Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ESTERLINE TECHNOLOGIES CORP | d549965dex991.htm |

| 8-K - FORM 8-K - ESTERLINE TECHNOLOGIES CORP | d549965d8k.htm |

Q2 2018 Supplemental Financial Information May 3, 2018 Exhibit 99.2

This presentation may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “should” or “will,” or the negative of such terms, or other comparable terminology. These forward-looking statements are only predictions based on the current intent and expectations of the management of Esterline, are not guarantees of future performance or actions, and involve risks and uncertainties that are difficult to predict and may cause Esterline’s or its industry’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Esterline's actual results and the timing and outcome of events may differ materially from those expressed in or implied by the forward-looking statements due to risks detailed in Esterline's public filings with the Securities and Exchange Commission including its most recent Annual Report on Form 10-K/A. This presentation also contains references to non-GAAP financial information subject to Regulation G. The reconciliations of each non-GAAP financial measure to its comparable GAAP measure as well as further information on management’s use of non-GAAP financial measures are included in Esterline’s press release dated May 3, 2018, included as Exhibit 99.1 to Form 8-K filed with the SEC on the same date, as well as in this presentation, including the Appendix.

Strategic Direction A high-performing aerospace and defense company whose engaged employees deliver value through world-class products, services, and technologies. Profitable & Balanced Sales Growth Enterprise Excellence Leverage the Enterprise Employee Engagement Regulatory & Customer Compliance Enhance operations, drive organic growth, generate cash

Q2 2018 Financial Results Sales of $517.6 million, up 1.7% over prior-year period Positive foreign exchange translation drove higher sales year-over-year FY18 Q1 to Q2 sales improvement in all three business segments GAAP EPS¹ of $0.80 per diluted share Book-to-bill of 1.26x Year-to-date free cash flow of $62.0 million* * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. ¹ From Continuing Operations

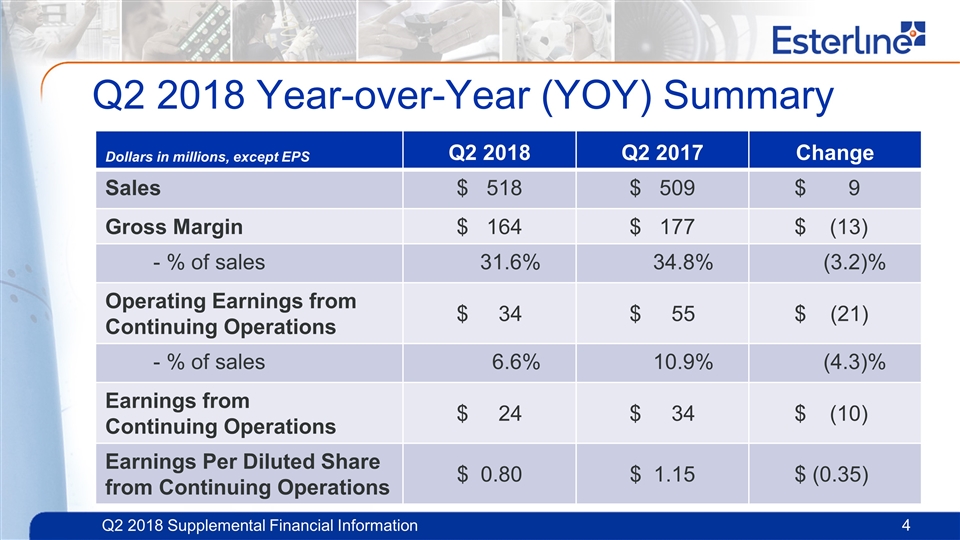

Q2 2018 Year-over-Year (YOY) Summary Dollars in millions, except EPS Q2 2018 Q2 2017 Change Sales $ 518 $ 509 $ 9 Gross Margin $ 164 $ 177 $(13) - % of sales 31.6% 34.8% (3.2)% Operating Earnings from Continuing Operations $ 34 $ 55 $ (21) - % of sales 6.6% 10.9% (4.3)% Earnings from Continuing Operations $ 24 $ 34 $ (10) Earnings Per Diluted Share from Continuing Operations $ 0.80 $ 1.15 $ (0.35)

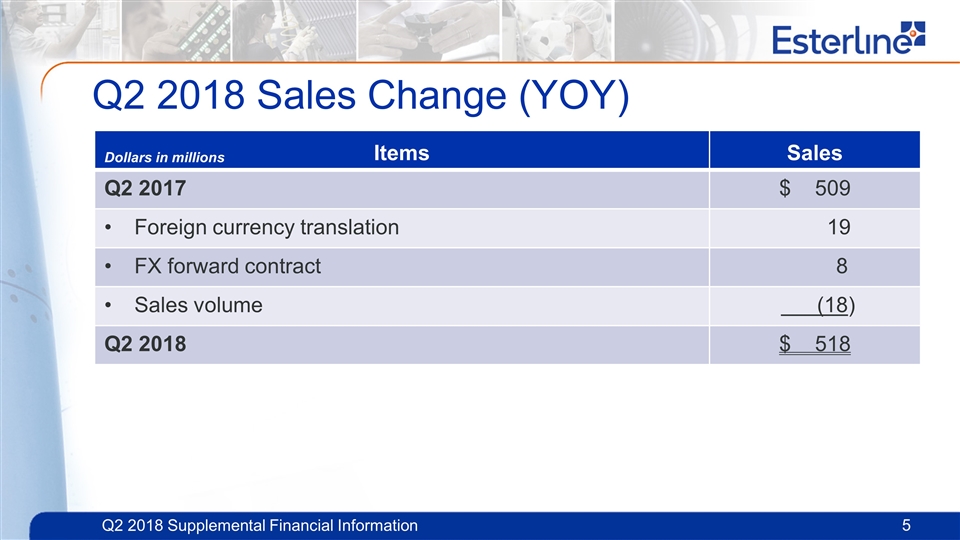

Q2 2018 Sales Change (YOY) Items Sales Q2 2017 $ 509 Foreign currency translation 19 FX forward contract 8 Sales volume (18) Q2 2018 $ 518 Dollars in millions

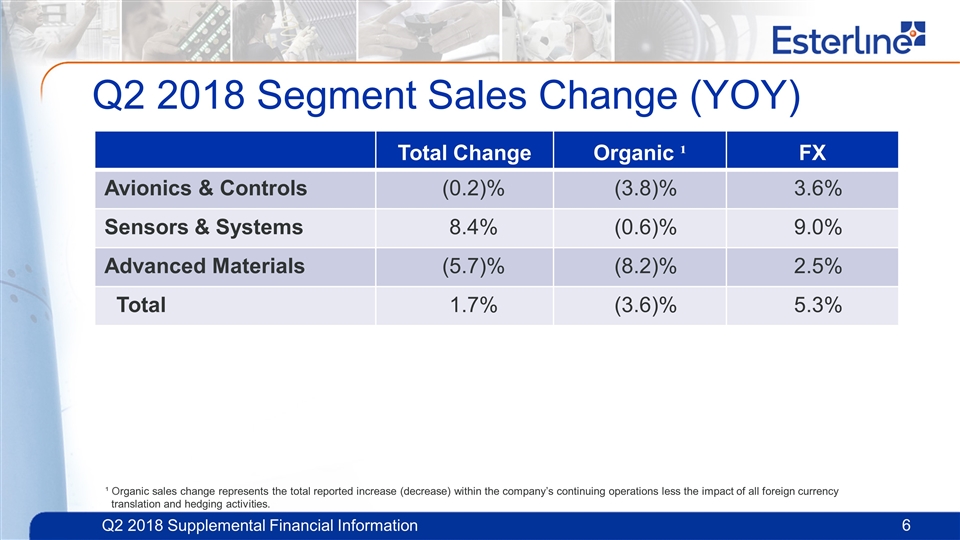

Q2 2018 Segment Sales Change (YOY) Total Change Organic ¹ FX Avionics & Controls (0.2)% (3.8)% 3.6% Sensors & Systems 8.4% (0.6)% 9.0% Advanced Materials (5.7)% (8.2)% 2.5% Total 1.7% (3.6)% 5.3% ¹ Organic sales change represents the total reported increase (decrease) within the company’s continuing operations less the impact of all foreign currency translation and hedging activities.

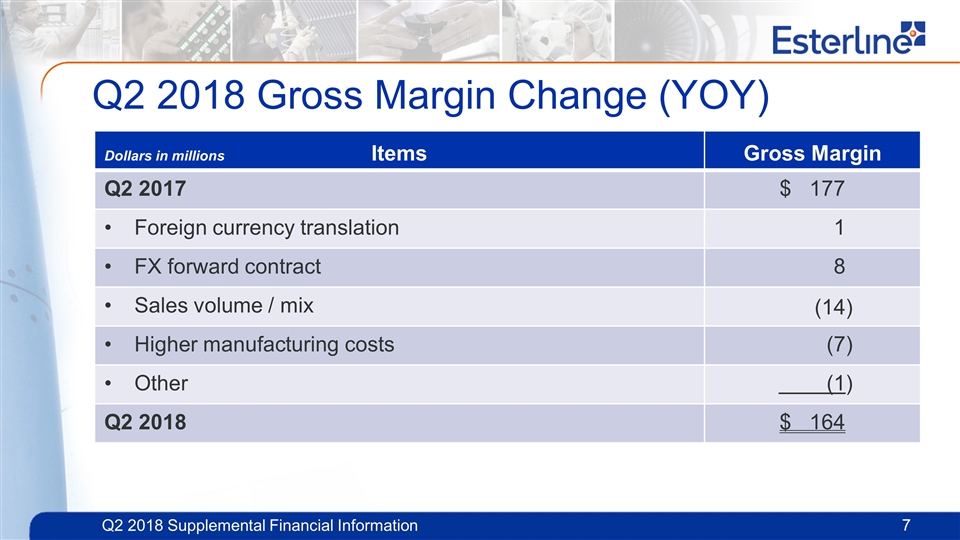

Q2 2018 Gross Margin Change (YOY) Items Gross Margin Q2 2017 $ 177 Foreign currency translation 1 FX forward contract 8 Sales volume / mix (14) Higher manufacturing costs (7) Other (1) Q2 2018 $ 164 Dollars in millions

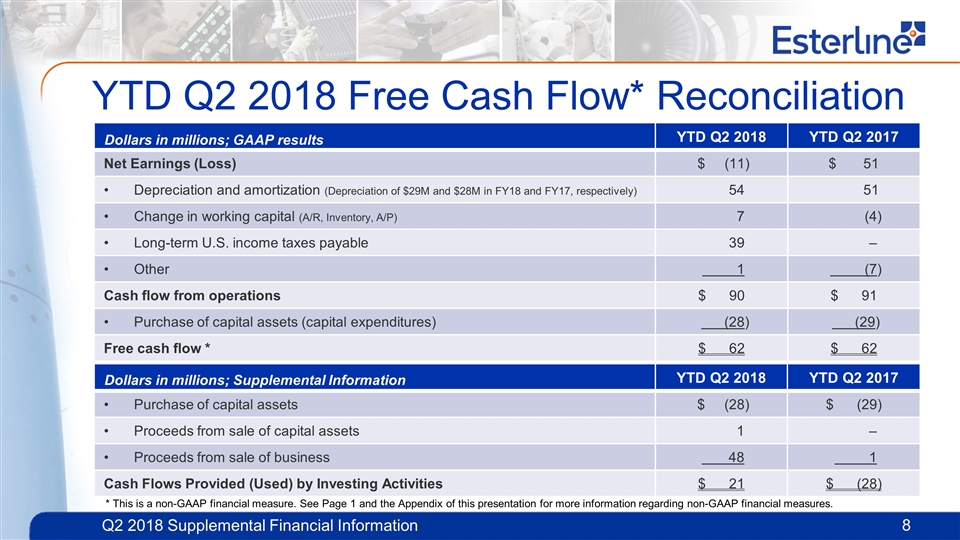

YTD Q2 2018 Free Cash Flow* Reconciliation YTD Q2 2018 YTD Q2 2017 Net Earnings (Loss) $ (11) $ 51 Depreciation and amortization (Depreciation of $29M and $28M in FY18 and FY17, respectively) 54 51 Change in working capital (A/R, Inventory, A/P) 7 (4) Long-term U.S. income taxes payable 39 ‒ Other 1 (7) Cash flow from operations $ 90 $ 91 Purchase of capital assets (capital expenditures) (28) (29) Free cash flow * $ 62 $ 62 Dollars in millions; GAAP results * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. YTD Q2 2018 YTD Q2 2017 Purchase of capital assets $ (28) $ (29) Proceeds from sale of capital assets 1 ‒ Proceeds from sale of business 48 1 Cash Flows Provided (Used) by Investing Activities $ 21 $ (28) Dollars in millions; Supplemental Information

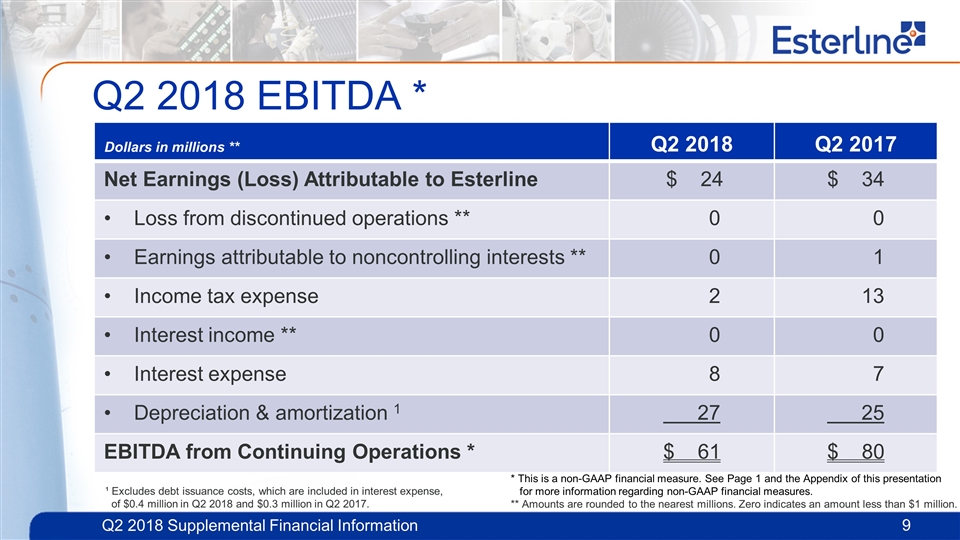

Q2 2018 EBITDA * Q2 2018 Q2 2017 Net Earnings (Loss) Attributable to Esterline $ 24 $ 34 Loss from discontinued operations ** 0 0 Earnings attributable to noncontrolling interests ** 0 1 Income tax expense 2 13 Interest income ** 0 0 Interest expense 8 7 Depreciation & amortization 1 27 25 EBITDA from Continuing Operations * $ 61 $ 80 Dollars in millions ** ¹ Excludes debt issuance costs, which are included in interest expense, of $0.4 million in Q2 2018 and $0.3 million in Q2 2017. * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. ** Amounts are rounded to the nearest millions. Zero indicates an amount less than $1 million.

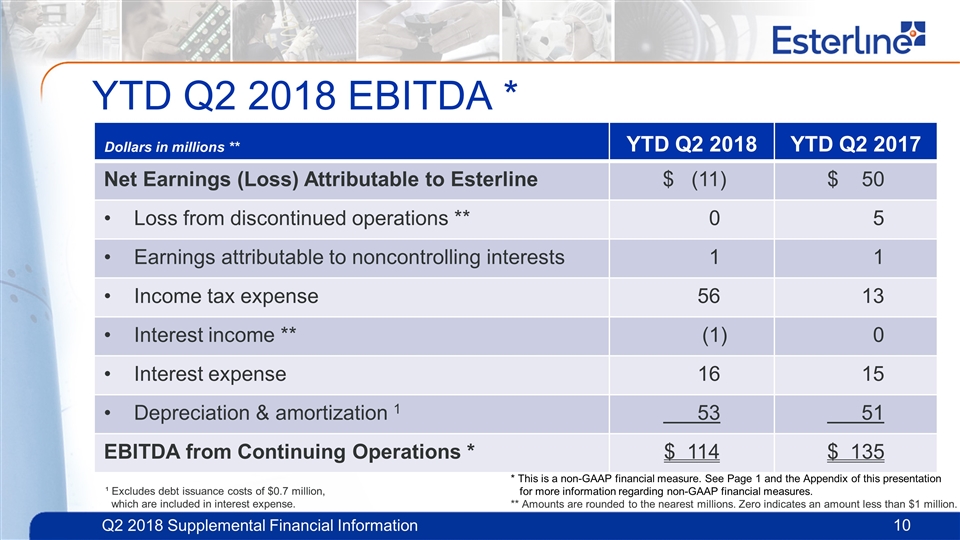

YTD Q2 2018 EBITDA * YTD Q2 2018 YTD Q2 2017 Net Earnings (Loss) Attributable to Esterline $ (11) $ 50 Loss from discontinued operations ** 0 5 Earnings attributable to noncontrolling interests 1 1 Income tax expense 56 13 Interest income ** (1) 0 Interest expense 16 15 Depreciation & amortization 1 53 51 EBITDA from Continuing Operations * $ 114 $ 135 Dollars in millions ** ¹ Excludes debt issuance costs of $0.7 million, which are included in interest expense. * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. ** Amounts are rounded to the nearest millions. Zero indicates an amount less than $1 million.

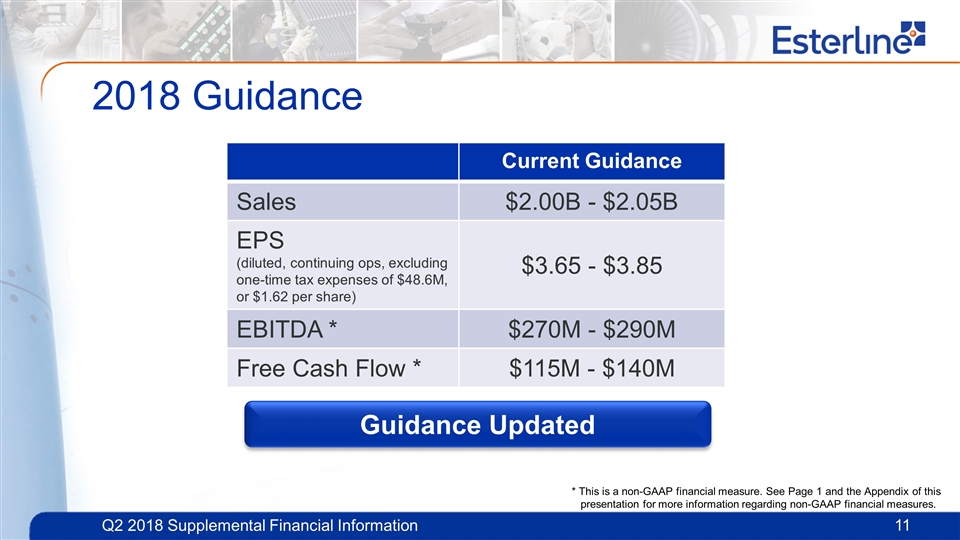

2018 Guidance Guidance Updated Current Guidance Sales $2.00B - $2.05B EPS (diluted, continuing ops, excluding one-time tax expenses of $48.6M, or $1.62 per share) $3.65 - $3.85 EBITDA * $270M - $290M Free Cash Flow * $115M - $140M * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures.

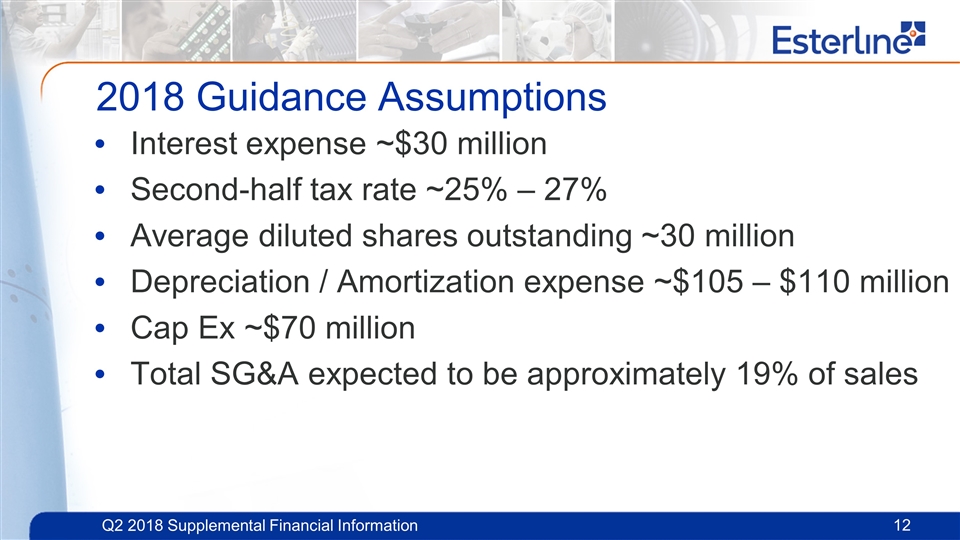

2018 Guidance Assumptions Interest expense ~$30 million Second-half tax rate ~25% – 27% Average diluted shares outstanding ~30 million Depreciation / Amortization expense ~$105 – $110 million Cap Ex ~$70 million Total SG&A expected to be approximately 19% of sales

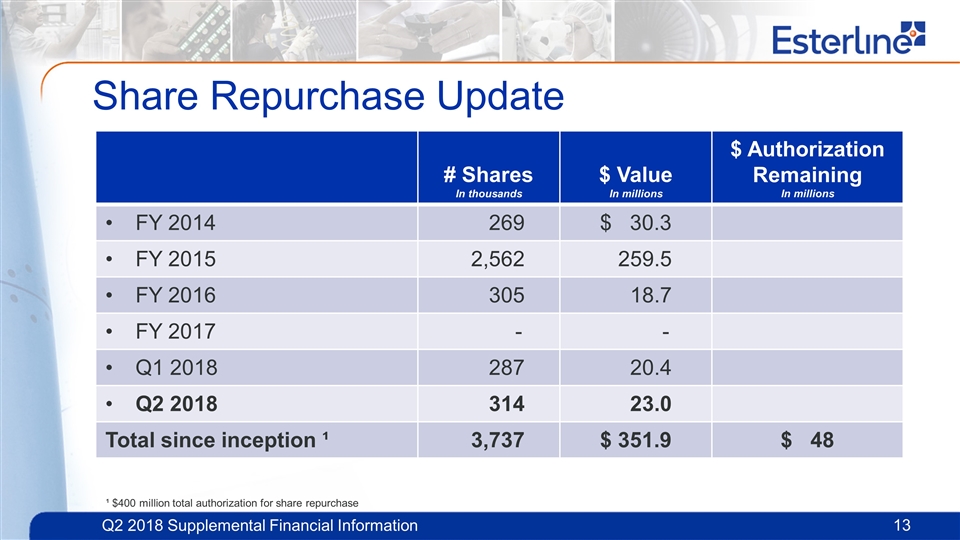

Share Repurchase Update # Shares In thousands $ Value In millions $ Authorization Remaining In millions FY 2014 269 $ 30.3 FY 2015 2,562 259.5 FY 2016 305 18.7 FY 2017 - - Q1 2018 287 20.4 Q2 2018 314 23.0 Total since inception ¹ 3,737 $ 351.9 $ 48 ¹ $400 million total authorization for share repurchase

Appendix

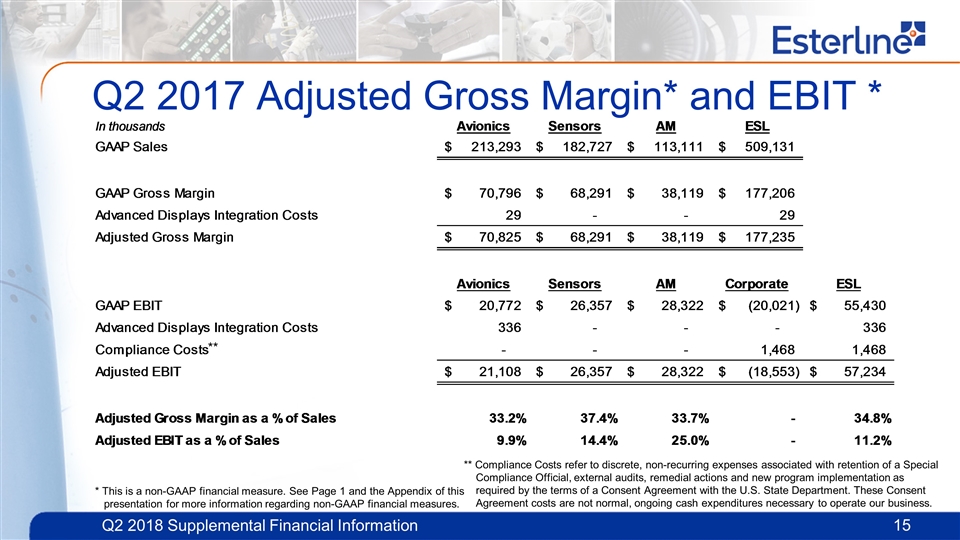

Q2 2017 Adjusted Gross Margin* and EBIT * ** * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. ** Compliance Costs refer to discrete, non-recurring expenses associated with retention of a Special Compliance Official, external audits, remedial actions and new program implementation as required by the terms of a Consent Agreement with the U.S. State Department. These Consent Agreement costs are not normal, ongoing cash expenditures necessary to operate our business.

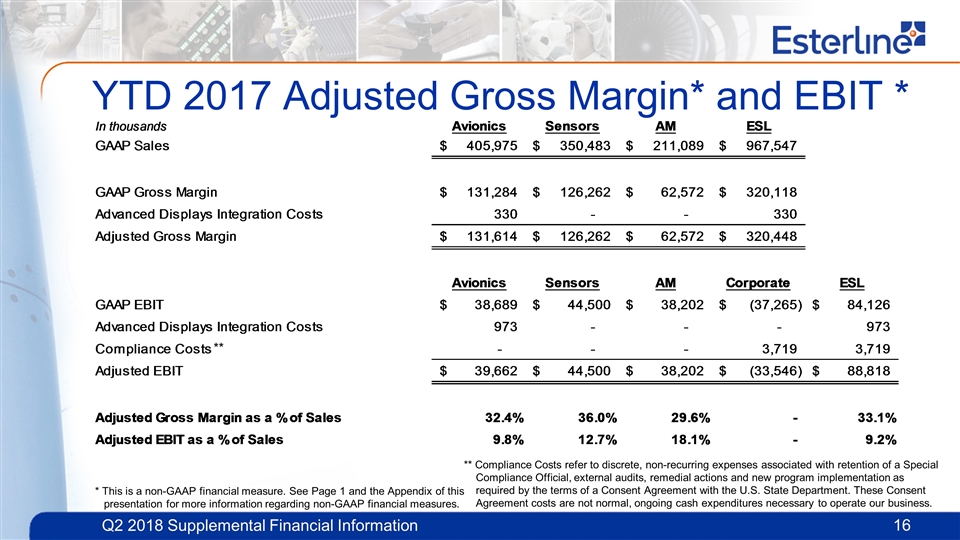

YTD 2017 Adjusted Gross Margin* and EBIT * ** ** Compliance Costs refer to discrete, non-recurring expenses associated with retention of a Special Compliance Official, external audits, remedial actions and new program implementation as required by the terms of a Consent Agreement with the U.S. State Department. These Consent Agreement costs are not normal, ongoing cash expenditures necessary to operate our business. * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures.