Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - TREDEGAR CORP | tg-ex322_20171231x10k.htm |

| EX-32.1 - EXHIBIT 32.1 - TREDEGAR CORP | tg-ex321_20171231x10k.htm |

| EX-31.2 - EXHIBIT 31.2 - TREDEGAR CORP | tg-ex312_20171231x10k.htm |

| EX-31.1 - EXHIBIT 31.1 - TREDEGAR CORP | tg-ex311_20171231x10k.htm |

| EX-23.1 - EXHIBIT 23.1 - TREDEGAR CORP | tg-ex231_20171231x10k.htm |

| EX-21 - EXHIBIT 21 - TREDEGAR CORP | tg-ex21_20171231x10k.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017 | |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission File Number 1-10258

TREDEGAR CORPORATION

(Exact name of registrant as specified in its charter)

Virginia | 54-1497771 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1100 Boulders Parkway, Richmond, Virginia | 23225 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 804-330-1000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock | New York Stock Exchange | |

Preferred Stock Purchase Rights | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | o | Accelerated filer | x | Smaller reporting company | o | ||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Emerging growth company | o | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter): $391,348,943*

Number of shares of Common Stock outstanding as of January 31, 2018: 33,014,831 (33,030,190 as of June 30, 2017)

* | In determining this figure, an aggregate of 7,283,549 shares of Common Stock beneficially owned by Floyd D. Gottwald, Jr., John D. Gottwald, William M. Gottwald and the members of their immediate families has been excluded because the shares are deemed to be held by affiliates. The aggregate market value has been computed based on the closing price in the New York Stock Exchange on June 30, 2017. |

Documents Incorporated By Reference

Portions of the Tredegar Corporation Proxy Statement for the 2018 Annual Meeting of Shareholders (the “Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

Index to Annual Report on Form 10-K

Year Ended December 31, 2017

Page | |||

Part I | |||

Item 1. | Business | 1-4 | |

Item 1A. | Risk Factors | 5-9 | |

Item 1B. | Unresolved Staff Comments | ||

Item 2. | Properties | ||

Item 3. | Legal Proceedings | ||

Item 4. | Mine Safety Disclosures | ||

Part II | |||

Item 5. | Market for Tredegar’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11-13 | |

Item 6. | Selected Financial Data | ||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | ||

Item 8. | Financial Statements and Supplementary Data | ||

Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | ||

Item 9A. | Controls and Procedures | ||

Item 9B. | Other Information | ||

Part III | |||

Item 10. | Directors, Executive Officers and Corporate Governance* | ||

Item 11. | Executive Compensation | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters* | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | ||

Item 14. | Principal Accounting Fees and Services | ||

Part IV | |||

Item 15. | Exhibits and Financial Statement Schedules | ||

Item 16. | Form 10-K Summary | ||

*Items | 11, 13 and 14 and portions of Items 10 and 12 are incorporated by reference from the Proxy Statement. |

PART I

Item 1. | BUSINESS |

Description of Business

Tredegar Corporation (“Tredegar”), a Virginia corporation incorporated in 1988, is engaged, through its subsidiaries, in the manufacture of polyethylene (“PE”) plastic films, polyester (“PET”) films and aluminum extrusions. The financial information related to Tredegar’s polyethylene plastic films, polyester films and aluminum extrusions segments and related geographical areas included in Note 5 of the Notes to Financial Statements is incorporated herein by reference. Unless the context requires otherwise, all references herein to “Tredegar,” “the Company,” “we,” “us” or “our” are to Tredegar Corporation and its consolidated subsidiaries.

The Company's reportable business segments are PE Films, Flexible Packaging Films and Aluminum Extrusions.

PE Films

PE Films manufactures plastic films, elastics and laminate materials primarily utilized in personal care materials, surface protection films, and specialty and optical lighting applications. These products are manufactured at facilities in the United States (“U.S.”), The Netherlands, Hungary, China, Brazil and India. PE Films competes in all of its markets on the basis of product innovation, quality, service and price.

Personal Care. Tredegar’s Personal Care unit is a global supplier of apertured, elastic and embossed films, laminate materials, and polyethylene and polypropylene overwrap films for personal care markets, including:

• | Apertured film and laminate materials for use as topsheet in feminine hygiene products, baby diapers and adult incontinence products (including materials sold under the ComfortAire™, ComfortFeel™ and FreshFeel™ brand names); |

• | Elastic materials for use as components for baby diapers, adult incontinence products and feminine hygiene products (including components sold under the ExtraFlex™ and FlexAire™ brand names); |

• | Three-dimensional apertured film transfer layers for baby diapers and adult incontinence products sold under the AquiDry® and AquiDry Plus™ brand names; |

• | Thin-gauge films that are readily printable and convertible on conventional processing equipment for overwrap for bathroom tissue and paper towels; and |

• | Polypropylene films for various industrial applications, including tape and automotive protection. |

In 2017, 2016 and 2015, personal care materials accounted for approximately 27%, 30% and 33% of Tredegar’s consolidated net sales (sales less freight) from continuing operations, respectively.

Surface Protection. Tredegar’s Surface Protection unit produces single- and multi-layer surface protection films sold under the UltraMask®, ForceField™ and ForceField PEARL™ brand names. These films are used in high-technology applications, most notably protecting high-value components of flat panel displays used in televisions, monitors, notebooks, smart phones, tablets, e-readers and digital signage, during the manufacturing and transportation process. In 2017, 2016 and 2015, surface protection films accounted for approximately 11%, 11% and 10%, respectively, of Tredegar’s consolidated net sales from continuing operations.

Bright View Technologies. Tredegar’s Bright View unit designs and manufactures a range of specialty film-based components that provide tailored functionality for the global engineered optics market. By leveraging multiple technology platforms, including film capabilities and its patented microstructure technology, Bright View offers high performance optical management solutions for a wide range of applications including LED illumination.

1

PE Films’ net sales by market segment over the last three years is shown below:

% of PE Films Net Sales by Market Segment * | |||||

2017 | 2016 | 2015 | |||

Personal Care | 70% | 72% | 75% | ||

Surface Protection | 28% | 25% | 23% | ||

Bright View | 2% | 3% | 2% | ||

Total | 100% | 100% | 100% | ||

* See previous discussion by market segment for comparison of net sales to the Company’s consolidated net sales for significant market segments for each of the years presented. | |||||

Raw Materials. The primary raw materials used by PE Films in polyethylene and polypropylene films are low density, linear low density and high density polyethylene and polypropylene resins. These raw materials are obtained from domestic and foreign suppliers at competitive prices. PE Films believes that there will be an adequate supply of polyethylene and polypropylene resins in the foreseeable future. PE Films also buys polypropylene-based nonwoven fabrics based on the resins previously noted and styrenic block copolymers, and it believes there will be an adequate supply of these raw materials in the foreseeable future.

Customers. PE Films sells to many branded product producers throughout the world, with the top five customers, collectively, comprising 68%, 69% and 73% of its net sales in 2017, 2016 and 2015, respectively. Its largest customer is The Procter & Gamble Company (“P&G”). Net sales to P&G totaled $122 million in 2017, $129 million in 2016 and $164 million in 2015 (these amounts include film sold to third parties that converted the film into materials used with products manufactured by P&G). For additional information, see “Item 1A. Risk Factors”.

Flexible Packaging Films

Flexible Packaging Films is comprised of Terphane Holdings LLC (“Terphane”). Flexible Packaging Films produces PET-based films for use in packaging applications that have specialized properties, such as heat resistance, strength, barrier protection and the ability to accept high-quality print graphics. These differentiated, high-value films are primarily manufactured in Brazil and sold in Latin America and the U.S. under the Terphane® and Sealphane® brand names. Major end uses include food packaging and industrial applications. In 2017, 2016 and 2015, Flexible Packaging Films accounted for approximately 12%, 14% and 12%, respectively, of Tredegar’s consolidated net sales from continuing operations. Flexible Packaging Films competes in all of its markets on the basis of product quality, service and price.

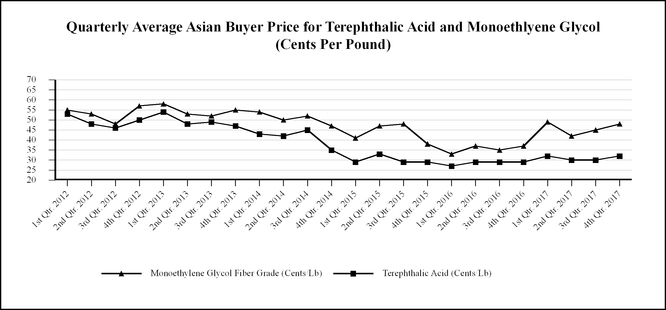

Raw Materials. The primary raw materials used by Flexible Packaging Films to produce polyester resins are purified terephthalic acid (“PTA”) and monoethylene glycol (“MEG”). Flexible Packaging Films also purchases additional polyester resins directly from suppliers. All of these raw materials are obtained from domestic Brazilian suppliers and foreign suppliers at competitive prices, and Flexible Packaging Films believes that there will be an adequate supply of polyester resins as well as PTA and MEG in the foreseeable future.

Aluminum Extrusions

The William L. Bonnell Company, Inc., known in the industry as Bonnell Aluminum, and its operating divisions, AACOA, Inc. and Futura Industries Corporation (“Futura”) (together, “Aluminum Extrusions”), produce high-quality, soft-alloy and medium-strength aluminum extrusions primarily for building and construction, automotive, consumer durables, machinery and equipment, electrical and distribution markets. Aluminum Extrusions manufactures mill (unfinished), anodized and painted (coated) and fabricated aluminum extrusions for sale directly to fabricators and distributors, and it competes primarily on the basis of product quality, service and price. Futura designs and manufactures a wide range of extruded aluminum products for a number of industries and end markets, including branded flooring trims and aluminum framing systems (TSLOTSTM), as well as OEM (original equipment manufacturer) components for electronics, store fixture, transportation, medical, marine, retail, solar and other applications. Sales are made predominantly in the U.S.

On February 15, 2017, Bonnell Aluminum acquired Futura on a net debt-free basis for approximately $92 million ($87 million net of a $5 million refund expected in 2018 from an earnout price adjustment mechanism). The acquisition was funded using Tredegar’s revolving credit agreement and treated as an asset purchase for U.S. federal income tax purposes. Futura, located in Clearfield, Utah, has a national sales presence and particular strength in the western U.S.

2

The end-uses in each of Aluminum Extrusions’ primary market segments include:

Major Markets | End-Uses | |

Building & construction - nonresidential | Commercial windows and doors, curtain walls, storefronts and entrances, walkway covers, ducts, louvers and vents, office wall panels, partitions and interior enclosures, acoustical walls and ceilings, point of purchase displays, pre-engineered structures, and flooring trims | |

Building & construction - residential | Shower and tub enclosures, railing and support systems, venetian blinds, swimming pools and storm shutters | |

Automotive | Automotive and light truck structural components, spare parts, after-market automotive accessories, grills for heavy trucks, travel trailers and recreation vehicles | |

Consumer durables | Furniture, pleasure boats, refrigerators and freezers, appliances and sporting goods | |

Machinery & equipment | Material handling equipment, conveyors and conveying systems, medical equipment, and aluminum framing systems (TSLOTSTM) | |

Distribution (metal service centers specializing in stock and release programs and custom fabrications to small manufacturers) | Various custom profiles including storm shutters, pleasure boat accessories, theater set structures and various standard profiles (including rod, bar, tube and pipe) | |

Electrical | Lighting fixtures, solar panels, electronic apparatus and rigid and flexible conduits | |

Aluminum Extrusions’ net sales by market segment over the last three years is shown below:

% of Aluminum Extrusions Net Sales by Market Segment* | ||||||

2017 | 2016 | 2015 | ||||

Building and construction: | ||||||

Nonresidential | 51% | 59% | 59% | |||

Residential | 9% | 6% | 6% | |||

Automotive | 8% | 9% | 8% | |||

Specialty: | ||||||

Consumer durables | 12% | 11% | 11% | |||

Machinery & equipment | 7% | 6% | 5% | |||

Electrical | 7% | 3% | 6% | |||

Distribution | 6% | 6% | 5% | |||

Total | 100% | 100% | 100% | |||

*Includes Futura as of its acquisition date of February 15, 2017. | ||||||

In 2017, 2016 and 2015, nonresidential building and construction accounted for approximately 26%, 27% and 26% of Tredegar’s consolidated net sales from continuing operations, respectively.

Raw Materials. The primary raw materials used by Aluminum Extrusions consist of aluminum ingot, aluminum scrap and various alloys, which are purchased from domestic and foreign producers in open-market purchases and under short-term contracts. Aluminum Extrusions believes that it has adequate long-term supply agreements for aluminum and other required raw materials and supplies in the foreseeable future.

3

General

Intellectual Property. Tredegar considers patents, licenses and trademarks to be significant to PE Films. As of December 31, 2017, PE Films held 266 issued patents (63 of which are issued in the U.S.) and 108 registered trademarks (9 of which are issued in the U.S.). Flexible Packaging Films held 1 patent, which was issued in the U.S. and 13 registered trademarks (2 of which are registered in the U.S.). Aluminum Extrusions held no U.S. patents and 3 registered trademarks (all of which are registered in the U.S.). These patents have remaining terms ranging from 1 to 20 years. Tredegar also has licenses under patents owned by third parties.

Research and Development. Tredegar’s spending for research and development (“R&D”) activities in 2017, 2016 and 2015 was primarily related to PE Films. PE Films has technical centers in Durham, North Carolina; Richmond, Virginia; and Terre Haute, Indiana. Flexible Packaging has a technical center in Bloomfield, New York. R&D spending by the Company was approximately $18.3 million, $19.1 million and $16.2 million in 2017, 2016 and 2015, respectively.

Backlog. Backlogs are not material to the operations in PE Films or Flexible Packaging Films. Overall backlog for continuing operations in Aluminum Extrusions was approximately $46.2 million at December 31, 2017 compared to approximately $27.1 million at December 31, 2016, an increase of $19.1 million, or approximately 70%. Backlog at December 31, 2017 included $5.7 million for Futura. Net sales for Aluminum Extrusions, which the Company believes is cyclical in nature, was $466.8 million in 2017, $360.1 million in 2016 and $375.5 million in 2015. Net sales for Futura since it was acquired on February 15, 2017 were $71.0 million.

Government Regulation. U.S. laws concerning the environment to which the Company’s domestic operations are or may be subject include, among others, the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Occupational Safety and Health Act, the National Environmental Policy Act, the Toxic Substances Control Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), regulations promulgated under these acts, and other federal, state or local laws or regulations governing environmental matters. Compliance with these laws is an important consideration because Tredegar uses hazardous materials in some of its operations, is a generator of hazardous waste, and wastewater from the Company’s operations is discharged to various types of wastewater management systems. Under CERCLA and other laws, Tredegar may be subject to financial exposure for costs associated with waste management and disposal, even if the Company fully complies with applicable environmental laws.

The U.S. Environmental Protection Agency has adopted regulations under the Clean Air Act relating to emissions of carbon dioxide and other greenhouse gases (“GHG”), including mandatory reporting and permitting requirements. Several of the Company’s manufacturing operations result in emissions of carbon dioxide or GHG and are subject to the current GHG regulations. The Company’s compliance with these regulations has yet to require significant expenditures. The cost of compliance with any future GHG legislation or regulations is not presently determinable, but Tredegar does not anticipate compliance to have a material adverse effect on its consolidated financial condition, results of operations and cash flows based on information currently available.

Tredegar is also subject to the governmental regulations in the countries where it conducts business.

At December 31, 2017, the Company believes that it was in substantial compliance with all applicable environmental laws, regulations and permits in the U.S. and other countries where it conducts business. Environmental standards tend to become more stringent over time. In order to maintain substantial compliance with such standards, the Company may be required to incur additional expenditures, the amounts and timing of which are not presently determinable but which could be significant, in constructing new facilities or in modifying existing facilities. Furthermore, failure to comply with current or future laws and regulations could subject Tredegar to substantial penalties, fines, costs and expenses.

Employees. Tredegar employed approximately 3,200 people at December 31, 2017.

Available Information and Corporate Governance Documents. Tredegar’s Internet address is www.tredegar.com. The Company makes available, free of charge through its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). Information filed electronically with the SEC can be accessed on its website at www.sec.gov. In addition, the Company’s Corporate Governance Guidelines, Code of Conduct and the charters of the Audit, Executive Compensation, and Nominating and Governance Committees are available on Tredegar’s website and are available in print, without charge, to any shareholder upon request by contacting Tredegar’s Corporate Secretary at 1100 Boulders Parkway, Richmond, Virginia 23225. The information on or that can be accessed through the Company’s website is not, and shall not be deemed to be, a part of this Annual Report on Form 10-K for the year ended December 31, 2017 (“Form 10-K”) or incorporated into other filings it makes with the SEC.

4

Item 1A. | RISK FACTORS |

There are a number of risks and uncertainties that could have a material adverse effect on the Company’s consolidated financial condition, results of operations, or cash flows. The following risk factors should be considered, in addition to the other information included in this Form 10-K, when evaluating Tredegar and its businesses.

PE Films

• | PE Films is highly dependent on sales associated with its top five customers, the largest of which is P&G. PE Films’ top five customers comprised approximately 26%, 29% and 32% of Tredegar’s consolidated net sales, in 2017, 2016 and 2015, respectively, with net sales to P&G alone comprising approximately 13%, 16% and 19% in 2017, 2016 and 2015, respectively. The loss or significant reduction of sales associated with one or more of these customers without replacement by new business could have a material adverse effect on the Company. Other factors that could adversely affect the business include, by way of example, (i) failure by a key customer to achieve success or maintain share in markets in which they sell products containing PE Films’ materials, (ii) key customers using products developed by others that replace PE Films’ business with such customer, (iii) delays in a key customer rolling out products utilizing new technologies developed by PE Films and (iv) operational decisions by a key customer that result in component substitution, inventory reductions and similar changes. While PE Films is undertaking efforts to expand its customer base, there can be no assurance that such efforts will be successful, or that they will offset any delay or loss of sales and profits associated with these large customers. |

In recent years, PE Films lost substantial sales volume due to product transitions and incurred other sales losses associated with various customers. PE Films anticipates a significant product transition after 2018 in the personal care operating segment of the PE Films reporting segment. PE Films currently estimates that this will adversely impact the annual sales of the business unit by $70 million sometime between 2019 and 2021. PE Films has been increasing its R&D spending (an increase of $6 million in 2017 versus 2014), expects to invest capital, and is accelerating sales and marketing efforts to capture growth and diversify its customer base and product offerings in personal care products, but there can be no assurance that such efforts will be successful or that they will offset any loss of business due to product transitions. The overall timing and net change in personal care’s revenues and profits and capital expenditures needed to support growth during this transition period are uncertain at this time.

PE Films also anticipates that, over the next few years, there is an increased risk that a portion of its film used in surface protection applications will be made obsolete by possible customer product transitions to less costly alternative processes or materials. PE Films estimates on a preliminary basis that the annual adverse impact on ongoing operating profit from customer shifts to alternative processes or materials in surface protection is in the range of $5 to $10 million. Given the technological and commercial complexity involved in bringing these alternative processes or materials to market, PE Films is very uncertain as to the timing and ultimate amount of the possible transitions. In response, the Company is aggressively pursuing new surface protection products, applications and customers, but there can be no assurance that such efforts will be successful or that they will offset any loss of business due to product transitions.

• | PE Films and its customers operate in highly competitive markets. PE Films competes on product innovation, quality, price and service, and its businesses and their customers operate in highly competitive markets. Global market conditions continue to exacerbate the Company’s exposure to margin compression due to competitive forces, especially as certain products move into the later stages of their product life cycles. In addition, the changing dynamics of consumer products retailing, including the impact of on-line retailers such as Amazon, is creating price and margin pressure on the customers of PE Films’ personal care business. While PE Films continually works to identify new business opportunities with new and existing customers, primarily through the development of new products with improved performance and/or cost characteristics, there can be no assurances that such efforts will be successful or that they will offset business lost from competitive dynamics or customer product transitions. |

• | Failure of PE Films’ customers, who are subject to cyclical downturns, to achieve success or maintain market share could adversely impact PE Films’ sales and operating margins. PE Films’ plastic films serve as components for, or are used in the production of, various consumer products sold worldwide. A customer’s ability to successfully develop, manufacture and market those products is integral to PE Films’ success. Also, consumers of premium products made with or using PE Films’ components may shift to less premium or less expensive products, reducing the demand for PE Films’ plastic films. Cyclical downturns may negatively affect businesses that use PE Films’ plastic film products, which could adversely affect sales and operating margins. |

• | The Company’s inability to protect its intellectual property rights or its infringement of the intellectual property rights of others could have a material adverse impact on PE Films. PE Films operates in an industry where its significant customers and competitors have substantial intellectual property portfolios. The continued success of PE Films’ business depends on its ability not only to protect its own technologies and trade secrets, but also to develop and sell new products |

5

that do not infringe upon existing patents or threaten existing customer relationships. Intellectual property litigation is very costly and could result in substantial expense and diversions of Company resources, both of which could adversely affect its consolidated financial condition, results of operations and cash flows. In addition, there may be no effective legal recourse against infringement of the Company’s intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors.

• | An unstable economic environment could have a disruptive impact on PE Films’ supply chain. Certain raw materials used in manufacturing PE Films’ products are sourced from single suppliers, and PE Films may not be able to quickly or inexpensively re-source from other suppliers. The risk of damage or disruption to its supply chain may increase if and when different suppliers consolidate their product portfolios, experience financial distress or disruption of manufacturing operations. Failure to take adequate steps to effectively manage such events, which are intensified when a product is procured from a single supplier or location, could adversely affect PE Films’ consolidated financial condition, results of operations and cash flows, as well as require additional resources to restore its supply chain. |

• | Our cost saving initiatives may not achieve the results we anticipate. PE Films has undertaken and will continue to undertake cost reduction initiatives to consolidate certain production, improve operating efficiencies and generate cost savings. PE Films cannot be certain that it will be able to complete these initiatives as planned or that the estimated operating efficiencies or cost savings from such activities will be fully realized or maintained over time. In addition, PE Films may not be successful in moving production to other facilities or timely qualifying new production equipment. Failure to complete these initiatives could adversely affect PE Films’ financial condition, results of operations and cash flows. |

Flexible Packaging Films

• | Overcapacity in Latin American polyester film production and a history of uncertain economic conditions in Brazil could adversely impact the financial condition, results of operations and cash flows of Flexible Packaging Films. Competition in Brazil, Terphane’s primary market, has been exacerbated by global overcapacity in the polyester industry generally, and by particularly acute overcapacity in Latin America. Additional PET capacity from a competitor in Latin America came on line in September 2017. These factors, plus a recent period of unfavorable economic and political conditions in Brazil, have resulted in significant competitive pricing pressures and U.S. Dollar equivalent margin compression. |

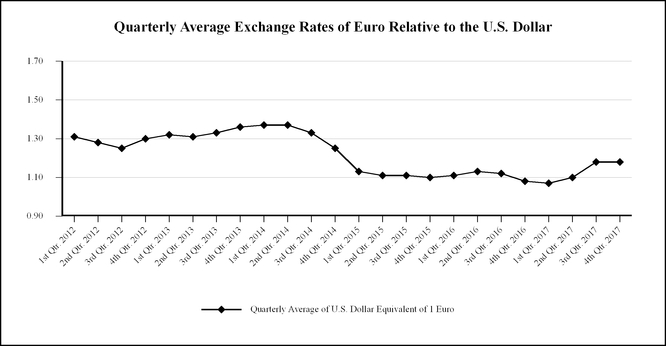

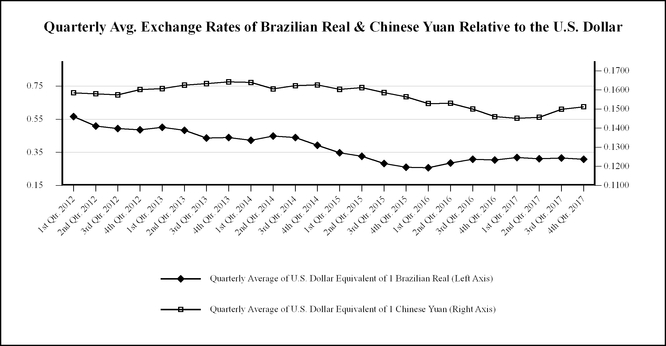

For flexible packaging films produced in Brazil, variable conversion, fixed conversion and sales, general and administrative costs for operations in Brazil have been adversely impacted by inflation in Brazil that is higher than in the U.S. Flexible Packaging Films is exposed to additional foreign exchange translation risk because almost 90% of Flexible Packaging Films’ Brazilian sales are quoted or priced in U.S. Dollars while a large part of its Brazilian costs are quoted or priced in Brazilian Real. This mismatch, together with a variety of economic variables impacting currency exchange rates, causes volatility that could negatively or positively impact operating profit for Flexible Packaging Films.

Tredegar has attempted to mitigate these impacts through new product offerings, cost saving measures, a currency hedge entered into in 2017, and manufacturing efficiency initiatives, but these efforts to-date have not been sufficient to prevent a significant decline in the operating profit for Flexible Packaging Films since the acquisition of Terphane in October 2011 and continuing efforts may not be successful, which could further adversely impact Flexible Packaging Films’ financial condition, results of operations and cash flows.

• | Governmental failure to extend anti-dumping duties in Brazil on imported products or prevent competitors from circumventing such duties could adversely impact Flexible Packaging Films. In recent years, excess global capacity in the industry has led to increased competitive pressures from imports into Brazil. The Company believes that these conditions have shifted the competitive environment from a regional to a global landscape and have driven price convergence and lower product margins for Flexible Packaging Films. Favorable anti-dumping rulings are in effect for products imported from China, Egypt, India, Mexico, UAE and Turkey. In January 2018, the Brazilian government opened new anti-dumping investigations for products imported from Peru and Bahrain. Competitors not currently subject to anti-dumping duties may choose to utilize their excess capacity by selling product in Brazil, which may result in pricing pressures that Flexible Packaging Films may not be able to offset with cost savings measures and/or manufacturing efficiency initiatives. There can be no assurance that efforts to impose anti-dumping constraints on products imported to Brazil from Peru and Bahrain, or to extend duties beyond 2018 on products imported from certain other countries, will be successful. |

6

Aluminum Extrusions

• | Sales volume and profitability of Aluminum Extrusions is cyclical and seasonal and highly dependent on economic conditions of end-use markets in the U.S., particularly in the construction sector. Aluminum Extrusions’ end-use markets can be cyclical and subject to seasonal swings in volume. Because of the capital intensive nature and level of fixed costs inherent in the aluminum extrusions business, the percentage drop in operating profits in a cyclical downturn will likely exceed the percentage drop in volume. In addition, during an economic slowdown, excess industry capacity often drives increased pricing pressure in many end-use markets as competitors protect their position with key customers. Any benefits associated with cost reductions and productivity improvements may not be sufficient to offset the adverse effects on profitability from pricing and margin pressure and higher bad debts (including a greater chance of loss associated with customers defaulting on fixed-price forward sales contracts) that usually accompany a downturn. In addition, higher energy costs can further reduce profits unless offset by price increases or cost reductions and productivity improvements. |

• | Failure to prevent competitors from circumventing anti-dumping and countervailing duties, or a reduction in such duties, could adversely impact Aluminum Extrusions. As of April 2017, the antidumping duty and countervailing duty orders on aluminum extrusions from China will remain in place until the next five-year review of the orders. Chinese and other overseas manufacturers continue to try to circumvent the antidumping and countervailing orders to avoid duties. A failure by, or the inability of, U.S. trade officials to curtail efforts to circumvent these duties, or the potential reduction of applicable duties pursuant to annual reviews of the orders, could have a material adverse effect on the financial condition, results of operations and cash flows of Aluminum Extrusions. |

• | The imposition of tariffs or duties on imported aluminum products could significantly increase the price of Aluminum Extrusions’ main raw material, which could adversely impact demand for its products. On April 27, 2017, President Trump directed the U.S. Department of Commerce (“DOC”) to begin an investigation under Section 232 of the Trade Expansion Act regarding the effects on U.S. economic and national security of aluminum imports into the U.S. On January 19, 2018, the DOC formally submitted to President Trump the results of its investigation, which included recommendations from the DOC that the President impose tariffs or quotas, or both, on imports into the U.S. of primary aluminum and semi-fabricated aluminum products. The President has 90 days to decide on any potential action based on the findings of the investigation. It is unknown at this time if the President will take any action as a result of the Section 232 investigation, and, if action is taken, what the impact of that action would be on Bonnell Aluminum. However, the President could impose tariffs or quotas on aluminum imports to the U.S. Bonnell Aluminum and other major U.S. aluminum extruders are net importers of aluminum raw materials. If high tariffs are imposed on imported aluminum ingots purchased by Bonnell, then the aggregate cost of aluminum extrusions produced by Bonnell could rise significantly. Bonnell would expect to be able to pass through the higher aluminum costs to its customers. However, a higher cost for aluminum extrusions could result in product substitutions in place of aluminum extrusions, which could materially and negatively affect Bonnell and other U.S. aluminum extrusion businesses and their results of operations. If tariffs were imposed on all primary aluminum imports into the U.S., then aluminum extruders located outside the U.S. who were not subject to similar tariffs in the country where they produced extrusions, could have a price advantage relative to U.S.-based aluminum extruders. |

• | Competition from China could increase significantly if China is granted market economy status by the World Trade Organization. China has launched a formal complaint at the World Trade Organization challenging its non-market economy status, claiming that as of December 11, 2016, China’s transition period as a non-market economy under its Accession Protocol to the World Trade Organization ended. China believes with respect to all Chinese-made products that it should receive market economy status and the rights attendant to that status under World Trade Organization rules. The U.S. and the European Union have each rejected that interpretation. If China is granted market economy status, the extent to which the U.S. antidumping laws will be able to limit unfair trade practices from China will likely be limited because the U.S. government will be forced to utilize Chinese prices and costs that do not reflect market principles in antidumping duty investigations involving China, which would ultimately limit the level of antidumping duties applied to unfairly traded Chinese imports. The volume of unfairly traded imports of Chinese aluminum extrusions would likely increase as a result and this, in turn, would likely create substantial pricing pressure on Aluminum Extrusions’ products and could have a material adverse effect on the financial condition, results of operations and cash flows of Aluminum Extrusions. |

7

• | The markets for Aluminum Extrusions’ products are highly competitive with product quality, service, delivery performance and price being the principal competitive factors. Aluminum Extrusions has approximately 1,700 customers that are in a variety of end-use markets within the broad categories of building and construction, distribution, automotive and other transportation, machinery and equipment, electrical and consumer durables. No single customer exceeds 4% of Aluminum Extrusions’ net sales. Future success and prospects depend on Aluminum Extrusions’ ability to provide superior service, high quality products, timely delivery and competitive pricing to retain existing customers and participate in overall industry cross-cycle growth. Failure in any of these areas could lead to a loss of customers, which could have an adverse material effect on the financial condition, results of operations and cash flows of Aluminum Extrusions. |

• | Aluminum Extrusions may not have sufficient capacity to meet its growth targets and service all of its customers. Aluminum Extrusions’ ability to grow and service existing customers is closely tied to having sufficient capacity. In recent years, increased demand, primarily from the nonresidential building and construction sector, has substantially increased Aluminum Extrusions’ average capacity utilization. |

General

• | Tredegar has an underfunded defined benefit (pension) plan. Tredegar sponsors a pension plan that covers certain hourly and salaried employees in the U.S. The plan was substantially frozen to new participants in 2007, and frozen to benefit accruals for active participants in 2014. As of December 31, 2017, the plan was underfunded under U.S. generally accepted accounting principles (“GAAP”) measures by $91.8 million. Tredegar expects that it will be required to make a cash contribution of approximately $5.3 million to its underfunded pension plan in 2018, and may be required to make higher cash contributions in future periods depending on the level of interest rates and investment returns on plan assets. |

• | An impairment of our identifiable intangible assets could have a material non-cash adverse impact on our results of operations. As of December 31, 2017, reporting units in PE Films and Aluminum Extrusions carried goodwill balances of $104 million and $24 million, respectively. PE Films’ goodwill balance was carried by its operating units, Personal Care Films and Surface Protection Films, at $47 million and $57 million, respectively. The Company assesses goodwill for impairment when events or circumstances indicate that the carrying value may not be recoverable, or, at a minimum, on an annual basis. The valuation of goodwill depends on a variety of factors, including the success in achieving the Company’s business goals, global market and economic conditions, earnings growth and expected cash flows, and goodwill impairment valuations can be sensitive to assumptions associated with such factors. Failure to successfully achieve projections could result in future impairments. Impairments to goodwill and identifiable intangible assets may also be caused by factors outside the Company’s control, such as increasing competitive pricing pressures, changes in foreign exchange rates, lower than expected sales and profit growth rates, and various other factors. Significant and unanticipated changes could require a non-cash charge for impairment in a future period, which may significantly affect the Company’s results of operations in the period of such charge. |

• | Noncompliance with any of the covenants in the Company’s $400 million revolving credit facility, which matures in March of 2021, could result in all debt under the agreement outstanding at such time becoming due and limiting its borrowing capacity, which could have a material adverse effect on consolidated financial condition and liquidity. The credit agreement governing Tredegar’s revolving credit facility contains restrictions and financial covenants that, if violated, could restrict the Company’s operational and financial flexibility. Failure to comply with these covenants could result in an event of default, which if not cured or waived, would result in all outstanding debt under the credit facility at such time becoming due, which could have a material adverse effect on the Company’s consolidated financial condition and liquidity. |

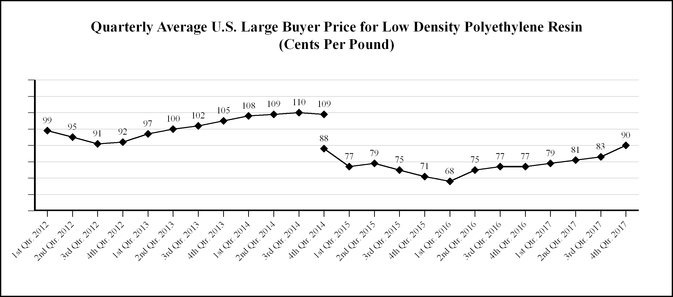

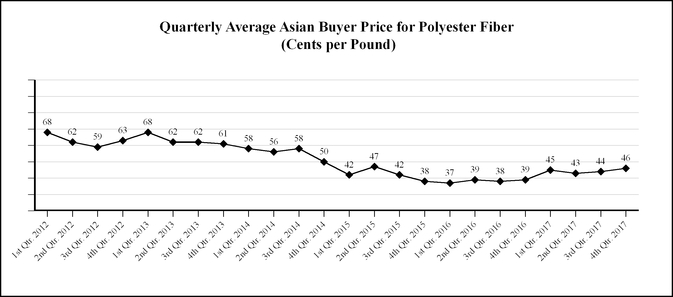

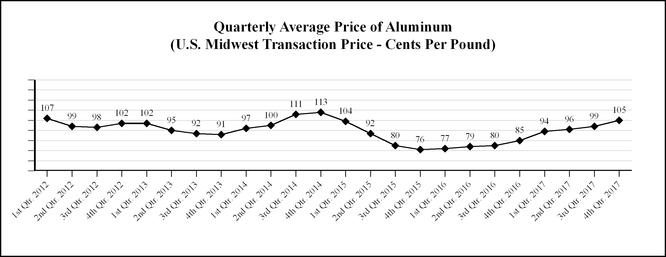

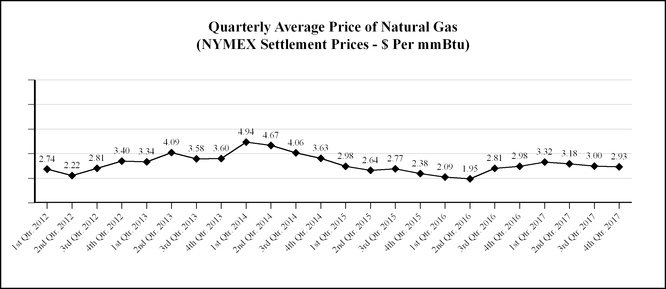

• | Tredegar’s performance is influenced by costs incurred by its operating companies, including, for example, the cost of raw materials and energy. These costs include, without limitation, the cost of resin (the raw material on which PE Films primarily depends), PTA and MEG (the raw materials on which Flexible Packaging Films primarily depends), aluminum (the raw material on which Aluminum Extrusions primarily depends), natural gas (the principal fuel necessary for Aluminum Extrusions’ plants to operate), electricity and diesel fuel. Resin, aluminum and natural gas prices are extremely volatile as shown in the charts in the Quantitative and Qualitative Disclosures section. The Company attempts to mitigate the effects of increased costs through price increases and contractual pass-through provisions, but there are no assurances that higher prices can effectively be passed through to customers or that Tredegar will be able to offset fully or on a timely basis the effects of higher raw material and energy costs through price increases or pass-through arrangements. Further, the Company’s cost control efforts may not be sufficient to offset any increases in raw material, energy or other costs. |

8

• | Tredegar may not be able to successfully integrate strategic acquisitions. Acquisitions, including our recent acquisition of Futura, involve special risks, including, without limitation, meeting revenue, margin, working capital and capital expenditure expectations that substantially drive valuation, diversion of management’s time and attention from existing businesses, the potential assumption of unanticipated liabilities and contingencies and potential difficulties in integrating acquired businesses and achieving anticipated operational improvements. Acquired businesses may not achieve expected results. |

• | Tredegar is subject to various environmental laws and regulations and could become exposed to material liabilities and costs associated with such laws. The Company is subject to various environmental obligations and could become subject to additional obligations in the future. Changes in environmental laws and regulations, or their application, including, but not limited to, those relating to global climate change, could subject Tredegar to significant additional capital expenditures and operating expenses. Moreover, future developments in federal, state, local and international environmental laws and regulations are difficult to predict. Environmental laws have become and are expected to continue to become increasingly strict. As a result, Tredegar expects to be subject to new environmental laws and regulations. However, any such changes are uncertain and, therefore, it is not possible for the Company to predict with certainty the amount of additional capital expenditures or operating expenses that could be necessary for compliance with respect to any such changes. See Government Regulation in “Item 1. Business” for a further discussion of this risk factor. |

• | Material disruptions at one of the Company’s major manufacturing facilities could negatively impact financial results. Tredegar believes its facilities are operated in compliance with applicable local laws and regulations and that the Company has implemented measures to minimize the risks of disruption at its facilities. Such a disruption could be a result of any number of events, including but not limited to: an equipment failure with repairs requiring long lead times, labor stoppages or shortages, utility disruptions, constraints on the supply or delivery of critical raw materials, and severe weather conditions. A material disruption in one of the Company’s operating locations could negatively impact production and its consolidated financial condition, results of operations and cash flows. |

• | An information technology system failure may adversely affect the business. Tredegar relies on information technology systems to transact its business. An information technology system failure due to computer viruses, internal or external security breaches, cybersecurity attacks, power interruptions, hardware failures, fire, natural disasters, human error, or other causes could disrupt its operation and prevent it from being able to process transactions with its customers, operate its manufacturing facilities, and properly report transactions in a timely manner. A significant, protracted information technology system failure may adversely affect Tredegar’s results of operations, financial condition, or cash flows. |

• | An inability to renegotiate the Company’s collective bargaining agreements could adversely impact its consolidated financial condition, results of operations and cash flows. Some of the Company’s employees are represented by labor unions under various collective bargaining agreements with varying durations and expiration dates. Tredegar may not be able to satisfactorily renegotiate collective bargaining agreements when they expire, which could result in strikes or work stoppages or higher labor costs. In addition, existing collective bargaining agreements may not prevent a strike or work stoppage at the Company’s facilities in the future. Any such work stoppages (or potential work stoppages) could negatively impact Tredegar’s ability to manufacture its products and adversely affect its consolidated financial condition, results of operations and cash flows. |

• | Tredegar’s valuation of its $7.5 million cost-basis investment in kaléo is volatile and uncertain. Tredegar uses the fair value method to account for its fully-diluted ownership interest of approximately 20% in kaleo, Inc. (“kaléo”), a privately held specialty pharmaceutical company. There is no active secondary market for buying or selling stock in kaléo. The Company’s fair value estimates can fluctuate materially between reporting periods, primarily due to variances in its performance versus expectations. Additionally, the estimated fair value of the Company’s investment in kaléo could decline. Kaléo’s first product, an epinephrine auto-injector, was licensed to sanofi-aventis U.S. LLC (“Sanofi”) in 2009. Sanofi commenced commercial sales in the first quarter of 2013. Kaléo subsequently developed and commenced commercial sales of its second product, a naloxone auto-injector, in the third quarter of 2014. In the fourth quarter of 2015, Sanofi announced a voluntary recall of the product and subsequently returned the rights to kaléo in 2016. Kaléo relaunched the epinephrine auto-injector in the U.S. in the first quarter of 2017. See Note 4 to the Notes to Financial Statements for more information. |

9

Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

Item 2. | PROPERTIES |

General

Most of the improved real property and the other assets used in the Company’s operations are owned. Certain of the owned property is subject to an encumbrance under the Company’s revolving credit facility (see Note 11 in the Notes to Financial Statements for more information). Tredegar considers the manufacturing facilities, warehouses and other properties and assets that it owns or leases to be in generally good condition. Capacity utilization at its various manufacturing facilities can vary with product mix and normal fluctuations in sales levels. The Company believes that its PE Films manufacturing facilities have sufficient capacity to meet its current production requirements. Flexible Packaging Films is operating at capacity but has an idled line that it expects will be restarted in 2018. Bonnell Aluminum is operating at nearly full capacity utilization in its building and construction sector. Tredegar’s corporate headquarters, which is leased, is located at 1100 Boulders Parkway, Richmond, Virginia 23225.

The Company’s principal manufacturing plants and facilities as of December 31, 2017 are listed below:

PE Films

Locations in the U.S. | Locations Outside the U.S. | Principal Operations | ||

Lake Zurich, Illinois Durham, North Carolina (technical center and production facility) (leased) Pottsville, Pennsylvania Richmond, Virginia (technical center) (leased) Terre Haute, Indiana (technical center and production facility) | Guangzhou, China Kerkrade, The Netherlands Pune, India Rétság, Hungary São Paulo, Brazil Shanghai, China | Production of plastic films and laminate materials | ||

Flexible Packaging Films

Locations in the U.S. | Locations Outside the U.S. | Principal Operations | ||

Bloomfield, New York (technical center and production facility) | Cabo de Santo Agostinho, Brazil | Production of polyester films | ||

Aluminum Extrusions

Locations in the U.S. | Principal Operations | |||

Carthage, Tennessee Elkhart, Indiana Newnan, Georgia Niles, Michigan Clearfield, Utah | Production of aluminum extrusions, fabrication and finishing | |||

Item 3. | LEGAL PROCEEDINGS |

None.

Item 4. | MINE SAFETY DISCLOSURES |

None.

10

PART II

Item 5. | MARKET FOR TREDEGAR’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Prices of Common Stock and Shareholder Data

Tredegar’s common stock is traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “TG”. There were 33,017,422 shares of common stock held by 1,951 shareholders of record on December 31, 2017.

The following table shows the reported high and low closing prices of Tredegar’s common stock by quarter for the past two years.

2017 | 2016 | ||||||||||||||

High | Low | High | Low | ||||||||||||

First quarter | $ | 25.00 | $ | 16.50 | $ | 16.01 | $ | 11.68 | |||||||

Second quarter | 17.65 | 14.90 | 17.37 | 14.80 | |||||||||||

Third quarter | 18.35 | 14.85 | 19.39 | 16.30 | |||||||||||

Fourth quarter | 20.20 | 18.20 | 25.55 | 17.30 | |||||||||||

The closing price of Tredegar’s common stock on February 16, 2018 was $16.80.

Dividend Information

Tredegar has paid a dividend every quarter since becoming a public company in July 1989. During the past three years, the Company paid quarterly dividends as follows:

•11 cents per share in the last three quarters of 2015 and each of the quarters of 2016 and 2017;

•9 cents per share in the first quarter of 2015.

All decisions with respect to the declaration and payment of dividends will be made by the Board of Directors in its sole discretion based upon earnings, financial condition, anticipated cash needs, restrictions in the Company’s revolving credit facility and other such considerations as the Board deems relevant. See Note 11 of the Notes to Financial Statements for the restrictions on the payment of dividends contained in the Company’s revolving credit agreement related to aggregate dividends permitted.

Issuer Purchases of Equity Securities

On January 7, 2008, Tredegar announced that its Board of Directors approved a share repurchase program whereby management is authorized at its discretion to purchase, in the open market or in privately negotiated transactions, up to 5 million shares of the Company’s outstanding common stock. The authorization has no time limit. Tredegar did not repurchase any shares in the open market or otherwise in 2017, 2016 and 2015 under this standing authorization. The maximum number of shares remaining under this standing authorization was 1,732,003 at December 31, 2017.

11

Comparative Tredegar Common Stock Performance

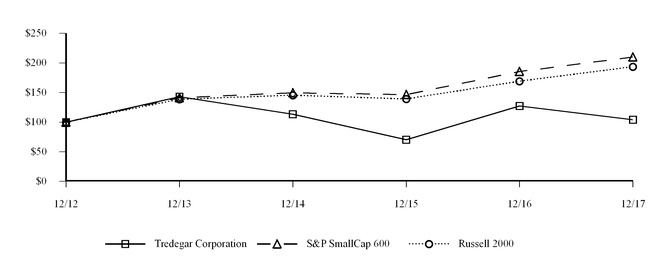

The following graph compares cumulative total shareholder returns for Tredegar, the S&P SmallCap 600 Stock Index (an index comprised of companies with market capitalizations similar to Tredegar) and the Russell 2000 Index for the five years ended December 31, 2017. Tredegar is part of both the S&P SmallCap 600 Index and Russell 2000 Index.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Tredegar Corporation, the S&P SmallCap 600 Index, and the Russell 2000 Index

*$100 invested on 12/31/12 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. Copyright© 2018 Standard & Poor's, a division of S&P Global. All rights reserved. Copyright© 2018 Russell Investment Group. All rights reserved. |

Inquiries

Inquiries concerning stock transfers, dividends, dividend reinvestment, consolidating accounts, changes of address, or lost or stolen stock certificates should be directed to Computershare Investor Services, the transfer agent and registrar for the Company’s common stock:

Computershare Investor Services

P.O. Box 30170

College Station, TX 77842-3170

Phone: 800-622-6757

www.computershare.com/us/contact

All other inquiries should be directed to:

Tredegar Corporation

Investor Relations Department

1100 Boulders Parkway

Richmond, Virginia 23225

Phone: 855-330-1001

E-mail: invest@tredegar.com

Website: www.tredegar.com

12

Quarterly Information

Tredegar does not generate or distribute quarterly reports to its shareholders. Information on quarterly results can be obtained from the Company’s website. In addition, Tredegar files quarterly, annual and other information electronically with the SEC, which can be accessed on its website at www.sec.gov.

13

Item 6. | SELECTED FINANCIAL DATA |

The tables that follow present certain selected financial and segment information for the five years ended December 31, 2017.

FIVE-YEAR SUMMARY

Tredegar Corporation and Subsidiaries

Years Ended December 31 | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||||||

(In thousands, except per-share data) | ||||||||||||||||||||||||

Results of Operations (g): | ||||||||||||||||||||||||

Sales | $ | 961,330 | $ | 828,341 | $ | 896,177 | $ | 951,826 | $ | 959,346 | ||||||||||||||

Other income (expense), net | 51,713 | (a) | 2,381 | (b) | (20,113 | ) | (d) | (6,697 | ) | (e) | 1,776 | (f) | ||||||||||||

1,013,043 | 830,722 | 876,064 | 945,129 | 961,122 | ||||||||||||||||||||

Cost of goods sold | 775,628 | (a) | 668,626 | (b) | 725,459 | (d) | 778,113 | (e) | 784,675 | (f) | ||||||||||||||

Freight | 33,683 | 29,069 | 29,838 | 28,793 | 28,625 | |||||||||||||||||||

Selling, general & administrative expenses | 85,501 | (a) | 75,754 | (b) | 71,911 | (d) | 69,526 | (e) | 71,195 | (f) | ||||||||||||||

Research and development expenses | 18,287 | 19,122 | 16,173 | 12,147 | 12,669 | |||||||||||||||||||

Amortization of identifiable intangibles | 6,198 | 3,978 | 4,073 | 5,395 | 6,744 | |||||||||||||||||||

Interest expense | 6,170 | 3,806 | 3,502 | 2,713 | 2,870 | |||||||||||||||||||

Asset impairments and costs associated with exit and disposal activities | 102,488 | (a) | 2,684 | (b) | 3,850 | (d) | 3,026 | (e) | 1,412 | (f) | ||||||||||||||

Goodwill impairment charge | — | — | 44,465 | (c) | — | — | ||||||||||||||||||

1,027,955 | 803,039 | 899,271 | 899,713 | 908,190 | ||||||||||||||||||||

Income (loss) from continuing operations before income taxes | (14,912 | ) | 27,683 | (23,207 | ) | 45,416 | 52,932 | |||||||||||||||||

Income tax expense (benefit) | (53,163 | ) | (a) | 3,217 | (b) | 8,928 | (d) | 9,387 | (e) | 16,995 | (f) | |||||||||||||

Income (loss) from continuing operations (g) | 38,251 | 24,466 | (32,135 | ) | 36,029 | 35,937 | ||||||||||||||||||

Income (loss) from discontinued operations, net of tax (g) | — | — | — | 850 | (g) | (13,990 | ) | (g) | ||||||||||||||||

Net income (loss) | $ | 38,251 | $ | 24,466 | $ | (32,135 | ) | $ | 36,879 | $ | 21,947 | |||||||||||||

Diluted earnings (loss) per share (g): | ||||||||||||||||||||||||

Continuing operations | $ | 1.16 | $ | 0.75 | $ | (0.99 | ) | $ | 1.11 | $ | 1.10 | |||||||||||||

Discontinued operations | — | — | — | 0.02 | (g) | (0.43 | ) | (g) | ||||||||||||||||

Net income (loss) | $ | 1.16 | $ | 0.75 | $ | (0.99 | ) | $ | 1.13 | $ | 0.67 | |||||||||||||

Refer to Notes to Financial Tables that follow these tables.

14

FIVE-YEAR SUMMARY

Tredegar Corporation and Subsidiaries

Years Ended December 31 | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

(In thousands, except per-share data) | ||||||||||||||||||||

Share Data: | ||||||||||||||||||||

Equity per share (l) | $ | 10.41 | $ | 9.44 | $ | 8.35 | $ | 11.47 | $ | 12.46 | ||||||||||

Cash dividends declared per share | $ | 0.44 | $ | 0.44 | $ | 0.42 | $ | 0.34 | $ | 0.28 | ||||||||||

Weighted average common shares outstanding during the period | 32,946 | 32,762 | 32,578 | 32,302 | 32,172 | |||||||||||||||

Shares used to compute diluted earnings (loss) per share during the period | 32,951 | 32,775 | 32,578 | 32,554 | 32,599 | |||||||||||||||

Shares outstanding at end of period | 33,017 | 32,934 | 32,682 | 32,422 | 32,305 | |||||||||||||||

Closing market price per share: | ||||||||||||||||||||

High | $ | 25.00 | $ | 25.55 | $ | 23.76 | $ | 28.45 | $ | 30.73 | ||||||||||

Low | $ | 14.85 | $ | 11.68 | $ | 12.63 | $ | 16.76 | $ | 21.06 | ||||||||||

End of year | $ | 19.20 | $ | 24.00 | $ | 13.62 | $ | 22.49 | $ | 28.81 | ||||||||||

Total return to shareholders (h) | (18.2 | )% | 79.4 | % | (37.6 | )% | (20.8 | )% | 42.5 | % | ||||||||||

Financial Position: | ||||||||||||||||||||

Total assets (k) | $ | 755,743 | $ | 651,162 | $ | 623,260 | $ | 788,626 | $ | 793,008 | ||||||||||

Cash and cash equivalents | $ | 36,491 | $ | 29,511 | $ | 44,156 | $ | 50,056 | $ | 52,617 | ||||||||||

Debt | $ | 152,000 | $ | 95,000 | $ | 104,000 | $ | 137,250 | $ | 139,000 | ||||||||||

Shareholders’ equity (net book value) | $ | 343,780 | $ | 310,783 | $ | 272,748 | $ | 372,029 | $ | 402,664 | ||||||||||

Equity market capitalization (i) | $ | 633,935 | $ | 790,411 | $ | 445,131 | $ | 729,173 | $ | 930,711 | ||||||||||

Refer to Notes to Financial Tables that follow these tables.

15

SEGMENT TABLES

Tredegar Corporation and Subsidiaries

Net Sales (j) | |||||||||||||||||||

Years Ended December 31 | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||

(In thousands) | |||||||||||||||||||

PE Films | $ | 352,459 | $ | 331,146 | $ | 385,550 | $ | 464,339 | $ | 495,386 | |||||||||

Flexible Packaging Films | 108,355 | 108,028 | 105,332 | 114,348 | 125,853 | ||||||||||||||

Aluminum Extrusions | 466,833 | 360,098 | 375,457 | 344,346 | 309,482 | ||||||||||||||

Total net sales | 927,647 | 799,272 | 866,339 | 923,033 | 930,721 | ||||||||||||||

Add back freight | 33,683 | 29,069 | 29,838 | 28,793 | 28,625 | ||||||||||||||

Sales as shown in Consolidated Statements of Income | $ | 961,330 | $ | 828,341 | $ | 896,177 | $ | 951,826 | $ | 959,346 | |||||||||

Identifiable Assets | |||||||||||||||||||

As of December 31 | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||

(In thousands) | |||||||||||||||||||

PE Films | $ | 289,514 | $ | 278,558 | $ | 270,236 | $ | 283,606 | $ | 291,377 | |||||||||

Flexible Packaging Films | 49,915 | 156,836 | 146,253 | 262,604 | 265,496 | ||||||||||||||

Aluminum Extrusions | 268,127 | 147,639 | 136,935 | 143,328 | 134,928 | ||||||||||||||

Subtotal | 607,556 | 583,033 | 553,424 | 689,538 | 691,801 | ||||||||||||||

General corporate | 111,696 | 38,618 | 25,680 | 49,032 | 48,590 | ||||||||||||||

Cash and cash equivalents | 36,491 | 29,511 | 44,156 | 50,056 | 52,617 | ||||||||||||||

Total | $ | 755,743 | $ | 651,162 | $ | 623,260 | $ | 788,626 | $ | 793,008 | |||||||||

Refer to Notes to Financial Tables that follow these tables.

16

SEGMENT TABLES

Tredegar Corporation and Subsidiaries

Operating Profit | ||||||||||||||||||||||||

Years Ended December 31 | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||||||

(In thousands) | ||||||||||||||||||||||||

PE Films: | ||||||||||||||||||||||||

Ongoing operations | $ | 41,546 | $ | 26,312 | $ | 48,275 | $ | 60,971 | $ | 61,866 | ||||||||||||||

Plant shutdowns, asset impairments, restructurings and other | (4,905 | ) | (a) | (4,602 | ) | (b) | (4,180 | ) | (d) | (12,236 | ) | (e) | (671 | ) | (f) | |||||||||

Flexible Packaging Films: | ||||||||||||||||||||||||

Ongoing operations | (2,626 | ) | 1,774 | 5,453 | (2,917 | ) | 9,100 | |||||||||||||||||

Plant shutdowns, asset impairments, restructurings and other | (89,398 | ) | (a) | (214 | ) | (b) | (185 | ) | (d) | (591 | ) | (e) | — | |||||||||||

Goodwill impairment charge | — | — | (44,465 | ) | (c) | — | — | |||||||||||||||||

Aluminum Extrusions: | ||||||||||||||||||||||||

Ongoing operations | 43,454 | 37,794 | 30,432 | 25,664 | 18,291 | |||||||||||||||||||

Plant shutdowns, asset impairments, restructurings and other | 321 | (a) | (741 | ) | (b) | (708 | ) | (d) | (976 | ) | (e) | (2,748 | ) | (f) | ||||||||||

Total | (11,608 | ) | 60,323 | 34,622 | 69,915 | 85,838 | ||||||||||||||||||

Interest income | 209 | 261 | 294 | 588 | 594 | |||||||||||||||||||

Interest expense | 6,170 | 3,806 | 3,502 | 2,713 | 2,870 | |||||||||||||||||||

Gain (loss) on investment accounted for under the fair value method | 33,800 | (a) | 1,600 | (b) | (20,500 | ) | (d) | 2,000 | (e) | 3,400 | (f) | |||||||||||||

Gain on sale of investment property | — | — | — | 1,208 | (e) | — | ||||||||||||||||||

Unrealized loss on investment property | — | 1,032 | (b) | — | — | 1,018 | (e) | |||||||||||||||||

Stock option-based compensation expense | 264 | 56 | 483 | 1,272 | 1,155 | |||||||||||||||||||

Corporate expenses, net | 30,879 | (a) | 29,607 | (b) | 33,638 | (d) | 24,310 | (e) | 31,857 | (f) | ||||||||||||||

Income (loss) from continuing operations before income taxes | (14,912 | ) | 27,683 | (23,207 | ) | 45,416 | 52,932 | |||||||||||||||||

Income tax expense (benefit) | (53,163 | ) | (a) | 3,217 | (b) | 8,928 | (d) | 9,387 | (e) | 16,995 | (f) | |||||||||||||

Income (loss) from continuing operations | 38,251 | 24,466 | (32,135 | ) | 36,029 | 35,937 | ||||||||||||||||||

Income (loss) from discontinued operations, net of tax (g) | — | — | — | 850 | (g) | (13,990 | ) | (g) | ||||||||||||||||

Net income (loss) | $ | 38,251 | $ | 24,466 | $ | (32,135 | ) | $ | 36,879 | $ | 21,947 | |||||||||||||

Refer to Notes to Financial Tables that follow these tables.

17

SEGMENT TABLES

Tredegar Corporation and Subsidiaries

Depreciation and Amortization | |||||||||||||||||||

Years Ended December 31 | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||

(In thousands) | |||||||||||||||||||

PE Films | $ | 14,609 | $ | 13,653 | $ | 15,480 | $ | 21,399 | $ | 25,656 | |||||||||

Flexible Packaging Films | 10,443 | 9,505 | 9,697 | 9,331 | 9,676 | ||||||||||||||

Aluminum Extrusions | 15,070 | 9,173 | 9,698 | 9,974 | 9,202 | ||||||||||||||

Subtotal | 40,122 | 32,331 | 34,875 | 40,704 | 44,534 | ||||||||||||||

General corporate | 155 | 141 | 107 | 114 | 121 | ||||||||||||||

Total depreciation and amortization expense | $ | 40,277 | $ | 32,472 | $ | 34,982 | $ | 40,818 | $ | 44,655 | |||||||||

Capital Expenditures | |||||||||||||||||||

Years Ended December 31 | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||

(In thousands) | |||||||||||||||||||

PE Films | $ | 15,029 | $ | 25,759 | $ | 21,218 | $ | 17,000 | $ | 15,615 | |||||||||

Flexible Packaging Films | 3,619 | 3,391 | 3,489 | 21,806 | 49,252 | ||||||||||||||

Aluminum Extrusions | 25,653 | 15,918 | 8,124 | 6,092 | 14,742 | ||||||||||||||

Subtotal | 44,301 | 45,068 | 32,831 | 44,898 | 79,609 | ||||||||||||||

General corporate | 61 | 389 | — | — | 52 | ||||||||||||||

Total capital expenditures | $ | 44,362 | $ | 45,457 | $ | 32,831 | 44,898 | 79,661 | |||||||||||

Refer to Notes to Financial Tables that follow these tables.

18

NOTES TO FINANCIAL TABLES

(a) | Plant shutdowns, asset impairments, restructurings and other charges for 2017 include: income of $11.9 million related to the settlement of an escrow arrangement (included in “Other income (expense), net” in the consolidated statements of income); charges related to the impairment of assets of Flexible Packaging in the amount of $101 million; income of $5.6 million related to the explosion that occurred in the second quarter of 2016 at Bonnell’s aluminum extrusions manufacturing facility in Newnan, Georgia, which includes the recognition of a gain of $5.3 million for a portion of the insurance recoveries received from the insurer for the replacement of capital equipment, plus the recovery of excess production costs incurred in 2016 for which recovery from insurance carriers was not previously considered to be reasonably assured, net of other nonrecoverable costs, of $0.3 million ($0.4 million benefit included in “Cost of goods sold” in the consolidated statements of income and $0.1 million charge included in “Selling, general and administrative expenses” in the consolidated statements of income); charges of $4.1 million for estimated excess costs associated with the ramp-up of new product offerings (included in “Cost of goods sold” in the consolidated statements of income); charges of $1.9 million related to expected environmental costs at certain Aluminum Extrusions manufacturing facilities (included in “Cost of goods sold” in the consolidated statements of income); charges of $3.3 million related to the acquisition of Futura Industries Corporation ($1.7 million included in “Cost of goods sold” and $1.6 million included in “Selling, general and administrative expense” in the consolidated statements of income), offset by pretax income of $0.7 million related to the fair valuation of an earnout provision (included in “Other income (expense), net” in the condensed consolidated statements of income); charges of $0.8 million associated with the consolidation of domestic PE Films manufacturing facilities, which includes asset impairments of $0.1 million, accelerated depreciation of $0.3 million and other facility consolidation-related expenses of $0.5 million (included in “Cost of goods sold” in the consolidated statements of income) offset by income of $0.1 million related to a reduction of severance and other employee-related accrued costs; charges of $2.4 million associated with a business development project included in “Selling, general and administrative” in the consolidated statements of income); charge of $0.7 million for severance and other employee-related costs associated with restructurings in PE Films ($0.2 million), Aluminum Extrusions ($0.1 million) and Corporate ($0.4 million); charges of $0.3 million associated with asset impairments in PE Films; charge of $0.2 million associated with the settlement of customer claims and the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana. The unrealized gain of $33.8 million on the Company’s investment in kaléo is included in “Other income (expense), net” in the consolidated statements of income. |

(b) | Plant shutdowns, asset impairments, restructurings and other charges for 2016 include income of $0.4 million related to the explosion that occurred in the second quarter of 2016 at Bonnell’s aluminum extrusions manufacturing facility in Newnan, Georgia, which includes the recognition of a gain of $1.9 million for a portion of the insurance recoveries approved by the insurer to begin the replacement of capital equipment, offset by the impairment of equipment damaged by the explosion of $0.3 million (net amount included in “Other income (expense), net” in the consolidated statements of income) and other costs related to the explosion that are not recoverable from insurance of $0.6 million (included in “Selling, general and administrative”) and excess production costs for which recovery from insurance is not assured of $0.6 million (included in “Cost of goods sold” in the consolidated statements of income); charges of $4.3 million associated with the consolidation of domestic PE Films manufacturing facilities, which includes severance and other employee-related costs of $1.2 million, asset impairments of $0.4 million, accelerated depreciation of $0.6 million (included in “Cost of goods sold” in the consolidated statements of income) and other facility consolidation-related expenses of $2.0 million ($1.6 million is included in “Cost of goods sold” in the consolidated statements of income); charges of $0.4 million associated with a business development project included in “Selling, general and administrative” in the consolidated statements of income); charge of $0.3 million for severance and other employee-related costs associated with restructurings in PE Films ($0.1 million) and Corporate ($0.2 million); charges of $0.6 million associated with the acquisition of Futura Industries Corporation (included in “Selling, general and administrative” in the consolidated statements of income); charges of $0.5 million related to expected future environmental costs at the Company’s aluminum extrusions manufacturing facility in Newnan, Georgia (included in “Cost of goods sold” in the consolidated statements of income); charges of $0.3 million related to the settlement of a tax dispute in the Flexible Packaging Films segment (included in “Cost of goods sold” in the consolidated statements of income); charges of $0.2 million associated with asset impairments in PE Films; gain of $0.1 million from the settlement of a Terphane pre-acquisition contingency (included in “Other income (expense), net” in the consolidated statements of income); charge of $0.1 million from the sale of the aluminum extrusions manufacturing facility in Kentland, Indiana at a pretax gain of $0.2 million, offset by pretax charges of $0.3 million associated with the shutdown of this facility. The unrealized gain of $1.6 million on the Company’s investment in kaléo is included in “Other income (expense), net” in the consolidated statements of income. |

(c) | Results for 2015 included a goodwill impairment charge of $44.5 million ($44.5 million after taxes) recognized in Flexible Packaging Films in the third quarter of 2015 upon completion of an impairment analysis performed as of September 30, 2015. |

(d) | Plant shutdowns, asset impairments, restructurings and other charges for 2015 include charges of $3.9 million (included in “Selling, general and administrative” in the consolidated statements of income) for severance and other employee-related costs associated with the resignation of the Company’s former chief executive and chief financial officers; charges of $2.2 million associated with the consolidation of domestic PE Films manufacturing facilities, which includes severance and other employee-related costs of $0.8 million, asset impairments of $0.4 million, accelerated depreciation of $0.4 million (included in “Cost of goods sold” in the consolidated statements of income) and other facility consolidation-related expenses of $0.6 million ($0.1 million is included in “Cost of goods sold” in the consolidated statements of income); charge of $2.2 million for severance and other employee-related costs associated with restructurings in PE Films ($2.0 million) ($0.4 million included in “Selling, general and administrative expense” in the consolidated statement of income), Flexible Packaging Films ($0.2 million), Aluminum Extrusions ($35,000) and Corporate ($26,000); charges of $1.0 million associated with a non-recurring business development project (included in “Cost of goods sold” in the consolidated statements of income); charges of $0.4 million associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana; and charges of $0.3 million related to expected future environmental costs at the Company’s aluminum extrusions manufacturing facility in Newnan, Georgia (included in “Cost of goods sold” in the consolidated statements of income). The unrealized loss of $20.5 million on the Company’s investment in kaléo is included in “Other income (expense), net” in the consolidated statements of income. |