Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CAMDEN NATIONAL CORP | ex991directorpr042418.htm |

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k042418annualmeetingpres.htm |

2018 Annual

Shareholders Meeting

Welcome to the

2018 Annual Shareholders’ Meeting

Lawrence Sterrs

Chair of the Board

1

Agenda

• Business Meeting

• Introductions

• Reading of the Minutes

• Shareholder Voting

• Presentations

• Financial Results – Debbie Jordan

• Strategic Update – Greg Dufour

• Questions and Answers

2

Camden National Bank

Board of Directors

• Larry Sterrs, Chair

• Gregory Dufour,

President/CEO

• Ann Bresnahan

• William Dubord

• David Flanagan

• James Markos, Jr.

• Robert Merrill

• David Ott

• Carl Soderberg

3

Camden National Corporation

Board of Directors

• Larry Sterrs, Chair

• Gregory Dufour,

President/CEO

• Ann Bresnahan

• Craig Denekas

• David Flanagan

• Catherine Longley

• David Ott

• James Page, Ph.D.

• Carl Soderberg

4

Senior Management Team

• Gregory Dufour, President and Chief Executive Officer

• Joanne Campbell, EVP - Risk Management Officer

• Mac Hayden, EVP – Chief Credit Officer

• Debbie Jordan, CPA, EVP – COO and CFO

• Jennifer Mirabile, SVP – Director of Wealth Management

• Tim Nightingale, EVP - Senior Loan Officer

• Patricia Rose, EVP - Retail and Mortgage Banking Officer

• Renée Smyth, EVP – Chief Experience and Marketing Officer

5

Meeting Minutes

6

• Proposal 1: Election of Directors

• Ann Bresnahan

• Gregory Dufour

• S. Catherine Longley

• Carl Soderberg

• Proposal 2: “Say On Pay”

• Proposal 3: Ratification of Independent

Registered Public Accounting Firm

• RSM US LLP

Proposals

7

Submission of Proxy Votes

8

Financial Results for 2017 and

First Quarter 2018

Debbie Jordan

Executive Vice President,

Chief Operating and Financial Officer

9

Forward Looking Statements

This presentation contains certain statements that may be considered forward-looking statements under the Private Securities Litigation

Reform Act of 1995 and other federal securities laws, including certain plans, exceptions, goals, projections, and statements, which are

subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the use of the words

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “plan,” “target,” or “goal” or future or conditional verbs such as “will,”

“may,” “might,” “should,” “could” and other expressions which predict or indicate future events or trends and which do not relate to

historical matters. Forward-looking statements should not be relied on, because they involve known and unknown risks, uncertainties and

other factors, some of which are beyond the control of Camden National Corporation (the “Company”). These risks, uncertainties and

other factors may cause the actual results, performance or achievements of the Company to be materially different from the anticipated

future results, performance or achievements expressed or implied by the forward-looking statements.

The following factors, among others, could cause the Company’s financial performance to differ materially from the Company’s goals,

plans, objectives, intentions, expectations and other forward-looking statements: weakness in the United States economy in general and

the regional and local economies within the New England region and Maine, which could result in a deterioration of credit quality, an

increase in the allowance for loan losses or a reduced demand for the Company’s credit or fee-based products and services; changes in

trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System;

inflation, interest rate, market, and monetary fluctuations; competitive pressures, including continued industry consolidation and the

increased financial services provided by non-banks; volatility in the securities markets that could adversely affect the value or credit

quality of the Company’s assets, impairment of goodwill, the availability and terms of funding necessary to meet the Company’s liquidity

needs, and could lead to impairment in the value of securities in the Company's investment portfolio; changes in information technology

that require increased capital spending; changes in consumer spending and savings habits; changes in tax, banking, securities and

insurance laws and regulations; and changes in accounting policies, practices and standards, as may be adopted by the regulatory

agencies as well as the Financial Accounting Standards Board ("FASB"), and other accounting standard setters.

You should carefully review all of these factors, and be aware that there may be other factors that could cause differences, including the

risk factors listed in the Company’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2017,

as updated by the Company's quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission. You should

carefully review the risk factors described therein and should not place undue reliance on our forward-looking statements.

These forward-looking statements were based on information, plans and estimates at the date of this report, and we undertake no

obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future

events or other changes, except to the extent required by applicable law or regulation.

10

2017 Financial Performance

• Loans increase 7%

• Deposits increase 6%

• Efficiency Ratio: 57.05%

• Strong Adjusted Return on:

• Assets - 1.07%(1)

• Tangible Equity - 14.35%(1)

11

(1) This is a non-GAAP measure. Please refer to the Company’s 2017 Annual Report on Form 10-K.

$22.8

$24.6

$21.0

$40.1

$28.5

$7.2 M&A

$14.2

Tax Impact

$24.1 $24.6

$28.2

$40.6

$42.7

2013 2014 2015 2016 2017

Adjusted Net Income(1)

(In Millions)

1st Quarter 2018 Financial Results

12

$10.1

$12.8

Q1 17 Q1 18

Net Income

(in millions)

Q1 2017 Q1 2018

Diluted Earnings Per

Share

0.64$ 0.82$

Return on Average

Assets

1.05% 1.28%

Return on Average

Tangible Equity (1)

14.37% 17.35%

Non-Performing

Assets to Total Assets

0.68% 0.47%

(1) This is a non-GAAP measure. Please refer to the Company’s 2017 Annual Report on Form 10-K.

Three Year Total Return

13

Proxy Peer – Average of 20 publicly traded commercial and savings banks in the Northeast.

Source: SNL Financial - Total Return includes stock appreciation and dividends from 4/1/15 to 3/31/18

27.43%

55.74%

57.75%

74.82%

80.10%

1

April 1, 2015 to March 31, 2018

SNL $1B to $5B Bank Index

KBW Bank Total Return Index

Proxy Peer Average

Russell 2000

Camden National

Voting Results

Larry Sterrs

Chair of the Board

14

Strategic Overview

Greg Dufour

President and Chief Executive Officer

15

Who we are

16

• Largest bank

headquartered in

Northern New England

• $4.1 billion in assets

• 60 branches (Maine) and

3 loan offices (New Hampshire

and Massachusetts)

• Market cap over $700 million

• Average daily share volume of

30,000

• Analyst Coverage

• Piper Jaffrey (overweight)

• KBW (market perform)

What we do

17

How we interact with customers

18

In person:

60 banking centers

2.8 million transactions

74 ATMs

1.4 million transactions

Online:

Web & Mobile Banking

85,000 customers

Over the phone:

Customer Assistance Center

• 193,400 calls (24% after normal hours)

• 26,400 emails

• 3,300 chat sessions – in just four months!

Technology Advancement.

Recently introduced:

• Mortgage TouchTM

• Treasury LinkTM

• Pay Up

How we measure our experience

• Actively survey our customers

• Utilize Net Promoter Score (“NPS”) to measure the

satisfaction and loyalty of our customers

• Consistently monitor our customers based on their

NPS category, method of transacting, geography and

age demographics.

NPS Category:

Promoter: Loyal and enthusiastic customers

Passive: Content but indifferent

Detractor: Frustrated and negative

19

High performing NPS

20

61 63

0

25

50

75

100

Survey 1 Survey 2

Net Promoter Score

High Performing Avg. 64

Finance Avg. 40

What we’ve heard

21

“Customer

service with

a smile...”

“Your mobile app

is also wicked

convenient and

useful.”

“Love the online banking.

Best that I’ve have used

from several banks.”

“My wife and I appreciate

the personal service that

ALL of your staff provides.”

“The app is great. The

ATM reimbursements are

always quick and a great

benefit. Online banking is

really simple.”

“Exceptionally friendly

and personalized

service --- the

bankers in my branch

really do know me.”

CamdenCircle

22

Always listening.

Continuously innovating.

Employee Engagement

• Working with IBM Consulting, we conduct

engagement surveys on an 18-month cycle

• We follow up with focus group sessions and specific

action plans in order to continually improve

23

More committed. Resulting in:

• Better team performance

• Higher service quality

• Higher customer satisfaction

• Higher shareholder returns

Engaged

employees

High Performing Employee

Engagement

24

70

76 78

0

25

50

75

100

2014 2016 2017

Employee Engagement Results

IBM Finance Norm: 73

75th Percentile Norm: 78

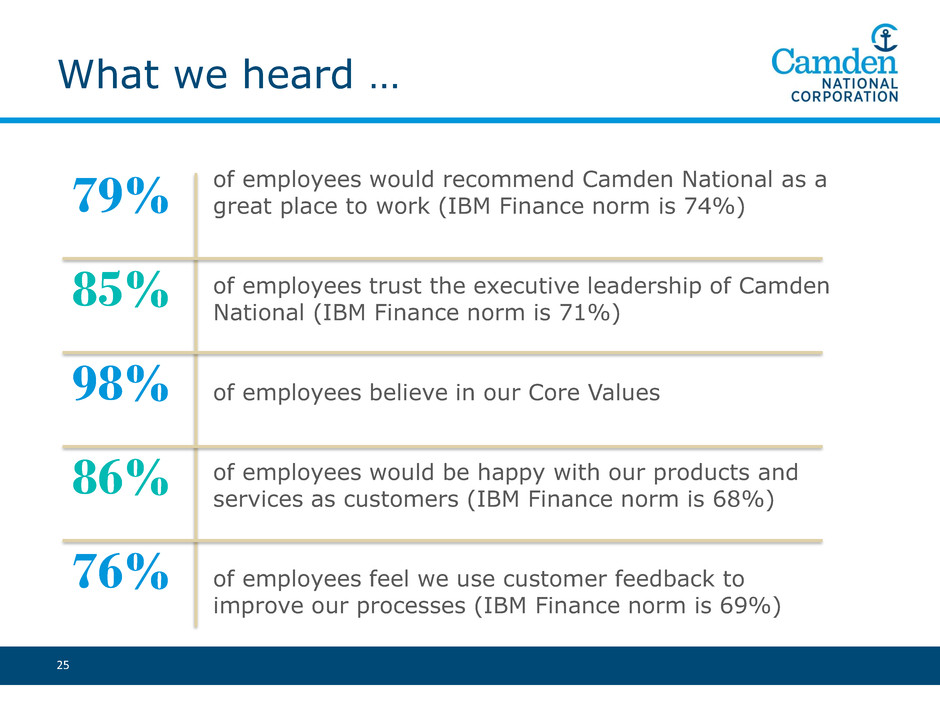

What we heard …

25

of employees would recommend Camden National as a

great place to work (IBM Finance norm is 74%)

of employees trust the executive leadership of Camden

National (IBM Finance norm is 71%)

of employees believe in our Core Values

of employees would be happy with our products and

services as customers (IBM Finance norm is 68%)

of employees feel we use customer feedback to

improve our processes (IBM Finance norm is 69%)

79%

85%

98%

86%

76%

Social Responsibility

26

Hope@Home.

Raising awareness

and support for

homelessness

$250,000 given

since its inception

in 2015

Leaders & Luminaries.

Recognizing board

leadership as integral to

the success of nonprofit

organizations

$107,000 given to date

in recognition of 31

nonprofit board members

Volunteerism.

Giving time and

talent to support

nonprofit

organizations

18,000 employee

volunteer hours to

over 50

organizations

Why Camden National?

• Strong board governance; “low risk” ISS rating

• Top tier employee engagement

• Strong Net Promoter Scores by customers

• A socially responsible community bank

• Strong shareholder returns;

• 80% total return vs. 56% proxy peer group

average

27

Question & Answers

28