Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - QCR HOLDINGS INC | d510659dex992.htm |

| EX-99.1 - EX-99.1 - QCR HOLDINGS INC | d510659dex991.htm |

| EX-2.1 - EX-2.1 - QCR HOLDINGS INC | d510659dex21.htm |

| 8-K - 8-K - QCR HOLDINGS INC | d510659d8k.htm |

April 18, 2018 Exhibit 99.3 Merger with Springfield Bancshares, Inc.

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of QCR Holdings (the “Company” or “QCRH”) and Springfield Bancshares. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of QCR Holdings’ and Springfield Bancshares’ management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. Additionally, all statements in this presentation, including forward-looking statements, speak only as of the date they are made, and neither QCR Holdings nor Springfield Bancshares undertakes any obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond the ability of QCR Holdings and Springfield Bancshares to control or predict, could cause actual results to differ materially from those in any forward-looking statements. These factors include, among others, the following: (i) the possibility that any of the anticipated benefits of the proposed transaction between QCR Holdings and Springfield Bancshares will not be realized or will not be realized within the expected time period; (ii) the risk that integration of operations of Springfield Bancshares with those of QCR Holdings will be materially delayed or will be more costly or difficult than expected; (iii) the inability to complete the proposed transaction due to the failure of the required stockholder approval; (iv) the failure to satisfy other conditions to completion of the proposed transaction, including receipt of required regulatory and other approvals; (v) the failure of the proposed transaction to close for any other reason; (vi) the effect of the announcement of the transaction on customer relationships and operating results; (vii) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (viii) the strength of the local, national and international economy; (ix) changes in state and federal laws, regulations and governmental policies concerning QCR Holdings’ and Springfield Bancshares’ general business; (x) changes in interest rates and prepayment rates of QCR Holdings’ and Springfield Bancshares’ assets; (xi) increased competition in the financial services sector and the inability to attract new customers; (xii) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (xiii) the loss of key executives or employees; (xiv) changes in consumer spending; (xv) unexpected results of acquisitions, including the acquisition of Springfield Bancshares; (xvi) unexpected outcomes of existing or new litigation involving QCR Holdings or Springfield Bancshares; (xvii) the economic impact of any future terrorist threats or attacks; (xviii) the economic impact of exceptional weather occurrences such as tornadoes, hurricanes, floods, and blizzards; and (xix) changes in accounting policies and practices. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning QCR Holdings and its business, including additional factors that could materially affect QCR Holdings’ financial results, are included in QCR Holdings’ filings with the Securities and Exchange Commission. FORWARD-LOOKING STATEMENTS

QCR Holdings will file a registration statement on Form S-4 with the SEC in connection with the proposed transaction. The registration statement will include a proxy statement of Springfield Bancshares that also constitutes a prospectus of QCR Holdings, which will be sent to the stockholders of Springfield Bancshares. Springfield Bancshares’ stockholders are advised to read the proxy statement/prospectus when it becomes available because it will contain important information about QCR Holdings, Springfield Bancshares and the proposed transaction. When filed, this document and other documents relating to the proposed transaction filed by QCR Holdings and Springfield Bancshares can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing QCR Holdings’ website at www.qcrh.com under the tab “Investors Relations” and then under “SEC Filings.” Alternatively, these documents, when available, can be obtained free of charge from QCR Holdings upon written request to QCR Holdings, Inc., Attention: Corporate Secretary, 3551 7th Street, Moline, Illinois 61265 or by calling (319) 743-7006, or from Springfield Bancshares, upon written request to Springfield Bancshares, Inc., Attention: Mr. Kirk Bossert, 2006 S. Glenstone Avenue, Springfield, Missouri 65804 or by calling (417) 851-5728. QCR Holdings, Springfield Bancshares and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the proposed transaction under the rules of the SEC. Information about these participants may be found in the definitive proxy statement of QCR Holdings relating to its 2018 Annual Meeting of Stockholders filed with the SEC on April 13, 2018. This definitive proxy statement can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants will also be included in the proxy statement/prospectus regarding the proposed transaction when it becomes available. This presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. ADDITIONAL INFORMATION

TRANSACTION Rationale Combination of two high performing organizations creating a $4.6 billion company Committed management team highly regarded in the Springfield, MO community Deep, long standing commercial relationships within the community Buy-in from key Springfield First Community Bank business development officers Meets all aspects of our M&A strategy Entry into a new market with approximately $550 million in total assets and significant room to grow Meaningful EPS accretion with a short tangible book value earnback period IRR is approximately 20% Compatible cultures with consistent client and community focus Strong asset quality Pristine and well reserved with historically low levels of non-performing assets and net charge-offs Significant opportunity for market share gains and consolidation Increased scale, operational support and improved funding provides the opportunity for Springfield First Community Bank to become the dominant community bank in the Springfield, MO MSA

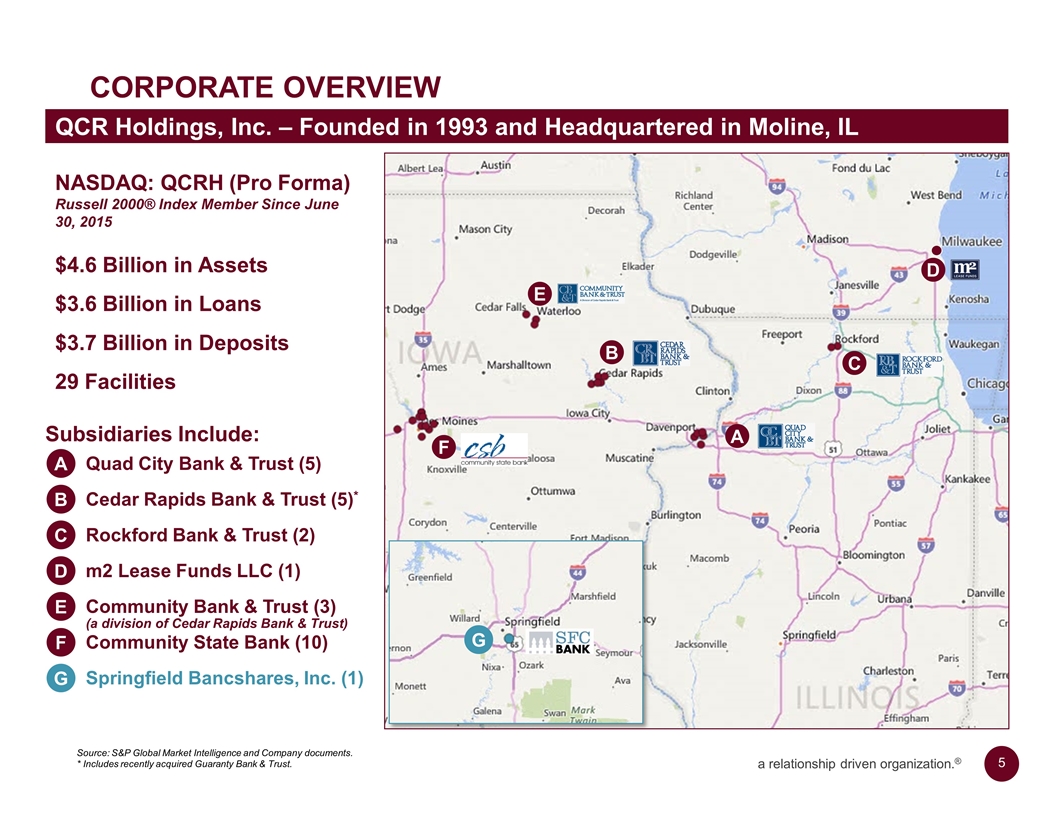

Subsidiaries Include: Corporate Overview NASDAQ: QCRH (Pro Forma) Russell 2000® Index Member Since June 30, 2015 $4.6 Billion in Assets $3.6 Billion in Loans $3.7 Billion in Deposits 29 Facilities Quad City Bank & Trust (5) Cedar Rapids Bank & Trust (5)* Rockford Bank & Trust (2) m2 Lease Funds LLC (1) Community Bank & Trust (3) Community State Bank (10) Springfield Bancshares, Inc. (1) A B C D E F QCR Holdings, Inc. – Founded in 1993 and Headquartered in Moline, IL F A B C D E G G Source: S&P Global Market Intelligence and Company documents. * Includes recently acquired Guaranty Bank & Trust. (a division of Cedar Rapids Bank & Trust)

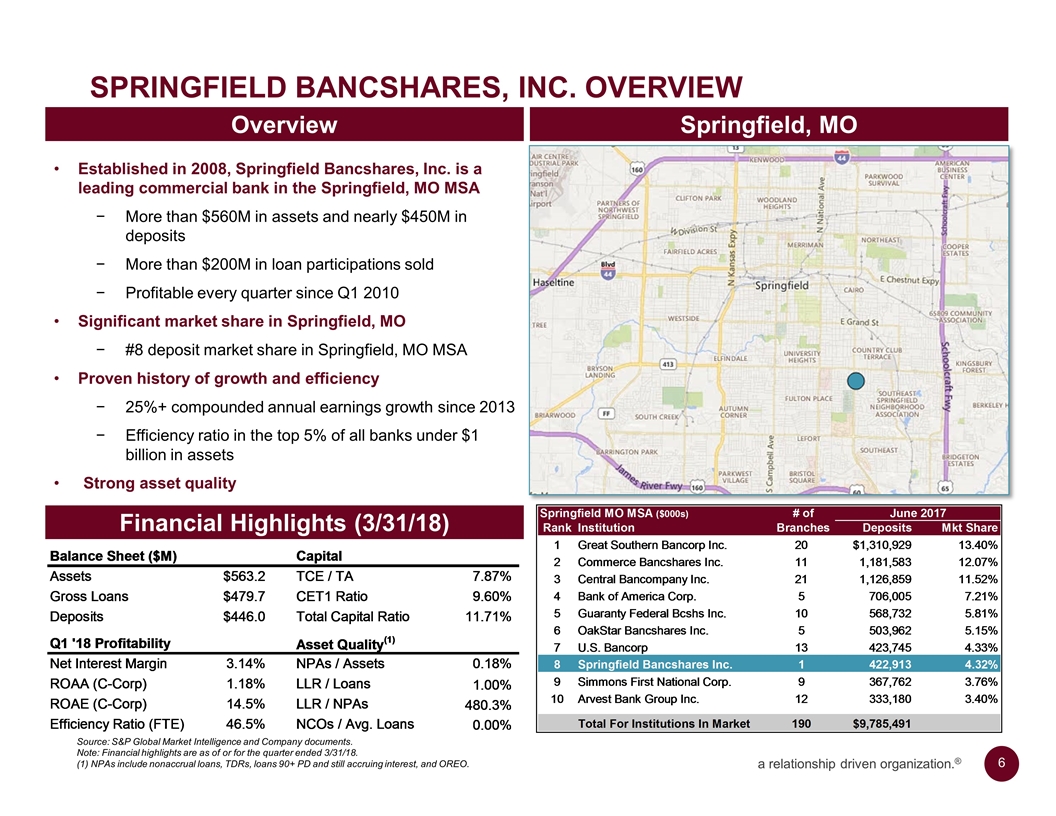

Springfield Bancshares, Inc. Overview Overview Springfield, MO Financial Highlights (3/31/18) Established in 2008, Springfield Bancshares, Inc. is a leading commercial bank in the Springfield, MO MSA More than $560M in assets and nearly $450M in deposits More than $200M in loan participations sold Profitable every quarter since Q1 2010 Significant market share in Springfield, MO #8 deposit market share in Springfield, MO MSA Proven history of growth and efficiency 25%+ compounded annual earnings growth since 2013 Efficiency ratio in the top 5% of all banks under $1 billion in assets Strong asset quality Source: S&P Global Market Intelligence and Company documents. Note: Financial highlights are as of or for the quarter ended 3/31/18. (1) NPAs include nonaccrual loans, TDRs, loans 90+ PD and still accruing interest, and OREO.

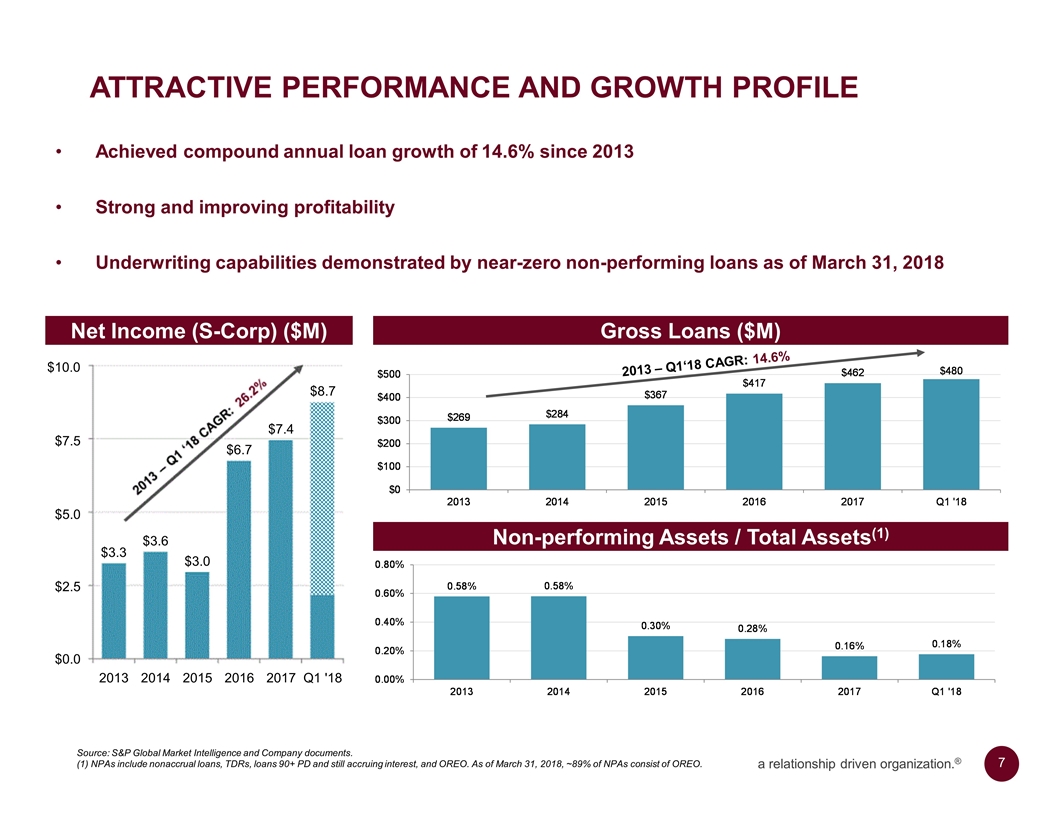

Attractive performance and growth profile Net Income (S-Corp) ($M) Gross Loans ($M) Achieved compound annual loan growth of 14.6% since 2013 Strong and improving profitability Underwriting capabilities demonstrated by near-zero non-performing loans as of March 31, 2018 Non-performing Assets / Total Assets(1) Source: S&P Global Market Intelligence and Company documents. (1) NPAs include nonaccrual loans, TDRs, loans 90+ PD and still accruing interest, and OREO. As of March 31, 2018, ~89% of NPAs consist of OREO. 2013 – Q1‘18 CAGR: 14.6% $3.3 $3.6 $3.0 $6.7 $7.4 $8.7 $0.0 $2.5 $5.0 $7.5 $10.0 2013 2014 2015 2016 2017 Q1 '18

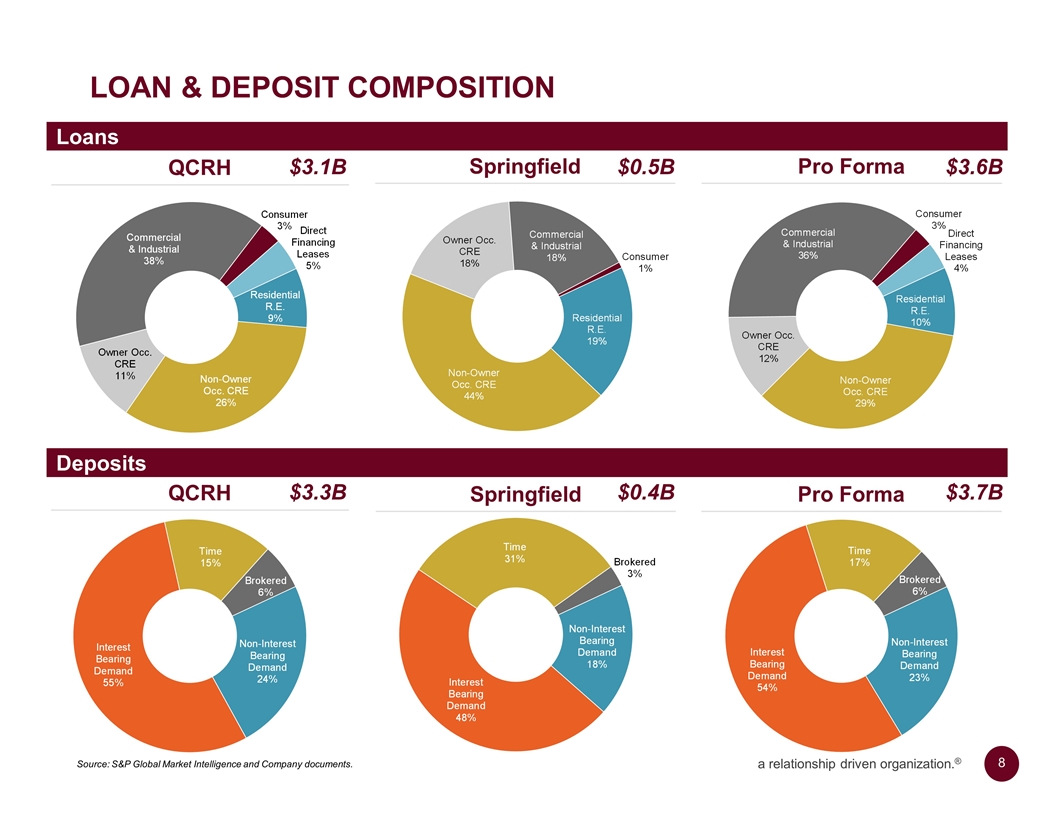

Loan & Deposit Composition QCRH Pro Forma Springfield QCRH Pro Forma Springfield Loans Deposits Source: S&P Global Market Intelligence and Company documents. $3.1B $0.5B $3.6B $3.3B $0.4B $3.7B

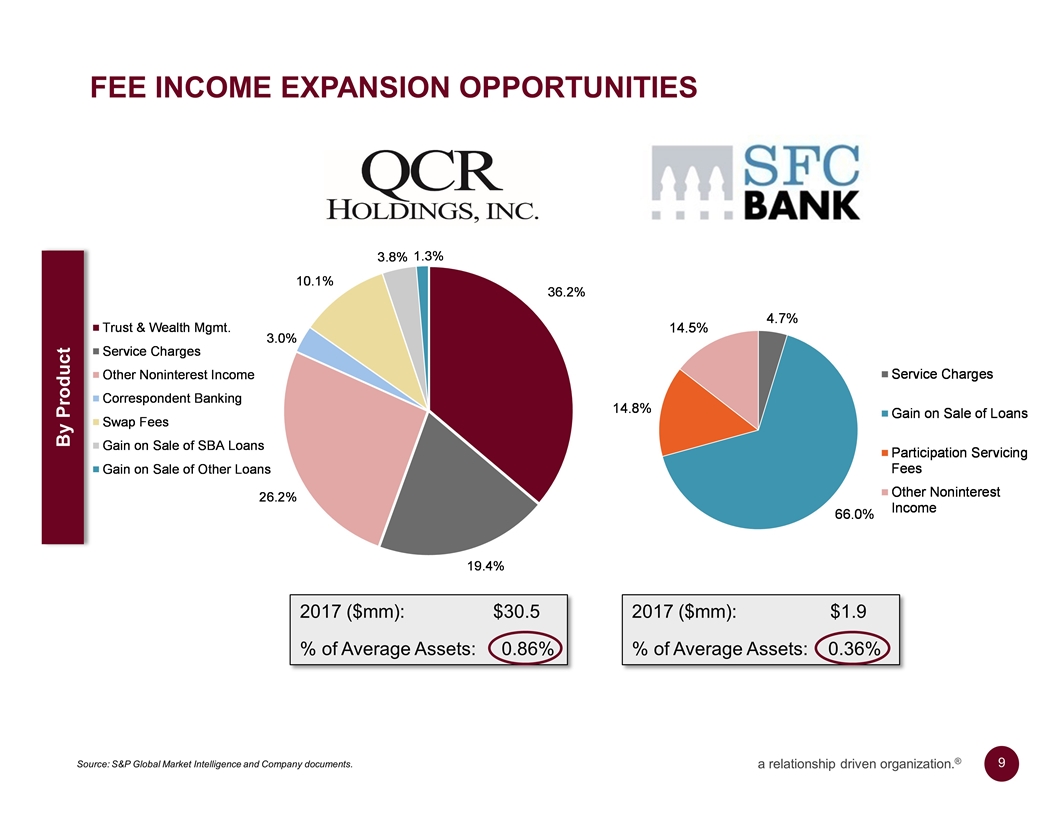

Fee Income expansion opportunities Source: S&P Global Market Intelligence and Company documents. By Product 2017 ($mm): $30.5 % of Average Assets: 0.86% 2017 ($mm): $1.9 % of Average Assets: 0.36%

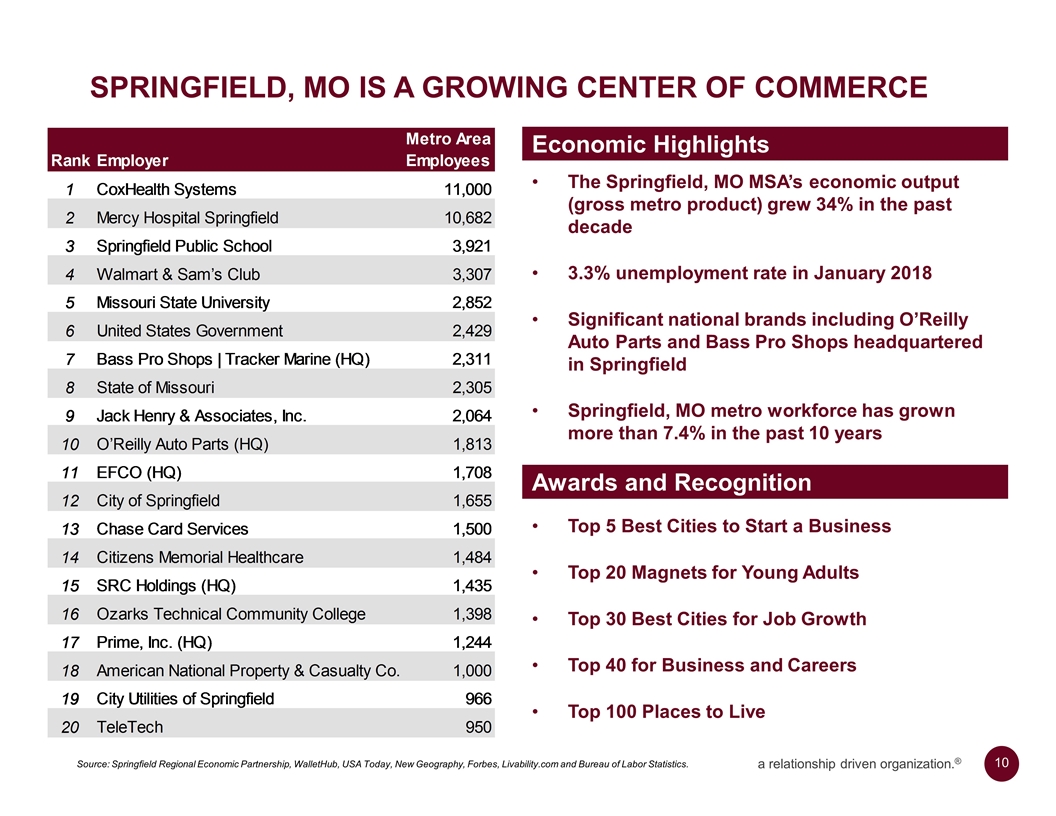

Springfield, mo is a growing center of commerce The Springfield, MO MSA’s economic output (gross metro product) grew 34% in the past decade 3.3% unemployment rate in January 2018 Significant national brands including O’Reilly Auto Parts and Bass Pro Shops headquartered in Springfield Springfield, MO metro workforce has grown more than 7.4% in the past 10 years Source: Springfield Regional Economic Partnership, WalletHub, USA Today, New Geography, Forbes, Livability.com and Bureau of Labor Statistics. Top 5 Best Cities to Start a Business Top 20 Magnets for Young Adults Top 30 Best Cities for Job Growth Top 40 for Business and Careers Top 100 Places to Live Awards and Recognition Economic Highlights

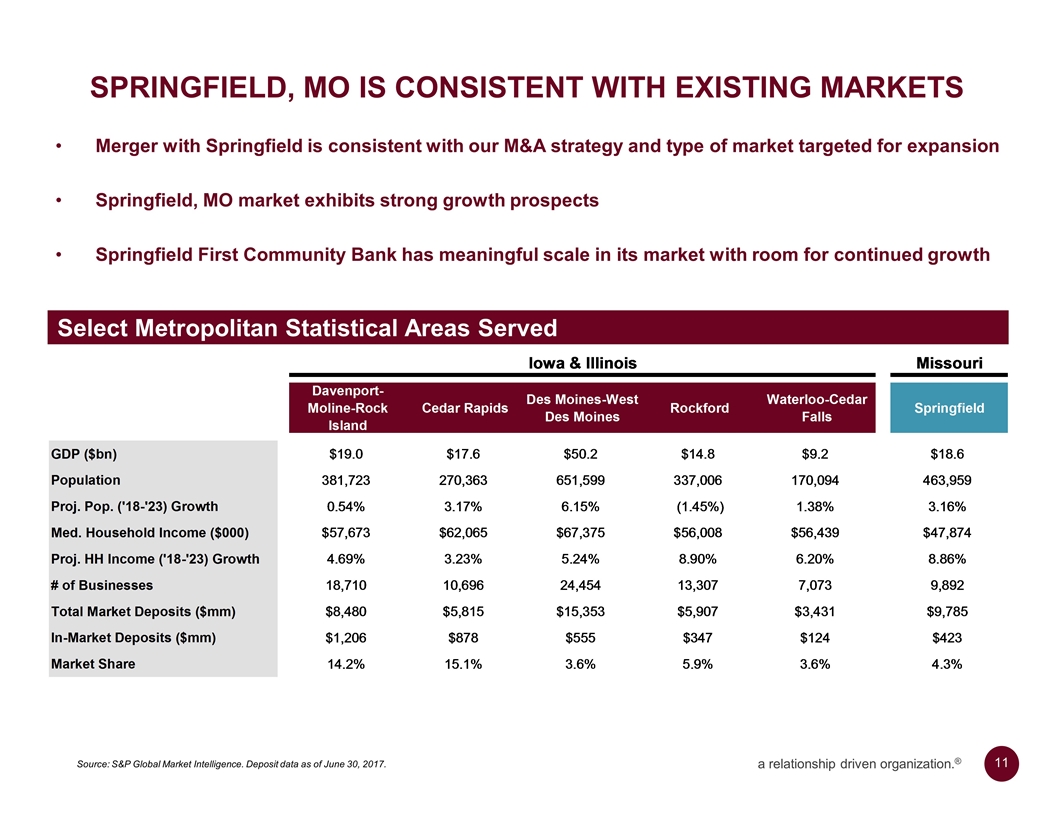

Springfield, MO is Consistent with Existing Markets Source: S&P Global Market Intelligence. Deposit data as of June 30, 2017. Merger with Springfield is consistent with our M&A strategy and type of market targeted for expansion Springfield, MO market exhibits strong growth prospects Springfield First Community Bank has meaningful scale in its market with room for continued growth Select Metropolitan Statistical Areas Served

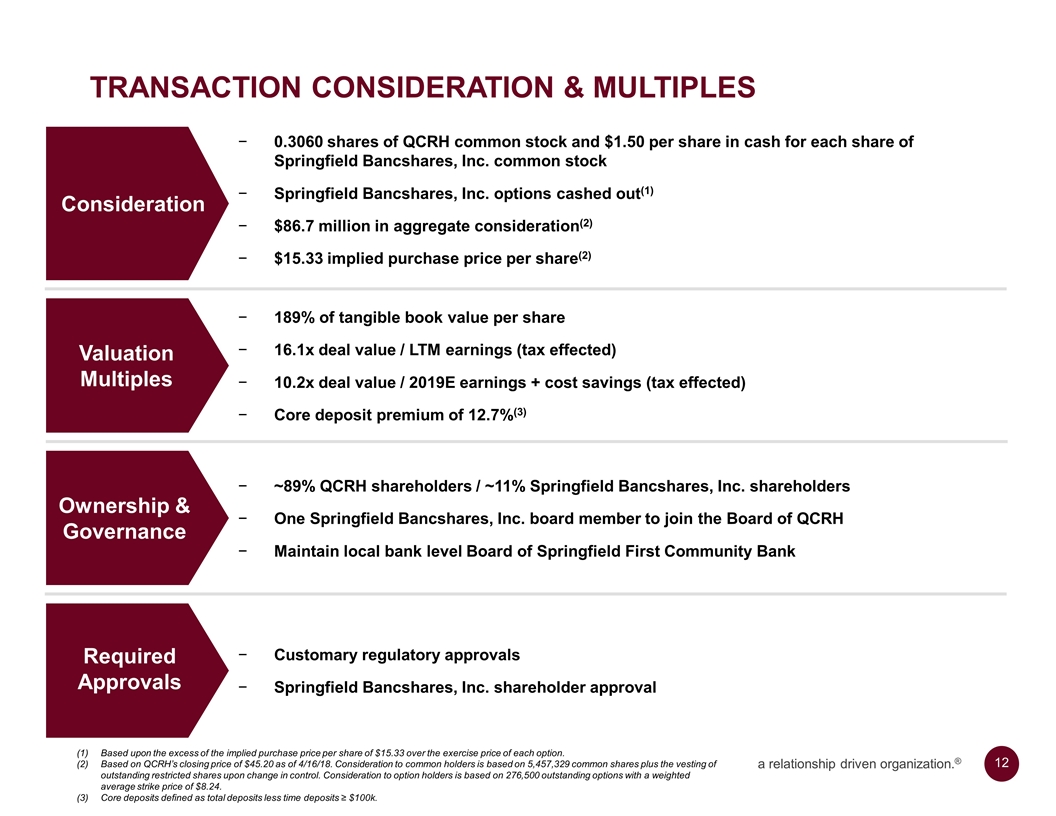

Transaction consideration & multiples Based upon the excess of the implied purchase price per share of $15.33 over the exercise price of each option. Based on QCRH’s closing price of $45.20 as of 4/16/18. Consideration to common holders is based on 5,457,329 common shares plus the vesting of outstanding restricted shares upon change in control. Consideration to option holders is based on 276,500 outstanding options with a weighted average strike price of $8.24. Core deposits defined as total deposits less time deposits ≥ $100k. Consideration Valuation Multiples Ownership & Governance Required Approvals 0.3060 shares of QCRH common stock and $1.50 per share in cash for each share of Springfield Bancshares, Inc. common stock Springfield Bancshares, Inc. options cashed out(1) $86.7 million in aggregate consideration(2) $15.33 implied purchase price per share(2) 189% of tangible book value per share 16.1x deal value / LTM earnings (tax effected) 10.2x deal value / 2019E earnings + cost savings (tax effected) Core deposit premium of 12.7%(3) ~89% QCRH shareholders / ~11% Springfield Bancshares, Inc. shareholders One Springfield Bancshares, Inc. board member to join the Board of QCRH Maintain local bank level Board of Springfield First Community Bank Customary regulatory approvals Springfield Bancshares, Inc. shareholder approval

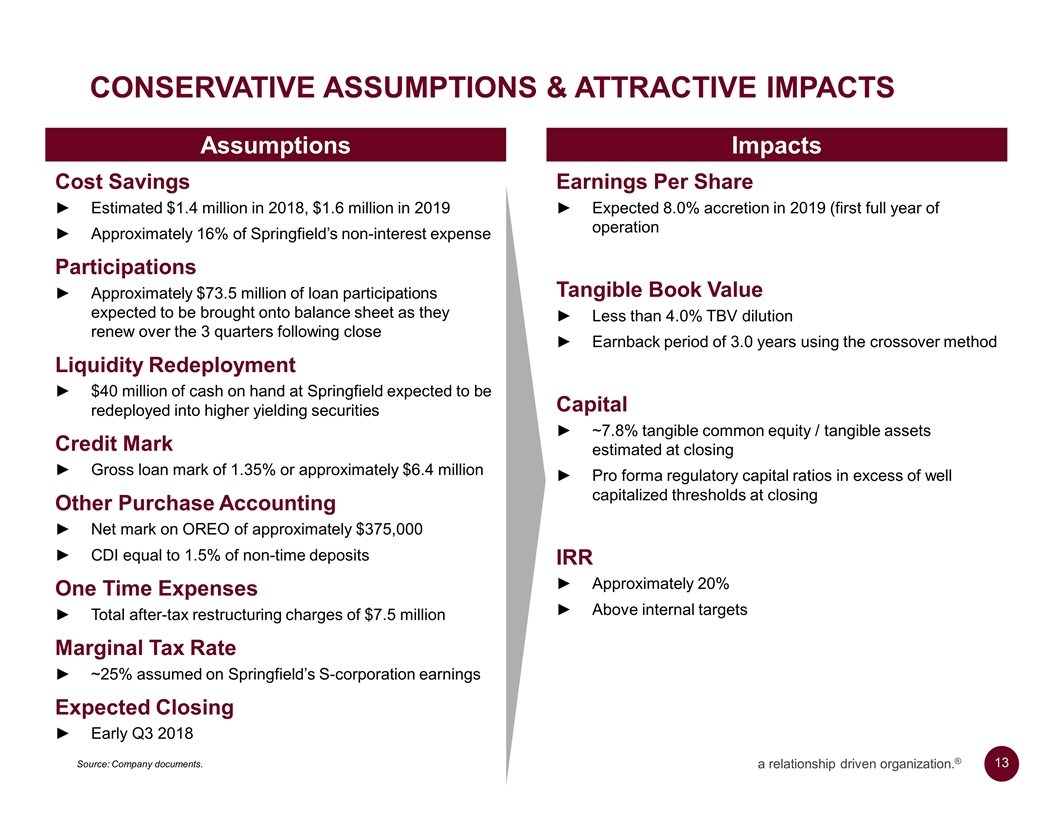

Conservative Assumptions & Attractive Impacts Assumptions Impacts Cost Savings Estimated $1.4 million in 2018, $1.6 million in 2019 Approximately 16% of Springfield’s non-interest expense Participations Approximately $73.5 million of loan participations expected to be brought onto balance sheet as they renew over the 3 quarters following close Liquidity Redeployment $40 million of cash on hand at Springfield expected to be redeployed into higher yielding securities Credit Mark Gross loan mark of 1.35% or approximately $6.4 million Other Purchase Accounting Net mark on OREO of approximately $375,000 CDI equal to 1.5% of non-time deposits One Time Expenses Total after-tax restructuring charges of $7.5 million Marginal Tax Rate ~25% assumed on Springfield’s S-corporation earnings Expected Closing Early Q3 2018 Earnings Per Share Expected 8.0% accretion in 2019 (first full year of operation Tangible Book Value Less than 4.0% TBV dilution Earnback period of 3.0 years using the crossover method Capital ~7.8% tangible common equity / tangible assets estimated at closing Pro forma regulatory capital ratios in excess of well capitalized thresholds at closing IRR Approximately 20% Above internal targets Source: Company documents.

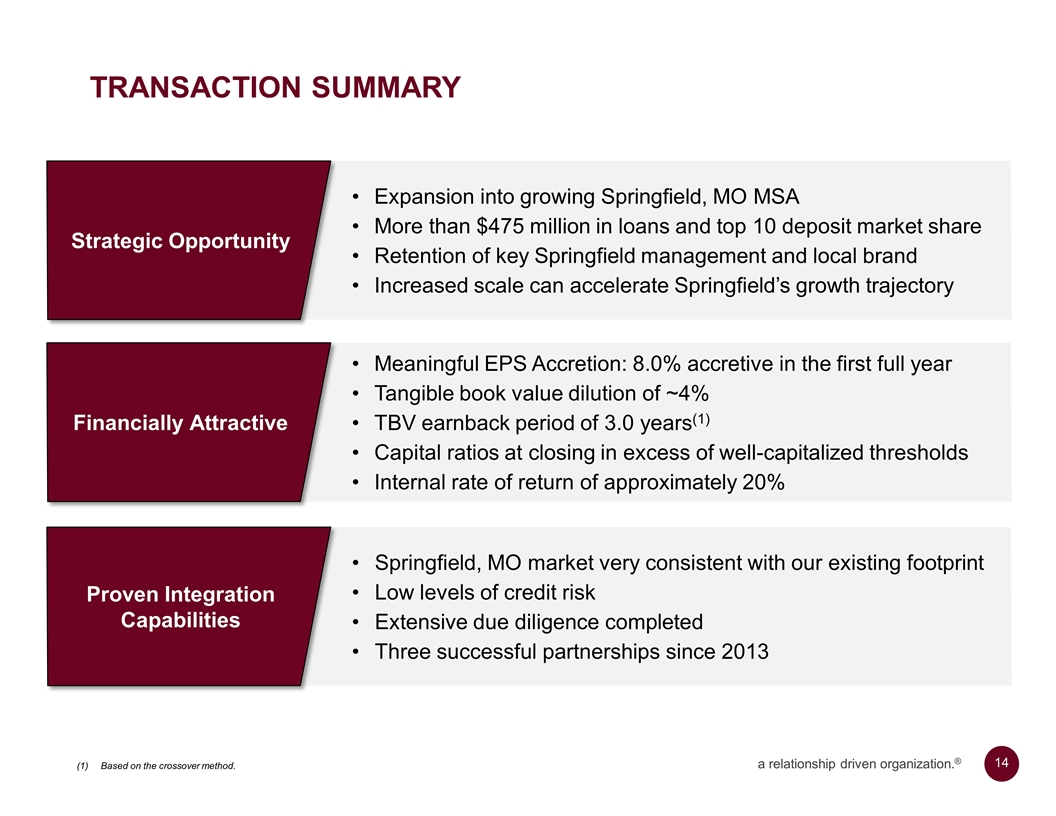

Meaningful EPS Accretion: 8.0% accretive in the first full year Tangible book value dilution of ~4% TBV earnback period of 3.0 years(1) Capital ratios at closing in excess of well-capitalized thresholds Internal rate of return of approximately 20% Financially Attractive Expansion into growing Springfield, MO MSA More than $475 million in loans and top 10 deposit market share Retention of key Springfield management and local brand Increased scale can accelerate Springfield’s growth trajectory Strategic Opportunity Springfield, MO market very consistent with our existing footprint Low levels of credit risk Extensive due diligence completed Three successful partnerships since 2013 Proven Integration Capabilities Transaction summary Based on the crossover method.

QCRH will be ranked in the top quartile ROA of peer firms by 2020 and continue to reward shareholders and employees while strengthening our communities The mission of QCR Holdings, Inc. is to make our customer’s financial dreams a reality OUR MISSION OUR VISION OUR VALUES – LIVED AND EXPECTED OF ALL AT QCRH Collaboration Achievement Personal Responsibility Innovation Fulfillment QCRH’S MISSION, VISION AND VALUES

3551 7th Street Moline, Illinois 61265 www.qcrh.com