Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - II-VI INC | d579445d8k.htm |

IIVI INVESTOR PRESENTATION May 2018 Exhibit 99.1

Matters discussed in this presentation may contain forward-looking statements that are subject to risks and uncertainties. These risks and uncertainties could cause the forward-looking statements and II-VI Incorporated’s (the “Company’s”) actual results to differ materially. In evaluating these forward-looking statements, you should specifically consider the “Risk Factors” in the Company’s most recent Form 10-K and Form 10-Q. Forward-looking statements are only estimates and actual events or results may differ materially. II-VI Incorporated disclaims any obligation to update information contained in any forward-looking statement. This presentation contains certain non-GAAP financial measures. Reconciliations of non-GAAP financial measures to their most comparable GAAP financial measures are presented at the end of this presentation. Safe Harbor Statement

14 Countries 45 Worldwide Locations 10,000+ Worldwide employees Refers to groups II and VI of the Periodic Table of Elements “TWO SIX” S Sulfur Se Selenium Zn Zinc Te Tellurium Cd Cadmium 972M FY2017 Revenue IIVI IPO 1982 1971 Founded World Headquarters: Saxonburg, PA, USA II-VI Overview Semi.Cap. Equip Life Sciences All other Military Segments 35% 43% 22% Photonics Laser solutions Performance Products 44% 30% 11% Markets Industrial Optical Communications FY2017 Revenue

Overview of Key Markets New Growth Markets Core Markets 3D Sensing Military Optical Communications Industrial Lasers SIC for EV SIC for Wireless

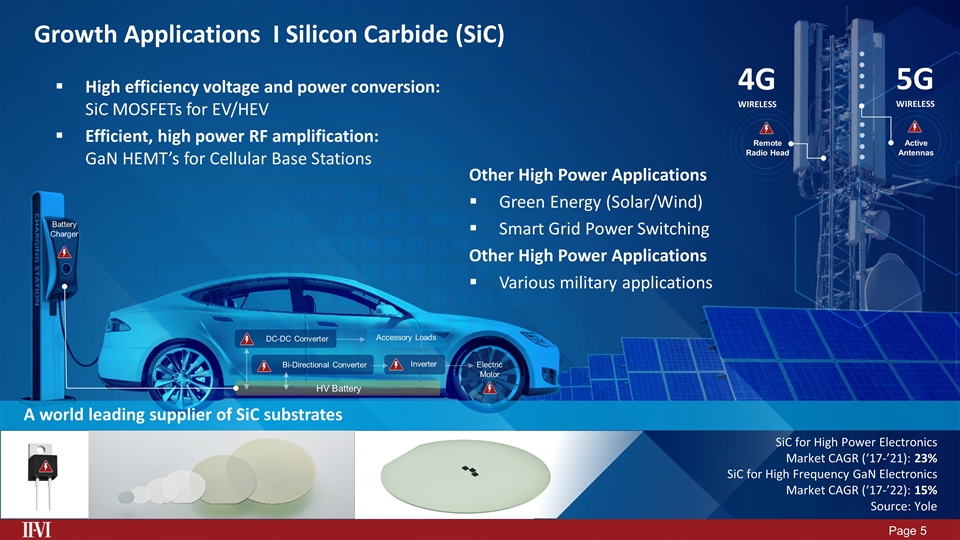

Growth Applications I Silicon Carbide (SiC) HV Battery Accessory Loads DC-DC Converter Bi-Directional Converter Inverter Battery Charger Electric Motor SiC for High Power Electronics Market CAGR (‘17-’21): 23% SiC for High Frequency GaN Electronics Market CAGR (‘17-’22): 15% Source: Yole 5G WIRELESS 4G WIRELESS High efficiency voltage and power conversion: SiC MOSFETs for EV/HEV Efficient, high power RF amplification: GaN HEMT’s for Cellular Base Stations A world leading supplier of SiC substrates Remote Radio Head Active Antennas Other High Power Applications Green Energy (Solar/Wind) Smart Grid Power Switching Other High Power Applications Various military applications

TAM for 3D Sensing expected to be $1B by 2020 Laser Diodes for LiDAR Market CAGR(’17-’22): +20% Source: Strategies Unlimited Growth Applications I 3D Sensing & LiDAR Components for 3D Sensing & LiDAR Semiconductor Lasers: VCSELs & edge emitting lasers Optics: Low angle shift filters & wide incidence angle mirrors Current market drivers: Finger Navigation, 3D sensing Emerging applications (2020): LiDAR, 3DS with Edge Emitters II-VI vertically integrated 6 inch GaAs compound semiconductor platform, one of the largest in the world

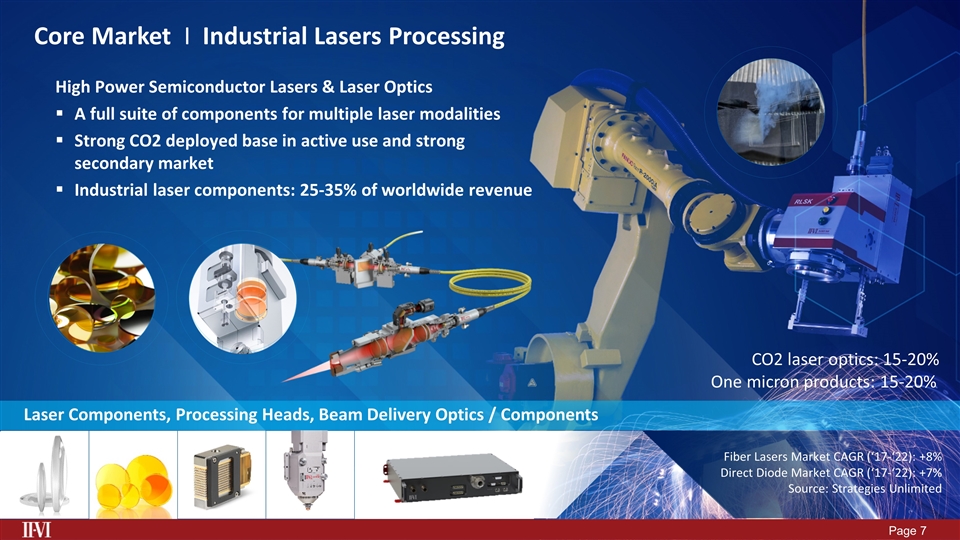

Fiber Lasers Market CAGR (‘17-‘22): +8% Direct Diode Market CAGR (‘17-‘22): +7% Source: Strategies Unlimited Core Market I Industrial Lasers Processing High Power Semiconductor Lasers & Laser Optics A full suite of components for multiple laser modalities Strong CO2 deployed base in active use and strong secondary market Industrial laser components: 25-35% of worldwide revenue Laser Components, Processing Heads, Beam Delivery Optics / Components CO2 laser optics: 15-20% One micron products: 15-20%

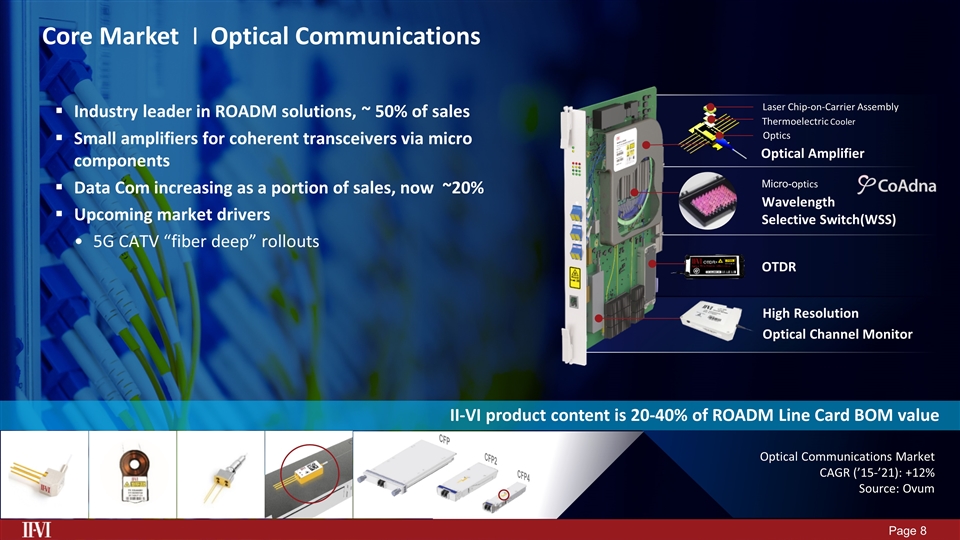

II-VI product content is 20-40% of ROADM Line Card BOM value Optical Communications Market CAGR (’15-’21): +12% Source: Ovum Optics OTDR Wavelength Selective Switch(WSS) High Resolution Optical Channel Monitor Optical Amplifier Laser Chip-on-Carrier Assembly Thermoelectric Cooler Micro-optics Core Market I Optical Communications Industry leader in ROADM solutions, ~ 50% of sales Small amplifiers for coherent transceivers via micro components Data Com increasing as a portion of sales, now ~20% Upcoming market drivers 5G CATV “fiber deep” rollouts CFP CFP2 CFP4

WSS Module Suzhou,China Liquid Crystals Low-power consumption, low-port count, high reliability WSS supplier II-VI Intention to Acquire CoAdna Background Est. 2000, Wavelength Selective Switch (WSS) innovator Manufacturing in Suzhou China, Technology Center in Silicon Valley Strategic Rationale Complementary product portfolio for ROADM line cards Increases new product development skills and scale Pro Forma Expectations, closing expected September 1, 2018 $45 million purchase price net of acquired cash Approximate annual revenues: $30M FY19 breakeven before deal costs and purchase price accounting Accretive beginning FY20 ROADM Line Cards WSS Monitors Amplifiers Micro-optics

Military-Aerospace business serves four strategic areas Intelligence surveillance & reconnaissance (ISR) Lasers Missiles and ordnance EMI & survivability Highly differentiated core capabilities & products Materials engineered in-house Complex electro-optics sub-assemblies with high value add Infrared Countermeasure Systems Market CAGR (’17-’22): +8% Source: Strategies Unlimited World leader in large sapphire panel output 24,000 sf dedicated facility F-35 Electro-Optical Targeting System (EOTS) Core Market I Military

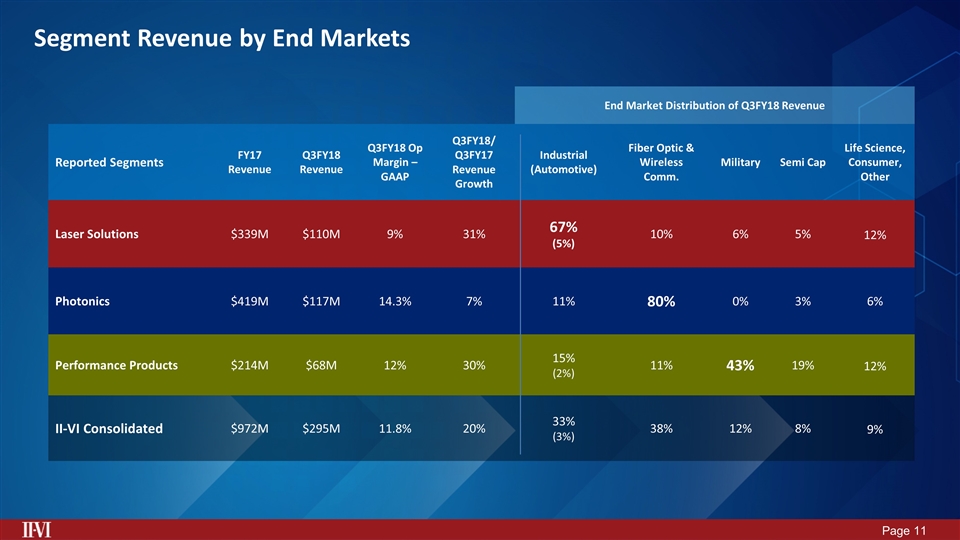

End Market Distribution of Q3FY18 Revenue Reported Segments FY17 Revenue Q3FY18 Revenue Q3FY18 Op Margin – GAAP Q3FY18/ Q3FY17 Revenue Growth Industrial (Automotive) Fiber Optic & Wireless Comm. Military Semi Cap Life Science, Consumer, Other Laser Solutions $339M $110M 9% 31% 67% (5%) 10% 6% 5% 12% Photonics $419M $117M 14.3% 7% 11% 80% 0% 3% 6% Performance Products $214M $68M 12% 30% 15% (2%) 11% 43% 19% 12% II-VI Consolidated $972M $295M 11.8% 20% 33% (3%) 38% 12% 8% 9% Segment Revenue by End Markets

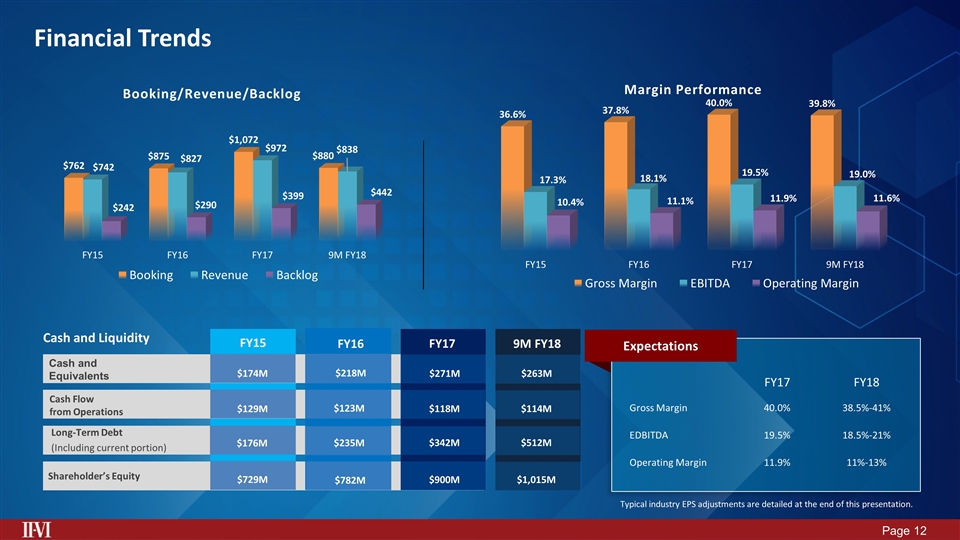

Financial Trends Expectations Cash and Equivalents Cash Flow from Operations Long-Term Debt (Including current portion) FY17 FY15 FY16 Shareholder’s Equity $271M $174M $218M $118M $129M $123M $342M $176M $235M $900M $729M $782M Cash and Liquidity 9M FY18 $263M $114M $512M $1,015M FY17 FY18 Gross Margin 40.0% 38.5%-41% EDBITDA 19.5% 18.5%-21% Operating Margin 11.9% 11%-13% Typical industry EPS adjustments are detailed at the end of this presentation.

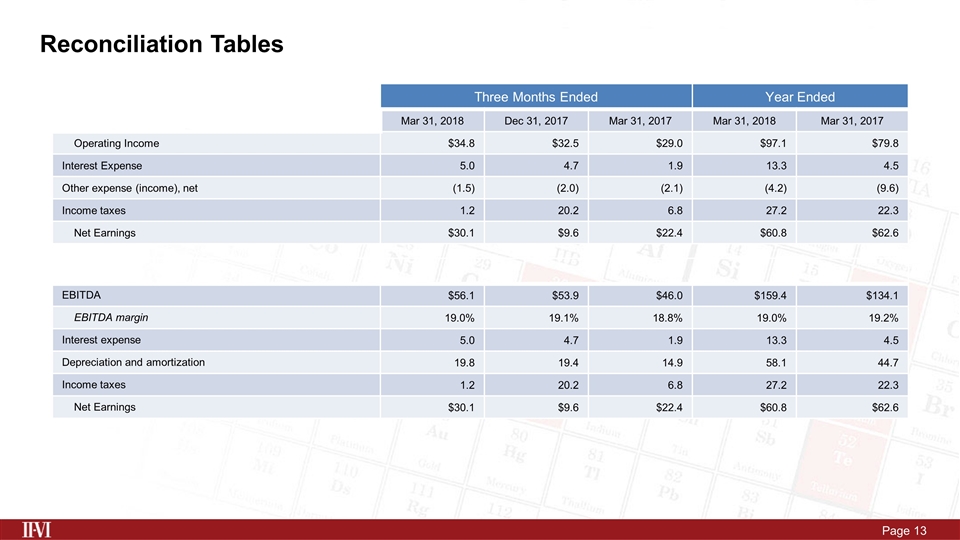

Reconciliation Tables Three Months Ended Year Ended Mar 31, 2018 Dec 31, 2017 Mar 31, 2017 Mar 31, 2018 Mar 31, 2017 Operating Income $34.8 $32.5 $29.0 $97.1 $79.8 Interest Expense 5.0 4.7 1.9 13.3 4.5 Other expense (income), net (1.5) (2.0) (2.1) (4.2) (9.6) Income taxes 1.2 20.2 6.8 27.2 22.3 Net Earnings $30.1 $9.6 $22.4 $60.8 $62.6 EBITDA $56.1 $53.9 $46.0 $159.4 $134.1 EBITDA margin 19.0% 19.1% 18.8% 19.0% 19.2% Interest expense 5.0 4.7 1.9 13.3 4.5 Depreciation and amortization 19.8 19.4 14.9 58.1 44.7 Income taxes 1.2 20.2 6.8 27.2 22.3 Net Earnings $30.1 $9.6 $22.4 $60.8 $62.6

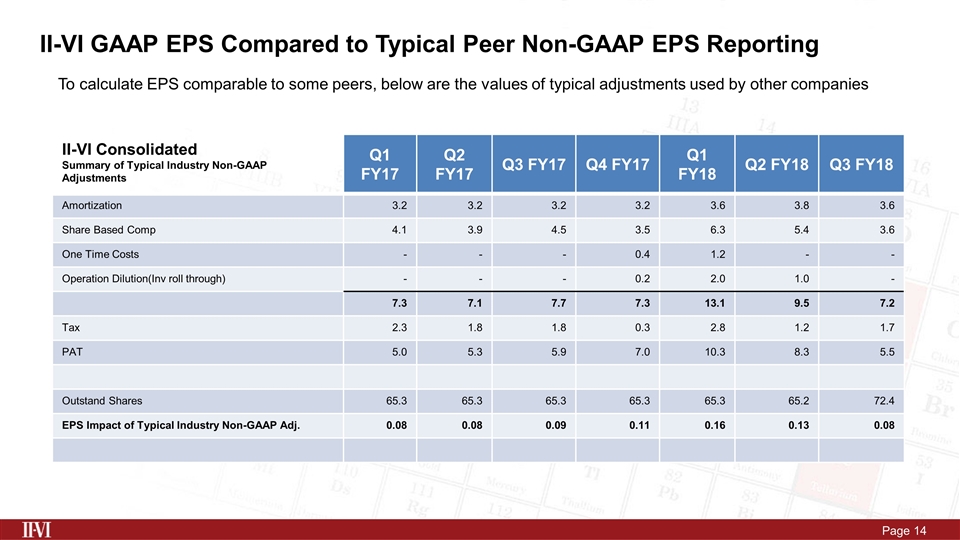

II-VI GAAP EPS Compared to Typical Peer Non-GAAP EPS Reporting II-VI Consolidated Summary of Typical Industry Non-GAAP Adjustments Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 Q1 FY18 Q2 FY18 Q3 FY18 Amortization 3.2 3.2 3.2 3.2 3.6 3.8 3.6 Share Based Comp 4.1 3.9 4.5 3.5 6.3 5.4 3.6 One Time Costs - - - 0.4 1.2 - - Operation Dilution(Inv roll through) - - - 0.2 2.0 1.0 - 7.3 7.1 7.7 7.3 13.1 9.5 7.2 Tax 2.3 1.8 1.8 0.3 2.8 1.2 1.7 PAT 5.0 5.3 5.9 7.0 10.3 8.3 5.5 Outstand Shares 65.3 65.3 65.3 65.3 65.3 65.2 72.4 EPS Impact of Typical Industry Non-GAAP Adj. 0.08 0.08 0.09 0.11 0.16 0.13 0.08 To calculate EPS comparable to some peers, below are the values of typical adjustments used by other companies