Attached files

| file | filename |

|---|---|

| EX-32.1 - DSG Global Inc. | ex32-1.htm |

| EX-31.1 - DSG Global Inc. | ex31-1.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________.

Commission file number 000-53988

DSG GLOBAL INC.

(Exact Name of Registrant as Specified in Its charter)

| Nevada | 26-1134956 | |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

214 – 5455 152nd Street, Surrey, British Columbia V3S 5A5, Canada

(Address of Principal Executive Offices) (Zip Code)

(604)

575-3848

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ ] (Do not check if smaller reporting company) |

Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

As of December 31, 2017, the aggregate market value of the voting and non-voting common equity held by non-affiliates was $177,277 based on the closing price on that date. As of April 18, 2018, the registrant had 966,394,233 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the registrant’s 2017 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of December 31, 2017, the last day of the fiscal year covered by this Annual Report on Form 10-K.

DSG

GLOBAL INC.

FORM 10-K

TABLE OF CONTENTS

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning the following:

| ● | our future financial and operating results; | |

| ● | our intentions, expectations and beliefs regarding anticipated growth, market penetration and trends in our business; | |

| ● | the timing and success of our business plan; | |

| ● | our plans regarding future financings; | |

| ● | our ability to attract and retain customers; | |

| ● | our dependence on growth in our customers’ businesses; | |

| ● | the effects of market conditions on our stock price and operating results; | |

| ● | our ability to maintain our competitive technological advantages against competitors in our industry; | |

| ● | the expansion of our business in our core golf market as well as in new markets like commercial fleet management and agriculture; | |

| ● | our ability to timely and effectively adapt our existing technology and have our technology solutions gain market acceptance; | |

| ● | our ability to introduce new offerings and bring them to market in a timely manner; | |

| ● | our ability to maintain, protect and enhance our intellectual property; | |

| ● | the effects of increased competition in our market and our ability to compete effectively; | |

| ● | the attraction and retention of qualified employees and key personnel; | |

| ● | future acquisitions of or investments in complementary companies or technologies; and | |

| ● | our ability to comply with evolving legal standards and regulations, particularly concerning requirements for being a public company. |

These forward-looking statements speak only as of the date of this Form 10-K and are subject to uncertainties, assumptions and business and economic risks. As such, our actual results could differ materially from those set forth in the forward-looking statements as a result of the factors set forth below in Part I, Item 1A, “Risk Factors,” and in our other reports filed with the Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Form 10-K may not occur, and actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements.

| 3 |

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Form 10-K to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed with the Securities and Exchange Commission as exhibits thereto with the understanding that our actual future results and circumstances may be materially different from what we expect.

Our Corporate History and Background Prior to the Closing of the Share Exchange Agreement

Boreal Productions Inc. (the Company) was incorporated under the laws of the State of Nevada on September 24, 2007. Andrea Fehsenfeld was then appointed sole officer and director. The Company was formed to option feature films and TV projects and then package them to sell at a profit to various studios and production companies.

At that time the board of directors voted to seek capital and begin development of our business plan. We received our initial funding of $9,000 through the sale of common stock to Ms. Fehsenfeld who purchased 3,000,000 shares of common stock at $0.003 per share and $45,000 from the sale of 3,000,000 shares of common stock issued to 30 un-affiliated investors at $0.015 per share. On June 11, 2008, we effected a five for one forward stock split of our authorized and issued and outstanding common stock. As a result, our authorized capital increased from 75,000,000 to 375,000,000 shares of common stock and our outstanding share capital increased from 6,000,000 shares of common stock to 30,000,000 shares of common stock.

We have not achieved revenues and have accrued a Net Loss of $153,964 since inception through May 6, 2015, the date of the reverse merger. We have been issued a going concern opinion by our auditors and rely upon the sale of our securities to fund operations. To date we have been unable to raise sufficient capital to finance the production of any film or television production and, consequently, our management has sought alternative strategies, such as business combinations or acquisitions, to create value for our shareholders.

On April 13, 2015, we entered into a share exchange agreement with DSG TAG and the shareholders of DSG TAG who become parties to the share exchange agreement. Pursuant to the terms of the share exchange agreement, we agreed to acquire not less than 75% and up to 100% of the issued and outstanding shares of DSG TAG’s common stock in exchange for the issuance by our company of up to 20,000,000 shares of our common stock to the shareholders of DSG TAG on the basis of one of our common shares for 5.4935 common shares of DSG TAG.

Previously, in anticipation of the share exchange agreement with DSG TAG, we undertook to change our name and effect a reverse stock split of our authorized and issued common stock. Accordingly, on January 19, 2015, our board of directors approved an agreement and plan of merger to merge with our wholly-owned subsidiary DSG Global Inc., a Nevada corporation, to effect a name change from Boreal Productions Inc. to DSG Global Inc. Our company remains the surviving company. DSG Global Inc. was formed solely for the change of name.

Also on January 19, 2015, our company’s board of directors approved a resolution to effect a reverse stock split of our authorized and issued and outstanding shares of common stock on a three (3) old for one (1) new basis. Upon effect of the reverse split, our authorized capital will decrease from 375,000,000 shares of common stock to 125,000,000 shares of common stock and correspondingly, our issued and outstanding shares of common stock will decrease from 30,000,000 to 10,000,000 shares of common stock, all with a par value of $0.001.

| 4 |

Articles of Merger to effect the merger and change of name and a Certificate of Change to effect the reverse stock split were filed with the Nevada Secretary of State on January 22, 2015, with an effective date of February 2, 2015. The name change and forward split were reviewed by the Financial Industry Regulatory Authority (FINRA) were approved for filing with an effective date of February 23, 2015.

The name change became effective with the Over-the-Counter Bulletin Board and OTC Markets quotation system at the opening of trading on February 23, 2015 under the symbol “BRPOD”. Effective March 19, 2015 our stock symbol changed to “DSGT”. Our new CUSIP number following the symbol change is 23340C104. The first trade of our common shares occurred on March 25, 2015.

On May 6, 2015, we completed the acquisition of approximately 75% (82,435,748 common shares) of the issued and outstanding common shares of DSG TAG Systems as contemplated by the share exchange agreement by issuing 15,185,875 shares of our common stock to shareholders of DSG TAG Systems who became parties to the agreement. In addition, concurrent with the closing of the share exchange agreement, we issued an additional 179,823 shares of our common stock to Westergaard Holdings Ltd. in partial settlement of accrued interest on outstanding indebtedness of DSG TAG Systems.

Following the initial closing of the share exchange agreement and through October 22, 2015, we acquired an additional 101,200 shares of common stock of DSG TAG Systems from shareholders who became parties to the share exchange agreement, and issued to these shareholders an aggregate of 18,422 shares of our common stock. Following completion of these additional purchases, DSG Global owns approximately 100% of the issued and outstanding shares of common stock of DSG TAG Systems. An aggregate of 4,229,384 shares of Series A Convertible Preferred Stock of DSG TAG Systems continues to be held by Westergaard Holdings Ltd., an affiliate of Keith Westergaard, a member of our board of directors.

The reverse acquisition was accounted for as a recapitalization effected by a share exchange, wherein DSG TAG Systems is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized. We adopted the business and operations of DSG TAG Systems upon the closing of the share exchange agreement.

Our principal executive office is located at 214 - 5455 152nd Street, Surrey, BC, V3S 5A5 Canada. The telephone number at our principal executive office is 1 (877) 589 - 8806.

Business Subsequent to the Closing of the Share Exchange Agreement

Subsequent to the closing of the share exchange agreement with DSG Tag Systems, Inc. (“DSG TAG”), we have adopted the business and operations of DSG TAG.

DSG TAG was incorporated under the laws of the State of Nevada on April 17, 2008 and extra provincially registered in British Columbia, Canada in 2008. In March 2011, DSG TAG formed DSG Tag Systems International, Ltd. in the United Kingdom (“DSG UK”). DSG UK is a wholly owned subsidiary of DSG TAG.

When used the terms “Company,” “we,” “our,” “us,” “DSG,” or “DSG TAG,” means DSG Global, Inc. and its subsidiary DSG Tag Systems, Inc. and its wholly-owned subsidiary DSG Tag Systems International, Ltd.

DSG Global Inc. (“DSG”) is a technology development company based in Surrey, British Columbia, Canada, engaged in the design, manufacture, and marketing of fleet management solutions for the golf industry, as well as commercial, government and military applications. Its principal activities are the sale and rental of GPS tracking devices and interfaces for golf vehicles, and related support services. The company was founded by a group of individuals who have dedicated their careers to fleet management technologies and have been at the forefront of the industry’s most innovative developments. The company has developed the TAG suite of products that represents a major breakthrough as the first completely modular fleet management solution for the golf industry. The Executive Team has over 50 years’ combined experience in the design and manufacture of wireless, GPS, and fleet tracking solutions. The TAG suite of products is currently sold and installed around the world in golf facilities and commercial applications through a network of established distributors and partnerships with some of the most notable brands in fleet and equipment manufacture.

| 5 |

The company specializes in the vehicle fleet management industry. DSG stands for “Digital Security Guard” which is the company’s primary value statement giving fleet operator’s new capabilities to track and control their vehicles. The company has developed a proprietary combination of hardware and software that is marketed around the world as the TAG System. The company has primarily focused on the golf industry where the TAG System is deployed to help golf course operators manage their fleet of golf carts, turf equipment, and utility vehicles. DSG is now a leader in the category of Fleet Management in the golf industry and was awarded “Best Technology of the Year” by Boardroom magazine the publication of the National Golf Course Owners Association in 2010. To date the TAG is installed on over 8,000 vehicles and the company has monitored over 6,000,000 rounds.

The TAG system fills a void in the marketplace by offering a modular structure which allows the customer to customize their system depending on desired functionality and budget constraints. In addition to the core TAG vehicle control functionality which can operate independently, DSG has two golfer information display systems; the alphanumeric TEXT and high definition TOUCH providing the operator two options which is unique in the industry.

The market for the TAG System is the 40,000 golf operations worldwide. While the golf industry is still the primary sales and marketing focus, the company has completed several successful pilots of the TAG in other vertical markets such as agriculture, and commercial fleet deployments. With appropriate resources in place the company will implement a sales and marketing strategy expanding into these markets.

We have a direct sales force in North America, which comprises the most significant portion of the golf fleet market, and have developed key relationships with distributors and golf equipment manufacturers such as E-Z-GO, Yamaha and Ransomes Jacobsen to help drive sales for the North American and worldwide markets.

Emerging Growth Company

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups (JOBS) Act.

We shall continue to be deemed an emerging growth company until the earliest of:

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.’.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

| 6 |

We have elected not to opt out of the extended transition period for complying with any new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

DSG Technologies and Products

Technology Overview

DSG produces a “modular” suite of products to provide fleet management solution for any vehicle required for a golf operation, and provides two golfer information display options to meet the operators budget requirements. DSG believes that it is currently the only company in the golf fleet management industry with these capabilities.

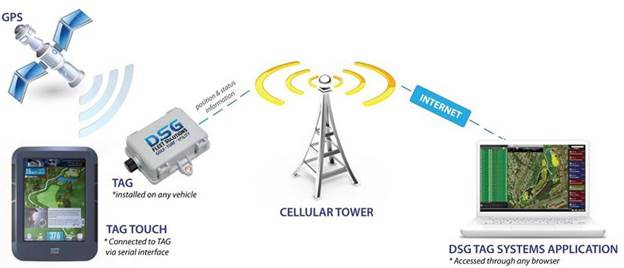

The DSG TAG System is designed from the ground up to be a golf/turf vehicle fleet management system. Its main function is addressing the golf course operator needs. While employing same core technology (cellular wireless and GPS) as traditional commercial vehicle fleet management systems, DSG has created patent pending solutions to adapt it to the very specific requirements of the golf environment. Compared to mainstream fleet tracking products, DSG collects 10 to 50 times more data points per MB (megabyte) of cellular data due to its proprietary data collection and compression algorithms. Also the relative positioning accuracy is improved by almost one order of magnitude by the use of application-specific geo-data validation and correction methods.

DSG’s proprietary methods make it possible to offer a solution suitable for use on golf courses at a price low enough to be affordable in the industry. Every system component incorporates state-of-the-art technology (server, mobile trackers, display). In developing its products DSG TAG Systems has adopted an application oriented approach placing the most emphasis (and research & development) on server and end-user software by taking advantage of the commodity level reached by mainstream technologies such as Global Positioning (GPS) and M2M (Machine to Machine) Cellular Data in the wider context of Commercial Fleet Management.

DSG leveraged the existence of an abundance of very cost effective telematics solutions by selecting an “off-the-shelf” hardware platform that meets all the main performance and environmental requirements for operation in the harsh, outdoor golf course environment. While removing all risk and cost associated with developing a proprietary hardware platform, DSG has maintained the unique nature of its hardware solution by developing a set of proprietary adapters and interfaces specifically for the golf application.

DSG has secured an exclusive supply agreement with the third-party hardware manufacturers for the vertical of golf industry. Additionally, DSG owns the design of all proprietary adapters and interfaces. This removes the risk of a potential competitor utilizing the same hardware platform. Competitors could attempt to reverse engineer or copycat the TAG technology and equipment. This risk factor is mitigated by the fact that our product does not rely on a particular technology or hardware platform to be successful but on a very specific vertical software application that is far more difficult to copy (and respectively easier to protect).

The application software contains patent features implemented in every core component of the system. The TAG device runs DSG proprietary firmware incorporating unique data collection and compression algorithms. The web server software which powers the end-user application is also proprietary and incorporates the industry knowledge accumulated through the over 70 years of collective experience of the DSG team.

This approach has given the product line a high level of endurance against technology obsolescence. At any point in time, if a hardware component is discontinued or a better/less expensive hardware platform becomes available, the software application can be easily adapted to operate on the new platform or with the new component. The company benefits from the constant increase of performance and cost reduction of mainstream hardware technology without any additional cost.

The web-based Software-as-a-Service (SaaS) model used by DSG TAG System is optimal for low operating and support costs and rapid-cycle release for software updates. It is also a major factor in eliminating or substantially reducing the need for any end-user premises equipment. Customers have access to the service through any internet connected computer or mobile device, there is no need for a local wireless network on the facility and installation time and cost are minimal.

| 7 |

DSG is positioned to take advantage of mainstream technology and utilize “best of breed” hardware platforms to create new generations of products. Our software is designed to be “portable” to future new platforms with better GPS and wireless technology in order to maintain the Company competitive edge.

All new product development effort of DSG is following the same model: select the best of breed third-party hardware platform, design and produce custom proprietary accessories while focusing the bulk of the development efforts on vertical software application to address a very specific set of end-customer needs.

The latest addition to the TAG family of products, the TAG TOUCH is a perfect example of this development philosophy in action: the main component is a last-generation Android tablet PC wrapped in a custom designed outdoor enclosure containing the power supply and interface components required for the golf environment. The software application is taking advantage of all the advanced high resolution graphics, touch user interface and computing power of the Android OS delivering a vastly superior user experience compared to competitive systems. The time to market for this product was 30% of how long it took to develop and launch this type of products in the past.

The TAG Control Unit

The company’s flagship product is the TAG Control unit. The TAG can operate as a “stand alone” unit or with one of two displays; the TEXT alphanumeric display or the TOUCH high definition “touch activated” screen. The TAG is GPS enabled and communicates with the TAG software using cellular GSM networks. Utilizing the cellular networks rather than erecting a local Wi-Fi network assures carrier grade uptime, and vehicle tracking “off- property”. GSM is the de facto global standard for mobile communications.

The TAG unit itself is discreetly installed usually in the nose of the vehicle to give the GPS clear line of site. It is then connected to the vehicle battery and ignition. The property is then mapped using the latest satellite imagery that is graphically enhanced and loaded into the TAG System as a map.

Once installed the vehicle owner utilizes the TAG software to locate the vehicle in real time using any computer, smartphone, or tablet that has an internet connection and perform various management operations.

The operator can use the geo-fencing capabilities to create “zones” on the property where they can control the vehicles behavior such as shutting down a vehicle that is entering a sensitive or dangerous area. The TAG System also monitors the strength of the vehicle’s battery helping to prevent sending out vehicles undercharged batteries which can be an inconvenience for the course and negatively impact the golfer experience.

| 8 |

Features and Benefits

| ● | Internal battery utilizing Smart Power technology which charges the battery only when the vehicle is running (gas) or being charged (electric) |

| ● | Pace of Play management and reporting which is a critical statistic for the golf operator |

| ● | No software to install |

| ● | Web based access on any computer, smartphone, or tablet |

| ● | Set up restricted zones to protect property, vehicles, and customers |

| ● | Real time tracking both on and off property (using Street Maps) |

| ● | Email alerts of zone activity |

| ● | Cart lockdown |

| ● | Detailed usage reporting for improved maintenance, proper vehicle rotation, and staff efficiency |

| ● | Geo fencing security features |

| ● | Ability to enforce cart path rules which is key to protecting course on wet weather days |

| ● | Modular system allows for hardware and feature options to fit any budget or operations |

TEXT Display

The TEXT is paired with the TAG Control unit as DSG’s entry level display system for operators who desire to provide basic hole distance information and messaging to the golf customer. The TEXT is a very cost effective solution for operators who desire to give their customers GPS services with the benefits of a Fleet Management back end. The TEXT can be mounted on the steering column or the dash depending on the customer’s preference.

| 9 |

DSG’s entry level alphanumeric golf information’s display

Features and benefits

| ● | Hole information display |

| ● | Yardage displays for front, middle, back locations of the pin |

| ● | Messaging capabilities – to individual carts or fleet broadcast |

| ● | Zone violation warnings |

| ● | Pace of Play notifications |

| ● | Smart battery technology to prevent power drain |

| ● | Versatile mounting option |

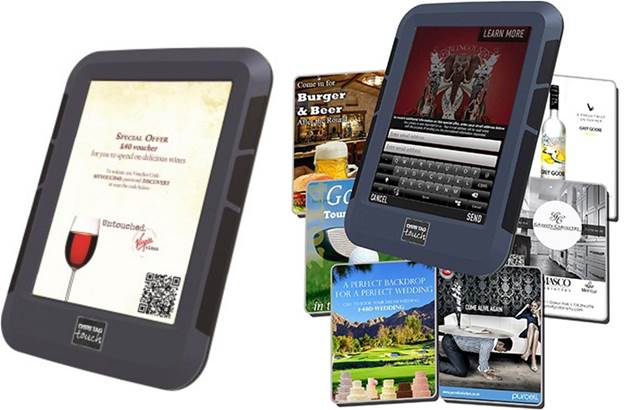

TOUCH Display

The TOUCH is a solution for operators who desire to provide a high level visual information experience to their customers. The TOUCH is a high definition “Touch” activated display screen mounted in the golf cart integrated with the TAG Control unit to provide a full back/front end Fleet Management solution. The TOUCH displays hole graphics, yardage, and detailed course information to the golfer and provides interactive features such as Food and Beverage ordering and scorekeeping.

The industry leading Touch HD – the most sophisticated display in the market.

| 10 |

Features and Benefits

| ● | Integrated Food and Beverage ordering |

| ● | Pro Tips |

| ● | Flyover capability |

| ● | Daily pin placement display |

| ● | Interactive Scorecard with email capability |

| ● | Multiple language choices |

| ● | No power drain with Smart Battery technology |

| ● | Full broadcast messaging capabilities |

| ● | Pace of Play display |

| ● | Vivid hole graphics |

| ● | Option of steering or roof mount |

| ● | Generate advertising revenue and market additional services |

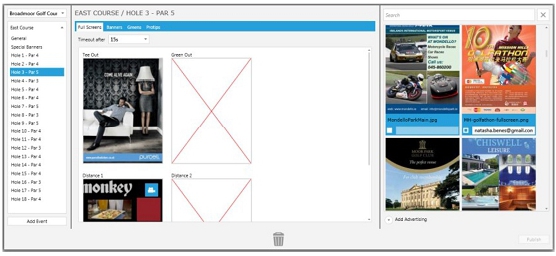

Advertising Platform

A unique feature of the TOUCH system is the advertising display capability. This can be used by the operator for internal promotion of services or for generating revenue by selling the ad real estate since the golf demographic is very desirable to advertisers. The TOUCH displays banner, panel, full page, pro tip, and Green view ads. There is also ad real estate on the interactive feature screens for Food and Beverage ordering and the scorecard. The Touch System can also display animated GIF files or play video for added impact.

| 11 |

Advertising displayed in multiple formats including animated GIF and video

DSG has developed proprietary “Ad Manager” software which is used to place and change the ads on the system(s) from a central NOC (Network Operations Center) in real time. The Ad Manager can deploy to a single system or multiple systems. This creates a network of screens that is also very desirable to advertisers as ad content can be deployed locally, regionally, or nationally. The advertising platform is an important part of the company’s future marketing and sales strategy.

| 12 |

DSG R3 Advertising Platform

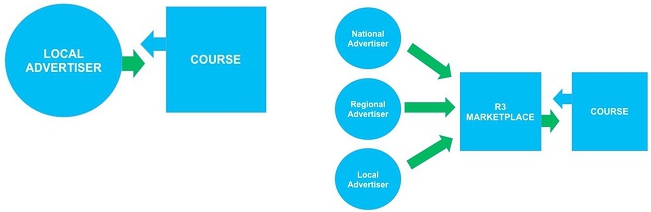

The DSG R3 program delivers advance ROI (Revenue Optimization Intelligence). Utilizing all streams of advertising delivery, such as automated, direct, and self-serve. The R3 program has the ability to deliver relevant advertising to golfers the moment they sit in the cart. The R3 model is more effective than the previous advertising model of ‘One to One’, these are local ads only sold through direct sales by courses, or 3rd party advertising sales firms. The new R3 model offers ‘Many to one’ advertising options, delivering thousands of national, regional, and local advertisers an opportunity to advertise on our screens through our R3 Marketplace.

Previous ‘One to One’ model vs the new R3 model ‘Many to One’

TAG TURF/ECO TAG

The TAG Turf and the new ECO TAG were developed to give course operators the same back end management features for their turf equipment and utility vehicles. Turf equipment is expensive and a single piece can run over $100,000 and represents a large portion of a golf course operating budget. The TAG Turf and ECO TAG have comprehensive reporting that the operator can utilize to implement programs that can increase efficiencies, reduce labor costs, help lower idle times, provide fuel consumption and equipment performance, provide historical data on cutting patterns, and reduce pollution from emissions by monitoring idle times. Since the golf course needs to be maintained regardless of volume these cost saving measures directly impact the operator’s bottom line.

| 13 |

Features and Benefits

| ● | Can be installed on any turf, utility, or service vehicle |

| ● | Work activity tracking and management |

| ● | Work breakdown and analysis per area, work group, activity type or specific vehicle |

| ● | Vehicle idling alerts |

| ● | Zone entry alerts |

| ● | Detailed travel (cutting patterns) history |

| ● | Detailed usage reports with mileage and hours |

| ● | Protection for ecological areas through geo fencing |

| ● | Vehicle lock down and ‘off property’ locating features |

The TAG Turf provides detailed trail history and cutting patterns

Revenue Model

DSG derives revenue from four different sources.

Systems Sales Revenue, which consists of the sales price paid by those customers who purchase our TAG system hardware.

| 14 |

Monthly Service Fees are paid by all customers for the wireless data fee charges required to operate the GPS tracking on the TAG systems.

Monthly Rental Fees are paid by those customers that rent the TAG system hardware. The amount of a customer’s monthly payment varies based on the type of equipment rented (a TAG, a TAG and TEXT, or a TAG and TOUCH).

Advertising Revenue is a source of revenue that has not been taken full advantage of. We believe it has the potential to be strategic for us in the future. Currently, courses can deliver their own advertising to our TOUCH units and soon we’ll be introducing our R3 program which automates the delivery of advertising.

Markets

Sales and Marketing Plan

The market for the TAG System is the worldwide golf cart and Turf equipment fleets. There are 40,000 golf courses around the world with North America being the largest individual market with 20,000. This represents over 3,000,000 vehicles. The golf market has five distinct types of operations. Municipal, Private Country Clubs, Destination Resorts, Public Commercial, Military and University affiliated. DSG has deployed and has case studies developed TAG systems in each of these categories.

Our marketing strategy is focused on building brand awareness, generating quality leads, and providing excellent customer service.

North America Sales

Since the largest market is North America the company employs a direct sales team and Sales Agents that provides full sales coverage. Our Sales Agents are experienced golf industry professionals who maintain established relationships with the golf industry and carry multiple golf lines. Our sales objective is to offer our existing and prospective customers a dedicated, knowledgeable, and outstanding customer service team.

In addition, our team is dedicated to existing accounts that focus on up-selling and cross-selling additional products to our current customer base, securing renewal agreements, and providing excellent customer service. The current regions are:

| ● | Western Canada |

| ● | Eastern Canada |

| ● | Northeast USA |

| ● | Western USA |

| ● | Southeastern USA |

| ● | Midwest USA |

International Sales

DSG focuses on select global golf markets that offer significant volume opportunities and that value the benefits that our products deliver.

| 15 |

We utilize strategic distributor partnerships in each targeted region/country to sell, install and service our products. Distributors are selected based on market strength, market share, technical and selling capability, and overall reputation. We believe that DSG solutions appeal to all distributors because they are universal and fit any make or model of vehicle. We maintain and leverage our strong relationship with Yamaha, E-Z-GO and Ransomes Jacobsen (sister company to E-Z-GO) in developing our distributor network around the world. Today, many of our distributor partners are the leading distributors for E-Z-GO and RJ and hold a dominant position in their respective markets. While they are Yamaha or E-Z-GO distributors, most sell DSG products to all courses regardless of their choice of golf car as a value add to their customers and to generate additional revenue. We complement this distributor base with independent distributors as needed to ensure we have sufficient coverage in critical markets.

Currently DSG is focused on Europe, Asia and South Africa. The company is looking to expand next into Australia and Latin America.

Management Companies

Many golf facilities are managed by management companies. The portfolios of these companies vary from a few to hundreds of golf courses. Troon®, the world’s largest player in golf course management, has over 200 courses under management. The management companies provide everything from branding, staffing, management systems, marketing, and procurement. DSG is currently providing products and services to Troon, OB Sports, Kemper Sports, Trump, Marriott Golf, Blue Green, Crown Golf, American Golf, Billy Casper, Club Corp, and Club Link.

DSG has been successful in completing installations and developing relationships with several of the key players who control a substantial number of courses. DSG will continue to implement system developments that are driven by the needs of these management companies such as combined reporting, multiple course access through a centralized dashboard. This development will become a competitive advantage for DSG in the management company market.

DSG has dedicated a team to create specific collateral for this market and has assigned a senior executive to have direct responsibility to manage these relationships.

Competition

We compete with a number of established producers and distributors of vehicle fleet management systems. Our competitors include producers of golf specific applications, such as GPS Industries, LLC., one of the leading suppliers of golf cart fleet management systems, as well as producers of non-golf specific utility vehicle fleet management systems, such as Toro. Many of our competitors have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we must:

| ● | demonstrate our products’ competitive advantages; | |

| ● | develop a comprehensive marketing system; and | |

| ● | increase our financial resources. |

However, there can be no assurance that even if we do these things we will be able to compete effectively with the other companies in our industry.

We believe that we will be able to compete effectively in our industry because of the versatility, reliability, and relative affordability of our products when compared to those of our competitors. We will attempt to build awareness of our competitive advantages among existing and potential customers through trade shows, sales visits and demonstrations, online marketing, and positive word of mouth advertising.

However, as we are newly-established company relative to our competitors, we face the same problems as other new companies starting up in an industry, such as limited access to capital. Our competitors may be substantially larger and better funded than us, and have significantly longer histories of research, operation and development than us. In addition, they may be able to provide more competitive products than we can and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their products or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

| 16 |

Our primary competitor in the field of golf course fleet management is GPS Industries, a company that was founded in 1996 by Mr. Bob Silzer, the founder of DSG TAG Systems. GPS Industries is currently the largest player in the marketplace with an installed base of approximately 750 golf courses worldwide. GPS Industries was consolidated by various mergers and acquisitions with a diversity of hardware platforms and application software. Since 2009, when GPS Industries has introduced their latest product offering called the Visage, in an exclusive partnership with Club Car, their strategy has been to target mostly their existing customers and motivate them into replacing their existing, older GPS system, with the Visage system.

GPS Industries is leveraging very heavily their partnership with Club Car, which is one of the three largest golf cars manufacturers in the world and at times is benefiting from golf operators’ preference for Club Car and their vehicles when they select their management system.

Market Mix

Since the introduction of the DSG product line, the golf course operators realized that they have now access to a budget-friendly fleet management tool that works not only on golf cars but also with all other vehicles used on the golf course such as turf maintenance, shuttles, and other utility vehicles.

Marketing studies have identified that half of the golf course operators only need a fleet management system and only 15% need a high-end GPS golf system. This illustrates the strong competitive advantage that DSG TAG Systems has versus GPS Industries since their product can only address the needs of a relatively small fraction of the marketplace.

Consequently, GPS Industries installed base has steadily declined since most of their new product installations have replaced older product for existing customers and some customers have opted for a lower budget system and switched over to DSG TAG Systems.

Marketing Activities

The company has a multi layered approach marketing the TAG suite of products. One of the foundations of this plan is attending industry trade shows which are well attended by golf operators. The two largest shows are the PGA Merchandise Show and the Golf Industry Show which are held in Florida at the end of January. The company also attends a number of regional shows around North America. International events are attended by our distributors and partners.

The second layer is memberships in key organizations such as the National Golf Course Owners Association, Golf Course Superintendents Association, and Club Managers Association of America. These are very influential in the industry and have marketing channels such as publications, email blasts, and web based marketing. The company also markets directly to course operators through email, surveys direct mail programs.

Lead Generation

One of the primary sources of lead generation is through the company’s strategic partnerships with EZ-GO, Yamaha, and Ransomes Jacobson. These relationships provide the company with a great deal of market intelligence. The sales forces of the partners work in tandem with the DSG sales team by passing on the leads, creating joint proposals, and distributing TAG sales material. The company has also created co-branded materials for specific value items of interest to operators such as Pace of Play solutions. DSG sale s and marketing staff attend partner sales events to conduct training and discuss marketing strategies.

The company is in the process of testing an internal telemarketing program in several key markets to gauge whether this particular channel warrants larger scale implementation.

| 17 |

Competitive Advantages

Pricing

One of the “heroes” of the TAG System is providing the course operator a range of modular fleet management options that are very competitively priced. Pricing options range from the TURF, TAG, Text, and Touch System, giving the customer a wide range of pricing options.

Functional advantages

DSG has the distinctive advantage of being able to offer a true fleet management system, encompassing all the vehicles on the golf course not just the golf carts. Due to the modular nature of the system, customers have now the option to configure their system’s configuration to match exactly their needs and their budget.

Product advantages

DSG products are the robust, reliable, and user friendly systems in the world. DSG is the only company currently providing systems that are waterproof with internal batteries to ensure our partners retain the full golf cart manufacturer’s warranty.

Operational Plan

Our Operations Department’s main functions are outlined below:

Product Supply Chain Management

| ● | Product procurement, lead-time management |

| ● | Inventory Control |

Customer Service

| ● | Training |

| ● | Troubleshooting & Support |

| ● | Hardware Repairs |

Installations

| ● | Content & graphics procurement |

| ● | System configurations |

| ● | Shipping and Installation |

Infrastructure Management

| ● | Communication Servers Management |

| ● | Cellular Data Carriers |

| ● | Service and administration tools |

Product Supply Chain

In order to maintain high product quality and control, as well as benefiting from cost savings, the company is currently procuring all main hardware components offshore. Final assembly is locally performed in order to ensure product quality. Other main components are also procured directly from manufacturers or from local suppliers that outsource components office in order to keep the price as low as possible.

The company is requesting the suppliers to perform a complete set of quality testing and minimum 24 hours’ burn-in before the product is delivered. The local hardware assembler and components supplier offers 12 months’ warranty. The main hardware components offshore supplier offers a warranty plan of 15 months from the date the product is shipped. With an extended 90 days beyond the current warranty, such repair service would be paid by the supplier except for component replacement costs, which would be paid by DSG.

| 18 |

Another important activity related to the management of the product supply chain is working closely with the suppliers and ensuring that we have alternate sources for the main components and identify well in advance any components that may go “end-of-life” and find suitable replacements before product shortages may occur.

Inventory Control

The Company has implemented strict inventory management procedures that govern the inbound flow of products from suppliers, the outgoing flow to customers as well as the internal movement of inventory between warehouses (Canada, US and UK). There are also procedures in place to control the flow of equipment returning from customers for repairs and their replacements.

Installation

The Company is utilizing a small number of its own field engineers, geographically positioned to be in close proximity of areas with high concentrations of current and future customers. Occasionally, when new installations exceed the internal capacity, the company employs a number of external contractors, on a project by project basis. Each contractor has been trained extensively to perform product installations and the Company has created an extensive collection of Installation Manuals for all products and vehicle types.

The product was designed with ease of installation as one of its features. Additionally, the installation process includes a pre-shipping configuration process that prepares each device with all the settings and graphics content (if applicable) required for the specific location it will be deployed. This makes the installation process a lot simpler and less time consuming in the field which reduces costs (accommodations, food, travel) for internal staff as well as external contractor cost (less billable time).

Another benefit of the simplified installation procedure is increased scalability in anticipation of increased number of installs in the future by reducing the skill level and training time requirements for additional contractors.

Customer Service

The company has deployed its Customer Service staff strategically, so it has at least one service representative active during business hours in North America, Europe and South Africa.

The company is handling Customer Service directly in North America and UK, offering telephone and on-line support to end-customers. In other international markets, the first-line customer service is handled by local distributor’s staff while DSG is supplying training and more advanced support to the distributors.

For the management of the customer service activities, the company is utilizing SalesForce.com CRM system which allows creating, updating, closing and escalation of service cases, including the issuance of RMA (Return Material Authorization) numbers for defective equipment. Using SalesForce.com also allows generation of management reports for service issues, customer satisfaction, and equipment failures in order to quickly identify trends, problem accounts or systemic issues.

In addition, DSG will begin to offer the DSG Par 72 Service & Support Plan to guarantee service and support to client courses in the golf business, this program will be available April 2016. This new program for client courses will guarantee service and support program within 24 hours of a problem arising.

Product Development and Engineering

The company employs a team of software engineers in house to develop and maintain the main components of the server software and firmware.

| 19 |

All product development is derived from business needs assessment and customer requests.

The Product Manager is reviewing periodically the list of feature requests with the Sales, establishes priorities and updates the Product Roadmap.

The software engineers are also responsible for developing specialized tools and systems utilized increase efficiency in the operation of the company. These projects include functionality such as: automated system monitoring, automatic service alerts, improved remote troubleshooting tools, cellular data monitoring and reporting. All these tools are critical in future ability to support more customers with less resources, streamline support, and improve internal efficiency.

All hardware development (electronics and mechanical) is generally outsourced, however small projects like mounting solutions or cabling are handled in house.

Material Contracts

On January 22, 2016, DSG TAG entered into a short-term loan agreement with Jeremy Yaseniuk for CAD$337,172 or USD$250,000, payable in either currency at the exchange rate of 1.35. The maturity date of the agreement is no more than six months of the agreement or July 22, 2016. The loan amount bears an interest rate of 10% per annum which shall be payable on the on the maturity date with minimum interest of $25,000.

On January 25, 2016, DSG TAG signed a Letter of Intent for exclusive work rights in golf courses and gated communities for Mullen Golf Cars of Mullen Technologies, Inc. DSG has the exclusive rights to offer models 100e 2 seater, 2 door 4 seater, the 100 e4 and any new Mullen golf worthy SLV to the gated communities known as The Villages, Florida, USA.

On March 5, 2016, by letter agreement dated December 31, 2015 with Westergaard Holdings Ltd., a corporation owned by a former director of the Company, we amended the Subscription and Debt Settlement Agreement dated September 26, 2014 between DSG Tag Systems, Inc. and Westergaard Holdings, as previously amended on October 4, 2015. Westergaard Holdings owns 4,229,384 shares Series A Convertible Preferred Stock of DSG TAG. Pursuant to the settlement agreement, the parties have agreed that DSG Global will complete financings for gross proceeds of at least $10 million and use a portion of the proceeds to redeem all of the Series A Convertible Preferred Shares. The letter agreement modifies the redemption provisions of the original agreement, which now obligate us to raise capital and redeem the Series A Convertible Preferred Shares at a price of $1.25 per share as follows: (i) on or before May 1, 2016, DSG Global must complete a financing for gross proceeds of at least $2.5 million and use at least $1.125 million to redeem a minimum of 900,000 Series A Shares; (ii) on or before June 1, 2016, DSG Global must complete an additional financing for gross proceeds of at least $2.5 million and use at least $1.125 million to redeem a minimum of 900,000 additional Series A Shares; and (iii) on or before July 1, 2016, DSG Global must complete an additional financing for gross proceeds of at least $5.0 million and use at least $3.04 million to redeem the remaining 2,429,384 Series A Shares.

On March 31, 2016, DSG TAG signed a promissory note for $54,000 CAD. The terms are payable on or before April 30th, 2016 to the order of E. Gary Risler, together with interest of 6% per annum simple interest. Interest will be accrued and payable at the time of promissory note repayment. Security for this note will $150,000 CAD of Tag, Touch, and Text inventory currently owed by DSG TAG.

On April 6, 2016, DSG TAG entered into a loan agreement with Westergaard Holdings Ltd. a corporation owned by a former director of the Company, pursuant to which we raised proceeds of $120,000 CAD. DSG TAG agrees to pay the loan plus fees no later than the final due date of July 6, 2016. The fees for service are as follows: (a) DSG TAG agrees to pay a fee for service equal to 5% of the amount of the loan or $6,000 CAD if the loan is paid in full, including fees on or before May 6, 2016; (b) DSG TAG agrees to pay a fee for service equal to 10% of the amount of the original loan, or $12,000 CAD if the loan is paid in full, including fees, between May 7, 2016 and June 5, 2016; and (c) DSG TAG agrees to pay a fee for service equal to 20% of the amount of the original loan, or $24,000 CAD if the loan is paid full, including fees, between June 6, 2016 and July 5, 2016. DSG TAG agrees to pay partial payments towards the principal amount of the loan and fees. DSG TAG agrees that fees will be charged on the initial amount of the loan.

| 20 |

On April 29, 2016 Westergaard Holdings Ltd., an affiliate of a member of our board of directors and a shareholder of the Company, amended the Subscription / Debt Settlement Agreement dated September 26, 2014 between DSG TAG and Westergaard Holdings, as previously amended. Westergaard Holdings owns 4,229,384 Series A Shares. Pursuant to the settlement agreement, DSG TAG has agreed that DSG Global Inc. will complete financings for gross proceeds of at least $10 million and use a portion of the proceeds to redeem all of the Series A Shares. The letter agreement modifies the redemption provisions, which now obligate the Company to raise capital and redeem the Series A Shares at a price of $1.25 per share as follows: (i) on or before August 1, 2016, the Company must complete a financing for gross proceeds of at least $2.5 million and use at least $1.125 million to redeem a minimum of 900,000 Series A Shares; (ii) on or before September 1, 2016, the Company must complete an additional financing for gross proceeds of at least $2.5 million and use at least $1.125 million to redeem a minimum of 900,000 additional Series A Shares; and (iii) on or before October 1, 2016, the Company must complete an additional financing for gross proceeds of at least $5.0 million and use at least $3.14 million to redeem the remaining 2,429,384 Series A Shares.

On August 5, 2016, DSG Global signed a convertible note agreement for $150,000 USD. The term of the note is 45 days from the date of contract with interest accrued at 2% per month. The principal and interest will be repaid in full by way of cash repayment or Class A common shares.

On November 7, 2016, we entered into a securities purchase agreement with Coastal Investment Partners. Pursuant to the agreement, Coastal Investment provided us with cash proceeds of $125,000 on November 10, 2016. In exchange, we issued a secured convertible promissory note in the principal amount of $138,888.89 (the “$138,888.89 Note”), inclusive of an 8% original issue discount, which bears interest at 8% per annum to the holder. The $138,888.89 Note matures six months from issuance and is convertible at the option of the holder into our common shares at a price per share that is the lower of $0. 12 or the closing price of our common stock on the conversion date. In addition, under the same terms, the company also issued a secured convertible note of $50,000 in consideration of cash proceeds of $10,000 and another secured convertible note of $75,000 in consideration of cash proceeds of $10,000.

On December 6, 2016, a convertible loan was received from Brent Silzer in the amount of $29,791 (CAD $40,000). Interest is 8% annual rate for one month and 4% monthly rate thereafter if not paid by January 15, 2017. The note is convertible, in whole or in part, at $0.05 per share.

On December 21, 2016, we entered into a convertible note agreement for the principal amount of $74,500. The terms are payable at the date of maturity, December 21, 2017, together with interest of 12% per annum. Interest will be accrued and payable at the time of promissory note repayment. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to the lessor of (i) the closing sale price of the Common Stock on the Principal Market on the Trading Day immediately preceding the Closing Date, and (ii) 50% of the lowest sale price for the Common Stock on the Principal Market during the twenty five (25) consecutive Trading Days immediately preceding the Conversion Date.

On January 3, 2017, we entered into an investor relations agreement with Chesapeake Group Inc., to assist in all phases of our investor relations including broker/dealer relations. The contract will commence on January 3, 2017 and end on July 2, 2017. In consideration for the agreement, we are committed to providing 1,800,000 restricted common shares within 10 days of the agreement, plus an additional 450,000 restricted common shares representing a monthly fee of $3,750. These restricted common shares are to be issued in monthly installments of 75,000 restricted common shares on the 2nd of each month beginning on February 2, 2017 and ending on July 2, 2017.

On January 18, 2017, we issued a convertible promissory note in the principal amount of $75,000. The terms are payable at the date of maturity, October 18, 2017, together with interest of 12% per annum. Interest will be accrued and payable at the time of promissory note repayment. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to the lessor of (i) 60% multiplied by the lowest Trading Price (representing a discount rate of 40%) during the previous twenty five (25) Trading Day period ending on the latest complete Trading Day prior to the date of this Note and (ii) the Variable Conversion Price which means 50% multiplied by the lowest Trading Price (representing a discount rate of 50%) during the previous twenty five (25) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date.

| 21 |

On March 15, 2017, we entered into a Securities Purchase Agreement, pursuant to which the Company agreed to issue 500,000 common shares of the Company at a price of $0.10 per share for aggregate consideration of $50,000.

On April 3, 2017, we issued a convertible promissory note in the principal amount of $110,000. The terms are payable at the date of maturity, October 3, 2017, together with interest of 10% per annum. Interest will be accrued and payable at the time of promissory note repayment. In connection with the issuance of this convertible promissory note, the Borrower shall issue 550,000 shares of common stock as a commitment fee provided, however, these shares must be returned if the Note is fully repaid and satisfied prior to the date which is 180 days following the issuance. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to the lessor of (i) 55% multiplied by the lowest Trading Price (representing a discount rate of 45%) during the previous twenty five (25) Trading Day period ending on the latest complete Trading Day prior to the date of this Note and (ii) the Alternate Conversion Price which means 55% multiplied by the lowest Trading Price (representing a discount rate of 45%) during the previous twenty five (25) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date.

On June 5, 2017, we issued a convertible promissory note in the principal amount of $110,000. The terms are payable at the date of maturity, December 5, 2017, together with interest of 10% per annum. Interest will be accrued and payable at the time of promissory note repayment. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to the lessor of (i) eight cents ($0.08) or (ii) the Alternate Conversion Price which means 55% multiplied by the lowest Trading Price (representing a discount rate of 45%) during the previous twenty five (25) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date.

On July 17, 2017, we issued a convertible promissory note in the principal amount of $135,000. The terms are payable at the date of maturity, July 17 2018, together with interest of 10% per annum. Interest will be accrued and payable at the time of promissory note repayment. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to the lessor of (i) six cents ($0.06) or (ii) 55% of (representing a 45% discount) to the lowest Trading during the previous twenty (20) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date.

On August 16, 2017, we issued a convertible promissory note in the principal amount of $110,250. The terms are payable at the date of maturity, August 16 2018, together with interest of 8% per annum. Interest will be accrued and payable at the time of promissory note repayment. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to (i) 58% of the the lowest Trading during the previous ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date.

On September 6, 2017, we issued a convertible promissory note in the principal amount of $107,000. The terms are payable at the date of maturity, March 6, 2018, together with interest of 10% per annum. Interest will be accrued and payable at the time of promissory note repayment. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to the lessor of (i) three cents ($0.03) and (ii) lowest Trading Price during the previous twenty five (25) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date.

On October 30, 2017, we issued a convertible promissory note in the principal amount of $107,000. The terms are payable at the date of maturity, April 30, 2018, together with interest of 10% per annum. Interest will be accrued and payable at the time of promissory note repayment. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to the lessor of (i) $0.004 or (ii) lowest Trading Price during the previous twenty five (25) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date.

| 22 |

On December 18, 2017, we issued a convertible promissory note in the principal amount of $82,000. The terms are payable at the date of maturity, June 18, 2018, together with interest of 10% per annum. Interest will be accrued and payable at the time of promissory note repayment. The Holder shall have the right to convert all or any part of the outstanding and unpaid principal amount into fully paid and non-assessable shares of Common Stock at a conversion price equal to the lessor of (i) $0.003 or (ii) lowest Trading Price during the previous twenty five (25) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date.

On February 15, 2017, DSG TAG signed an additional six-month extension on the current lease. The term will begin on February 1, 2017 and end on July 31, 2017. Currently space is leased on a month to month basis.

Description of Property

On January 21, 2016, DSG entered into a three-month Lease Agreement regarding the lease DSG’s offices located at 5455-152nd Street, Surrey, British Columbia. Pursuant to the agreement DSG has leased the approximately 2,957 square foot space on a month to month basis at the rate of CAD$5,518.63 (approximately USD $4,087.87) per month. DSG may terminate the lease with 30 days’ notice. On April 7, 2016, DSG has signed an additional two-month extension on the current lease at 214-5455 152nd Avenue, Surrey, BC, V3S 5A5. The term will on May 1, 2016 and end on July 31, 2016.

During the year ended December 31, 2016, the lease was extended and will expire on January 31, 2017. On February 15, 2017, an additional six-month extension on the lease was signed with the term beginning on February 1, 2017 and ending on July 31, 2017. Currently space is leased on a month to month basis.

For the year ended December 31, 2017, the aggregate rental expense was CAD$92,913. Rent expense included other amounts paid in Canada for warehouse storage and offices under month to month or as needed basis.

Intellectual Property

General

Our success will depend in part on our ability to protect our products and product candidates by obtaining and maintaining a strong proprietary position both in the United States and in other countries. To develop and maintain our proprietary position, we will rely on patent protection, trade secrets, know-how, continuing technological innovations and licensing opportunities. In that regard, we retain and rely on the advice of legal counsel specialized in the field of intellectual property.

Patents

| DSG owns two U.S. patents | ||

| ● | US Patent No. 8,836,490 for a “Vehicle Management” was issued September 16, 2014 and expires June 29, 2031. | |

| ● | US Patent No. 9,280,902 for a “Facilities Management” was issued March 8, 2016 and expires January 24, 2032. |

Domain Names

We have registered and own the domain name of our website www.dsgtag .com.

| 23 |

Copyright

We own the common law copyright in the contents of our website (www.dsgtag.com.) and our various promotional materials.

Trademarks

We own the common-law trademark rights in our corporate name, product names, and associated logos, including “DSG TAG”, “TAG Golf”, “ECO TAG”, “TAG Text”, “TAG Touch”, “TAG Turf”, “TAG Commercial” and “TAG Military”. We have not applied to register any trademarks with the U.S. Patent and Trademark Office.

Employees

As of April 18, 2018, we have 6 full-time employees in general and administrative, operations, engineering, research and development, business development, sales and marketing, and finance. We also engage independent contractors and consultants from time to time on an as-needed basis to supplement our core staff.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Form 10-K, including our consolidated financial statements and related notes, before investing in our common stock. If any of the following risks materialize, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish any history of profitable operations and have incurred net losses since our inception. We have generated only nominal revenues since our inception and do not anticipate that we will generate revenues which will be sufficient to sustain our operations in the near future. Our profitability will require the successful commercialization and sales of our products. We may not be able to successfully achieve any of these requirements or ever become profitable.

There is doubt about our ability to continue as a going concern due to recurring losses from operations, accumulated deficit and insufficient cash resources to meet our business objectives, all of which means that we may not be able to continue operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended December 31, 2017 and 2016 with respect to their doubt about our ability to continue as a going concern. As discussed in Note 2 to our financial statements for the years ended December 31, 2017 and 2016, we have generated operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raise doubt about our ability to continue as a going concern.

Our inability to complete our future research and development and engineering projects in a timely manner could have a material adverse effect of our results of operations, financial condition and cash flows.

If our research and development projects are not completed in a timely fashion, we could experience:

| ● | substantial additional cost to obtain a marketable product; | |

| ● | additional competition resulting from competitors in the surveillance and facial recognition market, and; | |

| ● | delay in obtaining future inflow of cash from financing or partnership activities. |

| 24 |

We face intense competition, which could result in lower revenues and higher research and development expenditures and could adversely affect our results of operations.

Unless we keep pace with changing technologies, we could lose existing customers and fail to win new customers. In order to compete effectively in the fleet management systems market, we must continually design, develop and market new and enhanced technologies. Our future success will depend, in part, upon our ability to address the changing and sophisticated needs of the marketplace. Fleet management technologies have achieved widespread commercial acceptance and our strategy of expanding our fleet management technologies business could adversely affect our business operations and financial condition.

Further, we expect to derive revenue from government contracts, which are often non-standard, involve competitive bidding, may be subject to cancellation with or without penalty and may produce volatility in earnings and revenue.

The market for our technologies is still developing and if the industry adopts technology standards that are different from our own our competitive position would be negatively affected.

Parts of our company’s business plan are dependent on business relationships with various parties.

We expect to rely in part upon original equipment manufacturers (OEM), and distribution partners to sell and install our products, and we may be adversely affected if those parties do not actively promote our products or pursue installations that use our products. Further, if our products are not timely delivered or do not perform as promised, we could experience increased costs, lower margins, liquidated damage payment obligations and reputational harm.

We must attract and maintain key personnel, or our business will fail.

Success depends on the acquisition of key personnel. We will have to compete with other companies both within and outside the electronics industry to recruit and retain competent employees. If we cannot maintain qualified employees to meet the needs of our anticipated growth, this could have a material adverse effect on our business and financial condition.

We may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions.

We anticipate requiring significant capital to fulfill our contractual obligations, continue development of our planned products to meet market evolution, and execute our business plan, generally. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States and Europe, or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

| 25 |

Our business and operating results could be harmed if we fail to manage our growth or change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must continue to try to locate skilled engineers and professionals and adequate funds in a timely manner.

Our business depends on GPS technology owned and controlled by others. If we do not have continued access to GPS technology, we will be unable to deliver our services and our revenues will decrease.

Our services rely on signals from GPS satellites built and maintained by the U.S. Department of Defense. GPS satellites and their ground support systems are subject to electronic and mechanical failures and sabotage. If one or more satellites malfunction, there could be a substantial delay before they are repaired or replaced, if at all, and our services may cease, and customer satisfaction would suffer.

Our GPS technology depends on the use of radio frequency spectrum controlled by others.

Our GPS technology is dependent on the use of radio frequency spectrum. The assignment of spectrum is controlled by an international organization known as the International Telecommunications Union, or ITU. The Federal Communications Commission, or FCC, is responsible for the assignment of spectrum for non-government use in the United States in accordance with ITU regulations. Any ITU or FCC reallocation of radio frequency spectrum, including frequency band segmentation or sharing of spectrum, could cause interference with the reception of GPS signals and may materially and adversely affect the utility and reliability of our products, which would, in turn, cause a material adverse effect on our operating results. In addition, emissions from mobile satellite service and other equipment operating in adjacent frequency bands or in band may materially and adversely affect the utility and reliability of our products, which could result in a material adverse effect on our operating results.

Government regulations and standards may harm our business and could increase our costs or reduce our opportunities to earn revenues.