Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TREDEGAR CORP | ex99_1.htm |

| EX-16.1 - EXHIBIT 16.1 - TREDEGAR CORP | ex16_1.htm |

| EX-10.1 - EXHIBIT 10.1 - TREDEGAR CORP | ex10_1.htm |

| 8-K - 8-K - TREDEGAR CORP | form8k.htm |

ANNUALMEETING 2018 Exhibit 99.2

2018 Annual Meeting Forward Looking Statements & Non-GAAP Measures 2 Certain statements contained in this presentation are forward-looking statements. Pursuant to federal securities regulations, we have set forth cautionary statements relating to those forward-looking statements in our Annual Report on Form 10-K for the year ended December 31, 2017, in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 and in other filings with the Securities and Exchange Commission. We urge readers to review and carefully consider these cautionary statements and the other disclosures we make in our filings with the SEC.This presentation contains non-GAAP financial measures that are not determined in accordance with United States GAAP. These non-GAAP financial measures should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with United States GAAP. A reconciliation of those financial measures to United States GAAP financial measures is included under “Supplemental Information” in this presentation and is available on the company’s website at www.tredegar.com under “Investors”.The presentation speaks as of the date thereof. Tredegar is not, and should not be deemed to be, updating or reaffirming any information contained therein. We do not undertake, and expressly disclaim any duty, to update any forward-looking statements made in this presentation to reflect any change in management’s expectations or any change in conditions, assumptions or circumstances on which such statements are based.

2018 Annual Meeting Agenda 3 Tredegar Financial ReportDrew Edwards, Vice President and Chief Financial OfficerUpdate on Surface ProtectionBapi DasGupta, President Surface ProtectionUpdate on Personal Care Steve Prince, President Personal CareConcluding RemarksJohn Gottwald, President and Chief Executive OfficerQuestions

Tredegar Financial Report Drew EdwardsVice President and Chief Financial Officer

2018 Annual Meeting Bridge of Tredegar First Quarter 2017 to 2018 EPS from Ongoing Operations 5 ($ Millions Except EPS Data)

2018 Annual Meeting Tredegar EPS from Ongoing Operations Since 2012 6

2018 Annual Meeting Tredegar Debt, Net of Cash (“Net Debt”) 7 ($ Millions)

Surface Protection Bapi DasGuptaPresident Surface Protection

2018 Annual Meeting Surface Protection Introduction 9 Leading provider of highly specialized films used to protect extremely sensitive surfaces of critical components, including optical films and specialty substrates in display devices (TVs, tablets, phones, etc.)Value Proposition – Improve yields and ensure pristine quality during customer manufacturing processes & shipment = $$$ savings to customers + supply reliability Technology and Quality Leader in Industry

2018 Annual Meeting Surface Protection Financial Performance 10 Display industry = $185 billion; Projected 5-Year CAGR = 4-5%*; Industry is cyclicalSurface Protection 10 year sales CAGR in line with industry at 6% with record operating profit in 2017 *Source: IHS Display Long Term Demand Forecast Tracker – Q3 2017

2018 Annual Meeting Surface Protection Threats, Challenges and Countermeasures 11 RisksProduct substitution ($5 - $10 million operating profit exposure)Customer concentrationElectronics industry cyclicality and pricing pressure Proactively addressing threats & challenges Countermeasures Customer diversification# 1 business priorityValue-added new productsContinuous improvement in quality for higher performance devices

2018 Annual Meeting Surface Protection Growth Strategy 12

2018 Annual Meeting Surface Protection Growth Opportunities 13 Growth opportunities driven by “Internet of Things” and demand for higher performance displays:Flexible displaysAutomotive displaysHigher performance mobile phone marketLarge screen displaysTouch screens Supported by robust product pipeline including potential technology disruptors

Personal Care Steve PrincePresident Personal Care

Feminine Care Products 2018 Annual Meeting What Does Personal Care Do? Our Areas of Focus: Acquisition Distribution Layer 15 We develop Topsheet, Acquisition Distribution Layer & Elastic Products for Feminine Care Pads, Diapers and Adult Incontinence Applications Elastics Adult Incontinence Under Garments Baby & AdultDiapers Topsheet

2018 Annual Meeting Personal Care Net Sales Trend 16

2018 Annual Meeting Personal Care R&D Spending to Drive Growth 17

2018 Annual Meeting Personal Care Elastics Growth 18 Now offering “zoned” elastic materialsExpecting continued growth in Elastics volumes in 2018New materials have captured new customers and applicationsBreathable elastic films and fabrics promoting quality of lifeInvesting $25 Million in North America ElasticsTwo state of the art manufacturing assets in Terre Haute, INLeveraging off of successes with European Elastics Become the “Go To” supplier and solution provider for Comfort, Fit & Confidence Moving Toward Full Utilization of $10 Million European Elastics Investment Baby & AdultDiapers

2018 Annual Meeting Personal Care Topsheet Strategy 19 Successful launch of ADL for baby diapers in Latin America$14 million revenue in 2017Leverage win in Latin America to globally penetrate ADLs Solve our customers’ toughest problem: Grow market share with improved product performance at lower costsDedicated R&D resources to launch next generation ADLsEnhance consumer’s diapering experience with superior dryness & comfortPlan to launch in North America and Europe in May 2018 AquiDry™ PlusADL

2018 Annual Meeting Personal Care Acquisition Distribution Layer (ADL) Growth 20 Strategy: Deliver Unsurpassed Comfort, Fit and Dryness by Emphasizing our Hydroforming TechnologyExpect Two New Platforms to Launch in 2019Cottony soft films Laminate fabrics that deliver a best-in-class combination of softness, dryness, and leakage prevention Establish Tredegar as the Topsheet Leader and Broaden Customer Base

2018 Annual Meeting Personal Care Summary 21 Personal Care Going Through a Total TransformationHistorical dependence on P&GStrategic Focus to Drive GrowthDiversifying our customer base Execute Elastics growth initiativesContinue to grow the ADL business with new productsDevelop and sell new Hydroformed Film & Laminate Topsheets Phoenix Rising PERSONAL CARE

Concluding Remarks John GottwaldPresident and Chief Executive Officer

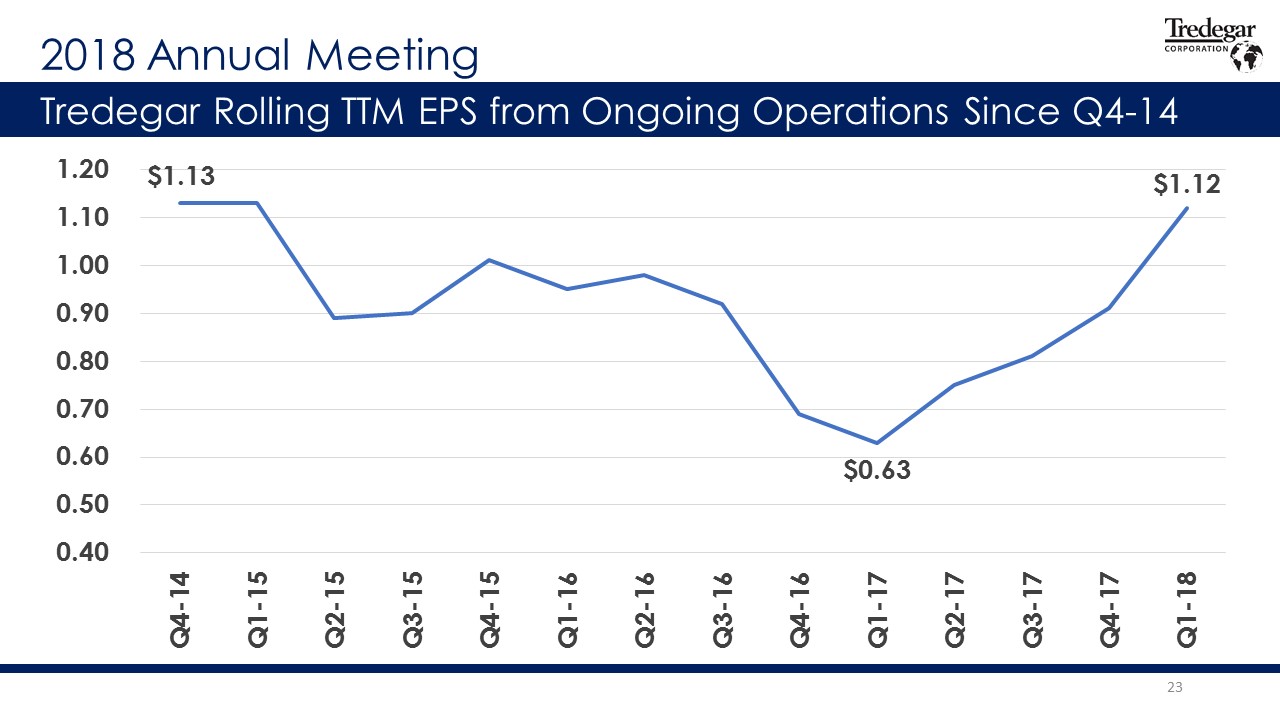

2018 Annual Meeting Tredegar Rolling TTM EPS from Ongoing Operations Since Q4-14 23

Record Year in 2017Strategic Focus:New ProductsNew Customers 2018 Annual Meeting Surface Protection 24

2018 Annual Meeting Personal Care Challenge 25 $70 Million Sales Decline on the Horizon

Invest$35 Million Capital in Elastics$11 Million R&D Spending in 2017ObjectiveNew ProductsNew Customers 2018 Annual Meeting Answer 26

Questions

GAAP to Non-GAAP Reconciliations

GAAP to Non-GAAP Reconciliations 29

GAAP to Non-GAAP Reconciliations 30 3. The rolling quarterly trailing 12 months EPS from ongoing operations was computed using the quarterly reconciliations of US GAAP EPS to non-GAAP EPS from ongoing operations provided in the quarterly earnings press releases and "Operating Results by Segment" on the Quarterly Results page of the Investors section on Tredegar’s website.