Attached files

| file | filename |

|---|---|

| EX-24.1 - EXHIBIT 24.1 - Ingersoll Rand Inc. | s002023x3_ex24-1.htm |

| EX-23.2 - EXHIBIT 23.2 - Ingersoll Rand Inc. | s002023x3_ex23-2.htm |

| EX-5.1 - EXHIBIT 5.1 - Ingersoll Rand Inc. | s002023x3_ex5-1.htm |

| EX-1.1 - EXHIBIT 1.1 - Ingersoll Rand Inc. | s002023x3_ex1-1.htm |

As filed with the Securities and Exchange Commission on April 30, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Gardner Denver Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization) |

3560

(Primary Standard Industrial Classification Code Number) |

46-2393770

(I.R.S. Employer Identification Number) |

222 East Erie Street, Suite 500

Milwaukee, Wisconsin 53202

Telephone: 414-212-4700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Andrew Schiesl, Esq.

General Counsel

222 East Erie Street, Suite 500

Milwaukee, Wisconsin 53202

Telephone: 414-212-4700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

|

Richard Fenyes, Esq.

Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 (212) 455-2000 |

Marc Jaffe, Esq.

Ian Schuman, Esq. Peter Sluka, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022-4834 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

☒ (Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

|

|

|

Emerging growth company

|

o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

Title Of Each Class Of

Securities To Be Registered |

Amount to be Registered(1)

|

Proposed Maximum Aggregate Offering Price Per Share(2)

|

Proposed Maximum Aggregate Offering Price(1)(2)

|

Amount of Registration Fee

|

||||||||

|

Common Stock, par value $0.01 per share

|

|

25,404,956

|

|

$

|

31.29

|

|

$

|

794,984,569.80

|

|

$

|

98,975.58

|

|

| (1) | Includes 3,313,690 shares of common stock subject to the underwriters’ option to purchase additional shares of common stock. See “Underwriting.” |

| (2) | Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended. The proposed maximum offering price per share and proposed maximum aggregate offering price are based on the average high and low prices of the Registrant’s common stock on April 27, 2018 as reported on the New York Stock Exchange. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated April 30, 2018

PRELIMINARY PROSPECTUS

22,091,266 Shares

Gardner Denver Holdings, Inc.

Common Stock

The selling stockholders named in this prospectus are offering 22,091,266 shares of common stock of Gardner Denver Holdings, Inc. We will not receive any proceeds from the sale of our common stock by the selling stockholders.

Our common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “GDI.” On April 27, 2018, the closing sales price of our common stock as reported on the NYSE was $31.84 per share.

To the extent the underwriters sell more than 22,091,266 shares of common stock, the underwriters have the option to purchase up to an additional 3,313,690 shares from investment funds affiliated with Kohlberg Kravis Roberts & Co. L.P. at the public offering price less the underwriting discounts and commissions within 30 days of the date of this prospectus. We will not receive any proceeds from the sale of our common stock pursuant to any exercise of the underwriters’ option to purchase additional shares.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 18 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission (the “SEC”), nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

Per Share

|

Total

|

||||

|

Public offering price

|

$

|

|

|

$

|

|

|

|

Underwriting discounts and commissions

|

$

|

|

|

$

|

|

|

|

Proceeds, before expenses, to the selling stockholders(1)

|

$

|

|

|

$

|

|

|

| (1) | See “Underwriting (Conflicts of Interest)” for additional information regarding underwriting compensation. |

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2018.

Joint Book-Running Managers

|

Goldman Sachs & Co. LLC

|

Citigroup

|

KKR

|

Prospectus dated , 2018.

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. Neither we nor the underwriters take any responsibility for, or can provide any assurance as to the reliability of, any information other than the information contained or incorporated by reference in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information included and incorporated by reference in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

Table of Contents

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

i

MARKET, RANKING AND OTHER INDUSTRY DATA

In addition to the industry, market and competitive position data referenced throughout this prospectus and the documents incorporated by reference herein that are prepared from our own internal estimates relying on our management’s knowledge and experience in the markets in which we operate and our research, some market data and other statistical information used throughout this prospectus and the documents incorporated by reference herein are based in part upon information provided by independent research and advisory firms, none of which have been commissioned by us, but for certain of which we have paid a subscription fee. Third-party industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our management’s knowledge and experience, in turn, are based on information obtained from our customers, distributors, suppliers, trade and business organizations and other contacts in the markets we operate. We are responsible for all of the disclosure included and incorporated by reference in this prospectus and while we believe that each of the publications, studies and surveys used throughout this prospectus and the documents incorporated by reference herein are prepared by reputable sources, neither we nor the underwriters have independently verified market and industry data from third-party sources. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus contains some of our trademarks, trade names and service marks, including, among others, CompAir, Elmo Rietschle, Emco Wheaton, Gardner Denver, Nash, Robuschi and Thomas. Each one of these trademarks, trade names or service marks is either (i) our registered trademark, (ii) a trademark for which we have a pending application or (iii) a trade name or service mark for which we claim common law rights. All other trademarks, trade names or service marks of any other company appearing in this prospectus belong to their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are presented without the TM, SM and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

Unless otherwise indicated or the context otherwise requires, the financial statements and other data included and incorporated by reference in this prospectus reflect the consolidated business and operations of Gardner Denver Holdings, Inc. and its consolidated subsidiaries, including Gardner Denver, Inc., its principal operating subsidiary. Unless the context otherwise requires, all references herein to “Gardner Denver,” the “Company,” “we,” “our” or “us” refer to Gardner Denver Holdings, Inc. and its consolidated subsidiaries. References in this prospectus to the “Sponsor” or “KKR & Co.” are to Kohlberg Kravis Roberts & Co. L.P. and certain of its affiliates.

All references to years in this prospectus, unless otherwise noted, refer to our fiscal years, which end on December 31.

Amounts in this prospectus are presented in U.S. dollars rounded to the nearest million, unless otherwise noted. Amounts in our consolidated financial statements incorporated by reference in this prospectus are presented in U.S. dollars rounded to the nearest thousand, unless otherwise noted. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. The accounting policies set out in the audited consolidated financial statements incorporated by reference in this prospectus have been consistently applied to all periods presented.

ii

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus and the documents incorporated by reference herein, including the information presented under the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and the consolidated financial statements and the notes thereto incorporated by reference in this prospectus, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties.

Our Company

We are a leading global provider of mission-critical flow control and compression equipment and associated aftermarket parts, consumables and services, which we sell across multiple attractive end-markets within the industrial, energy and medical industries. We manufacture one of the broadest and most complete ranges of compressor, pump, vacuum and blower products in our markets, which, combined with our global geographic footprint and application expertise, allows us to provide differentiated product and service offerings to our customers. Our products are sold under a collection of premier, market-leading brands, including Gardner Denver, CompAir, Nash, Emco Wheaton, Robuschi, Elmo Rietschle and Thomas, which we believe are globally recognized in their respective end-markets and known for product quality, reliability, efficiency and superior customer service. These attributes, along with over 155 years of engineering heritage, generate strong brand loyalty for our products and foster long-standing customer relationships, which we believe have resulted in leading market positions within each of our operating segments. We have sales in more than 175 countries and our diverse customer base utilizes our products across a wide array of end-markets that have favorable near- and long-term growth prospects, including industrial manufacturing, energy (with particular exposure to the North American upstream land-based market), transportation, medical and laboratory sciences, food and beverage packaging and chemical processing. For the year ended December 31, 2017, we generated revenue of $2,375.4 million, net income of $18.5 million and Adjusted EBITDA of $561.5 million. For a reconciliation of net income to Adjusted EBITDA, see Note (1) under “—Summary Historical Consolidated Financial and Other Data.”

Our products and services are critical to the processes and systems in which they are utilized, which are often complex and function in harsh conditions where the cost of failure or downtime is high. However, our products and services typically represent only a small portion of the costs of the overall system. As a result, our customers place a high value on our application expertise, product reliability and the responsiveness of our service. We support our customers globally with 39 key manufacturing facilities, more than 30 complementary service and repair centers across six continents and approximately 6,600 employees worldwide as of March 31, 2018.

The process-critical nature of our product applications, coupled with the standard wear and tear replacement cycles associated with the usage of our products, generates opportunities to support customers with our broad portfolio of aftermarket parts, consumables and services. Customers place a high value on minimizing any time their operations are offline. As a result, the availability of replacement parts and our repair and support services are key components of our value proposition, and our large installed base of products provides a recurring revenue stream through our aftermarket parts, consumables and services offerings. Our aftermarket revenue is significant, representing 41% of total revenue and approximately 45% of our combined Industrials and Energy segments’ revenue in 2017.

We were acquired by an affiliate of our Sponsor on July 30, 2013 (the “KKR Transaction”) and have undergone a significant transformation since that date. From 2014 to 2016, our transformation significantly improved our underlying operating performance, enabling us to achieve Segment Adjusted EBITDA margins in excess of 20% across all segments in 2016, notwithstanding the decline in our revenues from $2,570 million to $1,939 million, which was driven by the significant downturn in the upstream energy market and currency volatility during that period. We continued to expand margins in 2017, achieving Segment Adjusted EBITDA margins in excess of 21% in each of our segments. Our senior leadership team, led by our CEO Vicente Reynal, has been reconstituted and expanded, which we believe brought together deep expertise from leading global industrial organizations. In addition, 45% of our top 100 business managers, including the senior management team, have joined since the KKR Transaction, which we believe added significant new levels of talent to our leadership team. As part of our transformation, we also reorganized our Company into three business segments

1

because of the unique sales drivers and market characteristics of each. Together, our Industrials, Energy and Medical segments create a diverse portfolio with exposure to highly attractive end-markets, significant aftermarket revenues, upside from an upstream energy recovery and positive secular trends across all segments.

|

|

Industrials Segment

|

Energy Segment

|

Medical Segment

|

|

2017 Segment Revenue

|

$1,130.7 million

|

$1,014.5 million

|

$230.2 million

|

|

2017 Segment Adjusted EBITDA

|

$242.7 million

|

$296.1 million

|

$62.4 million

|

|

2017 Segment Adjusted EBITDA margin

|

21.5%

|

29.2%

|

27.1%

|

| • | Industrials (47% of 2017 total revenue): We design, manufacture, market and service one of the broadest portfolios of air compression, vacuum and blower products, including associated aftermarket parts, consumables and services, across a wide array of technologies and applications for use in diverse end-markets. We believe our ability to support custom industrial application needs from nearly full vacuum to approximately 7,000 pounds per square inch (psi) pressure levels makes us a partner of choice for many of our long-standing customers. Our large installed base also provides for a significant stream of recurring aftermarket revenue, which often cumulatively exceeds the original cost of the product. |

| • | Energy (43% of 2017 total revenue): We design, manufacture, market and service a diverse range of positive displacement pumps, including drilling pumps and hydraulic fracturing pumps (“frac pumps”), liquid ring vacuum pumps, compressors and integrated systems, engineered fluid loading and transfer equipment and associated aftermarket parts, consumables and services. The highly engineered products offered by our Energy segment serve customers across upstream, midstream and downstream energy markets, as well as petrochemical processing, transportation and general industrial sectors. Many of the products in our Energy segment are highly aftermarket-intensive in nature, with some applications, such as certain products we sell into upstream energy, for which the cumulative aftermarket revenue stream can be multiples of the cost of the original pump. |

| • | Medical (10% of 2017 total revenue): We design, manufacture and market a broad range of highly specialized gas, liquid and precision syringe pumps that are specified by medical equipment suppliers and integrated into their final equipment for use in applications such as oxygen therapy, blood dialysis, patient monitoring, laboratory sterilization and wound treatment, among others. We offer a comprehensive product portfolio across a breadth of technologies to address the medical and laboratory sciences pump and fluid handling industry, as well as a range of end-use vacuum products for laboratory science applications, and we recently expanded into liquid pumps and automated liquid handling components and systems. |

Our business is diversified across geographic regions, end-markets and type of product specification:

| (1) | Our geographic regions are grouped into North and South America (the “Americas”); Europe, Middle East and Africa (“EMEA”); and Asia Pacific (“APAC”). |

| (2) | The classification of end-markets for sales made through independent distributors (rather than through direct sales to end-users) is based on an assessment of the distribution channels through which such sales are made. |

Our top priority since the completion of the KKR Transaction has been the transformation of our business, which we have driven by investing in our corporate and business leadership team, expanding our commercial

2

reach, improving our operational capabilities and creating a performance-oriented organization. As a result, we significantly improved our underlying operating performance and, we believe, have laid the foundation for ongoing value creation. Some examples of the improvement achieved from 2014 to 2016 include:

| • | growing our Energy and Medical Segment Revenue by mid-single digit growth rates, excluding in each case the impact of the significant downturn in the upstream energy market and currency volatility; |

| • | growing Segment Adjusted EBITDA and meaningfully expanding Segment Adjusted EBITDA margins each year across all of our segments, excluding the impact of the significant downturn in the upstream energy market and currency volatility; |

| • | strengthening our customer service and connectivity by transitioning our sales team and realigning our product engineering and marketing teams in our Industrials segment into an integrated, global product and customer management structure; |

| • | transforming our upstream energy offering from being predominantly a pump manufacturer into a full service solutions provider that offers high quality, locally accessible aftermarket support; and |

| • | expanding our Industrials segment aftermarket revenues as a percentage of Industrials Segment Revenue from approximately 33% in 2014 to 35% in 2016. |

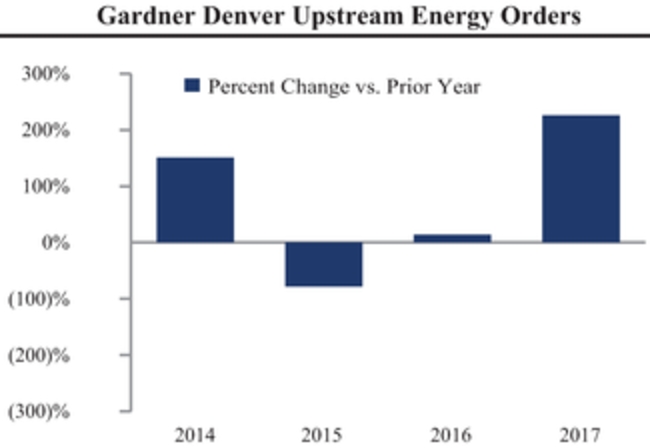

We believe the establishment and continued execution of our operational and strategic growth initiatives have positioned our Company for substantial revenue and Adjusted EBITDA growth with continued potential to expand margins. In 2017, we built upon this foundation, with 22.5% year-over-year revenue growth, net income of $18.5 million (compared to a $31.3 million net loss in 2016) and, Adjusted EBITDA of $561.5 million, an increase of 40.1% over the prior year, and Adjusted EBITDA margin of 23.6%, an increase of 290 basis points over the prior year.

Our Industries and Products

We operate in the global markets for flow control and air compression products for the industrial, energy and medical industries. Our highly engineered products and proprietary technologies are focused on serving specialized applications within these attractive and growing industries.

Industrials

Our Industrials segment designs, manufactures, markets and services a broad range of air compression, vacuum and blower products across a wide array of technologies and applications. Compression products are used to create varying levels of pressure in order to power machinery, industrial tools, material handling systems and automated equipment. Vacuum products create a range of pressures below atmospheric levels that are critical to many industrial and manufacturing processes such as drying, packaging, forming and aeration. Blower products are utilized to convey high volumes of air and gas at various flow rates and at low pressures, facilitating processes such as waste water aeration, biogas upgrading and conveying, pneumatic transport and dehydration.

Almost every manufacturing and industrial facility, and many service and process industry applications, use air compression, vacuum and blower products in a variety of process-critical applications. Within each of our compression, vacuum and blower product categories, we offer one of the broadest ranges of technologies in the market. The breadth and depth of our product offering creates incremental business opportunities by allowing us to cross-sell our full product portfolio and uniquely address customers’ needs in one complete solution.

|

Compression Technologies

|

Vacuum Technologies

|

Blower Technologies

|

|

• Rotary Screw

|

• Liquid Ring

|

• Rotary Lobe

|

|

• Reciprocating Piston

|

• Claw

|

• Screw

|

|

• Scroll

|

• Screw

|

• Claw & Vane

|

|

• Rotary Vane

|

• Rotary Vane

|

• Turbo

|

|

• Centrifugal

|

• Side Channel

|

• Side Channel & Radial

|

We continue to build on our strong competitive positions across our Industrials product categories. According to Frost & Sullivan, we currently maintain a top three position in the global industrial air compressor market, which is estimated to be a $13.2 billion industry. Furthermore, our management believes that we hold a leading position in our addressable portion of the global markets for vacuum products and blower products.

3

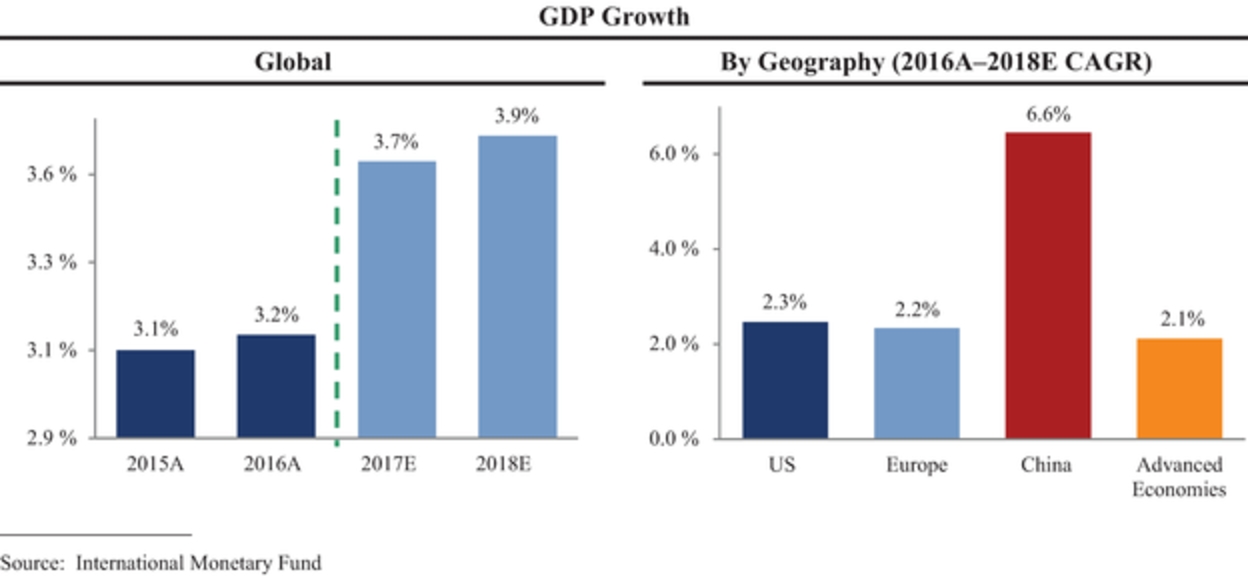

The mission-critical nature of our industrial products across manufacturing processes drives a demand environment and outlook that are highly correlated with global and regional industrial production, capacity utilization and long-term GDP growth. In the United States and Europe, we are poised to continue benefiting from expected growth in real GDP according to the International Monetary Fund (the “IMF”), along with an expected rebound in industrial production activity in 2017 and 2018 according to the U.S. Energy Information Administration (the “EIA”). In APAC, despite recent deceleration, GDP growth remains robust, and we believe that we are well-positioned to benefit from future growth in the region, which is estimated by the IMF to be a multiple of anticipated growth in the Americas and EMEA through 2018.

Furthermore, key industry trends that we believe will drive continued growth for our Industrials business are: (i) continuing customer desire for innovation and new technologies; (ii) increasing demand for service and monitoring; (iii) growing focus on comprehensive solutions and total life cycle cost; (iv) rising need for adaptability of products to accommodate new applications; and (v) increasing customer expectations for product reliability combined with superior customer service, quick aftermarket support and regular maintenance to reduce downtime.

Energy

Our Energy segment is one of the largest suppliers of equipment and associated aftermarket parts, consumables and services for the energy market applications that we serve, spanning upstream (petroleum exploration and production), midstream (transport, storage and wholesale marketing of petroleum products), downstream (refining, marketing and distribution of petroleum products) and petrochemical end-markets. The high cost of failure in these applications makes quality and reliability key purchase criteria for end-users and drives demand for our highly engineered and differentiated products.

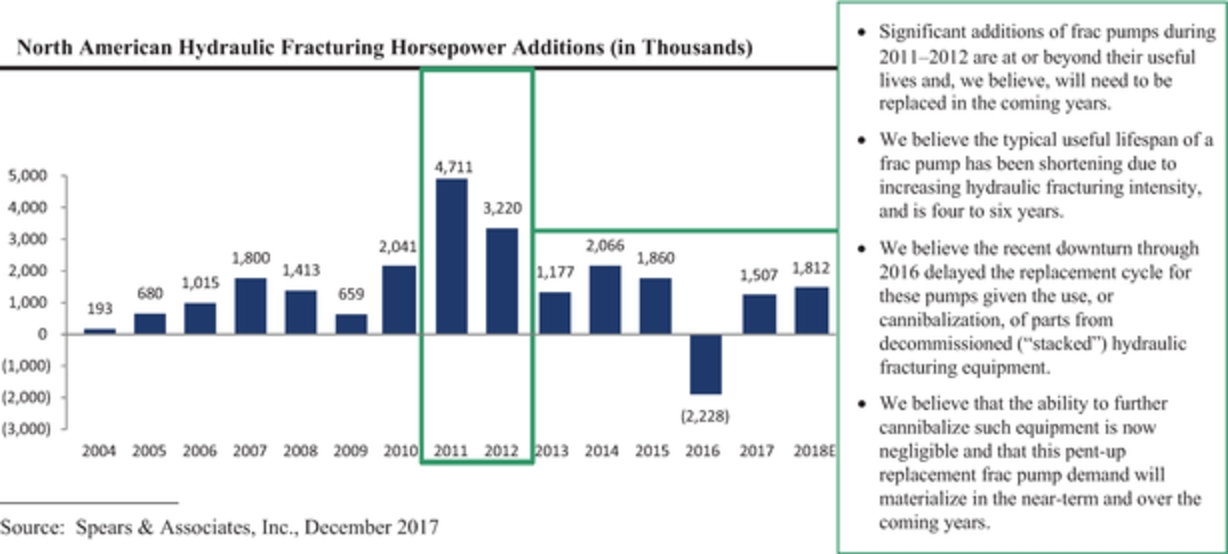

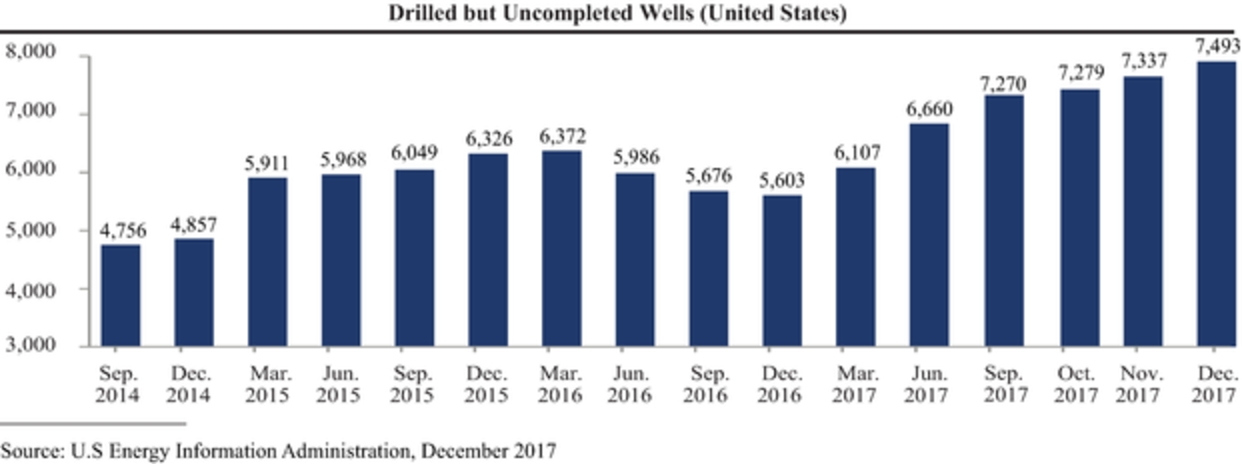

Upstream

Our sales to upstream energy end-markets consist of positive displacement pumps, fluid ends and other aftermarket parts, consumables and services that are used in oil and gas drilling, hydraulic fracturing and well servicing applications. We believe we are exposed to some of the highest growth market drivers in the context of the current upstream energy recovery, particularly in the North American land-based market. First, a significant number of frac pumps were put into service during 2011 and 2012, the replacement of which, we believe, has been deferred beyond typical useful lives due to the recent downturn in upstream energy. We believe that this wave of needed replacements, coupled with widespread deferred maintenance on installed frac pumps, will drive demand in the near-term and over the next several years independent of the current upstream energy recovery, and will provide an additional tailwind of growth in the context of the recovery.

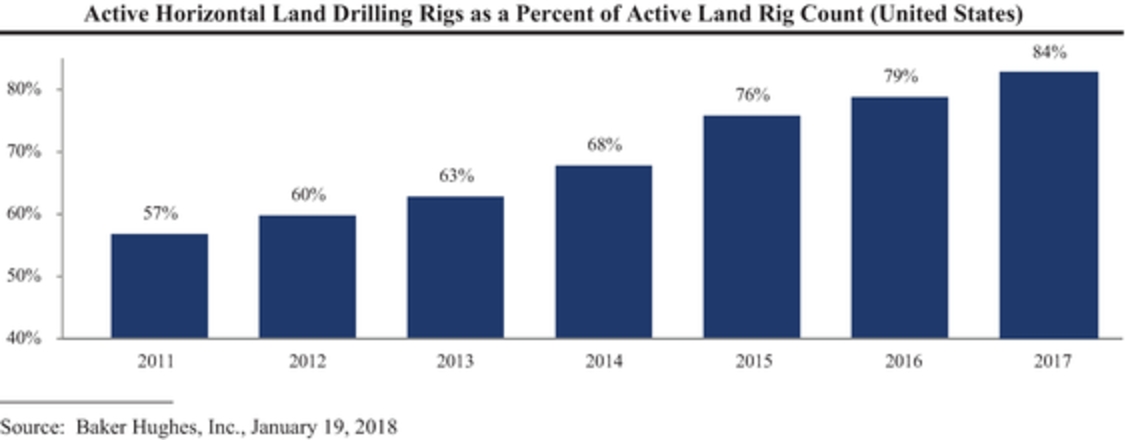

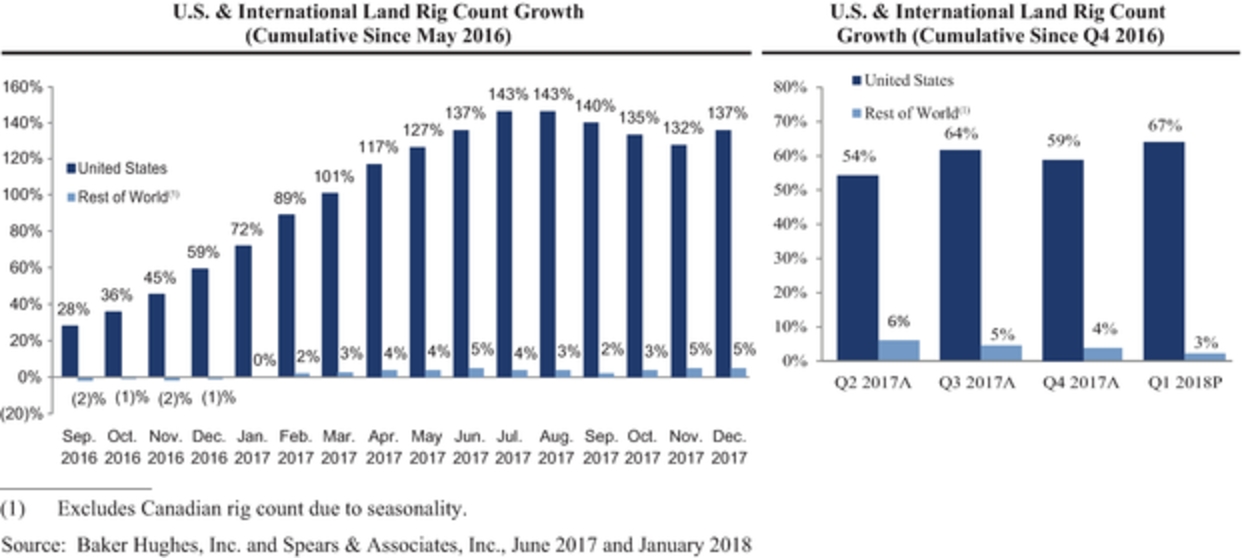

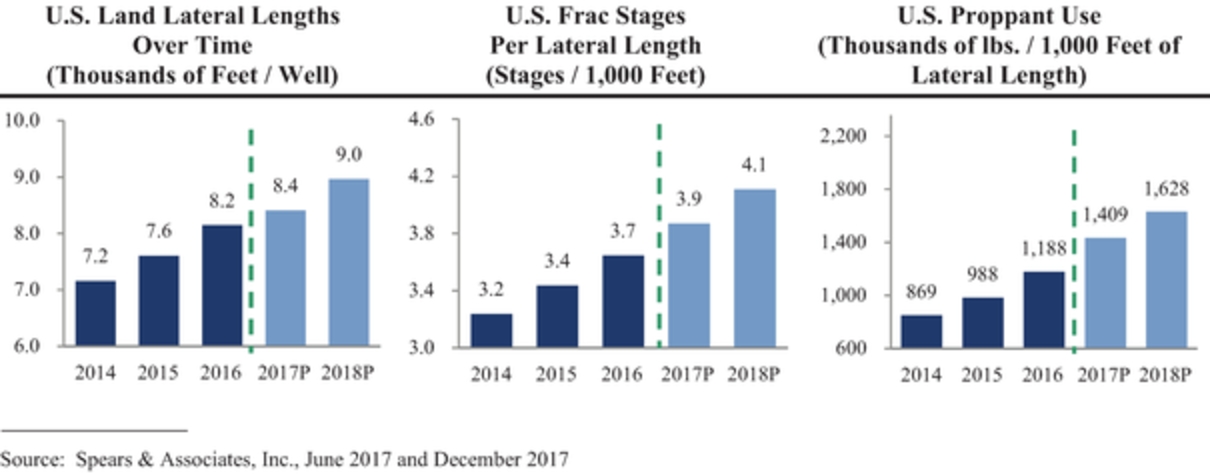

Furthermore, secular industry trends are driving increased demand for and utilization of newer, fit-for-purpose equipment that is highly engineered for demanding applications, and are increasing the frequency of replacement, refurbishment and upgrade cycles of pumping equipment. As a result of an improvement in crude oil prices and the threshold oil and gas prices at which wells are profitable to drill, an increased number of drilling rigs reentered the market in 2016 and 2017, which we expect to continue to drive growth. In turn, the associated usage of aftermarket parts and consumables used in drilling and hydraulic fracturing activity is also increasing. The number of wells drilled is growing at a faster rate than active rig count, with each active rig drilling more unconventional wells per unit of time than previously experienced. In addition, each unconventional well, on average, is being drilled with longer lateral well sections, or laterals, and more hydraulic fracturing stages per lateral length. Greater volumes of proppant (particles, such as sand, treated sand or ceramic materials, which operators mix with fluid to hold fissures open during the hydraulic fracturing process) are being used per length of lateral. As a result, multiple industry trends are independently driving demand for frac pumps and frequently replaced aftermarket parts, notably fluid ends, and associated consumables, resulting in a growth profile that is exposed to, but also meaningfully more robust than, underlying growth in active rig count.

Midstream and Downstream

Sales to midstream and downstream energy end-markets consist of liquid ring vacuum pumps and compressors and integrated systems, engineered fluid loading and transfer equipment and associated aftermarket parts and services. We focus on two basic types of midstream and downstream energy equipment: fluid transfer equipment and liquid ring vacuum pumps and compressors, which are employed in the midstream and downstream markets, respectively.

4

According to Petrochemical Update, North American downstream industry capital expenditures are expected to reach $17.3 billion in 2018, with the maintenance capital expenditure portion for U.S. refineries estimated to increase 39% in 2018 to a total of $1.3 billion. These large investments in midstream and downstream energy end-markets are expected to drive sales of our equipment and future sales of aftermarket parts and services as these facilities age. Further, deferred maintenance of downstream energy infrastructure is expected to drive increased future sales of our replacement products and aftermarket parts and services. Our midstream and downstream products are positioned to capitalize on these large and secularly growing applications, which provide relatively stable demand with attractive, long-term growth potential above GDP.

Petrochemical

Sales to petrochemical end-markets consist of vacuum and compression process systems, both of which are used in harsh, continuous-duty applications.

Demand for our petrochemical industry products correlates with growth in the development of new petrochemical plants as well as activity levels therein, which drive demand for aftermarket parts and services on our market-leading installed base of equipment. According to the American Chemistry Council, U.S. chemical industry capital spending is expected to grow at a 6.2% compound annual growth rate (“CAGR”) from 2017 to 2019. Advancements in the development of unconventional oil and natural gas resources in North America over the past decade have resulted in the abundant availability of locally-sourced natural gas as feedstock for petrochemical plants in North America, supporting long-term growth. In addition, new petrochemical plants are becoming larger and more complex, driving increased demand for more equipment.

Key trends for the Energy segment end-markets include:

|

Upstream

|

Midstream and Downstream

|

Petrochemical

|

|

• Drilled but uncompleted well counts are increasing (82% increase from December 2013 to December 2017)(1)

• Greater percentage of higher-specification drilling rigs (84% in 2017 vs. 53% in 2010)(2) • More wells drilled per rig per year, with increasing lateral lengths per well • Growth in (and increasing profitability of) hydraulic fracturing activity • Increased hydraulic fracturing intensity (4.1 frac stages per 1,000 ft. expected in 2018 vs. 3.2 in 2014)(3) • Greater volume of proppant used per length of lateral |

• Increased production (22% rise in U.S.

oil and gas production from December 2013 to October 2017) • Increased transportation of hydrocarbons • Deferred maintenance capital expenditures • Inclusion in initial specifications and increased size of projects • Increased environmental regulations creating higher cost of spillage and other environmental exposures • Petroleum products export growth |

• Increased production (U.S. chemical

capital spending expected to reach $48 billion by 2022 – more than double 2010 spending)(4) • Inclusion in initial specifications and increased size of projects • Abundant availability of locally-sourced oil and natural gas as feedstock, due to increased domestic U.S. production |

| (1) | U.S. Energy Information Administration, January 2018 |

| (2) | Baker Hughes, Inc., January 19, 2018 |

| (3) | Spears & Associates, Inc., June 2017 |

| (4) | American Chemistry Council, December 2017 |

Medical

The Medical segment designs, manufactures and markets a broad range of flow control products for the durable medical equipment, laboratory vacuum and automated liquid handling end-markets. Key technologies include gas, liquid and precision syringe pumps and compressors and automated liquid handling systems. We have established a history of innovation that enables us to work closely with our customers to create highly customized flow control solutions for their unique applications. These products are mission-critical in the ultimate device in which they are deployed and remain a key component over the entire life cycle of the end products. The regulated market structure and nature of long-tenured customer relationships enables us to have a highly visible, recurring revenue stream from key customers.

We are one of the largest product suppliers in the medical markets we serve. Based on internal estimates, the durable medical equipment pump market represents approximately a $1.2 billion opportunity globally and can

5

be divided into two primary sub-markets: gas pumps and liquid pumps. We estimate the size of the global gas pump market to be approximately $700 million and we estimate the liquid pump market to be a $450 million market globally. Liquid pumps transfer and meter both neutral and chemically aggressive fluids. Further, we believe that overall demand for flow control products and services in the medical space will benefit from attractive secular growth trends, including: (i) aging demographics requiring greater access to medical care; (ii) growth in emerging economies with increased awareness of medical services and greater availability of treatment options; (iii) rising investment in health solutions and safety infrastructures driving demand for medical pump products; (iv) stronger demand for higher healthcare efficiency requiring premium and high performance systems; and (v) increasing demand for durable medical equipment providing significant opportunity for pump products to be incorporated into new applications.

Our Business Transformation from Operational Execution and Strategic Investment

Our top priorities since the KKR Transaction have been creating a performance-driven organization and ensuring superior execution of our operating initiatives in order to transform our business and realize step-change improvements in our commercial and operational capabilities, financial characteristics and performance, pace of innovation and customer service. To support our business transformation, significant investment was dedicated to transformation initiatives across the Company’s three segments, primarily directed toward funding the Company’s growth strategies, further implementation of operational process efficiency actions and permanently reducing operating costs through structural reorganization changes.

Within the Industrials segment, we created an integrated salesforce and established a centralized demand generation team that allows us to maximize revenues across brands, customer accounts and geographies. We also strengthened our customer connectivity by realigning our product engineering and marketing teams into a single global product management structure, and have increased innovation via our new product management process. Furthermore, we significantly increased our profitability by optimizing our footprint and achieving structural cost reductions from back office and administrative areas.

Within the Energy segment, we transformed our upstream energy offering from being predominantly a pump manufacturer into a full-service solutions provider that offers high quality and locally accessible aftermarket support throughout the life cycle of our products. We invested significantly in our sales personnel, marketing strategy, supply chain and manufacturing capabilities, which will allow us to serve our customers better with greater profitability. In particular, we nearly doubled our sales personnel for upstream energy markets since 2012 and increased our service center footprint by 160%, which now covers approximately 85% of U.S. land-based activity. As a result, we believe that we will be even better positioned to capture market share and grow revenues and Segment Adjusted EBITDA independent of the current upstream energy recovery, while positioning ourselves to realize significantly increased sales, profitability and customer responsiveness in the context of the recovery.

The Medical segment was established as a standalone and strategic business in 2013 to accelerate growth, profitability and focused innovation. We upgraded our salesforce and enhanced demand generation efforts to better serve our customers and capture new business, including our recent expansion into automated liquid handling components and systems. Additionally, we also expanded the segment profitability by improving our global sourcing and supply chain strategies and optimizing our global footprint.

The significant operational improvements resulting from the execution of our business transformation initiatives have strengthened performance within each of our segments. We believe the establishment and continued execution of our operational and strategic growth initiatives has positioned our Company for substantial future revenue and Adjusted EBITDA growth, as well as margin expansion.

Our Competitive Strengths

Market Leadership with Strong Brand Portfolio and Reputation Built over 155 Years

With a deep heritage of more than 155 years of leading engineering and application expertise, we believe our portfolio of highly engineered products and proprietary technologies is among the most trusted and recognized in the industry. Our product portfolio is sold under more than 20 well-respected brands, most notably Gardner Denver, CompAir, Nash, Emco Wheaton, Robuschi, Elmo Rietschle and Thomas. By utilizing a multi-brand go-to-market strategy, we leverage each specific brand’s market position in well-defined market

6

segments or geographies. We believe each brand’s reputation for superior quality, reliability, efficiency and responsiveness, along with the often application-critical nature of our products within our customers’ operations, enhances our competitive position in the marketplace and is difficult to replicate given the length of time over which these brand reputations have developed. The strength of our brand portfolio is demonstrated by our leading global market share positions. We believe we have leading market positions within each of our operating segments.

Comprehensive Portfolio of Highly Engineered, Innovative and Application-Critical Equipment

We design, manufacture, market and service a broad array of application-critical flow control and compression equipment for customers seeking targeted solutions for specialized end-markets. Our products typically are part of large, complex systems and represent mission-critical components in the context of the broader systems in which they are utilized. In addition, our products often operate in harsh environments and specialized, precision applications such as in regulated end-markets, where customers require products capable of reliable performance in complex processes. Furthermore, while our products typically represent a low relative cost in the context of the broader applications in which they are employed, the high cost of failure in these applications makes quality and reliability key purchase criteria for end-users and drives demand for highly engineered and differentiated products. As a result, our customers value our product offerings on the basis of superior quality, reliability, efficiency and advanced technology. In addition, we believe the fact that we offer one of the broadest ranges of compressor, pump, vacuum and blower products in our markets allows us to provide differentiated product and service offerings to our customers, and creates incremental business opportunities by enabling us to cross-sell our full product portfolio. Finally, our product engineering teams are continuously enhancing our existing products and developing new applications to strengthen relationships with our growing base of customers that require advanced solutions.

Installed Base and Growing Aftermarket Platform Drives Highly Profitable Recurring Revenues

Our large installed base of products in our Industrials and Energy segments drives demand for recurring aftermarket revenue streams. Due to the critical applications in which our products are used and the high cost of failure or equipment downtime for our customers, we benefit from a consistent and time-sensitive demand for our portfolio of aftermarket parts, as well as service and repair capabilities. In the Industrials segment for example, on average, the life expectancy of a compressor is between 10 and 12 years. However, a customer typically services the compressor at regular intervals, starting within the first two years of purchase and continuing throughout the life of the product. The cumulative aftermarket revenue generated by a compressor over the product’s life cycle will typically exceed its original cost. In the Energy segment, for example, fluid ends, which are key aftermarket parts used in hydraulic fracturing operations, represent approximately 30% of the original cost of the pump and need to be replaced approximately four times per year on each operating pump (depending on the basin and operating nature of the hydraulic fracturing fleet). Other aftermarket parts, such as plungers, and consumables, such as valves, seats and packing, are replaced on even shorter time frames, creating aftermarket opportunities which, in aggregate, are often multiples of the cost of the original pump. Aftermarket sales in 2017 represented approximately 45% of our aggregate Industrials and Energy segments’ revenue.

Diversified Business with Attractive End-markets

Our revenue and earnings are diversified by product, geography, end-market and customer. In addition, we are well-positioned to benefit from secular trends in large, attractive developed economies and fast-growing emerging markets. We believe that our balanced revenue base across end-markets and exposure to early-, mid- and late-cycle growth drivers, along with the specialty nature of the applications on which we focus, enables us to reduce volatility in earnings across economic cycles. Many of our customers operate in attractive end-markets that benefit from secular trends including: (i) continued developed and emerging market growth and infrastructure build; (ii) accelerating land-based U.S. energy activity; (iii) efficiency driven upgrades of industrial systems; (iv) increasing demand for healthcare; (v) increasing complexity of oil and gas extraction; (vi) demand for improved water quality and access; and (vii) heightened environmental regulations. Our value-added services over the life cycle of our products reinforce our customer relationships and position our business for continued growth.

Expertise, Footprint and Expanded Product Portfolio to Capture Recovery in Upstream Energy

Our Energy business manufactures pumps and associated aftermarket parts and consumables used in oil and gas drilling, hydraulic fracturing and well servicing applications. Furthermore, our upstream energy service

7

network now covers approximately 85% of active U.S. land drilling activity as a result of our investment in a 160% increase in our service and repair facility locations since 2012. Even during the recent upstream energy industry downturn, when many of our competitors were closing facilities and cutting back investments, we continued investing in our capabilities within the energy markets. As a result of our investments, as well as our estimated leading global frac pump market position based on new unit sales in the last four years, we believe that we are even better positioned to capture market share and grow revenues and Segment Adjusted EBITDA independent of the upstream energy cycle, while positioning ourselves to realize significantly increased sales, profitability and customer responsiveness in the context of the current upstream energy recovery.

Highly Attractive Financial Profile

We participate in markets with attractive near- and long-term growth trends, and our business generates strong Adjusted EBITDA margins. For the year ended December 31, 2017, each of our segments had Segment Adjusted EBITDA margins above 21%: 21.5% in our Industrials segment, 29.2% in our Energy segment and 27.1% in our Medical segment. The power of our financial profile is evidenced by the Company maintaining approximately the same Adjusted EBITDA margins from 2014 to 2016, despite significant headwinds from external market factors, including the oil and gas depression and foreign exchange. Our financial profile and cash flow generation are further enhanced by our low capital requirements, as demonstrated by our capital expenditures averaging approximately 3% of revenues over the last three years. Our margin profile and low capital intensity have resulted in strong and stable free cash flows that we believe will enable us to continue to reduce our indebtedness, deploy our capital to fund strategic initiatives to drive innovation and organic growth opportunities and finance value-enhancing acquisitions. We believe that our financial profile reflects a strong and attractive business with potential for significant earnings growth over time.

Strength of Our Diverse, Long-Standing Customer Relationships

We serve a large number of well-established blue-chip customers who are globally recognized in the industries in which they operate, as well as regional and local customers, across a wide array of end-markets. In 2017, no single customer represented more than 4% of our total revenues, and our top 10 customers have been with the Company for an average of 20 years, highlighting the strength of our customer relationships. We are known for product quality, reliability, efficiency and superior customer service. These attributes, along with over 155 years of engineering heritage, generate strong brand loyalty for our products and foster long-standing customer relationships.

Strategically Positioned Global Manufacturing Footprint

We have one of the most extensive manufacturing and service networks in the industry with 39 key manufacturing facilities and an expansive network of more than 30 complementary service and repair centers across six continents as of March 31, 2018. We believe our extensive manufacturing and service footprint is a competitive advantage that allows us to source new business, provide superior customer service and more efficiently develop new products to serve our customers’ needs. Our expansive global footprint also allows us to optimize our manufacturing cost structure, by combining local manufacturing assets with the capability to leverage our footprint in lower cost geographies. We believe our worldwide presence enables us to provide timely and responsive support to our customers, many of whom operate internationally, and to capitalize on growth opportunities in both developed and emerging markets. Because of the critical nature of the applications in which our products are used, expedient response times are important to capturing and retaining our customers’ business.

Proven Strategy to Drive Operational Excellence

Our top priorities since the KKR Transaction have been creating a performance-driven culture and ensuring superior execution of our operating initiatives in order to transform our business and realize step-change improvements in our commercial and operational capabilities, financial characteristics and performance, pace of innovation and customer service. The implementation of our operational excellence initiatives has significantly improved our performance. We view operational excellence as a holistic approach to continuous improvement that spans our entire organization from manufacturing to sales and marketing to customer service. We believe this approach will drive strong revenue and earnings growth.

8

Highly Experienced Management Team with Track Record of Success

We invested in attracting a high-caliber senior management team with an average of 25 years of experience in relevant industries. In addition, 45% of our top 100 business managers, including the senior management team, have joined the Company since the KKR Transaction, which we believe added a significant new level of talent to our leadership team. We believe our current management team comprises individuals with the extensive operational, financial and managerial experience needed to effectively navigate the key opportunities and challenges facing our business today and has been responsible for developing and executing our business transformation. Our management team has a demonstrated track record of growth via operational improvements and strategic growth initiatives, and we believe that we have a strong, deep bench of talented leaders who are well-positioned to continue driving the Company towards profitable growth and margin expansion.

Our Growth Strategies

We intend to continue to drive shareholder value through the pursuit of best-in-class financial performance, consistent improvement in profitability and our ability to develop and retain world-class talent. Across all three of our segments, our comprehensive strategy to drive strong revenue and earnings growth is centered on five primary objectives: (i) enhancing commercial leadership by expanding our sales and service presence, adding product line adjacencies and accelerating our innovation funnel; (ii) driving aftermarket sales penetration of our large installed base; (iii) further improving our competitive position with our customers through salesforce effectiveness programs; (iv) executing our operational excellence initiatives to streamline our cost structure and support margin expansion, including through manufacturing footprint optimization, administrative expense efficiency and strategic sourcing; and (v) pursuing acquisitions focused on bolstering our product offerings and/or geographic or market presence. Specifically, we intend to focus on four primary growth strategies.

Accelerate Industrials Growth through Salesforce Effectiveness and Innovation and Drive Continued Margin Expansions by Focusing on Operational Excellence

Our salesforce effectiveness initiatives continue to support our ability to be increasingly responsive to our customers and cross-sell our comprehensive portfolio of market-leading products and services into existing and new applications. In addition, our demand generation platform allows for increased connectivity with our customer base, as we are utilizing integrated technology to develop more actionable leads for our salesforce. Over time, we expect these efforts to enhance product awareness and generate new customer wins. We also expect to expand our market share by growing in key emerging markets, specifically Asia, the Middle East and South America, which were previously underserved regions for the Industrials segment. In addition, the redesigned approach to product management within the Industrials segment is resulting in a greater pace of innovation leading to a growing pipeline of new products that we expect to commercialize over the coming years. Supplementing our commercial and innovation efforts is a focus on continued margin expansion. We are building upon our global operational excellence programs with a distinct focus on simplifying the way we conduct business. We believe we have significant potential for near- and long-term revenue and earnings growth and margin expansion through the continued execution of these initiatives.

Capitalize on Transformative Investments in Our Energy Segment and Benefit from a Recovery in Key Energy Markets

We optimized our Energy segment footprint and business model to sustain profitability while enhancing the upside of our earnings capacity in an upstream energy recovery. As a result of our substantial investment in the capabilities of our upstream energy business, we believe that we significantly increased our addressable market and overall earnings capacity relative to like-for-like activity levels in the 2014 and prior time period. Independent of the current upstream energy recovery, we believe that we are poised to capture favorable trends including pent-up demand for repairs and new parts due to deferred maintenance during the downturn, a significant wave of replacement demand from pumps installed over five years ago and share gain due to our enhanced presence and new product capabilities. In the context of the upstream energy recovery, we believe that these factors will contribute to driving even more growth upside than from the activity growth alone, and that we will generate substantially more revenue and profitability given our increased earnings capacity and operational improvements, such as the expansion of our service network. In the midstream, downstream and process industries, we believe our business will benefit from attractive long-term secular trends, including the increased global movement of hydrocarbons and other liquid commodities and expanded capacity of process industries.

9

Accelerate Growth and Enhance Market Share and Industry Presence of Our Medical Segment

We strategically invested in our Medical segment in order to expand sales and profitability. We believe a combination of our enhanced sales force, improved demand creation and recently implemented CRM platform, combined with our global manufacturing and sales footprint, will continue to position our Company to expand market share. Building on our strength in gas pump applications, we recently expanded into the liquid pump and automated liquid handling markets to gain share in sizable markets that were previously unaddressed by us. We view this space as an attractive adjacency to our existing strategy and one in which we are able to capture share in line with current operations in the gas pump market, building momentum and scale for our Medical business.

Pursue Complementary Acquisitions

In addition to our organic initiatives for each of our segments, we plan to pursue select strategic acquisition opportunities as part of our growth strategy. Our markets are fragmented and there is opportunity for continued consolidation within our industrial, energy and medical markets. Based on management estimates, approximately half of each such market consists of smaller players who maintain less than 5% market share. We have consistently employed a disciplined approach to acquisitions focused on opportunities that (i) strengthen our existing portfolio through the addition of new technologies, (ii) allow us to establish new flow control platforms in attractive markets, (iii) enhance our aftermarket offerings, (iv) grow our presence in strategic geographies, such as select emerging markets and/or (v) provide opportunity to realize synergies while expanding or strengthening our capabilities.

Risks Related to Our Business and this Offering

Investing in our common stock involves substantial risk, and our ability to successfully operate our business is subject to numerous risks. Risk factors related to our business include the following:

| • | We have exposure to the risks associated with instability in the global economy and financial markets, which may negatively impact our revenues, liquidity, suppliers and customers. |

| • | More than half of our sales and operations are in non-U.S. jurisdictions and we are subject to the economic, political, regulatory and other risks of international operations. |

| • | Our revenues and operating results, especially in the Energy segment, depend on the level of activity in the energy industry, which is significantly affected by volatile oil and gas prices. |

| • | Our results of operations are subject to exchange rate and other currency risks. A significant movement in exchange rates could adversely impact our results of operations and cash flows. |

| • | Potential governmental regulations restricting the use, and increased public attention to and litigation regarding the impacts, of hydraulic fracturing or other processes on which it relies could reduce demand for our products. |

| • | We face competition in the markets we serve, which could materially and adversely affect our operating results. |

| • | Large or rapid increases in the cost of raw materials and component parts, substantial decreases in their availability, or our dependence on particular suppliers of raw materials and component parts could materially and adversely affect our operating results. |

| • | Our operating results could be adversely affected by a loss or reduction of business with key customers or consolidation or the vertical integration of our customer base. |

| • | Our ongoing and expected restructuring plans and other cost savings initiatives may not be as effective as we anticipate, and we may fail to realize the cost savings and increased efficiencies that we expect to result from these actions. Our operating results could be negatively affected by our inability to effectively implement such restructuring plans and other cost savings initiatives. |

| • | Our success depends on our executive management and other key personnel. |

| • | If we are unable to develop new products and technologies, our competitive position may be impaired, which could materially and adversely affect our sales and market share. |

10

Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and the documents incorporated by reference herein and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock.

Corporate History and Information

On July 30, 2013, we were acquired by an affiliate of the Sponsor, pursuant to an agreement and plan of merger among Gardner Denver Holdings, Inc. (formerly known as Renaissance Parent Corp.), Renaissance Acquisition Corp. and Gardner Denver, Inc. Total cash consideration payable in connection with the KKR Transaction was approximately $3.8 billion. Gardner Denver Holdings, Inc. was incorporated in Delaware on March 1, 2013 by affiliates of the Sponsor.

Our principal executive offices are located at 222 East Erie Street, Milwaukee, Wisconsin 53202, Suite 500. The telephone number of our principal executive offices is (414) 212-4700. Our Internet address is www.gardnerdenver.com. Information on our web site is not incorporated by reference into this prospectus and does not constitute part of this prospectus.

About Our Sponsor

Founded in 1976 and led by Henry Kravis and George Roberts, KKR & Co. is a leading investment firm with $168.5 billion in assets under management as of December 31, 2017. With offices around the world, KKR & Co. manages assets through a variety of investment funds and accounts covering multiple asset classes. KKR & Co. seeks to create value by bringing operational expertise to its portfolio companies and through active oversight and monitoring of its investments. KKR & Co. complements its investment expertise and strengthens interactions with investors through its client relationships and capital markets platforms. KKR & Co. has been an active investor in the U.S. industrials sector since 2010, having acquired Capsugel, Capital Safety, Gardner Denver, The Crosby Group and CHI Overhead Doors for an aggregate purchase price of approximately $9.1 billion and total equity capital invested of approximately $3.6 billion. KKR & Co. L.P. is publicly traded on The New York Stock Exchange (NYSE: KKR). Investment funds associated with our Sponsor currently beneficially own approximately 61.4% of our common stock and will own approximately 50.3% of our common stock after the completion of this offering (48.6% if the underwriters exercise their option to purchase additional shares in full).

11

The Offering

Unless we indicate otherwise or the context otherwise requires, this prospectus reflects and assumes no exercise by the underwriters of their option to purchase 3,313,690 additional shares of our common stock.

Additionally, the number of shares of our common stock to be outstanding after this offering is based on the number of shares of our common stock outstanding as of March 31, 2018 and excludes: 11,515,460 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2018 at a weighted average

12

exercise price of $9.65 per share; 842,730 shares of common stock that may be issued upon the exercise of stock appreciation rights (“SARs”) outstanding as of March 31, 2018 at a weighted average strike price of $8.65 per share, although we currently expect 143,327 SARs to be settled in shares and all other SARs to be settled in cash; and 4,483,739 shares of common stock issuable upon the settlement of deferred stock units (“DSUs”) to be settled in shares, in each case granted under our 2013 Stock Incentive Plan (the “2013 Stock Incentive Plan”). Also excluded are 765,578 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2018 at a weighted average exercise price of $32.06 per share and 337,316 shares of common stock issuable upon the vesting of restricted stock units (“RSUs”) to be settled in shares, in each case granted under our 2017 Omnibus Incentive Plan (the “2017 Stock Incentive Plan”). There is a remainder of 7,913,462 shares of common stock reserved for issuance under our 2017 Omnibus Incentive Plan (the “2017 Stock Incentive Plan”). These grant amounts will be translated into a number of shares of restricted stock and stock options by taking such dollar amount and dividing it by the per share or per option “fair value” that will be used for reporting the compensation expense associated with the grant under applicable accounting guidance, which “fair value” will be based in part on the per share closing price of our common stock on the NYSE on the date of grant. See “Item 11. Executive Compensation—Compensation Discussion and Analysis” in our Annual Report on Form 10-K incorporated by reference in this prospectus for more information.

13

Summary Historical Consolidated Financial and Other Data

Set forth below is our summary historical consolidated financial and other data as of the dates and for the periods indicated. The summary historical financial data as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015 have been derived from our audited consolidated financial statements and related notes thereto incorporated by reference in this prospectus. The summary historical consolidated financial data as of March 31, 2018 and for each of the three months ended March 31, 2018 and March 31, 2017 have been derived from our unaudited condensed consolidated financial statements and related notes thereto incorporated by reference in this prospectus, which have been prepared on the same basis as our audited consolidated financial statements. The results of operations for any period are not necessarily indicative of the results to be expected for any future period. See “Risk Factors” and the notes to our consolidated financial statements incorporated by reference in this prospectus.

The summary historical consolidated financial and other data should be read in conjunction with, and are qualified by reference to, “Selected Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report and in our Quarterly Report and our consolidated financial statements and related notes thereto incorporated by reference in this prospectus.

|

|

For the Three Months Ended

March 31, |

Year Ended December 31,

|

|||||||||||||

|

|

|||||||||||||||

|

(in millions, except per share amounts)

|

2018

|

2017

|

2017

|

2016

|

2015

|

||||||||||

|

Consolidated Statements of Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

$

|

619.6

|

|

$

|

481.7

|

|

$

|

2,375.4

|

|

$

|

1,939.4

|

|

$

|

2,126.9

|

|

|

Cost of sales

|

|

387.7

|

|

|

307.1

|

|

|

1,477.5

|

|

|

1,222.7

|

|

|

1,347.8

|

|

|

Gross profit

|

|

231.9

|

|

|

174.6

|

|

|

897.9

|

|

|

716.7

|

|

|

779.1

|

|

|

Selling and administrative expenses(1)

|

|

106.9

|

|

|

102.3

|

|

|

446.6

|

|

|

414.3

|

|

|

427.0

|

|

|

Amortization of intangible assets

|

|

30.9

|

|

|

27.6

|

|

|

118.9

|

|

|

124.2

|

|

|

115.4

|

|

|

Impairment of goodwill

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

343.3

|

|

|

Impairment of other intangible assets

|

|

—

|

|

|

—

|

|

|

1.6

|

|

|

25.3

|

|

|

78.1

|

|

|

Other operating expense, net

|

|

4.3

|

|

|

7.9

|

|

|

222.1

|

|

|

48.6

|

|

|

20.7

|

|

|

Operating income (loss)

|

|

89.8

|

|

|

36.8

|

|

|

108.7

|

|

|

104.3

|

|

|

(205.4

|

)

|

|

Interest expense

|

|

26.0

|

|

|

45.9

|

|

|

140.7

|

|

|

170.3

|

|

|

162.9

|

|

|

Loss on extinguishment of debt

|

|

—

|

|

|

—

|

|

|

84.5

|

|

|

—

|

|

|

—

|

|

|

Other income, net(1)

|

|

(2.0

|

)

|

|

(0.5

|

)

|

|

(3.8

|

)

|

|

(2.8

|

)

|

|

(1.6

|

)

|

|

Income (loss) before income taxes

|

|

65.8

|

|

|

(8.6

|

)

|

|

(112.7

|

)

|

|

(63.2

|

)

|

|

(366.7

|

)

|

|

Provision (benefit) for income taxes

|

|

23.4

|

|

|

(1.6

|

)

|

|

(131.2

|

)

|

|

(31.9

|

)

|

|

(14.7

|

)

|

|

Net income (loss)

|

|

42.4

|

|

|

(7.0

|

)

|

|

18.5

|

|

|

(31.3

|

)

|

|

(352.0

|

)

|

|

Less: Net income (loss) attributable to noncontrolling interests

|

|

—

|

|

|

0.1

|

|

|

0.1

|

|

|

5.3

|

|

|

(0.8

|

)

|

|

Net income (loss) attributable to Gardner Denver Holdings, Inc.

|

$

|

42.4

|

|

$

|

(7.1

|

)

|

$

|

18.4

|

|

$

|

(36.6

|

)

|

$

|

(351.2

|

)

|

|

Basic earnings (loss) per share

|

$

|

0.21

|

|

$

|

(0.05

|

)

|

$

|

0.10

|

|

$

|

(0.25

|

)

|

$

|

(2.35

|

)

|

|

Diluted earnings (loss) per share

|

$

|

0.20

|

|

$

|

(0.05

|

)

|

$

|

0.10

|

|

$

|

(0.25

|

)

|

$

|

(2.35

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

201.6

|

|

|

148.5

|

|

|

182.2

|

|

|

149.2

|

|

|

149.6

|

|

|

Diluted

|

|

209.9

|

|

|

148.5

|

|

|

188.4

|

|

|

149.2

|

|

|

149.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Cash Flow Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows – operating activities

|

$

|

60.2

|

|

$

|

(2.6

|

)

|

$

|

200.5

|

|

$

|

165.6

|

|

$

|

172.1

|

|

|

Cash flows – investing activities

|

|

(102.0

|

)

|

|

(16.6

|

)

|

|

(60.8

|

)

|

|

(82.1

|

)

|

|

(84.0

|

)

|

|

Cash flows – financing activities

|

|

(8.2

|

)

|

|

(13.3

|

)

|

|

(17.4

|

)

|

|

(43.0

|

)

|

|

(35.0

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data (at period end):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

353.8

|

|

|

|

|

$

|

393.3

|

|

$

|

255.8

|

|

$

|

228.3

|

|

|

Total assets

|

|

4,775.4

|

|

|

|

|

|

4,621.2

|

|

|

4,316.0

|

|

|

4,462.0

|

|

|

Total liabilities

|

|

3,207.7

|

|

|

|

|

|

3,144.4

|

|

|

4,044.2

|

|

|

4,056.5

|

|

|

Total stockholders’ equity

|

|

1,567.7

|

|

|

|

|

|

1,476.8

|

|

|

271.8

|

|

|

405.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(2)

|

$

|

148.2

|

|

$

|

92.1

|

|

$

|

561.5

|

|

$

|

400.7

|

|

$

|

418.9

|

|

|

Adjusted Net Income(2)

|

|

80.7

|

|

|

20.1

|

|

|

249.3

|

|

|

133.6

|

|

|

128.1

|

|

|

Capital expenditures

|

|

10.1

|

|

|

16.4

|

|

|

56.8

|

|

|

74.4

|

|

|

71.0

|

|

|

Free Cash Flow(2)

|

|

50.1

|

|

|

(19.0

|

)

|

|

143.7

|

|

|

91.2

|

|

|

101.1

|

|

14

| (1) | In the first quarter of fiscal year 2018, the Company adopted the provisions of ASU 2017-07, Compensation — Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net periodic Postretirement Benefit Cost (“ASU 2017-07”). The following table summarizes the impacts of the retrospective adoption of ASU 2017-07 on the Company’s consolidated financial statements incorporated by reference in this prospectus. |

|

|

Year Ended December 31,

|

||||||||

|

(in millions)

|

2017

|

2016

|

2015

|