as well as integrated software and hardware solutions. The increased bundling of products and services and industry consolidation may adversely affect our competitive position, which could materially adversely affect our sales, revenue and market presence. Refer to Part I, Item 1, “Business - Competition,” of this Form 10-K for additional information.

Failure to innovate or adapt to technological changes, or develop and introduce new software products and services in a timely and market-accepted manner, could materially adversely affect our business.

We operate in a highly competitive industry characterized by rapid technological changes, evolving industry standards, changes in customer requirements and new delivery methods. The newer enterprise solutions markets in which we operate - including non-mainframe platforms from physical to virtual and cloud - are far more crowded and competitive than our traditional mainframe systems management markets.

12

Our ability to compete effectively depends upon many factors, including the success of our existing solutions, the timely introduction and success of future software products and services, including those that we acquire or develop, and related delivery methods (e.g., SaaS), as well as our ability to provide successful, timely and adequate customer support. Further, as our existing products mature, they may become obsolete. The emergence of cloud computing means that many of our enterprise solutions customers are themselves undergoing a radical shift in the way they deliver IT services to their businesses. The shift towards delivering infrastructure and SaaS from the cloud may negatively affect our ability to sell IT management solutions to our traditional enterprise solutions customers. Failure to adapt our products, solutions, delivery models and sales approaches to effectively plan for cloud computing may adversely affect our business. If we are not successful in anticipating the rate of market change towards the cloud computing paradigm and evolving with it by delivering solutions for IT management in the cloud computing environment, customers may forgo the use of our products, particularly certain mature product lines in our Enterprise Solutions segment, in favor of those with comparable functionality delivered via the cloud.

We have experienced long development cycles and product delays in the past, particularly with some of our enterprise solutions, and even with the Agile development methodology we may experience delays in the future. In addition, we have incurred and expect to continue to incur significant research and development costs to introduce new products and integrate products into solution sets. If there are delays in new product introduction or solution set integration, or if there is less-than-anticipated market acceptance of these new products or solution sets, we may have invested substantial resources without realizing adequate revenues in return. Furthermore, there can be no assurance that as technologies become outdated or new delivery methods are required, we will be able to adopt or introduce them as quickly as our competitors, or within budgeted costs and time frames, which could adversely affect our business and reputation.

If our products do not remain compatible with ever-changing operating environments, platforms, or third-party products, we could lose customers and the demand for our products and services could decrease, which could materially adversely affect our business, financial condition, operating results and cash flow.

The largest suppliers of systems and computing software are, in most cases, the manufacturers of the computer hardware systems used by most of our customers, particularly in the mainframe space. These companies periodically modify or introduce new operating systems, systems software and computer hardware. In the future, new products from these companies could require substantial modification of our products to maintain compatibility with these companies’ hardware or software. There can be no assurance that we will be able to adapt our products and our business to future changes introduced by hardware manufacturers and system software developers.

Further, our solutions interact with a variety of software and hardware developed by third parties and we may lose access to third-party code and specifications for the development of code, which could materially adversely affect our ability to develop software compatible with third-party software products in the future. Some software providers and hardware manufacturers, including some of the largest vendors, have a policy of restricting the use or availability of their code or technical documentation for some of their operating systems, applications, or hardware. To date, this policy has not had a material effect on us. Some companies, however, may adopt more restrictive policies in the future or impose unfavorable terms and conditions for such access. These restrictions may, in the future, result in higher research and development costs for us in connection with the enhancement and modification of our existing products and the development of new products. Any additional restrictions could materially adversely affect our business, financial condition, operating results and cash flow.

Given the global nature of our business, economic factors or political events beyond our control and other business and legal risks associated with global operations can affect our business in unpredictable ways.

International revenue has historically represented a significant percentage of our total worldwide revenue. Success in selling and developing our products throughout the world depends on a variety of factors, including:

• | Developing and executing an effective go-to-market strategy in various locations; |

• | Foreign exchange rates; |

• | Changes in global, economic and political landscapes; |

• | Acts of terrorism; |

• | Workforce reorganizations in various locations, including global reorganizations of sales, research and development, technical services, finance, human resources and facilities functions; |

• | Effectively staffing key managerial and technical positions; |

• | Successfully localizing software products for a significant number of international markets; |

• | Restrictive employment regulation; and |

• | Trade restrictions such as tariffs, duties, taxes or other controls. |

13

In addition, compliance by us and our partners (including unaffiliated third-party partners) with differing local laws, regulations and interpretations in multiple international jurisdictions, as well as compliance with U.S. laws and regulations where applicable in these international locations increases our cost of doing business. These laws and regulations include restrictive local laws regarding the transfer of funds from, or the conversion of currencies in, certain countries, international intellectual property laws, which may be more restrictive or may offer lower levels of protection than U.S. law, as well as anti-corruption, competition, anti-money laundering, export control and data privacy laws and regulations, including the U.S. Foreign Corrupt Practices Act of 1977, the UK Bribery Act of 2010, the EU-U.S. and Swiss-U.S. Privacy Shield Frameworks, as well as the new EU General Data Protection Regulation, which will become effective on May 25, 2018, the Network and Information Security Directive in the EU, trade controls and sanctions administered by the U.S. Office of Foreign Assets Control, and similar laws and regulations in other jurisdictions.

We have implemented policies, procedures and controls designed to achieve compliance with applicable laws and regulations, but our corporate policies, process and controls may not prevent or detect all potential breaches of law or other governance practices. Any violation of these laws could lead to substantial civil and criminal fines and penalties, litigation, loss of operating licenses or permits and other collateral consequences.

An unfavorable development regarding any of the foregoing factors, many of which are beyond our control, could materially adversely affect our business.

Failure to sell and renew license agreements on a satisfactory basis could materially adversely affect our business, financial condition, operating results and cash flow.

The success of our business depends on attracting new customers to our products and solution sets and retaining or increasing the level of revenues derived from existing customers. We utilize direct sales efforts, as well as third-party partners, to sell our products and solutions sets, and our sales efforts may be unsuccessful. Many of our existing customers have multi-year enterprise license agreements, some of which involve substantial aggregate fee amounts. These customers have no contractual obligation to purchase additional solutions. Customer renewal rates may decline or fluctuate as a result of a number of factors, including the level of customer satisfaction with our solutions or customer support, customer budgets and the pricing of our solutions as compared with the solutions offered by our competitors, any of which may cause our revenue to grow more slowly than expected, if at all. The failure to sell new license agreements and renew transactions in the future, or failure to replace those enterprise license agreements with renewal transactions of similar scope, on terms that are commercially attractive to us, could materially adversely affect our business, financial condition, operating results and cash flow.

Failure to expand partner programs and failure by our partners to leverage their sales channels to drive our revenue growth may result in lost sales opportunities and a weakening of our market position.

In addition to our direct sales efforts, we sell our products and solutions through various partner channels, which include resellers, global service providers, global system integrators, managed service providers and global technology partners. Through our various global partner programs, we provide incentives, training, enablement and marketing investments so our partners have the capability and expertise to sell and deliver these solutions to their customers. We also leverage global systems integrators and global service providers to assist with and influence the sales of solutions to our top customers and we utilize resellers to better penetrate the partner-driven commercial market. The failure to expand partner programs or failure by our partners to leverage their sales channels could result in lost incremental sales opportunities that adversely affect our overall business success, including our market position.

Our business may suffer if we are not able to retain and attract qualified professionals, including key managerial, technical, marketing and sales professionals.

We depend on our ability to identify, recruit, hire, train, develop and retain qualified and effective professionals and to attract and retain talent needed to execute our business strategy, which ability depends on, among other factors, the strength of our brand recognition. We also depend on our ability to perform these tasks with respect to professionals from acquired companies, which ability may be negatively impacted by our efforts to integrate and rationalize the products and lines of business we have acquired. Our ability to do so depends on numerous factors, including factors that we cannot control, such as competition and conditions in the local employment markets in which we operate. Effective succession planning is also important for our long-term success. Failure to ensure effective transfers of knowledge and smooth transitions involving key employees could hinder our strategic planning and execution. As our success depends in a large part on the continued contribution of our senior management and other key employees, a loss of a significant number of skilled managerial, technical or other professionals could have a negative effect on the quality of our products. A loss of a significant number of experienced and effective sales professionals could result in lower sales of our products. Furthermore, many of our key personnel receive a compensation package that includes equity awards. Any new regulations, volatility in the stock market or other factors could diminish our use, and the value, of our equity awards, forcing us to use a higher proportion of cash compensation to incentivize our key personnel, or putting us at a competitive disadvantage.

14

Changes in generally accepted accounting principles may materially adversely affect our reported results of operations or financial position.

From time to time, the Financial Accounting Standards Board (“FASB”) issues new accounting principles. For example, in May 2014, the FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers, with amendments in 2015, 2016 and 2017, which creates new Accounting Standards Codification Topic 606 (“Topic 606”) that will replace most existing revenue recognition guidance in U.S. generally accepted accounting principles (“GAAP”) when it becomes effective for us in the first quarter of fiscal 2019. Under Topic 606, more judgment and estimates will be required within the revenue recognition process than are required under existing GAAP. We currently anticipate that this standard will have a material effect on our consolidated financial statements, revenue recognition policies and related disclosures. We also presently anticipate that this standard could create volatility in our reported revenue and operating results, which could negatively impact our stock price. We currently believe the most significant effect relates to the timing of the recognition of our software license revenue. As a result, a significant portion of our revenue backlog (i.e., deferred revenue and future billings on committed contracts) relating to the license component of customer contracts at March 31, 2018 under existing GAAP will not be recognized as revenue in future periods but instead will be included as part of the cumulative effect adjustment within retained earnings upon adoption of Topic 606. Refer to Note 1, “Significant Accounting Policies,” in the Notes to the Consolidated Financial Statements for additional information about Topic 606 and other new accounting pronouncements. Changes to existing rules, or changes to the interpretations of existing rules, could lead to changes in our accounting policies, systems and internal controls over financial reporting. For example, in connection with our adoption of Topic 606, we are developing new policies and processes based on the changes in revenue recognition guidance and implementing a new revenue recognition accounting system. Such changes and any difficulties implementing such changes could materially adversely affect our reported financial results and the effectiveness of our internal controls.

We may encounter difficulties in successfully integrating companies and products that we have acquired or may acquire into our existing business, which could materially adversely affect our business, financial condition, operating results and cash flow.

In the past we have acquired, and in the future we expect to acquire, complementary companies, products, services and technologies through a number of different vehicles, including through mergers, asset acquisitions, joint ventures, partnerships, strategic alliances and equity investments. Additionally, we expect to acquire technology that is consistent with our business strategy. The risks we may encounter with any such acquisition or integration of an acquisition include:

• | We may find that the acquired company or assets do not improve our financial and/or strategic position as planned; |

• | We may have difficulty integrating the operations, facilities, personnel and compensation plans of the acquired business; |

• | We may have difficulty retaining the skills needed to further market, sell or provide services on the acquired products in a manner that will be accepted by the market; |

• | We may have difficulty incorporating the acquired technologies or products into our existing product lines, and in selling such technologies or products to our customers and through our partner programs; |

• | Our ongoing business may be disrupted by transition or integration issues and our management’s attention may be diverted from other business initiatives; |

• | Our relationships with current and new employees, customers and business partners could be impaired; |

• | An acquisition may result in increased litigation risk, including litigation from terminated employees or third parties, as well as product, customer or intellectual property liability; |

• | Our due diligence process may fail to identify significant issues with the acquired company’s product quality, financial disclosures, accounting practices, internal control deficiencies including material weaknesses, product architecture, legal and tax contingencies, compliance with differing, changing and potentially inconsistent local laws, regulations and interpretations in multiple international jurisdictions, as well as compliance with U.S. laws and regulations where applicable in these international locations, and other matters; and |

• | We may not be able to realize the benefits of recognized goodwill and intangible assets and this may result in the potential impairment of these assets. |

These risks can be heightened during periods when we seek to integrate multiple acquisitions at the same time or in a relatively short period of time. Furthermore, to the extent we issue shares of stock or other rights to purchase stock, including options, to pay for acquisitions or to retain employees, existing stockholders’ interests may be diluted and income per share may decrease. The occurrence of any of these risks could have a material adverse effect on our business, results of operations, financial condition and cash flow.

15

Our data center, network and software products, and the IT environments of our business partners and customers are subject to hacking or other cybersecurity threats, which could result in a loss or misuse of proprietary, personally identifiable and confidential information and/or harm to our customer relationships and the market perception of the effectiveness of our products.

Given that some of our products are intended to manage and secure IT infrastructures and environments, we expect to be an ongoing target of cybersecurity attacks. Open source code or other third-party software used in our infrastructure and products could also be targeted, as could our software being utilized by our customers. This risk can be heightened for acquired products, which may not have gone through the same testing and quality control measures as our organically developed products. Additionally, our SaaS business includes the hosting of customer data and uses third-party data centers that may also be subject to hacking incidents. If our SaaS business increases substantially, whether due to organic growth or the acquisition of SaaS businesses, our exposure to hacking incidents could increase due to the increase in the volume of SaaS business activity and the potential increase in the number of SaaS technology platforms we might maintain. Although we continually seek to improve our countermeasures to prevent such incidents, we may be unable to anticipate every scenario and it is possible that certain cyber threats or vulnerabilities will be undetected or unmitigated in time to prevent an attack on us and our customers. Cybersecurity attacks could require significant expenditures of our capital and diversion of our resources. Additionally, efforts by hackers or others could cause interruptions, delays or cessation of our product licensing, or modification of our software, which could cause us to lose existing or potential customers. If these attacks are successful, they could result in the theft of proprietary, personally identifiable, confidential and sensitive information of ours, our employees, our customers and our business partners, and could materially disrupt business for us, our customers and our business partners. A successful cybersecurity attack involving our data center, network or software products could also negatively impact the market perception of the effectiveness of our products or lead to contractual disputes, litigation or government regulatory action against us, any of which could materially adversely affect our business.

If we do not adequately manage, evolve and protect our information systems, infrastructure and processes, our ability to manage and grow our business may be harmed.

We rely on our information systems and those of third parties for managing the financial information of our business. For example, in connection with our adoption of Topic 606, we are implementing a new revenue recognition accounting system. Any disruption in such information systems could have a significant impact on our business. In addition, we continuously work to enhance our information systems and infrastructure and integrate those of acquired companies, which is frequently disruptive to the underlying business. Additionally, delays in adapting our information systems to address new business models, such as SaaS, or the adoption of Topic 606 could limit the success or result in the failure of those initiatives and impair the effectiveness of our internal controls.

Although we have implemented a disaster recovery program, our system redundancy may be ineffective or inadequate and our disaster recovery planning may not be sufficient for all situations, including scenarios associated with acquired companies. Failure to adequately address these issues, as well as to manage and protect our infrastructure, could adversely affect our ability to manage and grow our business, including our SaaS business.

General economic conditions and credit constraints, or unfavorable economic conditions in a particular region, business or industry sector, may lead our customers to delay or forgo technology investments and could have other impacts, any of which could materially adversely affect our business, financial condition, operating results and cash flow.

Our products are designed to improve the productivity and efficiency of our customers’ information processing resources. However, a general slowdown in the global economy or in a particular region, such as Europe, a disruption in a business or an industry sector or tightening of credit markets could cause our current or any new customers to have difficulty accessing credit sources, delay contractual payments, or delay or forgo decisions to (i) license our products (particularly with respect to discretionary spending for software), (ii) upgrade existing environments or (iii) purchase services.

Furthermore, a general slowdown in the global economy may also materially affect the global banking system, including individual institutions as well as a particular business or industry sector, which could cause consolidations or failures in that sector. Approximately one third of our revenue is derived from arrangements with financial institutions (i.e., banking, brokerage and insurance companies). In addition, we derive material portions of our revenue from other industries such as telecommunications and health care that rely on transaction processing. The majority of these arrangements are for the renewal of mainframe solutions capacity and maintenance associated with transactions processed by our customers. While we cannot predict what impact there may be on our business from changes to the financial industry, telecommunications or health care sectors, or the impact on our business from the economy in general, any material change in general economic conditions, or conditions in a particular sector, may lead our customers to delay or forgo technology investments and could have other impacts, any of which could affect the manner in which we are able to conduct business.

16

Our sales to government clients subject us to uncertainties regarding fiscal funding approvals, renegotiations or terminations at the discretion of the government, as well as audits and investigations, which could result in litigation, penalties and sanctions including early termination, suspension and debarment.

Approximately 7% of our total revenue backlog at March 31, 2018 is associated with multi-year contracts signed with the U.S. federal government and other U.S. state and local government agencies. These contracts are generally subject to annual fiscal funding approval and may be renegotiated or terminated at the discretion of the government. Termination, renegotiation or the lack of funding approval for a contract could adversely affect our sales, revenue and reputation. Additionally, our government contracts are generally subject to certain requirements, some of which are generally not present in commercial contracts and/or may be complex, as well as to audits and investigations. Failure to meet contractual requirements could result in various civil and criminal actions and penalties, and administrative sanctions, including termination of contracts, refund of a portion of fees received, forfeiture of profits, suspension of payments, fines and suspensions or debarment from doing business with the government and could materially adversely affect our business, financial condition, operating results and cash flow.

Fluctuations in foreign exchange rates could result in losses.

We operate global businesses and our consolidated financial results are reported in U.S. dollars. Most of the revenue and expenses of our foreign subsidiaries are denominated in local currencies. Given that cash is typically received over an extended period of time for many of our license agreements and given that a substantial portion of our revenue is generated outside of the United States, fluctuations in foreign exchange rates against the U.S. dollar could result in substantial changes in reported revenues and operating results due to the foreign exchange impact of translating these transactions into U.S. dollars.

In the normal course of business, we employ various hedging strategies to partially mitigate these risks, including the use of derivative instruments. These strategies may not be effective in protecting us against the effects of fluctuations from movements in foreign exchange rates. As a result, fluctuations of the foreign exchange rates could result in financial losses.

Discovery of errors or omissions in our software products could materially adversely affect our revenue and earnings.

The software products we offer are inherently complex. Despite testing and quality control, we cannot be certain that errors or omissions will not be found in current versions, new versions, documentation or enhancements of our software products. This risk can be heightened with acquired products which may not have gone through the same testing and quality control measures as our organically developed products. If new or existing customers have difficulty deploying our products or require significant amounts of customer support, our operating margins could be adversely affected. We could also face possible claims and higher development costs if our products contain errors that we have not detected, cause damage to customer or third-party systems, or otherwise fail to meet customer expectations. Significant technical challenges also arise with our products because our customers license and deploy our products across a variety of computer platforms and integrate them with a number of third party software applications and databases. These combinations increase our risk further because, in the event of a system-wide failure, it may be difficult to determine which product is at fault, which could cause us to be harmed by the failure of another supplier’s products. As a result of the foregoing, we could experience:

• | Loss of or delay in revenue and loss of market share; |

• | Loss of customers, including the inability to obtain repeat business with existing key customers; |

• | Damage to our reputation; |