Attached files

| file | filename |

|---|---|

| EX-31.4 - EXHIBIT 31.4 - ALASKA COMMUNICATIONS SYSTEMS GROUP INC | ex_111791.htm |

| EX-31.3 - EXHIBIT 31.3 - ALASKA COMMUNICATIONS SYSTEMS GROUP INC | ex_111790.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ___________

Commission File Number 000-28167

Alaska Communications Systems Group, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

52-2126573 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

600 Telephone Avenue Anchorage, Alaska |

|

99503-6091 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (907) 297-3000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

|

Common Stock, Par Value $.01 per Share |

|

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐ |

Accelerated filer ☒ |

|

Smaller reporting company ☐ |

|

Non-accelerated filer ☐ |

(Do not check if a smaller reporting company) |

Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the shares of all classes of voting stock of the registrant held by non-affiliates of the registrant on June 30, 2017 was approximately $109 million computed upon the basis of the closing sales price of the Common Stock on that date. For purposes of this computation, shares held by directors (and shares held by any entities in which they serve as officers) and officers of the registrant have been excluded. Such exclusion is not intended, nor shall it be deemed, to be an admission that such persons are affiliates of the registrant.

As of April 25, 2018, there were outstanding 53,110,320 shares of Common Stock, $.01 par value, of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE

None.

ALASKA COMMUNICATIONS SYSTEMS GROUP, INC.

AMENDMENT NO. 1 TO ANNUAL REPORT ON FORM 10-K/A

FOR THE YEAR ENDED DECEMBER 31, 2017

|

3 |

|

|

|

|

|

4 |

|

|

|

|

|

15 |

|

|

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance |

17 |

|

22 |

|

|

47 |

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence |

49 |

|

50 |

|

|

|

|

|

51 |

|

|

|

|

|

56 |

Alaska Communications Systems Group, Inc. and its consolidated subsidiaries (“we,” “our,” “us,” the “Company” or “Alaska Communications”) is filing this Amendment No. 1 on Form 10-K/A for the year ended December 31, 2017 (“Amendment”) to amend our Form 10-K for the year ended December 31, 2017, filed with the Securities and Exchange Commission (the “SEC”) on March 16, 2018 (the “Original Form 10-K”). We are filing this Amendment to (i) present in Part I, Item 1A, a revised risk factor, as described in Item 503(c) of Regulation S-K, that is applicable to the Company; (ii) present the information required by Part II (Item 5) of Form 10-K that was previously omitted from the Original Form 10-K; and (iii) present the information required by Part III of Form 10-K that was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K. The Company is hereby amending the Original Form 10-K as follows:

|

● |

On the cover page, to (i) delete the reference in the Original Form 10-K to the incorporation by reference of the Company’s proxy statement for its 2018 annual stockholders’ meeting and (ii) update the date as of which the number of outstanding shares of the Company’s common stock is being provided; |

|

● |

To present in Part I, Item 1A, a revised risk factor, as described in Item 503(c) of Regulation S-K, that is applicable to the Company, under the heading “Actions of Activist Stockholders;” |

|

● |

To present the information required by Part II (Item 5) and Part III of Form 10-K, which information was originally expected to be incorporated by reference to our definitive proxy statement to be delivered to our stockholders in connection with our 2018 annual meeting of stockholders; and |

|

● |

In Part IV, to amend and restate Item 15(b) and Exhibits 31.3 and 31.4 in their entirety to contain the currently dated certifications from the Company’s principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. The certifications of the Company’s principal executive officer and principal financial officer are attached to this Amendment as Exhibits 31.3 and 31.4. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. The Exhibit Index has also been amended and restated in its entirety to include the certifications as exhibits. |

Except as described above, no other changes have been made to the Original Form 10-K. This Amendment does not otherwise update information in the Original Form 10-K to reflect facts or events occurring subsequent to the filing date of the Original Form 10-K. This Amendment should be read in conjunction with the Original Form 10-K and with any of our filings made with the SEC subsequent to filing of the Original Form 10-K.

We face a variety of risks that may affect our business, financial condition and results of operations, some of which are beyond our control. The risks described below are not the only ones we face and should be considered in addition to the other cautionary statements and risks described elsewhere and the other information contained in this report and in our other filings with the SEC, including our subsequent reports on Forms 10-Q and 8-K. Additional risks and uncertainties not known to us or that we currently deem immaterial may also affect our business. If any of these known or unknown risks or uncertainties actually occurs, our business, financial condition and results of operations could be seriously harmed.

Risks Relating to Our Industry

Competition

The telecommunications industry in Alaska is competitive and creates pressure on our pricing and customer retention efforts.

Strong competitors make it more difficult for us to attract and retain customers, which could result in lower revenue, cash flow from operating activities and Adjusted Free Cash Flow.

Our principal facilities-based competitor for voice and broadband services is GCI, who is also the dominant cable television provider in Alaska. In the business and wholesale market, GCI holds a dominant position through its extensive fiber optic, microwave and satellite based middle mile network as well as its undersea fiber cable network, where it owns and operates two of the four existing undersea fiber optic cables connecting Alaska to the contiguous states. In the consumer market, GCI bundles its cable video services with voice, broadband and mobile wireless services. We do not offer video service and mobile wireless, and thus, are unable to offer competing bundles.

GCI continues to expand its statewide reach, including through its Terra Southwest project which is funded with federal subsidies, consisting of grants from the USDA Rural Utilities Service and federal low-interest loans. This subsidy gives GCI a substantial competitive advantage in the markets served by Terra Southwest, and GCI receives substantial additional funding for services offered over this facility from the federal E-Rate and Rural Health Care universal service support mechanisms. GCI has indicated it intends to replicate this government subsidized model in other markets in Alaska, which will create monopoly-type conditions in these markets which are subject to minimal regulatory oversight.

With a long history of operating in Alaska, AT&T has a terrestrial long-haul network in Alaska where the focus is on serving certain national customers. AT&T’s primary focus in Alaska is providing wireless services.

As we compete more extensively in the managed IT services business, we are likely to face new competition, both local and national. An example of this new competition is World Wide Technologies, a large equipment value add reseller. More recently we have seen a smaller Rural Local Exchange Carrier (RLEC), Matanuska Telephone Association (MTA), that operates predominantly in the Wasilla and Palmer communities north of Anchorage, acquire a data center and IT services provider called AlasConnect. With this acquisition, we now see MTA as a competitor for managed IT services particularly in our Anchorage and Fairbanks markets. There are many smaller firms that compete for IT business in Alaska. We believe that competition for managed IT services is fragmented in Alaska with no clear or dominant provider.

Our Cost Structure

We may not be able to maintain our cost structure which would create risk to our ability to generate bottom-line growth.

Subsequent to the Wireless Sale, wind-down of our wireless operations and positioning the Company as a more focused broadband and managed IT services company, we commenced a plan to generate synergies and achieve cost reductions. This plan was substantially implemented during the third and fourth quarters of 2015 and resulting benefits were realized during fiscal year 2016 and 2017. We have also recently implemented additional cost savings initiatives. Maintaining these cost reductions is a critical factor impacting our generation of cash flow from operating activities. If we fail to maintain these cost reductions, our financial condition will be impacted.

Technological Advancements and Changes in Telecommunications Standards

If we do not adapt to rapid technological advancements and changes in telecommunications standards, our ability to compete could be strained, and as a result, we would lose customers.

Our success will likely depend on our ability to adapt and fund the rapid technological changes in our industry. Our failure to adopt a new technology or our choice of one technology over another may have an adverse effect on our ability to compete or meet the demands of our customers. Technological changes could, among other things, reduce the barriers to entry facing our competitors providing local service in our service areas. The pace of technology change and our ability to deploy new technologies may be constrained by insufficient capital and/or the need to generate sufficient cash to make interest payments on our debt.

New products and services may arise out of technological developments and our inability to keep pace with these developments may reduce the attractiveness of our services. Some of our competitors may have greater resources to respond to changing technology than we do. If we fail to adapt successfully to technological changes or fail to obtain access to new technologies, we could lose customers and be unable to attract new customers and/or sell new services to our existing customers. We may be unable to successfully deliver new products and services, and we may not generate anticipated revenues from such products or services.

To be competitive we need to maintain an on-going investment program to continuously upgrade our access network. We define the access network as the connection from the end user location – either a home or a business – to the first aggregation point in the network. The connection can be copper or fiber and the aggregation point is typically a central office or remote serving node. The access network determines the speeds we are able to deliver to our end customer. We may not be able to maintain the level of investment needed for long term competitiveness in offering broadband speeds to all segments of our market.

As we seek to grow as the leading Cloud Enabler for businesses in Alaska, we will have to partner with various IT technology and cloud services providers. Technology trends and developments in this area can be far more disruptive and tend to change in shorter cycles compared to telecommunications technologies. Our ability to invest in the training, certifications, and skills required to develop these partnerships will be important in determining our success in this area of managed IT services.

Our limited access to middle mile infrastructure limits our ability to compete in certain geographic and customer segments in Alaska.

We define middle mile as the connection between the first aggregation point into a local community and the interconnection point to the internet or switch which connects the community to the outside world. These are typically high capacity connections and can span hundreds of miles in the case of Alaska. It is unlikely that we will have the capital needed for middle mile investments, and GCI controls significant elements of the middle mile network in Alaska, and through its government funded programs is creating monopoly conditions in certain areas of the state. This limits our ability to compete in certain markets.

Risks Relating to Our Debt

Our debt could adversely affect our financial health, financing options and liquidity position, and our ability to service debt is, in part, dependent on maintaining the synergies achieved following the Wireless Sale. Due to uncertainty in the capital markets, we may be unable to retire or refinance our long-term debt when it becomes due, or if we are able to refinance it, we may not be able to do so with attractive interest rates or terms.

2017 Senior Credit Facility

On March 13, 2017, we entered into a senior credit facility consisting of a Term A-1 Facility of $120.0 million, a Term A-2 Facility of $60.0 million and a Revolving Facility of $15.0 million (together the “2017 Senior Credit Facility” or “Agreement”). On March 28, 2017, the Company utilized proceeds from the 2017 Senior Credit Facility and cash on hand to repay, in full, the outstanding principal balance and accrued interest of its 2015 Senior Credit Facilities. Principal payments under the 2015 Senior Credit Facility were due in 2017 and 2018. Proceeds from the 2017 Senior Credit Facility were also utilized to fund the tender offer and settlement of the Company’s 6.25% Convertible Notes in the principle amount of $94.0 million.

Principal payments on the Term A-1 Facility are $1,500 thousand per quarter beginning in the fourth quarter of 2017 through the first quarter of 2020, $2,250 thousand per quarter beginning in the second quarter of 2020 through the first quarter of 2021, and $4,000 thousand per quarter beginning in the second quarter of 2021 through the fourth quarter of 2021. The remaining outstanding principal balance is due on March 13, 2022. Principal payments on the Term A-2 Facility are $150 thousand per quarter beginning in the fourth quarter of 2017 through the first quarter of 2021 and $600 thousand per quarter beginning in the second quarter of 2021 through the fourth quarter of 2022. The remaining outstanding principal balance is due on March 13, 2023.

The 2017 Senior Credit Facility also requires that we perform against certain financial covenants.

Our debt also exposes us to adverse changes in interest rates. As a component of our cash flow hedging strategy and as required under the terms of the 2017 Senior Credit Facility, we hold a pay-fixed, receive-floating interest rate swap in the notional amount of $90.0 million at 6.49425%, inclusive of a 5.0% LIBOR spread, through June 2019.

6.25% Convertible Notes due 2018

The remaining principle amount of the 6.25% Convertible Notes due in 2018 of $10.0 million will purchased or settled with restricted cash designated for this purpose. Our ability to complete the repurchase depends on meeting certain liquidity requirements specified in our 2017 Senior Credit Facility. If we are unable to meet those liquidity requirements or obtain a waiver from our lenders, we may be in default of our obligations under the notes and our credit facility.

Continuing global, national, and state fiscal insecurity, as well as uncertainty regarding our future performance adds refinancing risk to the Company.

We are also subject to credit risk related to our counterparties on the swaps and to interest rate fluctuations on interest generated by our debt in excess of the notional term loans referenced above. For more specific information related to our exposure to changes in interest rates and our use of interest rate swaps, please see “Item 7A, Quantitative and Qualitative Disclosures About Market Risk” in the Original Form 10-K.

Risks Related to our Business

Rural Health Care Universal Service Support Program

We may not receive some of the subsidies for Rural Health Care for which our customers have applied and amounts previously received may be challenged by the FCC.

Beginning with the 2016 Funding Year (July 1, 2016 – June 30, 2017), and again for Funding Year 2017 (July 1, 2017 – June 30, 2018), demand for support under the Rural Health Care Universal Service Support Program has exceeded the available budget. On March 15, 2018, USAC announced that demand for rural health care support had exceeded the programs’ annual cap in Funding Year 2017, which began July 1, 2017 and ends on June 30, 2018, and that successful applicants would receive 85% of the funding for which they would otherwise be eligible. These budget constraints could reduce the affordability of our services to rural health care providers, and potentially reduce demand for our services from these customers in the future.

The budget constraints have also prompted the Universal Service Administrative Company (“USAC”), which administers the program, to engage in substantially more rigorous reviews of rural health care support, raising compliance costs and delaying issuance of support payments. In connection with that review, the Company has received certain inquiries and requests for information from USAC and from the FCC Enforcement Bureau.

This rising uncertainty and unpredictability in the Rural Health Care program negatively impacted the Company’s revenue in 2017, and may have a negative impact on future revenue and demand for our services from rural healthcare providers.

Also, we may be subject to further investigation for the Company’s compliance with FCC and USAC rules, regulations, and practices for prior periods. Such investigations of other companies have resulted in refunding certain previously awarded funds, as well as fines and penalties.

Access and High Cost Support Revenue

Revenues from access charges will continue to decline and revenue from various regulated support mechanisms is subject to rule changes at the FCC and the RCA.

We received approximately 2.2% and 2.5% of our operating revenues for the years ended December 31, 2017 and 2016, respectively, from access charges. The amount of revenue that we receive from these access charges is calculated in accordance with requirements set by the FCC and the RCA. Any change in these requirements may reduce our revenues and earnings. Access charges have consistently decreased in past years and we expect this trend to continue due to declines in voice usage and migration to VoIP services which do not generate access revenue for us.

Interstate switched access has been on a phase-out schedule for several years, and according to the schedule set forth by the FCC, it reached its final phase in July 2017 and will be reduced to zero on July 1, 2018. Interstate switched access is currently a relatively small component of all access revenue, and modest declines are anticipated at this time for other components of interstate access revenue. Traditional intrastate access revenues have already been reduced, replaced in part by COLR support. The RCA has commenced a proceeding that could impact COLR support in the future, and while it is impossible to predict the state commission’s future decisions, there is a risk that revenue will be reduced.

Furthermore, the FCC has actively reviewed new mechanisms for inter-carrier compensation that will eliminate certain access charges entirely. Elimination of access charges would have a material adverse effect on our revenue and earnings. Similarly, the RCA has adopted regulations modifying intrastate access charges that may reduce our revenue.

As discussed in “Regulations,” the FCC released its order for CAF II on October 31, 2016. As a result, we currently expect our high cost support revenue to be relatively unchanged for the next eight years. Substantial changes are expected to be enacted by the FCC regarding our future high cost loop support funding and obligations thereunder. It is difficult to predict the future growth in this source of revenue as well as the future obligations that we will be required to accept that are tied to this funding.

Regulations

New governmental regulations may impose obligations on us to upgrade our existing technology or adopt new technology that may require additional capital and we may not be able to comply in a timely manner with these new regulations.

Some of our markets are regulated and we cannot predict the extent to which the government will impose new unfunded mandates on us. Such mandates have included those related to emergency location, emergency “E-911” calling, law enforcement assistance and local number portability. Each of these government mandates has imposed new requirements for capital that we could not have predicted with any precision. Along with these obligations, the FCC has imposed deadlines for compliance with these mandates. We may not be able to provide services that comply with these or other regulatory mandates. Further, we cannot predict whether other mandates from the FCC or other regulatory authorities will occur in the future or the demands they may place on our capital expenditures. For more information on our regulatory environment and the risks it presents to us, see “Item 1, Business – Regulation” in the Original Form 10-K.

There is a risk that FCC Orders will materially impact our revenue.

The 2011 Transformation Order established a new framework for high cost universal service support that replaced existing support mechanisms that provide support to carriers, like us, that serve high-cost areas with new CAF support mechanisms and service obligations that are focused on broadband Internet access services. We recognized $19.7 million in federal high cost universal service payment revenues to support our wireline operations in high cost areas in each of the twelve months ended December 31, 2017 and 2016. The FCC released its CAF Phase II order on October 31, 2016.

In addition, the FCC has imposed strict new compliance requirements governing enrollment of low-income subscribers in the FCC’s Lifeline program, which provides carriers like us with USF support to reduce the cost of wireline and wireless services to low-income consumers. For the twelve months ended December 31, 2017, we recognized wireline lifeline revenue of $0.3 million. Over the same period the number of wireline lifeline customers we served decreased from 1,131 to 934. We expect the amount of Lifeline USF support we receive in connection with our wireline customers to continue to decrease, because we expect that it will be more difficult for low-income consumers to qualify for Lifeline, and to remain enrolled in Lifeline, than it was under the former rules.

Economic Conditions

The successful operation and growth of our businesses depends on economic conditions in Alaska which may deteriorate due to reductions in crude oil prices and other factors.

The vast majority of our customers and operations are located in Alaska. Due to our geographical concentration, the successful operation and growth of our businesses depends on economic conditions in Alaska. The Alaska economy, in turn, depends upon many factors, including:

|

● |

the strength of the natural resources industries, particularly oil production and prices of crude oil; |

|

● |

the strength of the Alaska tourism industry; |

|

● |

the level of government and military spending; and |

|

● |

the continued growth of service industries. |

The population of Alaska, which declined marginally in 2017, is approximately 740,000 with Anchorage, Fairbanks and Juneau serving as the primary population and economic centers in the state.

It is estimated that one-third of Alaska’s economy is dependent on federal spending, one-third on natural resources, in particular the production of crude oil, and the remaining one-third on drivers such as tourism, mining, timber, seafood, international air cargo and miscellaneous support services.

Alaska’s economy is dependent on investment by oil companies, and state tax revenues correlate with the price of oil as the State assesses a tax based on the retail price of oil that transits the pipeline from the North Slope. The price of crude oil dropped substantially during 2014 through 2016, and began to rebound in 2017. Economists currently expect oil prices to increase marginally in 2018 and slowly trend up in the near term. The decline in the price of crude oil has impacted the state in two ways:

|

1. |

Resource based companies reduced their level of spending in the state, and in particular the North Slope, through reducing their operating costs. |

|

|

2. |

The State of Alaska budget, which represents approximately 15% of the states total economy, is incurring deficits, but had budgetary reserves that were available through 2017. Proposals to address these deficits include spending reductions, utilization of earnings from the state’s permanent fund and additional revenues, including selected income taxes. Reduced spending by the State has had a dampening effect on overall economic activity in the state. |

Economists anticipate that slowly increasing oil prices and growing industry optimism bode well for continued new development and increased activity on the North Slope in 2018, supporting an increase in the volume of oil moving through the pipeline and the generation of revenue for the state government.

Economists believe the Alaskan economy entered a moderate recession beginning in the second half of 2015. They are currently projecting that this recession will continue into 2018. Employment levels in the state declined approximately 1.3% in 2017 (compared with a 2.3% decline in 2016) driven by declines in the oil and gas industry, construction, and Federal and state government, offset by increases in health care and local government. The negative effects of the recession have been mitigated by diversity in the Alaskan economy, including growth in the health care and tourism industries. However, economists believe that, without a long-term solution to the state budget deficit, a full economic recovery may remain elusive.

Our terrestrial fiber network on the North Slope of Alaska (described below) which allows us to provide broadband solutions to the oil and gas sector may be negatively impacted by declining crude oil prices in the near term. Additionally, overall macro impacts from a sustained lower price of crude oil, if maintained over time, will ultimately impact our growth in the future.

North Slope Fiber Optic Network

Our joint venture with Quintillion Holdings, LLC established, in part, to provide broadband solutions to the North Slope of Alaska may not prove to be as successful as currently anticipated.

During the second quarter of 2015, we acquired a fiber optic network on the North Slope of Alaska and entered into a joint venture with Quintillion to operate and expand the network. This network enables commercially-available, high-speed connectivity where only high-cost microwave and satellite communications were previously available. The success of this joint venture is dependent, in part, on the utilization of the network by other telecom carriers.

Quintillion has invested in a submarine network with landing stations in several northwest Alaska communities, including a terrestrial route from the North Slope to Fairbanks. The network became operational in late 2017. We have acquired capacity on this system and expect to deliver service to customers in this area beginning in 2018. Delays in acquiring customers and providing those customers with service could negatively impact our investment in the joint venture and our financial results.

Erosion of Access Lines

We provide services to many customers over access lines, and if we continue to lose access lines, our revenues, earnings and cash flow from operating activities may decrease.

Our business generates revenue by delivering voice and data services over access lines. We have experienced net access line loss over the past few years and the rate of loss has been accelerating. During the years ended December 31, 2017 and 2016 our business access line erosion was 2,278 and 2,621, respectively, while over the same period our consumer access line erosion was 4,156 and 4,265 respectively. We expect to continue to experience net access line loss in our markets, affecting our revenues, earnings and cash flow from operating activities.

Network / E-911 Failure

A failure of our network could cause significant delays or interruptions of service, which could cause us to lose customers.

To be successful, we will need to continue to provide our customers reliable service over our network. Our network and infrastructure are constantly at risk of physical damage as a result of human, natural or other factors. These factors may include pandemics, acts of terrorism, sabotage, natural disasters, power surges or outages, software defects, contractor or vendor failures, labor disputes and other disruptions that may be beyond our control. Should we experience a prolonged system failure or a significant service interruption, our customers may choose a different provider and our reputation may be damaged. Further, we may not have adequate insurance coverage, which would result in unexpected expense. Notably, similar to other undersea fiber optic cable operators, we do not carry insurance that would cover the cost of repair of our undersea cables and, thus, we would bear the full cost of any necessary repairs.

A failure of enhanced emergency calling services associated with our network may harm our business.

We provide E-911 service to our customers where such service is available. We also contract from time to time with municipalities to upgrade their dispatch capabilities such that those facilities become capable of receiving our transmission of a 911 caller’s location information and telephone number. If the emergency call center is unable to process such information, the caller is provided only basic 911 services. In these instances, the emergency caller may be required to verbally advise the operator of such caller’s location at the time of the call. Any inability of the dispatchers to automatically recognize the caller’s location or telephone number, whether or not it occurs as a result of our network operations, may cause us to incur liability or cause our reputation or financial results to suffer.

Actions of Activist Stockholders

Actions of activist stockholders against us could be disruptive and costly and the possibility that activist stockholders may wage proxy contests or seek representation on, or control of, our Board could cause uncertainty about the strategic direction of our business.

Stockholders with uncertain agendas may from time to time engage in proxy solicitations, advance stockholder proposals or board nominations or otherwise attempt to effect changes, assert influence or acquire some level of control over us.

On February 9, 2018, TAR Holdings LLC, a New Jersey limited liability company of which Karen S. Singer is the sole member (“TAR Holdings”), submitted to the Company a purported notice of nominations (the “Singer Purported Nominating Notice”) to notify the Company that it intends to nominate three candidates for election to our six-member Board at our 2018 Annual Meeting of Stockholders (the “2018 Annual Meeting”). On April 25, 2018, the Alaska Communications Board, acting upon the recommendation of our Board’s Nominating and Corporate Governance Committee, unanimously determined, in consultation with its legal advisors, that the Singer Purported Nominating Notice did not comply with our Amended and Restated Bylaws (the “Bylaws”) in numerous material respects and that, accordingly, TAR Holdings had not submitted to Alaska Communications a timely and proper advance notice of nominations in compliance with the Bylaws. On April 26, 2018, the Company’s Corporate Secretary sent TAR Holdings a letter, which the Company publicly filed as an exhibit to a Current Report on Form 8-K and DEFA14A filed on the same date, informing TAR Holdings of such determination and that, if TAR Holdings attempted to nominate its purported proposed candidates for election to our Board at the 2018 Annual Meeting, then, pursuant to the Bylaws, such purported proposed candidates would be disregarded and any ballots cast for such purported proposed candidates would be void. The April 26, 2018 letter further indicated that, notwithstanding the Board’s determination that the Singer Purported Nominating Notice was not submitted in compliance with the Bylaws, the Company remained interested in continuing to discuss a settlement with TAR Holdings that contemplated adding to the Board two new independent directors recommended by TAR Holdings. Notwithstanding the Board’s determination that TAR Holdings has not submitted to the Company a timely and proper advance notice of nominations in compliance with the Bylaws, it is possible that TAR Holdings may seek to challenge such determination, including, but not limited to, through litigation, and/or still seek to send to the Company’s stockholders proxy solicitation materials such as an opposition proxy statement and proxy card or voting instruction form.

According to Amendment No. 8 to the Schedule 13D filed with the SEC on April 30, 2018 by Ms. Singer and TAR Holdings (collectively, the “Singer 13D Group”), the Singer 13D Group beneficially owns in the aggregate approximately 5.03% of our outstanding common stock.

Our Board and management team strive to maintain constructive, ongoing communications with all of the Company’s stockholders, including the Singer 13D Group, and welcomes our stockholders’ views and opinions with the goal of enhancing value for all stockholders, including any suggestions stockholders may have for enhancing the depth and breadth of our Board. However, an activist campaign such as the one intended by the Singer 13D Group to replace three members of our six-member Board could have an adverse effect on us because:

|

● |

Responding to such actions by activist stockholders can disrupt our operations, are costly and time-consuming, and divert the attention of our Board and senior management team away from the pursuit of business strategies, which could adversely affect our results of operations and financial condition; |

|

● |

Perceived uncertainties as to our future direction as a result of changes to the composition of our Board may lead to the perception of a change in the direction of the business, instability or lack of continuity which may be exploited by our competitors, cause concern to our current or potential clients, may result in the loss of potential business opportunities and make it more difficult to attract and retain qualified personnel and business partners; |

|

● |

These types of actions could cause significant fluctuations in our stock price based on temporary or speculative market perceptions or other factors that do not necessarily reflect the underlying fundamentals and prospects of our business; and |

|

● |

If individuals are elected to our Board with the objective of furthering a specific agenda, it may adversely affect our ability to effectively implement our business strategy and create additional value for our stockholders. |

Employees

We depend on the availability of personnel with the requisite level of technical expertise in the telecommunications industry.

Our ability to develop and maintain our networks and execute our business plan is dependent on the availability of technical engineering, IT, service delivery and monitoring, product development, sales, management, finance and other key personnel within our geographic location.

Labor costs and the terms of our principal collective bargaining agreement can negatively impact our ability to remain competitive, which could cause our financial performance to suffer.

Labor costs are a significant component of our expenses and, as of December 31, 2017, approximately 54% of our workforce is represented by the IBEW. The Master Collective Bargaining Agreement (“CBA”) between the Company and the IBEW, which was ratified on December 8, 2017 and is effective through December 31, 2023, governs the terms and conditions of employment for all IBEW represented employees working for the Company in the state of Alaska and has significant economic impacts on the Company as it relates to wage and benefit costs and work rules that affect our ability to provide superior service to our customers. We believe our labor costs are higher than our competitors who employ a non-unionized workforce because we are required by the CBA to contribute to the IBEW Health and Welfare Trust and the Alaska Electrical Pension Fund (“AEPF”) for benefit programs, including defined benefit pension plans and health benefit plans, that are not reflective of the competitive marketplace. Furthermore, work rules under the existing agreement limit our ability to efficiently manage our workforce and make the incremental cost of work performed outside normal work hours high. In addition, we may make strategic and operational decisions that require the consent of the IBEW. While we believe our relationship with the IBEW is constructive, and although the IBEW generally has provided necessary consents, the IBEW may not provide consent when we need it, it may require additional wages, benefits or other consideration be paid in return for its consent, or it may call for a work stoppage against the Company. The Company considered relations with the IBEW to be stable in 2017; however, any deterioration in the relationship with the IBEW would have a negative impact on the Company’s operations.

Vendors

We rely on a limited number of key suppliers and vendors for timely supply of equipment and services for our network infrastructure and customer support services. If these suppliers or vendors experience problems or favor our competitors, we could fail to obtain the equipment and services we require to operate our business successfully.

We depend on a limited number of suppliers and vendors for equipment and services for our network and certain customer services. If suppliers of our equipment or providers of services on which we rely experience financial difficulties, service or billing interruptions, patent litigation or other problems, subscriber growth and our operating results could suffer.

Suppliers that use proprietary technology, effectively lock us into one or a few suppliers for key network components. Other suppliers require us to maintain exclusive relationships under a contract. As a result, we have become reliant upon a limited number of suppliers of network equipment. In the event it becomes necessary to seek alternative suppliers and vendors, we may be unable to obtain satisfactory replacement suppliers or vendors on economically attractive terms on a timely basis, or at all, which could increase costs and may cause disruption in service.

Networks, Monitoring Centers and Data Hosting Facilities

Maintaining the Company’s networks, around the clock monitoring centers and data hosting facilities requires significant capital expenditures, and our inability or failure to maintain and upgrade our networks and data centers would have a material impact on our market share and ability to generate revenue.

The Company currently operates an extensive network that includes monitoring and hosting facilities. To provide contractual levels of service to our customers and remain competitive, we must expend significant amounts of capital. In many cases, we must rely on outside vendors whose performance and costs may not be sufficiently within our control.

Information Technology Systems

A failure of back-office IT systems could adversely affect the Company’s results of operations and financial condition.

The efficient operation of the Company’s business depends on back-office IT systems. The Company relies on back-office IT systems, including certain systems provided by third party vendors, to effectively manage customer billing, business data, communications, supply chain, order entry and fulfillment and other business processes. Some of these systems are no longer supported under maintenance agreements from the underlying vendor. A failure of the Company’s IT systems, or the IT systems provided by third party vendors, to perform as anticipated could disrupt the Company’s business and result in a failure to collect accounts receivable, transaction errors, processing inefficiencies, and the loss of sales and customers, causing the Company’s reputation and results of operations to suffer. In addition, IT systems may be vulnerable to damage or interruption from circumstances beyond the Company’s control, including fire, natural disasters, systems failures, security breaches and viruses. Any such damage or interruption could have a material adverse effect on our business, operating results, margins and financial condition.

Undersea Fiber Optic Cable Systems

If failures occur in our undersea fiber optic cable systems, our ability to immediately restore our service may be limited.

Our undersea fiber optic cable systems carry a large portion of our traffic to and from the contiguous lower 48 states. If a failure occurs and we are not able to secure alternative facilities, some of the communications services we offer to our customers could be interrupted, which could have a material adverse effect on our business, financial position, results of operations or liquidity.

Managed IT Services

Our expansion into managed IT services may not be achieved as planned which could impact our ability to grow revenue.

We are expanding our business to provide more managed IT services along with our traditional telecom services. The delivery of professional services is not without risk, and it is possible that we may fail to execute on one or more managed IT service projects exposing the company to legal claims and reputational risk.

Intellectual Property

Third parties may claim that the Company is infringing upon their intellectual property, and the Company could suffer significant litigation or licensing expenses or be prevented from selling products.

Although the Company does not believe that any of its products or services infringe upon the valid intellectual property rights of third parties, the Company may be unaware of intellectual property rights of others that may cover some of its technology, products or services. Any litigation growing out of third party patents or other intellectual property claims could be costly and time consuming and could divert the Company’s management and key personnel from its business operations. The complexity of the technology involved and the uncertainty of intellectual property litigation increase these risks. Resolution of claims of intellectual property infringement might also require the Company to enter into costly license agreements. Likewise, the Company may not be able to obtain license agreements on acceptable terms. The Company also may be subject to significant damages or injunctions against development and sale of certain of its products. Further, the Company often relies on licenses of third party intellectual property for its businesses. The Company cannot ensure these licenses will be available in the future on favorable terms or at all. If any of these risks materialize, it could have a material adverse effect on our business, operating results, margins and financial condition.

Security Breaches

A failure in or breach of our operational or security systems or infrastructure, or those of third parties, could disrupt our businesses, result in the disclosure of confidential information or damage our reputation. Any such failure also could have a significant adverse effect on our cash flows, financial condition, and results of operations.

Our operations rely on the secure processing, storage and transmission of confidential and other information in our computer systems and networks. Although we take protective measures and endeavor to modify them as circumstances warrant, the security of our computer systems, software and networks may be vulnerable to breaches, unauthorized access, misuse, computer viruses or other malicious code and other events that could have a security impact. Additionally, breaches of security may occur through intentional or unintentional acts by those having authorized or unauthorized access to confidential or other information. If one or more such events occur, this potentially could jeopardize our information or our customers’ information processed and stored in, and transmitted through, our computer systems and networks. We may be required to expend significant additional resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures arising from operational and security risks, and we may be subject to litigation and financial losses that are either not insured against or not fully covered through any insurance maintained by us.

With regard to the physical infrastructure that supports our operations, we have taken measures to implement backup systems and other safeguards, but our ability to conduct business may be adversely affected by any disruption to that infrastructure. Such disruptions could involve electrical, communications, internet, transportation or other services used by us or third parties with whom we conduct business. The costs associated with such disruptions, including any loss of business, could have a significant adverse effect on our results of operations or financial condition.

Any of these operational and security risks could lead to significant and negative consequences, including reputational harm as well as loss of customers and business opportunities, which in turn could have a significant adverse effect on our businesses, financial condition and results of operations.

Cyber-attacks may damage our networks or breach customer and other proprietary data, leading to service disruption, harm to reputation, loss of customers, and litigation over privacy violations.

All industries that rely on technology in customer interactions are increasingly at risk for cyber-attacks. A cyber-attack could be levied against our network, causing disruption of operations and service, requiring implementation of greater network security measures, and resulting in lost revenue due to lost service. A cyber-attack could also be targeted to infiltrate customer proprietary and other data, breaching customer privacy, resulting in misuse of customer information and other data, and possibly leading to litigation over privacy breaches and causing harm to the Company’s reputation. In the event of a cyber-attack, Company insiders could utilize their knowledge of such an attack in trading the Company’s publicly traded shares. We rely on a variety of procedures to guard against cyber-attacks, and to take appropriate actions in the event of a cyber-attack, but the frequency of threats from these attacks is growing globally and the risk to us is also growing.

Pension Plans

We may incur substantial and unexpected liabilities arising out of our pension plans.

Our pension plans could result in substantial liabilities on our balance sheet. These plans and activities have and will generate substantial cash requirements for us and these requirements may increase beyond our expectations in future years based on changing market conditions. The difference between projected plan obligations and assets, or the funded status of the plans, is a significant factor in determining the net periodic benefit costs of our pension plans and the ongoing funding requirements of those plans. Changes in interest rates, mortality rates, health care costs, early retirement rates, investment returns and the market value of plan assets can affect the funded status of our defined benefit pension and cause volatility in the net periodic benefit cost and future funding requirements of the plans. In the future, we may be required to make additional contributions to our defined benefit plan. Plan liabilities may impair our liquidity, have an unfavorable impact on our ability to obtain financing and place us at a competitive disadvantage compared to some of our competitors who do not have such liabilities and cash requirements.

Our most significant pension plan is the AEPF in which we participate on behalf of substantially all of our employees. The AEPF is a multi-employer pension plan to which we make fixed, per employee, contributions through our collective bargaining agreement with the IBEW, which covers our IBEW represented workforce, and a special agreement, which covers most of our non-represented workforce. Because our contribution requirements are fixed, we cannot easily adjust our annual plan contributions to address our own financial circumstances. Currently, this plan is not fully funded, which means we may be subject to increased contribution obligations, penalties, and ultimately, we could incur a contingent withdrawal liability should we choose to withdraw from the AEPF for economic reasons. Our contingent withdrawal liability is an amount based on our pro-rata share among AEPF participants of the value of the funding shortfall. This contingent liability becomes due and payable by us if we terminate our participation in the AEPF. Moreover, if another participant in the AEPF goes bankrupt, we would become liable for a pro-rata share of the bankrupt participant’s vested, but unpaid, liability for accrued benefits for that participant’s employees. This could result in a substantial unexpected contribution requirement and making such a contribution could have a material adverse effect on our cash position and other financial results. These sources of potential liability are difficult to predict.

Given the complexity of pension-related matters we may not, in every instance, be in full compliance with applicable requirements.

Key Members of Senior Management

We depend on key members of our senior management team; our performance could be adversely impacted if they depart and we cannot find suitable replacements.

Our success depends largely on the skills, experience and performance of key members of our senior management team as well as our ability to attract and retain other highly qualified management and technical personnel. There is competition for qualified personnel in our industry and we may not be able to attract and retain the personnel necessary for the development of our business. Our remote location also presents a challenge to us in attracting new talent. If we lose one or more of our key employees, our ability to successfully implement our business plan could be materially adversely affected. We do not maintain any “key person” insurance on any of our personnel.

Future Acquisitions

Future acquisitions could result in operating and financial difficulties.

Our future growth may depend, in part, on acquisitions. To the extent that we grow through acquisitions, we will face the operational and financial risks that commonly accompany that strategy. We would also face operational risks, such as failing to assimilate the operations and personnel of the acquired businesses, disrupting their ongoing businesses, increasing the complexity of our business, and impairing management resources and management’s relationships with employees and customers as a result of changes in their ownership and management. Further, the evaluation and negotiation of potential acquisitions, as well as the integration of an acquired business, may divert management time and other resources. Some acquisitions may not be successful and their performance may result in the impairment of their carrying value.

Volatility Risks Related to our Common Stock

Continued volatility in the price of our common stock could negatively affect us and our stockholders.

The trading price of our common stock has been impacted by factors, many of which are beyond our control, including actual or anticipated variations in quarterly financial results, changes in financial expectations by securities analysts and announcements by our current and future competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments. In addition, our financial results in the future may be below the expectations of securities analysts and investors. Broad market and industry factors could also negatively affect the price of our common stock regardless of our operating performance. Future volatility in our stock price could materially adversely affect the trading market and prices for our common stock as well as our ability to issue additional securities or to secure additional financing.

Declines in our Market Capitalization or Share Price

Declines in our market capitalization or share price may affect our ability to access the capital markets.

Our ability to issue convertible notes is, in part, a function of our share price and market capitalization, as is our ability to be listed on a national stock exchange. To the extent either declines substantially, our ability to access the capital markets may be impaired.

Location Specific Risk

We operate in remote areas subject to geologic instability and other natural events which could negatively impact our operations.

Many of our operations are located in areas that are prone to earthquakes, fires, and other natural disturbances. Many of these areas have limited emergency response assets and may be difficult to reach in an emergency situation. Should an event occur, it could be weeks or longer before remediation efforts could be implemented, if they could be implemented at all. The scope and risk of such an event occurring is difficult to gauge.

Internal Control Over Financial Reporting

Our internal control over financial reporting may not be effective, which could cause our financial reporting to be unreliable.

Because of its inherent limitations, and irrespective of the existence of material weaknesses, our internal control over financial reporting may not prevent or detect all misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that such controls may become inadequate because of changes in conditions, or the degree of compliance with policies and procedures may deteriorate. Any of these circumstances could cause our financial reporting to be unreliable.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is traded on the Nasdaq Global Select Market under the symbol ‘ALSK.’ The following table presents, for the periods indicated, the high and low sales prices of our common stock as reported by Nasdaq.

|

2017 Quarters |

High |

Low |

2016 Quarters |

High |

Low |

||||||||||||

|

4th |

$ | 2.91 | $ | 2.04 |

4th |

$ | 1.80 | $ | 1.49 | ||||||||

|

3rd |

$ | 2.48 | $ | 2.02 |

3rd |

$ | 1.85 | $ | 1.64 | ||||||||

|

2nd |

$ | 2.61 | $ | 1.76 |

2nd |

$ | 1.97 | $ | 1.64 | ||||||||

|

1st |

$ | 1.96 | $ | 1.60 |

1st |

$ | 1.90 | $ | 1.30 | ||||||||

As of April 25, 2018, there were 53,110,320 shares of our common stock issued and outstanding and approximately 342 record holders of our common stock. Because brokers and other institutions hold many of our shares of existing common stock on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders.

Dividends

In the fourth quarter of 2012, our Board of Directors suspended the quarterly dividend paid to stockholders. The dividend suspension was required in connection with the amendment to our 2010 Senior Credit Facility as part of the AWN transaction. Under the terms of our 2017 Senior Credit Facility, payment of cash dividends on our common stock is not permitted until such time that the Company’s Net Total Leverage Ratio is not more than 2.75 to 1.00 and certain other liquidity measures are met. See “Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Original Form 10-K.

Our Net Total Leverage Ratio was higher than 2.75 at December 31, 2017.

Our ability to re-institute dividend payments in the future will depend on future competitive market and economic conditions and financial, business, regulatory and other factors, many of which are beyond our control.

Additional factors that may affect our future dividend policy include:

|

● |

our reliance on dividends, interest and other payments, advances and transfer of funds from our subsidiaries to meet our debt service and pay dividends, if any; |

|

● |

reductions in the availability of cash due to changes in our operating earnings, working capital requirements and anticipated cash needs; |

|

● |

the discretion of our Board of Directors; and |

|

● |

restrictions under Delaware law. |

Notably, nothing requires us to declare or pay dividends. Our stockholders have no contractual or other legal right to dividends.

See “Item 1A, Risk Factors—Volatility Risks Related to our Common Stock.”

Securities Authorized for Issuance under Equity Compensation Plans

The information set forth in this Report under “Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters—Securities Authorized for Issuance under Equity Compensation Plans” is incorporated herein by reference.

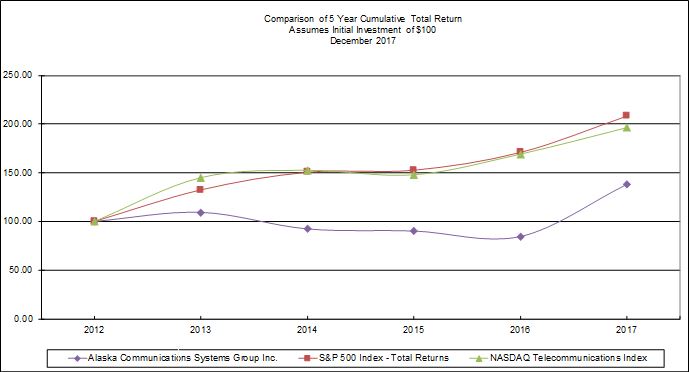

Common Stock Performance Graph

The following line graph compares the cumulative total stockholder return on our common stock from December 31, 2012 through December 31, 2017 with the cumulative total return of the S&P 500, and the cumulative total return of the Nasdaq Telecommunications Index. The graph assumes an initial investment of $100 in our common stock and in each of the S&P 500, and Nasdaq Telecommunications indices on December 31, 2012, and assumes that dividends, if any, were reinvested.

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

||||||||||||||||||||

|

Alaska Communications Systems Group Inc. |

Cum $ |

100.00 | 109.28 | 92.27 | 90.21 | 84.54 | 138.14 | ||||||||||||||||||

|

S&P 500 Index - Total Returns |

Cum $ |

100.00 | 132.39 | 150.51 | 152.59 | 170.84 | 208.14 | ||||||||||||||||||

|

NASDAQ Telecommunications Index |

Cum $ |

100.00 | 145.01 | 152.49 | 147.88 | 169.11 | 196.34 | ||||||||||||||||||

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Board of Directors

|

Edward (Ned) J. Hayes, Jr. Chairman of the Board of Directors Age: 63 Director Since: 2006 Elected Chairman April 2011 Alaska Communications Committees • Audit |

Skills, Qualifications and Factors |

Mr. Hayes is currently a private investor in, and consultant to, the high-tech industry. In January of 2015, he announced his retirement as Senior Vice President and Chief Financial Officer (“CFO”) of Aviat Networks, Inc. (Nasdaq: AVNW) a leading company in wireless transmission and networking solutions for the mobile and non-mobile markets. He joined Aviat Networks in October of 2011 after serving as the CFO of Pillar Data Systems, Inc., a privately held enterprise data storage company. Prior to joining Pillar, Mr. Hayes served as Executive Vice President and CFO of Quantum Corporation (NYSE: QTM), a global leader in data back-up, recovery and archive storage. He joined Quantum after serving as President and Chief Executive Officer (“CEO”) of DirecTV Broadband, Inc. Prior to DirecTV Broadband, Mr. Hayes served as Executive Vice President and CFO at Telocity, Inc. (Nasdaq: TLCT), and Financial Vice President and CFO in two of Lucent Technologies’ divisions, including the $20 billion global service provider business. He has also held senior financial management positions at other multinational companies such as Unisys Corporation (NYSE: UIS), Asea Brown Boveri (ABB), and Credit Suisse First Boston. Mr. Hayes is a Board Leadership Fellow with the National Association of Corporate Directors (“NACD”). He has previously served as an independent director and chair of the audit committee of New Wave Research, Inc. and as an independent director and chair of the audit committee of NPTest, Inc. Mr. Hayes has served as an advisor to the President and CEO of Super Micro Computer, Inc. (Nasdaq: SMCI) after having served the company as an independent director and chair of the audit committee. Mr. Hayes conducted his graduate studies in accounting and finance at New York University’s Stern Graduate School of Business and received his undergraduate degree in Philosophy from Colgate University in New York.

|

Margaret L. Brown Director Age: 68 Director Since: 2012 Alaska Communications Committees • Compensation and Personnel • Nominating and Corporate Governance |

Skills, Qualifications and Factors |

Ms. Brown held the position of president and CEO of CIRI, an Alaska Native Regional Corporation, from 2005 to 2013. In her position as CEO, Ms. Brown led the corporation through significant growth by diversifying its interests across several industries, including real estate, energy and infrastructure, hospitality, oil field support and construction, and environmental services. During her more than 35 years at CIRI Ms. Brown also held several management positions within CIRI. Ms. Brown worked with state and federal agencies, as well as the U.S. Congress, to help implement the Cook Inlet Land Exchange, widely considered one of the largest land exchanges in the nation’s history. Ms. Brown currently serves on the boards of the CIRI, Student Conservation Association and the National Museum of the American Indian. Ms. Brown is a member of an advisory board for Alaska Airlines. Her leadership in Alaska has been recognized with the Alaska Journal of Commerce’s Business Person of the Year in 2013, an Athena Award in 2012, the fDi Magazine business personality of the year award in 2008, and the Alaska Business Hall of Fame laureate honor in 2009. Ms. Brown holds a BS degree in biology from the University of Oregon and a MBA degree in business administration from the University of Colorado. She is also a Board Leadership Fellow with the NACD. Ms. Brown is a lifelong Alaskan of Yup’ik descent and was raised in Takotna, a small village in central Alaska.

|

David W. Karp Director Age: 51 Director Since: 2011 Alaska Communications Committees • Compensation and Personnel • Nominating and Corporate Governance (Chair) |

Skills, Qualifications and Factors • experience as the CEO of a business expanding into the contiguous 48 states; |

Mr. Karp is the president and CEO of Northern Aviation Services, Inc., an Anchorage based company that manages Northern Air Cargo, Aloha Air Cargo, and various other aviation related businesses. The company operates a fleet of Boeing 737 aircraft within the states of Alaska and Hawaii, the contiguous U.S. states, Canada and Mexico. Mr. Karp previously served as the Vice President and Chief Operating Officer of Anchorage-based Hawaiian Vacations. Prior to that, Mr. Karp served as the executive director of the Alaska Tourism Marketing Council, overseeing the cooperative tourism marketing efforts between the State of Alaska and over 1000 private sector tourism businesses. Mr. Karp also serves as a member of the board of directors for Anchorage based Northrim Bankcorp, Inc. (Nasdaq: NRIM). He serves as the board chairman of the National Air Carriers Association, is a member of the Board of Trustees for the Alaska Aviation Museum, a board member of the Anchorage Economic Development Corporation and is involved in multiple nonprofit organizations in the community. Mr. Karp is a graduate of the University of Oregon, and he completed the Owner President Manager Program at the Harvard School of Business in March 2011. Mr. Karp is also a Board Leadership Fellow with the NACD.

|

Peter D. Ley Director Age: 58 Director Since: 2008 Alaska Communications Committees • Audit (Chair) • Nominating and Corporate Governance |

Skills, Qualifications and Factors |

Mr. Ley is currently a private investor. In June 2015, he retired from the position of CFO of Hargray Holdings, LLC, a provider of cable television and telecommunications services serving the coastal regions of South Carolina and Georgia. He held this position from 2012 to 2015. Prior to joining Hargray, Mr. Ley served as CFO of Connexion Technologies, an operator of residential communications networks for gated communities and high-rise towers. In April of 2012, Connexion filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. Prior to joining Connexion in November 2007, Mr. Ley served for seven years as a managing director at Bank of America Securities, responsible for managing client relationships with the U.S. telecommunications industry. Prior to joining Bank of America, he served as CFO of Pennsylvania-based Commonwealth Telephone Enterprises, Inc. Mr. Ley has also served as an investment banker at Dominick & Dominick, Furman Selz, Robert Fleming, Morgan Grenfell and Salomon Brothers. Mr. Ley holds an MBA from Harvard University in Massachusetts and a BA from Dartmouth College in New Hampshire.

|

Brian A. Ross Director Age: 60 Director Since: 2011 Alaska Communications Committees • Audit • Compensation and Personnel (Chair) |

Skills, Qualifications and Factors |

Mr. Ross is both the Principal of Mid-Market Growth Partners, which assist clients to align their strategic objectives with operating performance, and an Advisor with The Center for Business Transition at RSM, LLP. The Center for Business Transition helps owners plan to successfully transition their businesses. Previously, Mr. Ross served as President and CEO of KnowledgeWorks, an educational non-profit that provides innovative teaching pedagogies, and as the Chief Operating Officer (“COO”) and CFO as part of his 13-year-tenure at Cincinnati Bell. He is also a member of the board of Otelco, Inc. (Nasdaq: OTEL), a telecommunications firm with rural properties. Mr. Ross served as a member of the board of directors of Healthwarehouse.com (OTCQB: HEWA), a national, on-line pharmacy from September 2015 to March 2016, and as a member of the board of Journal Media Group, Inc. (formerly NYSE: JMG), from its inception in April 2015 to its sale to Gannett in April 2016. Mr. Ross holds a BA in economics, mathematics and statistics from Miami University as well as an MA in statistics from the University of California.

|

Anand Vadapalli President and Chief Executive Officer Age: 53 Director Since: 2011 |

Skills, Qualifications and Factors |

Mr. Vadapalli was appointed by the Board, effective February 1, 2011, to serve as President and CEO of the Company. Prior to that, Mr. Vadapalli served as Executive Vice President and COO of the Company beginning October 26, 2009, with responsibility for all operational facets of our business, including network operations, technology, sales and service. Mr. Vadapalli served as our Executive Vice President, Operations and Technology, from December 2008 until October 2009 and previously was our Senior Vice President, Network & Information Technology beginning in August 2006, when he joined the Company. Before joining us, Mr. Vadapalli had most recently served as Vice President of Information Technology at Valor Telecom since February 2004. Prior to Valor, from January 2003 to February 2004, he served as Executive Vice President and Chief Information Officer at Network Telephone Corporation, and from January 1996 through January 2003, he served in various positions at Broadwing / Cincinnati Bell, including as Vice President, Information Technology. Mr. Vadapalli holds a Bachelor of Engineering in Mechanical Engineering from Osmania University in Hyderabad, India as well as a Post Graduate Diploma in Management from the Indian Institute of Management in Calcutta, India. He currently serves as a member of the board of directors of Premera Blue Cross. In addition, Mr. Vadapalli is an active participant in industry associations, and currently chairs the Board of USTelecom Association.

Executive Officers

The table below sets forth certain information as of April 25, 2018 about those persons currently serving as executive officers of the Company. Biographical information on Anand Vadapalli, our President and CEO, is included above in the section “Board of Directors.”

|

Name |

Age |

Title |

|

Anand Vadapalli |

53 |

President and Chief Executive Officer |

|

Laurie M. Butcher |

55 |

Senior Vice President, Finance |

|

William H. Bishop |

52 |

Senior Vice President, Business Market |

|

Randy M. Ritter |

58 |

Senior Vice President, Shared Services |

|

Leonard A. Steinberg |

64 |

Senior Vice President, Legal, Regulatory & Government Affairs and Corporate Secretary |

Laurie M. Butcher serves as our Senior Vice President, Finance, leading the Company’s revenue, treasury and finance departments. Ms. Butcher joined Alaska Communications in 1997, and has served in several leadership roles, most recently as Vice President, Finance and Controller, before taking her current role in November of 2015. She is responsible for accounting, budgeting, and forecasting for Alaska Communications, in addition to leading strategy for free cash flow growth and EBITDA margin expansion. Ms. Butcher brings more than 28 years of finance expertise to Alaska Communications, including roles in public accounting at PricewaterhouseCoopers and Deloitte & Touche and as controller for Teamsters Local 959. Ms. Butcher serves as a management trustee for the Alaska Electrical Trust Pension Fund and is on the board of directors for the United Way of Anchorage. A lifelong Alaskan, she holds a BBA degree in accounting from the University of Alaska and is a licensed Certified Public Accountant.

William H. Bishop serves as our Senior Vice President, Business Market. He joined Alaska Communications in August of 2004, and has served in several leadership roles for both consumer and business sales and operations. Mr. Bishop provides executive level leadership to IT services, business sales, product and marketing to provide a consistent, quality customer experience. Mr. Bishop has over 25 years of experience in telecommunications and business leadership including positions at AT&T and McCaw Communications as well as at a federal government logistic contracting company. He serves on the board of directors for the Alaska State Chamber of Commerce and as chairman of the board for Alaska Business Week. Mr. Bishop holds a BS degree in Natural Sciences from the University of Alaska Anchorage and is completing his MBA in Strategic Leadership at Alaska Pacific University.

Randy M. Ritter serves as our Senior Vice President, Shared Services. Mr. Ritter joined Alaska Communications in September of 2013 to lead our growth in managed IT services and now oversees network strategy and planning, engineering, service activation, network management, field services and capital project management to provide a great customer service experience for Alaska businesses and consumers. He brings more than 20 years of telecommunications experience to the Company and previously served as Vice President, Product Management at Sprint, Vice President, Product Marketing at Sprint-Nextel, Senior Vice President, Sales and Marketing at One Communications and Chief Operating Officer at MacroSolve, Inc. His expertise and strong track record in building teams and defining, launching and growing telecommunications and IT services brings great value to our customers, employees and stockholders. Mr. Ritter holds a BS degree in accounting from the University of South Alabama. He is also a Certified Public Accountant (inactive) and a Chartered Global Management Accountant.

Leonard A. Steinberg serves as our Senior Vice President, Legal, Regulatory and Government Affairs and Corporate Secretary. Mr. Steinberg is responsible for the Company’s legal affairs, corporate governance, regulatory compliance and risk management functions. He also serves as the Company’s Chief Ethics Officer. He previously served as our Vice President, General Counsel and Corporate Secretary from 2001 through 2011 after joining us as a senior attorney in June 2000. From 1998 to 2000, Mr. Steinberg used his expertise in regulatory and administrative law to represent telecommunications and energy clients at Brena, Bell & Clarkson, P.C., an Anchorage, Alaska law firm. Prior to that, Mr. Steinberg was a partner in the firm of Hosie, Wes, Sacks & Brelsford with offices in Anchorage, Alaska and San Francisco, California. Mr. Steinberg practiced in the firm’s Anchorage office from 1996 to 1998 and in the firm’s San Francisco office from 1988 to 1996 where he primarily represented large clients in oil and gas royalty and tax disputes. Mr. Steinberg holds a JD degree from the University of California’s Hastings College of Law, an MPA from Harvard University’s Kennedy School of Government, an MBA from the University of California Berkeley’s Haas School of Business, and a BA degree from the University of California at Santa Cruz.

Section 16(a) Beneficial Ownership Reporting Compliance

Federal securities laws require executive officers, directors, and owners of more than 10% of our common stock to file reports (Forms 3, 4 and 5) with the SEC and any stock exchange or trading system on which our securities are listed. These reports relate to the number of shares of our common stock that each such person owns and any change in their ownership. Based solely on our review of Forms 3, 4 and 5 filed with the SEC, we believe that all persons required to file such forms have done so in a timely manner during 2017.

Corporate Governance