Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CAMDEN NATIONAL CORP | ex991earningsreleaseq118.htm |

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k_033118earnings.htm |

First Quarter Report - 2018

First Quarter Report - 2018Dear Fellow Shareholders:

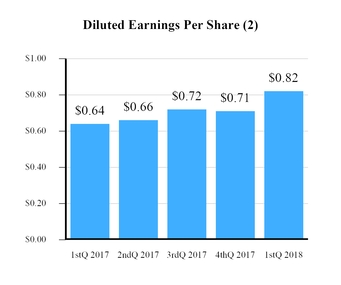

Our first quarter 2018 financial results reflect our organization’s strong foundation and the benefit of lower corporate taxes. Net income reached $12.8 million for the first quarter of 2018, an increase of 27% compared to the first quarter of 2017. Earnings per diluted share rose 28% to $0.82 per share from $0.64 over the same period last year, and quarterly cash dividends increased 9% to $0.25 per share, up from a year ago.

The Tax Cuts and Jobs Act of 2017 (the “Tax Act”), reduced our effective tax rate to approximately 20% for the first quarter of 2018, providing an estimated benefit of $1.9 million, or $0.12, per diluted share for the first three months of the year. The lower tax rate contributed to net income growth year over year and our core fundamentals remain strong with solid asset quality and healthy loan and deposit growth over the same period last year. Our first quarter 2018 performance ratios reflect the positive impact of adherence to our strategic plan, including a return on average equity of 12.91% compared to 10.36% for the three months ended March 31, 2017, and a return on average assets of 1.28% and 1.05% over the same time period, respectively.

During the first quarter of 2018, we recorded a negative credit loss provision of $497,000 which increased earnings, compared to an expense of $579,000 in the first quarter of 2017. This was driven by continued asset quality improvement, which included the favorable resolution of a troubled commercial real estate loan. Our asset quality indicators continue to be strong as shown by a 0.69% ratio of non-performing loans to total loans. We are fortunate to have a highly experienced, dedicated team of credit and special asset professionals who work extremely hard to maximize potential recoveries and diligently protect our organization’s assets.

The first quarter of 2018 saw a 4% increase in net interest income over the first quarter of 2017 driven by average loan growth of 6% and average low cost deposit growth of 9%. This growth is attributable to our commercial, residential mortgage and retail banking teams, which we expanded throughout 2017. In March 2018, we opened a second loan production office in Portsmouth, New Hampshire, with the objective of expanding services to include wealth management in the Seacoast marketplace.

We continue to see customers rapidly adopt our digitally-based services, which complement our 60 banking centers, so they can bank when and where they want. As of March 31, 2018, nearly 85,000 customers were banking electronically through our online and mobile banking channels. Remarkably, we also experienced a 47% increase in electronic statement adoption over the previous year. To continue innovating and prioritizing customer needs, we recently introduced “Pay Up,” our person-to-person payment solution, which adds to our other digital services including mobile deposit, Touch ID, and real-time fraud alerts.

While many customers actively utilize our banking centers, we continue to experience increased activity in our call center. We provide a high-touch customer experience as the only Maine-based community bank with a 24 hour call center. In the first three months of 2018, this specialized team has already fielded 60,000 customer interactions. About 13,000 customers were served outside of our normal banking hours, including banking center closures due to multiple winter storms.

We continue to monitor and respond to opportunities and challenges resulting from rising interest rates, cyclical highs in the credit cycle and other economic conditions on the global and local levels. The prudent investments we’ve made in our risk and financial management infrastructure position us well to take advantage of opportunities. We remain well capitalized as shown by our Tier 1 leverage ratio of 9.23% and Total risk based capital ratio of 14.32%.

Your support of Camden National Corporation is greatly appreciated.

Sincerely,

Gregory A. Dufour

President and Chief Executive Officer

Financial Highlights (unaudited) | |||||||

Three Months Ended March 31, | |||||||

(Dollars in thousands, except per share data) | 2018 | 2017 | |||||

Earnings and Dividends | |||||||

Net interest income | $ | 28,902 | $ | 27,855 | |||

(Credit) provision for credit losses | (497 | ) | 579 | ||||

Non-interest income | 8,804 | 8,572 | |||||

Non-interest expense | 22,304 | 21,428 | |||||

Income before taxes | 15,899 | 14,420 | |||||

Income taxes | 3,079 | 4,344 | |||||

Net income | $ | 12,820 | $ | 10,076 | |||

Diluted earnings per share | $ | 0.82 | $ | 0.64 | |||

Cash dividends declared per share | 0.25 | 0.23 | |||||

Performance Ratios | |||||||

Return on average equity | 12.91 | % | 10.36 | % | |||

Return on average assets | 1.28 | % | 1.05 | % | |||

Net interest margin | 3.10 | % | 3.15 | % | |||

Efficiency ratio1 | 58.76 | % | 58.00 | % | |||

Balance sheet (end of period) | |||||||

Investments | $ | 913,653 | $ | 943,061 | |||

Loans and loans held for sale | 2,798,696 | 2,650,818 | |||||

Allowance for loan losses | 22,990 | 23,721 | |||||

Total assets | 4,113,185 | 3,938,465 | |||||

Deposits | 3,025,580 | 2,937,183 | |||||

Borrowings | 622,347 | 556,922 | |||||

Shareholders' equity | 404,055 | 397,827 | |||||

Book Value per Share and Capital Ratios | |||||||

Book value per share | $ | 25.96 | $ | 25.65 | |||

Tangible book value per share1 | 19.57 | 19.14 | |||||

Tangible common equity ratio1 | 7.59 | % | 7.74 | % | |||

Tier I leverage capital ratio | 9.23 | % | 8.90 | % | |||

Total risk-based capital ratio | 14.32 | % | 14.05 | % | |||

Asset Quality | |||||||

Allowance for loan losses to total loans | 0.82 | % | 0.90 | % | |||

Net charge-offs to average loans (annualized) | 0.10 | % | 0.00 | % | |||

Non-performing loans to total loans | 0.69 | % | 0.99 | % | |||

Non-performing assets to total assets | 0.47 | % | 0.68 | % | |||

1 This is a non-GAAP measure. A reconciliation of non-GAAP measures to GAAP can be found in the Company's earnings release dated and filed with the SEC on April 24, 2018.

2 Adjusted diluted EPS for the fourth quarter of 2017 excludes the impact of the one-time revaluation of the Company's deferred tax assets and liabilities due to the lower federal corporate income tax rate. Adjusted diluted EPS for all other periods presented is unchanged from diluted EPS.

A complete set of financial statements for Camden National Corporation may be obtained upon written request to Camden National Corporation, P.O. Box 310, Camden, Maine 04843.