Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SIMMONS FIRST NATIONAL CORP | f8k_041918.htm |

Exhibit 99.1

2018 SHAREHOLDERS’ MEETING

ITEM 1 2 ELECTION OF DIRECTORS

ITEM 2 3 TO ELECT 15 PERSONS AS DIRECTORS William E. Clark, III Christopher R. Kirkland Steven A. Cossé Mark C. Doramus Edward Drilling Jerry M. Hunter Eugene Hunt Jay D. Burchfield Russell Teubner Robert L. Shoptaw Susan S. Lanigan George A. Makris, Jr. Malynda K. West W. Scott McGeorge Tom E. Purvis

ITEM 3 4 ADOPTION OF NON - BINDING RESOLUTION APPROVING THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS

ITEM 4 5 RATIFICATION OF INDEPENDENT ACCOUNTING FIRM

ITEM 5 6 AMENDMENT OF THE ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF CLASS A, $0.01 PAR VALUE, COMMON STOCK FROM 120,000,000 TO 175,000,000

2018 SHAREHOLDERS’ MEETING 7

FORWARD - LOOKING STATEMENTS & NON - GAAP FINANCIAL MEASURES 8 Certain statements contained in this presentation may not be based on historical facts and are "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements may be identified by reference to a future period(s) or by the use of forward - looking terminology, such as "anticipate," "estimate," "expect," "foresee," "may," "might," "will," "would," "could" or "intend," future or conditional verb tenses, and variations or negatives of such terms . These forward - looking statements include, without limitation, those relating to the Company's future growth, revenue, assets, asset quality, profitability and customer service, critical accounting policies, net interest margin, non - interest revenue, market conditions related to the Company's common stock repurchase program, allowance for loan losses, the effect of certain new accounting standards on the Company's financial statements, income tax deductions, credit quality, the level of credit losses from lending commitments, net interest revenue, interest rate sensitivity, loan loss experience, liquidity, capital resources, market risk, earnings, effect of pending litigation, acquisition strategy, legal and regulatory limitations and compliance and competition . Readers are cautioned not to place undue reliance on the forward - looking statements contained in this presentation in that actual results could differ materially from those indicated in such forward - looking statements, due to a variety of factors . These factors include, but are not limited to, changes in the Company's operating or expansion strategy, availability of and costs associated with obtaining adequate and timely sources of liquidity, the ability to maintain credit quality, possible adverse rulings, judgments, settlements and other outcomes of pending litigation, the ability of the Company to collect amounts due under loan agreements, changes in consumer preferences, effectiveness of the Company's interest rate risk management strategies, laws and regulations affecting financial institutions in general or relating to taxes, the effect of pending or future legislation, the ability of the Company to repurchase its common stock on favorable terms, the ability of the Company to successfully implement its acquisition strategy, changes in interest rates and capital markets, inflation, customer acceptance of the Company's products and services, and other risk factors . Other relevant risk factors may be detailed from time to time in the Company's press releases and filings with the Securities and Exchange Commission . Any forward - looking statement speaks only as of the date of this Report, and we undertake no obligation to update these forward - looking statements to reflect events or circumstances that occur after the date of this Report . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results . Non - GAAP Financial Measures This document contains financial information determined by methods other than in accordance with generally accepted accounting principles (GAAP) . The Company's management uses these non - GAAP financial measures in their analysis of the company's performance . These measures typically adjust GAAP performance measures to include the tax benefit associated with revenue items that are tax - exempt, as well as adjust income available to common shareholders for certain significant activities or nonrecurring transactions . Since the presentation of these GAAP performance measures and their impact differ between companies, management believes presentations of these non - GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the company's core businesses . These non - GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies .

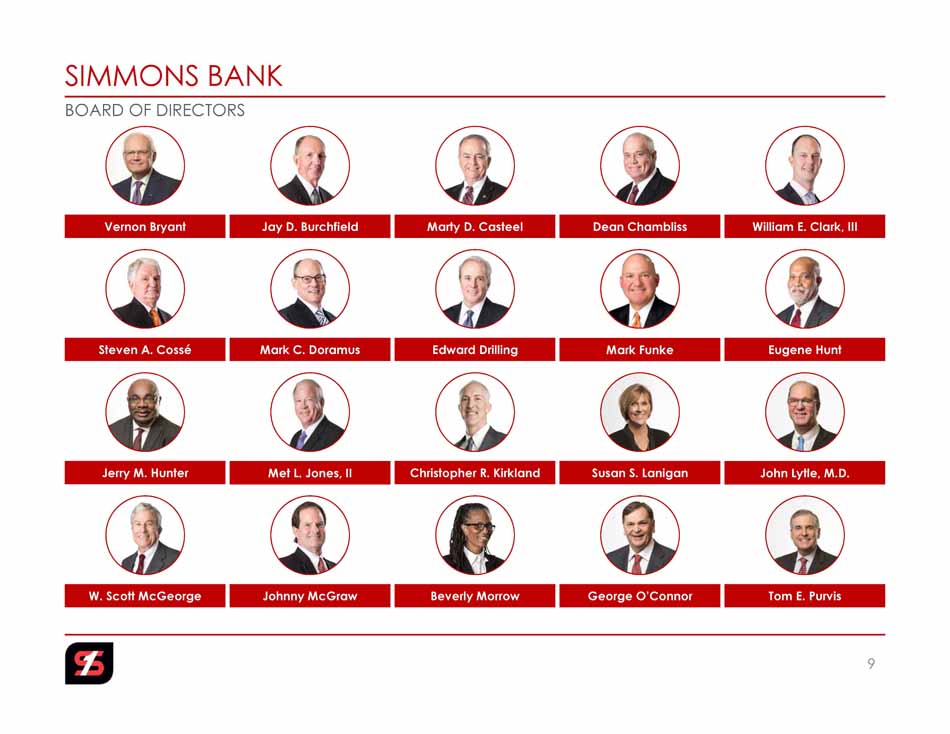

BOARD OF DIRECTORS SIMMONS BANK 9 William E. Clark, III Christopher R. Kirkland Steven A. Cossé Mark C. Doramus Edward Drilling Jerry M. Hunter Eugene Hunt Jay D. Burchfield Susan S. Lanigan W. Scott McGeorge Vernon Bryant Dean Chambliss Marty D. Casteel Mark Funke Met L. Jones, II John Lytle, M.D. Johnny McGraw Beverly Morrow Tom E. Purvis George O’Connor

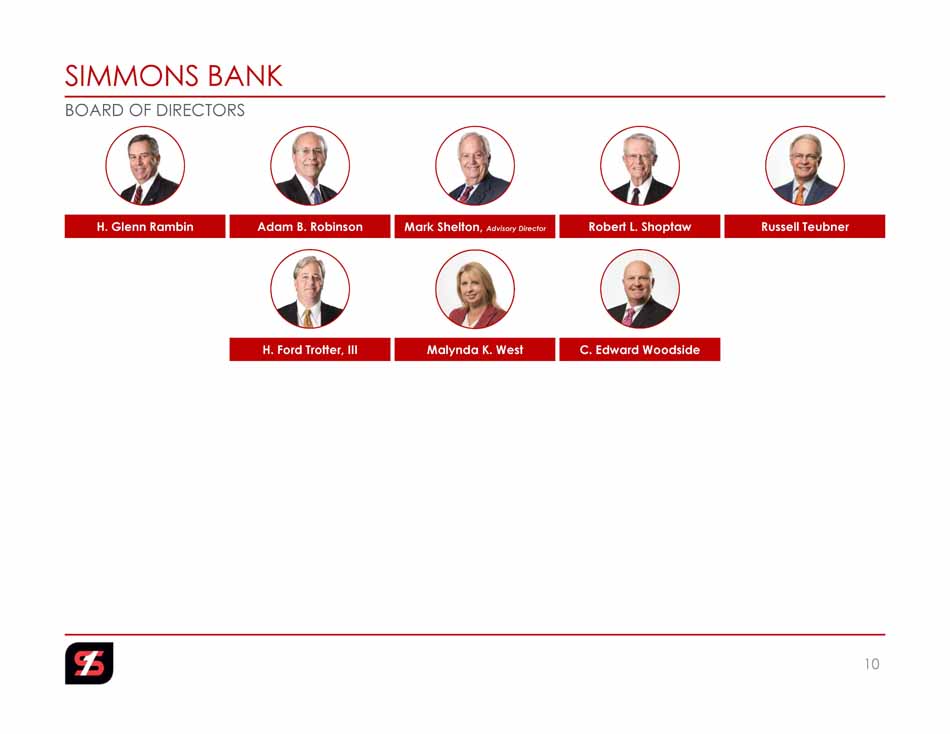

BOARD OF DIRECTORS SIMMONS BANK 10 Malynda K. West C. Edward Woodside H. Ford Trotter, III Russell Teubner Robert L. Shoptaw H. Glenn Rambin Mark Shelton, Advisory Director Adam B. Robinson

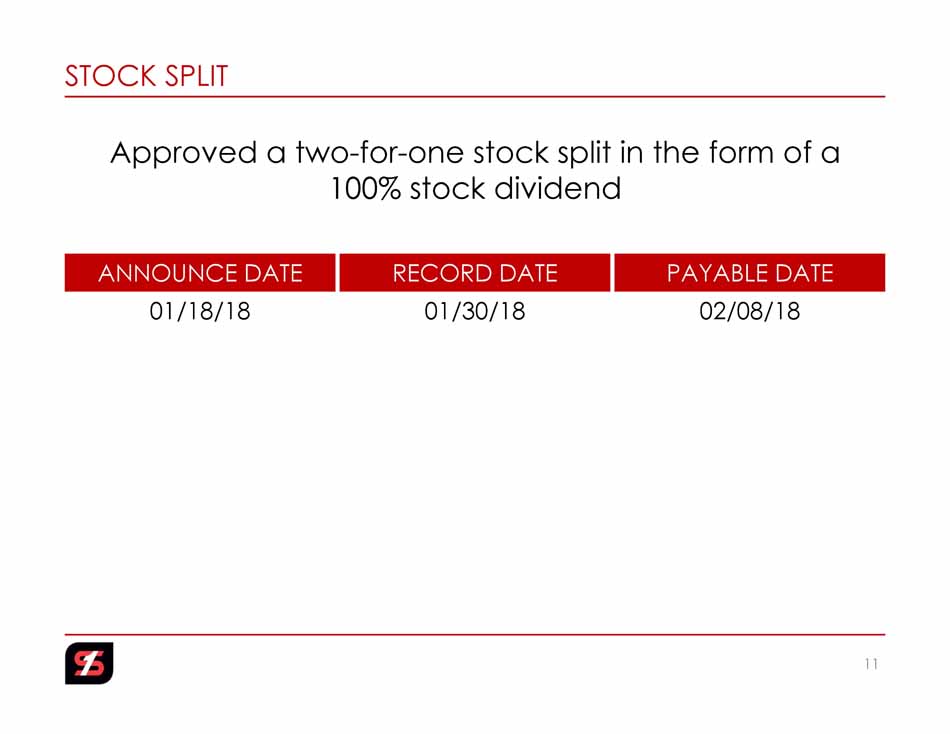

STOCK SPLIT 11 Approved a two - for - one stock split in the form of a 100% stock dividend ANNOUNCE DATE RECORD DATE PAYABLE DATE 01/18/18 02/08/18 01/30/18

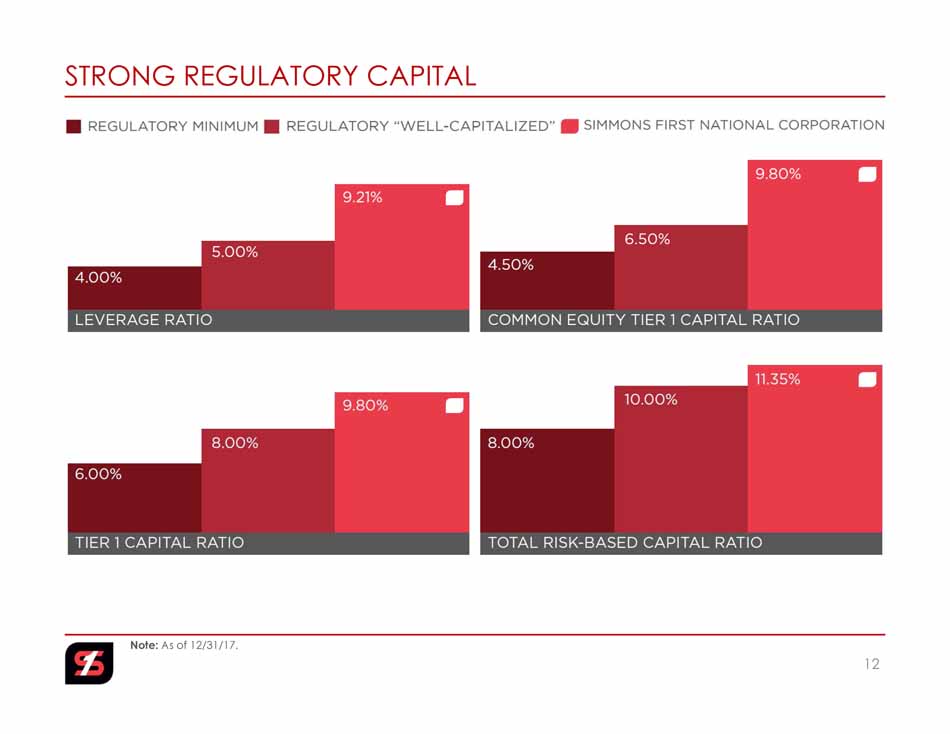

Note: As of 12/31/17. STRONG REGULATORY CAPITAL 12

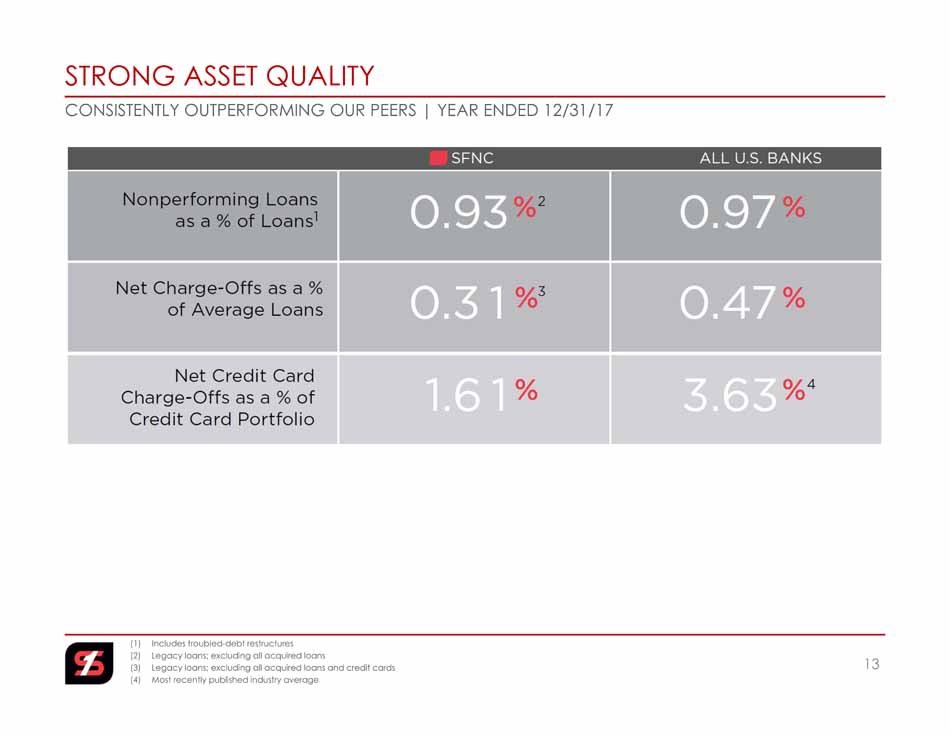

CONSISTENTLY OUTPERFORMING OUR PEERS | YEAR ENDED 12/31/17 (1) Includes troubled - debt restructures (2) Legacy loans; excluding all acquired loans (3) Legacy loans; excluding all acquired loans and credit cards (4) Most recently published industry average STRONG ASSET QUALITY 13

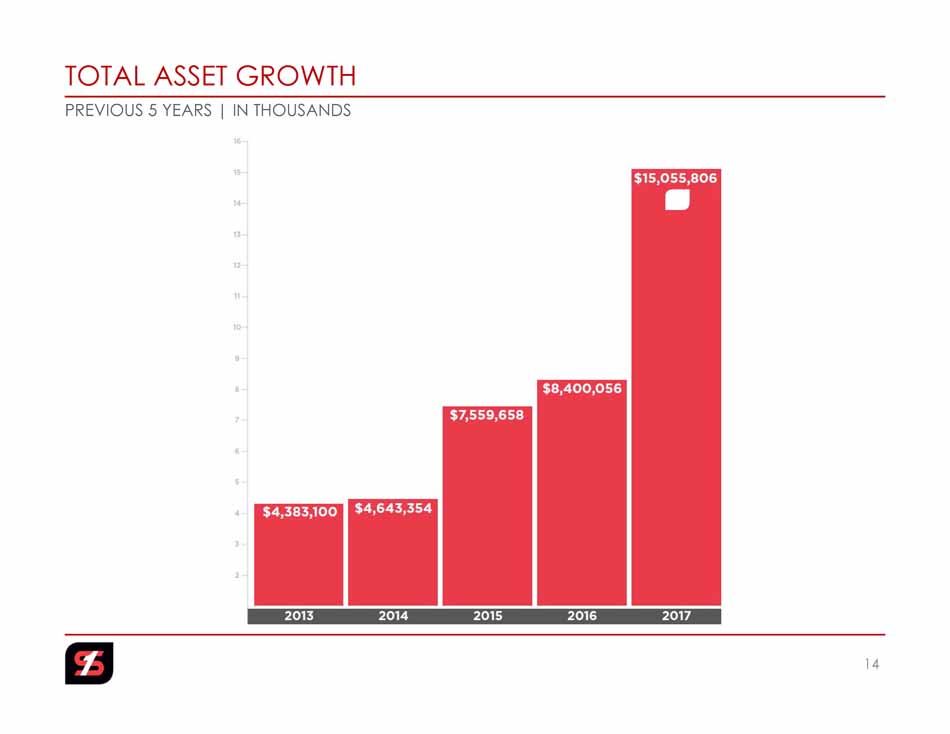

PREVIOUS 5 YEARS | IN THOUSANDS TOTAL ASSET GROWTH 14

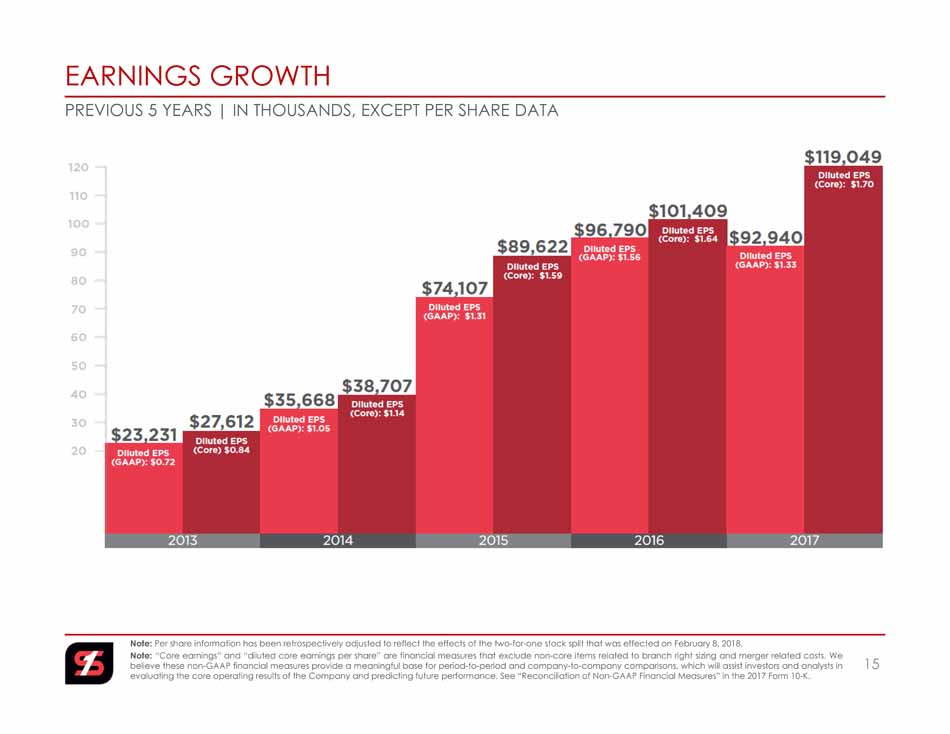

PREVIOUS 5 YEARS | IN THOUSANDS, EXCEPT PER SHARE DATA Note : Per share information has been retrospectively adjusted to reflect the effects of the two - for - one stock split that was effected on February 8 , 2018 . Note : “Core earnings” and “diluted core earnings per share” are financial measures that exclude non - core items related to branch right sizing and merger related costs . We believe these non - GAAP financial measures provide a meaningful base for period - to - period and company - to - company comparisons, which will assist investors and analysts in evaluating the core operating results of the Company and predicting future performance . See “Reconciliation of Non - GAAP Financial Measures” in the 2017 Form 10 - K . EARNINGS GROWTH 15

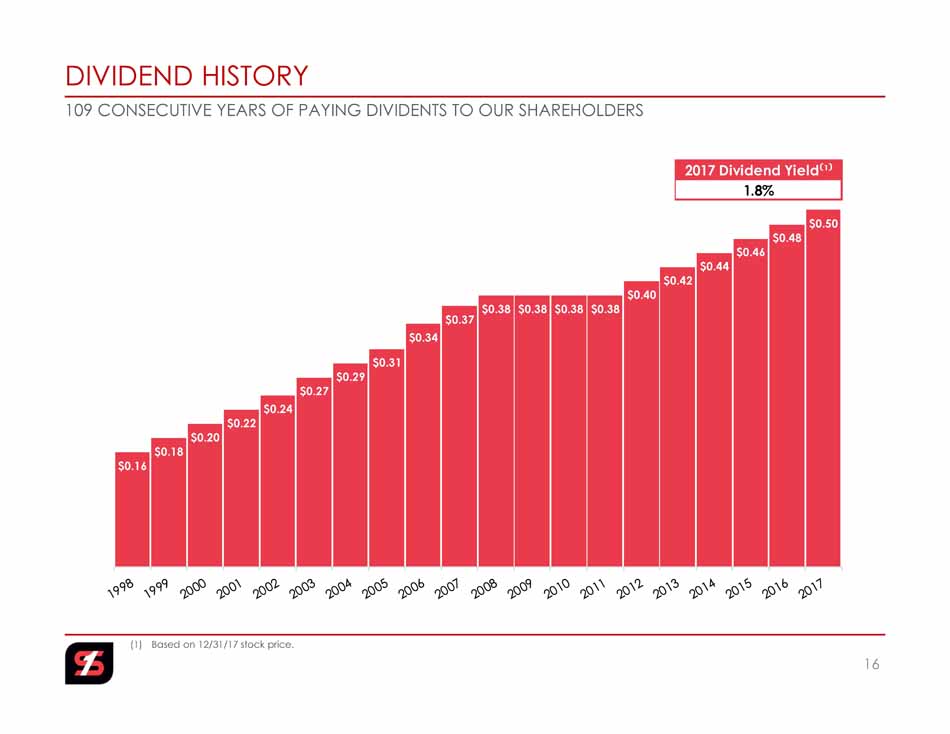

$0.16 $0.18 $0.20 $0.22 $0.24 $0.27 $0.29 $0.31 $0.34 $0.37 $0.38 $0.38 $0.38 $0.38 $0.40 $0.42 $0.44 $0.46 $0.48 $0.50 109 CONSECUTIVE YEARS OF PAYING DIVIDENTS TO OUR SHAREHOLDERS (1) Based on 12/31/17 stock price. DIVIDEND HISTORY 16 2017 Dividend Yield ⁽ ¹ ⁾ 1.8%

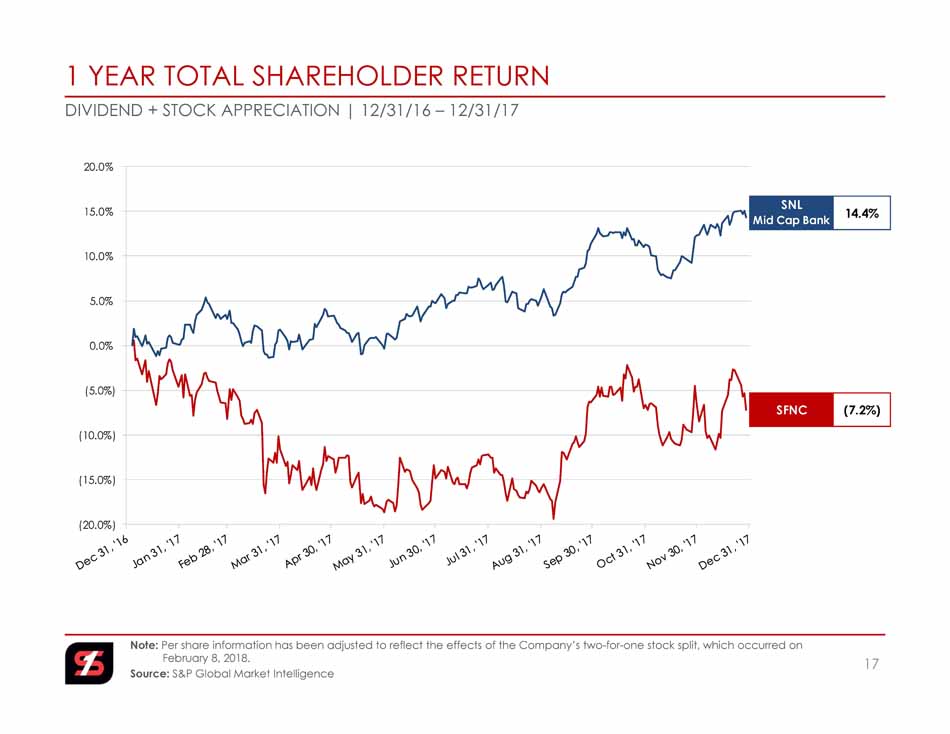

DIVIDEND + STOCK APPRECIATION | 12/31/16 – 12/31/17 Note: Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. Source: S&P Global Market Intelligence 1 YEAR TOTAL SHAREHOLDER RETURN 17 (20.0%) (15.0%) (10.0%) (5.0%) 0.0% 5.0% 10.0% 15.0% 20.0% SFNC (7.2%) SNL Mid Cap Bank 14.4%

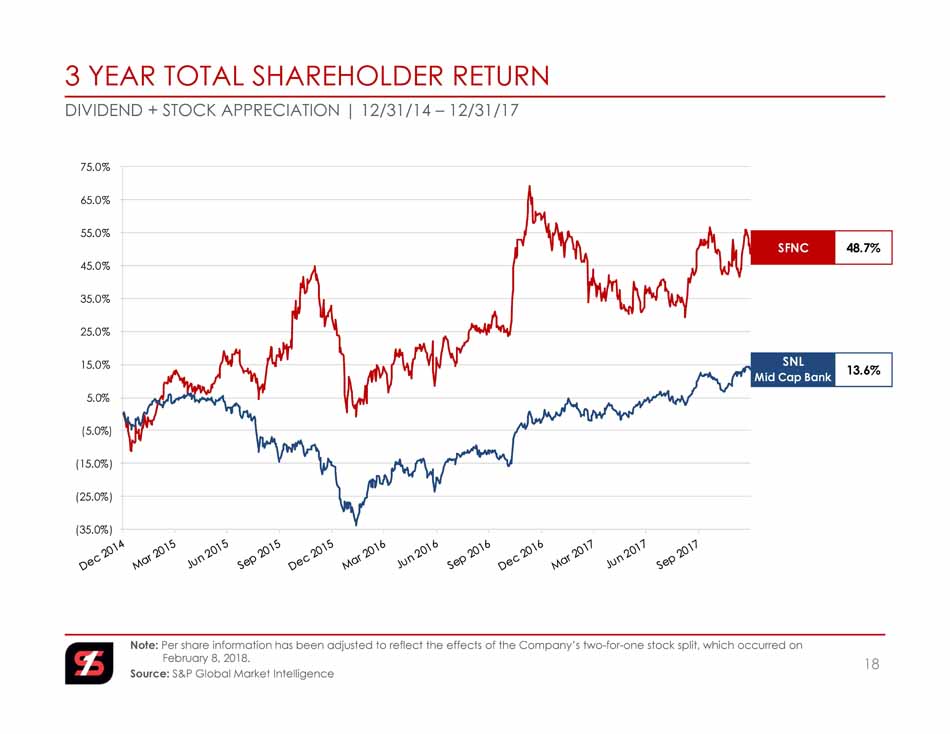

DIVIDEND + STOCK APPRECIATION | 12/31/14 – 12/31/17 Note: Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. Source: S&P Global Market Intelligence 3 YEAR TOTAL SHAREHOLDER RETURN 18 (35.0%) (25.0%) (15.0%) (5.0%) 5.0% 15.0% 25.0% 35.0% 45.0% 55.0% 65.0% 75.0% SFNC 48.7% SNL Mid Cap Bank 13.6%

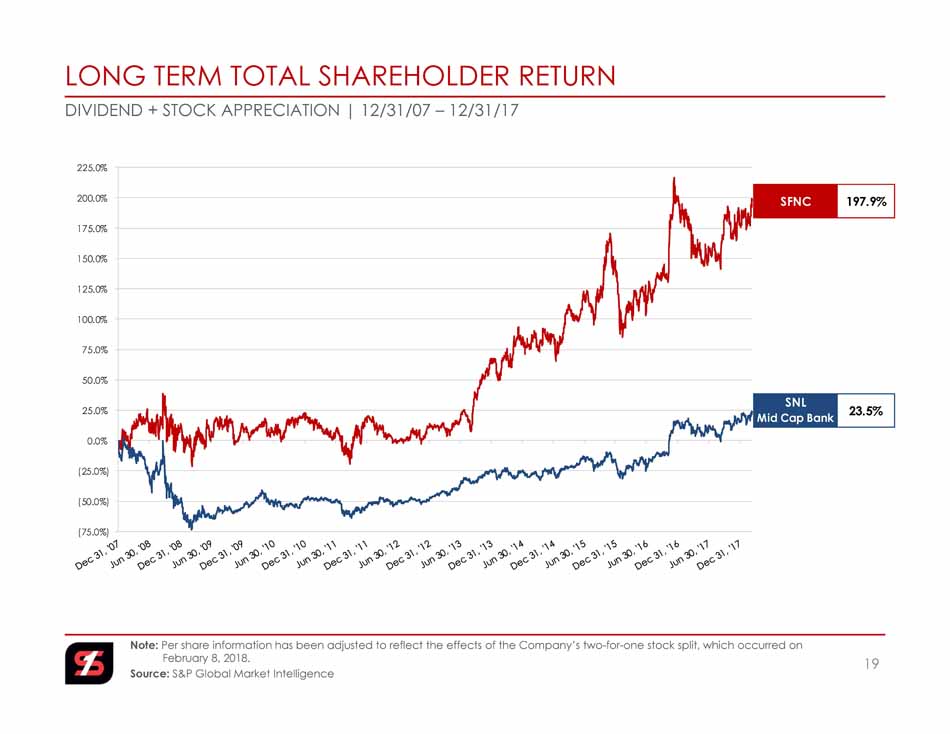

DIVIDEND + STOCK APPRECIATION | 12/31/07 – 12/31/17 Note: Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. Source: S&P Global Market Intelligence LONG TERM TOTAL SHAREHOLDER RETURN 19 (75.0%) (50.0%) (25.0%) 0.0% 25.0% 50.0% 75.0% 100.0% 125.0% 150.0% 175.0% 200.0% 225.0% SFNC 197.9% SNL Mid Cap Bank 23.5%

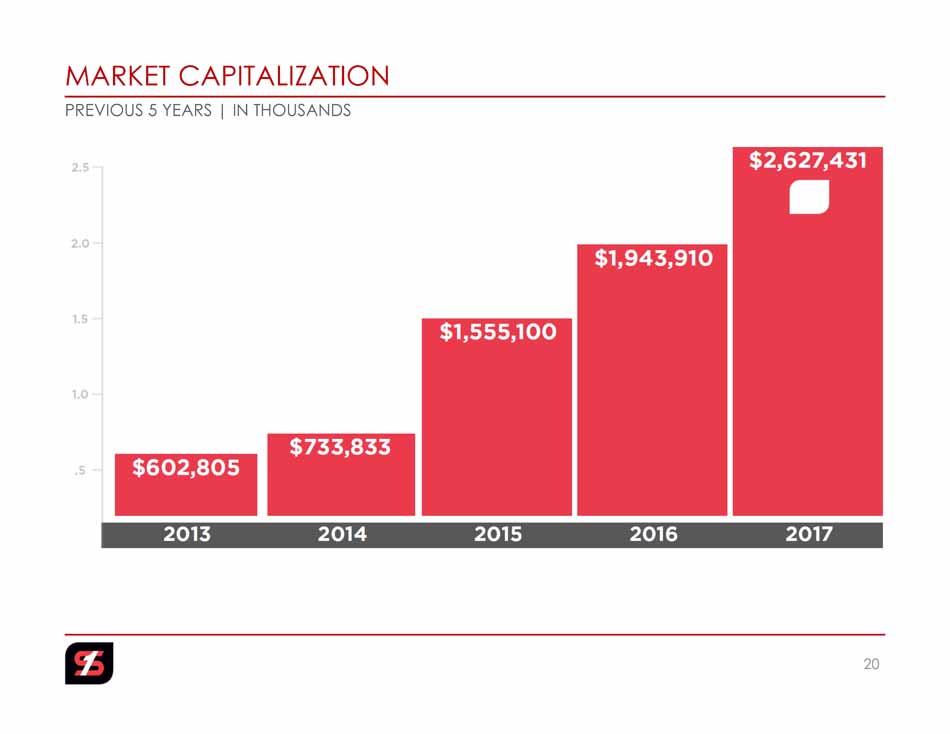

PREVIOUS 5 YEARS | IN THOUSANDS MARKET CAPITALIZATION 20

COMMUNITY BANK OF THE YEAR 21 SOUTHEAST ARKANSAS COMMUNITY BANK

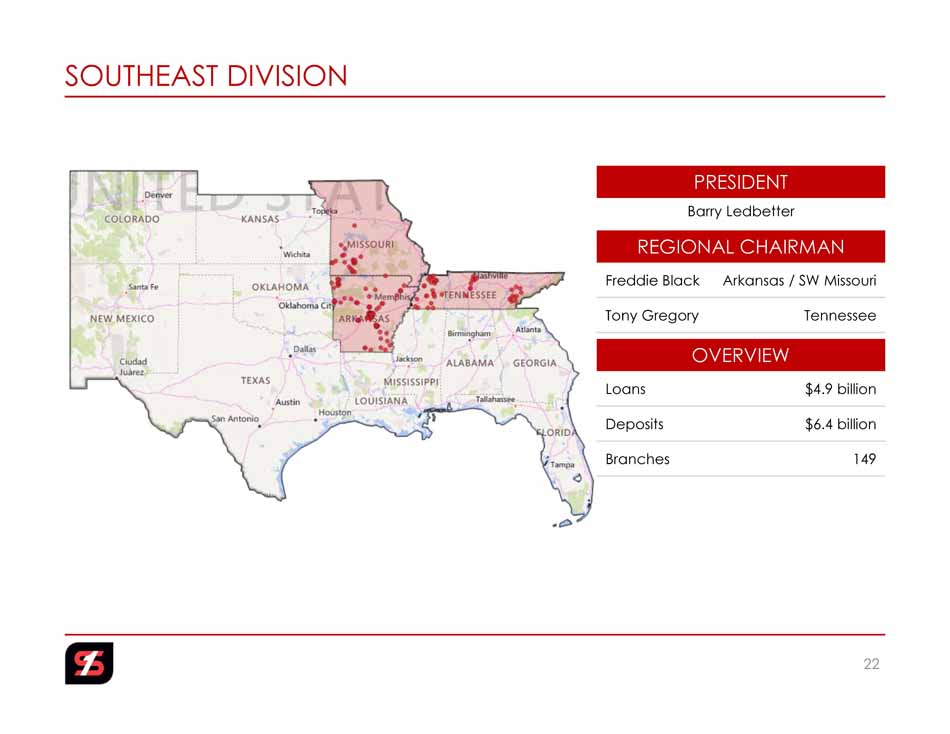

SOUTHEAST DIVISION 22 PRESIDENT REGIONAL CHAIRMAN OVERVIEW Barry Ledbetter Loans $4.9 billion Deposits $6.4 billion Branches 149 Freddie Black Arkansas / SW Missouri Tony Gregory Tennessee

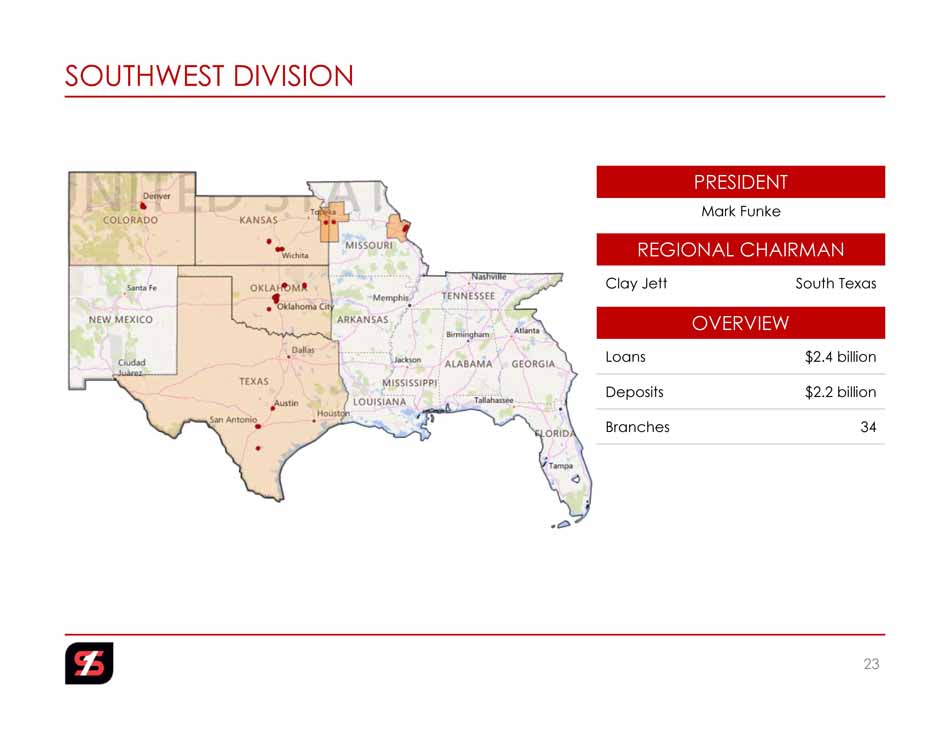

SOUTHWEST DIVISION 23 PRESIDENT REGIONAL CHAIRMAN OVERVIEW Mark Funke Loans $2.4 billion Deposits $2.2 billion Branches 34 Clay Jett South Texas

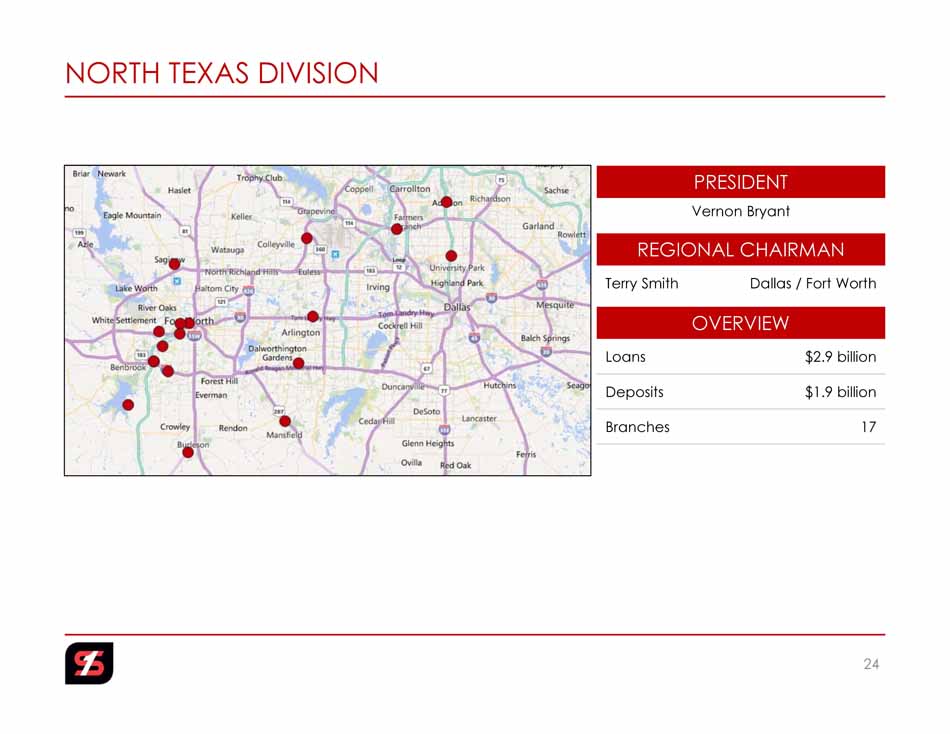

NORTH TEXAS DIVISION 24 PRESIDENT REGIONAL CHAIRMAN OVERVIEW Vernon Bryant Loans $2.9 billion Deposits $1.9 billion Branches 17 Terry Smith Dallas / Fort Worth

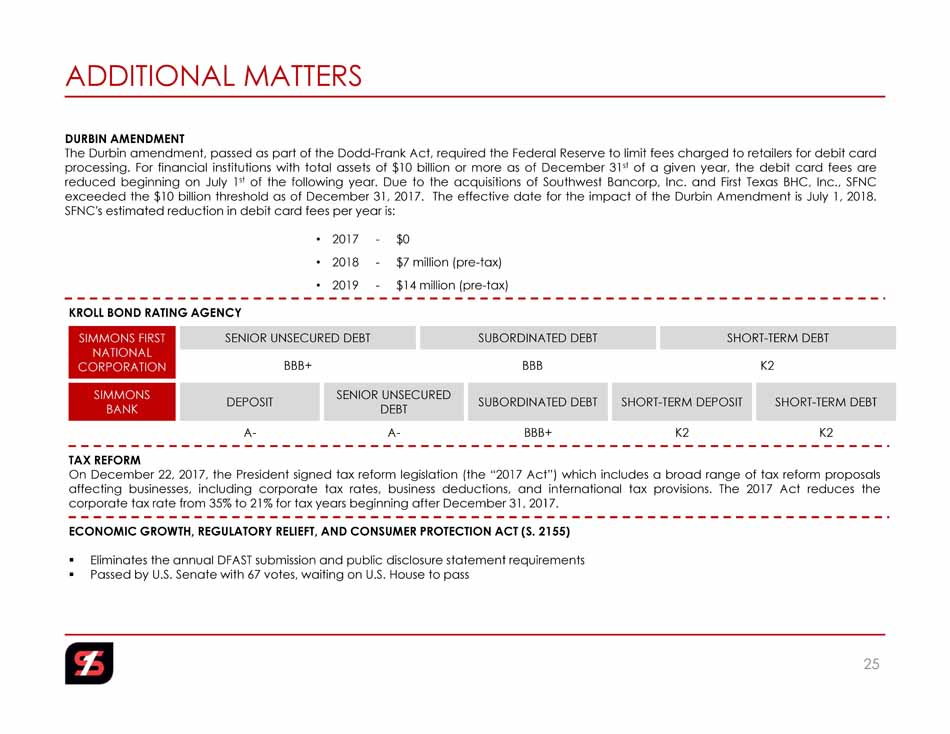

SENIOR UNSECURED DEBT SHORT - TERM DEBT SUBORDINATED DEBT SENIOR UNSECURED DEBT SHORT - TERM DEBT SUBORDINATED DEBT SHORT - TERM DEPOSIT DEPOSIT BBB+ BBB K2 SIMMONS FIRST NATIONAL CORPORATION SIMMONS BANK A - A - BBB+ K2 K2 ADDITIONAL MATTERS 25 DURBIN AMENDMENT The Durbin amendment, passed as part of the Dodd - Frank Act, required the Federal Reserve to limit fees charged to retailers for debit card processing . For financial institutions with total assets of $ 10 billion or more as of December 31 st of a given year, the debit card fees are reduced beginning on July 1 st of the following year . Due to the acquisitions of Southwest Bancorp, Inc . and First Texas BHC, Inc . , SFNC exceeded the $ 10 billion threshold as of December 31 , 2017 . The effective date for the impact of the Durbin Amendment is July 1 , 2018 . SFNC's estimated reduction in debit card fees per year is : • 2017 - $0 • 2018 - $7 million (pre - tax) • 2019 - $14 million (pre - tax) KROLL BOND RATING AGENCY TAX REFORM On December 22 , 2017 , the President signed tax reform legislation (the “ 2017 Act”) which includes a broad range of tax reform proposals affecting businesses, including corporate tax rates, business deductions, and international tax provisions . The 2017 Act reduces the corporate tax rate from 35 % to 21 % for tax years beginning after December 31 , 2017 . ECONOMIC GROWTH, REGULATORY RELIEFT, AND CONSUMER PROTECTION ACT (S. 2155) ▪ Eliminates the annual DFAST submission and public disclosure statement requirements ▪ Passed by U.S. Senate with 67 votes, waiting on U.S. House to pass

2018 SHAREHOLDERS’ MEETING 26