Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NEXEON MEDSYSTEMS INC | f8k043018_nexeonmed.htm |

Exhibit 99.1

Nexeon MedSystems Inc. Corporate Overview www.nexeonmed.com Nexeon MedSystems Inc. Corporate Overview www.nexeonmed.com

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Safe Harbor Statement 2 This presentation contains forward - looking statements and projections. The company makes no express or implied representation or warranty as to the completeness of this information or, in the case of projections, as to their attainability or the accuracy and completeness of the assumptions from which they are derived. It must be recognized that estimates of the company’s performance are necessarily subject to a high degree of uncertainty and may vary materially from actual results. In particular, this presentation contains statements, including without limitation the projections, that constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this presentation and include, but are not limited to, statements regarding the company’s plans, intentions, beliefs, expectations and assumptions, as well as other statements that are not necessarily historical facts. The company commonly uses words in this presentation such as “will,” “may,” “plans,” “potential,” “preliminary,” “anticipates”, “believes”, “plans”, “expects”, “future”, “intends” and similar expressions to identify forward - looking statements and projections. You are cautioned that these forward - looking statements and projections are not guarantees of future performance and involve risks and uncertainties. The company’s actual results may differ materially from those in the forward - looking statements and projections due to various factors, including those set forth in the sections titled “Risk Factors” in our filing with th e Securities and Exchange Commission. The information contained in this presentation describes several, but not necessarily all, important factors that could cause these differences. Any forward - looking statement in this presentation reflects our current view with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, industry and future growth. Given these uncertainties, you should not place undue reliance on these forward looking statements. Except as required by law, we assume no obligation to update or revise these forward - looking statements for any reason, even if new information becomes available in the future

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Nexeon Overview 3 Best - in - Class Device Large Addressable Market Multiple Near - Term Catalysts Protected Platform Current Business Highlights Bioelectronic device combining current steering, directional leads, closed loop sensing all on a rechargeable platform Existing $700M market 1 with strong reimbursement CE Mark and FDA approvals pending Potential licensing / partnership opportunities ~150 patent matters from Medtronic / Siemens Existing profitable OEM business with strong contracts Reimbursement codes exist for DBS product 1 Neuromodulation Devices: Market Size, Segmentation, Growth, Competition and Trends (1st ed., p. 35, Rep.). ( n.d. ). DeciBio Consulting, LLC.

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Leadership WILL ROSELLINI Chairman, CEO BRIAN BLISCHAK President, CCO CHRIS MILLER CFO • 6 advanced degrees related to neurotechnology • 15 - yr vet in neurotech • 4 successful exits (MTI in pivotal studies) • Neuroengineer with 20 yrs in medical device field • Successfully led 3 neurostimulation product launches from new product to US approval • 15+ yrs serving as CFO, treasurer, and interim CFO for wide variety of early - stage & non - profit organizations, both public & private Doherty & Co., LLC

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Selected Catalysts and Anticipated Timeline 5 2018 2019 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 FDA Plan - DBS regulatory pathway defined Potential Partnership - Licensing opportunity aVNS 510K Filing Expected - Depression / Anxiety / Sleep aVNS Study Expected Completion - Atrial Fibrillation N=20 DBS CE Filing Expected - Filing for CE Mark for sales in EU – Parkinson’s, Essential Tremor, and Dystonia DBS PMA Filing Expected - Sales targeted for second half of 2019 DBS CE Mark Approval Expected - EU sales commence DBS PMA Approval Expected - US sales commence

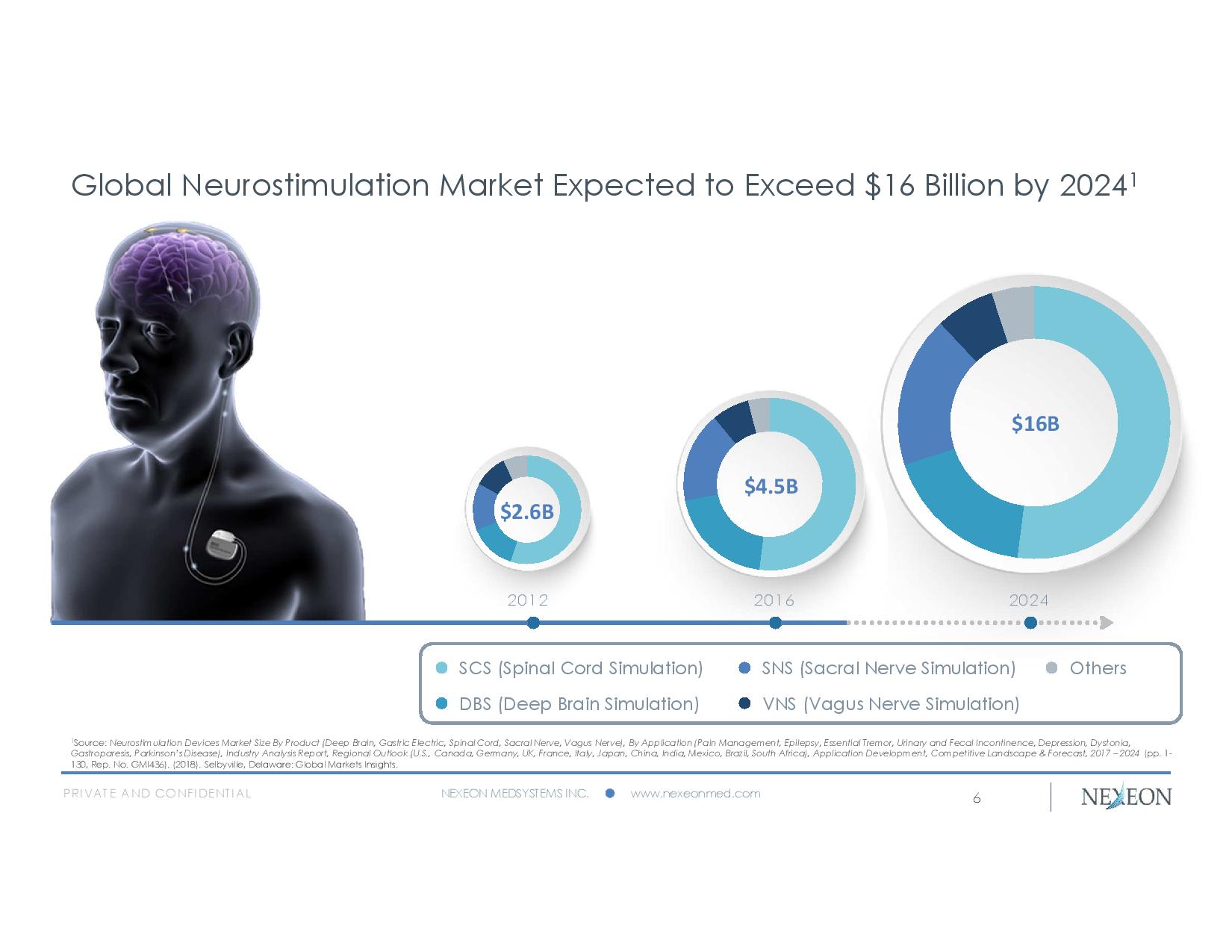

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com 2012 2016 2024 SCS (Spinal Cord Simulation) DBS (Deep Brain Simulation) SNS (Sacral Nerve Simulation) VNS ( Vagus Nerve Simulation) Others $4.5B $2.6B $16B Global Neurostimulation Market Expected to Exceed $16 Billion by 2024 1 6 1 Source: Neurostimulation Devices Market Size By Product (Deep Brain, Gastric Electric, Spinal Cord, Sacral Nerve, Vagus Nerve), By Application (Pain Management, Epilepsy, Essential Tremor, Urinary and Fecal Incontinence, Depression, Dystonia, Gastroparesis, Parkinson’s Disease), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Ja pan , China, India, Mexico, Brazil, South Africa), Application Development, Competitive Landscape & Forecast, 2017 – 2024 (pp. 1 - 130, Rep. No. GMI436). (2018). Selbyville, Delaware: Global Markets Insights.

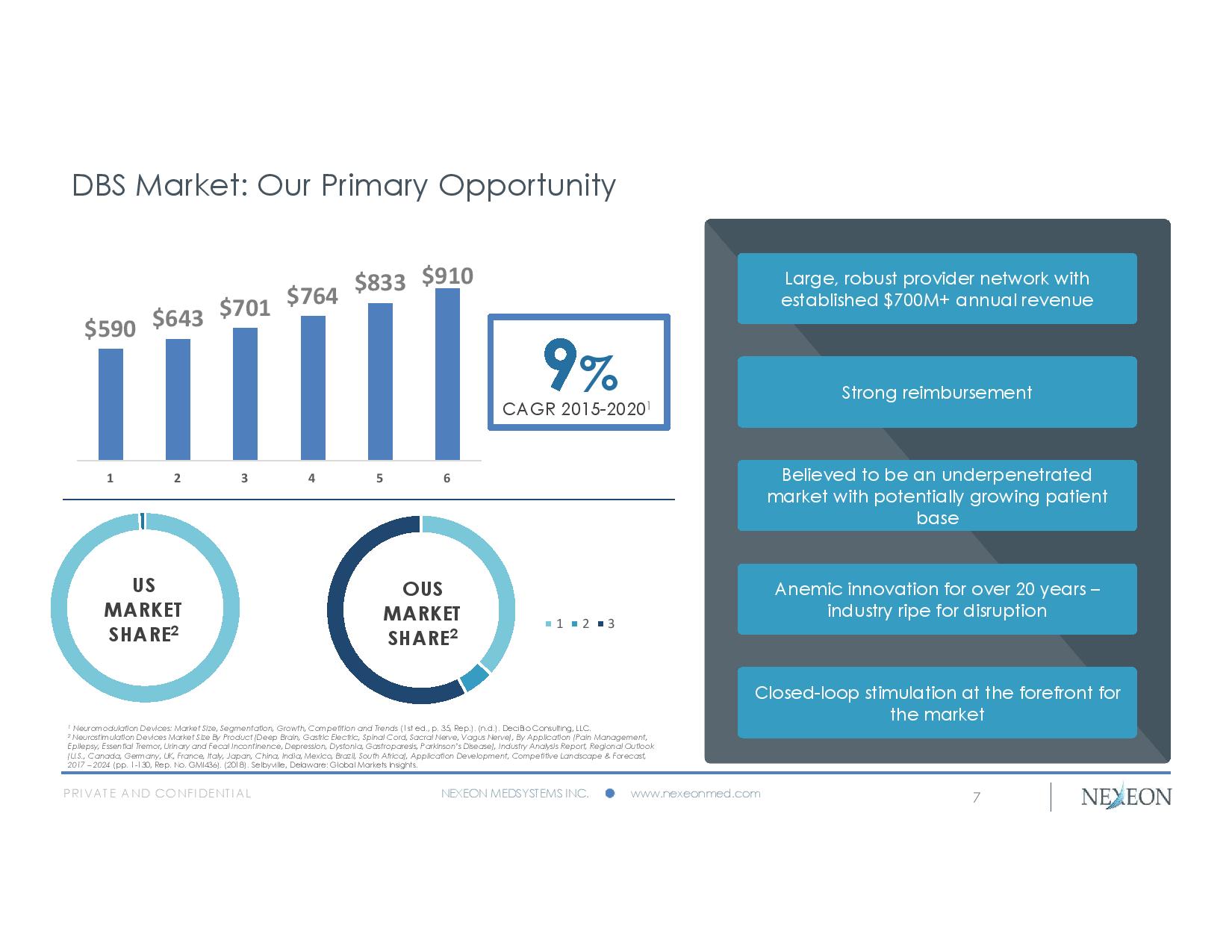

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com DBS Market: Our Primary Opportunity 7 9 % CAGR 2015 - 2020 1 US MARKET SHARE 2 1 2 3 OUS MARKET SHARE 2 Large, robust provider network with established $700M+ annual revenue Strong reimbursement Believed to be an underpenetrated market with potentially growing patient base Anemic innovation for over 20 years – industry ripe for disruption Closed - loop stimulation at the forefront for the market 1 Neuromodulation Devices: Market Size, Segmentation, Growth, Competition and Trends (1st ed., p. 35, Rep.). (n.d.). DeciBio Consulting, LLC. 2 Neurostimulation Devices Market Size By Product (Deep Brain, Gastric Electric, Spinal Cord, Sacral Nerve, Vagus Nerve), By Application (Pain Management, Epilepsy, Essential Tremor, Urinary and Fecal Incontinence, Depression, Dystonia, Gastroparesis, Parkinson’s Disease), Indust ry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Japan, China, India, Mexico, Brazil, South Africa), Application Development, Compe tit ive Landscape & Forecast, 2017 – 2024 (pp. 1 - 130, Rep. No. GMI436). (2018). Selbyville, Delaware: Global Markets Insights. $590 $643 $701 $764 $833 $910 1 2 3 4 5 6

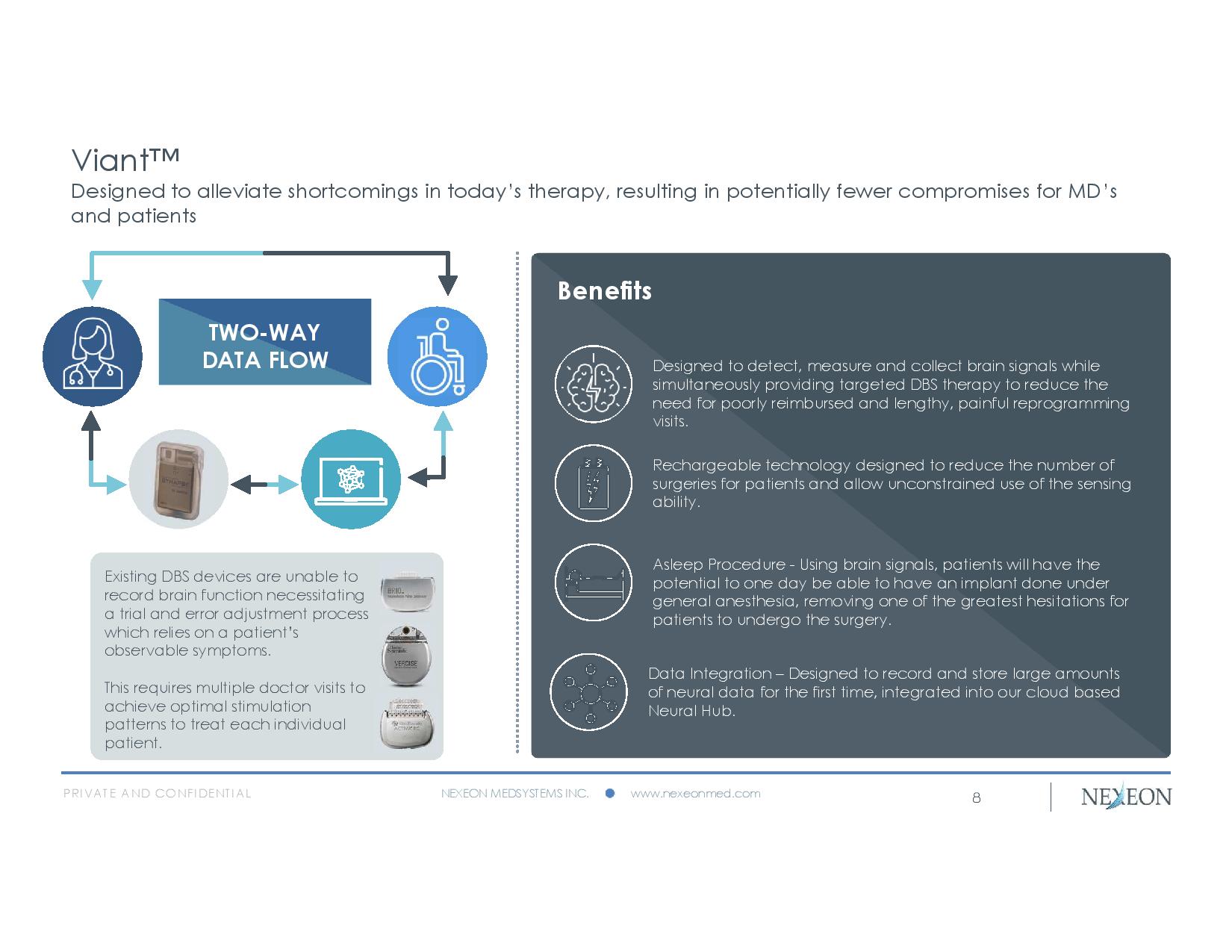

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Viant ™ Designed to alleviate shortcomings in today’s therapy, resulting in potentially fewer compromises for MD’s and patients 8 TWO - WAY DATA FLOW Existing DBS devices are unable to record brain function necessitating a trial and error adjustment process which relies on a patient’s observable symptoms. This requires multiple doctor visits to achieve optimal stimulation patterns to treat each individual patient. Benefits Designed to detect, measure and collect brain signals while simultaneously providing targeted DBS therapy to reduce the need for poorly reimbursed and lengthy, painful reprogramming visits. Rechargeable technology designed to reduce the number of surgeries for patients and allow unconstrained use of the sensing ability. Data Integration – Designed to record and store large amounts of neural data for the first time, integrated into our cloud based Neural Hub. Asleep Procedure - Using brain signals, patients will have the potential to one day be able to have an implant done under general anesthesia, removing one of the greatest hesitations for patients to undergo the surgery.

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Adaptive DBS 9 • Significant unmet need for alternative to trial - and - error based manual DBS reprogramming • Reduce physician burden • More effectively personalize treatment • Facilitate use of more complex lead designs, potentially contributing to greater patient benefit Manual Adaptive Basis for Adjustment Observable symptoms and side effects Brain signal detection and measurement Time to Optimization 18 - 32 hours over multiple doctor visits during first year post - procedure Near - real - time, based on defined parameters Lead Design Simple: Cylindrical Contacts Complex: Directional Leads Source: Daria Nesterovich Anderson et al 2017 J. Neural Eng. Algorithmic Reprogramming has the potential to maximize therapeutic benefit while mitigating side effects

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Our Goal: To Address Unmet Needs 10 Uniquely positioned platform, combining all necessary capabilities to advance DBS Rechargeable, one surgery versus multiple Recording designed to enable disease discovery to lower reprogramming time Deliver any conceivable waveform; designed to enable new discoveries and potentially create IP opportunities 16 controllable current source enables customized therapy Pathway to closed loop stimulation, 24/7 patient symptom optimization Directional leads designed to increase efficacy a nd potentially lower side effects Neural Hub Analytics Platform, Dropbox for neurologists designed to make new discoveries and optimize patient care

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Clinical Results 11 Encouraging outcome for both patient & surgeon “The described excellent surgical response adds to the notion that combined thalamic and pallidal DBS is a safe and effective treatment option in selected MDS patients” “The used deep brain stimulation device has proven safe and efficient for the multi - electrode treatment” - C.K.E. Moll, et al: Long - term follow - up of concomitant thalamic and palladial stimulation in a dystonic head tremor patient using the Nuviant Medical Synapse™ System Minimal adverse effects reported after 5 years Data accepted for presentation at EFSSN conference Sept 2016 2017 Acute clinical study, N=6 to optimize signal to noise in LFP recording

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com European Market Sales Goals and Market Size 12 Management’s past experience suggests minimal sales force required to achieve 10% market penetration UK Netherlands Germany Austria France Spain Estimated Targeted Annual Implants 1 Initial Target Hospitals in Each Country Implant 75 - 150 Units Per Year 290+ 200+ 1,700+ 200+ 1,900+ 1,000+ 1 Source: Company Estimates Based on Reasonable Assumptions

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Attractive margins at scale Provider Network US Reimbursement Procedure Established Market Strong Health Economics Potential Opportunity Known Reimbursements Health Economics Strong health economic with rechargeable battery Hospital Competitiveness Attract patients who want asleep procedure Technology Cutting edge technology Competitive Differentiators Average private - pay reimbursement rates Implantable Pulse Generator - Neurostimulator $26,900 Extensions - 8 Channel X2 2,000 Lead - 8 Channel Directional X2 8,000 Patient Programmer 1,190 Charger 2,390 Total System Sales Price $40,480 US Commercialization Summary Patient / Caregiver Value Designed to provide value to patient / caregiver by lowering reprogramming time and visits Profitable for physicians and hospitals 13

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Sales and Marketing Leadership 14 BRIAN BLISCHAK President, Chief Commercial Officer DANIEL POWELL VP of Sales Marketing • >20 years’ experience in medical device field; 16 years’ experience in neuromodulation • SVP Sales and Marketing at ImThera Medical, developer of implantable neurostimulation system for sleep apnea • Expanded customer base from 1 to 28 implanting centers in 8 countries • 12 years in Neuromodulation Division at St. Jude Medical • Led commercial launch of two DBS product families (>20 products) in more than 15 countries • Led enrollment and management for U.S. DBS pivotal trials (136 patients across 15 sites) • Recruited and led 10 - member upstream and downstream marketing and clinical support team • >20 years’ experience working with advanced technology products; 12 years experience in neuromodulation • Director of Global Marketing at LivaNova • Led global marketing for Company’s flagship $315m VNS Epilepsy Therapy business • Launched Cyberonics AspireSR in US market; first implantable device for seizure detection and response • Director, Product Management at St. Jude Medical • Launched DBS franchise in key European markets • Led all upstream marketing activities for neuromodulation division • Actively engaged with prescribing physicians

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Competitive Landscape and Fit 15 Company Overview Barrier to Compete DBS Companies Boston Scientific Gaining EU market share from Medtronic 1 ; Received US approval December, 2017 System change to add sensing 3 - 4 years; Focused on US market entry Medtronic Largest company in DBS 1 Complete system redesign on all major features 4 - 5 years Abbott Gaining EU market share from Medtronic 1 Complete system redesign on all major features: 4 - 5 years Non - DBS Companies Nevro New company to the SCS pain market Complete development from inception 4 - 5 years Nuvectra 5 th place in the SCS pain market 2 , focused on expanding into sacral nerve stimulation for incontinence and overactive bladder Complete development from inception 4 - 5 years, licensed DBS program to Aleva Galvani Completed OEM manufacturing agreement with Nexeon for 60 units in Q1 Focused primarily on industry partnerships 3 LivaNova Strong global VNS for Epilepsy business Complete development from inception 1 Morgan Stanley: NANS 2017: The Field is Evolving; 2 SunTrust Robinson Humphrey: NVTR, The SCS Alternative; 3 Electroceuticals: the 'bonkers' gamble that could pay off for GlaxoSmithKline

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Manufacturing Business: Historical Revenues & Synergies 16 • Attractive cash flows and EBITDA margins • Long - term contracts with key accounts • Production capacity to support growing pipeline Synergies include supply chain and lead manufacturing, potentially leading to 2nd product launch 2013 2014 2015 2016 2017 Total Revenue $5.6M $6.4M $6.1M $6.1M $7.4M Revenue Growth - 7% 14% - 5% 0% 21% Gross Profit $1.9M $2.1M $1.9M $1.9M $2.1M EBITDA $618,276 $634,567 $475,172 $609,164 $695,200 EBITDA/GP Margin % 33% 30% 25% 32% 33% Unaudited: Reflects Medi - Line Fiscal Year Apr - Mar and adjusted to U.S. GAAP. Euros converted to U.S. dollars at historic conversion rates.

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com 17 External vagus nerve stimulation • Multiple completed and ongoing studies • Pilot study in aF in progress, pivotal in preparation • Potential opportunities in: Atrial Fibrillation, Sleep, Depression, Anxiety, Cognition • 510K clearance pathway along with de Novo pathway for new indications The risk of developing Atrial Fibrillation at age 40 is 1 in 4 1 Parkinson’s Disease • Comorbidity of Sleep Disorders • Comorbidity of Depression / Anxiety • Prelude to DBS Implant Stroke • Cognitive Rehabilitation • Atrial Fibrillation Improvements • Proof for VNS Implant Alzheimer’s • Potentially Improve Cognition • Proof for VNS Implant External neurostimulation program: Mediline Annual Economic COSTS of atrial fibrillation 2 estimated ~$4,700 per patient $6.65B with 276,000 ER visits and 350,000 hospitalizations 1 http://www.preventaf - strokecrisis.org/ ; 2 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3324990/

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com 13 Patents Granted 7 Patents Pending 68 Patents Granted 6 Patents Pending Transvascular Stimulation (Bates, MD portfolio) Remote Monitoring (Medtronic portfolio) Internet of Medical Things (Siemens portfolio) Proprietary IPG (Synaptix acquisition) Intellectual Property Portfolio 18

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com NXNN: Nexeon Market Cap Profile 1 OTC:QB Shares Issued & Outstanding 27,715,911 Options Outstanding 4,999,900 (@ $0.99) Warrants 1,160,761 (@ $2.32) Fully Diluted Shares 33,876,572 Float ~7.2M Market Cap $23,000,000 16 1 As of 04/23/2018

PRIVATE AND CONFIDENTIAL NEXEON MEDSYSTEMS INC. www.nexeonmed.com Anticipated Timeline Q4 Q3 Q2 Q1 2018 2019 FDA Plan DBS regulatory pathway defined aVNS 510K Target Filing Depression / Anxiety / Sleep Target aVNS Study completion 1) Atrial Fibrillation N=20 DBS CE Target Filing Filing for CE Mark for sales in EU – Parkinson’s, Essential Tremor, and Dystonia aVNS 510K Target Submission Derisk pilot launch DBS PMA Target Filing Sales targeted for last half of 2019 Targeted DBS CE Mark Approval DBS PMA Target Approval VNS PMA Target Submission 17 Potential Partnership Licensing opportunity

Nexeon MedSystems Inc. Corporate Overview www.nexeonmed.com