Attached files

| file | filename |

|---|---|

| EX-99.3 - PRESS RELEASE ANNOUNCING ACQUISITION - Capitol Federal Financial, Inc. | cffnccbrelease043018.htm |

| EX-99.1 - PRESS RELEASE ANNOUNCING ACQUISITION AND EARNINGS - Capitol Federal Financial, Inc. | earningsrelease0318.htm |

| 8-K - CURRENT REPORT, ITEMS 2.02, 7.01, 8.01 AND 9.01 - Capitol Federal Financial, Inc. | pressrelease8k0418.htm |

April 30, 2018

Capitol Federal Financial, Inc.

Announces Agreement to Acquire

Capital City Bancshares, Inc.

Except for the historical information contained in this press release, the matters discussed may be deemed to be "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include

statements about our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions. The words "may," "could,"

"should," "would," "will," "believe," "anticipate," "estimate," "expect," "intend," "plan," and similar expressions are intended to identify

forward-looking statements. Forward-looking statements that involve risks and uncertainties, including the requisite regulatory and

shareholder approvals for this acquisition might not be obtained, the exchange transaction involving the minority shareholders of CCB

might not be consummated, or other conditions to completion of the transaction might not be satisfied or waived; expected costs

savings, synergies and other benefits from Capitol Federal’s merger and acquisition activities, including this acquisition, might not be

realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to

customer and employee retention, might be greater than expected; changes in economic conditions in the Company's market area;

changes in policies or the application or interpretation of laws and regulations by regulatory agencies and tax authorities; other

governmental initiatives affecting the financial services industry; changes in accounting principles, policies or guidelines; fluctuations in

interest rates; demand for loans in the Company's market area; the future earnings and capital levels of Capitol Federal, which would

affect the ability of the Company to pay dividends in accordance with its dividend policies; competition; and other risks detailed from

time to time in documents filed or furnished by the Company with the SEC. Actual results may differ materially from those currently

expected. These forward-looking statements represent the Company's judgment as of the date of this release. The Company disclaims,

however, any intent or obligation to update these forward-looking statements.

No Offer or Solicitation

This press release is being provided for informational purposes only and does not constitute (i) an offer to purchase, nor a solicitation of

an offer to sell, subscribe for or buy any securities, (ii) an offer to exchange any securities or (iii) the solicitation of any vote for approval of

any transaction. There shall not be any offer, solicitation, sale or exchange of any securities in any state or other jurisdiction in which such

offer, solicitation, sale, or exchange is not permitted.

Safe Harbor Statements

2

Strategically and financially attractive acquisition of a highly regarded, Topeka-based

community commercial bank with approximately $400 million in assets

1) Represents a natural extension of our single family lending model through the expansion of our

product offerings to include commercial lending and commercial deposit services

2) Provides an opportunity to enhance our deposit mix, penetrate our markets through the expansion of

our deposit channels, and improve our cost of deposits, driving stronger future net interest margins,

while allowing for reductions to our loan to deposit ratio

3) Expected to produce approximately 3% EPS accretion in the first full year, growing to the mid-single

digits in the years following (1), while representing only 2.1% of pro forma market capitalization (2)

4) Results in minimal impact to TBVPS, with less than 1% dilution at closing, and with TBVPS dilution

earned back in less than 2.5 years (3)

5) Allows Capitol Federal to remain under $10 billion in assets with this acquisition and for the

foreseeable future, resulting in no need to adjust our current dividend strategy in the near term

Introduction

3

(1) Expected EPS impact excluding transaction related expenses, and measured over the first two years following closing of the merger

(2) Capital City shareholders will own approximately 2.1% of pro forma common shares

(3) Based on the cross-over method; earn-back timeframe excludes any potential increase in the pro forma company dividend related to expected

increases in earnings

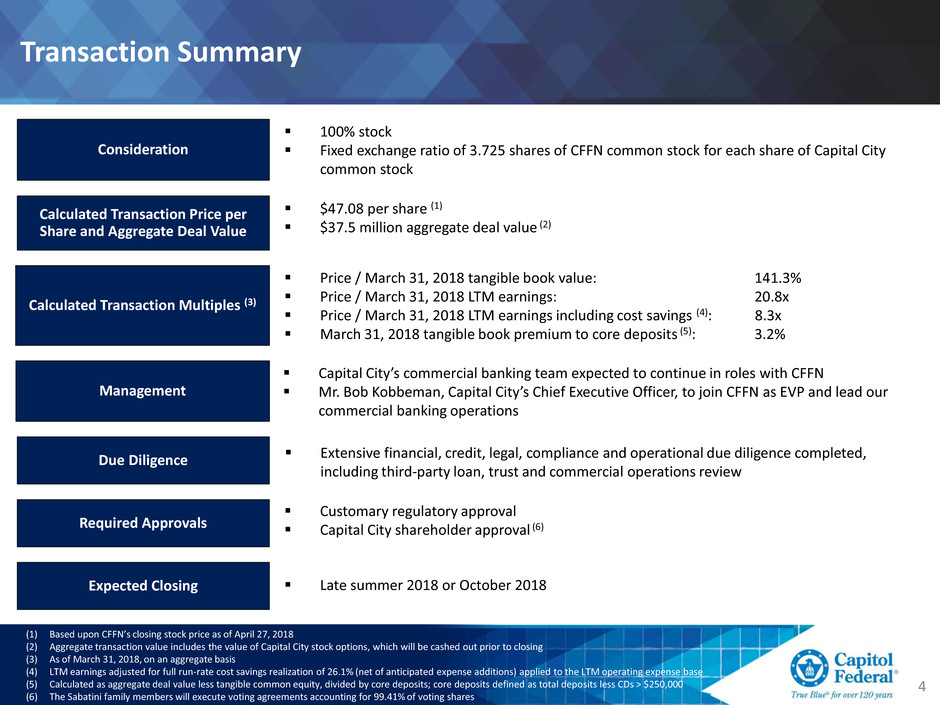

100% stock

Fixed exchange ratio of 3.725 shares of CFFN common stock for each share of Capital City

common stock

Transaction Summary

4

$47.08 per share (1)

$37.5 million aggregate deal value (2)

Calculated Transaction Price per

Share and Aggregate Deal Value

Consideration

Late summer 2018 or October 2018Expected Closing

Customary regulatory approval

Capital City shareholder approval (6)Required Approvals

(1) Based upon CFFN’s closing stock price as of April 27, 2018

(2) Aggregate transaction value includes the value of Capital City stock options, which will be cashed out prior to closing

(3) As of March 31, 2018, on an aggregate basis

(4) LTM earnings adjusted for full run-rate cost savings realization of 26.1% (net of anticipated expense additions) applied to the LTM operating expense base

(5) Calculated as aggregate deal value less tangible common equity, divided by core deposits; core deposits defined as total deposits less CDs > $250,000

(6) The Sabatini family members will execute voting agreements accounting for 99.41% of voting shares

Calculated Transaction Multiples (3)

Price / March 31, 2018 tangible book value: 141.3%

Price / March 31, 2018 LTM earnings: 20.8x

Price / March 31, 2018 LTM earnings including cost savings (4): 8.3x

March 31, 2018 tangible book premium to core deposits (5): 3.2%

Capital City’s commercial banking team expected to continue in roles with CFFN

Mr. Bob Kobbeman, Capital City’s Chief Executive Officer, to join CFFN as EVP and lead our

commercial banking operations

Management

Due Diligence Extensive financial, credit, legal, compliance and operational due diligence completed,

including third-party loan, trust and commercial operations review

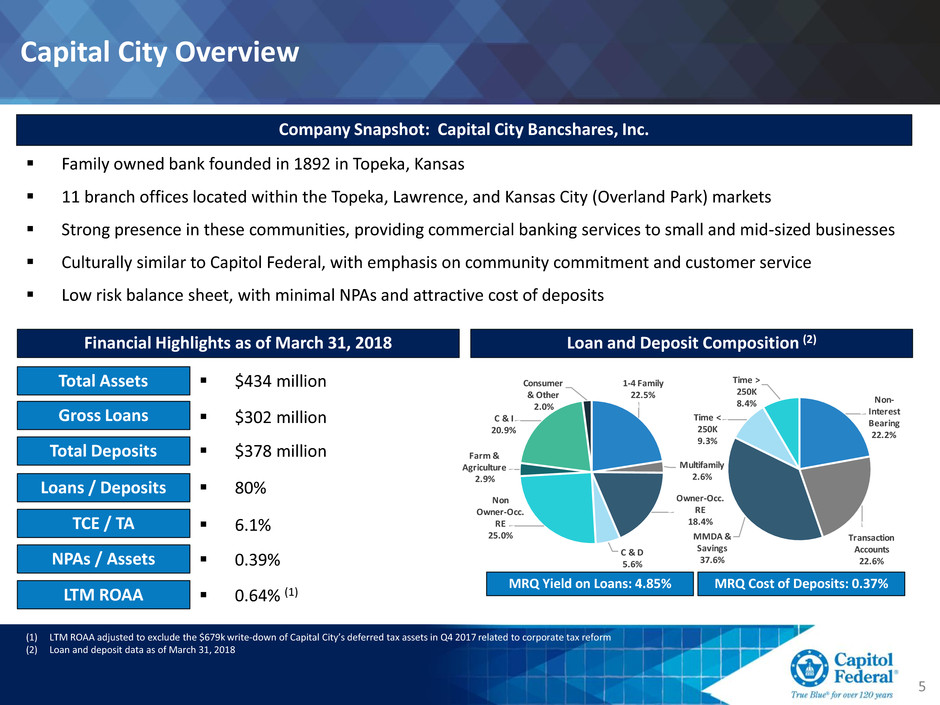

Family owned bank founded in 1892 in Topeka, Kansas

11 branch offices located within the Topeka, Lawrence, and Kansas City (Overland Park) markets

Strong presence in these communities, providing commercial banking services to small and mid-sized businesses

Culturally similar to Capitol Federal, with emphasis on community commitment and customer service

Low risk balance sheet, with minimal NPAs and attractive cost of deposits

Company Snapshot: Capital City Bancshares, Inc.

$434 million

Capital City Overview

5

Financial Highlights as of March 31, 2018

$302 millionGross Loans

$378 millionTotal Deposits

80%Loans / Deposits

6.1%TCE / TA

0.39%NPAs / Assets

Total Assets

Loan and Deposit Composition (2)

(1) LTM ROAA adjusted to exclude the $679k write-down of Capital City’s deferred tax assets in Q4 2017 related to corporate tax reform

(2) Loan and deposit data as of March 31, 2018

0.64% (1)LTM ROAA

1-4 Family

22.5%

Multifamily

2.6%

Owner-Occ.

RE

18.4%

C & D

5.6%

Non

Owner-Occ.

RE

25.0%

Farm &

Agriculture

2.9%

C & I

20.9%

Consumer

& Other

2.0%

Non-

Interest

Bearing

22.2%

Transaction

Accounts

22.6%

MMDA &

Savings

37.6%

Time <

250K

9.3%

Time >

250K

8.4%

MRQ Yield on Loans: 4.85% MRQ Cost of Deposits: 0.37%

Overlapping Market Presence

6

Pro forma deposit market

share rank of #1 in

Shawnee, Douglas and

Johnson counties

Capital City branch office

locations:

Seven branches in the

Topeka market

Three branches in the

Lawrence market

One branch in the

Kansas City MSA, located

in Overland Park

Branch consolidation

opportunities in the

Topeka and Lawrence

markets

No deposit divestitures

expected due to HHI

measures

Market Overview

CFFN

Capital City

Note: Branch map excludes Capitol Federal’s Manhattan, Emporia, Wichita and Salina branches

Source for map: S&P Global Market Intelligence

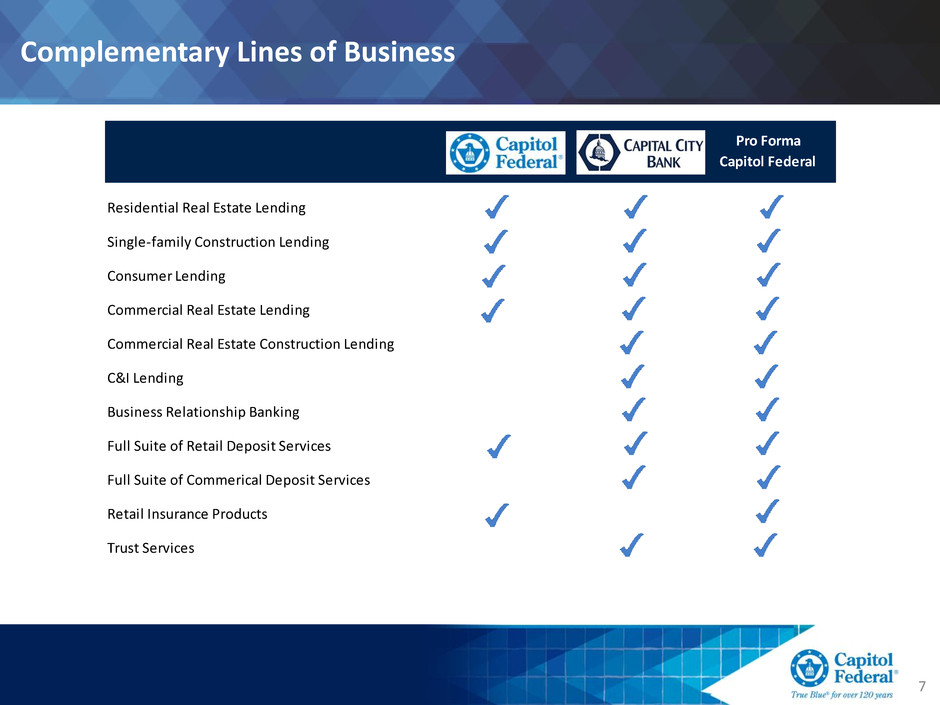

Complementary Lines of Business

7

Residential Real Estate Lending

Single-family Construction Lending

Consumer Lending

Commercial Real Estate Lending

Commercial Real Estate Construction Lending

C&I Lending

Business Relationship Banking

Full Suite of Retail Deposit Services

Full Suite of Commerical Deposit Services

Retail Insurance Products

Trust Services

Pro Forma

Capitol Federal

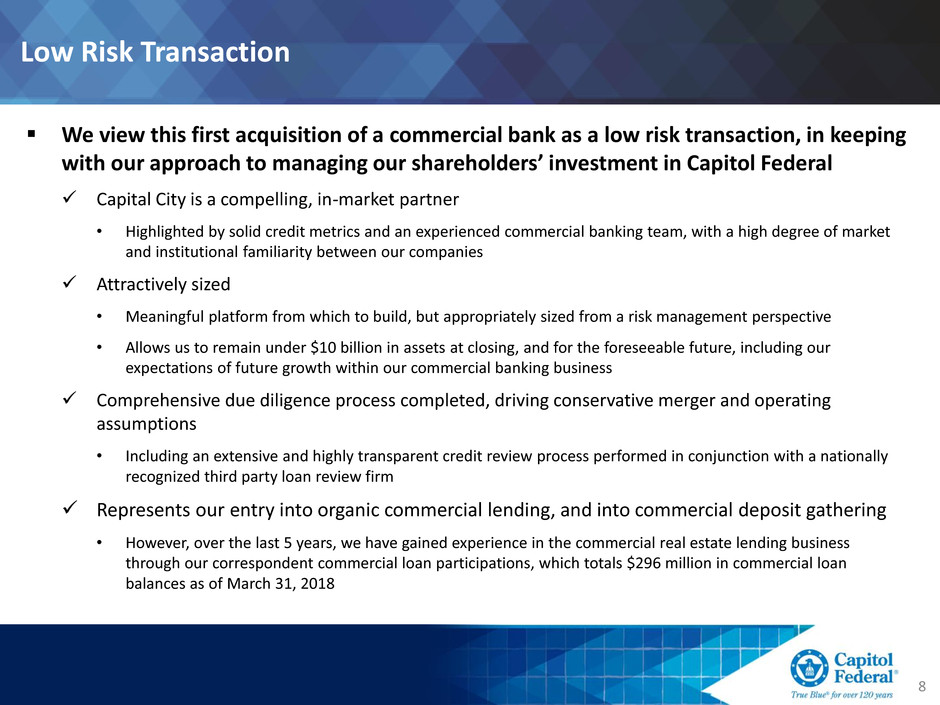

We view this first acquisition of a commercial bank as a low risk transaction, in keeping

with our approach to managing our shareholders’ investment in Capitol Federal

Capital City is a compelling, in-market partner

• Highlighted by solid credit metrics and an experienced commercial banking team, with a high degree of market

and institutional familiarity between our companies

Attractively sized

• Meaningful platform from which to build, but appropriately sized from a risk management perspective

• Allows us to remain under $10 billion in assets at closing, and for the foreseeable future, including our

expectations of future growth within our commercial banking business

Comprehensive due diligence process completed, driving conservative merger and operating

assumptions

• Including an extensive and highly transparent credit review process performed in conjunction with a nationally

recognized third party loan review firm

Represents our entry into organic commercial lending, and into commercial deposit gathering

• However, over the last 5 years, we have gained experience in the commercial real estate lending business

through our correspondent commercial loan participations, which totals $296 million in commercial loan

balances as of March 31, 2018

Low Risk Transaction

8

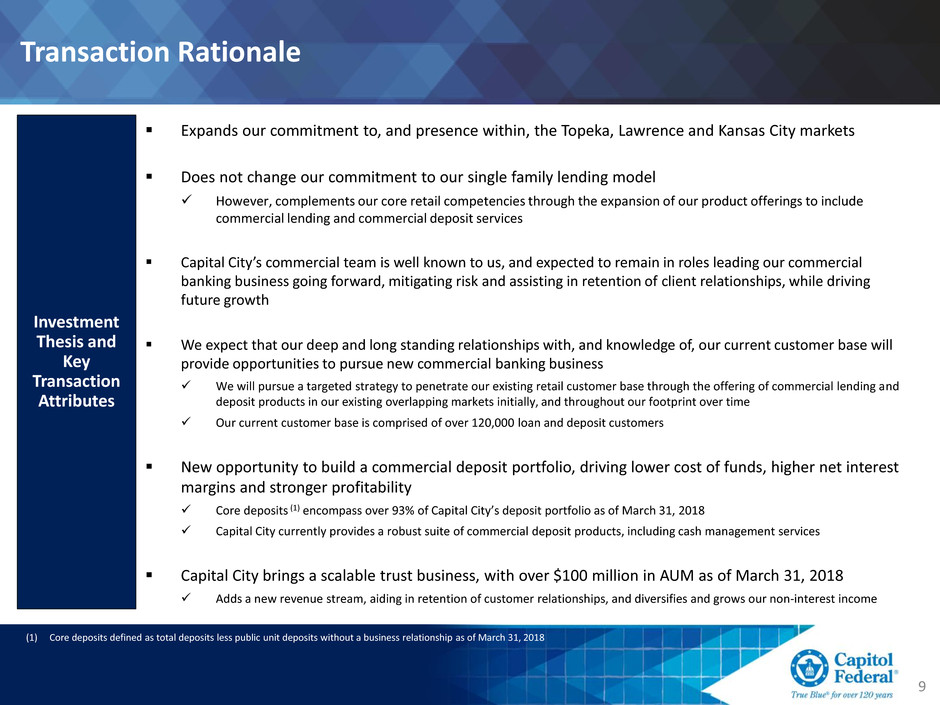

Expands our commitment to, and presence within, the Topeka, Lawrence and Kansas City markets

Does not change our commitment to our single family lending model

However, complements our core retail competencies through the expansion of our product offerings to include

commercial lending and commercial deposit services

Capital City’s commercial team is well known to us, and expected to remain in roles leading our commercial

banking business going forward, mitigating risk and assisting in retention of client relationships, while driving

future growth

We expect that our deep and long standing relationships with, and knowledge of, our current customer base will

provide opportunities to pursue new commercial banking business

We will pursue a targeted strategy to penetrate our existing retail customer base through the offering of commercial lending and

deposit products in our existing overlapping markets initially, and throughout our footprint over time

Our current customer base is comprised of over 120,000 loan and deposit customers

New opportunity to build a commercial deposit portfolio, driving lower cost of funds, higher net interest

margins and stronger profitability

Core deposits (1) encompass over 93% of Capital City’s deposit portfolio as of March 31, 2018

Capital City currently provides a robust suite of commercial deposit products, including cash management services

Capital City brings a scalable trust business, with over $100 million in AUM as of March 31, 2018

Adds a new revenue stream, aiding in retention of customer relationships, and diversifies and grows our non-interest income

Transaction Rationale

9

Investment

Thesis and

Key

Transaction

Attributes

(1) Core deposits defined as total deposits less public unit deposits without a business relationship as of March 31, 2018

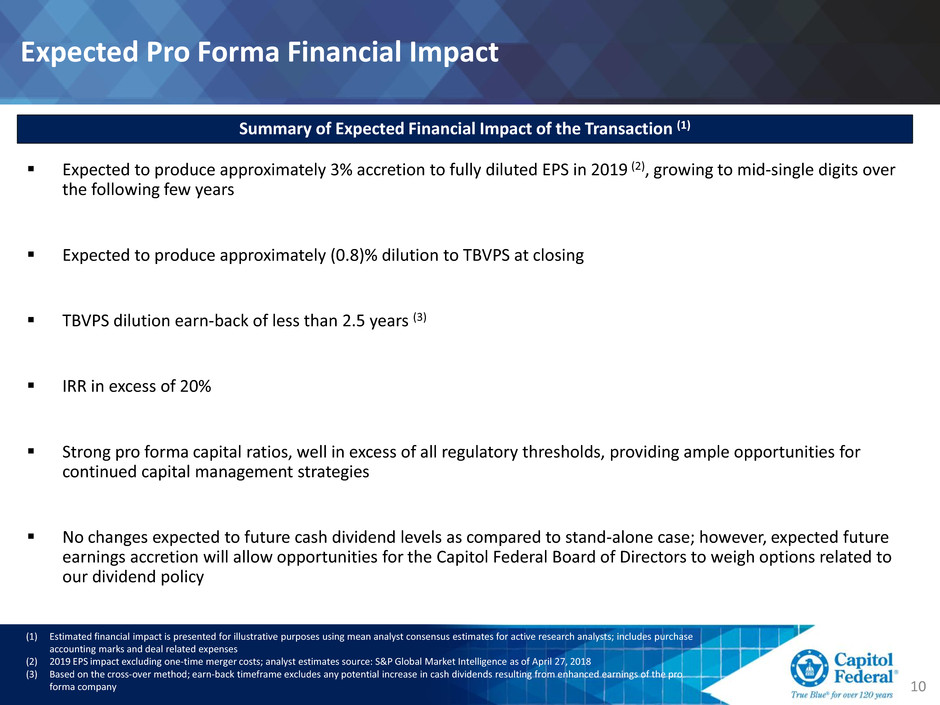

Expected Pro Forma Financial Impact

10

Summary of Expected Financial Impact of the Transaction (1)

Expected to produce approximately 3% accretion to fully diluted EPS in 2019 (2), growing to mid-single digits over

the following few years

Expected to produce approximately (0.8)% dilution to TBVPS at closing

TBVPS dilution earn-back of less than 2.5 years (3)

IRR in excess of 20%

Strong pro forma capital ratios, well in excess of all regulatory thresholds, providing ample opportunities for

continued capital management strategies

No changes expected to future cash dividend levels as compared to stand-alone case; however, expected future

earnings accretion will allow opportunities for the Capitol Federal Board of Directors to weigh options related to

our dividend policy

(1) Estimated financial impact is presented for illustrative purposes using mean analyst consensus estimates for active research analysts; includes purchase

accounting marks and deal related expenses

(2) 2019 EPS impact excluding one-time merger costs; analyst estimates source: S&P Global Market Intelligence as of April 27, 2018

(3) Based on the cross-over method; earn-back timeframe excludes any potential increase in cash dividends resulting from enhanced earnings of the pro

forma company

Appendix

11

Key Transaction Assumptions

12

26.1% net cost savings, identified in detail during our due diligence review, including expense

additions related primarily to commercial banking IT costs across our platform

Cost savings realized 81% in the first 12 months following closing, with 100% realized in future

periods

Cost Savings

Merger-related Charges and

Revenue Synergies

Pre-tax transaction costs of approximately $4.5 million

50% realized pre-closing, 50% realized post-closing

Revenue synergy opportunities identified, but not included in pro forma modeling

Balance Sheet Growth

Assumes Capital City loan and deposit growth of 5% in 2019, then growth of between 10%

and 12% in forward periods (based, in part, on Capitol Federal’s greater capital resources)

Purchase

Accounting

and TruPs

Redemption

Loan Portfolio

(2.3)% gross loan portfolio mark, equating to ($7.2) million

(1.9)% credit mark, equating to ($5.8) million

(0.4)% interest rate mark, equating to ($1.4) million accreting over 6.0 years

OREO (17.4)% mark, equating to ($0.2) million

TruPs $10.2 million of outstanding trust preferred securities redeemed at closing (1)

Low Income Housing

Partnerships

1.75% core deposit intangible, equating to $5.6 million amortized straight-line over 8.0 yearsCDI

HTM Securities (1.2)% mark, equating to ($1.2) million

Mark equating to ($0.4) million

Time Deposits 0.50% mark, equating to $0.3 million amortized over 1.5 years

(1) Inclusive of a $95k call premium

Investor Inquiries

13

700 South Kansas Avenue

Topeka, KS

66603

Main Phone: (785) 235-1341

https://www.capfed.com

John Dicus

Chairman, President & Chief Executive Officer

Direct Phone: (785) 231-6370

Email: jdicus@capfed.com

Kent Townsend

EVP & Chief Financial Officer

Direct Phone: (785) 231-6360

Email: ktownsend@capfed.com