Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | a20181qpressrelease.htm |

| 8-K - 8-K - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | a2018q18k.htm |

Fannie Mae Quarterly Financial Supplement

Q1 2018

May 3, 2018

© 2018 Fannie Mae. Trademarks of Fannie Mae.

Some of the terms and other information in this presentation are defined and discussed more fuly in Fannie Mae’s Form 10-Q for

the quarter ended March 31, 2018 (“Q1 2018 10-Q”) and Form 10-K for the year ended December 31, 2017 (“2017 Form 10-K”).

This presentation should be reviewed together with the Q1 2018 10-Q and the 2017 Form 10-K, which are available at

www.fanniemae.com in the “About Us—Investor Relations—SEC Filings” section. Information on or available through the

company's website is not part of this supplement.

Some of the information in this presentation is based upon information from third-party sources such as selers and servicers of

mortgage loans. Although we generaly consider this information reliable, we do not independently verify al reported

information.

Due to rounding, amounts reported in this presentation may not add to totals indicated (or 100%).

Unless otherwise indicated, data labeled as "YTD 2018" is as of March 31, 2018 or for the first three months of 2018. Data for

prior years is as of December 31 or for the ful year indicated.

Note references are to endnotes, appearing on pages 22 to 24.

Terms used in presentation

CAS: Connecticut Avenue Securities™

CIRT™: Credit Insurance Risk Transfer™

CRT: credit risk transfer

DTI ratio: Debt-to-income ratio

DUS : Fannie Mae’s Delegated Underwriting and Servicing program

GDP: U.S. gross domestic product

HARP : Home Afordable Refinance Program, which alows eligible Fannie Mae borrowers with high LTV ratio loans to refinance

into more sustainable loans

LTV ratio: loan-to-value ratio

MSA: metropolitan statistical area

MTMLTV ratio: mark-to-market loan-to-value ratio

OLTV ratio: origination loan-to-value ratio

Refi Plus™: our Refi Plus initiative, which ofers refinancing flexibility to eligible Fannie Mae borrowers

REO: real estate owned

TCCA: Temporary Payrol Tax Cut Continuation Act of 2011

UPB: unpaid principal balance

§

§

§

§

§

§

© 2018 Fannie Mae. Trademarks of Fannie Mae. 1

®

®

Table of Contents

Corporate Financial Highlights

Market Liquidity

Key Market Economic Indicators

Treasury Draws and Dividend Payments 7

6

5

4

Financial Overview

Single-Family Highlights

Certain Credit Characteristics of Single-Family Loan Acquisitions

Certain Credit Characteristics of Single-Family Conventional Guaranty Book of Business

Single-Family Credit Risk Transfer

Single-Family Problem Loan Statistics

Credit Loss Concentration of Single-Family Conventional Guaranty Book of Business

Single-Family Cumulative Default Rates 15

14

13

12

11

10

9

Single-Family Business

Multifamily Highlights

Certain Credit Characteristics of Multifamily Acquisitions

Certain Credit Characteristics of Multifamily Guaranty Book of Business

Multifamily Serious Delinquency Rates and Credit Losses 20

19

18

17

Multifamily Business

Financial Overview Endnotes

Single-Family Business Endnotes

Multifamily Business Endnotes 24

23

22

Endnotes

© 2018 Fannie Mae. Trademarks of Fannie Mae. 2

Financial Overview

© 2018 Fannie Mae. Trademarks of Fannie Mae. 3

1Q18 4Q17 Variance

Net interest income

Fee and other income

Net revenues

Investment gains, net

Fair value gains (losses), net

Administrative expenses

Credit-related income

Benefit for credit losses

Foreclosed property expense

Total credit-related income

Temporary Payrol Tax Cut Continuation Act of 2011

(TCCA) fees

Other expenses, net

Income before federal income taxes

Provision for federal income taxes

Net Income

Other comprehensive income (loss)

Total comprehensive income $10,625

(169)

$10,794

10,358

436

208

(13)

(375)

(32)

(343)

(47)

1,236

(583)

10

(111)

$121

($6,687)

(154)

($6,533)

(11,489)

4,956

(411)

(544)

430

(130)

560

(703)

(191)

833

5,542

431

$5,111

$3,938

(323)

$4,261

(1,131)

5,392

(203)

(557)

55

(162)

217

(750)

1,045

250

5,552

320

$5,232

2014 2015 2016 2017 YTD 2018

0%

20%

40%

60%

80%

100%

%

Ne

t In

ter

est

In

com

e

$0

$100

$200

$300

$400

$500

$600

Re

tai

ne

d M

ort

ga

ge

Po

rfo

lio

($

) B

illi

on

s

$272.4

$413.3

$345.1

$230.8 $228.3

Net interest income from retained mortgage portfolio and other activities

Net interest income from guaranty fees and other consolidated trust income

Retained mortgage portfolio at end of period

Key Highlights

Summary of Q1 2018 Financial Results Sources of Net Interest Income and Retained MortgagePortfolio Balance

Corporate Financial Highlights

© 2018 Fannie Mae. Trademarks of Fannie Mae. 4

_______________________________

_______________________________

_______________________________

_______________________________

_______________________________

_______________________________

i ome (loss)

enues

(1)

comprhensve income (loss)

§ Fannie Mae reported first quarter 2018 net income of $4.3 bilion and

comprehensive income of $3.9 bilion. This compares to a net loss of $6.5 bilion

in the fourth quarter of 2017, which was due to remeasurement of the company's

deferred tax assets resulting from enactment of tax legislation during the quarter.

Fannie Mae’s pre-tax income was $5.4 bilion for the first quarter of 2018 and

$5.0 bilion for the fourth quarter of 2017, reflecting the strength of the company’s

underlying business fundamentals.

§ Two primary factors drove the diference between net income in the first

quarter of 2018 compared to the net loss in the fourth quarter of 2017: a $9.9

bilion provision for federal income taxes in the fourth quarter of 2017 that

resulted from the enactment of the Tax Cuts and Jobs Act of 2017; and net fair

value gains of $1.0 bilion in the first quarter of 2018, primarily driven by gains on

the company’s mortgage commitment and risk management derivatives.

2014 2015 2016 2017 YTD 2018

0.0M

0.5M

1.0M

1.5M

2.0M

2.5M

3.0M

0.8M

0.6M

0.9M

0.9M

0.4M

0.2M

0.2M

0.3M

0.7M

1.0M

1.0M

1.4M

1.2M

1.2M

1.1M

Rental Units

Home Purchases (Loans)

Mortgage Refinancings (Loans)

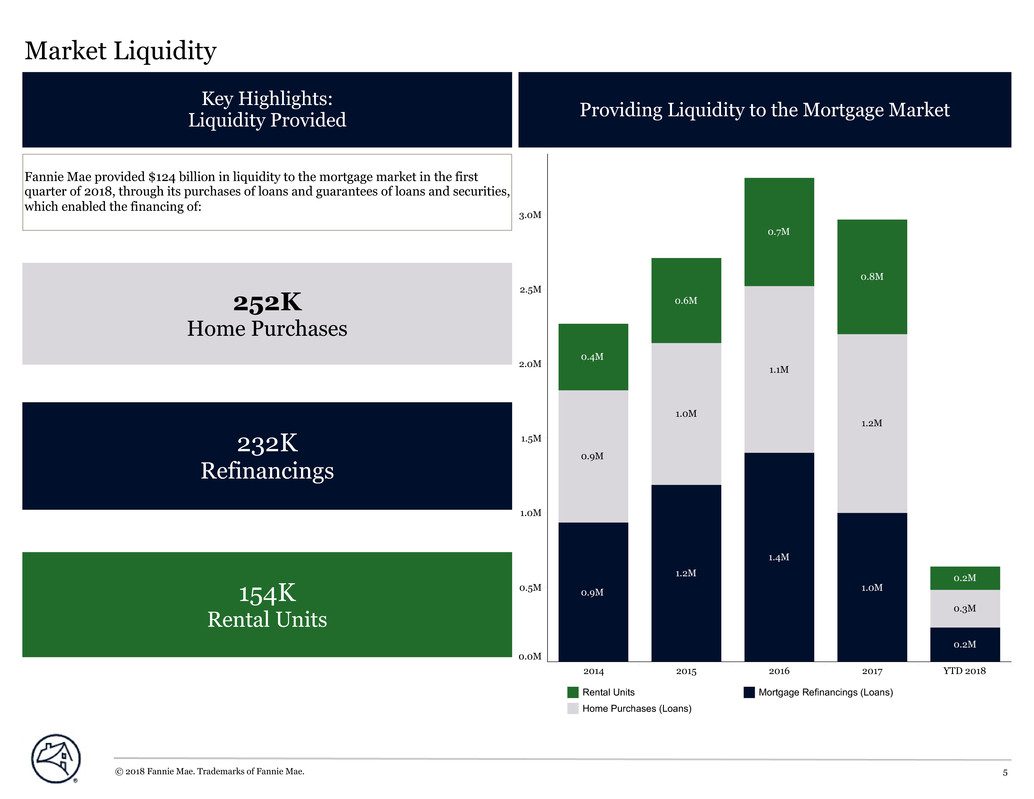

252K

Home Purchases

232K

Refinancings

154K

Rental Units

Key Highlights:

Liquidity Provided

Fannie Mae provided $124 bilion in liquidity to the mortgage market in the first

quarter of 2018, through its purchases of loans and guarantees of loans and securities,

which enabled the financing of:

Providing Liquidity to the Mortgage Market

Market Liquidity

© 2018 Fannie Mae. Trademarks of Fannie Mae. 5

2014 2015 2016 2017 YTD 2018

0.0%

2.0%

4.0%

2.83% 3.00%

3.46%

0.90% 1.18%

1.45%

2.08%

2.58%2.17%

2.41%

2.74%

3.13%

2.45%

3.00%

2.27%

2014 2015 2016 2017 YTD 2018

0.0%

2.0%

4.0%

6.0%

4.6%4.2%

1.0%

5.7% 5.7%

2014 2015 2016 2017 YTD 2018

0.0%

2.0%

4.0%

6.0% 5.60%

4.10%

2.40% 2.30%

4.70%

2.30%

5.00%

1.50%

2.60%

4.10%

NM

MN

MO

WA

WV

MAWY

NH

ME

OH

MT ND

MS

OR

OK

NV

NE

GA

NC

NY

AR

CO

TN

UT

WI

VACA KY

TX

MI

SD

PA

LA

NJ

AL

AZ

KS

SC

FL

IN

ID

IA

IL

Benchmark Interest Rates Single-Family Home Price Growth Rate U.S. GDP Growth Rate andUnemployment Rate

One Year Home Price Change as of Q1 2018

United States 5.5%

Key Market Economic Indicators

HI

AK

State Home Price

Growth Rate

Share of Fannie

Mae Single-Family

Guaranty Book

CA

TX

FL

NY

IL

NJ

WA

VA

CO 3.0%

3.4%

3.6%

3.7%

3.7%

5.1%

5.7%

6.3%

19.5%

7.9%

3.6%

12.0%

3.8%

2.8%

5.6%

7.0%

3.8%

8.7%

Top 10 States by UPB

© 2018 Fannie Mae. Trademarks of Fannie Mae. 6

State Growth Rate

0 to 4.9%

5 to 9.9%

10% and above

(2)

(2)

(2)

(3)

10-year Treasury rate

2-year swap rate

30-year Fannie MBS par coupon rate

Change based on Fannie Mae national home price index U.S. GDP Growth Rate, annualized for most recent period

U.S. Unemployment Rate

Draws from

Treasury

Dividend payments

to Treasury

Draws from

Treasury

Dividend payments

to Treasury

Draws from

Treasury

Dividend payments

to Treasury

Draws from

Treasury

Dividend payments

to Treasury

Draws from

Treasury

Dividend payments

to Treasury

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

($)

Bi

llio

ns

$144.8

$116.1

$0.0

$9.6 $12.0

$3.7

$0.0 $0.0

$166.4

$119.8

Draws from Treasury Dividend payments to Treasury

Treasury Draws and Dividend Payments

Treasury Draws and Dividend Payments: 2008 - YTD 2018

2008-2015 2016 2017 YTD 2018 Total

© 2018 Fannie Mae. Trademarks of Fannie Mae. 7

(5)

(4)

Single-Family Business

© 2018 Fannie Mae. Trademarks of Fannie Mae. 8

Private-label securities

3%

Freddie Mac

22%

Fannie Mae

42%

Ginnie Mae

33%

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

$0

$50

$100

$150

$200

UP

B (

$)

Bil

lio

ns

0

10

20

30

40

50

Ba

sis

Po

int

s

$60

$84

$50

$66

$69

$59

$52

$53

$47

$74

47.147.1

45.4

48.0

48.7

$118 $121

$134 $128

$112

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

$0

$1,000

$2,000

$3,000

$4,000

UP

B (

$)

Bil

lio

ns

0

10

20

30

40

50

Ba

sis

Po

int

s

$2,850 $2,870$2,823 $2,835$2,811

42.642.442.141.9 42.8

Refinance

Purchase

Average charged guaranty fee on new acquisitions, net of TCCA (bps)

Average charged guaranty fee on conventional guaranty book, net of TCCA (bps)

Average UPB outstanding of Single-Family conventional guaranty book

Key HighlightsQ1 2018 Market Share: New Single-Family Mortgage-Related Securities Issuances

§ Fannie Mae provided approximately $113 bilion in liquidity to the

single-family mortgage market in the first quarter 2018 while serving as

the largest issuer of single-family mortgage-related securities in the

secondary market. The company’s estimated market share of new

single-family mortgage-related securities issuances was 42 percent for

the first quarter of 2018.

§ The single-family guaranty book of business continued to grow in the

first quarter of 2018, while the average charged guaranty fee (net of

TCCA fees) on the single-family guaranty book as of March 31, 2018

remained relatively flat compared to year end at 42.8 basis points.

Single-Family Conventional Loan Acquisitions Conventional Guaranty Book of Business

Single-Family Highlights

Q1 2018

$4,561M

Net interest income

$1,034M

Fair value gains,

net

$242M

Investment gains,

net

$3,681M

Net income

$34M

Credit-related

income

© 2018 Fannie Mae. Trademarks of Fannie Mae. 9

(2)

(2)

(1)(1)

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Ful Year 2017 Q1 2018

Total Unpaid Principal Balance (UPB) ($B)

Total UPB excluding Refi Plus ($B)

Weighted Average Origination LTV (OLTV) Ratio

Origination LTV Ratio > 90%

Weighted Average FICO Credit Score

FICO Credit Score < 660

DTI Ratio > 45%

Fixed-rate

Condo/Co-op 9%

98%

23%

6%

743

19%

75%

$110.3

$112.2

10%

97%

10%

6%

745

18%

75%

$487.7

$501.8

10%

98%

19%

6%

743

18%

76%

$125.2

$127.9

10%

97%

8%

5%

745

20%

76%

$131.5

$134.2

10%

97%

7%

6%

745

19%

76%

$117.6

$121.2

10%

98%

7%

5%

746

15%

73%

$113.4

$118.5

Loans with

OLTV

Ratio > 90%

Loans with

FICO Credit

Score < 660

Loans with

DTI

Ratio > 45%

10%

98%

100%

7%

734

20%

76%

$25.9

$25.9

6%

100%

29%

100%

640

15%

73%

$6.0

$6.5

9%

100%

25%

5%

738

100%

95%

$20.5

$20.7

2014 2015 2016 2017 YTD 2018

0%

20%

40%

60%

80%

100%

We

igh

ted

Av

era

ge

OL

TV

Ra

tio

0%

5%

10%

15%

20%

25%

30%

Or

igi

na

tio

n L

TV

>

90

%

74%75% 75% 75%77%

18%18%

15%16%

19%

2014 2015 2016 2017 YTD 2018

0%

20%

40%

60%

80%

100%

Sh

are

of

Ac

qu

isi

tio

ns

20%

20%

30%

44%

26%22%

33%

56%

45%52% 53%

19%

16%

19% 19%

12% 6%

OLTV > 90%

Weighted Average OLTV Ratio

2014 2015 2016 2017 YTD 2018

0

200

400

600

800

We

igh

ted

Av

era

ge

FIC

O C

red

it S

cor

e

0%

2%

4%

6%

8%

10%

12%

14%

FIC

O C

red

it S

cor

e <

66

0

748 750744 743745

6%5% 6%

4%

7%

FICO Credit Score < 660

Weighted Average FICO Credit Score

Certain Credit Characteristics of Single-Family Conventional Loans

by Acquisition Period

YTD 2018 Acquisition

Credit Profile by

Certain Product Features

Origination

Loan-to-Value Ratio FICO Credit Score Acquisitions by Loan Purpose

Certain Credit Characteristics of Single-Family Loan Acquisitions

Refi Plus including HARP

Refinance (excluding cash-out & Refi Plus)

Cash-out refinance

Purchase

© 2018 Fannie Mae. Trademarks of Fannie Mae. 10

(3)

(3)

(3)

(3)

®

(4)

(4)

(1)

Overal

Book

2004 &

Earlier 2005-2008 2009-2015 2016 2017 2018

Total Unpaid Principal Balance (UPB) ($B)

Average Unpaid Principal Balance

Share of Single-Family Conventional Guaranty Book

Serious Delinquency Rate

Weighted Average Origination LTV Ratio

Origination LTV Ratio > 90%

Weighted Average Mark-to-Market LTV Ratio

Weighted Average FICO Credit Score

Share of Loans with Credit Enhancement

Fixed-rate 99%

33%

742

75%

18%

75%

0.00%

2%

$230,300

$63.3

98%

55%

744

72%

19%

76%

0.22%

16%

$221,340

$463.6

99%

64%

751

64%

16%

74%

0.41%

18%

$218,450

$505.0

98%

37%

752

51%

17%

75%

0.61%

55%

$161,002

$1,579.3

67%

19%

696

66%

15%

76%

6.22%

6%

$131,412

$171.2

79%

7%

701

40%

13%

74%

3.24%

3%

$68,737

$94.3

95%

43%

745

58%

17%

75%

1.16%

100%

$167,594

$2,876.7

Refi Plus

Including HARP Alt-A

Loans with

FICO Credit

Score < 660

Origination LTV

Ratio > 90%

98%

73%

732

79%

100%

101%

1.82%

17%

$175,547

$485.4

90%

32%

628

63%

24%

79%

4.91%

7%

$133,034

$198.6

70%

9%

709

63%

18%

79%

4.76%

2%

$139,999

$68.9

99%

11%

730

57%

38%

86%

0.98%

13%

$138,300

$367.1

2014 2015 2016 2017 YTD 2018

0%

10%

20%

30%

40%

50%

60%

70%

We

igh

ted

Av

era

ge

MT

ML

TV

0%

2%

4%

6%

8%

10%

%

MT

ML

TV

>

10

0%

60%

64% 62%

58% 58%

2%

3%

5%

1% 1%

2014 2015 2016 2017 YTD 2018

0

200

400

600

800

We

igh

ted

Av

era

ge

FIC

O C

red

it S

cor

e

0%

5%

10%

15%

20%

%

FIC

O C

red

it S

cor

e <

66

0

744 744 745 745 745

7%8% 8% 7%7%

Weighted Average Mark-To-Market

Loan-to-Value (MTMLTV) Ratio FICO Credit Score

2014 2015 2016 2017 YTD 2018

0.0%

2.0%

4.0%

6.0%

8.0%

Se

rio

us

De

lin

qu

en

cy

Ra

te

6.39%

1.20%

6.55%

8.39%

7.60%

1.89%

1.55% 1.24%

6.22%

3.06% 2.82%

3.24%3.26%

1.16%

3.28%

0.36% 0.36%0.35% 0.53% 0.51%

Serious Delinquency Rate by Vintage

Origination Year Certain Product Features

% FICO Credit Score < 660

Weighted Average FICO Credit Score

% MTMLTV > 100%

Weighted Average MTMLTV

Certain Credit Characteristics of Single-Family Conventional Guaranty Book of Business

Certain Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Origination Year and Product Features

Total single-family conventional guaranty book of business

2004 and prior

2005-2008

2009-2018

As of March 31, 2018

© 2018 Fannie Mae. Trademarks of Fannie Mae. 11

(8)

(9)

(11)

(3)

(13) (3)

(12)

(10)

(10)

(3)

(1)

2014 2015 2016 2017 YTD 2018

$0

$500

$1,000

$1,500

UP

B (

$)

Bil

lio

ns

0%

10%

20%

30%

40%

%

Sin

gle

-Fa

mi

ly

Co

nv

en

tio

na

l G

ua

ran

ty

Bo

ok

$1,002

$250

$429

$627

$927

22%

15%

9%

32%

35%

% Single-family conventional guaranty book in a CRT transaction

UPB outstanding of loans in a CRT transaction

Single-Family Loans Included in Credit Risk Transfer

Transactions, Balance of Covered Loans

Single-Family Credit Risk Transfer

Single-Family Loans with Credit Enhancement

Single-Family Credit Risk Transfer Issuance

2016

Outstanding

UPB

Percent of

Book

Outstanding

2017

Outstanding

UPB

Percent of

Book

Outstanding

YTD 2018

Outstanding

UPB

Percent of

Book

Outstanding

Primary mortgage insurance & other

Connecticut Avenue Securities™ (CAS)

Credit Insurance Risk Transfer™ (CIRT™)

Lender risk-sharing

(Less: loans covered by multiple credit

enhancements)

Total UPB of single-family loans with credit

enhancement 33%

(8%)

1%

4%

18%

18%

$925B

($211B)

$23B

$101B

$503B

$509B

40%

(12%)

2%

6%

24%

20%

$1,158B

($335B)

$65B

$181B

$681B

$566B

43%

(12%)

3%

7%

25%

20%

$1,223B

($362B)

$78B

$193B

$731B

$583B

2013 2014 2015 2016 2017 YTD 2018

$0

$100

$200

$300

$400

UP

B (

$)

Bil

lio

ns

$240

$222

$265

$102

$189

$40

$44

$76$27

$71

$17

$32

$233 $239

$331

$410

$103

Lender risk-sharing Connecticut Avenue Securities Credit Insurance Risk Transfer

Credit Enhancement

© 2018 Fannie Mae. Trademarks of Fannie Mae. 12

___________________________________________________________________________________________

___________________________________________________________________________________________

(7)

(6)

(5)

(6)

(7)

NM NM

MN MN

MO MO

WA WA

WV WV

MA MAWY WY

NH NH

ME ME

OH OH

MT MTND ND

MS MS

OR OR

OK OK

NV NV

NE NE

GA GA

NC NC

NY NY

AR AR

TN TN

CO COUT UT

WI WI

VA VACA CAKY KY

TX TX

MI MI

SD SD

PA PA

LA LA

NJ NJ

AL AL

AZ AZ

KS KS

FL FL

SC SC

IN IN

ID ID

IA IA

IL IL

Less than 0.50% 0.50% to 0.99% 1.00% to 1.99% 2.00% to 2.99% 3.00% and Above

2014 2015 2016 2017 YTD 2018

$0

$10

$20

$30

$40

UP

B (

$)

Bil

lio

ns

0

50

100

150

200

(N

um

be

r o

f L

oa

n W

ork

ou

ts)

Th

ou

san

ds

$16.6 $14.6$14.4

$21.7

$6.6

$4.2

$3.9

$2.1$3.1

26.0K

103.5K 100.6K

122.3K

164.6K

$28.3

$20.7

$17.5 $16.7

$4.2

2014 2015 2016 2017 YTD 2018

0K

20K

40K

60K

80K

100K

RE

O E

nd

ing

In

ven

tor

y

87K

57K

38K

26K 24K

Single-Family Problem Loan Statistics

Single-Family Serious Delinquency Rate by State as of March 31, 2018

Single-Family Loan Workouts REO Ending Inventory

REO Ending Inventory

AK AK

PR

HI HI

PR PR

VI VI

State

Serious

Delinquency

Rate

Average

Months to

Foreclosure

CA

TX

FL

NY

IL

NJ

WA

VA

CO

PA 25

22

16

36

60

24

68

51

24

21

1.30%

0.25%

0.62%

0.46%

1.91%

1.15%

1.87%

3.56%

1.34%

0.39%

Top 10 States by UPB

Foreclosure Alternatives

Home Retention Solutions

Total Loan Workouts

© 2018 Fannie Mae. Trademarks of Fannie Mae. 13

(15)

(16)

(10)

(14)

2014 2015 2016 2017 YTD 2018 2014 2015 2016 2017 YTD 2018

Alt-A

Interest Only

Origination LTV Ratio > 90%

FICO Credit Score < 660 and Origination LTV Ratio > 90%

FICO Credit Score < 660

Refi Plus including HARP 12.8%

6.9%

1.6%

16.9%

1.1%

2.4%

13.2%

7.0%

1.7%

16.7%

1.2%

2.5%

15.4%

7.3%

1.8%

16.4%

1.7%

3.1%

17.6%

7.8%

2.0%

16.3%

2.1%

3.7%

19.1%

8.0%

2.0%

15.9%

2.5%

4.2%

16.3%

37.2%

9.9%

23.3%

11.9%

21.6%

15.9%

33.0%

9.0%

23.9%

15.7%

21.9%

14.0%

35.8%

8.8%

21.9%

12.2%

24.9%

7.8%

29.7%

6.5%

16.4%

18.0%

29.3%

10.4%

29.7%

6.6%

15.3%

10.2%

17.4%

2014 2015 2016 2017 YTD 2018 2014 2015 2016 2017 YTD 2018

2009 - YTD 2018

2005 – 2008

2004 & Prior 3.3%

6.0%

90.8%

3.5%

6.2%

90.3%

4.5%

8.1%

87.4%

5.8%

10.1%

84.1%

7.3%

12.2%

80.5%

16.7%

59.7%

23.6%

12.2%

64.8%

23.1%

16.4%

64.7%

19.0%

12.1%

77.6%

10.3%

12.0%

74.7%

13.3%

3.0%

78.9%

3.7%

3.7%

5.7%

5.1%

51.8%

11.2%

11.7%

11.7%

5.4%

8.1%

Al Other States

Florida

Ilinois

New Jersey

New York

Pennsylvania

Al Other States

Florida

Ilinois

New Jersey

New York

Pennsylvania

Credit Loss Concentration of Single-Family Conventional Guaranty Book of Business

% of Single-Family Conventional Guaranty Book of Business % of Single-Family Credit Losses

% of Single-Family Conventional Guaranty Book of Business

by State as of March 31, 2018 % of Q1 2018 Single-Family Credit Losses by State

© 2018 Fannie Mae. Trademarks of Fannie Mae. 14

100%

$2.9T

100%

$0.5B

(17) (18)

(9)

Certain Product Features

Vintage

(3)

(3)

Yr

1-Q

1

Yr

1-Q

2

Yr

1-Q

3

Yr

1-Q

4

Yr

2-Q

1

Yr

2-Q

2

Yr

2-Q

3

Yr

2-Q

4

Yr

3-Q

1

Yr

3-Q

2

Yr

3-Q

3

Yr

3-Q

4

Yr

4-Q

1

Yr

4-Q

2

Yr

4-Q

3

Yr

4-Q

4

Yr

5-Q

1

Yr

5-Q

2

Yr

5-Q

3

Yr

5-Q

4

Yr

6-Q

1

Yr

6-Q

2

Yr

6-Q

3

Yr

6-Q

4

Yr

7-Q

1

Yr

7-Q

2

Yr

7-Q

3

Yr

7-Q

4

Yr

8-Q

1

Yr

8-Q

2

Yr

8-Q

3

Yr

8-Q

4

Yr

9-Q

1

Yr

9-Q

2

Yr

9-Q

3

Yr

9-Q

4

Yr

10

-Q

1

Yr

10

-Q

2

Yr

10

-Q

3

Yr

10

-Q

4

Yr

11-

Q1

Yr

11-

Q2

Yr

11-

Q3

Yr

11-

Q4

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

Cu

mu

lat

ive

De

fau

lt R

ate

2007

2008

2002

2009

20102011201220132014201520162017

2006

2005

2004

2003

2018

Single-Family Cumulative Default Rates

Cumulative Default Rates of Single-Family Conventional Guaranty Book of Business by Origination Year

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012*

2013*

2014*

2015*

2016*

2017*

2018*

Time Since Beginning of Origination Year

© 2018 Fannie Mae. Trademarks of Fannie Mae. 15

* As of March 31, 2018, cumulative default rates on the loans originated from 2012-2018 was less than 1.0%

(19)

Multifamily Business

© 2018 Fannie Mae. Trademarks of Fannie Mae. 16

Multifamily Highlights

Q1 2018 Acquisitions Guaranty Book of Business

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

$0.0

$5.0

$10.0

$15.0

$20.0

UP

B (

$)

Bil

lio

ns

$20.3

$16.2

$12.3

$17.4

$11.3

$17.4

$13.2

$16.2

$20.3

$11.3

Multifamily Guaranty Fee and

Credit Loss (Benefit) Ratio

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

$0

$100

$200

$300

$400

UP

B (

$)

Bil

lio

ns

0%

20%

40%

60%

80%

100%

Sh

are

of

M

ult

ifa

mi

ly

Gu

ara

nty

Bo

ok

wi

th

Le

nd

er

Ris

k S

ha

rin

g$265.4$253.3 $257.2

$281.3$277.3

96%96% 97%95%95%

Share of guaranty book with lender risk-sharing

UPB outstanding of Multifamily guaranty book of business

Key Highlights

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

0

20

40

60

80

100

Ba

sis

Po

int

s

76.7 77.9 79.8 78.7 78.9

0.0 0.3 (2.4) (0.8) 0.6

Annualized credit loss (benefit) ratio

Average guaranty fee at end of period (bps)

§ New multifamily business volume was $11.3 bilion in the first quarter

of 2018, a decrease from $20.3 bilion in the fourth quarter of 2017.

Approximately 38 percent of Fannie Mae’s first quarter 2018

multifamily new business volume counted toward FHFA’s 2018

multifamily volume cap.

§ Fannie Mae supported 154,000 units of multifamily housing in the

first quarter of 2018. More than 90 percent of the units the company

financed were afordable to families earning at or below 120 percent of

the area median income, providing support for both afordable and

workforce housing.

§ The multifamily guaranty book of business continued to grow in the

first quarter of 2018, while the average charged guaranty fee on the

multifamily guaranty book remained relatively flat compared to year

end at 78.9 basis points as of March 31, 2018.

Other rental business volume Multifamily new business volume

$671M

Net interest income

$162M

Fee and other

income

$21M

Credit-related

income

$11M

Fair value gains

$580M

Net income

© 2018 Fannie Mae. Trademarks of Fannie Mae. 17

(1)

(2)

Certain Credit Characteristics of Multifamily Acquisitions

2014 2015 2016 2017 YTD 2018

0%

20%

40%

60%

80%

100%

Sh

are

of

Ac

qu

isi

tio

ns

48% 48% 50%

49%

58%

43%

57%

41%

51% 51%

% Origination LTV less than or equal to 70%

% Origination LTV greater than 70% and less than or equal to 80%

% Origination LTV greater than 80%

2014 2015 2016 2017 YTD 2018

0%

20%

40%

60%

80%

100%

Sh

are

of

Ac

qu

isi

tio

ns

80%

20%

84%

28% 23%

79% 72% 77%

16%21%

$0.6B

$0.6B

$0.6B

$0.4B

$0.2B

$0.2B

$0.2B

$0.5B

$0.5B

$1.0B

Variable Rate

Fixed Rate

2014 2015 2016 2017 YTD 2018

Total Unpaid Principal Balance (UPB) ($B)

Weighted Average Origination LTV Ratio

Loan Count

% Lender Recourse

% DUS™ 100%

100%

811

66%

$11.3

98%

100%

3,861

67%

$67.1

99%

99%

3,335

68%

$55.3

99%

99%

2,869

68%

$42.4

99%

99%

2,361

68%

$28.9

Certain Credit Chacteristics of Multifamily Loans by Acquisition Period

Origination Loan-to-Value Ratio Acquisitions by Note TypeTop 10 MSAs by YTD 2018Acquisition UPB

Atlanta

Dalas

Denver

Houston

Los Angeles

New York

Orlando

Portland

San Francisco

Washington, DC

© 2018 Fannie Mae. Trademarks of Fannie Mae. 18

(3)

(4)

Share of

Acquistions: 43.1%

Total UPB: $4.9B

Certain Credit Characteristics of Multifamily Guaranty Book of Business

2014 2015 2016 2017 YTD 2018

0%

20%

40%

60%

80%

100%

Sh

are

of

M

ult

ifa

mi

ly

Bo

ok

of

Bu

sin

ess

80% 80%

20% 20%

82% 82%

18% 18%

81%

19%

$20.2B

$25.2B

$13.5B

$12.1B

$8.8B

$8.3B

$8.3B

$6.4B

$6.3B

$7.9B

Atlanta

Chicago

Dalas

Houston

Los Angeles

Miami

New York

San Francisco

Seattle

Washington, DC

Overal Book

2004 &

Eariler 2005 - 2008 2009 - 2015 2016 2017 2018

Total Unpaid Principal Balance (UPB) ($B)

Average Unpaid Principal Balance ($M)

Weighted Average Origination LTV Ratio

% Fixed-rate

Loan Count

% of Book

% of Smal Balance Loans

% Lender Recourse

% DUS

Serious Delinquency Rate

100%

100%

22%

4%

813

84%

66%

$13.9

$11.3

0.04%

97%

100%

18%

24%

3,837

80%

67%

$17.4

$66.6

0.17%

99%

100%

18%

19%

3,175

79%

68%

$16.6

$52.7

0.16%

98%

96%

38%

47%

13,998

90%

66%

$9.5

$132.3

0.36%

87%

76%

85%

4%

4,725

54%

64%

$2.5

$11.8

0.01%

96%

95%

69%

2%

1,490

21%

71%

$4.4

$6.5

0.13%

97%

97%

42%

100%

28,038

82%

67%

$10.0

$281.3

Conventional

/ Co-op Senior Student Manufactured

100%

99%

28%

4%

926

87%

67%

$10.7

$9.9

0.11%

100%

99%

15%

4%

563

79%

67%

$18.2

$10.3

0.10%

98%

100%

2%

5%

705

62%

67%

$21.4

$15.1

0.14%

97%

96%

44%

87%

25,844

84%

67%

$9.5

$246.1

Certain Credit Characteristics of Multifamily Book of Business by Acquisition Year, Asset Class, or Targeted Afordable Segment

UPB by Maturity Year Multifamily Book of Businessby Note TypeTop 10 MSAs by UPB

$3.1B

$215.3B

$22.4B

$16.0B

$12.6B$11.9B

2018

2019

2020

2021

2022

Other

Variable Rate

Fixed Rate

Acquisition Year Asset Class or Targeted Afordable Segment

Privately Owned

with Subsidy

0.23%

95%

95%

41%

12%

3,842

66%

70%

$8.7

$33.5

© 2018 Fannie Mae. Trademarks of Fannie Mae. 19

(3)

(8)

(4)

(7)

As of March 31, 2018

Share of Book

of Business: 100%

Total UPB: $281.3B

Share of Book

of Business: 41.6%

Total UPB: $117.0B

(5) (5) (5) (5) (6)

(1)

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 YTD 2018

0.0%

0.5%

1.0%

1.5%

2.0%

Cr

ed

it L

oss

Ra

te

0.0%

0.2%

0.1% 0.0%

0.4%0.3%

0.0%

0.4%

0.5%

0.9%

0.2%

0.7%

0.9%

1.2%

1.1%

0.8%

0.9%

1.4%

0.3%0.3%

0.1% 0.1%0.0%0.1% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

DUS Credit Loss Rate Total Credit Loss Rate Non-DUS Credit Loss Rate

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 YTD 2018

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

Se

rio

us

De

lin

qu

en

cy

Ra

te

0.55%

0.34%

0.15%

0.05%

0.56%

0.11%

1.36%

0.44%

1.20%

0.24%

0.71%

0.21% 0.21%

0.18%

0.24%

0.63%

0.13%

0.50%

0.10%

0.59%

0.09%0.08% 0.08%

0.07%

0.07%

0.05%

0.39%

0.92%

DUS Serious Delinquency Rate

Multifamily Total Serious Delinquency Rate

Non-DUS Serious Delinquency Rate

DUS/Non-DUS Cumulative Credit Loss Rates by Acquisition Year Through YTD 2018

Serious Delinquency Rates

2013 2014 2015 2016 2017 YTD 2018

-2.0

-1.0

0.0

1.0

2.0

3.0

Ba

sis

Po

int

s

(0.7)

(0.2)

2.5

0.6

(2.7)

(2.3)

Credit Loss (Benefit) Ratio

Multifamily Serious Delinquency Rates and Credit Losses

© 2018 Fannie Mae. Trademarks of Fannie Mae. 20

(4) (9)

(4) (8) (2) (10)

Endnotes

© 2018 Fannie Mae. Trademarks of Fannie Mae. 21

Financial Overview Endnotes

Guaranty fee income includes the impact of a 10 basis point guaranty fee increase implemented in 2012 pursuant to the Temporary Payrol Tax Cut Continuation Act of

2011, the incremental revenue from which is remitted to Treasury and not retained by the company.

Home price estimates are based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of March 2018. UPB estimates

are based on data available through the end of March 2018. Including subsequent data may lead to materialy diferent results. Home price change is not seasonaly

adjusted.

Source: Bureau of Economic Analysis. GDP growth rate is calculated using the quarterly annualized growth rate for the most recent period and the annual growth rate for

prior periods.

Under the terms of the senior preferred stock purchase agreement, dividend payments we make to Treasury do not ofset our prior draws of funds from Treasury, and we

are not permitted to pay down draws we have made under the agreement except in limited circumstances.

Treasury draws are shown in the period for which requested, not when the funds were received by us. Draw requests have been funded in the quarter folowing a net

worth deficit.

(1)

(2)

(3)

(4)

(5)

© 2018 Fannie Mae. Trademarks of Fannie Mae. 22

Single-Family Business Endnotes

Single-family conventional population consists of: (a) single-family mortgage loans of Fannie Mae; (b) single-family mortgage loans underlying Fannie Mae MBS; and (c) other

credit enhancements that we provide on single-family mortgage assets, such as long-term standby commitments. It excludes non-Fannie Mae single-family mortgage-related

securities held in our retained mortgage portfolio for which we do not provide a guaranty. Refers to mortgage loans and mortgage-related securities that are not guaranteed or

insured, in whole or in part, by the U.S. government or one of its agencies.

Calculated based on the average guaranty fee rate for our single-family guaranty arrangements during the period plus the recognition of any upfront cash payments over an

estimated average life. Excludes the impact of a 10 basis point guaranty fee increase implemented in 2012 pursuant to the TCCA, the incremental revenue from which is remitted to

Treasury and not retained by us.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan.

Population excludes HARP and other Refi Plus loans acquired under our Refi Plus™ initiative.

Refers to loans included in an agreement used to reduce credit risk by requiring primary mortgage insurance, colateral, letters of credit, corporate guarantees, or other agreements

to provide an entity with some assurance that it wil be compensated to some degree in the event of a financial loss. Excludes loans covered by credit risk transfer transactions

unless such loans are also covered by primary mortgage insurance.

Outstanding unpaid principal balance represents the underlying loan balance, which is diferent from the reference pool balance for CAS and some lender risk-sharing transactions.

Includes mortgage pool insurance transactions covering loans with an unpaid principal balance of approximately $7 bilion at issuance and approximately $4 bilion outstanding as

of March 31, 2018.

Calculated based on the aggregate unpaid principal balance of single-family loans for each category divided by the aggregate unpaid principal balance of loans in our single-family

conventional guaranty book of business. Loans with multiple product features are included in al applicable categories.

For a description of our Alt-A loan classification criteria, refer to Fannie Mae’s 2017 Form 10-K. We discontinued the purchase of newly originated Alt-A loans in 2009, except for

those that represent the refinancing of a loan we acquired prior to 2009, which has resulted in our acquisitions of Alt-A mortgage loans remaining low and the percentage of the

book of business attributable to Alt-A to continue to decrease over time.

“Serious delinquency rate" refers to single-family conventional loans that are 90 days or more past due or in the foreclosure process in the applicable origination year, product

feature, or state, divided by the number of loans in our single-family conventional guaranty book of business in that origination year, product feature, or state.

The average estimated mark-to-market LTV ratio is based on the unpaid principal balance of the loan divided by the estimated current value of the property, which we calculate

using an internal valuation model that estimates periodic changes in home value. Excludes loans for which this information is not readily available.

Percentage of loans in our single-family conventional guaranty book of business, measured by unpaid principal balance, included in an agreement used to reduce credit risk by

requiring colateral, letters of credit, mortgage insurance, corporate guarantees, inclusion in a credit risk transfer transaction reference pool, or other agreement that provides for

our compensation to some degree in the event of a financial loss relating to the loan. Because we include loans in reference pools for our Connecticut Avenue Securities™ and Credit

Insurance Risk Transfer™ credit risk transfer transactions on a lagged basis (typicaly about six months to one year after we initialy acquire the loans), we expect the percentage of

our 2017 and 2018 single-family loan acquisitions with credit enhancement wil increase in the future.

The aggregate estimated mark-to-market LTV ratio is based on the unpaid principal balance of the loan as of the end of each period divided by the estimated value of the property as

of the end of the period.

Measured from the borrowers’ last paid instalment on their mortgages to when the related properties were added to our REO inventory for foreclosures completed during the first

three months of 2018. Home Equity Conversion Mortgages insured by the Department of Housing and Urban Development are excluded from this calculation.

Consists of (a) short sales, in which the borrower, working with the servicer and Fannie Mae, sels the home prior to foreclosure for less than the amount owed to pay of the loan,

accrued interest and other expenses from the sale proceeds and (b) deeds-in-lieu of foreclosure, which involve the borrower’s voluntarily signing over title to the property.

Consists of (a) modifications, which do not include trial modifications, loans to certain borrowers who have received bankruptcy relief that are accounted for as troubled debt

restructurings, or repayment plans or forbearances that have been initiated but not completed; (b) repayment plans, reflects only those plans associated with loans that were 60

days or more delinquent; and (c) forbearances, not including forbearances associated with loans that were less than 90 days delinquent when entered.

Based on the unpaid principal balance (UPB) of the single-family conventional guaranty book of business as of period end.

Credit losses consist of (a) charge-ofs net of recoveries and (b) foreclosed property expense (income). Percentages exclude the impact of recoveries that have not been alocated to

specific loans.

Defaults include loan foreclosures, short sales, sales to third parties at the time of foreclosure and deeds-in-lieu of foreclosure. Cumulative Default Rate is the total number of

single-family conventional loans in the guaranty book of business originated in the identified year that have defaulted, divided by the total number of single-family conventional

loans in the guaranty book of business originated in the identified year. Data as of March 31, 2018 is not necessarily indicative of the ultimate performance of the loans and

performance is likely to change, perhaps materialy, in future periods.

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

(14)

(15)

(16)

(17)

(18)

(19)

© 2018 Fannie Mae. Trademarks of Fannie Mae. 23

Multifamily Business Endnotes

Our multifamily guaranty book of business consists of: (a) multifamily mortgage loans of Fannie Mae; (b) multifamily mortgage loans underlying Fannie Mae MBS; and

(c) other credit enhancements that we provide on multifamily mortgage assets. It excludes non-Fannie Mae multifamily mortgage-related securities held in our retained

mortgage portfolio for which we do not provide a guaranty. The information presented excludes loans for which our loan level information is incomplete, which

comprised less than 1% of our multifamily guaranty book of business as of March 31, 2018.

Credit loss (benefit) ratio represents the credit loss or benefit for the period divided by the average unpaid principal balance of the multifamily guaranty book of

business for the period. Credit benefits are the result of recoveries on previously charged-of amounts.

Represents the percentage of loans with lender risk-sharing agreements in place, measured by unpaid principal balance.

Under the Delegated Underwriting and Servicing, or DUS, program, Fannie Mae acquires individual, newly originated mortgages from specialy approved DUS lenders

using DUS underwriting standards and/or DUS loan documents. Because DUS lenders generaly share the risk of loss with Fannie Mae, they are able to originate,

underwrite, close and service most loans without our pre-review.

See https://www.fanniemae.com/multifamily/products for definitions. Loans with multiple product features are included in al applicable categories.

The Multifamily Afordable Business Channel focuses on financing properties that are under an agreement that provides long-term afordability, such as properties with

rent subsidies or income restrictions.

Multifamily loans with an original unpaid balance of up to $3 milion nationwide or up to $5 milion in high cost markets.

Multifamily loans are classified as seriously delinquent when payment is 60 days or more past due.

Cumulative credit loss rate is the cumulative credit losses (gains) through March 31, 2018 on the multifamily loans that were acquired in the applicable period, as a

percentage of the total acquired unpaid principal balance of multifamily loans in the applicable period.

Credit loss (benefit) ratio is annualized for the most recent period.

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

© 2018 Fannie Mae. Trademarks of Fannie Mae. 24